#semiconductor shortage

Explore tagged Tumblr posts

Text

Rising Demand, Bull Market, Leads to ASIC Mining Hardware Price Hikes

The Bitcoin mining hardware market is experiencing notable price increases, with Bitmain’s Antminer S21 series units rising by 5-10% month-over-month across various marketplaces. Older models, such as the Antminer S19j Pro, have seen even more significant price hikes, with increases reaching up to 30% in the same timeframe. These price surges reflect a growing demand for efficient mining…

#Antminer S19j Pro#Antminer S21 series#Bitcoin halving#Bitcoin mining hardware#hardware availability#Market Trends#mining equipment demand#mining profitability#price increase#semiconductor shortage

0 notes

Text

ASML chip machines blocked from export to China

Cutting-edge chip manufacturing machines from Dutch semiconductor giant ASML have been blocked from export to China, according to the firm, amid a report of US pressure in the strategic sector. ASML said in a statement late Monday the Dutch government had recently revoked a licence for shipping an unspecified number of machines “impacting a small number of customers in China.” Semiconductors,…

View On WordPress

#ASML ban#ASML chip#ASML chip blocked#ASML chip machines#china chip ban#chip ban#chip machine#chip shortage#semiconductor#semiconductor shortage#us chip ban

0 notes

Text

US launches $1.6B bid to outpace Asia in packaging tech

New Post has been published on https://thedigitalinsider.com/us-launches-1-6b-bid-to-outpace-asia-in-packaging-tech/

US launches $1.6B bid to outpace Asia in packaging tech

.pp-multiple-authors-boxes-wrapper display:none; img width:100%;

The US is betting big on the future of semiconductor technology, launching a $1.6 billion competition to revolutionise chip packaging and challenge Asia’s longstanding dominance in the field. On July 9, 2024, the US Department of Commerce unveiled its ambitious plan to turbocharge domestic advanced packaging capabilities, a critical yet often overlooked aspect of semiconductor manufacturing.

This move, part of the Biden-Harris Administration’s CHIPS for America program, comes as the US seeks to revitalise its semiconductor industry and reduce dependence on foreign suppliers. Advanced packaging, a crucial step in semiconductor production, has long been dominated by Asian countries like Taiwan and South Korea. By investing heavily in this area, the US aims to reshape the global semiconductor landscape and position itself at the forefront of next-generation chip technology, marking a significant shift in the industry’s balance of power.

US Secretary of Commerce Gina Raimondo emphasised the importance of this move, stating, “President Biden was clear that we need to build a vibrant domestic semiconductor ecosystem here in the US, and advanced packaging is a huge part of that. Thanks to the Biden-Harris Administration’s commitment to investing in America, the US will have multiple advanced packaging options across the country and push the envelope in new packaging technologies.”

The competition will focus on five key R&D areas: equipment and process integration, power delivery and thermal management, connector technology, chiplets ecosystem, and co-design/electronic design automation. The Department of Commerce anticipates making several awards of approximately $150 million each in federal funding per research area, leveraging additional investments from industry and academia.

This strategic investment comes at a crucial time, as emerging AI applications are pushing the boundaries of current technologies. Advanced packaging allows for improvements in system performance, reduced physical footprint, lower power consumption, and decreased costs – all critical factors in maintaining technological leadership.

The Biden-Harris Administration’s push to revitalise American semiconductor manufacturing comes as the global chip shortage has highlighted the risks of overreliance on foreign suppliers. Asia, particularly Taiwan, currently dominates the advanced packaging market. According to a 2021 report by the Semiconductor Industry Association, the US accounts for only 3% of global packaging, testing, and assembly capacity, while Taiwan holds a 54% share, followed by China at 16%.

Under Secretary of Commerce for Standards and Technology and National Institute of Standards and Technology (NIST) Director Laurie E. Locascio outlined an ambitious vision for the program: “Within a decade, through R&D funded by CHIPS for America, we will create a domestic packaging industry where advanced node chips manufactured in the US and abroad can be packaged within the States and where innovative designs and architectures are enabled through leading-edge packaging capabilities.”

The announcement builds on previous efforts by the CHIPS for America program. In February 2024, the program released its first funding opportunity for the National Advanced Packaging Manufacturing Program (NAPMP), focusing on advanced packaging substrates and substrate materials. That initiative garnered significant interest, with over 100 concept papers submitted from 28 states. On May 22, 2024, eight teams were selected to submit complete applications for funding of up to $100 million each over five years.

According to Laurie, the goal is to create multiple high-volume packaging facilities by the decade’s end and reduce reliance on Asian supply lines that pose a security risk that the US “just can’t accept.” In short, the government is prioritising ensuring America’s leadership in all elements of semiconductor manufacturing, “of which advanced packaging is one of the most exciting and critical areas,” White House spokeswoman Robyn Patterson said.

The latest competition is expected to attract significant interest from the US semiconductor ecosystem and shift that balance. It promises substantial federal funding and the opportunity to shape the future of American chip manufacturing. As the global demand for advanced semiconductors continues to grow, driven by AI, 5G, and other emerging technologies, the stakes for technological leadership have never been higher.

As the US embarks on this ambitious endeavour, the world will see if this $1.6 billion bet can challenge Asia’s stronghold on advanced chip packaging and restore America’s position at the forefront of semiconductor innovation.

(Photo by Braden Collum)

See also: Global semiconductor shortage: How the US plans to close the talent gap

Want to learn more about AI and big data from industry leaders? Check out AI & Big Data Expo taking place in Amsterdam, California, and London. The comprehensive event is co-located with other leading events including Intelligent Automation Conference, BlockX, Digital Transformation Week, and Cyber Security & Cloud Expo.

Explore other upcoming enterprise technology events and webinars powered by TechForge here.

Tags: ai, AI semiconductor, artificial intelligence, chips act, law, legal, Legislation, Politics, semiconductor, usa

#2024#5G#Accounts#Administration#ai#ai & big data expo#AI semiconductor#America#amp#applications#Art#artificial#Artificial Intelligence#Asia#automation#betting#biden#Big Data#billion#Business#challenge#China#chip#chip shortage#chips#chips act#Cloud#Commerce#competition#comprehensive

3 notes

·

View notes

Text

8 Regional Microelectronics Hubs Across US To Bolster Chip Industry

The U.S. Defense Department is establishing eight regional microelectronics hubs in seven states across the country aimed at helping spur manufacturing innovation to bolster the domestic semiconductor-industrial base.

View On WordPress

0 notes

Text

breaking out my ic card holder again 😌

#mine#also glad i brought mine bc apparently they stopped selling new ic cards indefinitely due to a semiconductor shortage @__@

1 note

·

View note

Text

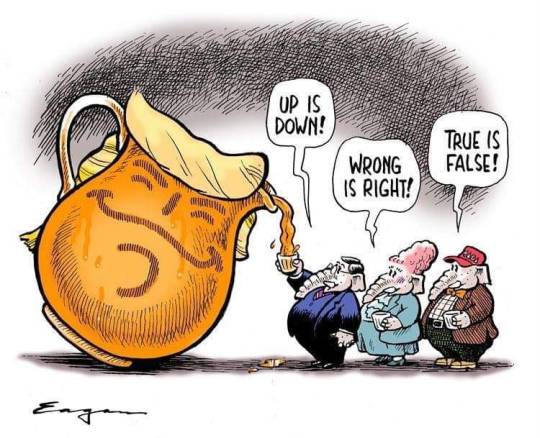

Autoenshittification

Forget F1: the only car race that matters now is the race to turn your car into a digital extraction machine, a high-speed inkjet printer on wheels, stealing your private data as it picks your pocket. Your car’s digital infrastructure is a costly, dangerous nightmare — but for automakers in pursuit of postcapitalist utopia, it’s a dream they can’t give up on.

Your car is stuffed full of microchips, a fact the world came to appreciate after the pandemic struck and auto production ground to a halt due to chip shortages. Of course, that wasn’t the whole story: when the pandemic started, the automakers panicked and canceled their chip orders, only to immediately regret that decision and place new orders.

