#tax and accounting Airdrie

Text

Accounting and Financial Services Company

Our goal is to make income tax planning and preparation understandable and uncomplicated. Well-informed clients make better decisions. Our customer-service approach ensures that the technical aspects are communicated in language that makes sense so that our clients understand how circumstances might impact them and their businesses.

#Accounting Services Airdrie#Accounting Company Airdrie#tax and accounting Airdrie#Accounting Company irricana

0 notes

Text

Basic Understanding of Tax Brackets and Marginal Rates in Canada

A solid understanding of tax brackets and marginal rates is crucial for efficient tax return completion and effective financial management, especially when utilizing tax preparation services in Calgary. Canadian taxpayers aim to minimize their tax payments by staying updated on current taxation information.

As we step into 2024, individuals and businesses face both challenges and opportunities in the evolving tax landscape. This article aims to guide Calgary homeowners through the process of filing their 2024 tax returns while providing a comprehensive understanding of Canada’s different tax brackets and rates.

Basic Tax Concepts, Tax Brackets, and Marginal Rates

Tax rates in Canada vary across income levels, with each level defined by a tax bracket. The progressive taxation system means that as income increases, so does the tax rate. Within each tax bracket, the marginal rate applies to the last earned dollar, resulting in higher rates for those with elevated incomes.

For the 2024 tax year, the Canadian government has revised tax brackets and marginal rates to align with economic circumstances and fiscal policy goals. These changes impact all Canadians, including residents of Calgary.

Federal Tax Brackets and Marginal Rates for 2024

Total income tax paid by Canadians comprises federal and provincial components. While the federal government sets the general structure of tax rates and brackets, provinces and territories can impose additional taxes. Therefore, taxpayers in different provinces have unique tax obligations. Here are the federal tax brackets and marginal rates for 2024:

15% on taxable income up to $55,867

20.5% on income between $55,867.01 and $111,733

26% on income between $111,733.01 and $173,205

29% on income between $173,205.01 and $246,752

33% on income above $246,752.01

It’s important to note that these rates apply nationwide, while additional provincial taxes may vary.

Tax Brackets and Marginal Rates for Alberta (including Calgary) in 2024

Alberta, home to Calgary, follows a flat-rate tax structure for all income levels, simplifying tax calculations but potentially posing challenges for low-wage workers. Here are the Alberta tax brackets and marginal rates for 2024:

10% on the first $148,269 of taxable income

12% on income between $148,269.01 and $177,922

13% on income between $177,922.01 and $237,230

14% on income between $237,230.01 and $355,845

15% on income above $355,845

Tax Planning Strategies

Effective tax planning is essential for individuals and corporations to minimize tax burdens and enhance after-tax income. Consider the following tax preparation strategies:

Savings for Retirement:

RRSP contributions offer tax deductibility, reducing taxable income.

TFSA investments use after-tax cash, providing tax-free gains and withdrawals.

Income Splitting:

Spousal RRSP contributions can be owned by the other spouse, allowing income sharing.

Capital Gains/Losses:

Timing capital gains can reduce taxes, and offsetting gains with losses is beneficial.

Credits and Deductions:

Utilize deductions such as mortgage interest, charitable donations, and educational credits to lower taxable income.

Strategies for Businesses:

Corporations can benefit from income splitting, tax deferral, and small company tax rates.

Deferring Taxes:

Delaying bonuses or retirement payouts to a lower-tax year can be advantageous.

Conclusion

A solid grasp of Canadian tax brackets and marginal rates is essential for individuals and businesses to navigate the tax system effectively. Staying informed about the latest amendments is crucial, and seeking professional tax services, such as D. Knight Consulting Inc, can assist in prompt and accurate tax return completion. By staying informed and seeking professional guidance, taxpayers can significantly reduce their tax burden while meeting their filing obligations.

0 notes

Text

Accounting and Financial Services Solutions Company

NSI Accounting and Financial Services offer customer-focused tax Preparation and accounting services to our clients across Calgary, Airdrie, Red Deer, Balzac, Chestermere, and Cochrane. Over the years, our clientele has grown in numbers, and our industry scope has diversified; however, our focus remains the same: the provision of tax preparation and planning — along with accounting services — to corporations, small and medium-sized businesses, individuals, and not-for-profit organizations across Canada and abroad.

