#irs form 1040

Explore tagged Tumblr posts

Text

Understanding Multiple Income Reporting on IRS Form 1040: A Comprehensive Guide

Introduction to Tax Filing

The IRS Form 1040 is your shield against tax uncertainties. It's the primary document for reporting multiple income streams, ensuring accurate tax calculations and compliance with federal regulations. Whether you\ are handling W-2 income or self-employment earnings, proper documentation is your key to a secure and confident 1040 tax form submission.

Core Components of Income Reporting The IRS Form 1040

The IRS Form 1040 features distinct sections for various income types, making it essential to understand each component. The form begins with earned income reporting on Line 1, covering wages, salaries, and tips from W-2 forms.

Key Income Sections

Lines 1a-1i (Earned Income):

This covers standard wages, household employee payments, and specialized income categories on your 1040 tax return. These lines ensure comprehensive reporting of all earned income sources.

Lines 2-4 (Other Income):

Addresses interest, dividends, and IRA distributions. Understanding these sections is crucial when filing your IRS 1040 form 2025, especially for investors with multiple income streams.

Lines 5-7 (Additional income):

This includes Retirement and Capital Gains Reports, pension, social security, and investment gains/losses. Proper documentation here significantly affects your overall 1040 tax form calculations.

Lines 8-10 (Total Income and Adjustments): It covers additional income and adjustments to income reported on Schedule 1, Line 10, and Line 26.

Additional Considerations in IRS Form 1040

Understanding the distinction between taxable and non-taxable income is necessary when preparing your 1040 tax return. Some retirement distributions and government benefits may be partially or fully tax-exempt.

Tax Forms and Schedules

These schedules complement your IRS 1040 form 2025 filing, providing detailed breakdowns of specific income types.

To know about the schedules in depth, go through our blog on Schedules for Form 1040 Alphabetically Explained.

Schedule D: Capital Gains/Losses

Schedule E: Rental Income

Schedule C: Business Income

Important Deadlines and Extensions

The standard deadline for filing your 1040 tax return is April 15th, but you can file a tax extension using Form 7004 for an additional six months. Remember that extensions apply only to filing, not payment obligations.

If the deadline is on a public holiday, it gets extended to the next working day.

Penalty Framework for IRS Form 1040:

Late filing can result in significant penalties:

5% monthly penalty for failure to file.

0.5% monthly penalty for failure to pay.

Additional interest charges on unpaid taxes.

Tax Reduction Strategies

When preparing your 1040 tax form, consider various deductions and credits:

Standard vs. itemized deductions

Child Tax Credit

Earned Income Tax Credit

Practical Example

A taxpayer with full-time employment, freelance work, and rental property would need to:

The report combined employment income on Line 7

Use Schedule C for freelance income

Complete Schedule E for rental property

Key Considerations for 1040 tax return

Following are the key considerations for 1040 tax return:

Maintain detailed records for all income sources.

Understand filing deadlines and extension options.

Utilize appropriate schedules for different income types.

Consider professional consultation for complex situations.

Conclusion

To know more about filing IRS form 1040 go through our Blog on Filing Form 1040 Federal Taxes and US Individual Tax Returns.

Whether you're submitting a standard 1040 tax return or need to file a tax extension, maintaining detailed records and understanding filing requirements is essential for compliance and optimal tax outcomes.

Get a free consultation for filing IRS form 1040.

0 notes

Text

#Recovery Rebate Credit#IRS non-filer alert#Claim stimulus credit#Tax rebate for non-filers#COVID-19 financial assistance#Filing for rebate credit#IRS tax deadline#Non-filer rebate eligibility#IRS 1040 Form#Stimulus rebate for small businesses

0 notes

Text

#form 1040#tax prep#IRS form#estimated taxes#tax preparation service#accounting and bookkeeping service#bookkeeperlive#united states

0 notes

Text

Everything about Child Tax Credit (CTC)

Raising a child can be expensive, one of the most significant expenses for many American Taxpayers. Various studies have found that the cost of raising a child can go up to $200,000, and taxpayers with children need to be well aware of its consequences on their tax bills. The Child Tax Credit, or the CTC, is one of these implications and often proves to be one of the biggest tax deductibles for many taxpayers. Therefore, taxpayers with children must know the Child Tax Credit and understand how to claim it. Let us delve deeper into this topic and learn about the Child Tax Credit.

History of Child Tax Credit

The American government devised this tax credit to help low-income families better care for their children and families. However, it is essential to know that introducing these credits has not been majorly beneficial to low-income families, as previously, the rules related to it could have been more practical. At a point in time, the CTC was only given to families with three or more children, and the amount of tax credits made available to the public was way less. Several amendments have been made to the laws and regulations related to the CTC. Since 2022, these amendments have somewhat been observed to be effective as more people receive help from the government in the form of CTC,

How much Child Tax Credit you can get:

The amount of Child Tax Credit one can avail depends upon the number of children raised by a taxpayer and the age of these children. For children under the age of 6, parents can avail of a Child Tax Credit of $3,600. This is the maximum tax credit available for a single child. For children 6 to 17 years old, you can avail of a maximum tax credit of $3,000. You cannot claim this tax deductible for a kid above 17 years old. However, if your kid is more than 17 years old and is still a student that depends on you, you can take the student credit. You can receive half of the tax credit you are eligible for every month and get the remaining half when your tax refunds get credited for the year.

Who can get the Child Tax Credit

If you file your taxes separately and your AGI is below $75,000, you can file a claim for the total amount of the Child Tax Credit. However, if you are married but file your taxes jointly with your spouse, you can avail of the full Child Tax Credit if the total AGI of your family is below $1,500. If your AGI crosses these limits, you lose $50 for every additional $1000 above the AGI limit. In addition to the AGI limit, another qualifying factor must be met for taxpayers to avail of the Child Tax Credit. Parents can claim a Child Tax Return for children under 17 years old. The tax credit for children under six years is higher than it is for children older than six years. It is also essential for the mentioned child to live with the parent for more than six months within a year. The six months to be counted don't have to be consecutive. Child Tax Credit is also provided in many cases where the child lives away from the parent.

Process of claiming the tax credit

Parents need to remember that even if they do not file tax returns, they can avail of the Child Tax Credit 2022. To file a Child Tax Credit 2022 claim, one must file the 1040 Form. A taxpayer willing to claim CTC must attach a Schedule 8812. You can file your claim on paper like any other tax deductible. However, it is suggested that the taxpayer mentions the Social Security Number of their children to ensure that they receive tax returns at the earliest. You must provide the right SSN to ensure your returns. You will be required to file an amended tax return to the IRS, to make changes in the tax return. This takes a lot of time. It is also suggested that the taxpayers ensure that they only claim the tax credit for children, not availing the same for themselves.

Example of Child Tax Credit

Suppose you have a five-year-old daughter and earn $60,000 per year. This implies that your earnings are within limits set by the IRS to receive the full child tax credits. However, if you make more than $150,000 as a couple with your spouse, or $112,500, as a single parent, you would have to pay a phase-out that reduces the first $1,600 parents receive if their kids are five years or younger. In addition, if you have another phase-out in the picture, you would start losing money on the $2,000 Child Tax Credit. The phase-out lowers the credit by $50 per $1,000 you earn above the limit. If you, as a single parent, earn $117,000, you would be entitled to a Child Tax Credit of $1,750, and so on. This is how the Child Tax Credits you are eligible for, are calculated.

