#overpriced and overvalued

Explore tagged Tumblr posts

Text

My cousins: you should come to Austin, we have x y and z

And it sounds like the worst thing on earth

2 notes

·

View notes

Text

Facebook reached through my phone and attacked me

#I am a garbage bag full of yarn#garbage#yarn#pei#new memes#do it#this fb page is so weird and my friend is obsessed#I see so much shit for sale#it’s glorified Kijiji which is already overpriced junk#people on this island highly overvalue their trash

1 note

·

View note

Text

"Hahaha it cost $180mil-"

Lower the budget.

"It starting in the top ten and ending in the top ten didn't justify the cost-"

So, lower. the. budget.

"Yeah TCW was initially poorly received, but it didn't cost-"

90% of entertainment currently being made is vastly overproduced and overvalued and overpriced. It is unreasonable to compare the cost of a live action show made by the largest entertainment corporation in the world in 2024 to a cartoon made nearly 20 years ago by fucking Cartoon Network.

Additionally, s1 had to build props/sets etc. If they haven't already Destroyed everything, there's no reason it couldn't have been reused.

Hell, I watched Once Upon a Time. I watched the Prequels. You think I give a fuck if they use green-screen to cut costs?

No, I do not.

Bring back the actors AND the writers and let them finish the story. Give them a reasonable amount of Time to do it in instead of 3hrs.

334 notes

·

View notes

Note

When people complain about rich users lowballing I am skeptical that the person whining hasn't just overvalued the dragon.

The vast majority of "rich" users have been here longer than you and know the price ranges better. While I'm not saying lowballing doesn't happen, the vast majority of the time there's a mass hatching event like the auraboa release, the poorer/newer/non-g1 collecting players who hatch the doubles get overexcited and massively overprice them. For example, if someone hatched like a magenta/pink XYY dragon and shoved it on the AH for 30kg then yeah it would be overpriced even though it's an all pink double.

As a "rich" player if I see a nice dragon I'm not ever going to overpay for it but I will make an offer in the right range if the seller is open to that. It sounds like it's those people throwing the tantrum that someone with a large collection of G1s isn't overpaying 10kg for their kinda matchy G1 because "they can afford it".

12 notes

·

View notes

Note

whats mju stand for

It’s named after the Greek letter μ, though that’s typically spelled “mu.”

More specifically, I got the name from the line of point-and-shoot film cameras from Olympus, which are also called μ but spelled “mju.” They’re overpriced, overvalued, and I hate them, but at least the name is cool.

6 notes

·

View notes

Text

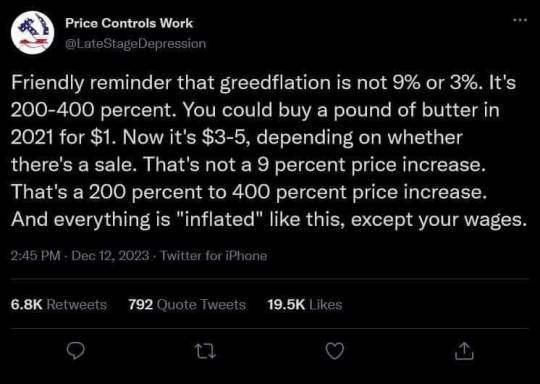

Price gouging = completely unsustainable practice that has eventually fall to equilibrium price.

Problem is.... literally everything in the world seems overvalued & price gouged lately.

Evidence is in yourself. Every person knows when they are buying something that they perceive as inherently overpriced, but only if they are given the proper information.

The trajectory of American capitalism since the 1980s has seen prices rise phenomenally, but only for some people. I'm saying, of course, that the economic disparity is higher now than in 1980s.

Economic disparity is inherently against an equilibrium. Workers are paid an undervalued amount, rich rentiers are hoarding excess supplies to keep prices up.

Every part of this system that feels unfair, just is. Period.

And every theory of economic investing which is used to make money in this world can, in fact, be turned around to show how that exact search for profits is driving the manic/depressive bubbles of capitalism.

