#future of procurement 2025

Explore tagged Tumblr posts

Text

Which of these five "experts" predicting the right future for procurement in 2025?

Based on what you read in this post, which one of the five reports would you read?

As we near the end of 2024, virtually all industry players are publishing their procurement predictions for their respective 2025 reports. Because there are so many reports – think granuals of sand on a beach, as part of my assessment process I asked ChatGPT to provide its take on the five organizations below. Based on the ChatGPT assessment I would ask you the following three questions: Which…

#AI#Deloitte#Digital Transformation#Focal Point#future of procurement 2025#Gartner#McKinsey#procurement#spend matters#supply chain

0 notes

Text

U.S. Air Force Awards RTX $1 Billion Contract to Upgrade F-22 Sensors

The contract follows the recent news about the tests of new advanced sensors on the F-22 Raptor, which the U.S. Air Force is planning to field quickly as part of the ongoing upgrade program.

Parth Satam

F-22 new sensors contract

An F-22 Raptor takes off from Nellis Air Force Base, Nevada, June 30, 2022. (U.S. Air Force photo by Senior Airman Zachary Rufus)

Amid the acute need for 5th generation fighters in modern combat scenarios against peer adversaries, the U.S. Air Force is looking to upgrade its F-22 Raptor with a series of sensors to make it more survivable and relevant. The service announced on Aug. 29, 2024, the award of a $1 billion contract to RTX‘s Raytheon for new sensors that are categorized as “Group B hardware”, together with spares and support equipment.

“Work will be performed in McKinney, Texas, and is expected to be completed by May 8, 2029,” said the DoD contracts statement. The Aviationist had recently reported that the Air Force was testing new sensors on the F-22 to extend its service life, which would also be applied to the NGAD (Next Generation Air Dominance) family of systems.

That report also quoted Brig. Gen. Jason D. Voorheis, the Program Executive Officer for Fighter and Advanced Aircraft, who said they were hoping to field these sensors faster. The Raptor team had conducted six flight tests to demonstrate the advanced sensors.

“The F-22 team is working really hard on executing a modernization roadmap to field advanced sensors, connectivity, weapons, and other capabilities. We’re executing that successfully, and that will lead to […] a rapid fielding in the near future.” This would be done through a Middle Tier Acquisition (MTA) program.

Some of the sensors included in the contract could be the stealthy pods seen on the F-22. Air and Space Forces earlier quoted officials who confirmed that the pods host IRST (Infrared Search and Track) sensors. The development of a new IRST sensor for the Raptor was also confirmed by the service’s 2025 budget request, which however did not mention the sensor being podded.

This work is part of an F-22 improvement campaign that calls for $7.8 billion in investments before 2030, which includes $3.1 billion for research and development and $4.7 billion in procurement.

An F-22 Raptor with the Air Combat Command F-22 Raptor Demonstration Team performs a flyover and air demonstration at the U.S. Air Force Academy in Colorado Springs, Colo., Aug 13, 2024. (U.S Air Force Photo by Trevor Cokley)

F-22’s future in the U.S. Air Force

The development is also in contrast with previously reported USAF plans to retire the older F-22 airframes, for which it had sought approval from the Congress. These F-22s are 32 Block 20 units from a total fleet of 186. At the same time, the service aims to upgrade the remaining 154 with new cryptography, an expanded open architecture, new weapons and an advanced threat warning receiver, beside the IRST.

However, the service now appears to be reconsidering that plan, after Voorheis was quoted in the ASF report: “From an F-22 sunsetting perspective, I don’t have a date for you.” “What I can tell you is that we are hyper-focused on modernization to sustain that air superiority combat capability for a highly contested environment for as long as necessary,” he added.

IMAGE 3: A U.S. Air Force F-22 Raptor assigned to the 3rd Wing takes off above Joint Base Elmendorf-Richardson, Alaska, Jun. 17, 2024. (Image credit: USAF/Senior Airman Julia Lebens)

The U.S. Air Force describes the Raptor as a combination of stealth, supercruise, maneuverability, and integrated avionics, designed to project air dominance, rapidly and at great distance. Initially introduced as an air-superiority-only asset, the F-22 later started performing both air-to-air and air-to-ground missions.

