#mercer philanthropy

Explore tagged Tumblr posts

Text

Новости Сиэтла - 28-11-2023

Вы голосовали? Многие ваши соседи этого не сделали.

В Сиэтле предпринимаются попытки разрешить городам проводить выборы по четным годам. Лига женщин-избирателей Вашингтона выразила обеспокоенность по поводу низкой явки избирателей и считает, что многие избиратели считают, что их голос не имеет значения. Тем не менее, лига подчеркивает, что каждый голос важен и может иметь значение в напряженных гонках, таких как выборы в городской совет Сиэтла в этом году. Президент лиги Мэри Колтрейн уверяет, что выборы в штате Вашингтон, проводимые по почте, безопасны и надежны, а голосование удивительно простое. The Seattle Times сохраняет редакционный контроль над освещением событий, а Microsoft Philanthropies частично гарантирует визуальное освещение местных новостей и тенденций.

Источник: https://www.seattletimes.com/seattle-news/voter-turnout-hits-modern-low-in-wa/

Перекрытие дорог и парковка на Сиэтлском марафоне.

В эти выходные в Сиэтле пройдет Сиэтлский марафон, традиция в честь Дня благодарения, в рамках которой бегуны выйдут на улицы и вызовут перекрытие нескольких дорог. Марафон, спонсируемый UW Medicine, состоится в воскресенье утром. Департамент транспорта штата Вашингтон объявил о нескольких крупных перебоях в движении, о которых должны знать водители и велосипедисты. Скоростные полосы на межштатной автомагистрали 5 будут закрыты до 9:30 утра, в то время как шоссе 99 в северном направлении между Харрисон-стрит и Северной 63-й улицей будет закрыто с 6:30 до 13:30. Кроме того, с 6:00 до 7:10 на бульваре Монтлейк на Северо-восточной тихоокеанской улице будет приостановлено движение, а съезд с шоссе 520 в западном направлении на бульвар Монтлейк будет закрыт с 6:30 до 11 утра.

Марафон начнется в Сиэтл-центре, а именно на Пятой авеню и Харрисон-стрит, полный марафон начнется в 7 утра, а полумарафон — в 7:30 утра. 26-мильная дистанция проведет бегунов через центр Сиэтла, кампус Вашингтонского университета, дендрарий Вашингтон-парка, парк Gas Works и мост Аврора, прежде чем вернуться в центр Сиэтла.

Для тех, кто посетит мероприятие, координаторы рекомендуют парковаться в Сиэтл-центре, где есть два гаража, расположенных на 516 Harrison St. и 650 Third Ave. N., а также парковка на Second Avenue North и Mercer Street. Уличная парковка также может быть доступна в районе Королевы Анны к северу от центра Сиэтла.

Для получения дополнительной информации с Лулу Рамадан можно связаться по телефону 206-464-2331 или [email protected]. Лулу Рамадан — журналист-расследователь газеты The Seattle Times и почетный научный сотрудник Local Reporting Network компании ProPublica.

Источник: https://www.seattletimes.com/seattle-news/transportation/seattle-marathon-road-closures-and-parking/

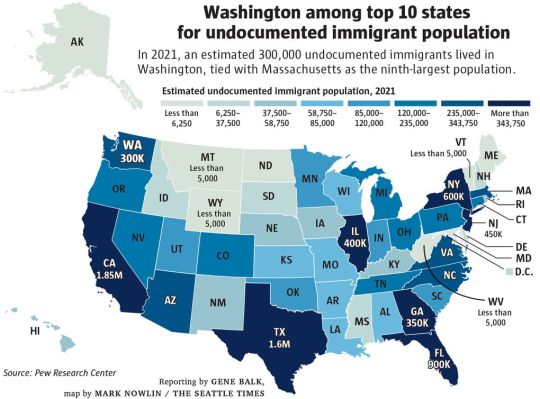

Западная Австралия - один из двух штатов, где нелегальная иммиграция выросла | К вашему сведению.

В Сиэтле резко возросло число молодых людей, принимающих лекарства от депрессии и тревоги. Хотя Сиэтл считается более либеральным, чем когда-либо, он не входит в топ-5 самых синих городов Соединенных Штатов. Кроме того, количество людей без высшего образования в Сиэтле становится все более редким.

Что касается иммиграции, то около 34% нелегальных иммигрантов в Вашингтоне в 2021 году были из Мексики, что составляет около 102 000 человек. Однако с 2017 года число нелегальных иммигрантов из Мексики сократилось почти на 900 000 человек. Это снижение может быть связано с различными факторами, в том числе с более широким снижением миграции из Мексики в Соединенные Штаты и увеличением числа мексиканских иммигрантов, возвращающихся в Мексику. Кроме того, появилось больше возможностей для легальной миграции, особенно для временных сельскохозяйственных рабочих.

В то время как число нелегальных иммигрантов из Мексики сократилось, увеличилось число нелегальных иммигрантов из других частей мира. Наибольший рост был отмечен в Центральной Америке, за ней следуют Азия и Европа/Канада.

В Вашингтоне в 2021 году в составе рабочей силы насчитывалось около 220 000 нелегальных иммигрантов, что составляет 5,6% от общей численности рабочей силы штата. Этот показатель вы��е, чем в среднем по стране (4,6%). Интересно, что большинство нелегальных иммигрантов в Вашингтоне работают в «белых воротничках», что нетипично по сравнению с другими штатами, где большинство работает в сфере обслуживания или на строительстве. Отраслью с наибольшим количеством нелегальных иммигрантов в Вашингтоне являются бизнес-услуги, в которую входят компании, оказывающие профессиональную, научную и техническую поддержку другим отраслям.

Что касается населения, то в 2021 году в Вашингтоне насчитывалось 300 000 нелегальных иммигрантов, что составляет 3,9% населения штата. Это связано с Коннектикутом, который занимает восьмое место по проценту среди штатов. Самый высокий процент был в Неваде - 5,9%, за ней следуют Техас и Нью-Джерси.

Число нелегальных иммигрантов в Вашингтоне значительно выросло за последние годы. В 1990 году в стране насчитывалось 40 000 нелегальных иммигрантов, а в 2005 году их число резко возросло до 240 000. С тех пор особых изменений не было до 2018 года, когда население подскочило до 300 000 человек, где оно оставалось до 2021 года.

В целом, в Сиэтле наблюдается рост числа молодых людей, обращающихся за лекарствами для лечения проблем с психическим здоровьем, уменьшение числа людей без высшего образования, а также изменение демографической ситуации среди нелегальных иммигрантов с уменьшением числа иммигрантов из Мексики и увеличением числа иммигрантов из других частей мира.

Источник: https://www.seattletimes.com/seattle-news/data/washington-one-of-just-two-states-where-illegal-immigration-is-up/

0 notes

Photo

Get Rebekah Mercer Out of Our Museum #AMNH

The Mercer’s and their Mercer Family Foundation philanthropy is nothing more than PR. Using their money to whiten up their soiled image when they’re NOT:

1. Using their offshore shell companies to buy votes, buy and elect politicians to set domestic and foreign policy

#TaxCutsForTheRich

#TaxCutsForCorporations

#TaxCutsForGOPDonors

2. Trafficking and funding #Hate #Racism

Richard Spencer #AltRight #Nazis #Charlottesville

Milo Yiannopoulos #AltWhite #WhiteSupremacy

Steve Bannon #Breibart #Fascism

#Trump #GOP #MuslimBan #DACA #ShitholeCountries

3. Trafficking and funding Lies

#ClimateDenial

#ScienceDenial

#CitizensUnited #DarkMoney #ParadisePapers

4. Paying millions to have IRS Commissioner John Koskinen FIRED so they don’t have to pay $6.8 billion in back taxes. Sound familiar?

A few examples of the Ultra Rich Buying Acceptance

Sackler family, prominent cultural donors, to the company that produces OxyContin, the powerful painkiller that has been involved in opioid overdoses.