Ergo-- I believe that this really, truly is end-stage capitalism. Thats what makes sense. Its shooting itself in the foot & doesnt even know. The exact drive to be the best in the world is destroying the world

(who coulda thought. Maybe a 6 year old who watches kids cartoons about fairness and 'sharing is caring'?)

Evidence further for more disbelievers? Read into what caused the 1929 & 2008 crashes. Unfortunately a lot of bad-faith actors in economics definitely want to victim blame (demand side blame) for these. But I'm confident we're through will that bs mentality.

These issues are inherently issues with an inefficient allocation of resources, a problem which grows worse and worse as few and fewer people control the resources

Vague, well hidden oversupply issues + 'inflation' = overvalued lies.

Ask yourself. Has your SALARY gone up as much as the goods you require to maintain the energy you need to even MAKE that salary. Huge flaw

Why do you think every story about a shortage gets so much air time? Because it reinforces a public belief that demand has not completely lost sight of the world supply.

No, it enforces the belief that there SHOULD be prices rising. But every empty shelf we see is NOT the fully imformed picture.

Corporations report losses from "shrinkage" and I think thats one of the biggest places theyve been able to tuck the over supply problems away.

They are allowed, by law, to report shrinkage as an aggregate of expired goods, employee, and customer theft.

Never have I seen a company give me an exact figure for how much of their losses were wasted supply

Every argument about this, again, seeks to victim blame.

"Corporate theft is rampant" ya it is and its happening by the corporations right in everyone's face ya projecting abusing fucks

Prices will fall. Only a matter of when & exactly how much

It is ridiculous how much grocery prices have increased

73K notes

·

View notes

Text

Everything is overvalued at this point

Adam Taggart

Nov 05, 2024

To better understand the current economic environment we find ourselves in, it helps to better understand how we ended up here.

And few have as detailed an understanding as today's guest, who has been a true insider in both Washington DC and Wall Street for his extremely long & accomplished career.

We're fortunate today to speak with former Congressman, economic policymaker & financier, David Stockman.

David represented Southern Michigan in the U.S. House of Representatives from 1976 to 1981, and later served as the Director of the Office of Management and Budget in the Reagan Administration and was the youngest Cabinet member of the twentieth century. Since then he has held executive positions in many of the most influential banking, buyout and private equity firms, including The Blackstone Group and Salomon Brothers.

He warns that "everything is overpriced" that it will be "damn near impossible" to continue the current high levels of deficit spending without re-stoking inflation.

It would not surprise him to see a 30-50% downwards correction in financial asset prices begin next year.

To hear his many reasons why, click here or on the video below:

0 notes

Text

The reason is simple...because all those people with those overvalued, oversupplied, largely useless, and very overpriced degrees...vote Democrat.

They made a bad bet, and they want sometime else to cover it.

757 notes

·

View notes

Text

Why You Need a Miami Business Broker to Sell Your Business Faster

Selling your business is a major decision, and navigating the complexities of finding the right buyer quickly can be overwhelming. This is where Miami business brokers come in. They offer specialized local knowledge and extensive networks to help you sell faster and for a better price. Many business owners try to handle the sale themselves, only to face delays and difficulties. By working with Miami business brokers, you gain access to their expertise in valuation, marketing, and negotiation, ensuring a smooth and efficient process. In a competitive market like Miami, having the right broker can save you time, reduce stress, and maximize your business's value during the sale.

Access to a Broader Network of Potential Buyers

Broad Network of Qualified Buyers: Miami business brokers have access to a vast, well-established network of serious buyers, from local entrepreneurs to national investors, ensuring your business reaches the right audience for a quicker sale. Their specialized knowledge helps target buyers who are specifically looking for businesses in the Miami area, giving your business maximum exposure.

Pre-Screening for Serious Buyers: Miami business brokers only connect you with qualified buyers who have the financial ability and intent to purchase. This eliminates time-wasting inquiries and accelerates the sales process by focusing on prospects who are ready to make a deal, helping you sell faster and with confidence.

Accurate Business Valuation

Avoiding Mispricing with Expert Knowledge: Accurately pricing your business is essential for attracting serious buyers. Overpricing may lead to your business sitting on the market for too long, while under-pricing could result in a financial loss. This is where Miami business brokers provide invaluable expertise. They use their in-depth knowledge of the local market and your industry to assess the true value of your business. By considering factors like profitability, cash flow, and market conditions, they ensure that you are neither overvaluing nor undervaluing your business. This precision helps you avoid losing out on potential buyers or leaving money on the table, making the entire selling process smoother and faster.