Although the tax filing process might appear straightforward, there's always a catch, and you must be aware of all the laws and regulations related to the tax credit you intend to apply for. It would be best if you met several conditions to qualify for the Child Tax Credit. These conditions include a range of AGI based on the taxpayer's filing status and the kids' age listed on Form 1040. If you are a business owner working towards expanding your business, keeping track of all the tax deductions you can benefit from and accumulating the documents that need to be produced to back these claims can get hectic. Taxpayers need to be able to file all the deductions they are eligible for to keep their tax bills low. NSKT Global specializes in accounting and strategizing one's tax returns. The team of experienced professionals at NSKT Global requires credentials to connect your bank account to their infrastructure, allowing them to access information regarding the tax deductions you are entitled to. Top-of-the-line infrastructure, combined with highly affordable prices, proves to be beneficial for SMEs. Click here to find out how NSKT Global can help you keep an eye on all your tax affairs and lower tax bills!

FAQs:

1. Which form do I need to fill up to avail of the Child Tax Credits?

You would need to fill up Form 1040. To file for child tax credits, one must list them, just like the remaining tax deductions and refunds.

2. What do I need to do with Form 1040 to avail of the Child tax credit?

You need to fill up the name of your children and their SSNs to file a claim for the CTC.

3. How can NSKT Global help me lower my tax bills?

NSKT Global helps you stay on top of your accounts and strategize the best tax return strategies, so your tax liabilities go down this year.

Schedule a Free Consultation

0 notes

Text

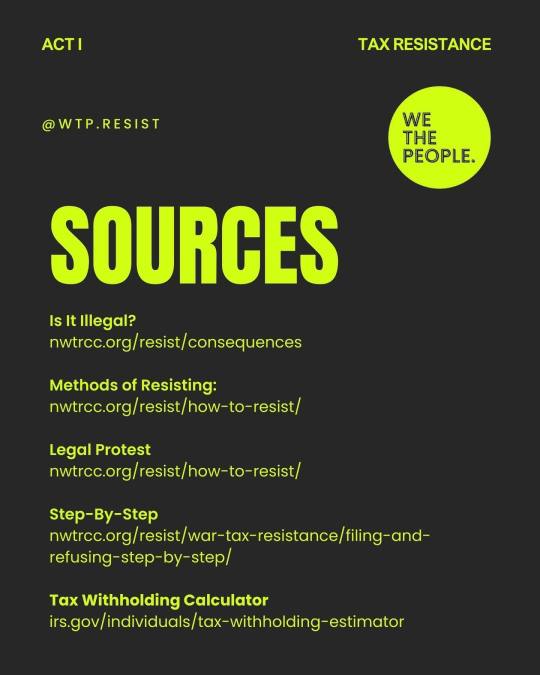

from @/wtp.resist on Instagram:

Tax Day is Monday, April 15th... just 4 days away ‼️ 💸 ⠀⠀⠀⠀⠀⠀⠀⠀⠀ Follow this outline for an easy-to-understand guide on how to participate in war tax resistance this year. If you are unable to participate in war tax resistance but still wish to legally protest, please see slide #7. We want to encourage people to think big and act with courage, but we also understand not everyone can resist in the same way, so we wanted to provide several measures of resistance and resistance support in our Act I — War Tax Resistance — Tax Blackout 2024 Campaign. ⠀⠀⠀⠀⠀⠀⠀⠀⠀ Our #TaxBlackout goal is 50 million people... with 16% of the U.S. population participating with at least 5% being redirected to vetted emergency relief in Gaza, Washington D.C. will receive a message loud and clear: ⠀⠀⠀⠀⠀⠀⠀⠀⠀ We will not fund Genocide and Imperialism!

transcript of all slides under the cut

slide 1: Act I Tax Resistance

by @ WTP.resist / We the People

The Tax Blackout 2024 Guide

Tax Resistance

slide 2: Is It Illegal?

Taking any type of direct resistance or civil disobedience action for peace often means taking risks. War tax resistance is no exception.

Since World War I, only two war tax resisters (James Otsuka (1949) and J. Tony Serra (2005)) have been brought into Federal court, convicted, or jailed because of war tax resistance. Most resisters have been taken to court for failure to file, "falsifying" 1040 forms, contempt of court (by refusing to produce records), or (in the early 1970s) "fraudulently" claiming too many dependents on their W-4 form.

slide 3: Filing And Refusing - Step-By-Step

How to File as a War Tax Resister (typical process):

1. File your Form 1040 on or before April 15

Fill out the form per IRS filing instructions. To avoid being considered a "frivolous filer" (an IRS category) and being subject to frivolous filing penalties, do not make claims or write your thoughts on the form.

2. You can enclose a letter that explains your refusal to pay part (or all) of your taxes

Many war tax resisters send letters to explain their refusal to pay is an act of conscience, of civil disobedience. War tax resistance is about refusal to pay for war, not promoting tax evasion or challenging the constitutionality of taxation or war taxes.

slide 4: Filing And Refusing - Step-By-Step

3. Refusal Options:

Refuse a symbolic amount, a percentage (at least 5%), or refuse all of the federal income tax (see next slides).

4. Withholding Adjustments:

Salaried employees can increase the # of deductions on their W-4 form at any time to owe federal income taxes on April 15, and then can choose how much you want to refuse. Take the form home fill it out and return only the first page of the form, not the worksheet (page 3), to your employer. If you are self-employed and don't use a W-4 form, you must adjust the amount of estimated taxes you pay quarterly to resist when you file.

slide 5: Methods Of Resistance

1. File and Refuse to Pay

This involves filling out a 1040 form and refusing to pay either a token amount of your taxes (we are asking at least 5%) a percentage representing a "military" portion, or the total amount (since a portion of whatever is paid still goes to the military).

2. Refuse to File a Tax Return

NWTRCC recommends filing your taxes or the IRS will file on your behalf. They cannot garnish wages until the tax debt has been assessed, which can take some time. The statute of limitations begins at the point the tax is assessed.

slide 6: Methods Of Resistance Continued

3. Earn Less Than The Taxable Income

This can involve having such a low income that you are not required to file federal income tax returns (approximately $12,550 for a single person in 2021), or it can mean filing and taking deductions so that no income tax is owed.

4. Tariffs and Excise Taxes

Today, thousands of people continue to "Hang Up On War" by refusing to pay the small amount on their local telephone bill listed as "Federal Excise Tax" or "Federal Tax." This federal excise tax, like many others, pays into the general fund of the U.S. government - the same place your federal income taxes go. The monies in the general fund help to pay for the Pentagon, the militarization of our culture, and war.

slide 7: Ways To Legally Resist

Send a letter of protest with your 1040 tax form. Enclose it along with (but do not staple it to) your form. Send copies to your elected officials.

Write letters to editors protesting taxes for war, especially when people are thinking about taxes during tax filing season between January and April.

Write a message of protest on the check you send with your tax forms.