But it was too late: semiconductor production had taken a serious body-blow, and when Big Car placed its new chip orders, it went to the back of a long, slow-moving line. It was a catastrophic bungle: microchips are so integral to car production that a car is basically a computer network on wheels that you stick your fragile human body into and pray.

The car manufacturers got so desperate for chips that they started buying up washing machines for the microchips in them, extracting the chips and discarding the washing machines like some absurdo-dystopian cyberpunk walnut-shelling machine:

https://www.autoevolution.com/news/desperate-times-companies-buy-washing-machines-just-to-rip-out-the-chips-187033.html

These digital systems are a huge problem for the car companies. They are the underlying cause of a precipitous decline in car quality. From touch-based digital door-locks to networked sensors and cameras, every digital system in your car is a source of endless repair nightmares, costly recalls and cybersecurity vulnerabilities:

https://www.reuters.com/business/autos-transportation/quality-new-vehicles-us-declining-more-tech-use-study-shows-2023-06-22/

What’s more, drivers hate all the digital bullshit, from the janky touchscreens to the shitty, wildly insecure apps. Digital systems are drivers’ most significant point of dissatisfaction with the automakers’ products:

https://www.theverge.com/23801545/car-infotainment-customer-satisifaction-survey-jd-power

Even the automakers sorta-kinda admit that this is a problem. Back in 2020 when Massachusetts was having a Right-to-Repair ballot initiative, Big Car ran these unfuckingbelievable scare ads that basically said, “Your car spies on you so comprehensively that giving anyone else access to its systems will let murderers stalk you to your home and kill you:

https://pluralistic.net/2020/09/03/rip-david-graeber/#rolling-surveillance-platforms

But even amid all the complaining about cars getting stuck in the Internet of Shit, there’s still not much discussion of why the car-makers are making their products less attractive, less reliable, less safe, and less resilient by stuffing them full of microchips. Are car execs just the latest generation of rubes who’ve been suckered by Silicon Valley bullshit and convinced that apps are a magic path to profitability?

Nope. Car execs are sophisticated businesspeople, and they’re surfing capitalism’s latest — and last — hot trend: dismantling capitalism itself.

Now, leftists have been predicting the death of capitalism since The Communist Manifesto, but even Marx and Engels warned us not to get too frisky: capitalism, they wrote, is endlessly creative, constantly reinventing itself, re-emerging from each crisis in a new form that is perfectly adapted to the post-crisis reality:

https://www.nytimes.com/2022/10/31/books/review/a-spectre-haunting-china-mieville.html

But capitalism has finally run out of gas. In his forthcoming book, Techno Feudalism: What Killed Capitalism, Yanis Varoufakis proposes that capitalism has died — but it wasn’t replaced by socialism. Rather, capitalism has given way to feudalism:

https://www.penguin.co.uk/books/451795/technofeudalism-by-varoufakis-yanis/9781847927279

Under capitalism, capital is the prime mover. The people who own and mobilize capital — the capitalists — organize the economy and take the lion’s share of its returns. But it wasn’t always this way: for hundreds of years, European civilization was dominated by rents, not markets.

A “rent” is income that you get from owning something that other people need to produce value. Think of renting out a house you own: not only do you get paid when someone pays you to live there, you also get the benefit of rising property values, which are the result of the work that all the other homeowners, business owners, and residents do to make the neighborhood more valuable.

The first capitalists hated rent. They wanted to replace the “passive income” that landowners got from taxing their serfs’ harvest with active income from enclosing those lands and grazing sheep in order to get wool to feed to the new textile mills. They wanted active income — and lots of it.

Capitalist philosophers railed against rent. The “free market” of Adam Smith wasn’t a market that was free from regulation — it was a market free from rents. The reason Smith railed against monopolists is because he (correctly) understood that once a monopoly emerged, it would become a chokepoint through which a rentier could cream off the profits he considered the capitalist’s due:

https://locusmag.com/2021/03/cory-doctorow-free-markets/

Today, we live in a rentier’s paradise. People don’t aspire to create value — they aspire to capture it. In Survival of the Richest, Doug Rushkoff calls this “going meta”: don’t provide a service, just figure out a way to interpose yourself between the provider and the customer:

https://pluralistic.net/2022/09/13/collapse-porn/#collapse-porn

Don’t drive a cab, create Uber and extract value from every driver and rider. Better still: don’t found Uber, invest in Uber options and extract value from the people who invest in Uber. Even better, invest in derivatives of Uber options and extract value from people extracting value from people investing in Uber, who extract value from drivers and riders. Go meta.

This is your brain on the four-hour-work-week, passive income mind-virus. In Techno Feudalism, Varoufakis deftly describes how the new “Cloud Capital” has created a new generation of rentiers, and how they have become the richest, most powerful people in human history.

Shopping at Amazon is like visiting a bustling city center full of stores — but each of those stores’ owners has to pay the majority of every sale to a feudal landlord, Emperor Jeff Bezos, who also decides which goods they can sell and where they must appear on the shelves. Amazon is full of capitalists, but it is not a capitalist enterprise. It’s a feudal one:

https://pluralistic.net/2022/11/28/enshittification/#relentless-payola

This is the reason that automakers are willing to enshittify their products so comprehensively: they were one of the first industries to decouple rents from profits. Recall that the reason that Big Car needed billions in bailouts in 2008 is that they’d reinvented themselves as loan-sharks who incidentally made cars, lending money to car-buyers and then “securitizing” the loans so they could be traded in the capital markets.

Even though this strategy brought the car companies to the brink of ruin, it paid off in the long run. The car makers got billions in public money, paid their execs massive bonuses, gave billions to shareholders in buybacks and dividends, smashed their unions, fucked their pensioned workers, and shipped jobs anywhere they could pollute and murder their workforce with impunity.

Car companies are on the forefront of postcapitalism, and they understand that digital is the key to rent-extraction. Remember when BMW announced that it was going to rent you the seatwarmer in your own fucking car?

https://pluralistic.net/2020/07/02/big-river/#beemers

Not to be outdone, Mercedes announced that they were going to rent you your car’s accelerator pedal, charging an extra $1200/year to unlock a fully functional acceleration curve:

https://www.theverge.com/2022/11/23/23474969/mercedes-car-subscription-faster-acceleration-feature-price

This is the urinary tract infection business model: without digitization, all your car’s value flowed in a healthy stream. But once the car-makers add semiconductors, each one of those features comes out in a painful, burning dribble, with every button on that fakakta touchscreen wired directly into your credit-card.

But it’s just for starters. Computers are malleable. The only computer we know how to make is the Turing Complete Von Neumann Machine, which can run every program we know how to write. Once they add networked computers to your car, the Car Lords can endlessly twiddle the knobs on the back end, finding new ways to extract value from you:

https://doctorow.medium.com/twiddler-1b5c9690cce6

That means that your car can track your every movement, and sell your location data to anyone and everyone, from marketers to bounty-hunters looking to collect fees for tracking down people who travel out of state for abortions to cops to foreign spies:

https://www.vice.com/en/article/n7enex/tool-shows-if-car-selling-data-privacy4cars-vehicle-privacy-report

Digitization supercharges financialization. It lets car-makers offer subprime auto-loans to desperate, poor people and then killswitch their cars if they miss a payment:

https://www.youtube.com/watch?v=4U2eDJnwz_s

Subprime lending for cars would be a terrible business without computers, but digitization makes it a great source of feudal rents. Car dealers can originate loans to people with teaser rates that quickly blow up into payments the dealer knows their customer can’t afford. Then they repo the car and sell it to another desperate person, and another, and another:

https://pluralistic.net/2022/07/27/boricua/#looking-for-the-joke-with-a-microscope

Digitization also opens up more exotic options. Some subprime cars have secondary control systems wired into their entertainment system: miss a payment and your car radio flips to full volume and bellows an unstoppable, unmutable stream of threats. Tesla does one better: your car will lock and immobilize itself, then blare its horn and back out of its parking spot when the repo man arrives:

https://tiremeetsroad.com/2021/03/18/tesla-allegedly-remotely-unlocks-model-3-owners-car-uses-smart-summon-to-help-repo-agent/

Digital feudalism hasn’t stopped innovating — it’s just stopped innovating good things. The digital device is an endless source of sadistic novelties, like the cellphones that disable your most-used app the first day you’re late on a payment, then work their way down the other apps you rely on for every day you’re late:

https://restofworld.org/2021/loans-that-hijack-your-phone-are-coming-to-india/

Usurers have always relied on this kind of imaginative intimidation. The loan-shark’s arm-breaker knows you’re never going to get off the hook; his goal is in intimidating you into paying his boss first, liquidating your house and your kid’s college fund and your wedding ring before you default and he throws you off a building.