Leveraging Market Data and Trends: One of the biggest advantages of working with Miami business brokers is their ability to leverage comprehensive market data and trends. Brokers use industry-specific benchmarks and local economic factors to get a complete picture of your business’s worth. They compare your business to similar ones sold recently in Miami, giving you a competitive edge in pricing. By understanding what buyers are willing to pay in your industry and location, brokers can help you set a price that reflects current market demand. This ensures that your business is positioned attractively, drawing in serious offers and speeding up the sale process.

Streamlined Marketing and Advertising

Streamlined Marketing Strategies: Miami business brokers excel at crafting and executing marketing strategies that target the right audience. They have access to exclusive platforms, industry-specific listings, and extensive buyer databases that most business owners wouldn’t have. By leveraging these tools, they ensure that your business gets maximum exposure, attracting qualified and motivated buyers quickly. With their expertise, they can identify potential buyers, place your business in front of them, and reduce the time it stays on the market.

Presentation & Positioning: Miami business brokers are skilled at showcasing your business’s strengths. They create professional listings that highlight key selling points, financial performance, and future potential, making your business more appealing to prospective buyers. Through carefully crafted ads, social media campaigns, and email outreach, brokers position your business to stand out in a competitive marketplace. This targeted approach not only attracts interest but also accelerates the selling process by drawing serious buyers early on.

Handling Legal and Administrative Complexities

Simplifying Legal Requirements: Navigating the legal side of selling a business can be tricky, but Miami business brokers are well-versed in the necessary documentation and procedures. From drafting contracts to ensuring you comply with local and federal regulations; a broker takes on the heavy lifting. This ensures you avoid costly mistakes, which could lead to delays or even jeopardize the sale.

In addition, Miami business brokers know how to maintain confidentiality throughout the process, ensuring that sensitive information about your business is protected. They handle non-disclosure agreements (NDAs) and other essential legal paperwork that keeps both you and your business safe during negotiations.

Managing Administrative Tasks: Another major benefit of working with Miami business brokers is that they manage the often-tedious administrative tasks involved in selling a business. Preparing financial statements, compiling sales reports, and ensuring all documents are properly signed and filed can eat up a lot of your time. A broker steps in to handle these responsibilities so you can focus on running your business without worrying about missed details.

Not only do Miami business brokers save you time, but they also streamline the process by knowing exactly what needs to be done at every step. They ensure that deadlines are met, paperwork is in order, and everything runs smoothly, making the entire transaction more efficient.

Negotiation and Closing the Deal

Expert Mediators: Miami business brokers act as professional negotiators, facilitating smooth communication between buyers and sellers. Their expertise ensures that all parties feel heard and that any disagreements are quickly resolved. Brokers are skilled at removing the emotional element from negotiations, focusing solely on achieving the best possible outcome for both parties. This balanced approach often results in quicker agreements and a more positive experience for everyone involved.

Seamless Transaction Process: Miami business brokers streamline the entire closing process by handling all necessary paperwork and coordinating with legal and financial professionals. They ensure every step is completed on time, preventing delays and ensuring a smoother, faster closing experience.

Selling your business can be a daunting task, but with the help of Miami business brokers, the process becomes much smoother and quicker. These professionals bring years of expertise, a network of serious buyers, and an in-depth understanding of the local market, ensuring your business gets the exposure it needs for a successful sale. By handling everything from marketing to negotiations and legal paperwork, Miami business brokers take the burden off your shoulders, allowing you to focus on running your business while they secure the best possible deal. If you’re looking for a faster, hassle-free sale, working with Miami business brokers is your best option for achieving success.

0 notes

Text

Pentagon audit finds $1.9 billion overpricing of US weapons for Ukraine – report

The US Department of Defence overestimated by $1.9 billion the cost of some weapons supplied to Ukraine, according to a Pentagon press release.