Our goal is to make income tax planning and preparation understandable and uncomplicated. Well-informed clients make better decisions. Our customer-service approach ensures that the technical aspects are communicated in language that makes sense so that our clients understand how circumstances might impact them and their businesses.

We also strive to empower individuals and organizations to manage and grow their finances. We provide tax education through comprehensive consultation or workshops for entrepreneurs and self-employed individuals on the fundamentals of running a small corporation and business, as well as preparing for tax season.

Personal Tax Return

Every individual needs financial planning for his future endeavors. Before you plan, you should be aware of the taxes involved with your income, ways to use deductions or credits to reduce the taxable income, long and short-term financial goals, and other calculations involved with your taxes and finances. Moreover, you need an expert’s advice to file your taxes and the returns correctly without missing the deadline.

Experts at NSI Accounting & Financial Services are committed to assisting you in terms of providing expert advice and information on the everchanging government rules associated with taxes. Our services under personal taxes include:

Income Tax Preparation (T1s)

Non-Resident Tax Considerations

Retirement and Financial Planning

Real Estate Transactions and Rental Property Tax Considerations

Voluntary Tax Disclosure and Tax Appeals

We provide personal tax consultation and benefits claims for salaried individuals, independent contractors, students, Uber & Lyft drivers, and IT contractors from Calgary, Airdrie, Red Deer, Balzac, Chestermere, and Cochrane.

Bookkeeping

If you are a small business owner, vendor, non-profit organization, or a large corporate in Calgary, Airdrie, Red Deer, Balzac, Chestermere, and Cochrane, you need to have proper bookkeeping to ensure you do not miss anything while submitting your financial statements to the CRA. As a client of NSI Accounting & Financial Services, we provide customizable bookkeeping services and help you to focus on your business. Whether it is weekly, monthly, quarterly or annual accounts receivable/payable, payroll, tax filings, bank reconciliations, budgeting, or financial statements, our team will take over the financial matters, saving more time, taxes, and unwanted stress.

Our bookkeeping services include:

Data Entry

General Accounts Payable/Receivable Maintenance

Vendor Cheque Issuance

Bank Reconciliation

GST Returns

WCB Returns

Payroll Services

Whether it is a small business or a corporation, you need an updated, accurate payroll system for the timely remittance of pay-cheques to your employees. All we require is the monthly, bi-weekly, or weekly timesheet of employees from you. Our accountants at NSI Accounting & Financial Services take away your stress by handling the complex part of payroll services. We always stay up-to-date with the latest payroll legislation, keep you posted on any development or changes, and update the calculations accordingly.

Services included under payroll:

Processing of Direct Deposit Payroll

Annual T4 Statements

Canadian Emergency Wage Subsidy Support

0 notes

Link

Edmonton and Sherwood Park Bomcas Accounting and Tax Services Phone: 780-667-5250 email: [email protected] Website: https://ift.tt/3qNKqZe and https://bomcas.ca Grande Prairie Income Tax Return Preparation Services Medicine Hat Income Tax Return Preparation Services Airdrie Income Tax Return Preparation Services Camrose Income Tax Return Preparation Services Spruce Grove Income Tax Return Preparation Services Wetaskiwin Income Tax Return Preparation Services Lacombe Income Tax Return Preparation Services Cold Lake Income Tax Return Preparation Services Fort Saskatchewan Income Tax Return Preparation Services Canmore Income Tax Return Preparation Services Lloydminister Income Tax Return Preparation Services Brooks Income Tax Return Preparation Services Chestermere Income Tax Return Preparation Services Banff Income Tax Return Preparation Services Cochrane Income Tax Return Preparation Services High River Income Tax Return Preparation Services Stony Plain Income Tax Return Preparation Services Sylvan Lake Income Tax Return Preparation Services Okotoks Income Tax Return Preparation Services Strathmore Income Tax Return Preparation Services Drumheller Income Tax Return Preparation Services Morinville Income Tax Return Preparation Services Whitecourt Income Tax Return Preparation Services Hinton Income Tax Return Preparation Services Wood Buffalo Income Tax Return Preparation Services Blackfalds Income Tax Return Preparation Services Taber Income Tax Return Preparation Services Edson Income Tax Return Preparation Services Rocky Mountain House Income Tax Return Preparation Services Saint Paul Income Tax Return Preparation Services Wainwright Income Tax Return Preparation Services Olds Income Tax Return Preparation Services Slave Lake Income Tax Return Preparation Services Jasper Income Tax Return Preparation Services Coaldale Income Tax Return Preparation Services Stettler Income Tax Return Preparation Services Fort MacLeod Income Tax Return Preparation Services Cardston Income Tax Return Preparation Services Devon Income Tax Return Preparation Services Innisfail Income Tax Return Preparation Services Pincher Creek Income Tax Return Preparation Services Ponoka Income Tax Return Preparation Services