David H. Koch in 2014 gave $65 million to rename the Metropolitan Museum of Art’s fountain plaza

Museum and the Arts: STOP accepting #BloodMoney

#mercer family#robert mercer#rebekah mercer#diana mercer#mercer family foundation#citizens united#plutocracy#philantrophy#mercer philanthropy#blood money#bad pr#steve bannon#donald trump#trump#potus#republicans#gop#buying america#buying votes#sackler family#david koch#dark money#amnh#natural history museum#science denial

3 notes

·

View notes

Text

*This should be shared from one side of this country to the next. Here are their names.**

**· Mukesh D. Ambani, Chairman, Reliance Industries**

**· Peter Brabeck-Letmathe, Vice-Chairman of the Board of Trustees WEF**

**· Mark Carney, UN Special Envoy for Climate Action**

**· Chrystia Freeland, Deputy Prime Minister and Minister of Finance, Canada**

**· Kristalina Georgieva, Managing Director of the IMF**

**· Queen Rania of Jordan**

**· David M. Rubenstein, Co-Founder and Executive Chairman, Carlyle Group**

**· Klaus Schwab, Founder and Executive Chairman, WEF**

**· Marc Benioff, Chair and Chief Executive Officer, Salesforce**

**· Thomas Buberl, CEO, AXA**

**· Laurence Fink, Chairman & CEO, BlackRock**

**· Orit Gadiesh, Chairman, Bain & Company**

**· Fabiola Gianotti, Director General, CERN**

**· L. Rafael Reif, President of MIT**

**· Mark Schneider, CEO, Nestlé**

**· Tharman Shanmugaratnam, Defense Minister, Singapore**

**· Robert Mercer, Renaissance Fund**

**· Larry Page, Google**

**· Al Gore, Environmentalist**

**· Angel Gurría, Secretary General OECD**

**· Paula Ingabire, Minister of Information Communication Technology, Rwanda**

**· Yo-Yo Ma, Cellist**

**· Luis Alberto Moreno, WEF**

**· Jim Hagemann Snabe, Chairman of Siemens and of Maersk**

**· Feike Sijbesma, Philco**

**· Zhu Min, Deputy Managing Director, IMF**

**· Mark Zuckerberg, Facebook/Meta**

**· Bill Gates, Microsoft**

**· Herman Gref, CEO, Sberbank**

**· André Hoffmann, Vice-Chairman Hoffman-La Roche**

**· Christine Lagarde, President, European Central Bank**

**· Peter Maurer, President, Red Cross**

**· Patrice Motsepe, Chairman, African Rainbow Minerals**

**· Julie Sweet, CEO, Accenture**

**· Heizo Takenaka, Economist**

**· Dustin Moskovitz, Open Philanthropy Co-Founder of FB**

3 notes

·

View notes

Text

Mayor Lewis,

I moved to Stardew Valley on a whim. Honestly, I didn’t think I’d be living here for long; I thought I’d stay for a few months, then move off to Zuzu City or whatever other town lied in my path. However, It’s been a year, and I am still here.

Why do you think that is, Mayor? I’ll give you a few seconds to mull it over.

Done?

It was the people. It wasn’t my paradisaical escapist fantasy, it wasn’t the beauty of the Valley-- it was the people. You may remember that you hired me as the photographer for quite a few Valley events, and I can tell you from first-hand experience: I have never seen such a tight-knit community of people who look out for one another, who care for each other, and who make each other thrive. If it weren’t for them, I wouldn’t be here right now. They have not only provided me with opportunities and employment (I was a regular employee at the Mercer General Store), but they have also offered compassion, friendship, and loyalty.

Locally run businesses like the Mercer General Store make Stardew Valley what it is. It is a natural extension of that tight-knit community this place has fostered over the years. Made by dewers, for dewers. They have a stake in this valley, one that is much deeper than any other corporation you could try and force onto us. I think the recent protests and calls to boycott are proof enough of that, aren’t they?

Joja Mart is not a part of Stardew Valley. It never has been, and it never could be. Our “neighbors” have been destroying our local economy, leaving many citizens unemployed or forced to work in the strenuous circumstances the corporation places its workers under (don’t worry, word of overworked and exhausted employees runs fast in a small town). Joja does not represent our valley, our values, or our community, nor has it helped us in the slightest, no matter what poor excuse for “philanthropy” they try to hide behind. The bus would have been fixed much sooner if Joja hadn’t run us dry by then, forcing themselves into their own savior narrative.

Stardew Valley thrives when its people thrive. I know capitalistic ventures like Joja might seem enticing, and those dollar signs might be blinding, but know that this isn’t what the Valley wants or needs. If you do think it’s what the Valley wants and needs, I advise you to take a step back and listen to the citizens that have been directly affected by your and Joja’s actions. I’m sure they will tell you otherwise.

Joja will run this town dry. There’s no other way to put it. And if we have to protest, to expose Joja for the sham it is, to scream at the top of our lungs, we will do so, because this community sticks together. I hope you realize that before it’s too late. I’ve included a few things in this envelope that I hope will help you realize what Stardew Valley truly is.

Best regards,

Finley Martin

[ In the envelope, there is one of the BOYCOTT JOJA! flyers, along with several photographs Finley had taken during the Dance of the Moonlight Jellies-- people talking, laughing, sitting together and dipping their toes into the water, children running down the pier, the faint glow of the jellies in the background. ]

#dewtask007#( finley: letters )#years of sending passive aggressive emails to professors have prepared finley for this moment

4 notes

·

View notes

Photo

Harrison Held’s SceneAroundTown.... I’m very excited to attend the 5th annual Roger Neal & Maryanne Lai Oscar Viewing Dinner tomorrow! The event will be held at the beautiful Hollywood Museum in the historic former Max Factor Building at Hollywood & HIghland right across the street from the Dolby Theatre where the Academy Awards are held. It will be a terrific evening! Before Oscar broadcast 2020 begins at 5pm Icon Awards will be given at the Roger Neal & Maryanne Lai dinner to broadcaster Nancy O’Dell for Television, Mamie Van Doren for Motion Picture Actress, Terry Moore for Motion Picture Actress, Obba Babatunde for Television Actor, Singer Andy Madadian for Music, Record Producer Joel Diamond for Music, Lee Meriweather for Television Actress, and to Hollywood Museum president and founder Donelle Dadigan who will receive The Woman In Philanthropy Award - Congratulations to all - my pal Terry Moore told me “I am almost excited as I would be for getting an Academy Award, I am so grateful to still be working and recognized and loved, and I want to thank Roger Neal and Maryanne Lai for making this happen”. It will be a great nite with catering by favorite Hoy;s Wok Mandarin on Sunset. The black tie evening is sponsored by SINO TV NETWORK & Emerald Hare Wines and will benefit the Jose Iturbi Foundation. Thank you for your hospitality and generosity Maryanne Lai, and Lynn & Roger Neal. Goldie Gillespie lead singer for the real Rick James Band RJ2 will entertain at the after party. Event PR is by Edward Lozzi & Associates. HH

Photo of Mamie Van Doren and Harrison Held by Alan Mercer - Photo of Terry Moore and Harrison Held by Billy Bennight

1 note

·

View note

Text

The Covid Orchestra, Board of Trustees

“The Names of the People Killing Humanity” compiled by Dr David Martin.

Related posts: https://t.me/robinmg/11281, https://t.me/robinmg/11277

1. Al Gore, Vice-President of the United States (1993-2001), Chairman and Co-Founder, Generation Investment Management LLP

2. Andre Hoffmann, Vice- Chairman, Roche

3. Angel Gurria, QECD

4. Bill Gates, Bill & Melinda Gates Foundation

5. Christine Lagarde, President European Central Bank

6. Chrystia Freeland, Deputy Prime Minister & Minister of Finance, Office of the Deputy Prime minister of Canada

7. David M. Rubenstein, Co-Founder and Co-Executive Chairman, Carlyle Group

8. Dustin Moskovitz, Open Philanthropy

9. Fabiola Gianotti, Director-General, European Organisation for Nuclear Research (CERN)

10. Feike Sybesma, Chairman of the Supervisory Board, Royal Philips

11. H.M. Queen Rania Al Abdullah of the Hashemite Kingdom of Jordan, Queen of the Hashemite Kingdom of Jordan, Office of H.M Queen Rania Al Abdullah

12. Heizo Takenaka, Professor Emeritus, Keio University

13. Herman Gref, Chief Executive Officer and Chairman of the Board, Sberbank

14. Jim Hagemann Snabe,Chairman Siemens

15. Julie Sweet , Chief Executive Officer, Accenture

16. Klaus Schwab, Founder and Executive Chairman, World Economic Forum

17. Kristalina Georgeva, Managing Director, International Monetary Fund (IMF)

18. L. Rafael Reif, President, Massachusetts Institute of Technology

19. Larry Page, Google

20. Laurence D Fink, Chair and Chief Executive Officer, BlackRock

21. Luis Alberto Moreno, Member of the Board of Trustees World Economic Forum

22. Marc Benioff, Chair and Chief Executive Officer, Salesforce

23. Mark Carney, United Nations Special Envoy for Climate Action and Finance, United Nations

24. Mark Schneider, Chief Executive Officer, Nestle

25. Mark Zuckerberg, Facebook

26. Mukesh D Ambani, Chairman and Managing Director of Reliance Industries

27. Orit Gadiesh, Chairman, Bain & Company

28. Patrice Motsepe, Founder and Executive Chairman, African Rainbow Minerals

29. Paula Ingabire, Minister of Information Technology and Innovation, Ministry of Information Communication Technology and Innovation of Rwanda