Inspector General Robert P. Storch announced that the Department of Defence Office of Inspector General (DoD OIG) released the “Audit of the DoD’s Revaluation of the Support Provided to Ukraine Through Presidential Drawdown Authority” on 13 June.

According to the Pentagon audit, the price of 2,300 vehicles, armoured personnel carriers, tanks, and radars sent to Ukraine was overstated by $653 million. Meanwhile, they should have been sold at an undervalued price due to wear and tear.

The authors noted that the cost of missiles and ammunition was also overstated by $1.25 billion. In total, the Pentagon overstated the price of military aid to Ukraine by $8.1 billion.

In June 2023, the DoD acknowledged a $6.2 billion error stemming from its overvaluation of PDA provided to the Government of Ukraine (GoU). (…) Combined with the previously acknowledged $6.2 billion error, the total of overvalued defense articles provided through PDA is $8.1 billion.

Storch said the discovery of “an additional $1.9 billion in overvalued defence articles” showed that the Department of Defence and its components had failed to fully implement the updated policy.

We also discovered instances where some DoD Components involved in the valuation of defense articles lacked a full understanding of the accounting principles in the DoD Comptroller’s policy updates and were unable to implement these updates due to financial reporting material weaknesses.

It also recommended that the Under Secretary of Defence and the Chief Financial Officer request the military departments to conduct a full data review.

The DoD OIG will continue to monitor progress on all recommendations.

Read more HERE

#world news#world politics#news#usa news#usa politics#usa today#united states#united states of america#us politics#us news#politics#pentagon#pentagon audit#ukraine#war in ukraine#ukraine war#ukraine conflict#ukraine news#ukraine russia news#ukraine russia conflict#russia ukraine war#russia ukraine crisis#russia ukraine conflict#russia ukraine today

1 note

·

View note

Text

Common Mistakes to Avoid When Buying a Home in Brampton

Brampton is an awesome place to purchase a home. But the road to homeownership can be full of pitfalls if you're not careful. Between sketchy sellers, overpriced fixer-uppers, and terrible locations, a lot can go wrong when looking for homes for sale Brampton. Avoid these common mistakes and you'll sail smoothly into your dream home.

Didn't Do Enough Neighborhood Research?

Choosing the wrong 'hood in Brampton is a big mistake that'll have you regretting your purchase in no time. Some areas are way more incomplete than others, with problems like excessive noise, lack of amenities, and high crime rates. You've got to get careful with your research - checking out potential streets at different times of day, studying crime rates, and getting the full scoop from locals.

Other areas might seem perfect until you realize your commute is a nightmare from there. Don't just look at Google Maps estimates, actually drive and see what you're really in for.

Simply Skipped the Home Inspection?

I don't care how nice homes for sale Brampton look or how motivated you are to just get it over with. Never skip the home inspection. You need a certified inspector to go through that place with a fine-toothed comb and make sure there aren't any nightmare-level problems lingering.

Whether it's structural issues, outdated electrical, or mold, you do not want to get stuck with a pit of repairs right after spending a big amount of money. Home inspections feel like a headache, but they could potentially save you tens of thousands down the line. Worth it!

Only Looked at List Prices?

List prices can sometimes be deceiving when shopping for homes for sale Brampton. Sellers often purposely underlist, knowing it'll kick off a bidding war that drives the costs way up. Other times, homes are overvalued based on unrealistic expectations. You can look for pre construction homes Brampton as well for an affordable financing approach.

You need to dig into the true sold data for similar properties in the same area. Walking into a deal blind can mean paying way more than you should've. Speaking of agents...using a bad one, or attempting to buy without an agent at all, is another common Brampton home-buying blunder!

Can't Forget About Pre-Construction Pitfalls

Buying pre construction homes Brampton has its challenges. Closing dates that are wildly inaccurate, shoddy construction quality, surprise fees - the list goes on. Working with a savvy pre-con agent becomes essential to avoid headaches down the road.

The pre-construction world also moves at lightspeed compared to resale. So procrastinating on making decisions can literally cost you your desired units, incentives, and more.

At the end of the day, patience, prioritizing quality over hype, and leaning on experienced real estate agents are key to keeping your Brampton home purchase nightmare-free.