Thanks to the malleability of computerized systems, digital arm-breakers have an endless array of options they can deploy to motivate you into paying them first, no matter what it costs you:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Car-makers are trailblazers in imaginative rent-extraction. Take VIN-locking: this is the practice of adding cheap microchips to engine components that communicate with the car’s overall network. After a new part is installed in your car, your car’s computer does a complex cryptographic handshake with the part that requires an unlock code provided by an authorized technician. If the code isn’t entered, the car refuses to use that part.

VIN-locking has exploded in popularity. It’s in your iPhone, preventing you from using refurb or third-party replacement parts:

https://doctorow.medium.com/apples-cement-overshoes-329856288d13

It’s in fuckin’ ventilators, which was a nightmare during lockdown as hospital techs nursed their precious ventilators along by swapping parts from dead systems into serviceable ones:

https://www.vice.com/en/article/3azv9b/why-repair-techs-are-hacking-ventilators-with-diy-dongles-from-poland

And of course, it’s in tractors, along with other forms of remote killswitch. Remember that feelgood story about John Deere bricking the looted Ukrainian tractors whose snitch-chips showed they’d been relocated to Russia?

https://doctorow.medium.com/about-those-kill-switched-ukrainian-tractors-bc93f471b9c8

That wasn’t a happy story — it was a cautionary tale. After all, John Deere now controls the majority of the world’s agricultural future, and they’ve boobytrapped those ubiquitous tractors with killswitches that can be activated by anyone who hacks, takes over, or suborns Deere or its dealerships.

Control over repair isn’t limited to gouging customers on parts and service. When a company gets to decide whether your device can be fixed, it can fuck you over in all kinds of ways. Back in 2019, Tim Apple told his shareholders to expect lower revenues because people were opting to fix their phones rather than replace them:

https://www.apple.com/newsroom/2019/01/letter-from-tim-cook-to-apple-investors/

By usurping your right to decide who fixes your phone, Apple gets to decide whether you can fix it, or whether you must replace it. Problem solved — and not just for Apple, but for car makers, tractor makers, ventilator makers and more. Apple leads on this, even ahead of Big Car, pioneering a “recycling” program that sees trade-in phones shredded so they can’t possibly be diverted from an e-waste dump and mined for parts:

https://www.vice.com/en/article/yp73jw/apple-recycling-iphones-macbooks

John Deere isn’t sleeping on this. They’ve come up with a valuable treasure they extract when they win the Right-to-Repair: Deere singles out farmers who complain about its policies and refuses to repair their tractors, stranding them with six-figure, two-ton paperweight:

https://pluralistic.net/2022/05/31/dealers-choice/#be-a-shame-if-something-were-to-happen-to-it

The repair wars are just a skirmish in a vast, invisible fight that’s been waged for decades: the War On General-Purpose Computing, where tech companies use the law to make it illegal for you to reconfigure your devices so they serve you, rather than their shareholders:

https://memex.craphound.com/2012/01/10/lockdown-the-coming-war-on-general-purpose-computing/

The force behind this army is vast and grows larger every day. General purpose computers are antithetical to technofeudalism — all the rents extracted by technofeudalists would go away if others (tinkereres, co-ops, even capitalists!) were allowed to reconfigure our devices so they serve us.

You’ve probably noticed the skirmishes with inkjet printer makers, who can only force you to buy their ink at 20,000% markups if they can stop you from deciding how your printer is configured:

https://pluralistic.net/2022/08/07/inky-wretches/#epson-salty But we’re also fighting against insulin pump makers, who want to turn people with diabetes into walking inkjet printers:

https://pluralistic.net/2022/06/10/loopers/#hp-ification

And companies that make powered wheelchairs:

https://pluralistic.net/2022/06/08/chair-ish/#r2r

These companies start with people who have the least agency and social power and wreck their lives, then work their way up the privilege gradient, coming for everyone else. It’s called the “shitty technology adoption curve”:

https://pluralistic.net/2022/08/21/great-taylors-ghost/#solidarity-or-bust

Technofeudalism is the public-private-partnership from hell, emerging from a combination of state and private action. On the one hand, bailing out bankers and big business (rather than workers) after the 2008 crash and the covid lockdown decoupled income from profits. Companies spent billions more than they earned were still wildly profitable, thanks to those public funds.

But there’s also a policy dimension here. Some of those rentiers’ billions were mobilized to both deconstruct antitrust law (allowing bigger and bigger companies and cartels) and to expand “IP” law, turning “IP” into a toolsuite for controlling the conduct of a firm’s competitors, critics and customers:

https://locusmag.com/2020/09/cory-doctorow-ip/

IP is key to understanding the rise of technofeudalism. The same malleability that allows companies to “twiddle” the knobs on their services and keep us on the hook as they reel us in would hypothetically allow us to countertwiddle, seizing the means of computation:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

The thing that stands between you and an alternative app store, an interoperable social media network that you can escape to while continuing to message the friends you left behind, or a car that anyone can fix or unlock features for is IP, not technology. Under capitalism, that technology would already exist, because capitalists have no loyalty to one another and view each other’s margins as their own opportunities.

But under technofeudalism, control comes from rents (owning things), not profits (selling things). The capitalist who wants to participate in your iPhone’s “ecosystem” has to make apps and submit them to Apple, along with 30% of their lifetime revenues — they don’t get to sell you jailbreaking kit that lets you choose their app store.

Rent-seeking technology has a holy grail: control over “ring zero” — the ability to compel you to configure your computer to a feudalist’s specifications, and to verify that you haven’t altered your computer after it came into your possession:

https://pluralistic.net/2022/01/30/ring-minus-one/#drm-political-economy

For more than two decades, various would-be feudal lords and their court sorcerers have been pitching ways of doing this, of varying degrees of outlandishness.

At core, here’s what they envision: inside your computer, they will nest another computer, one that is designed to run a very simple set of programs, none of which can be altered once it leaves the factory. This computer — either a whole separate chip called a “Trusted Platform Module” or a region of your main processor called a secure enclave — can tally observations about your computer: which operating system, modules and programs it’s running.

Then it can cryptographically “sign” these observations, proving that they were made by a secure chip and not by something you could have modified. Then you can send this signed “attestation” to someone else, who can use it to determine how your computer is configured and thus whether to trust it. This is called “remote attestation.”

There are some cool things you can do with remote attestation: for example, two strangers playing a networked video game together can use attestations to make sure neither is running any cheat modules. Or you could require your cloud computing provider to use attestations that they aren’t stealing your data from the server you’re renting. Or if you suspect that your computer has been infected with malware, you can connect to someone else and send them an attestation that they can use to figure out whether you should trust it.

Today, there’s a cool remote attestation technology called “PrivacyPass” that replaces CAPTCHAs by having you prove to your own device that you are a human. When a server wants to make sure you’re a person, it sends a random number to your device, which signs that number along with its promise that it is acting on behalf of a human being, and sends it back. CAPTCHAs are all kinds of bad — bad for accessibility and privacy — and this is really great.

But the billions that have been thrown at remote attestation over the decades is only incidentally about solving CAPTCHAs or verifying your cloud server. The holy grail here is being able to make sure that you’re not running an ad-blocker. It’s being able to remotely verify that you haven’t disabled the bossware your employer requires. It’s the power to block someone from opening an Office365 doc with LibreOffice. It’s your boss’s ability to ensure that you haven’t modified your messaging client to disable disappearing messages before he sends you an auto-destructing memo ordering you to break the law.