Pay the tax with hundreds of small-denomination checks or coins.

Lobby for Peace Tax Fund legislation that would allow conscientious objectors to pay taxes to a fund that would not be used for military spending.

slide 8: Remember!

If at any time you have questions about risks and how to prepare:

War Tax Resistance Counselor: NWTRCC.org/resist/contacts-counselors

War Tax Resistance Hotline: TEL: +1-800-269-7464

slide 9: Sources

Is It Illegal?

nwtrcc.org/resist/consequences

Methods of Resisting:

nwtrcc.org/resist/how-to-resist/

Legal Protest

nwtrcc.org/resist/how-to-resist/

Step-By-Step

nwtrcc.org/resist/war-tax-resistance/filing-and-refusing-step-by-step/

Tax Withholding Calculator

irs.gov/individuals/tax-withholding-estimator

#tax resistance#war tax resistance#we the people#free palestine#palestine#EndIsraelsGenocide#tax blackout 2024#anti imperialism

29 notes

·

View notes

Note

Fuck bosses.

We still don't have our W2s and at least one employees paycheck bounces every month. It's been like this for over a year.

Per IRS.gov

January 31st is the deadline to file W-2s using Business Services Online or to submit paper Form W-2. If this date falls on a Saturday, Sunday, or legal holiday, the deadline will be the next business day.

January 31st is the deadline to distribute Forms W-2 to employee(s).

Per findlaw.com

Call the Boss, Then Call the IRS

The first step is to contact your employer and request your missing form. Verify whether you previously signed up to receive your W-2 electronically. If you have, check your junk or spam box in your email. If you didn’t sign up for an electronic copy, and require a paper copy, verify that your employer has the correct address.

If contacting your employer doesn’t work, try calling the Internal Revenue Service at 800-TAX-1040 or visit an IRS Taxpayer Assistance Center if one is near you. The IRS will need your name, Social Security number, address, and phone number. They will also need your employer’s name, address, and phone number, as well as your dates of employment. The agent will ask you to estimate the amount of wages and any income tax withheld, so be sure you have your last pay stub or earnings statement available. The IRS will then contact your employer for you and try to obtain your W-2.

Ultimately, the IRS can’t force your employer to send your W-2. But non-compliance with the W-2 delivery deadline can be a big inconvenience for both the employee and the employer. For each W-2 that is up to 30 days late, an employer may be fined $50. If a W-2 is sent after August 1, the IRS can issue a fine of $290. An intentional failure to file W-2 information with the IRS can lead to a fine of $580 per statement. This can add up to hundreds of thousands of dollars in fines for employers that don’t give out W-2s to any of their employees.

There are a couple of additional options available should you still find yourself without a W-2 after speaking with your employer.

192 notes

·

View notes

Text

One of my tiny pet peeves is fellow Americans whining about having to do their taxes themselves instead of the government sending them a bill.

The reason you have to do this is because of the existence of sole proprietorships and LLCs; ie, freelancers and small business owners like myself. A sole proprietorship isn't required to have an Employee Identification Number (EIN) that fully separates its finances from that of the individual taxpayer. You can, if you have a large business with a lot of expenses, but it's not required.

Because I have an LLC, I pay my business taxes on my own, normal tax return, and this isn't that unusual. I don't have any employees other than myself, and all my income/expenses is coming from my bank accounts, not a business bank account. A business bank account/credit card requires me to sign up for an EIN, an expense and hassle I don't need because I don't have employees other than me. I have a Tax Identification Number (TIN) which is ... just my Social Security number.

I get multiple 1040s and royalty statements that I input together before taking out my deductions. The government does not keep track of how many 1040s I get, or how much I make in royalties; that's my responsibility to manage.

And businesses take out a lot of deductions for business expenses like marketing, equipment, travel, etc. Any marketing, including Facebook ads or Tumblr ads? I can deduct them. I can deduct writing guides, computers, headphones, cover artists, editors, and so on. This then lowers the amount of money I have to pay back, because I don't get tax withholding like other people.

No, it doesn't cover everything, it's not like I just get these things for free. I just don't have to pay quite so much in taxes. In a good year I can shave about $1,500 off from my bill. (Again, I'm a very small business owner. Others can deduct thousands more than this.)

The government isn't keeping track of my expenses for me, either. How could they? It would be absolutely insane. Maybe they'll create an accounting tool someday that lets businesses track expenses and transmits this to the IRS on tax day, but for fuck's sake we haven't even rolled out a tax return system for all of the US yet, it's not going to happen.

So the government doesn't know how much of my money is coming in through my LLC. They also don't know how much I've spent on my business that I can deduct. I have to tell them all of this so that they can calculate how much I need to pay them because, again, I don't get withholding from any of my clients. And because I have an LLC that is inextricably tied to my own, individual tax return, it would be impossible for the government to tell me how much I owe versus how much my business owes.

Because not everyone gets witholding, and because there are millions of LLCs that do individual tax returns like I do, the IRS just has everyone do their own taxes. It's easier for people to start businesses through LLCs, which improves business activity in the country, and in return, the everyday non business owner just needs to copy their W2 into a form.

(Which you can do for free, btw, through places likes FreeTaxUSA. They even do my weird convoluted taxes with my millions of expenses for free. Stop paying for TurboTax. I promise you don't need it if you're a wage/salary worker.)

And no, the IRS is almost certainly never going to get rid of LLCs. It's not going to force them to do one individual tax return and one LLC tax return because that would be a stupid high amount of paperwork just for the individual tax return to have absolutely nothing on it, and the LLC to have everything.

I promise that you probably pay way less taxes than I do and you likely get a refund at the end of the year instead of having to calculate how much you'll have to pay throughout the year, put that in a savings account, and manage your expenses around tax day. It takes you maybe an hour tops to do your taxes. Me? It takes me a good half of the day.

So please stop complaining about having to take one hour out of your year to send in your taxes. You have to do this because of the many small businesses that make your food, sell you cute artwork, write stuff for you, and do a million other things that you enjoy. Just be grateful that your company does almost all of it for you and you just have to input the numbers they print on your W2.

#taxes#us taxes#death and taxes#tax#I'm just so sick of this stupid ass whining I see every year#it suggests you know not even the slightest tiniest thing about businesses#it's also very self-absorbed especially if you have very straightforward taxes#oh no you had to take an hour or two out of the day once a year!! the horror!!

5 notes

·

View notes

Text

Into, Across and Beyond! Scripting: Paying Taxes

(Based on this)

Sometime following Tails of Trials, OMT!Tails and OMT!Mina were just spending some time in the former's home, when Mr. Needlemouse came a-knocking.

Mr. Needlemouse: Tails!

OMT!Mina: Wha-?!

Mr. NM: My taxes are due today, and I have no idea how to do them!

OMT!Mina: Erm, okay?

Mr. NM: You gotta help me!

OMT!Tails: How do you know I'm not busy with my own?

Mr. NM: Cuz I know in da back of my thumb ya didn't do 'em last minute!

OMT!Tails: I mean, I had to wait 'til January 22nd before this year's 1099 forms all came in, but...

Mr. NM: Please, bub! Ya gotta help me! I'd be on my knees if MCStudio had the drawing skills for it!!!