The F-35 is largely a strike fighter and an airborne sensor-fusion and data-processing capable command post in its tactical orientation. But the Raptor is a pure air dominance interceptor. Although costly to upgrade and maintain, it nevertheless can play an important role in degrading adversary air power through either long-range BVR (Beyond Visual Range) and dogfights.

Moreover, having F-22s also increases the number of LO (Low Observable) aircraft in the inventory, at least until more F-35s are available, especially the TR-3 (Technology Refresh-3) Block 4 upgraded variants.

In 2021 too, then Air Force chief General Charles Q. Brown Jr. revealed his “4+1” fighter plan, suggesting the F-22 to be replaced by the NGAD while retaining the F-35, F-15E and EX, and the F-16. The “plus 1” was the A-10, but in March 2023, Brown said the A-10s were being retired faster than expected and the entire fleet would possibly be divested by 2030.

Meanwhile the NGAD’s future itself is uncertain after U.S.A.F have noted its technical complexity and financial implications. The F-22 thus seems to be back in the running.

On Jul. 10, 2024, Air Combat Command chief Gen. Kenneth Wilsbach said during a Mitchell Institute event that the service has no official plan to retire its F-22 Raptors. “Right now, there’s…frankly isn’t an F-22 replacement and the F-22 is a fantastic aircraft,” said Wilsbach. “I’m in favor of keeping the Block 20s. They give us a lot of training value, and even if we had to in an emergency use the Block 20s in a combat situation, they’re very capable.”

F-22 Indonesia

U.S. Air Force F-22 Raptors assigned to the 27th Expeditionary Fighter Squadron, conduct Dynamic Force Employment operations at I Gusti Ngurah Rai Air Force Base, Indonesia, on Aug. 6, 2024. (U.S. Air Force photo by Senior Airman Mitchell Corley)

Other known F-22 upgrades

Other upgrades mentioned in the 2025 budget request are a Mode 5 Identification Friend or Foe (IFF), Link 16, a Multifunction Information Distribution System Joint Tactical Radio System (MIDS JTRS), a new Operational Fight Program, advanced radar Electronic Protection and an Embedded GPS/Inertial Navigation System (INS) Modernization (EGI-M).

Voorheis also mentioned the GRACE (Government Reference Architecture Compute Environment) software that would allow “non-traditional F-22 software” to be installed on the aircraft and provide “additional processing and pilot interfaces.”

A new helmet is also being tested, as part of the Next Generation Fixed Wing Helmet program to replace the current 40-year-old HGU-55P headgear. The new helmet would also allow the introduction of helmet-mounted devices which provide essential flight and weapon aiming information through line of sight imagery, easing the workload of the pilots.

About Parth Satam

Parth Satam's career spans a decade and a half between two dailies and two defense publications. He believes war, as a human activity, has causes and results that go far beyond which missile and jet flies the fastest. He therefore loves analyzing military affairs at their intersection with foreign policy, economics, technology, society and history. The body of his work spans the entire breadth from defense aerospace, tactics, military doctrine and theory, personnel issues, West Asian, Eurasian affairs, the energy sector and Space.

@Theaviationist.com

15 notes

·

View notes

Text

Two new satellites added to Galileo constellation for increased resilience

The European Galileo satellite navigation system keeps growing: a new pair of satellites has joined the constellation after a journey on a Falcon 9 rocket, launched from the Kennedy Space Center in Florida on 18 September at 00:50 CEST (17 September 18:50 local time).

The 13th launch in the Galileo programme, performed by SpaceX under contract with ESA, has taken Galileo satellites number 31 and 32 (FM26 and FM32) to medium Earth orbit, extending the constellation to make it more robust and resilient. In the coming weeks, the new satellites will reach their final destination at 23 222 km, where they will be tested prior to starting operations.

ESA Director of Navigation Javier Benedicto said, “With the deployment of these two satellites, Galileo completes its constellation as designed, reaching the required operational satellites plus one spare per orbital plane. The remaining 6 Galileo First Generation satellites are expected to be deployed in 2025 and 2026 for increased robustness and performance, solidifying the resilience and reliability of Galileo and enabling uninterrupted delivery of the world’s most precise navigation.”