30. Peter Brabeck-Latmathe, Vice Chairman of the Board of Trustees, World Economic Forum

31. Peter Maurer, President, International Committee of the Red Cross (ICRC)

32. Robert Mercer, Renaissance Fund

33. Tharman Shanmugaratnam, Senior Minister, Government of Singapore

34. Thomas Buberi, Chief Executive Officer, AXA

35. Yo-Yo Ma, Cellist

36. Zhu Min, Chairman, National Institute of Financial Research

0 notes

Text

THE COVID ORCHESTRA

But this, Ladies and Gentlemen is the slide you wanted to see. This is actually the names and faces of the people who are, in fact killing humanity. And that’s ALL of them. Now, here’s the bad news: There’s a lot of people on that slide, aren’t there? Here’s the better news…I’ll actually give you all this slide, because why not? Lets make sure that we don’t ever forget the names and the faces of the people who decided to kill us…”

Here is a list of all the people in that slide:

Mukesh D. Ambani, Chairman, Reliance Industries

Peter Brabeck-Letmathe, Vice-Chairman of the Board of Trustees WEF

Mark Carney, UN Special Envoy for Climate Action

Chrystia Freeland, Deputy Prime Minister and Minister of Finance, Canada

Kristalina Georgieva, Managing Director of the IMF

Queen Rania of Jordan

David M. Rubenstein, Co-Founder and Executive Chairman, Carlyle Group

Klaus Schwab, Founder and Executive Chairman, WEF

Marc Benioff, Chair and Chief Executive Officer, Salesforce

Thomas Buberl, CEO, AXA

Laurence Fink, Chairman & CEO, BlackRock

Orit Gadiesh, Chairman, Bain & Company

Fabiola Gianotti, Director General, CERN

L. Rafael Reif, President of MIT

Mark Schneider, CEO, Nestlé

Tharman Shanmugaratnam, Defense Minister, Singapore

Robert Mercer, Renaissance Fund

Larry Page, Google

Al Gore, Environmentalist

Angel Gurría, Secretary General OECD

Paula Ingabire, Minister of Information Communication Technology, Rwanda

Yo-Yo Ma, Cellist

Luis Alberto Moreno, WEF

Jim Hagemann Snabe, Chairman of Siemens and of Maersk

Feike Sijbesma, Philco

Zhu Min, Deputy Managing Director, IMF

Mark Zuckerberg, Facebook/Meta

Bill Gates, Microsoft

Herman Gref, CEO, Sberbank

André Hoffmann, Vice-Chairman Hoffman-La Roche

Christine Lagarde, President, European Central Bank

Peter Maurer, President, Red Cross

Patrice Motsepe, Chairman, African Rainbow Minerals

Julie Sweet, CEO, Accenture

Heizo Takenaka, Economist

Dustin Moskovitz, Open Philanthropy

DUSTIN MOSKOVITZ: EDITING THE HUMAN GENOME

“So let’s get really clear on Dustin Moskovitz. Shall we, Dustin Moskovitz?… Let’s talk about him for a minute. The Co-Founder of Facebook that you’ve never heard of…also the guy who founded Open Philanthropy, who was the actual check-writer for Event201. You were told that it was the World Economic Forum. You were told it was the Bill and Melinda Gates Foundation. You were told it was Johns Hopkins University. But the actual check that cleared for the program was signed by none other than Dustin Moskovitz…

0 notes

Text

Frederick’s Place and Old Jewry, London

Frederick’s Place and Old Jewry, City of London Buildings Restoration, Architecture Refurbishment, Images

Frederick’s Place and Old Jewry in London

22 Sep 2020

Frederick’s Place and Old Jewry

Design: John Robertson Architects

Location: London, England

JRA revitalises 18th-century enclave in the City of London

John Robertson Architects (JRA) has completed the sensitive refurbishment and restoration of 1-3 and 7-8 Frederick’s Place, and 35 Old Jewry, as part of its master plan for the Mercers’ Company.

JRA’s master plan – which provides a framework for the regeneration of the Mercers’ home estate next to their livery hall in The City of London – extends the economic life of the existing buildings through extensive renovation, updating them for contemporary office use. The principal design strategies were to refurbish sensitively the listed (and non-listed) buildings, revitalise Frederick’s Place by incorporating different uses and improve and enrich the public realm. JRA’s work respects the character, quality and historic fabric of the buildings, several of which are Grade II listed.

Situated within the historic Guildhall conservation area in the heart of the City of London, this quiet 18th-century Georgian enclave forms an attractive cul-desac accessed from Old Jewry in the east and bounded by Cheapside and Becket House to the south and Ironmonger Lane to the west.

The pedestrian thoroughfare of St Olave’s Court forms the northern boundary of the site.

Originally designed by Robert Adam in the 1770s, work began in 1775 and was completed in 1778. Frederick’s Place is one of the few surviving examples of speculative building in the City of London dating from this era – Nos. 2, 3, 7 and 8, together with 35 Old Jewry, are all Grade II listed.

Located in an area characterised by narrow streets and plot widths, and with few buildings exceeding six storeys, the site forms part of a rich tapestry of architectural styles that have gradually evolved within the area’s medieval street pattern.

Avoiding the need for significant structural alterations, JRA removed suspended ceilings, floors and kitchenettes at Nos. 1-3, creating a new office entrance and reception area via No. 3. Showers and lockers are provided at sub-basement level, while new, extended double-glazed windows maximise the provision of daylight into the office.

Roof terraces on the first, fourth and fifth floors have been improved. JRA has also reinstated the entrance to No. 2, with a new bridge link spanning a lightwell.

JRA’s work at 7 & 8 Frederick’s Place and 35 Old Jewry brings these listed buildings back into commercial use, interconnecting them to provide a contemporary workplace and restoring the remaining Adam features within specific rooms.

Fireplaces with late 18th-century foliated mouldings have been retained and restored, as well as ceilings and cornices in the first floor Adam rooms. JRA has incorporated a new office entrance to No. 8, while upgrading an existing roof terrace to the rear of No. 7, creating a calm space where employees can relax.

The properties at 7, 8 and 35 were leased within a month of launching, demonstrating the strong demand for this type of historic workplace with modern City occupiers.

John Robertson, Director of John Robertson Architects comments: “These projects are the culmination of 10 years’ master planning work for the Mercers’ Company on their home estate in the City of London. Our sensitive intervention has brought these historic Robert Adam buildings back to life, restoring them to their former glory. The buildings were leased within a month of completion, which shows there is demand for modern workspace providing amenity and character.”

Simon Taylor, Property Director at the Mercers’ Company, adds: “Our company’s ambitions for the Frederick’s Place project were to make a positive contribution to our home estate by repurposing a number of vacant and dilapidated buildings, and enhance the property income stream to benefit the Mercers’ Company philanthropy. The JRA scheme exceeded our expectations in not only providing for a first-class refurbishment but also supplying the office leasing market with a unique product that combined historic architecture with elements of modernity. This resulted in the scheme letting much faster and at better rents than we envisaged. There is simply nothing better we could have asked for!”

Renowned asset management consultancy, MJ Hudson, have now moved into their offices at 1 Frederick’s Place, whilst leading food specialists, Wright Brothers will open their restaurant at 33 Old Jewry in 2021. Situated on Old Jewry, between Gresham Street and Cheapside, Frederick’s Place is less than a minute’s walk from Bank station.