1 note

·

View note

Text

Choosing the Best Accounting Services

We can track our home and small business financial matters using software applications, and that’s why there is an increase in their popularity every day. However, a lot of people still prefer to use accounting services. Your financial issues will be taken care of when you hire such professionals, and this will make you enjoy peace of mind. Several factors have to be checked before accounting services are hired. Your personal situation will be suited by the accounting service that you will find with the help of those factors. Before you hire such service providers you should check their credentials. Before you sign any contract with them, this should be the first step you should make. The accounting service that you should hire is the one that has the proper credentials and training.

Because the laws and regulations for accounting keep changing every day, you should pick the one that is updated with the latest news. Accounting is governed by different laws even though this depends with where you come from. You should make sure you choose an accounting service that is appropriately qualified to work in your area. You should ask for referrals from people you know if you do not know where you can find the best accounting services. You can find several reputable accounting services also when you ask for referrals from business associates. Check out also Airdrie business accounting for more insight.

You need to know that there pros and cons of both small and large accounting services before you hire such services. The smaller service are the ones you should hire if a more personalized level of service is the one you want. Even though they might be the best option for you, they do not have a proper level of expertise for every situation. All the accountants of large accounting service handle the financial areas, and because of that reason, they are the best ones. The best option for you should be large accounting services if you have complicated taxes or financial issue. Sometimes they are impersonal even if they are the best option for your issues.

Before the financial issues of your business are handled by accounting services which you have haired, you should check how their price their services. Because large accounting firms want to remain competitive with other firms, they of the best rates sometimes. But some small firms may suit your budget because they have lower expenses. An advanced level of education is found with those account firms that employ certified public accountants. All kinds of financial issues can be solved by accountants of such services when hired. You should be prepared to pay higher fees if you want to employ the best services. See more here!

Try also to read this related post - https://www.huffingtonpost.com/deborah-sweeney/five-reasons-why-your-accounting_b_5120911.html

1 note

·

View note

Text

With Mounties due for a pay bump, cash-strapped municipalities seek reprieve from Ottawa

Mounties are due to obtain a chunk of retroactive pay after negotiating their first-ever collective agreement. Some municipalities say the looming income bump will stress their budget — and they prefer Ottawa to step up.

This summer, the federal government and the union representing RCMP participants ratified an agreement to deliver a large pay increase to nearly 20,000 members. Constables — who account for more than half of all RCMP officers — will see their maximum earnings jump from $86,110 as of April 2016 to $106,576 next year.

The deal also lays out retroactive pay increases going back to 2017. The RCMP last updated its wage scale in 2016. According to the agreement, the prices of pay will change within 90 days of Aug. 6, when the collective agreement was signed. It's then up to the RCMP to make its "best effort" to enforce the retroactive payable amounts within 270 days of signing.

The Federation of Canadian Municipalities (FCM) says communities that pay the RCMP for policing services are growing alarmed over the agreement's cost. "It's widespread coast to coast to coast and our municipalities are really very concerned, very, very concerned," said FCM president Joanne Vanderheyden, also the mayor of the municipality of Strathroy-Caradoc in Ontario.

"This problem is really urgent given the possible impacts on municipal finances." The RCMP is a federal organization but it offers policing services, under contract, to eight provinces, all three territories, about 150 municipalities and more than 600 Indigenous communities.

The price of the RCMP's offerings — including salaries and equipment — is split between the federal government and other levels of government. How much a municipality is on the hook for depends on its size.

Municipalities with populations of less than 15,000 pay 70 per cent of the costs, while the federal government can pay 30 per cent. Municipalities with more than 15,000 residents pay 90 per cent. Vanderheyden said that while negotiations on the collective agreement were happening behind closed doors, municipalities were advised through the federal government to set money aside to cover the expected pay hike.