OMT!Mina: *sigh* Alright.

OMT!Tails: I'm sure with my brains we can get this sorted out in no time!

They headed inside.

Mr. NM: (So boooring...)

He followed them in.

OMT!Tails: Okay, so, first order of business. How much did you make last year?

Mr. NM: Wait, I was supposed to be countin'?

OMT!Mina: Didn't you get a W2 from your employer?

Mr. NM: Employer...?

OMT!Mina: Well, what do you even do for a job?

Mr. NM: ... Does robbing Melody Hill Zone and framing Beeman for it 24/7 count as a job?

OMT!Tails: Like, stealing money slash rings regularly?

Mr. NM: Yep!

OMT!Mina: Who even makes it that easy to rob?

Mr. NM: Easy! I have a professional conman disguised as a lawyer freeing my bum every time!

OMT!Mina: Well, I doubt we'll be getting a 1099 from said lawyer.

OMT!Tails: It's okay, though! We can still fill out the 1040 using your own accounting.

Mr. NM: So I was supposed to be countin'!

OMT!Tails: You haven't been keeping track? NM...

Mr. NM: Okay, okay relax! I got 540 something in Emerald Hill... stole 250 from the local retirement home... stole 25 thousand worth of gold in Calteron... and stole some of Aureya's tech and sold 'em for 20 bucks!

OMT!Mina: I seriously doubt the IRS is gonna tolerate that.

Mr. NM: It was in three different dimensions! Whatever crimes I'm accountable for there, I'm not accountable for here!

OMT!Tails: Anyway! Let's talk business expenses. Do you even have those?

Mr. NM: Well... I did sell Beeman to the Dark Webz and passed him off as a rare species of bee. Does that count?

OMT!Mina: The dark web?!

OMT!Tails: Why did you go selling stuff on there?! And that's not even an expense!

Mr. NM: Well, where else can you sell someone? The other markets deemed it "illegal" for ridiculous reasons!

OMT!Tails: You can't put illegal purchases and selling on your federal tax return!

Mr. NM: Why not?

OMT!Mina: For Gaia's sake...

A few minutes later, everything was sorted out and the signature was put on the sheet.

Mr. NM: Phew! That took forever...

OMT!Tails: You're welcome.

Mr. NM: Now all I gotta do is put it in the mail, yeah?

OMT!Tails: Those were the federal taxes. The dimension taxes should take no more than 5 minutes to-.

Mr. NM: Actually, I think I'm good!

He started walking to the door.

OMT!Tails and OMT!Mina: Huh?!

Mr. NM: I've decided I'm not paying taxes!

OMT!Mina: Needle, you have to pay your taxes!

Mr. NM: Why? It's not like they do anything.

OMT!Tails: Star Light was literally built with the funding from taxpayer rings and coins.

Mr. NM: Yup. And they used the money to build loop-de-loops and floating platforms. Which, granted, cool as hell for me, but hell for the chumps that wasted their sweet time paying for 'em!

He prepared to leave through the front door.

OMT!Mina: I mean, he got a point there.

OMT!Tails: Still, if you don't pay your taxes, the IRS will come after you, Needlemouse!

Mr. NM: And I'm a living cartoon character! They can't catch me!

Cut to him now thrown in prison for planned tax evasion.

(AoSTH Robotnik sprite by Soap Surfin' and XtremeXavier)

Mr. NM: Oh, damn... Guess they caught me. (looking to his right) So what you in for?

AoSTH Robotnik: I placed a bunch of golden rrrrrrrrings on the ground, and they told me to send the proper 1099 forms to people who picked them up. I didn't just to be diabolical, and, well... I've been serving my time here since before Across All Worlds.

Mr. NM: Call me Judge Doom, cuz you're getting the Dip!

AoSTH Robotnik: No, stop!

Mere seconds later, he was pulled from his jail cell after serving his time there.

IRS Member: Alright, you're free to return to your dimension.

AoSTH Robotnik: Anything to get away from that hedgehog, er... rabbit, erm... whatever that thing is! He's worse than Sonic, and that says a lot!

Dr. Beeman: You think that's bad? Try living in his world mindin' yer own business!

IRS Member: Well, the rabbit-hog's gonna be staying there for at least the next six months for planned tax evasion.

Mr. NM: Aw, really? I can get my lawyer to bust me outta-.

IRS Member: And you have charges of selling a half-human on the dark web, robbery, framing for said robbery, evading court through your properties, using a conman to get yourself out of jail, vandalism, disorderly conduct, parking illegally, amongst too many other offences to list here. And if you don't pay the legal fees out of the money you stole, which will all go back to the places you stole them from, you'll be here for at least 70 more years.

Mr. NM: Oh, COME ON!!!!! >:(

(Confirmation from @mcgamejolter himself: Mr. Needlemouse preferred the 70 extra years in jail over being a decent person, but of course, they made him send back the stolen goods whether he wanted to or not. Him trying to evade his taxes was just the last straw that got him tossed behind bars.)

#sonic the hedgehog#sonic exe#sth#sonic#sonic fandom#spider verse#sonic au#sth au#spider man#please don't commit tax fraud or tax evasion#what mr. needlemouse does is illegal#pay your taxes

4 notes

·

View notes

Text

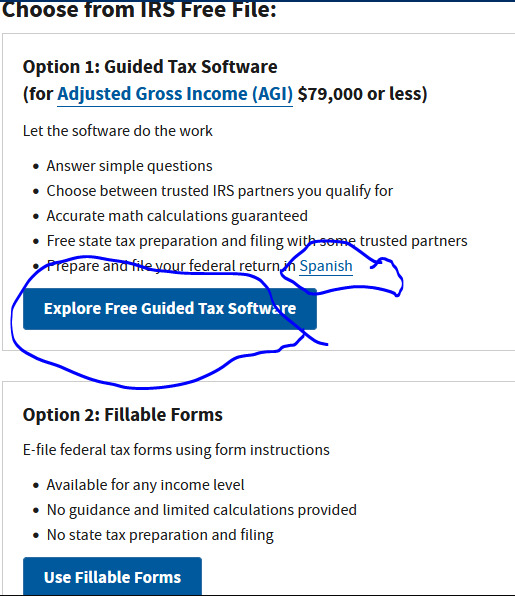

Taxes 2024: glass's quick and gritty guide to free filing those bitches

By god I hate doing my taxes but what I hate more is paying money for someone to do them for me.

Here's the thing. If taking your W2s and property taxes to someone with the training and paying them $70 makes you feel better. Do it. BUT if you're stubborn and bitchy, you CAN do it yourself and if you're reading this post I'm going to make the assumption that your AGI is less than $79000 and therefore you qualify for free file. (and if you don't know what an AGI is then yes, you qualify).

It's honestly going to be okay. We will get through it together.

This guide is not going to be thorough, and while I will try to answer questions if you ask them, I'm not an expert: my knowledge comes from filing my own taxes for the fourth (fifth?) year in a row using the free file program and going through a number of life changes that I have to reflect on my taxes.

The post includes a link and screenshots. I will describe the bare minimum information of the images in Alt Text, but will not fully transcribe the full text as all the images will be from the IRS website which has accessibility options.