ESA, as design authority and system development prime, together with manufacturer OHB, has developed and tested 38 satellites since the conception of Galileo. All but six satellites have been launched, with the remaining ones ready to join the constellation starting next year. They will be launched in pairs by Ariane 6, ESA’s new launcher that successfully completed its inaugural flight in July. Thereafter, the first batch of Galileo Second Generation (G2) satellites, currently under development by Thales Alenia Space and Airbus Defence and Space, will also be placed in orbit by ESA’s heavy launcher.

Galileo, onwards and upwards

2024 has been a busy year in the Galileo programme, that moves ahead at full speed. In April, the first dual launch of the year placed satellites 29 and 30 in orbit. After a successful early orbit phase and test campaign, the pair entered into service in September.

Just a few days prior to the April launch, Galileo’s new Public Regulated Service (PRS) signals started broadcasting. This encrypted navigation service is specifically designed for authorised governmental users and sensitive applications, contributing to increase Europe’s autonomy and resilience in the critical domain of satellite navigation.

Also in April, Galileo’s ground segment, the largest in Europe and one of the continent’s most critical infrastructures, was migrated with no user impact. This upgrade was needed in part to prepare the system for Galileo’s Second Generation, that is being built by European industry. G2 satellites will be ground-breaking with fully digital navigation payloads, electric propulsion, a more powerful navigation antenna, inter-satellite link capacity and an advanced atomic clock configuration.

About Galileo

Galileo is currently the world’s most precise satellite navigation system, serving over four billion smartphone users around the globe since entering Open Service in 2017. All smartphones sold in the European Single Market are now guaranteed Galileo-enabled. In addition, Galileo is making a difference across the fields of rail, maritime, agriculture, financial timing services and rescue operations.

A flagship programme of the EU, Galileo is managed and funded by the European Commission. Since its inception, ESA, as system development prime and design authority, leads the design, development and qualification of the space and ground systems, and procures launch services. ESA is also entrusted with research and development activities for the future of Galileo within the EU programme Horizon Europe. The EU Agency for the Space Programme (EUSPA) acts as the system prime for the operational system provider, ensuring exploitation and safe and secure delivery of services while overseeing market demands and application needs.

6 notes

·

View notes

Text

U.S. Defense Department officials profess to have learned one of the starkest lessons from the war in Ukraine: that high-intensity conflicts consume a huge number of munitions and that weapons production cannot rapidly expand. William LaPlante, the undersecretary of defense for acquisition and sustainment, coined the phrase “production is deterrence” in late 2023, and this mantra has been repeated by other senior leaders, including Deputy Defense Secretary Kathleen Hicks.

Unfortunately, the Defense Department’s budget request for fiscal year 2025, which asks for $1.2 billion less than last year for key conventional precision-guided munitions, belies these claims. The Pentagon cannot continue to kick the can down the road and promise to buy more munitions next year. Supplemental appropriations are needed to replenish inventories of weapons given to partners and expended during operations in the Middle East, but on their own, they are a Band-Aid that will not fix the fundamental problem of production levels that do not match the intensity of modern warfare. The Pentagon needs to consistently buy more of the right weapons to support allies and partners, deal with the threats it faces today, and deter future challenges.

Understandably, U.S. military weapons stockpiles shrunk and the defense industrial base consolidated at the end of the Cold War as the threat of superpower war receded. Over the next few decades, the Pentagon sought to become leaner and more efficient, deciding that it was wasteful to buy and store large caches of weapons that might never be used.

Instead, the department purchased small stockpiles, typically numbering no more than several thousand of the more sophisticated, longer-range missiles—such as the PAC-3, SM-6, Tomahawk, or Advanced Anti-Radiation Guided Missiles— that could be supplemented by just-in-time production. This procurement strategy was sufficient for U.S. forces that were focused on lower-intensity counterterrorism and counterinsurgency operations because the demand for weapons was expected to be low.

But even small contingencies, such as the 1999 air war in Kosovo and the 2014 operation against the Islamic State in Syria and Iraq, nearly exhausted U.S. stores of key precision weapons.

In response, munitions procurement followed boom and bust cycles. The military bought weapons when they were being used during a conflict and stores ran low, but then quickly deprioritized weapons purchases once the immediate need subsided. Inconsistent buys led the armaments industry to atrophy and lose its ability to surge, a result of increasingly fragile supply chains and a proliferation of sole-source suppliers. For example, there are currently only two American companies that produce the solid rocket motors that propel the majority of U.S. missile systems.