And there’s a new remote attestation technology making the rounds: Google’s Web Environment Integrity, which will leverage Google’s dominance over browsers to allow websites to block users who run ad-blockers:

https://github.com/RupertBenWiser/Web-Environment-Integrity

There’s plenty else WEI can do (it would make detecting ad-fraud much easier), but for every legitimate use, there are a hundred ways this could be abused. It’s a technology purpose-built to allow rent extraction by stripping us of our right to technological self-determination.

Releasing a technology like this into a world where companies are willing to make their products less reliable, less attractive, less safe and less resilient in pursuit of rents is incredibly reckless and shortsighted. You want unauthorized bread? This is how you get Unauthorized Bread:

https://arstechnica.com/gaming/2020/01/unauthorized-bread-a-near-future-tale-of-refugees-and-sinister-iot-appliances/amp/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

[Image ID: The interior of a luxury car. There is a dagger protruding from the steering wheel. The entertainment console has been replaced by the text 'You wouldn't download a car,' in MPAA scare-ad font. Outside of the windscreen looms the Matrix waterfall effect. Visible in the rear- and side-view mirror is the driver: the figure from Munch's 'Scream.' The screen behind the steering-wheel has been replaced by the menacing red eye of HAL9000 from Stanley Kubrick's '2001: A Space Odyssey.']

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#shitty technology adoption curve#unauthorized bread#automotive#arm-breakers#cars#big car#right to repair#rent-seeking#digital feudalism#neofeudalism#drm#wei#remote attestation#private access tokens#yannis varoufakis#web environment integrity#paternalism#war on general purpose computing#competitive compatibility#google#enshittification#interoperability#adversarial interoperability#comcom#the internet con#postcapitalism#ring zero#care#med-tech

4K notes

·

View notes

Text

Semiconductor-free logic gates pave the way for fully 3D-printed active electronics

Active electronics—components that can control electrical signals—usually contain semiconductor devices that receive, store, and process information. These components, which must be made in a clean room, require advanced fabrication technology that is not widely available outside a few specialized manufacturing centers. During the COVID-19 pandemic, the lack of widespread semiconductor fabrication facilities was one cause of a worldwide electronics shortage, which drove up costs for consumers and had implications in everything from economic growth to national defense. The ability to 3D print an entire, active electronic device without the need for semiconductors could bring electronics fabrication to businesses, labs, and homes across the globe.

Read more.

18 notes

·

View notes

Text

Semiconductors: The Driving Force Behind Technological Advancements

The semiconductor industry is a crucial part of our modern society, powering everything from smartphones to supercomputers. The industry is a complex web of global interests, with multiple players vying for dominance.

Taiwan has long been the dominant player in the semiconductor industry, with Taiwan Semiconductor Manufacturing Company (TSMC) accounting for 54% of the market in 2020. TSMC's dominance is due in part to the company's expertise in semiconductor manufacturing, as well as its strategic location in Taiwan. Taiwan's proximity to China and its well-developed infrastructure make it an ideal location for semiconductor manufacturing.

However, Taiwan's dominance also brings challenges. The company faces strong competition from other semiconductor manufacturers, including those from China and South Korea. In addition, Taiwan's semiconductor industry is heavily dependent on imports, which can make it vulnerable to supply chain disruptions.

China is rapidly expanding its presence in the semiconductor industry, with the government investing heavily in research and development (R&D) and manufacturing. China's semiconductor industry is led by companies such as SMIC and Tsinghua Unigroup, which are rapidly expanding their capacity. However, China's industry still lags behind Taiwan's in terms of expertise and capacity.

South Korea is another major player in the semiconductor industry, with companies like Samsung and SK Hynix owning a significant market share. South Korea's semiconductor industry is known for its expertise in memory chips such as DRAM and NAND flash. However, the industry is heavily dependent on imports, which can make it vulnerable to supply chain disruptions.

The semiconductor industry is experiencing significant trends, including the growth of the Internet of Things (IoT), the rise of artificial intelligence (AI), and the increasing demand for 5G technology. These trends are driving semiconductor demand, which is expected to continue to grow in the coming years.

However, the industry also faces major challenges, including a shortage of skilled workers, the increasing complexity of semiconductor manufacturing and the need for more sustainable and environmentally friendly manufacturing processes.

To overcome the challenges facing the industry, it is essential to invest in research and development, increase the availability of skilled workers and develop more sustainable and environmentally friendly manufacturing processes. By working together, governments, companies and individuals can ensure that the semiconductor industry remains competitive and sustainable, and continues to drive innovation and economic growth in the years to come.

Chip War, the Race for Semiconductor Supremacy (2023) (TaiwanPlus Docs, October 2024)

youtube

Dr. Keyu Jin, a tenured professor of economics at the London School of Economics and Political Science, argues that many in the West misunderstand China’s economic and political models. She maintains that China became the most successful economic story of our time by shifting from primarily state-owned enterprises to an economy more focused on entrepreneurship and participation in the global economy.

Dr. Keyu Jin: Understanding a Global Superpower - Another Look at the Chinese Economy (Wheeler Institute for Economy, October 2024)

youtube

Dr. Keyu Jin: China's Economic Prospects and Global Impact (Global Institute For Tomorrow, July 2024)

youtube

The following conversation highlights the complexity and nuance of Xi Jinping's ideology and its relationship to traditional Chinese thought, and emphasizes the importance of understanding the internal dynamics of the Chinese Communist Party and the ongoing debates within the Chinese system.

Dr. Kevin Rudd: On Xi Jinping - How Xi's Marxist Nationalism Is Shaping China and the World (Asia Society, October 2024)

youtube

Tuesday, October 29, 2024

#semiconductor industry#globalization#technology#innovation#research#development#sustainability#economic growth#documentary#ai assisted writing#machine art#Youtube#presentation#discussion#china#taiwán#south korea

7 notes

·

View notes

Text

matthalle, tbc?? (1,300 words)

(some was already posted) @neallo sorz im late

Nothing happens at an expensive pub in South London. The lights are low, dark wood and frosted glass. Vermouth distilled in the 80s. Loafers and calf leather Oxfords.

Matt’s chilled lager sweats in his hand.

Halle stares out the window. Another odd Tuesday. They’re both three drinks in.

It’s fine company.

—

Thing is, Matt has always been taken by vicious blondes. Call it a character flaw, a rule of his life. Since Mary in the first grade. Linda, Mello. Maybe the Amane chick was a bit of a departure, not so vicious, but just barely. A change of pace but not of theme.

And really, who could blame Matt’s blue balls, six months in a one-room with Mello. Lockdown, for the detox and even more for the mission, for fancying Amane’s pigtails and perky tits.

Halle is another beast altogether. Matt’s learned about her three older brothers. Military father, granddaughter of a minister. All-girl’s finishing school in Massachusetts, Oxford, Cambridge, UN, Interpol. Matt imagines she’s the type to wear vintage La Perla under her pantsuits. He knows her heels have red under soles, and that her perfume is worth more than his two year lease in Covent Garden.

She hasn’t let him verify the panties hunch. But to be fair, he hasn’t tried and hasn’t asked. They get along. Every elephant in the room can be shut out with booze, or blow, or chatting about this case or the weather in Nairobi, the coups in Bolivia, the semiconductor shortages, the latest episode of Doctor Who.

—

Nothing happens at the bar. Amongst the suits and the highballers, they talk. It's difficult to find someone else who's been through the same shit as you, these days. They're all dead.

Halle knew Mello. Matt knew Mello. Halle's beautiful. Matt's got a tender spot for beauty, being a mediocre creature of god surrounded by chosen ones and manmade smiles.

Something does change when Halle offers to take him running. Him. Running.

Asthmatic kid on the playground. Five years out from a coma and a collapsed lung and a bullet dug out of his thigh.

She says she'll go easy. He imagines she just wants to see him in pain.