Frederick’s Place and Old Jewry in London – Building Information

Design: John Robertson Architects

Client: The Mercers’ Company Architect / Principal Designer: John Robertson Architects Development Manager: Hanover Cube LLP Project Manager: SG Consulting Ltd Planning Consultant: DP9 Adviser to Principal Designer: Bureau Veritas Building Services Engineer: KJ Tait Engineers Structural Engineer: AKT II Cost Consultant: Avison Young Fire Engineer: Bureau Veritas Approved Inspector: Bureau Veritas Lift Consultant: TUV SUD Dunbar & Boardman Party Wall Surveyor: Joel Michaels Associates Rights of Light: Point 2 Surveyors Ltd Agency / Lease Advisory: Knight Frank / Ingleby Trice Heritage Consultant: KM Heritage Main Contractor: Osborne

Photography: Peter Cook

Frederick’s Place and 35 Old Jewry, London, England images/information received 220920

Location: London, England, UK

London Building Designs

Contemporary London Architectural Designs

London Architecture Links – chronological list

London Architecture Tours – bespoke UK capital city walks by e-architect

London Architects Offices

London Architecture News

London Skyscraper

City of London Tower Buildings

1 Leadenhall Tower Skyscraper Design: Make Architects image from architects 1 Leadenhall Tower

The Scalpel Design: Kohn Pederson Fox – KPF image courtesy of the architects The Scalpel City of London Skyscraper

Swiss Re Tower

Lloyds Building

Canary Wharf Tower

Comments / photos for Frederick’s Place and 35 Old Jewry, London page welcome

City of London

The post Frederick’s Place and Old Jewry, London appeared first on e-architect.

0 notes

Text

Black Lives Matter Protesters Tear Down Slave Trader Statue In Bristol And Dump In Harbour

The controversial memorial to Edward Colston has stood since 1895.

Black Lives Matter protesters in Bristol have torn down the controversial statue of a slave trader and rolled it into the River Avon, as thousands of people marched through the city in protest against police brutality following the death of George Floyd.

The memorial to Edward Colston, who made his fortune in the slave trade in the 1600s, has stood in the city since 1895 but in recent years has been the subject of a number of petitions – the most recent of which has garnered more than 10,000 signatures.

On Sunday demonstrators took matter into their own hands, tying a rope around the head of the statue – which had previously been covered in a black shroud for the march – and pulling it to the ground.

It was then rolled from the city centre and dumped unceremoniously into Bristol’s harbour – almost exactly at the point where Edward Colston’s ships would have once left for West Africa.

Avon and Somerset Police superintendent Andy Bennett has since announced that the force has launched an investigation to identify a small group of people “who clearly committed an act of criminal damage”.

Home secretary Priti Patel said the toppling of the statue was “utterly disgraceful”.

Bristol’s history is tightly interwoven with the slave trade, and in the 18th century the city was one of the UK’s largest slave ports.

The point at which the statue was tipped into the water is directly next to Pero’s Bridge, which was was named in honour of Pero Jones who came to live in Bristol as a slave.

One of the men who helped roll the statue into the water told HuffPost UK: “It’s what he deserved. I’ve been waiting my whole life for this moment.

“It’s an amazing feeling, it feels like the end of a chapter. It’s what we all needed.”

Asked about what this moment meant to him, the man – who asked to remain anonymous – said: “I don’t think racism will ever be dead, but I think what we need in the future is more consequence for bad actions and for more people to stand up and help each other.

“If we see inequality for any race, any sexuality, any religion, we have to come together.”

Edward Colston

Colston’s legacy has proved hugely divisive as while his money was derived largely from the slave trade, who used much of it to set up charitable foundations some of which survive to this day.

Born into a prosperous Bristol merchant’s family, Colston was educated in London and joined the Mercers’ Company in 1673, where he traded in woollen textiles and wine, PA Media reports.

He became a member of the London-based Royal African Company – which at the time had the monopoly of Britain’s slave trade – in 1680, and between 1689-1690 took on the role of deputy governor.

Other members of the Colston family also had connections with the company: his brother Thomas supplied beads that were used to buy slaves, and his father William owned shares.

By 1689, the company had transported around 100,000 enslaved Africans in chains to the Americas, who were branded with the firm’s initials RAC on their chests.

Unhygienic and cramped conditions meant many of those enslaved died while being shipped, with their bodies said to be thrown overboard.

Colston donated money to causes in and around Bristol before his death in 1721 – including to the city’s churches, founded almshouses, Queen Elizabeth’s Hospital School, and founding a religious school for boys.

According to Historic England, his involvement in the slave trade was the source of much of the money which he bestowed in the city.

Due to his philanthropy, Colston’s legacy has been honoured by the city he once called home, where streets, memorials and buildings bear his name.

A number of Labour MPs tweeted in solidarity with protesters who pulled down the statue.

Earlier, protestor John McAllister, 71, tore down black bin bags used to hide the statue to denounce it in front of fellow protesters.

He told the PA news agency: “It says ‘erected by the citizens of Bristol, as a memorial to one of the most virtuous and wise sons of this city’.

“The man was a slave trader. He was generous to Bristol but it was off the back of slavery and it’s absolutely despicable. It’s an insult to the people of Bristol.”

Police said 10,000 people had attended the Black Lives Matter demonstration in Bristol and the majority did so “peacefully”.

Many protesters wore masks and gloves, but the sheer number of attendees meant that social distancing was impossible at points.

Speaking from the plinth upon which Colston’s statues used to stand, one protester told the crowd: “It’s all well and good every two or three years shouting ‘Black Lives Matter’ but how are you actually going to change what’s going on on this earth”

“We have to start by educating ourselves and our children, education is power. Violence will never change anything. We need to teach our little children for the future.”

— By Sarah Turnnidge, Chris York | Huffingtonpost.Co.UK | Sunday June 7, 2020

Tens of thousands join Black Lives Matter protest in London

Fourteen police officers were injured in "shocking and completely unacceptable" assaults during anti-racism protests in central London on Saturday, London police chief Cressida Dick said on Sunday.

LONDON (Reuters) - Tens of thousands took to the streets of London on Sunday, rallying for a second day running to condemn police brutality after the killing of George Floyd in Minneapolis, with some wearing face masks bearing the slogan “Racism is a virus”.

— Rueters | June 7, 2020 | Michael Holden, Guy Faulconbridge

0 notes

Text

Publish or Perish

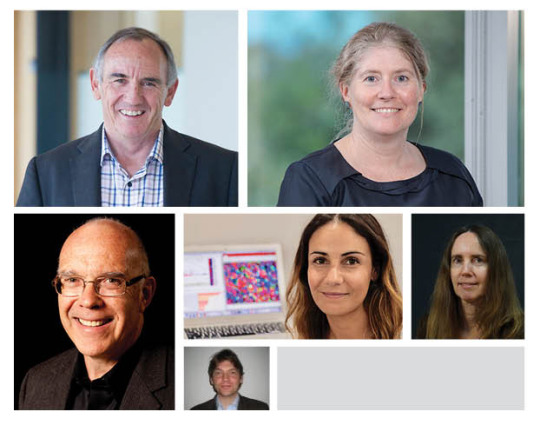

The future of academic publishing and biomedical research Tuesday, 18 June 2019

REGISTER

Australia’s medical research community has in recent years faced important pressures and challenges. Funding cuts, uncertain research career prospects and research careers cut short, the push for better research translation for social impact are among some of the issues that are confronting many researchers. We have convened a panel to discuss an emerging issue for the local biomedical research community: the disruption to academic publishing and its likely impact on the sector.

Academic journals have been the longstanding method for scientists to communicate new knowledge and ideas to their peers. They are influential in building the reputation and career of researchers as well as the reputation and ranking of research institutes and universities, in securing research funding, and in facilitating translation for impact. Access to this new knowledge is only possible through a subscription model where scientists or institutions pay to access journals, commonly referred to as the paywall barrier. As a result, publishing of academic journals has also become a major business.

The digital revolution is disrupting academic publishing. Digital journals have changed the nature of and access to scholarly academic material through new distribution channels. Authors are bypassing subscription-based publishing and adopting an Open Access publishing model, where no payment is required to access articles or journals. In the biomedical sciences, examples of Open Access is represented by journals such as PLOS (Public Library of Science) and BioMed Central.

Open Access publishing is gaining support, with a growing number of universities in the US and Europe deciding not to renew traditional multi-year licences with journal publishers. The European Union has resolved that all European scientific publications should be accessible by Open Access from 2020. A largely European-based initiative, Coalition S, is also insisting that by 2020, it will be mandatory that any research funded by consortium members be freely and immediately available to the public.

The disruption of academic publishing is a global phenomenon, but what impact may it may have on our biomedical research community?

What are the features of the Open Access model?

How should researchers choose between publishing in traditional or Open Access journals?

Will Open Access publishing result in better outcomes – for researchers, universities, research institutes and the economy?

Will Open Access result in better innovation?

How are our universities and funding bodies responding to this new publishing model?

We are bringing together a panel of experts representing the key stakeholders in Australian biomedical research to address and other questions.