With their 2024 budget request, U.S. defense officials addressed this problem of volatile munitions buys by requesting multiyear procurement authorities for several priority weapons. Across the portfolio, according to Hicks, the request focused on procuring “the maximum amount of munitions” for defeating “aggression in the Indo-Pacific” and strengthening production lines. Our analysis of the 2024 request confirmed that the Defense Department was addressing critical gaps in maritime strike and air defense weapons, but needed to do more.

Unfortunately, the fiscal 2025 presidential request does not sufficiently build on the progress made last year. Spending levels for key conventional precision munitions are down in this request, dropping from $12.3 billion to $11.1 billion. Congressionally imposed fiscal caps forced the Pentagon to make hard choices in this budget, and munitions once again became the bill payer.

The news isn’t all bad, however. The Defense Department is seeking additional multiyear procurement contracts and continues to request more maritime strike weapons—the latter of which is one of the greatest needs for a potential war with China. In particular, the Air Force and Navy nearly doubled the number of long-range anti-ship cruise missiles bought last year. But after decades of neglecting anti-ship weapons, the Pentagon is still not making the scale of investments needed to meet projected demands.

The Navy, for example, stopped buying heavyweight torpedoes for decades, and since restarting production lines, it has only purchased 539 torpedoes. That’s enough to arm 20 Virginia class submarines—just half of the Navy’s attack submarine fleet.

In a Center for a New American Security war game conducted for the U.S. House of Representatives select committee on China, the U.S. team fired approximately 90 percent of its inventory of air-launched anti-ship cruise missiles and 80 percent of its long-range air-launched land-attack weapons in less than a week. The U.S. team managed to destroy approximately 25 percent of the Chinese surface ships and more than 150 Chinese combat aircraft, but it could not keep that level of pressure beyond the first week of the fight. Thus, Chinese troops secured a lodgment on Taiwan, and the U.S. team did not have enough weapons to stop reinforcements.

The United States also does not have the weapons inventories to support less stressing but persistent challenges, such as Iranian and Houthi attacks in the Middle East. Between October 2023 and this February, U.S. naval vessels fired more than 100 standard missiles to shoot down Houthi drones and missiles fired at ships in the Red Sea.

Most of the munitions used by the United States were older SM-2 missiles, but the Navy also fired some of its advanced SM-6 missiles. Each of these interceptors’ costs between $4 million to $6 million today, so the Navy is buying only 17 SM-2s and 125 SM-6s this year, bringing total historical buys to fewer than 10,000 and 1,681 respectively. Only 219 SM-2 have been bought since 2009, while investments have been made to increase SM-6 annual production from 125 missiles a year to 200 missiles a year by 2026.

U.S. forces have also conducted offensive strikes to destroy Houthi missiles and drones before they could be fired. For example, the Navy used at least 94 Tomahawk cruise missiles in multiple strikes against the Houthis in January, expending almost two years’ worth of missile buys in less than a month. The Navy purchased no land-attack Tomahawks last year, and it is not buying any this year.

U.S. air defenses were stressed again in April, when Iran launched more than 300 missiles and drones against Israel. For the first time, U.S. missile destroyers successfully employed SM-3s in combat to intercept four to six Iranian ballistic missiles, while Air Force F-15 and F-16 fighters shot down at least 80 kamikaze drones.

Despite this, the Pentagon plans to terminate production of SM-3 block IB missiles to save $1.9 billion and proposes purchasing only 12 SM-3 block IIA annually for the next four years. The weapons used by U.S. fighter aircraft were not disclosed. But if, for instance, the fighters employed one AIM-9X air-to-air missile to interdict each of the 80 drones, they would have expended 40 percent of the Air Force’s 2024 purchase in one operation.

While supplemental appropriations help to restore weapons stockpiles to their prior levels, the Pentagon has not adequately increased the baseline number of weapons that it is buying and continues to count on industry to surge when needed. But as the U.S. defense industry has struggled to meet the Ukrainian military’s needs, it has become clear that it cannot quickly surge—and that it will not make investments to expand production that may not yield returns because of inconsistent annual buys.