0 notes

Text

Bitcoin, Ethereum, XRP, ADA, Dogecoin, Matic Network, Shiba Inu, Uniswap, and Chainlink are currently undervalued according to their MVRV Z-Scores. The MVRV Z-Score measures the difference between an asset's current market value and its realized value, with a score below -1.3 indicating undervaluation and above 1.3 indicating overvaluation. Recent data from Santiment shows several top crypto assets, including Bitcoin and Ethereum, are undervalued, presenting potential investment opportunities.

Investors should still carefully assess associated risks. As the market matures, tools like the MVRV Z-Score become crucial for identifying investment opportunities and avoiding overpriced assets. By understanding both short and long-term returns, this metric helps investors make informed decisions.

Monitoring the MVRV Z-Score allows investors to identify undervalued assets and avoid overpaying, thereby improving investment strategies. In conclusion, the MVRV Z-Score is essential for evaluating the value of crypto assets and understanding market trends, aiding investors in making smarter, risk-mitigated decisions for potentially greater returns.

4o

0 notes

Text

Renowned financial expert Jim Cramer has issued a warning against the recent surge in 'meme stock mania,' advising investors to steer clear of GameStop and AMC Entertainment. Cramer cautions that these popular stocks may be overvalued and recommends selling to avoid potential losses. Stay informed and make wise investment decisions in today's unpredictable Market. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Recently, CNBC's Jim Cramer cautioned investors against putting their money into stocks like GameStop and AMC, which experienced significant surges driven by social media hype. Cramer labeled the meme stock mania as irrational, pointing out that these stocks should not have reached such high levels independently. The surge in GameStop and AMC came after Roaring Kitty, a key figure in the 2021 GameStop short squeeze, resurfaced online after three years. While both stocks saw massive rallies, interest in them has started to diminish. Cramer compared GameStop to Best Buy, highlighting that the former is overvalued when considering their respective Market positions. Despite similar Market capitalizations, Best Buy boasts stronger financials compared to GameStop. On the other hand, Cramer expressed concerns about AMC's financial health, predicting that the movie theater chain could face financial woes by 2026 due to its massive debt. In a nutshell, Cramer advised investors to tread carefully when dealing with these volatile stocks. While GameStop may be overpriced, AMC's future looks bleak according to Cramer. Staying informed and making informed decisions will be crucial for investors eyeing these stocks. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. What is 'meme stock mania'? Cramer warns against 'meme stock mania' refers to the sudden rise in stock prices driven by social media hype rather than the company's fundamentals. 2. Why does Cramer advise selling GameStop and AMC? Cramer advises selling GameStop and AMC because the stocks are overvalued due to the meme stock craze and could potentially experience a sharp decline in value. 3. Should I follow Cramer's advice to sell GameStop and AMC? It is ultimately up to you as an investor to decide whether to follow Cramer's advice or not. It's always a good idea to do your own research and consider your financial goals before making any investment decisions. 4. What are the risks of investing in meme stocks like GameStop and AMC? Investing in meme stocks like GameStop and AMC can be risky because their prices are often driven by hype rather than the company's performance. This can lead to sharp declines in value if the hype fades. 5. How can I protect myself from the dangers of meme stock investing? To protect yourself from the dangers of meme stock investing, it's important to diversify your portfolio, focus on long-term investment strategies, and avoid making investment decisions based solely on social media hype. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

Gallerist Helly Nahmad Arrested For Suspected Gambling Related Money Laundering

The well known international art dealer Helly Nahmad’s New York gallery was raided by the FBI on Tuesday morning for suspected illegal gambling and money laundering breaches . The gallery located at the Carlyle Hotel on Madison Ave was thoroughly searched and computers were removed by the federal agency. Forbes stated that it was part of a “sweep of illegal gambling rings operated by Russian organised crime.” The New York Times have also reported “Helly Nahmad has been indicted for his role operating and financing high-stakes poker games involving Wall Street financiers, Hollywood celebrities and professional athletes.”