So be it. His doctor tells him he needs to exercise. He's entered the latter half of his twenties. Things stick out, and his skin folds where it didn't used to. Which is great. But the Ritalin work the same anymore, and he's tired all the time.

Mainly, he just wants to watch Halle run in front of him. What is he without someone like that—running ahead, egging him on, prodding him or leading him until he's blue in the face. Blood on his tongue. Her firm ass far below eye level.

She smiles, and they set the date for Sunday. 9 AM. The devil's hour!

Matt, his beat up trainers, ratty gym shorts from the charity shop, long-sleeved T-shirt, Hyde Park.

Halle, gym shorts, hair in a tight ponytail, sports bra, no tank top.

It is August. It's also London—overcast, sky considering an afternoon shower.

At 9 AM, it's cool enough to bother with a shirt if she’d chosen to.

So Halle's first one-uppance is her abs. Matt hasn't had abs since he was wasting away in a hospital bed in Tokyo, still blissfully unaware that his friend-lover-boss had died. And still, those were coma abs. But Halle has her tanned skin in England. She smiles at him. He studies a freckle on the back of his hand.

"One lap. If you stop, I'm throwing you in the pond, Jeevas."

The case of the month involves a series of bodies washed up on the banks of the Thames. A rare one close to home. Matt's on standby—they don't need tech work for this, and he has a contract that says he doesn't have to do anything in the field. If Near doesn't dare venture out of his tower, why should he? He’s bored. Bodies in the Thames—what else is new?

The momentary crack of sunlight is oppressive. Halle's pace is punishing. The doctors in Japan had done a great job, so his English doctors said, at repairing the muscle in his inner thigh. They'd also told him, he, “wouldn't be running any marathons any time soon."

Halle knows. She's a bit of a cunt, Matt's learned.

He trots along.

If there's one thing two years semi-sober have taught him, it's that pain offers no worthy gain. It just sucks—but the alternative is what? Admitting defeat.

Matt’s been waving a white flag since he was twelve. This is supposed to be his second chance. A life. Standing in the presence of someone undeniably better, but still standing.

Ten meters before the end of the lab, he doubles over and hurls into a flowerbed, turns, and smiles up at her.

"Happy, you fucking übermensch?"

"I don't speak German." As though übermensch isn’t a loan word.

"You went to grade school there." Matt knows the gist of her story—military family. Childhood all over the world, and the dead sister. From an old German family that came to the U.S. at the dawn of World War Two.

"You don't speak Japanese." She counters. She knows he spent some time there. It’s not in his need-to-know file, but most of the group knows the outline of how he ended up working with Near five years after the end of the Kira case.

"I was only there for, like, a month. おはよう."

"Also, I went to grade school in the states."

"You can’t be German and work for the C.I.A," Matt quips. She’s American.

"I had noncitizen coworkers."

"Like, spies and defectors?"

"Yeah. If you can talk, you can run, Jeevas. We're going around again."

—

It happens, inevitably, when Matt’s still weak in the knees. He’s just taken a shower at Halle’s place—a beautiful loft with a waterfront view—and he’s sitting awkwardly on the edge of her bed wearing her—“my old boyfriend’s clothes.”

Her old boyfriend was clearly at least half a foot taller than Matt. His loungewear does not fit, but it’s clothes, and she offered a shower and clean towels.

When she gets out of the shower, she hasn’t changed.

He gives her the once-over.

“Man, you can just ask.”

“Good boys don’t talk back, Jeevas.”

“You didn’t say any—”

She drops the towel and smiles. “Aw, you’re still shaking from our run.”

He offers a lopsided smile, and stares at her breasts. They’re better without the fitted blouse, he decides. Her abs, still damp, are fun, too.

“So, what’s the safeword?” He asks, on the verge of reaching out to touch.

Halle looks about to slap his hand away. Instead, she smiles. Her K-9s are sharp. No surprise.

“My dog is well trained, no?” She reaches for his face, instead. Unchipped French nails gentle at his cheek.

“You decide.”

And that’s that.

—

Through their three month (and no longer) tryst, Matt learns that he likes being choked—of all the things, Mello never choked him. That the post-runner’s jitters—the endorphins—collide with the sex endorphins and leave him just plain happy. Halle makes fun of how much he smiles during scenes. When she’s choking him, when she’s on top of him, setting the pace, giving him nothing.

The best time is in Monaco. Matt tagged along on one of her assignments. Intel—it’s always intel. For a week, they look like the wet dream of a young couple on holiday. She picks out his clothes, dresses him like a fucking douchebag. Sends him to get a haircut.

They don’t go to any races. They only visit one casino, and that’s strictly business. The only place to take a jog in Monaco is the hotel’s luxury sports center. They pick side by side treadmills. She isn’t able to reach over to up his tempo. But she does give him a withering look when he slows. He doesn’t mind.

After dinners at hotel steakhouses or casino bars, they retire to their room. There is no being tied to bedframes or hot candle wax. Halle never uses anything besides her two hands. Long nails. Soft fingers, pressure points. Give and take.

They're both clever enough to know it can never last, but that's the fun part.

7 notes

·

View notes

Text

EVERYONE RECALLS THE SHORTAGES of toilet paper and pasta, but the early period of the pandemic was also a time of gluts. With restaurants and school cafeterias shuttered, farmers in Florida destroyed millions of pounds of tomatoes, cabbages, and green beans. After meatpacking plants began closing, farmers in Minnesota and Iowa euthanized hundreds of thousands of hogs to avoid overcrowding. Across the country, from Ohio to California, dairies poured out millions of gallons of milk and poultry farms smashed millions of eggs.

The supply chain disruptions continue. Last year, there was a rice glut, and big box stores like Walmart and Target complained of bloated inventories. There was a natural gas glut in both Europe and in India, as well as a surfeit of semiconductor chips in the tech sector. Florida cabbages, microchips, and Asian rice may not seem like they have much in common, but each of these stories represents a fundamental if disavowed aspect of capitalism: a crisis of overproduction.

All economic systems have problems of scarcity, but only capitalism also has problems of abundance. The reason is simple: the pursuit of profit above all else leads capitalism to produce too much of things that are profitable but socially destructive (oil, private health insurance, Facebook) and not enough of things that are socially beneficial but not privately profitable (low-income housing, public schools, the ecosystem of the Amazon rainforest). For over a century, from the Industrial Revolution through the Great Depression, crises of overproduction were the target of criticism from across the political spectrum—from aristocratic conservatives like Edmund Burke who feared the anarchy of markets was corroding the social order to socialist radicals like Eugene Debs who thought it generated exploitation and poverty.

But the idea of capitalism’s inherent predilection for overproduction has almost completely disappeared from economic discourse today. It seldom appears in the popular press, including in stories about producers destroying surpluses, a problem that is instead explained away by pointing to freak accidents, contingencies, and unforeseen dislocations. To be sure, many gluts of the past few years have been the result of the pandemic and the war in Ukraine. But overproduction preceded 2020 and shows no signs of going away. Revisiting historical arguments about the problem can help us better understand the interlocking crises of supply chain disruption, deliquescent financial markets, and climate change. The history of overproduction and its discontents offers a set of tools and ideas with which to consider whether “market failures” like externalities and inventory surpluses really are exceptions or are intrinsic to commercial society, whether markets ever actually do equilibrate, and whether the drive for growth is possible without continual excess and waste.

20 notes

·

View notes

Text

SEOUL, South Korea — In fried-chicken-obsessed South Korea, restaurants serving the nation's favourite fast-food dish dot every street corner.

But Kang Ji-young's establishment brings something a little different to the table: a robot is cooking the chicken.

Eaten at everything from tiny family gatherings to a 10-million-viewer live-streamed "mukbang" -- eating broadcast -- by K-pop star Jungkook of BTS fame, fried chicken is deeply embedded in South Korean culture.

Paired with cold lager and known as "chimaek" -- a portmanteau of the Korean words for chicken and beer -- it is a staple of Seoul's famed baseball-watching experience.

The domestic market -- the world's third largest, after the United States and China -- is worth about seven trillion won ($5.3 billion).