National Security Advisor Jake Sullivan asserted that the U.S. defense industry is “still underestimating” the worldwide demand for weapons, suggesting that it should invest in production capacity based on expected foreign military sales. Yet foreign sales are not enough to strengthen the munitions industrial base. Industry is unwilling to invest without a predictable demand signal—for example, through multiyear contracts—and the process of selling weapons to other countries is notoriously slow and uncertain.

The Defense Department vastly underestimates the number of munitions that it needs to deal with adversaries in the Middle East that have large stocks of relatively cheap missiles and drones, let alone what it would need to face a more capable potential foe—such as China, which is believed to have thousands of sophisticated long-range missiles and drones. The first seven days of a conventional war with China would likely exhaust supplies. Despite the Pentagon’s continued pledges to expand inventories of key conventional weapons, munitions continue to lose in budget battles to larger platforms. But these ships, submarines, aircraft, and guns will be worthless without the missiles, torpedoes, and bullets to arm them.

Even in today’s constrained budget environment, the U.S. Defense Department needs to do more to prioritize munitions buys and prove it has learned the lessons of Ukraine. Congress can play a role in holding the Pentagon to its word here, increasing the buys of key conventional weapons as well as authorizing and appropriating money for the multiyear munitions contracts that would give much-needed stability to the munitions industry.

When it comes to these critical weapons, dramatic and consistent change is necessary to reverse the Defense Department’s poor record. Business as usual will not cut it.

2 notes

·

View notes

Text

ERP Systems for Small and Medium-Sized Businesses in Saudi Arabia: What to Consider?

What Is an ERP System

ERP stands for “Enterprise Resource Planning” and refers to a type of software system that manages and integrates a range of business processes across an organization.

ERP systems provide a centralized database that can be accessed by different departments within an organization handling various business processes such as finance, procurement, production, inventory management, human resources, and customer relationship management. ERP systems integrate these processes to provide a comprehensive view of the entire organization and help to improve operational efficiency and decision-making.

Market Trend for ERP Systems

Research and Markets, the global market research firm, indicates that the ERP software market in Saudi Arabia would grow at a rate of around 17.4% between 2020 and 2025, primarily due to escalating demand for business process automation and the need for data-driven decisions. A robust ERP system is the best way forward for any business to succeed.

Features of ERP Systems

That said, let’s take a look at some of the key features of a good ERP system.

Integration of different business processes and departments

Centralized database with real-time data

Standardization of business processes

Automation of routine tasks

Reporting and analytics capabilities

User access controls to ensure data security

Scalability to support the growth of the organization

Key Considerations for Choosing the Best ERP Software

There are several popular ERP systems in Saudi Arabia such as Oracle ERP Cloud, SAP Business One, Microsoft Dynamics 365, Sage 300, Infor ERP, and Hal Business Success ERP. However, you need to pay attention to the following factors while choosing the best ERP software system that would meet your needs.ConsiderationDescriptionBusiness needsThe system should be able to support the business processes that need to be automated or streamlined ScalabilityThe ERP system should be able to support the future growth of the organizationIntegrationThe ERP system should be able to integrate seamlessly with the organization’s other business applications or systemsCustomizationIt should be possible to customize the ERP system to meet the specific needs of the organizationUser friendlinessThe ERP system should be easy to use and the required training and support should be available for usersSecurityThe system needs to have adequate security features including data encryption and user access controls

ERP systems are thus designed to benefit small and medium-sized businesses, manage their resources and improve efficiency through streamlined business processes, improved decision-making, enhanced visibility and better collaboration. These systems support growth and customer satisfaction and drive the businesses to scale greater heights.

Source Link : https://halsimplify.com/blog/erp-systems-for-small-and-medium-sized-businesses-in-saudi-arabia-what-to-consider/

2 notes

·

View notes

Text

Current Rules Governing Rubbish Removal in Perth

Western Australia has established various regulations to encourage environmentally responsible rubbish removal and minimise the reliance on landfills. Below are the most notable policies currently in place:

Waste Avoidance and Resource Recovery Act 2007 (WARR Act)

This legislation outlines a framework aimed at reducing waste production and improving recycling across diverse sectors, including businesses.

Companies are required to adopt strategies such as material reuse and optimised recycling to align with local sustainability objectives.

Waste Strategy 2030

The state government’s comprehensive waste management initiative seeks to achieve a 75% recovery rate for all waste materials by 2030.