Here we go:

I want you to go to this page and then chose the first big blue button (unless you want it all in Spanish, then click on Spanish and I'll pray for you that it's all the same process)

If you are a brave, brave soul then take the fillable forms and be free, my children. I cannot help you there.

BUT if you chose the guided software options it's going to take you to these options

You may chose to browse options on your own. This does feel somewhat choose-your-own-adventure and I'm not your mother or your boss. HOWEVER. I implore you to take the guidance as far as you can. Chose the big blue button that says "Find Your Trusted Partner(s)" (very polycurious, if I may say).

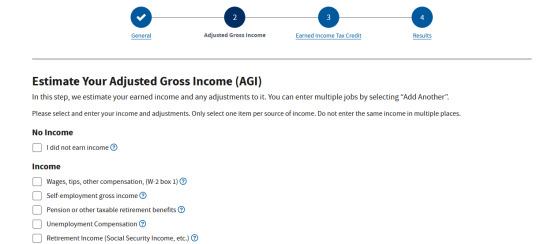

This survey is meant to be straightforward. There is a little blue questionmark that opens to explain the filing statuses very clearly and in detail. Chose the right status for you, then some other questions will show up. Answer the questions that come up (again, this general page should be info that is straightforward. most of us should be able to answer the general questions with just what's in our heads), then click next when the questions are done.

Now, you will need to know your income for this page, which probably mean you need your W2s or whatever other forms you might have that reflect/summarize your 2023 income. You don't need to get into extreme detail, you just need totals. Worked a couple of jobs and have W2s for all of them? Add "box 1" from each W2 together, select the first box under "Income" and type in your total in the fillable box that opens.

Further down this page is space for adjustments to your income, so stuff about student loans and health savings would be helpful, but again this survey isn't about the nitty gritty. Round numbers are fine.

Once you're done here, you'll click next and then it'll ask you about the Earned Income Tax Credit which is really just about if you have kids or not. Answer that question, click next and BOOM

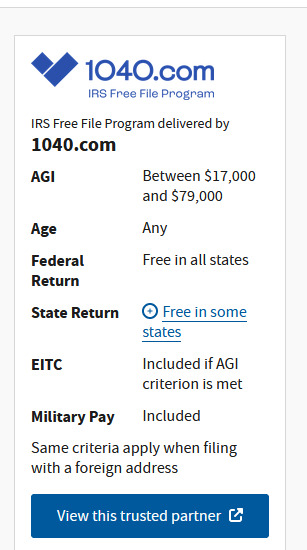

This is the only free file partner that I qualify for this year (again, life changes), but in previous years I have used HRBlock and Tax Slayer. All three sites have been guided similarly to this survey and as easy to use as can be possible given the US tax system.

Thus ends my guided portion, as going to 1040(.)com will show you a great deal of my personal info, but I will give you a few more notes:

Throughout the year, collect your tax forms/important papers in a safe, secure place that YOU WILL NOT FORGET. (preferably a safe or at least a heavy fireproof security box).

Once you get to the tax website you're going to use, you will need all those papers.

Start your filing early. I like to start when I get my W2s.

For one, you'll get everything done and then in April when someone, stressed and anxious, asks if you remember that taxes are due, you can smugly say you filed ages ago. For another, if you do run into significant issues, you have lots of time to resolve them.

Don't necessarily file super early. Sometimes congress does stuff that affects taxes as late as March. It's easier and less stressful to edit your pending forms than it is to file a correction.

When you have all the information in, look up the local and national news and see if there's anything going on regarding taxes. This year there's talk about extending the child tax credit. I haven't kept up with that because it doesn't apply to me, but it might be important to you. If there's nothing happening that might affect you, go ahead and file.

If you have a question, ask! Even the free file services have a help section

I lied, one last snip. This is from 1040. They have an FAQ section, and it's not just about the site itself. I have submitted questions to all three services I've used and all of them have answered me.

They won't hold your hand through every step, but if you have a specific question, they'll do their best to answer it.

You can also do a general internet search! "what this form?" and "do i need to include XYZ on my taxes" are all things i've found the answers for by searching them on duckduckgo

HRBlock has a huge amount of accessible information that I've used often.

I'll wrap here by just saying - if you get frustrated, save your work and walk away.

I called my employer's HR to ask something, waited a couple days then started an email to them, and realized the answer as I was writing the email.

The earlier you start, the more time you have to figure things out. You can do it. Good luck.

#US taxes#taxes#tax help#sorry it's all one block of text. I don't have the energy to make it less Like This

4 notes

·

View notes

Text

A fix for US elections: Federal ballots become part of the IRS 1040 form. State and local ballots become part of the state equivalent.

Every taxpayer votes. No income? File a 1040 anyway and get your vote in. If you're a human living and earning money in the US you get a say in how that money is used.

2 notes

·

View notes

Note

No. 5 "this marriage was supposed to be a scam but, but listen" im sorry, but this prompt screams greens, and no, i won't change my mind (but also: pretty pls????? ily and i miss your writing) (totally understand that real life can be overwhelming and it's totally cool)(hope you're doing well ❤️)

OPE, anon, you've unlocked a super secret drabble regarding a future!domestic fic I'll never have the time to write :)

prompt 5: this marriage was supposed to be a scam but, but listen

Background summary: After losing a bus full of kids to a horrible accident, Buttercup's having a crisis of self. She's not the hero she once thought she'd be, but when she finds Butch half dead in a ditch, she thinks maybe if she can just do this one thing, save this one person, she can prove to herself she's a hero after all. In a way, they end up saving each other. Again. And again. And again.

-----------------------------------------------------------

Buttercup poured over the tax forms before looking up at him with a deep sigh, "I literally don't know what I'm doing. Why don't they teach us this shit in school!" She grabbed a random form and shook it at him, "Do you get any of this?"

He shook his head as he continued to shovel spoon full after spoon full of cereal into his mouth. After swallowing, he said, "The only thing I know about taxes is how to evade it, but Bryan Davis—" he smirked, referring to his alter ego, "—is of the straight and narrow variety, so that's off the table."

"Har. Har." She rolled her eyes, turning back to the tax documents, "I think I'll just call my dad. He's good with numbers. Or maybe, uh, turbo tax? We can't afford an accountant."

At the mere mention of money (and, thus, by extension, their late bills), Butch looked at the time and jumped up with a hiss, "Shit, I'm late!"

"How late are you going to be tonight?" She asked him, watching as he rinsed out his cereal bowl and shoved on his work boots. "We've got to figure this tax stuff out."

"I don't know. They got me doing a job out in the counties for the next few weeks. Traffic's going to be hell. And then there's gas going up, and—"

"Butch, we have to figure this shit out at one point, for real. Tonight." She glared at him, "We can't keep putting it off."

"If I could fly home right after, Buttercup, I would," He huffed back, throwing his lunch together, "but Bryan Davis can't fly, remember? He sits in traffic."

She tsked, "He never fails to remind me, but could you please remind Bryan Davis he also has to fill out a Form 1040? Because if he doesn't, the IRS is on our ass, and they're worse than Blossom."

"And why can't Brittany Davis just do it for the both of them? Don't married people get to do shit like that?"