However, labour shortages are starting to bite as South Korea faces a looming demographic disaster due to having the world's lowest birth rate.

Around 54 percent of business owners in the food service sector report problems finding employees, a government survey last year found, with long hours and stressful conditions the likely culprit, according to industry research.

Korean fried chicken is brined and double-fried, which gives it its signature crispy exterior, but the process -- more elaborate than what is typically used by US fast food chains -- creates additional labour and requires extended worker proximity to hot oil.

Enter Kang, a 38-year-old entrepreneur who saw an opportunity to improve the South Korean fried chicken business model and the dish itself.

"The market is huge," Kang told AFP at her Robert Chicken franchise.

Chicken and pork cutlets are the most popular delivery orders in South Korea, and the industry could clearly benefit from more automation "to effectively address labour costs and workforce shortages," she said.

Kang's robot, composed of a simple, flexible mechanical arm, is capable of frying 100 chickens in two hours -- a task that would require around five people and several deep fryers.

But not only does the robot make chicken more efficiently -- it makes it more delicious, says Kang.

"We can now say with confidence that our robot fries better than human beings do," she said.

Investing in 'foodtech'

Already a global cultural powerhouse and major semiconductor exporter, South Korea last year announced plans to plough millions of dollars into a "foodtech" fund to help startups working on high-tech food industry solutions.

Seoul says such innovations could become a "new growth engine," arguing there is huge potential if the country's prowess in advanced robotics and AI technology could be combined with the competitiveness of Korean food classics like kimchi.

South Korea's existing foodtech industry -- including everything from next-day grocery delivery app Market Kurly to AI smart kitchens to a "vegan egg" startup -- is already worth millions, said food science professor Lee Ki-won at Seoul National University.

Even South Korea's Samsung Electronics -- one of the world's biggest tech companies -- is trying to get in on the action, recently launching Samsung Food, an AI-personalised recipe and meal-planning platform, available in eight languages.

Lee predicted South Korea's other major conglomerates are likely to follow Samsung into foodtech.

"Delivering food using electric vehicles or having robots directly provide deliveries within apartment complexes, known as 'metamobility,' could become a part of our daily lives," he said.

"I am confident that within the next 10 years, the food tech industry will transform into the leading sector in South Korea."

'Initially struggled'

Entrepreneur Kang now has 15 robot-made chicken restaurants in South Korea and one branch in Singapore.

During AFP's visit to a Seoul branch, a robot meticulously handled the frying process -- from immersing chicken in oil, flipping it for even cooking, to retrieving it at the perfect level of crispiness, as the irresistible scent of crunchy chicken wafted through the shop.

Many customers remained oblivious to the hard-working robotic cook behind their meal.

Kim Moon-jung, a 54-year-old insurance worker, said she was not sure how a robot would make the chicken differently from a human "but one thing is certain -- it tastes delicious."

The robot can monitor oil temperature and oxidation levels in real time while it fries chicken, ensuring consistent taste and superior hygiene.

When Kang first started her business, she "initially struggled" to see why anyone would use robots rather than human chefs.

"But after developing these technologies, I've come to realise that from a customer's perspective, they're able to enjoy food that is not only cleaner but also tastier," she told AFP.

Her next venture is a tip-free bar in Koreatown in New York City, where the cocktails will feature Korea's soju rice wine and will be made by robots.

youtube

Entrepreneur aims to improve South Korea's dish using robot

11 September 2023

#South Korea#chimaek#fried chicken#beer#Korean fried chicken#Robert Chicken#Kang Ji-young#advanced robotics#AI technology#Samsung Food#Samsung Electronics#metamobility#Youtube#robot

9 notes

·

View notes

Text

All roads lead to Phoenix. On the gravy train of greenfield investment riding on the back of Inflation Reduction Act legislative incentives in the United States, no county ranks higher than Arizona’s Maricopa. The county leads the nation in foreign direct investment, with Taiwan Semiconductor Manufacturing Corp. (TSMC), Intel, LG Energy, and others expanding their footprint in the Grand Canyon State. But Phoenix is neither the next Rome nor the next Detroit. The reasons boil down to workers and water.

First, the labor. America’s skilled worker shortage has been well documented since before the Trump-era immigration slump and pandemic border closures. Especially in the tech industry—the United States’ most productive, high-wage, and globally dominant sector—a huge deficit in homegrown engineering talent and endlessly bungled immigration policies have left Big Tech with no choice but to outsource more jobs abroad.

Arizona dangled its low taxes and sunshine, but TSMC has had to fly in Taiwanese technicians to jump-start production at the 4 nanometer chip plant that was meant to be completed by 2024, but has been delayed until 2025 at the earliest.

The salvage operation calls into question whether the more advanced and miniaturized 3 nanometer plant—scheduled to open in 2026 will stay on course. (With two-thirds of its customer base—including Apple, AMD, Qualcomm, Broadcom, Nvidia, Marvell, Analog Devices, and Intel—in the United States, it’s no wonder TSMC wants to speed things up.)

From electric vehicles to gaming consoles, the forecasted demand for the company’s industry-leading chips is projected to rise long into the future—and its market share is already north of 50 percent. Given the geopolitical risks it faces in Asia, a well-trained U.S. workforce could give it the comfort to establish the United States as a quasi-second headquarters. After all, Morris Chang, the company’s founder, had a long first career with Texas Instruments.

But the next slowdown they may face is Arizona’s dwindling water supply. In just the past year, Scottsdale cut off water to Rio Verde Foothills, an upscale unincorporated suburb on its fringes, due to the region’s ongoing megadrought and its curtailed allocation of Colorado River water. This was followed by Phoenix freezing new construction permits for homes that rely on groundwater.

Forced to find other sources, industry players have stepped up buying water rights from farmers, essentially bribing them to stop growing food that would serve the region’s fast-growing population. Then there are the backroom deals involved in an Israeli company receiving the green light for a $5.5 billion project to desalinate water from Mexico’s Sea of Cortez and pipe it 200 miles uphill through deserts and natural preserves to Phoenix.

Water risk brings political risk for companies. Especially in Europe, governments are carefully weighing the short-term benefits of corporate investment versus the climate stress it exacerbates. They have good reason to be suspicious: Firms such as Microsoft have been notoriously inconsistent in reporting their water consumption, and promises to replenish consumed water haven’t been delivered on. And even if data centers are becoming more efficient, growing demand just means more of them. Some European provinces have blocked data center development, pushing them to locations with high heat risk.

Europe’s regulatory stringency has long been off-putting to foreign investors, which is what makes European officials so weary of Washington’s aggressive Inflation Reduction Act, CHIPS and Science Act and Infrastructure Investment and Jobs Act.

But to fulfill its promise of putting the United States on a path toward sustainable industrial self-sufficiency, these policies need to better align investment with resources, matching companies to geographies that best suit their needs. It would be better to direct capital allocation to climate resilient regions than to throw good money after potentially stranded assets.

If any company ought to know better on all these matters, it’s TSMC. In Taiwan itself, the industry’s huge energy and water consumption are a source of controversy and difficulty. Not only have droughts on the island occasionally slowed production, but the company’s own water consumption rose 70 percent from 2015-19.

Furthermore, Taiwan knows that its real special sauce is precisely the technically skilled workforce that the United States lacks. Yet TSMC has doubled down on Phoenix, a place without a reliable long-term water supply for industry, little in the way of renewable energy, and a construction freeze that will make it challenging to house all the workers it needs to import.

With all the uncertainty over both water and workers, this begs the question of whether the semiconductor company the entire world is courting would have been better off establishing its U.S. beachhead in the upper Midwest or northeast instead? Ohio, upstate New York, and Michigan rank high in greenfield corporate investments, resilience to climate shocks, and are abundant in quality universities and technical institutes.

Amid accelerating climate change and an intensifying war for global talent, how can those devising U.S. industrial policy better select the appropriate locations to steer investment to?

States with higher climate resilience than Arizona are starting to flex for greater investment. According to recent data, Illinois has climbed to second place nationally for corporate expansion and relocation projects. The greater Chicago area and state as a whole are touting their tax benefits, underpriced real estate, growth potential, and grants to prepare businesses to cope with climate change.