Particular emphasis is placed on reducing waste from industrial and commercial sources, which contribute significantly to landfill volumes.

Businesses are encouraged to implement advanced recycling and waste sorting systems to meet these ambitious targets.

Container Deposit Scheme (WA Return Recycle Renew)

This scheme incentivises the recycling of beverage containers commonly found in both domestic and commercial waste streams.

Businesses handling these containers must participate in authorised collection schemes to ensure proper recycling or reuse.

Single-Use Plastics Ban

Certain single-use plastic items, including straws, cutlery, and bags, have been phased out in Western Australia.

Businesses are required to switch to reusable or biodegradable alternatives, impacting procurement and daily operations.

These regulations demonstrate a clear governmental push towards creating a circular economy where waste is minimised and resources are continuously reused.

Future Changes to Waste Management Rules

Businesses in Perth will soon need to adjust to upcoming regulations designed to further advance sustainable waste practices:

Mandatory Food and Garden Waste Separation (FOGO)

By 2025, businesses will be required to separate food and garden waste for composting or recovery, diverting these materials from landfills.

Industries such as hospitality and landscaping will need to introduce new systems for waste segregation.

Increased Landfill Levies

The state plans to significantly raise landfill levies, making disposal at landfill sites more expensive.

This move is intended to encourage businesses to invest in better recycling and waste reduction measures.

Extended Producer Responsibility (EPR) Programs

Producers will be made accountable for the entire lifecycle of their products, from production to disposal.

Businesses may be required to implement processes that ensure their products and packaging are recyclable or disposed of responsibly.

These changes aim to promote sustainable waste management practices, making compliance both a financial and legal priority.

How Regulations Affect Perth Businesses

The tightening of waste management regulations brings both challenges and opportunities for businesses:

Increased Costs

Higher landfill levies and new compliance measures may lead to higher waste management expenses.

Operational Changes

Businesses will need to adopt processes for waste segregation, such as implementing FOGO bins and enhancing recycling efforts.

Training staff and updating waste-handling systems will be necessary to comply with the new rules.

Compliance Risks

Failing to meet regulatory standards could result in fines, penalties, or damage to a business’s reputation.

Industries that generate large amounts of waste may face more frequent audits and inspections.

Opportunities in Sustainability

Companies that embrace sustainable waste practices can improve their brand image, appeal to eco-conscious customers, and potentially reduce costs over the long term.

Steps to Ensure Compliance and Sustainability

Businesses can prepare for these changes by taking proactive steps to align with Perth’s waste management policies:

Conduct Waste Assessments

Regularly review your waste streams to identify areas for improvement, such as opportunities to recycle or reduce waste.

Work with Professional Rubbish Removal Services

Partnering with rubbish removal companies familiar with local regulations ensures proper disposal and compliance.

These experts can also provide advice on recycling and waste segregation best practices.

Adopt Sustainable Materials

Switch to biodegradable or reusable materials to reduce waste output and comply with single-use plastic bans.

Train Employees

Educate your team on effective waste management practices, such as sorting and recycling, to streamline compliance efforts.

Stay Updated

Monitor regulatory developments by subscribing to updates from the Department of Water and Environmental Regulation (DWER) and local councils.

Utilise Smart Waste Management Solutions

Consider implementing smart bins or waste tracking systems to optimise recycling, minimise waste, and simplify compliance reporting.

Conclusion

Waste management regulations in Perth are evolving, with significant implications for businesses. While adapting to these changes may seem challenging, they also present opportunities for companies to enhance sustainability, meet customer expectations, and reduce environmental impact.

By staying informed about regulatory requirements, conducting regular waste audits, and collaborating with professional rubbish removal Perth services, businesses can maintain compliance and contribute to Perth’s waste reduction goals.

Take the first step towards sustainable waste management today by engaging a trusted rubbish removal service in Perth.

https://www.swannrubbish.com/current-regulations-governing-rubbish-removal-in-perth/

0 notes

Text

Multi-factor Authentication Industry 2030 Trends, Growth, Revenue, Outlook and Future Estimation

The global multi-factor authentication (MFA) market was valued at USD 14.28 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 14.2% from 2023 to 2030. Multi-factor authentication strengthens security by adding multiple verification layers to authenticate user identity and secure online transactions. This increased security is crucial in today’s landscape, where organizations face escalating cyberattacks and data breaches. The rising frequency of such breaches, coupled with stricter regulatory requirements for safeguarding sensitive data, is expected to significantly drive MFA market growth.