Our panel members:

Professor James McCluskey AO, Deputy Vice-Chancellor (Research), University of Melbourne

Dr Julie Glover, Executive Director of the Research Foundations Branch,National Health and Medical Research Council

Dr Glenn Begley, CEO, BioCurate Ltd

Dr Clare Fedele, Senior Postdoctoral Researcher, Peter MacCallum Cancer Centre

Mr James Mercer, Regional Sales Director Oceania, Springer Nature

Professor Beth Webster (Moderator), Director, Centre for Transformative Innovation, Swinburne University of Technology

Who will benefit by attending?

Researchers, particularly in the sciences, bioengineering and computing disciplines

Businesses related to the biotechnology, pharmaceuticals and medical technology industries

Undergraduate and postgraduate students

Anyone interested in the future of biomedical research in Australia

Professor James McCluskey

James McCluskey AO, FAA, FAHMS B Med Sci (UWA), MBBS (UWA), FRACP, FRCPA, MD (UWA) is Deputy Vice Chancellor Research and Redmond Barry Distinguished Professor in Microbiology and Immunology at The University of Melbourne.

He trained in Perth as a physician and as a research fellow at the National Institutes of Health (USA). He has held senior positions at Monash University, Flinders University and the Australian Red Cross Blood Service in Adelaide, South Australia. He established the SA unrelated bone marrow donor registry.

He has published more than 320 scientific articles on HLA, immunogenetics, antigen presentation and immune recognition. His work has spanned transplantation biology, autoimmunity, T cell hypersensitivity and recognition of non-peptide ligands by unconventional T cells.

He led the development, funding and establishment of the Peter Doherty Institute for Infection and Immunity and coordinated the team that won a USD$50M grant from The Atlantic Philanthropies to help to establish a new Fellowship program focused on indigenous leadership to effect social change.

He is a past President of the Australasian Society for Immunology, The Australasian & South East Asian Tissue Typing Society and the International Histocompatibility Workshop Group.

He has been a director of more than 10 independent medical research institutes and cooperative research centres.

Dr Julie Glover

Dr Glover is the Executive Director of the Research Foundations Branch. This includes responsibility for directing NHMRC’s research support schemes, leading strategic research activities and international collaborations.

Dr Glover completed a PhD in the Faculty of Science at the Australian National University in 1996 and held research positions until joining the Bureau of Rural Sciences in 2002. In 2007 Julie moved into the Innovation Division of the Department of Industry and spent the next four years developing and delivering key innovation policies. Dr Glover joined NHMRC as a Director in 2011.

Dr C. Glenn Begley M.B., B.S., Ph.D., F.R.A.C.P., F.R.C.P.A., F.R.C.Path., F.A.H.M.S.

Dr Begley is the inaugural CEO of BioCurate, a joint initiative of Monash and Melbourne Universities and created to provide commercial focus in the early phases of drug development.

He served as Chief Scientific Officer at Akriveia Therapeutics, California (2016-2027) and TetraLogic Pharmaceuticals, Pennsylvania (2012-2016). From 2002-2012, he was Vice-President and Global Head of Hematology/Oncology Research at Amgen, Thousand Oaks, California, responsible for building, directing and integrating Amgen’s 5 research sites. There he highlighted the issue of research integrity and scientific reproducibility.

Since then he has made multiple presentations on the subject of scientific integrity including to President Obama's Science Council, the White House, US National Institutes of Health, US Academies of Science, US National Institute of Standards and Technology, the British Broadcasting Company, Wellcome Trust, Australian National Health and Medical Research Council, and numerous Universities, Research Institutes and companies.

Before Amgen he had over 20 years of clinical experience in medical oncology and hematology. His personal research focused on regulation of hematopoietic cells and translational clinical trials. His early studies, in Prof Donald Metcalf’s department first described human G-CSF, and in later clinical studies, performed in Professor Richard Fox’s Department at the Royal Melbourne Hospital, the group first demonstrated that G-CSF-"mobilized" blood stem cells hastened hematopoietic recovery, a finding that revolutionized bone-marrow transplantation.

His honors include being elected as the first Foreign Fellow to the American Society of Clinical Investigation in 2000, to the Association of American Physicians in 2008, and in 2014 to the Research "Hall of Fame" at his alma mater, the Royal Melbourne Hospital and to the Australian Academy of Health and Medical Sciences.

Dr Clare Fedele

Dr Clare Fedele is a cancer scientist and Strategic Research Communications Officer at the Peter MacCallum Cancer Centre.

She has a PhD in biochemistry from Monash University and has been the recipient of prestigious fellowships from the NHMRC and the Victorian Cancer Agency.

Clare is passionate about science outreach and is a regular on ABC Melbourne Breakfast radio, where she brings biomedical science stories to life.

In 2017 Clare was named a Superstar of STEM by Science and Technology Australia, a federal program aimed at increasing the public visibility of female leaders in STEM industries.

Mr James Mercer

James Mercer is the Regional Sales Director Oceania, Springer Nature. He has worked in academic publishing in commercial roles for 20 years. Joining Springer in 2008 he has been responsible for Springer Nature’s sales in Southeast Asia and Oceania. Between 2004 and 2008 he was responsible for Oxford University Press’ journals business across the Asia-Pacific region.

Prior to joining OUP James fulfilled a number of positions at Blackwell’s in the UK after graduating from the University of Leeds in 1999.

Professor Beth Webster

Beth Webster is the Director of the Centre for Transformative Innovation at Swinburne University. Previously she was Director at Intellectual Property Research Institute of Australia and Professorial Fellow, Melbourne Institute of Applied Economics and Social Research. She has a PhD from the University of Cambridge. She has undertaken wide-ranging research on the economics of innovation, intellectual property, as well as more general research on the performance of Australian enterprises. This includes over 100 articles in refereed journals.

Recent government clients include the Commonwealth Departments of Industry, Technology and Resources; Employment; Education, Training; IP Australia; the Fair Pay Commission; AusAID and the Victorian Departments of Treasury and Finance and Environment, the European Commission, the OECD and the Garnaut Climate Change Review. Industry clients include IBM, Medicines Australia; the Business Council of Australia.

In recent years she has undertaken many studies on industry performance, both using BLADE and other relevant datasets, for the Victorian Government, The Australia Department of Industry, Austrade, IP Australia, The Department of Foreign Affairs and Trade inter alia.

REGISTER

Event details:

Date: Tuesday, 18 June 2019

Time: 6.00pm – 7.30pm

Venue:

Elisabeth Murdoch Theatre A

Elisabeth Murdoch Building, Spencer Road

University of Melbourne

Parkville

0 notes

Text

Highlights of ‘Impact Investment for Institutional Investors’

Earlier this month, Bridges Ventures and Cheyne Capital hosted a packed room of institutional investors in London for a discussion about the challenges and opportunities of impact investment for institutional investors. Featuring contributions from Sir Ronald Cohen and Nick Hurd MP (the former Minister for Civil Society), the event gave investors a chance to hear from peers who are already active in the space, and from fund managers who are developing investment products to meet a range of different investor needs.

The following summary is for the benefit of the 65 investors who attended, and others who expressed an interest to attend but weren’t able to join us.

Key takeaways:

·There is increasing global momentum behind the impact investing movement

· More and more entrepreneurs are setting out to solve social and environmental problems

·There is a range of possible impact investing strategies – including private equity, property and fixed income – to suit a range of risk/reward profiles

·There is a growing body of evidence that investing for impact can create competitive advantage and deliver at- or even above-market returns

·Government has an important role to play as a facilitator (and buyer of social outcomes)

A few highlights of the discussion:

“The invisible heart of markets”

Sir Ronald Cohen described impact investing as the new venture capital. Just as venture had previously emerged in response to the needs of innovative tech entrepreneurs, so the rise of impact investing is a response to the needs of the growing number of social and environmental entrepreneurs – and just as ERISA legislation had made it easier for institutions to invest in venture capital, so legislative changes were making it easier for institutions to invest for impact, too. “This is already a global movement, demonstrated by the engagement of the G7 countries, the EU, Australia, Brazil, India, Israel, Mexico and Portugal in the work of the Global Social Impact Investment Steering Group.” And it brings a new dimension to investment decision making across asset classes, bringing “the invisible heart of markets to guide their invisible hand”. He pointed to the extraordinarily high calibre of people in the space, as well as to the potential for attractive uncorrelated returns from financial products like social impact bonds.

Next, a group of investors talked about their experiences of investing for impact, in a panel chaired by (outgoing) Big Society Capital CEO Nick O’Donohoe.