"Well, the percentage was way too low," she said, adding the retroactive pay also came as a surprise to most mayors. "We are really not against collective bargaining. That's not it. It's when you're not at the table and the direct impact comes to you."

The FCM has written a letter to the federal government asking it to absorb all retroactive costs associated with the collective agreement. Without federal help, Vanderheyden said, "municipalities will be forced to make quite difficult decisions because they're either along have to make cuts to their imperative services or bypass it alongside to the property tax, local residents. Because they can't go into arrears, they can't go to deficits."

Peter Brown, mayor of Airdrie in Alberta, said that while he firmly supports paying RCMP officers more, he was surprised by the final price tag. He said his city, just north of Calgary, has budgeted and held money back over the past few years but nonetheless has only about half of what it wishes to cover the added policing costs.

"The message from me is, recognize that we've all been hit. We're all suffering," he said, referring to the pandemic. Malcolm Brodie, mayor of Richmond, B.C., said his municipality estimates the retroactive pay lump sum will cost it something between $9 million and $11 million, plus the annual pay increase itself.

"What that means for us is to cover that the amount going forward on our budget, it is about a one-time 2.5 to 3.5 per cent tax increase," he said. "We certainly have stayed with the RCMP for a good reason. We think that they've achieved a proper job for our community. Having said that, you know, it's getting a whole lot more expensive."

A spokesperson for the federal Department of Public Safety said the department has kept in touch with regions with RCMP contracts on a normal basis since 2018. "Contracting jurisdictions were aware that the salary of RCMP officers had been frozen since 2016 and that the collective bargaining process began in 2020. With the new collective agreement for RCMP regular members and reservists, salaries are in line with other police services across Canada," said Tim Warmington.

"It is fair for regular members and reservists as well as reasonable for Canadian taxpayers."

0 notes

Text

Giving Bookies Heavy Beatz to Keeping Fash Off Our Streets

Ok Kidz, So let’s see how the Investment Portfolio is performing this season, update on some old and new positions plus a little bit of politics. Politics I was very proud to be part of a successful counter demonstration to the far right DFLA in London . We blocked their path at one stage which led to them being re-routed. No Pasaran. No time for complacency though as media darling Stephen Yaxley-Lennon aka Tommy Knobinson will be keen to put the Forces of Darkness back on the streets.

Family Big Summer in the IceMan Family with Little Miss IceMan getting married to an Accountant (who can help count my winning). The occasion meant Mr and Mrs IceMan Junior travelled over from the States to attend so we had a fantastic get together.

Football Championship. Backed Derby at 5/1 for promotion and they sit in a play off position and only two points off an automatic promotion slot. Frank Lampard has some exciting young players in his squad and I expect them to be in the shake up come end of season . Now trading at 100/30 so an (IcePrice).

League One Charlton made a good start and caretaker-manager Lee Bowyer was appointed permanent manager off the back of it . Have gone backwards a bit lately and sit 5 points off a play off berth but have a game in hand . Backed at 9/2 for promotion but currently trade at a generous 10/1 so (ShitePrice) . Still hope they can remain competitive in chasing a play off place.

League Two Mansfield taken at 9/4 for promotion are now 7/4 so (IcePrice). This side have a habit of drawing too many games when throwing away winning positions . They should be challenging for automatic promotion but find themselves 6 points shy of the play offs. However they have 2 games in hand and I remain optimistic their fortunes will improve.

National League I did not originally make a pick in this Division as I was reluctant to take on firm favourites Salford. However after a couple of rounds of games I was surprised to see Leyton Orient available at 13/2 for promotion. I had to have some of that and it has turned out to be a nice touch . They now sit on top of the league and trading at 6/4 (IcePrice). Still a hard division to get out of and Salford are only a point behind.

Scottish Championship Got on Ross County at 5/2 to win this league. They sit nicely on top and trade at 4/6 (IcePrice) . This is obviously going well but I am not as happy as these odds would suggest. They have a one point margin over Ayr and a dangerous Dundee United are notŵ out of it.