Other parts of the Great Lakes region, such as Michigan and Ohio, are also regaining confidence in their industrial revival, pitching heavily for both domestic and foreign commercial investment while emphasizing their affordability and climate adaptation plans.

Just over the border, Canada has been wildly successful in poaching foreign skilled workers unable to secure or maintain green card status in the United States while also investing heavily in economic diversification—all with the benefit of nearly unlimited natural resources and energy supplies. While Canada hasn’t yet rolled out Inflation Reduction Act-style tax breaks to lure investors, it abounds in critical minerals for EV batteries (nickel, cobalt, lithium and rare earths such as neodymium, praseodymium, and niobium) as well as hydropower.

The more that climate change warps the United States, the more grateful it should be that its most natural and staunch ally occupies the most climate resilient real estate on the North American continent, even taking into account the raging wildfires of this summer. But rather than covet Canada the way China does Russia—as a vast and depopulated resource bounty—the United States and Canada should cooperate far more proactively on a continental scale industrial policy that would bring about true self-sufficiency from the Arctic to the Caribbean.

This is where geopolitical interests, economic competition, and climate adaptation converge. As Canada’s population surges by up to 1 million new permanent migrants annually, a more unified North American system would be more self-sufficient in crucial commodities and industries, less vulnerable to supply chain disruptions abroad, and avoid unnecessary carbon emissions from excessive inter-continental trade. Thirty years after the NAFTA agreement, it seems more sensible than ever to graduate toward a more formal, autarkic North American Union.

One can easily imagine Greenland joining one day—the country already enjoys autonomy from its colonizer (Denmark) and is now pushing for complete independence, driven partly by the desire to control more of the riches that climate change has revealed it to possess.

Meanwhile, in Taipei, there are far more complex geopolitical consequences to consider. TSMC has long been considered Taiwan’s “silicon shield,” a leader of industry so important that a conflict that took it offline would be a major own-goal for China. But it is precisely the combination of the China threat, environmental stress, and pandemic-era supply chain disruptions that convinced TSMC’s customers that its home nation represents too large a concentration risk.

Now TSMC and its rivals are expanding production from Japan to the United States, Europe, and India. This globally diversified set of chip manufacturers is easier for China to exploit as countries more susceptible to Chinese pressure become less rigid in compliance with U.S.-led export controls over advanced technologies.

At the same time, if the United States no longer depends on Taiwan itself for the majority of its semiconductor supply in just five to seven years, will it be as willing to defend Taiwan militarily? This, not Ukraine, is what Beijing is watching for as it pursues its own “Made in China” quest for self-sufficiency.

Industrial policy is back in vogue as a national security and economic strategy. But to get it right requires aligning investment into industry and infrastructure with the geographies of resources and resilience. The countries that build climate adaptation into their strategies will be the ones that build back better.

11 notes

·

View notes

Text

The semiconductor crisis could have cost Brazil its democracy

The Brazilian Report tells the story of how former diplomats from Brazil and the U.S. championed an effort to unclog semiconductor supplies to electronic voting machines — without which the 2022 election would have been in jeopardy

When Covid forced people to work from home in 2021, it also triggered an unprecedented global semiconductor crisis. Sales of personal computers soared, as did demand for data centers (with people spending more of their time video-calling and video-streaming), providing a stress test for an industry already accustomed to cyclical gluts and shortages.

The shortage of chips, which power everything from phones to machines to cars, slowed production lines and fueled inflation in many countries. In Brazil, however, the semiconductor crisis also posed an existential threat to the country’s democracy.

In 1996, Brazil began implementing electronic voting; for more than 20 years, all elections in the country have been 100 percent electronic. But the voting machines that allow Brazil to tally more than 123 million votes in a matter of hours also run on the same chips that had become scarce worldwide, forcing electoral authorities to launch a covert diplomatic mission in mid-2021 to unclog supply chains and allow for the substitution of roughly 225,000 machines in time for the 2022 election.

The operation involved electoral officials, current and former diplomats from Brazil and the U.S., as well as private companies and consulting firms that helped voting machine manufacturers get the chips they needed and avoid the worst.

Continue reading.

#brazil#politics#technology#democracy#brazilian elections#brazilian politics#brazilian elections 2022#united states#foreign policy#international politics#mod nise da silveira#image description in alt

9 notes

·

View notes

Photo

LETTERS FROM AN AMERICAN

April 3, 2023

Heather Cox Richardson

On Saturday, April 1, the emergency measures Congress put in place to extend medical coverage at the beginning of the Covid-19 pandemic expired. This means that states can end Medicaid coverage for people who do not meet the pre-pandemic eligibility requirements, which are based primarily on income. As many as 15 million of the 85 million people covered by Medicaid could lose coverage, although most will be eligible for other coverage either through employers or through the Affordable Care Act. The 383,000 who will fall through the cracks are in the 10 states that have refused to expand Medicaid.

The pandemic prompted the United States to reverse 40 years of cutbacks to the social safety net. These cuts were prescribed by Republican politicians who argued that concentrating money upward would promote economic growth by enabling private investment in the economy. That “supply side” economic policy, they said, would expand the economy so effectively that everyone would prosper. In 2017, Republicans passed yet another tax cut, primarily for the wealthy and for corporations, to advance this policy.

As the economy fell apart during the coronavirus pandemic, though, it was clear the government must do something to shore up the tattered social safety net, and even Republicans got on board fast. On March 6, 2020, Trump signed the Coronavirus Preparedness and Response Supplemental Appropriations Act, allocating $8.3 billion to fund vaccine research and give money to states and local governments to try to stop the spread of the virus. On March 18, he signed the Families First Coronavirus Response Act, which provided food assistance, sick leave, $1 billion in unemployment insurance, and Covid testing. On the same day, the Federal Housing Administration put moratoriums on foreclosure and eviction for people with government-backed loans.

On March 27, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (CARES), which appropriated $2.3 trillion, including $500 billion for companies, $349 billion for small businesses, $175 billion for hospitals, $150 billion to state and local government, $30.75 billion for schools and universities, individual one-time cash payments, and expanded unemployment benefits.

Trump signed another stimulus package on April 24, 2020, which appropriated another $484 billion. And on December 27, 2020, he signed another $900 billion stimulus and relief package.

When he took office, President Joe Biden promised to rebuild the American middle class. He and the Democratic Congress began to shift the government’s investment from shoring up the social safety net to repairing the economy. On March 19, 2021, he signed the American Rescue Plan into law, putting $1.9 trillion behind economic stimulus and relief proposals.

Biden signed the Infrastructure Investment and Jobs Law, also known as the Bipartisan infrastructure Act, on November 15, 2021, putting $1.2 trillion into so-called hard infrastructure projects: roads and bridges and broadband.

On August 9, 2022, he signed the CHIPS and Science Act, putting about $280 billion in new funding behind scientific research and the manufacturing of semiconductors. And days later, on August 16, Biden signed the Inflation Reduction Law, putting billions behind addressing climate change and energy security while also raising money to pay for new policies and to reduce the deficit by raising taxes on corporations and the wealthy, funding the Internal Revenue Service to stop cheating, and permitting Medicare to negotiate with pharmaceutical companies over drug prices.

This dramatic investment in the demand side, rather than the supply side, of the economy helped to spark record inflation, compounded by supply chain issues that created shortages and encouraged price gouging. To combat that inflation, the Federal Reserve has been raising interest rates. Numbers released Friday show that inflation cooled in February, suggesting that the Federal Reserve is seeing the downward trend it has been hoping for, although there is concern that the sudden decision of the Organization of the Petroleum Exporting Countries (OPEC) this weekend to slash production of crude oil might drive the price of oil back up, dragging prices with it.