Matt Christensen fromAXA IM said his organisation had originally started thinking about impact as the positive element of its responsible investment strategy, to complement its risk mitigation strategies (like divestment, integration of ESG factors, and so on). AXA IM has now looked at more than 300 fund opportunities across different asset classes, he said, of which 50 were “institutionally ready”. He discussed the importance of impact being “in the DNA of the fund” rather than “accidental”; he thinks linking fund manager incentives to impact might help in that respect. In light of its success to date, and the substantial interest this has generated internally, AXA IM is now seeking to increase its activity in this area: it plans to launch a second impact investment fund of funds. Matt believes we will increasingly see buyers pay a premium for impactful businesses.

Lisa Hall fromSkopos Impact Fund said that, contrary to some investor concerns about a lack of institutional quality product, her team has been able to invest more than €70 million across two different portfolios in less than two years. She stressed the importance of recognising that there is a broad spectrum of possible impact investments (as per the Bridges Spectrum of Capital); Skopos only invests in funds seeking risk adjusted market-rate returns, and there is growing evidence that this is possible, she said (notably in the recent Wharton report ‘Great Expectations’). She also highlighted the importance of impact measurement, to ensure impact is “not just promised but real” – and also truly additional. Companies that follow sustainable business practices are more likely to be adhering to best practices throughout their organisations, she added.

Aled Jones fromMercer suggested his firm’s clients were only really interested in market-rate return products – and that there was a small but growing number of institutional-quality managers in that space. Mercer is very focused on the dependability of impact measurement processes, he said; but generally speaking, it assesses a potential impact investment opportunity in much the same way as it would assess any other potential investment.

Next up was Nick Hurd MP, the former UK Minister for Civil Society. He argued that as our social and environmental problems become ever larger and more complex, and with public spending shrinking across the developed world, Governments desperately need new and innovative solutions. So they have a huge role to play as a facilitator of the social investment market and as a buyer of social outcomes. He also believes that social businesses will become increasingly important in the creation of sustainable jobs, particularly for young people. There are cultural challenges to overcome, he admitted – but he believes this is one of the few issues on which there is cross-party consensus in the UK. Quoting Victor Hugo’s aphorism that “there is nothing more powerful than an idea whose time has come”, he urged those investors present to “take action” and commit the capital required.

Finally, a group of fund managers discussed their own impact investing strategies, in a panel chaired by Emma Daviesof The Wellcome Trust.

Shamez Alibhai, partner and manager of the Social Property Impact Fund at Cheyne Capital, an alternative investment manager, said that his fund was helping to plug the gap as Government funding was withdrawn from the social housing market. Investors recognise that serving the socially-disadvantaged doesn’t have to mean sacrificing returns, he said: three-quarters of the fund’s investors do not even have a specific impact allocation. Cheyne had brought in an external expert (New Philanthropy Capital) to assess the social impact of all its investments, he added.

Michele Giddens, partner and co-founder at Bridges Ventures, a specialist sustainable and impact investor, talked about how investing for impact could act as a competitive advantage – in terms of the quality and passion of the team it allows a manager to attract, and the alignment of interest it demonstrates to mission-driven entrepreneurs. By developing a platform of different funds (from growth capital for SMEs, to property investment, to social sector funding), Bridges now has a range of tools to tackle societal challenge – and a range of products to meet different investors’ requirements, she said.

Simon Bond, lead portfolio manager of the Threadneedle UK Social Bond Fund – a partnership between fund manager Columbia Threadneedle and social investor Big Issue Invest – talked about how the vehicle is giving a range of retail and institutional investors an opportunity to invest for impact via a daily liquid fund. Big Issue Invest designed the methodology used to assess the impact of the bond investments under consideration – and almost half of Threadneedle’s management fee goes towards Big Issue’s charitable efforts, Bond said.

Cheyne Capital was established in 2000 by Jonathan Lourie (CEO & CIO) and Stuart Fiertz (President) after working together at Morgan Stanley. Today Cheyne is one of the largest providers of European Real Estate Debt and has developed an Investment Grade & Crossover Corporate Credit programme that has generated net annualised returns of 14% since its inception in 2002.

0 notes

Text

Highlights of ‘Impact Investment for Institutional Investors’

Earlier this month, Bridges Ventures and Cheyne Capital hosted a packed room of institutional investors in London for a discussion about the challenges and opportunities of impact investment for institutional investors. Featuring contributions from Sir Ronald Cohen and Nick Hurd MP (the former Minister for Civil Society), the event gave investors a chance to hear from peers who are already active in the space, and from fund managers who are developing investment products to meet a range of different investor needs.

The following summary is for the benefit of the 65 investors who attended, and others who expressed an interest to attend but weren’t able to join us.

Key takeaways:

·There is increasing global momentum behind the impact investing movement

· More and more entrepreneurs are setting out to solve social and environmental problems

·There is a range of possible impact investing strategies – including private equity, property and fixed income – to suit a range of risk/reward profiles

·There is a growing body of evidence that investing for impact can create competitive advantage and deliver at- or even above-market returns

·Government has an important role to play as a facilitator (and buyer of social outcomes)

A few highlights of the discussion:

“The invisible heart of markets”

Sir Ronald Cohen described impact investing as the new venture capital. Just as venture had previously emerged in response to the needs of innovative tech entrepreneurs, so the rise of impact investing is a response to the needs of the growing number of social and environmental entrepreneurs – and just as ERISA legislation had made it easier for institutions to invest in venture capital, so legislative changes were making it easier for institutions to invest for impact, too. “This is already a global movement, demonstrated by the engagement of the G7 countries, the EU, Australia, Brazil, India, Israel, Mexico and Portugal in the work of the Global Social Impact Investment Steering Group.” And it brings a new dimension to investment decision making across asset classes, bringing “the invisible heart of markets to guide their invisible hand”. He pointed to the extraordinarily high calibre of people in the space, as well as to the potential for attractive uncorrelated returns from financial products like social impact bonds.

Next, a group of investors talked about their experiences of investing for impact, in a panel chaired by (outgoing) Big Society Capital CEO Nick O’Donohoe.

Matt Christensen fromAXA IM said his organisation had originally started thinking about impact as the positive element of its responsible investment strategy, to complement its risk mitigation strategies (like divestment, integration of ESG factors, and so on). AXA IM has now looked at more than 300 fund opportunities across different asset classes, he said, of which 50 were “institutionally ready”. He discussed the importance of impact being “in the DNA of the fund” rather than “accidental”; he thinks linking fund manager incentives to impact might help in that respect. In light of its success to date, and the substantial interest this has generated internally, AXA IM is now seeking to increase its activity in this area: it plans to launch a second impact investment fund of funds. Matt believes we will increasingly see buyers pay a premium for impactful businesses.

Lisa Hall fromSkopos Impact Fund said that, contrary to some investor concerns about a lack of institutional quality product, her team has been able to invest more than €70 million across two different portfolios in less than two years. She stressed the importance of recognising that there is a broad spectrum of possible impact investments (as per the Bridges Spectrum of Capital); Skopos only invests in funds seeking risk adjusted market-rate returns, and there is growing evidence that this is possible, she said (notably in the recent Wharton report ‘Great Expectations’). She also highlighted the importance of impact measurement, to ensure impact is “not just promised but real” – and also truly additional. Companies that follow sustainable business practices are more likely to be adhering to best practices throughout their organisations, she added.

Aled Jones fromMercer suggested his firm’s clients were only really interested in market-rate return products – and that there was a small but growing number of institutional-quality managers in that space. Mercer is very focused on the dependability of impact measurement processes, he said; but generally speaking, it assesses a potential impact investment opportunity in much the same way as it would assess any other potential investment.

Next up was Nick Hurd MP, the former UK Minister for Civil Society. He argued that as our social and environmental problems become ever larger and more complex, and with public spending shrinking across the developed world, Governments desperately need new and innovative solutions. So they have a huge role to play as a facilitator of the social investment market and as a buyer of social outcomes. He also believes that social businesses will become increasingly important in the creation of sustainable jobs, particularly for young people. There are cultural challenges to overcome, he admitted – but he believes this is one of the few issues on which there is cross-party consensus in the UK. Quoting Victor Hugo’s aphorism that “there is nothing more powerful than an idea whose time has come”, he urged those investors present to “take action” and commit the capital required.

Finally, a group of fund managers discussed their own impact investing strategies, in a panel chaired by Emma Daviesof The Wellcome Trust.