Scottish League One Well every season there is always one shocker and this year it looks like Airdrie. Backed each way so I get a pay out if they come in top three. Thought 8/1 was good value but they are now 33/1 ( total ShitePrice).They are currently 6 points adrift of third place but their form has gone to pieces and they are fast moving backwards. This club is situated in the infamous Buckfast Triangle and it seems their players may have been on the brew.

Scottish League Two backed Clyde last season and to be fair they let me down . However they finished strongly and I was hoping some of that momentum would carry through to this season . They did in fact start brightly but their form has fallen way recently and they are 9 points behind shock leaders Edinburgh City and probably more ominously have given a 7 point head start to Peterhead as well . Took 11/4 and remarkably they still trade at 5/1 (ShitePrice) which suggests someone thinks they can improve. I though think this is in the loss column with Airdrie.

Bits and Bobs (new). Not many new positions taken and just as well as looking at the state of these two I seem to have been distracted by wedding events . NFL dunno why I bother but had a great tip that Jacksonville Jaguars were overpriced at 22/1 and so it looked as they started brilliantly and the odds tumbled to 11/1. This was then followed by four losses on the spin and an incident with a unpaid bar bill in London. Anyways price has gone out to 66/1 (total ShitePrice). The other recent bet was Athletico Madrid 16/1 Champions League . Had an easy looking group and good track record so what could go wrong. Well they got thrashed the other night 4-0 by Dortmund . There are somehow still trading at my price but I have gone very cool on them.

Bits and Bobs (old) Shame my GAA positions on Galway went down the pan . The Gaelic football was always a long shot but very disappointed about the Hurling . Galway started the game as strong favourites but were turned over by a determined Limerick team.

Lost on the long-standing Ryder Cup Golf bet. Had backed USA who got thrashed by Europe. This one did not hurt as much as Galway because had USA won then Trump would have claimed a slice of the Glory.

Speaking of the racist, misogynistic , narcissistic hate monger, let’s hope he takes a beating in the upcoming mid term elections . Predictions are he will keep the senate possibly strengthening his position due to the seats that are up for election at this cycle. However it is expected that he will lose the House which means Democrats can protect the Mueller investigation and pursue His dodgy tax returns. (unless he finds a reason to claim the election is void)

Sad to say Kurdish led SDF forces have been taking a lot of losses as a result of ‘Daesh’ attacks on the Syrian/ Iraqi border. Hoping they can regroup and defend territory against islamofash.

So that’s it.

Siamso Tutti Anti Fascisti

IceMan Investment Portfolio - More in Return

0 notes

Link

Crosby Business and Tax Services Ltd. tax accountants provide personal and corporate tax services to professionals and small businesses, wealth management, tax preparation, and planning services across Airdrie, North East, and North West Calgary.

0 notes

Text

Metro Bank creates 500 jobs in branch expansion

By: Sky News

Metro Bank has announced plans to create 500 new jobs as it continues to expand its interests beyond London and the South East.

The loss-making challenger bank, which first hit high streets a little over six years ago as major lenders juggled the damaging fallout from the financial crisis, said the new roles included customer-facing and head office positions.

It is also seeking more staff for its online operations and looming branch openings – with 12 in the immediate pipeline.

The lender currently has a branch network of 48 across London and southern England.

While it remains a small player, it has attracted 900,000 customer accounts.

Many of those people are likely to have been drawn in by its proposition of seven-day-a-week store opening – maybe even a pooch-friendly policy that includes free water and dog biscuits.

Its ambition, at least, is in stark contrast to the closure of branches and dramatic shift towards online banking followed by bigger, and its biggest, rivals in the domestic market as they look to save costs and invest more digitally.

Image Caption:

Many major banks in the UK are focused on their post-Brexit future

It was announced only on Wednesday that Clydesdale and Yorkshire banks were shutting more than a third of branches with the loss of 400 jobs.

While Airdrie Savings Bank, the UK’s last remaining independent savings bank, said it was to close after 182 years with 70 jobs going.

Both decisions were partly linked to the growth in mobile and internet banking but there is a wider issue for the sector in that retail banking profitability has been damaged by years of rock bottom interest rates – designed to help prop up the economy.

Lenders have moved to bolster earnings through higher volumes – with credit provision at an 11-year high.

:: Carney: Consumer-led growth may fizzle out

Metro Bank, which listed on the London Stock Exchange almost a year ago with shares offered at a reduced price because of wider market turmoil, has seen its stock climb 47% in value since.