The actions taken on 16 April were part of a wider probe into Russian organised crime in the United States. Nahmad has been named for his involvement with a Bronx plumbing company used to launder profits from suspected gambling. The U.S. Attorney for the Southern District of New York issued statements alleging that one enterprise in this scheme laundered tens of millions of dollars through Cyprus companies and bank accounts. In NY, a 32-year-old JPMorgan Chase branch manager is alleged to have been involved in transactions in order to avoid bank reporting requirements. The Cyprus’ banking system has been under scrutiny as a haven for Russian organised crime for years. Last month a $13 billion bailout of its economy by the EU and IMF devalued the currency by 40%.

It is thought that the funds were placed into real estate and hedge fund investment. Mr. Nahmad, according to the indictment, also wired money $500,000 and $850,000 from his father’s bank account in Switzerland to a bank account in America to help fund the gambling operation. The government is seeking the forfeiture of four high-end properties, including an apartment at Trump Tower on Fifth Avenue and two Miami estates, in connection with the case. In a separate case, Mr. Nahmad has been accused of defrauding a client by overpricing a $50k painting by selling it for an overvalued $300,000.

The roots of the Nahmad family are in Aleppo, Syria, where Sephardic Jewish banker Hillel Nahmad lived until just after the second world war. Following anti-Jewish violence in 1947, he moved to Beirut, Lebanon and when the situation there became difficult, he took his three sons, Joseph (Giuseppe), Ezra and David, to Milan in the early 1960s. As teenagers in the 1960s, they began to deal in art. Ezra and David skipped school to trade on the Italian stock market. At a Juan Gris exhibition in Rome organised by cubist dealer Daniel-Henry Kahnweiler, Ezra and David bought two works – the only pieces sold. Kahnweiler befriended them, selling them works by Picasso, Braque, Gris. With the emergence of the Red Brigades terror group in the 1970s, Milan was perceived as too dangerous, and the family moved again. Joseph and Ezra headed for Monaco, and David to New York. New York’s Helly Nahmad Gallery, on Madison Avenue, is a separate company run by David’s son, who took over his father’s earlier Davlyn Gallery. David Nahmad was the 1996 Backgammon World Champion, and is known for betting large amounts of money on the game. This latest case is part of a Stateside probe into organised crime.

0 notes

Text

The Roles of Various Stakeholders in the Mortgage Life Cycle

The journey of homeownership is a multifaceted process that involves various stages, each crucial for the successful acquisition of property. The Mortgage Life Cycle, encompassing everything from loan initiation to repayment, is a complex web of interactions between different stakeholders. Understanding the roles played by each participant is key to ensuring a smooth and efficient process.

Borrowers

At the heart of the Mortgage Life Cycle are the borrowers – individuals or families aspiring to own a home. Their role extends beyond merely applying for a loan. Borrowers must meticulously assess their financial health, understand mortgage terms, and provide accurate documentation. This phase is critical, as it sets the foundation for the entire process. Choosing the right mortgage and understanding its implications are vital steps that can significantly impact a borrower's financial future.

Lenders

Lenders play a pivotal role in the Mortgage Life Cycle, acting as the financial gatekeepers who evaluate the risk associated with lending. Their responsibilities include assessing the borrower's creditworthiness, verifying documentation, and determining the loan amount and interest rates. Throughout the process, lenders act as guides, providing crucial information to borrowers and helping them navigate the intricate world of mortgages. Their decisions have a direct impact on the borrower's ability to acquire a home.

Real Estate Agents

Real estate agents are the bridge between borrowers and sellers, offering valuable insights into the housing market. Their role in the Mortgage Life Cycle involves understanding the specific needs of the borrowers, identifying suitable properties, and facilitating negotiations between buyers and sellers. Additionally, they play a crucial part in coordinating with lenders and ensuring a seamless flow of information, contributing to a faster and more efficient mortgage approval process.

Appraisers

An often overlooked but essential part of the Mortgage Life Cycle, appraisers determine the fair market value of a property. Lenders rely on their expertise to ensure that the loan amount aligns with the property's actual worth. Appraisers not only protect lenders from overvaluing assets but also safeguard borrowers from potential overpricing. Their impartial evaluations contribute to a fair and transparent mortgage process.