Shamez Alibhai, partner and manager of the Social Property Impact Fund at Cheyne Capital, an alternative investment manager, said that his fund was helping to plug the gap as Government funding was withdrawn from the social housing market. Investors recognise that serving the socially-disadvantaged doesn’t have to mean sacrificing returns, he said: three-quarters of the fund’s investors do not even have a specific impact allocation. Cheyne had brought in an external expert (New Philanthropy Capital) to assess the social impact of all its investments, he added.

Michele Giddens, partner and co-founder at Bridges Ventures, a specialist sustainable and impact investor, talked about how investing for impact could act as a competitive advantage – in terms of the quality and passion of the team it allows a manager to attract, and the alignment of interest it demonstrates to mission-driven entrepreneurs. By developing a platform of different funds (from growth capital for SMEs, to property investment, to social sector funding), Bridges now has a range of tools to tackle societal challenge – and a range of products to meet different investors’ requirements, she said.

Simon Bond, lead portfolio manager of the Threadneedle UK Social Bond Fund – a partnership between fund manager Columbia Threadneedle and social investor Big Issue Invest – talked about how the vehicle is giving a range of retail and institutional investors an opportunity to invest for impact via a daily liquid fund. Big Issue Invest designed the methodology used to assess the impact of the bond investments under consideration – and almost half of Threadneedle’s management fee goes towards Big Issue’s charitable efforts, Bond said.

Cheyne Capital was established in 2000 by Jonathan Lourie (CEO & CIO) and Stuart Fiertz (President) after working together at Morgan Stanley. Today Cheyne is one of the largest providers of European Real Estate Debt and has developed an Investment Grade & Crossover Corporate Credit programme that has generated net annualised returns of 14% since its inception in 2002.

0 notes

Text

Highlights of ‘Impact Investment for Institutional Investors’

Earlier this month, Bridges Ventures and Cheyne Capital hosted a packed room of institutional investors in London for a discussion about the challenges and opportunities of impact investment for institutional investors. Featuring contributions from Sir Ronald Cohen and Nick Hurd MP (the former Minister for Civil Society), the event gave investors a chance to hear from peers who are already active in the space, and from fund managers who are developing investment products to meet a range of different investor needs.

The following summary is for the benefit of the 65 investors who attended, and others who expressed an interest to attend but weren’t able to join us.

Key takeaways:

·There is increasing global momentum behind the impact investing movement

· More and more entrepreneurs are setting out to solve social and environmental problems

·There is a range of possible impact investing strategies – including private equity, property and fixed income – to suit a range of risk/reward profiles

·There is a growing body of evidence that investing for impact can create competitive advantage and deliver at- or even above-market returns

·Government has an important role to play as a facilitator (and buyer of social outcomes)

A few highlights of the discussion:

“The invisible heart of markets”

Sir Ronald Cohen described impact investing as the new venture capital. Just as venture had previously emerged in response to the needs of innovative tech entrepreneurs, so the rise of impact investing is a response to the needs of the growing number of social and environmental entrepreneurs – and just as ERISA legislation had made it easier for institutions to invest in venture capital, so legislative changes were making it easier for institutions to invest for impact, too. “This is already a global movement, demonstrated by the engagement of the G7 countries, the EU, Australia, Brazil, India, Israel, Mexico and Portugal in the work of the Global Social Impact Investment Steering Group.” And it brings a new dimension to investment decision making across asset classes, bringing “the invisible heart of markets to guide their invisible hand”. He pointed to the extraordinarily high calibre of people in the space, as well as to the potential for attractive uncorrelated returns from financial products like social impact bonds.

Next, a group of investors talked about their experiences of investing for impact, in a panel chaired by (outgoing) Big Society Capital CEO Nick O’Donohoe.

Matt Christensen fromAXA IM said his organisation had originally started thinking about impact as the positive element of its responsible investment strategy, to complement its risk mitigation strategies (like divestment, integration of ESG factors, and so on). AXA IM has now looked at more than 300 fund opportunities across different asset classes, he said, of which 50 were “institutionally ready”. He discussed the importance of impact being “in the DNA of the fund” rather than “accidental”; he thinks linking fund manager incentives to impact might help in that respect. In light of its success to date, and the substantial interest this has generated internally, AXA IM is now seeking to increase its activity in this area: it plans to launch a second impact investment fund of funds. Matt believes we will increasingly see buyers pay a premium for impactful businesses.

Lisa Hall fromSkopos Impact Fund said that, contrary to some investor concerns about a lack of institutional quality product, her team has been able to invest more than €70 million across two different portfolios in less than two years. She stressed the importance of recognising that there is a broad spectrum of possible impact investments (as per the Bridges Spectrum of Capital); Skopos only invests in funds seeking risk adjusted market-rate returns, and there is growing evidence that this is possible, she said (notably in the recent Wharton report ‘Great Expectations’). She also highlighted the importance of impact measurement, to ensure impact is “not just promised but real” – and also truly additional. Companies that follow sustainable business practices are more likely to be adhering to best practices throughout their organisations, she added.

Aled Jones fromMercer suggested his firm’s clients were only really interested in market-rate return products – and that there was a small but growing number of institutional-quality managers in that space. Mercer is very focused on the dependability of impact measurement processes, he said; but generally speaking, it assesses a potential impact investment opportunity in much the same way as it would assess any other potential investment.

Next up was Nick Hurd MP, the former UK Minister for Civil Society. He argued that as our social and environmental problems become ever larger and more complex, and with public spending shrinking across the developed world, Governments desperately need new and innovative solutions. So they have a huge role to play as a facilitator of the social investment market and as a buyer of social outcomes. He also believes that social businesses will become increasingly important in the creation of sustainable jobs, particularly for young people. There are cultural challenges to overcome, he admitted – but he believes this is one of the few issues on which there is cross-party consensus in the UK. Quoting Victor Hugo’s aphorism that “there is nothing more powerful than an idea whose time has come”, he urged those investors present to “take action” and commit the capital required.

Finally, a group of fund managers discussed their own impact investing strategies, in a panel chaired by Emma Daviesof The Wellcome Trust.

Shamez Alibhai, partner and manager of the Social Property Impact Fund at Cheyne Capital, an alternative investment manager, said that his fund was helping to plug the gap as Government funding was withdrawn from the social housing market. Investors recognise that serving the socially-disadvantaged doesn’t have to mean sacrificing returns, he said: three-quarters of the fund’s investors do not even have a specific impact allocation. Cheyne had brought in an external expert (New Philanthropy Capital) to assess the social impact of all its investments, he added.

Michele Giddens, partner and co-founder at Bridges Ventures, a specialist sustainable and impact investor, talked about how investing for impact could act as a competitive advantage – in terms of the quality and passion of the team it allows a manager to attract, and the alignment of interest it demonstrates to mission-driven entrepreneurs. By developing a platform of different funds (from growth capital for SMEs, to property investment, to social sector funding), Bridges now has a range of tools to tackle societal challenge – and a range of products to meet different investors’ requirements, she said.

Simon Bond, lead portfolio manager of the Threadneedle UK Social Bond Fund – a partnership between fund manager Columbia Threadneedle and social investor Big Issue Invest – talked about how the vehicle is giving a range of retail and institutional investors an opportunity to invest for impact via a daily liquid fund. Big Issue Invest designed the methodology used to assess the impact of the bond investments under consideration – and almost half of Threadneedle’s management fee goes towards Big Issue’s charitable efforts, Bond said.

Cheyne Capital was established in 2000 by Jonathan Lourie (CEO & CIO) and Stuart Fiertz (President) after working together at Morgan Stanley. Today Cheyne is one of the largest providers of European Real Estate Debt and has developed an Investment Grade & Crossover Corporate Credit programme that has generated net annualised returns of 14% since its inception in 2002.

0 notes

Text

Highlights of ‘Impact Investment for Institutional Investors’

Earlier this month, Bridges Ventures and Cheyne Capital hosted a packed room of institutional investors in London for a discussion about the challenges and opportunities of impact investment for institutional investors. Featuring contributions from Sir Ronald Cohen and Nick Hurd MP (the former Minister for Civil Society), the event gave investors a chance to hear from peers who are already active in the space, and from fund managers who are developing investment products to meet a range of different investor needs.

The following summary is for the benefit of the 65 investors who attended, and others who expressed an interest to attend but weren’t able to join us.