It has outlined ambitious plans to achieve 110 branches by 2020 – with its expansion dragging on profitability to leave it loss-making on an annual basis since its launch.

It made its first pre-tax trading profit, of £0.6m, in the third quarter of 2016.

The post Metro Bank creates 500 jobs in branch expansion appeared first on GNL.

via: http://bit.ly/2jOQvme Geordie Norman Media 2013 ©

0 notes

Text

Every individual needs financial planning for his future endeavors. Before you plan, you should be aware of the taxes involved with your income, ways to use deductions or credits to reduce the taxable income, long and short-term financial goals, and other calculations involved with your taxes and finances. Moreover, it would be best if you had an expert’s advice to file your taxes and returns correctly without missing the deadline.

#Accounting Services Airdrie#Accounting Company Airdrie#tax and accounting Airdrie#Accounting Company irricana

0 notes

Text

How outsourced accounting can fuel your business’s growth

Do you want to explore how outsourced accounting can enhance business growth? If yes, then this blog can give you some better perception about it and also let you know why get professional accounting services in Airdrie.

At present, accounting firms need to create better innovation & planning to achieve success very effectively. During that time, considering outsourced accounting is the winning strategy and that can help you grab more benefits.

Top businesses can run their core operations successfully with multiple benefits by using the expertise of outsourced accounting service. Enterprises can reach new heights of long term growth & success with the help of outsourced accounting.

Many business leaders in the present business environment want better accounting service. A traditional accounting is the labor-intensive process that can help you maintain basic accounting & bookkeeping and track your business’s finances.

But it is the major function of most companies. It only gives limited financial details that can be somewhat helpful for companies. But when the company expects something more in accounting, then outsource accounting is the better choice.

Impact of client accounting services (CAS):

The client accounting service is not a strange service. It is similar to the outsourced accounting that has an experienced team to take care of business’s financial requirements. From simple to challenging business decisions they can make and handle the financial requirements of your business.

With this effective service, you can outsource your complete back-office accounting department and solve your accounting requirements. You can also effectively get the customized solution and lead your business into the success path.

Through outsourced accounting, your financial reporting process will get simple by leveraging the cloud technology platforms. It can be possible through easy-to-use dashboards, real-time reporting, enhanced day-to-day efficiencies and automated processes.

Different ways outsourced accounting fuel business growth:

There are different ways available that outsourced accounting can be helpful for business owners to fuel their growth. Check out below and explore such different ways:

Save cost via virtual accounting

Through outsourced accounting, it is possible to reduce overhead costs in multiple ways. There will be no need for you to train any in-house accounting bookkeeping experts when you have an outsourcing option. Therefore, here you can save cost via outsourced accounting. It can also eradicate additional office space, equipment and salary expenses. It can let companies use these resources to fuel their business growth.

Improved accuracy

During handling financial tasks, concentrating on accuracy is very essential. The outsourced accounting is completely responsible for the improved accuracy in handling your financial tasks. CPA firms have more expertise to ensure accurate financial records, outsource business accounting operations, compliance with regulations & timely tax filings.

Save time

Generally, the accounting process is really a hectic task and it will take more time to complete when people don’t have enough experience. It can also make you lose your concentration on other business activities.

During that time, outsourced accounting can help you a lot to save more time. With that, you can focus on your business strategy, sales and customer service. Finally, outsourced accounting can help you improve business productivity and growth by saving time.

Scalability

Accounting needs become very complex when your company expands. During that time, outsourced accounting can give you better scalability and flexibility to adapt to the requirements. Outsourced accounting can accommodate your changing needs if you need any support in accounting during peak seasons.

Access to advanced tools and technology

Outsourcing accounting has all the advanced tools & technology to simplify the financial operations effectively. Therefore companies can get access to technological advancements without any requirement for investment. It can help you use advanced tools to optimize financial management.

Better financial insights

Professional accounting firms have experienced accounting bookkeeping experts with better expertise and in-depth knowledge in tax regulations & finance. Through outsourced accounting, you can gain better access to the expertise and get better financial insights that can help you make better business decisions and enhance growth.

Mitigate risks

Outsourced accounting can be helpful to mitigate the risk of errors and fraud. It can ensure the security and integrity of the financial data by robust internal controls implementation. It can enhance overall stability and eradicate the financial management risks.