Additional factors driving the adoption of MFA solutions include growing investments in cloud technologies and enterprise mobility, along with the increasing trend of bring-your-own-device (BYOD) policies in enterprises. As more businesses shift to cloud-based and mobile environments, the need for robust security solutions like MFA becomes essential. Furthermore, the emergence of authentication-as-a-service solutions, which offer advanced security and user authentication capabilities, is anticipated to further propel the growth of the MFA market.

Despite the promising growth trajectory, high costs and implementation complexities present challenges to the MFA market. However, these barriers are expected to diminish as technology evolves. With the rising incidence of data breaches, many industries are establishing stricter data security standards, prompting organizations to adopt MFA solutions. Implementing MFA is often complex, especially in diverse IT environments, and requires significant capital for procurement, setup, maintenance, and management.

Gather more insights about the market drivers, restrains and growth of the Multi-factor Authentication Market

Regional Insights:

North America Multi-factor Authentication Market Trends

North America is also expected to experience substantial growth in the MFA market over the forecast period. Key drivers in this region include advancements in technology, the widespread adoption of smartphones, improved network connectivity, and high uptake of digital services. The region has also seen a rise in cyberattacks, which has intensified the need for MFA solutions. North America’s growth is further supported by the presence of major technology providers, including CA Technologies, Symantec Corporation, Vasco Data Security International, Inc., and RSA Security LLC, which are expected to bolster market momentum.

Asia Pacific Multi-factor Authentication Market Trends

In 2022, the Asia Pacific region held the largest revenue share of 30.3% in the MFA market and is expected to achieve the fastest growth, with a projected CAGR of 15.4% over the forecast period. This growth is driven by increased spending on connected devices, significant investments in cloud and Internet of Things (IoT) technologies, and a growing demand for digital services. There is also a heightened focus on data security and transaction authentication, alongside stricter regulatory compliance, which is accelerating MFA adoption in the region.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

The global BFSI contact center analytics market size was valued at USD 458.2 million in 2024 and is projected to grow at a CAGR of 19.1% from 2025 to 2030.

The global travel insurance market size was estimated at USD 27.05 billion in 2024 and is projected to grow at a CAGR of 15.4% from 2025 to 2030.

Key Companies & Market Share Insights:

Leading companies in the MFA market are pursuing both organic and inorganic strategies, such as new product launches, acquisitions, and collaborations, to strengthen their global presence and market share. For example, in February 2023, Microsoft introduced a “Number Matching” feature in its Authenticator app to mitigate MFA fatigue attacks. These attacks involve hackers using social engineering tactics to repeatedly prompt authentication requests in an attempt to wear down the user and gain unauthorized account access. Microsoft enabled this new feature for Microsoft Azure users starting in May 2023, adding an extra layer of security against such tactics.

By innovating and enhancing their products, companies in the MFA industry aim to provide more resilient and user-friendly solutions, which are critical for sustaining long-term market growth in an increasingly digitalized world.

Key Multi-factor Authentication Companies:

Vasco Data Security International, Inc.

RSA Security LLC

Fujitsu America, Inc.

NEC Corporation

Symantec Corporation

Thales

3M

aPersona, Inc.

CA Technologies.

Safran S.A.

Order a free sample PDF of the Multi-factor Authentication Market Intelligence Study, published by Grand View Research.

0 notes

Text

Apollo Green Energy plans to go public, aims to achieve Rs 10,000-cr portfolio by 2025

Apollo Green Energy Limited (AGEL), part of Apollo International Group, on November 5 said it is set to build a Rs 10,000-crore project portfolio by 2025. Currently, the company manages an order book of Rs 3,500 crore, with Rs 2,500 crore of ongoing solar projects across various states in India. As part of its growth plan, AGEL is also preparing for a public listing in 2025 to support its expansion and secure new projects.