That investment in the demand side of the economy also meant that the child poverty rate in the U.S. fell almost 30%, while food insufficiency fell by 26% in households that received the expanded child tax credit. The U.S. economy recovered faster than that of any other G7 nation after the worst of the pandemic. Wages for low-paid workers grew at their fastest rate in 40 years, with real income growing by 9%. MIddle-income workers’ wages grew by only between 2.4% and 3.9% after inflation, but that, too, was the biggest jump in 40 years. Unemployment has fallen to its lowest level since 1969, and a record 10 million people have applied to start small businesses.

This public investment in the economy has attracted billions in private-sector investment—chipmakers have planned almost $200 billion of investments in 17 states—while it has also pressured certain companies to act in the public interest: the three major insulin producers in the U.S., making up 90% of the market, have all capped prices at $35 a month.

As the economy begins to smooth out, Biden and members of his administration are touting the benefits of investing in the economy “from the bottom up and the middle out.” They have emphasized that they are working to support unions and the rights of consumers, taking on “junk fees,” noncompete agreements, and nondisparagement clauses. After the collapse of the Silicon Valley Bank, the administration has suggested that deregulation of banking institutions went too far, and Biden has continued to push increased support for child care and health care.

A recent Associated Press–NORC poll shows that while 60% of Americans say the federal government spends too much money, they actually want increased investment in specific programs: 65% want more on education (12% want less); 63% want more on health care (16% want less); 62% want more on Social Security (7% want less); 58% want more spending on Medicare (10% want less); 53% want more on border security (23% want less); and 35% want more spending on the military (29% want less).

This puts the political parties in an odd spot. A week ago, Biden and members of the administration began barnstorming the country to highlight how their policy of “Investing in America” has been building the economy: “unleashing a manufacturing boom, helping rebuild our infrastructure and bring back supply chains, lowering costs for hardworking families, and creating jobs that don’t require a four-year degree across the country,” as the White House puts it.

Meanwhile, the Republicans are doubling down on the idea that such investments are a waste of money, and are forcing a fight over the debt ceiling to try to slash the very programs that the administration is celebrating. Ignoring that the 2017 Trump tax cuts and spending under Trump added about 25% to the debt, they are focusing on Biden’s policies and demanding that the government balance the budget in 10 years without raising taxes and without cutting defense, veterans benefits, Social Security, or Medicare, which would require slashing everything else by an impossible 85%, at least (some estimates say even 100% cuts wouldn’t do it).

As David Firestone put it today in the New York Times: “Cutting spending…might sound attractive to many voters until you explain what you’re actually cutting and what effect it would have.” Republicans cut taxes and then complain about deficits “but don’t want to discuss how many veterans won’t get care or whose damaged homes won’t get rebuilt or which dangerous products won’t get recalled.” Firestone noted that this disconnect is why the House Republicans cannot come up with a budget. “The details of austerity are unpopular,” Firestone notes, “and it’s easier to just issue fiery news releases.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#kookaid#Republican Kool-Ade#budget#Federal Government spending#pandemic#medicare#medicaid#income inequality#Corrupt GOP

9 notes

·

View notes

Text

The Crucial Role of Chips: Unveiling the Technological Advancements in China's 2023 College Entrance Examination

Introduction:

The 2023 College Entrance Examination in China witnessed an extraordinary leap in technological advancements, particularly in the field of chips. These tiny electronic components have become the backbone of modern society, revolutionizing various industries and empowering the development of cutting-edge technologies. In this blog post, we will explore the significance of chips in the context of the 2023 Chinese College Entrance Examination and the broader implications for China's technological landscape.

1. The Era of Smart Devices:

In recent years, China has witnessed a remarkable surge in the popularity of smart devices. Smartphones, tablets, and wearable gadgets have become an integral part of our daily lives. This trend heavily relies on the advancements in chip technology, specifically in terms of processing power, energy efficiency, and connectivity. The 2023 College Entrance Examination embraced this technological wave, as students were allowed to utilize electronic devices during certain sections of the exam, utilizing the power of chips to enhance their test-taking experience.

2. Empowering Artificial Intelligence:

Artificial Intelligence (AI) has emerged as a transformative force across various sectors, including education. In the 2023 College Entrance Examination, AI-powered systems were employed to analyze and evaluate students' answers, ensuring fair and accurate grading. The success of such systems largely depends on the performance of chips embedded within these AI frameworks. Advanced chips equipped with neural processing units (NPUs) can efficiently process massive amounts of data, accelerating AI algorithms and enabling real-time analysis.

3. The Rise of Edge Computing:

The proliferation of Internet of Things (IoT) devices has given rise to the concept of edge computing, where data processing occurs closer to the source rather than relying solely on centralized cloud servers. Chips play a pivotal role in enabling efficient edge computing, ensuring low latency and enhancing data security. In the context of the 2023 College Entrance Examination, edge computing facilitated seamless data transfer and real-time interaction between students' devices and the examination system, thereby enhancing efficiency and reliability.

4. Next-Generation Chip

To maintain China's position as a global technological leader, significant investments have been made in developing next-generation chip technologies. The 2023 College Entrance Examination served as a testing ground for these advancements, showcasing chips with enhanced performance, power efficiency, and miniaturization. Technologies such as 7-nanometer and 5-nanometer process nodes, stacked chip architectures, and novel materials like gallium nitride (GaN) contributed to the creation of highly advanced chips that powered the examination systems.

5. Addressing Challenges and Future Prospects:

Despite the remarkable progress in chip technology, challenges remain. The shortage of key raw materials, increasing energy consumption, and geopolitical considerations are among the obstacles that need to be addressed. However, China's commitment to research and development, collaboration with global partners, and strategic investments in semiconductor manufacturing capacity indicate a promising future for chip technology. The 2023 College Entrance Examination exemplified China's determination to leverage chips as a driving force behind its technological advancements.

Conclusion:

The 2023 Chinese College Entrance Examination highlighted the vital role of chips in enabling technological progress across various sectors. From empowering smart devices and AI systems to facilitating edge computing, chips have revolutionized the way we interact with technology. China's dedication to chip research, development, and manufacturing is shaping a future where chips will continue to be at the forefront of technological innovation. As we move forward, it is crucial to address challenges and seize opportunities, ensuring a prosperous era for chip technology in China and beyond.

#gaokao#electroniccomponents#icchip#semiconductor#semiconductor industry#semiconductor chips#semiconductor manufacturing

2 notes

·

View notes

Text

Lansheng Technology: Automotive chips become bright spot

Rising sales of electric vehicles -- which tend to use more semiconductors than gasoline-powered cars -- combined with greater automation in all vehicles have kept car chip makers busy. Tesla CEO Elon Musk said last week that the long-term outlook for the market appeared to be strong, detailing his car company's plan to expand annual vehicle production to 20 million vehicles by 2030 from about 1.3 million in 2022 car.

Chip executives say the growth in the number of chips used in cars is staggering. By 2021, the average car will have about 1,200 chips, twice as many as in 2010, and that number is likely to rise, executives said.

Including Dutch automotive chip company NXP, German chip company Infineon, Japanese company Renesas and American companies TI and ADI are important players in this market.

Auto-related revenue should grow more than 30% in the current quarter, even as the company's overall revenue is expected to shrink, Matthew Murphy, chief executive of Marvell Corp of America, said on Thursday. The company's auto-related chip sales could reach $500 million in the next few years, up from about $100 million now, he said.

NXP's automotive chip sales rose 25 percent last year, and the company said it expects growth of about 15 percent in the first quarter of this year. Renesas' automotive business grew nearly 40 percent last year, and analysts expect more growth this quarter. Nearly a quarter of Analog Devices' sales come from the automotive industry, which grew 29 percent last year.

It’s not just the cars themselves that are getting more chip-intensive; semiconductor executives say so is auto production as manufacturers adopt greater automation to cope with labor shortages and try to keep costs down.

Chip companies are generally preparing to increase production capacity to meet rising automotive demand and expect a rebound in other industries such as PCs and smartphones. Texas Instruments said last month it would build an $11 billion chip factory in Lehi, Utah, and NXP said it was considering expanding in Texas.

Lansheng Technology Limited is a global distributor of electronic components that has been established for more than 10 years, headquartered in Shenzhen China, who mainly focuses on electronic spot stocks.

2 notes

·