"Yeah, sure, if Brittany Davis was a real person and not actually Buttercup Utonium, who is not actually married to Bryan Davis." She deadpanned, shuffling a pile of papers together. "Just when you get home, we gotta do this, okay? And I'm not getting suckered into doing it by myself again."

"Yeah, yeah," He rolled his eyes, opening the door and then pausing across the threshold.

"Have a good day," She said over her shoulder, attention more on the tax documents than on him.

Butch stared at the back of her head with a smile. Her bedhead was horrible, and she wore an oversized, stained shirt; it made him think of his last girlfriend, who had been just as strung out as he had been. His last girlfriend, whatever her name was, he really only just remembered her being there, hadn't given two shits about taxes or when he'd be home. Outside of Boomer and maybe Brick, he couldn't think of anyone else who had.

It was nice.

Being with Buttercup was nice. Homey. He liked homey, and despite living together for a while now, he hadn't realized how much he liked it until now, watching her balance her cereal bowl over their pile of taxes.

"Hey," She snapped at him, turning in her chair to glare, "shut the door, will you? You're letting all the air conditioning out."

His smile stretched further across his face, "What if Buttercup Utonium really was married to Bryan Davis? Would we be able to file together then?"

One of her eyebrows quirked up in question, "Well, yeah, I guess? Probably get more on our return, too."

"Then, why not?"

"Why not what?"

He let the door fall shut behind him as he stepped back into the room. "Why not get married, then?"

"Wait, what?"

"For real, this time." He dropped to his knee in front of her, and her eyes practically bugged out of her head. He took her hand and shrugged, "I mean, I ain't gotta ring yet or anything, but tax day's like a month away. We're working under a time constraint."

"Y-ou're asking me to marry you right now?" Buttercup stuttered, "Over our taxes? At five in the morning? Right before you go to work? With no ring?"

Butch laughed, "Yeah, I guess I am. Whaddya say?"

She let out a short laugh, blinking away her surprise as she leaned in for a kiss, "You're just lucky I'm not much of a jewelry person."

"I am," He agreed, laughing breathlessly into the kiss.

#they end up with kids in this au they're all menaces#sappy sappy sappy#also boring#im sorry#this is like a very intense domestic au split into 2 parts: no kids/kids that bounces between the 2 simultaneously#which is all to say individual drabbles dont do a good enough job lol#prompt ask game!

9 notes

·

View notes

Text

Having the feeling like the whole world is playing a trick on me. Apparently I have to fill out a whole separate form to file my state taxes that is purely state specific. I only learned about this when I got a letter from my state informing me I had no filled out this form. I am extremely confused because I have never, uh, experienced this before? I've always filed my 1040 form through the free website from the IRS. At no point, not when I was growing up, not when I was learning how to file taxes, not when I've talked to people about filing taxes, was I ever made aware that you need to file a separate form with the state. I sort of assumed that since the 1040 requires you to include information on state taxes, that took care of that. So like, I'm trying to figure out how I, a 30 year old person who has been filing my own taxes for over 10 years, missed this information. How did I make it this far without knowing this? And literally everyone I've tried to explain this to and ask just responds with some version of "well, state taxes are different than federal taxes." Okaay???? That helps me how????? I know that state taxes and federal taxes are different what I don't know is why when I was living and working in CA, I didn't have to file a separate state tax form, but that apparently filing a separate state tax form is common in other states and no one told me. Was I supposed to intuit this? Was I supposed to spring forth from the womb with knowledge of how to file taxes in all 50 US states already in my head like some kind of tax Athena? Feeling a little, uh, nuts here.

5 notes

·

View notes

Text

Hello everyone! When I was a teenager I did more tax returns in two years than most people do in a lifetime, and you all get to reap the benefits. Here are 9 things to know about doing your federal income taxes in the USA!

1. Bring snacks. You need snacks.

2. You probably don't have to pay TurboTax I swear there are other options

3. Search "IRS Freefile Program" to get free tax prep software if you make under like 70k.

4. Search "IRS VITA Program" to find people near you who will do your taxes for you for free if you make under like 70k. They're IRS-certified volunteers, and they're legit - they get trained and certified every year.

5. The main tax form, the 1040, is just a numbered list of instructions. The most complicated math you do is division, and for every single step 20 different websites have already written explanatory articles. The internet (probably) has your answers!

6. You'll probably have one of two types of income forms: W-2 (for employees) or 1099 (for "independent contractors" aka actual contractors, gig workers, and whoever else companies feel like fucking over).

If you got sent a 1099 form, I'm sorry. You'll probably owe money, from a double whammy of no taxes taken out of your check over the years and more taxes being taken from contractor income. Please make sure to mark down all your business expenses (including miles driven! That's a common one) so that your taxable income is a little lower.

7. Are you being claimed as a dependent on someone else's taxes? Are you claiming someone else as a dependent, and that someone is paying taxes this year? Everyone needs to be on the same page about who is or is not a dependent.

A dependent is (basically) someone who you paid for half or more of their living expenses. If someone claims you as a dependent, you have to note on your tax return that you are being claimed as a dependent.

Call if you're not sure whether someone will claim you or if you're not sure whether someone knows you'll claim them. It's a very common reason tax returns get rejected.

8. It's well known but it bears repeating: don't go to any tax return place that guarantees a tax refund. The only way to guarantee a refund is to do tax fraud.

9. Yeah the whole tax return system is needlessly complex and does not have to suck as much as it does. Fistbump of fellow-feeling, y'all 👊

Good luck, everyone! May your taxes be easy and your refund surprisingly large.

#posts from the rat race#for future reference#taxes#personal taxes#income taxes#autism.taxt#aiden.txt

18 notes

·

View notes

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Text

You know what really sucks? If you know that something is important and has real consequences if you don't do it or if you do it wrong, but you have no idea how to actually do the thing. It's scary and can make doing the thing very intimidating.

You know what's a really common thing everyone has to do but very few people are taught about?

Income taxes.

This infuriates me. So I sat down to write a brief and basic breakdown of how US federal income taxes work. It ended up being less brief than I originally envisioned, but the headers are in all caps so you can skip ahead to the questions you are interested in. But first here's my disclaimer. Do your own research, talk to a tax professional if you have questions, I'm not speaking on behalf of any tax return preparation company, don't sue me if you screw up your taxes, etc, etc. If you want to dig deeper into anything here, go to irs.gov and search for whatever you're looking for. The IRS website is actually pretty useful.

Alright. Let's go. Here's like, the basic, most over-simplified explanation of federal income taxes.

WHAT IS TAXES?

When a bunch of people get together and decide that they want to operate under the same set of rules, they form a government. That government takes money to run. They use it to hire people and fund programs that do things for their country and sometimes other countries. Sometimes the things the government spends money on are good things. Sometimes they are bad things. Sometimes they are good ideas executed poorly.

We're not going to get into that right now.

The point is, the government gets its money from the people it governs. I mean. Not all of it, probably. But the parts that are important for this conversation it does.

You, if you are a US citizen or someone living in the US, are required to pay a percentage of your income to the federal government. The amount is not a flat percentage. People who make more money get taxed on higher percentages of that money*. Somebody has to add up all the money you made during the year to figure out how much you should have paid in taxes. You do this sometime between January and mid-April (barring national disasters or ill-timed holidays that push back the due date) by filing a tax return. The normal due date is April 15.