Business focus

Outsourced accounting can let you focus on your business strategic goals and core competencies. You can enhance customer satisfaction, explore new opportunities, grow business and much more.

Highly competitive advantage

Business can leverage the specialized resources and expertise with the help of outsourced accounting. It can be more helpful to streamline business financial processes and make better decisions and get timely financial data.

Finally, outsourced accounting can help business owners to overcome their competitors very easily. You can easily position your company for extraordinary growth. With that, you can experience how outsourced accounting fuels your business.

When businesses need outsourced accounting?

There are more reasons available that businesses need outsourced accounting, such reasons are:

Requirement for better systems

Businesses can get the better data when they get the access to the up-to-date accounting systems after outsourced accounting involvement.

Requirement for better data

Businesses can easily get proper visibility into the data like key ratios, industry comparisons and trends.

Lack of time in getting information from in-house staff

The in-house staff usually give financial information very slowly and hence businesses have more possibilities of losing many processes. An outsourced accounting can help you during this time and let you get financial information on time.

Books are inaccurate or messy

Sure ordinary bookkeepers never provide accurate accounting data. Hence the financial information many get completely wrong. During that time, outsourced accounting can give accurate information regarding financial details.

Labor costs

If the business needs to train an accounting team it can cost more. They have to pay more salary. But instead, outsourced accounting can save more labor costs.

Conclusion:

From the above mentioned scenario, you have now explored how outsourced accounting can enhance business growth and why get professional accounting services in Airdrie. Hence outsourced accounting can effectively fuel your business.

Source – wordhippo

#professional accounting services in Airdrie#Outsource accounting#outsourced accounting#Accounting Firm in Airdrie#Airdrie Accountant Near Me#Airdrie Accounting Services#Airdrie Business Accounting#Business Valuation Services Airdrie#accounting#accounting services

0 notes

Text

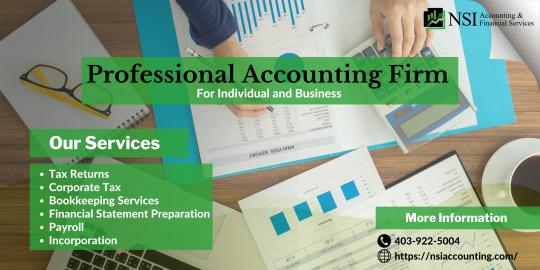

Professional Accounting Firm

NSI Accounting and Financial Services is the best choice for small to medium businesses and individuals seeking tax filing, incorporation services, and financial advice. We stay updated with the latest changes in provincial and tax reforms and incorporate them without delay.

#accounting agency#accounting service company airdrie#corporate accounting services Airdrie#tax and accounting services Airdrie

0 notes

Text

Tax Preparation Services

Need help in Tax preparation in Calgary? NSI Accounting is here to help with all types of tax preparation for your business. Call now at 403-922-5004.

#tax and accounting services airdrie#accounting company irricana#tax prep#tax preparation Calgary#Tax Preparation Airdrie

0 notes

Text

Our goal is to make income tax planning and preparation understandable and uncomplicated. Well-informed clients make better decisions. Our customer-service approach ensures that the technical aspects are communicated in language that makes sense so that our clients understand how circumstances might impact them and their businesses.

#Accounting Services Airdrie#tax and accounting services Airdrie#accounting services company cochrane#tax and accounting services cochrane#Accounting Services irricana

0 notes

Text

We also strive to empower individuals and organizations to manage and grow their finances. We provide tax education through comprehensive consultation or workshops for entrepreneurs and self-employed individuals on the fundamentals of running a small corporation and business, as well as preparing for tax season.

#Accounting Services Airdrie#tax and accounting services Airdrie#accounting services company cochrane#tax and accounting services cochrane#Accounting Services irricana

0 notes

Link

Every individual needs financial planning for his future endeavors. Before you plan, you should be aware of the taxes involved with your income, ways to use deductions or credits to reduce the taxable income, long and short-term financial goals, and other calculations involved with your taxes and finances. Moreover, you need an expert’s advice to file your taxes and the returns correctly without missing the deadline.

#Accounting Services Airdrie#Accounting Services cochrane#tax and accounting services Airdrie#tax and accounting services cochrane

0 notes