Title Companies

Title companies play a critical role in ensuring the legal integrity of a property transaction. They conduct thorough title searches to identify any potential legal issues that could affect the property's ownership. Clearing these issues is vital for obtaining a mortgage, as it provides lenders and borrowers with confidence in the property's legal standing. The work of title companies is essential for the smooth progression of the Mortgage Life Cycle.

Underwriters

Once the borrowers submit their application, underwriters step in to assess the overall risk associated with the mortgage. Their role involves scrutinizing the borrower's financial history, employment status, and creditworthiness. Underwriters ensure that the mortgage aligns with the lender's risk tolerance and guidelines. Their meticulous analysis is fundamental to the approval process, as they act as guardians of risk management, protecting lenders from potential financial pitfalls.

Government Agencies

Government agencies, such as the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA), play a regulatory role in the Mortgage Life Cycle. They provide guidelines, insurance, and support for specific types of mortgages. These agencies aim to make homeownership accessible to a broader population and ensure fair lending practices. Government intervention helps maintain stability and integrity within the mortgage market.

Insurance Providers: Safeguards for Borrowers and Lenders

Insurance providers offer a safety net for both borrowers and lenders. Mortgage insurance protects lenders in case of borrower default, allowing them to recover a portion of the outstanding loan. On the other hand, homeowners' insurance provides financial protection to borrowers in the event of property damage or loss. These insurance components are integral to Mortgage Life Cycle, offering security and peace of mind to all stakeholders involved.

Conclusion

The Mortgage Life Cycle is a collaborative journey that involves a myriad of stakeholders, each with a unique and indispensable role. From borrowers and lenders to real estate agents and insurance providers, the success of homeownership relies on the seamless interaction of these participants. Understanding and appreciating the contributions of each stakeholder fosters a more informed and empowered approach to navigating the complex world of mortgages. As we delve into the intricacies of the Mortgage Life Cycle, it becomes evident that every role, no matter how seemingly small, is crucial in contributing to the homeownership.

0 notes

Text

Understanding implied volatility in options

Understanding implied volatility in options is crucial for options traders as it directly impacts the pricing of options contracts. Here are the pros and cons of understanding implied volatility:

Pros:

Better Pricing Accuracy: Implied volatility reflects the market's expectations of future price movements. By understanding implied volatility, traders can better gauge whether options are overpriced or underpriced relative to historical volatility, allowing for more accurate pricing and potentially profitable trades.

Enhanced Strategy Selection: Different options trading strategies benefit from varying levels of implied volatility. For example, strategies like selling options benefit from high implied volatility, while buying options may be more favorable when implied volatility is low. Understanding implied volatility enables traders to select the most suitable strategy for prevailing market conditions.

Risk Management: Implied volatility serves as a measure of uncertainty in the market. Higher implied volatility implies greater uncertainty and potential risk, while lower implied volatility suggests less uncertainty. By incorporating implied volatility into risk management practices, traders can adjust position sizes or hedge accordingly to mitigate potential losses during volatile market conditions.

Opportunity for Profits: When options are mispriced due to discrepancies between implied and historical volatility, traders can capitalize on these inefficiencies by buying undervalued options or selling overvalued options. Understanding implied volatility provides traders with opportunities to profit from such mispricings in the options market.

Cons:

Complexity: Implied volatility is a complex concept influenced by various factors such as market sentiment, supply and demand dynamics, and external events. Analyzing and interpreting implied volatility data requires a thorough understanding of options pricing models and statistical techniques, which can be challenging for novice traders.

Subjectivity: Interpreting implied volatility involves a degree of subjectivity as it reflects market expectations rather than concrete data. Different traders may interpret implied volatility differently, leading to varying conclusions about the direction of future price movements and potential trading opportunities.

Potential Losses: Incorrectly assessing implied volatility can lead to losses, particularly for traders who rely heavily on options strategies sensitive to changes in volatility. Misjudging market sentiment or failing to anticipate shifts in implied volatility levels can result in losses on options positions.

In conclusion, while understanding implied volatility offers numerous advantages for options traders, it also comes with complexities and risks that require careful consideration and analysis. Traders should continuously monitor and adapt to changes in implied volatility to make informed trading decisions and effectively manage risk.

0 notes