*Look. Explaining exactly how tax brackets work requires pictures and/or hand gestures. You don't need to worry about it now.

HOW DOES A TAX RETURN WORK?

If you (and your spouse if you have one) work "normal" jobs, you'll get a form called a W-2 from any employers you worked for during the year. They contain info about how much money you made and how much of it was already sent to the government on your behalf. The most important boxes are box 1 (wages, tips, and other compensation) and box 2 (federal withholding). This shows 1. what you made before taxes were taken out and 2. how much of it was sent to the government for your federal tax payments. Filling out your tax return (Form 1040) will add up all your income, calculate how much you should have paid in taxes (AKA your tax liability), and compare that to what you DID pay. If you overpaid, you get a refund. If you underpaid, you have to make up the difference. If you underpaid by a LOT, there may be an underpayment penalty. (Note: the failure to file penalty, for not filing a tax return, is always more than the failure to pay penalty! If you owe the IRS it's better to go ahead and file on time. If you can't pay what you owe at once there are payment plan options. If you can't file on time you can file an extension which pushes your due date for filling back to October 15, usually. You can send a payment with your extension if required.)

If you're not using a professional, I highly reccommend using some kind of tax software to fill out your tax return. You'll get tax forms from your sources of income, and a few other select places. If it came in the mail or email and says "IMPORTANT TAX DOCUMENT ENCLOSED" you should save it and have it with you when you start preparing your tax return. Your software/tax professional should ask what you have, and then you or they will plug it into the software. You should just have to plug in basic info about yourself (legal name, date of birth, social security number, address, etc) and the data from any tax forms you received, and let the software do the work!

So that's basically it. You use the 1040 to figure out how much income you made, if you're elligible for any credits, and what you should have put into withholding. If you overpaid, you get a refund. If you underpaid, you will owe the IRS. All you really need to do is collect your tax documents and do some data entry. If you don't have any tax credits and you're not self-employed or retired and you don't have any kids or investment money, you can skip to the WHERE DO I FILE section.

WAIT WHAT ARE TAX CREDITS?

Tax credits are money that the government credits to you because you meet certain criteria. They can either be nonrefundable or refundable. Nonrefundable tax credits can reduce your tax liability (tax liability is the money you should have paid in income tax throughout the year, based on your total yearly income). Basically, if you had a tax liability of $3000 and you get a nonrefundable tax credit of $1000 it brings your tax liability down to $2000. But if you had a liability of $3000 and a nonrefundable tax credit of $4000 it can only bring your liability down to $0.

Refundable tax credits can give you money back, though. If you had a tax liability of $2000 and a refundable tax credit of $3000, that's $1000 the IRS owes YOU, baby.

COMMON TAX CREDITS

Child Tax Credit

If you supported a descendant of yours who is under age 17 and lived with you more than half the year, you get a credit for that! The "normal" use of this credit is for your kids, but grandkids, step kids, and young siblings and niblings can count too if you are the one supporting them. If you split custody of your kids with their other parent to whom you are not married, only one of you gets to claim them. If the two of you can't peacefully decide who that is going to be, and you want to claim them, you need to be able to prove that you supported the kid(s) and they lived with you. Notes from the kid's school and/or doctor are often used for this.

As of the time of this writing (2023), the Child Tax Credit is $2000/kid. If you make a ton of money this credit may be phased out. The Child Tax Credit is one of those nonrefundable credits that we talked about. It can only take your tax liability down to $0. BUT if you had some of the credit "left over" after your tax liability was wiped out, you may qualify for the Additional Child Tax Credit, which is a refundable credit, but it maxes out at $1500/kid instead.

Other Dependent Credit

This is a credit you can get if you supported a dependent who doesn't fit the criteria for the Child Tax Credit. This can be a child age 17 or older, a parent who you support, your live-in girlfriend who doesn't work (if she lived with you ALL YEAR), etc. (Please note: your spouse is NOT your dependent. Even if they don't work.) Not sure if someone qualifies as your dependent? The IRS website has a tool for that. The Other Dependent Credit is currently $500/person.

"Daycare Credit" AKA Child and Dependent Care Expenses Credit

If you send your kid or disabled dependent or spouse to daycare so you can work, go to school, or look for work, you can get a percentage of that money back as a credit. The exact percentage depends on your income.

The facility where you send your kid should provide you with an end of year statement showing the expenses you paid that year. You'll also need their EIN (Employer ID Number) and basic info like their name, address, and phone number. If you paid an individual you'll need their social security number instead.

Earned Income Credit

This is a credit for people who have worked during the year but who haven't made what the government considers to be "enough" money. You were trying. But you probably need some help. The amount you can receive depends on how much money you made and how many kids you have. Any tax software should calculate this automatically. It can be a real life-save for some families.

"Solar Panel Credit" AKA Residential Energy Credit

I'm only going to talk about the solar panel part here because it's most common. Basically, if you install solar panels, you can get a credit for up to (currently; it changes year to year) 30% of what you spent/financed. BUT a VERY IMPORTANT thing that the solar salespeople often don't tell you is that this is a NONREFUNDABLE credit. If you only have a tax liability of $2000, this credit will only give you $2000 for this year even if it's a $16,000 credit! Don't count on the whole 30% to go towards your solar loan principal if you don't usually have a big tax liability! The good news is that the unused portion of your credit will "carry forward" to next year, meaning it can help reduce your next year's liability if you don't use it all up this year. And the next, etc. Keep up with your old tax returns so you can put any carryforward credit onto the next year's return!

"Higher Education Credits" AKA American Opportunity Tax Credit and Lifetime Learning Credit

The short version is that if you spent money out of your pocket or if you took out a loan to pay for higher education for you, your spouse, or your dependent (or your kid that their other parent claims), you can get a percentage of that back as a credit. The AOTC is better but you can only take it for a total of 4 years, then you get bumped down to the Lifetime Learning Credit. You'll need to get the 1098-T from the school to see what you paid, and you may be able to also include expenses for things like textbooks.

Other Credits

There's also a credit if you're adopting a kid, but I'm not going to get into it here. Just know to look it up if you ever adopt!

There is a small credit for people who contribute to a retirement plan and have income under a certain amount. This is the Saver's Credit.

I'm not listing every credit that exists, just the ones I see the most. A lot of people don't know about the college credits, which sucks, because they can really help!

HANG ON I'M SELF-EMPLOYED WHAT DO I DO?

Congrats on being your own boss! If you are self-employed/freelance/contract labor, you get a 1099 at the end of the year instead of a W-2. Usually a 1099-NEC (NEC for non-employee compensation). This means that instead of your employer sending money to the government to pay your taxes for you, you have to do it yourself! The parts that go to Social Security and Medicare taxes are called "Self-Employment Taxes" and they get calculated at the end of the year in addition to your Income Taxes.

WHAT DOES THAT MEAN FOR ME?

When you are filing your tax return, you'll have to fill out a Schedule C for each business. Do you drive for Doordash and you also clean your aunt's house every week? Congrats. You have two businesses. One as a delivery driver and one as a housekeeper. But if you drive for Doordash and Uber Eats, you just have one job as a delivery driver.