Key takeaways:

·There is increasing global momentum behind the impact investing movement

· More and more entrepreneurs are setting out to solve social and environmental problems

·There is a range of possible impact investing strategies – including private equity, property and fixed income – to suit a range of risk/reward profiles

·There is a growing body of evidence that investing for impact can create competitive advantage and deliver at- or even above-market returns

·Government has an important role to play as a facilitator (and buyer of social outcomes)

A few highlights of the discussion:

“The invisible heart of markets”

Sir Ronald Cohen described impact investing as the new venture capital. Just as venture had previously emerged in response to the needs of innovative tech entrepreneurs, so the rise of impact investing is a response to the needs of the growing number of social and environmental entrepreneurs – and just as ERISA legislation had made it easier for institutions to invest in venture capital, so legislative changes were making it easier for institutions to invest for impact, too. “This is already a global movement, demonstrated by the engagement of the G7 countries, the EU, Australia, Brazil, India, Israel, Mexico and Portugal in the work of the Global Social Impact Investment Steering Group.” And it brings a new dimension to investment decision making across asset classes, bringing “the invisible heart of markets to guide their invisible hand”. He pointed to the extraordinarily high calibre of people in the space, as well as to the potential for attractive uncorrelated returns from financial products like social impact bonds.

Next, a group of investors talked about their experiences of investing for impact, in a panel chaired by (outgoing) Big Society Capital CEO Nick O’Donohoe.

Matt Christensen fromAXA IM said his organisation had originally started thinking about impact as the positive element of its responsible investment strategy, to complement its risk mitigation strategies (like divestment, integration of ESG factors, and so on). AXA IM has now looked at more than 300 fund opportunities across different asset classes, he said, of which 50 were “institutionally ready”. He discussed the importance of impact being “in the DNA of the fund” rather than “accidental”; he thinks linking fund manager incentives to impact might help in that respect. In light of its success to date, and the substantial interest this has generated internally, AXA IM is now seeking to increase its activity in this area: it plans to launch a second impact investment fund of funds. Matt believes we will increasingly see buyers pay a premium for impactful businesses.

Lisa Hall fromSkopos Impact Fund said that, contrary to some investor concerns about a lack of institutional quality product, her team has been able to invest more than €70 million across two different portfolios in less than two years. She stressed the importance of recognising that there is a broad spectrum of possible impact investments (as per the Bridges Spectrum of Capital); Skopos only invests in funds seeking risk adjusted market-rate returns, and there is growing evidence that this is possible, she said (notably in the recent Wharton report ‘Great Expectations’). She also highlighted the importance of impact measurement, to ensure impact is “not just promised but real” – and also truly additional. Companies that follow sustainable business practices are more likely to be adhering to best practices throughout their organisations, she added.

Aled Jones fromMercer suggested his firm’s clients were only really interested in market-rate return products – and that there was a small but growing number of institutional-quality managers in that space. Mercer is very focused on the dependability of impact measurement processes, he said; but generally speaking, it assesses a potential impact investment opportunity in much the same way as it would assess any other potential investment.

Next up was Nick Hurd MP, the former UK Minister for Civil Society. He argued that as our social and environmental problems become ever larger and more complex, and with public spending shrinking across the developed world, Governments desperately need new and innovative solutions. So they have a huge role to play as a facilitator of the social investment market and as a buyer of social outcomes. He also believes that social businesses will become increasingly important in the creation of sustainable jobs, particularly for young people. There are cultural challenges to overcome, he admitted – but he believes this is one of the few issues on which there is cross-party consensus in the UK. Quoting Victor Hugo’s aphorism that “there is nothing more powerful than an idea whose time has come”, he urged those investors present to “take action” and commit the capital required.

Finally, a group of fund managers discussed their own impact investing strategies, in a panel chaired by Emma Daviesof The Wellcome Trust.

Shamez Alibhai, partner and manager of the Social Property Impact Fund at Cheyne Capital, an alternative investment manager, said that his fund was helping to plug the gap as Government funding was withdrawn from the social housing market. Investors recognise that serving the socially-disadvantaged doesn’t have to mean sacrificing returns, he said: three-quarters of the fund’s investors do not even have a specific impact allocation. Cheyne had brought in an external expert (New Philanthropy Capital) to assess the social impact of all its investments, he added.

Michele Giddens, partner and co-founder at Bridges Ventures, a specialist sustainable and impact investor, talked about how investing for impact could act as a competitive advantage – in terms of the quality and passion of the team it allows a manager to attract, and the alignment of interest it demonstrates to mission-driven entrepreneurs. By developing a platform of different funds (from growth capital for SMEs, to property investment, to social sector funding), Bridges now has a range of tools to tackle societal challenge – and a range of products to meet different investors’ requirements, she said.

Simon Bond, lead portfolio manager of the Threadneedle UK Social Bond Fund – a partnership between fund manager Columbia Threadneedle and social investor Big Issue Invest – talked about how the vehicle is giving a range of retail and institutional investors an opportunity to invest for impact via a daily liquid fund. Big Issue Invest designed the methodology used to assess the impact of the bond investments under consideration – and almost half of Threadneedle’s management fee goes towards Big Issue’s charitable efforts, Bond said.

Cheyne Capital was established in 2000 by Jonathan Lourie (CEO & CIO) and Stuart Fiertz (President) after working together at Morgan Stanley. Today Cheyne is one of the largest providers of European Real Estate Debt and has developed an Investment Grade & Crossover Corporate Credit programme that has generated net annualised returns of 14% since its inception in 2002.

0 notes

Text

Highlights of ‘Impact Investment for Institutional Investors’

Earlier this month, Bridges Ventures and Cheyne Capital hosted a packed room of institutional investors in London for a discussion about the challenges and opportunities of impact investment for institutional investors. Featuring contributions from Sir Ronald Cohen and Nick Hurd MP (the former Minister for Civil Society), the event gave investors a chance to hear from peers who are already active in the space, and from fund managers who are developing investment products to meet a range of different investor needs.

The following summary is for the benefit of the 65 investors who attended, and others who expressed an interest to attend but weren’t able to join us.

Key takeaways:

·There is increasing global momentum behind the impact investing movement

· More and more entrepreneurs are setting out to solve social and environmental problems

·There is a range of possible impact investing strategies – including private equity, property and fixed income – to suit a range of risk/reward profiles

·There is a growing body of evidence that investing for impact can create competitive advantage and deliver at- or even above-market returns

·Government has an important role to play as a facilitator (and buyer of social outcomes)

A few highlights of the discussion:

“The invisible heart of markets”

Sir Ronald Cohen described impact investing as the new venture capital. Just as venture had previously emerged in response to the needs of innovative tech entrepreneurs, so the rise of impact investing is a response to the needs of the growing number of social and environmental entrepreneurs – and just as ERISA legislation had made it easier for institutions to invest in venture capital, so legislative changes were making it easier for institutions to invest for impact, too. “This is already a global movement, demonstrated by the engagement of the G7 countries, the EU, Australia, Brazil, India, Israel, Mexico and Portugal in the work of the Global Social Impact Investment Steering Group.” And it brings a new dimension to investment decision making across asset classes, bringing “the invisible heart of markets to guide their invisible hand”. He pointed to the extraordinarily high calibre of people in the space, as well as to the potential for attractive uncorrelated returns from financial products like social impact bonds.

Next, a group of investors talked about their experiences of investing for impact, in a panel chaired by (outgoing) Big Society Capital CEO Nick O’Donohoe.

Matt Christensen fromAXA IM said his organisation had originally started thinking about impact as the positive element of its responsible investment strategy, to complement its risk mitigation strategies (like divestment, integration of ESG factors, and so on). AXA IM has now looked at more than 300 fund opportunities across different asset classes, he said, of which 50 were “institutionally ready”. He discussed the importance of impact being “in the DNA of the fund” rather than “accidental”; he thinks linking fund manager incentives to impact might help in that respect. In light of its success to date, and the substantial interest this has generated internally, AXA IM is now seeking to increase its activity in this area: it plans to launch a second impact investment fund of funds. Matt believes we will increasingly see buyers pay a premium for impactful businesses.

Lisa Hall fromSkopos Impact Fund said that, contrary to some investor concerns about a lack of institutional quality product, her team has been able to invest more than €70 million across two different portfolios in less than two years. She stressed the importance of recognising that there is a broad spectrum of possible impact investments (as per the Bridges Spectrum of Capital); Skopos only invests in funds seeking risk adjusted market-rate returns, and there is growing evidence that this is possible, she said (notably in the recent Wharton report ‘Great Expectations’). She also highlighted the importance of impact measurement, to ensure impact is “not just promised but real” – and also truly additional. Companies that follow sustainable business practices are more likely to be adhering to best practices throughout their organisations, she added.