During the year, you need to do 2 basic things:

1. Save back money to pay your taxes, and send it to the IRS quarterly. These are called Quarterly Estimated Tax Payments and you can do it by mail or online. The IRS has a tool to help you calculate how much you should be sending.

2. Keep track of your expenses and milage! If you spend money on things that you use exclusively for business, you can count those as expenses. (I'll get to expenses in a minute.) If you use something mostly for work, like a cell phone, you can count a fraction of that expense. If you drive your personal vehicle for work (not TO work; commuting doesn't count for this), keep track of the miles you drive! You get to count that as expenses, a certain number of cents/mile. It adds up. If any of this applies to you, please do more research, maybe download an app to keep track of things. This is just to let you know what you need to know so you can look up in depth what applies to you.

HOLD ON GO BACK. WHAT ARE EXPENSES?

Okay. Basically, to calculate what money is taxable if you're self-employed, you add up your income (what you got paid), and then total all your expenses (the money you spent to run your business). Income - Expenses = Profit or Loss. You only get taxed on the profit (called a "gain" on the form). A loss can offset some of your "regular" income, but please do more research if that applies to you.

If you got paid $10,000 for the year in your home bakery business but spent $8000 on things like flour, cake boxes, and renting a catering van, you only made a profit of $2000 and that's all that counts for your income and self-employment taxes. That's why it's important to keep track of your expenses and mileage! Less profit = less taxes. But you know. Don't make crap up. Assuming that you will be audited eventually will help keep you out of trouble!

OKAY, THIS IS ALL NICE, BUT I GET RETIREMENT MONEY

That's cool! If you get social security, you'll get an SSA-1099. If you get money from IRAs or other pensions, you'll get a 1099-R. Just plug 'em into your tax software and it will calculate everything automatically. If you tend to owe money at the end of the year and you don't want to, you can have more withholding taken out of either your social security or your pension by talking to whoever oversees your account.

WHAT IF I HAVE INVESTMENT MONEY?

Look. If you have investment income and you came here for tax advice, you are in the wrong place, buddy. I'm happy for you but we do not have time for that right now. If you get like $20 in interest from your checking account or whatever, fine. Just plug that 1099-INT into your software and you're good to go. If you have, like, dividends, or you trade stock or whatever? You're the kind of person who leaves your documents with your tax pro and they get back to you next week.

WAIT YOU HAVEN'T EVEN TALKED ABOUT SHORT FORM VS LONG FORM

That's because it's not a thing anymore, sweetie. There are only two forms for personal tax returns: the 1040 and the 1040-SR. The only difference is that the 1040-SR, for seniors, has a bigger font. Really. That's it.

What you are thinking of is itemizing vs taking the standard deduction.

Basically, you add up your total income for the year and then subtract either the standard deduction or your itemized deductions. Gross income minus standard or itemized deductions = taxable income. So the more you can deduct here, the less tax liability you have. For this year (tax year 2022 since I'm writing this in 2023), the standard deduction for single is $12,950, $25,900 for married filing jointly, and $19,400 for Head of Household (an unmarried adult who has at least one dependent). If you itemize deductions instead of taking the standard deduction, you can add up various deductions and subtract that from your gross income instead. Common things you can itemize include

* unreimbursed medical expenses that exceed 7.5% percent of your total income

* charitable giving

* interest on your mortgage

* state or local income or sales tax

Itemizing is only useful if the total of all the deductions you can take is higher than the standard deduction. For most people, it isn't, so I'm not going to go any deeper into this and waste everyone's time.

WHERE DO I FILE?

If all of this has made you tired, and you still just want to pay someone else to do it for you, and you can afford that, great! Professionals exist to do hard stuff for you in exchange for money. Ask about the price up front. It may vary depending on how complicated your return is. Some places will let you take your fees out of your refund, if you get one, usually for an additional fee.

I'D REALLY RATHER NOT PAY MONEY TO DO THIS ACTUALLY

Good news! If your total income was $73,000 or less (as of this writing), there are places you can do your taxes online for free! Just go to IRS.gov, click "File Your Taxes for Free," and use their tools to find a program that will work for you. You may have to pay a small fee to file a state return, if you lived or worked in a state that collects state income taxes.

GEE, THANKS FOR THE EXPLANATION. IS THERE ANYTHING ELSE YOU WANTED TO TELL US?

Why, yes, there is! Thanks for asking!

A TAX RETURN IS NOT A TAX REFUND.

Please stop saying "return" when you mean "refund." Yes, I know, that they are kind of synonyms in regular English but a tax return is the form you file when you file your taxes. If you get money back, that is a refund. Thank you.

JUST BECAUSE YOU WORKED HARD DOESN'T MEAN YOU GET A BIG REFUND

That's like... not how it works at all. Did I include this just because one man stormed out of my office because he was mad that he was getting only a couple hundred dollars back instead of the several thousand dollars that his underemployed girlfriend with two kids got? Maybe. Credits are for people who the government decided need help (like people with kids or low incomes) OR for things the government is bribing you to do (like install solar panels). If none of these things apply to you and you still want a big refund, you could have your employer hold more withholding out of your paychecks, but that means you'll get smaller paychecks and that the government is just using your money interest free until they give it back to you when you file your tax return. Some people like to do that, though. They treat the IRS like a savings account they're not allowed to tap into except once a year.

LET'S TALK ABOUT FILING STATUSES FOR A SECOND

There are five filing statuses:

Married Filing Jointly. This is for two people who are legally married. If you live in a state that allows for common law marriage, you can be common law married and file jointly. But if you ever decide you don't want to be married anymore you are supposed to get a divorce if you want to go back to filing single. MFJ has the highest standard deduction. One spouse will be listed as "taxpayer" and the other as "spouse." It doesn't matter which is which. Sex doesn't matter. Income doesn't matter. The IRS just wants you to do it the same every year for record-keeping purposes.

Married Filing Separately. This is for two people who are married but don't want to file jointly. It is usually the worst way to file because several credits are not available to MFS people, but sometimes your spouse won't cooperate with you or maybe they have weird financial crap going on and you don't want it tied up with your financial crap. Approach with caution. It's half the standard deduction, but if your spouse itemized, you must itemize too.

Single. This is for people who aren't married and don't have any dependents. It's half of what the MFJ standard deduction is.

Head of Household. Forget whatever you think you know about how normal people use this phrase normally. Head of Household, for tax purposes, is for an unmarried adult with one or more dependents (if you're married and your spouse has abandoned you and you have kids you can use this status though! As long as the spouse didn't live with you for the last half of the year). It's one and a half times the single standard deduction.

Qualifying Widow(er). This is an uncommon filing status. If someone was married with kids and their spouse died, they get to file as MFJ with that spouse the year that their spouse died, as long as they don't remarry that same year. For the next two years, the surviving spouse can file QW. The Qualifying Widow(er) deduction is the same as MFJ. After that, providing they still have dependents, they get bumped back down to Head of Household.

WOW, THANKS. TAXES DON'T SEEM SO SCARY ANYMORE.

I'm glad to hear it! Go forth with more knowledge.

3 notes

·

View notes