With a strong focus on renewable energy solutions across India, AGEL leverages Apollo International’s two decades of experience in the Engineering, Procurement, and Construction (EPC) sector. AGEL is a leading EPC company specialising in renewable energy, providing a range of solutions that includes utility-scale solar, energy storage systems, green hydrogen initiatives, and hybrid power. Operating in eight states, the company manages a diverse portfolio of projects, including 400 MW of solar installations. The company has been involved in the execution of Flue Gas Desulfurization (FGD) systems to reduce sulfur dioxide emissions, a major contributor to pollution, in power generation. This project, valued at approximately Rs 700 crore, is nearing completion.

"AGEL is at the forefront of meeting the rising demand for renewable energy, strategically building a robust project pipeline that aligns with India’s ambitious goal of achieving 500 GW of renewable capacity by 2030. By focusing on solar, green hydrogen, and hydro energy projects, the company not only supports the nation’s energy transition but also delivers long-term value for stakeholders. With impressive revenue growth from Rs 324.83 crore in FY22 to Rs 1,174.77 crore in FY24, AGEL is poised to sustain this momentum through FY25, underscoring its commitment to operational efficiency. Its expanding portfolio includes major solar installations across multiple states, solidifying AGEL’s critical role in propelling India toward a cleaner, more energy-independent future," said the company in a statement.

Sanjay Gupta, CEO, Apollo Green Energy Limited (AGEL) said, "As we advance our operations at Apollo Green Energy, we aim to establish a strong foundation for developing & executing renewable energy projects in India. With over 200 professionals and an order book of Rs 3,500 crore, we are focused on delivering projects that meet the nation's energy needs and promote sustainability. Our upcoming IPO in 2025 will further strengthen our financial base, enabling us to scale our operations and invest in cutting-edge renewable technologies.”

“Currently, we are executing large utility scale solar project which requires different technical expertise, like we are doing 40 MW solar fixed tilt in Odisha, 50 MW floating solar project (first of its kind)in Kerala and 200 MW solar with tracker technology in Gujarat. We are also executing 1,50,000 smart solar street lights project in Bihar. Going forward, AGEL will also expand its footprint in wind, hybrid, green Hydrogen and battery storage solutions,” he added.

0 notes

Text

[ad_1] Scholars Merit, a dynamic IT consultancy firm headquartered in Noida, specializing in services such as the i-merit platform and SM360-focused on the professional development of students for a seamless transition into the corporate world-now unveils its suite of innovative solutions designed to empower IT businesses and professionals. TaskOne, WebOne, and CloudOne are set to help organizations scale their operations, address inefficiencies, and drive digital transformation, positioning them for enhanced performance in today's competitive market.Scholars Merit Online At the forefront of this initiative is TaskOne, a unique platform that merges project management with staff augmentation. This innovative approach enables businesses to scale their workforce seamlessly without incurring additional overhead. As companies increasingly turn to outsourcing-57% currently do so to focus on core functions-TaskOne provides a solution that can lead to savings of up to 40% on operational costs. Furthermore, 36% of organizations leverage outsourcing for improved operational flexibility and scalability, allowing them to adapt swiftly to changing market demands. By offering access to a skilled pool of professionals, TaskOne simplifies the process of meeting project needs while ensuring high-quality service delivery and cost efficiency. Complementing TaskOne is CloudOne, which offers comprehensive cloud infrastructure management to help businesses optimize their cloud operations. With Gartner predicting that more than 85% of organizations will adopt a cloud-first strategy by 2025, CloudOne is positioned to facilitate this transition by providing a full range of services-from cloud procurement to optimization. This solutions consumption-based pricing ensures that companies pay only for what they use. A dedicated project manager oversees operations, enabling businesses to focus on innovation and growth while CloudOne manages the technical complexities of cloud services. In addition to these powerful tools, WebOne simplifies website development by offering scalable and customizable solutions that help businesses establish a robust online presence. As 88% of consumers research products online before making a purchase, having a professional and functional website is essential for success. WebOne empowers organizations to create websites that evolve with their needs, providing ongoing support and design expertise throughout the process.Sumit Shukla, CEO of Scholars Merit, stated, "With the launch of TaskOne, WebOne, and CloudOne, we are excited to provide tools that will help businesses in the IT sector grow and become more efficient. Our goal is to make it easier for companies to tackle their challenges, improve their operations, and take full advantage of digital transformation. We understand the changing needs of IT professionals, and we are committed to supporting them in building a successful future." As Scholars Merit introduces TaskOne, WebOne, and CloudOne, it reinforces its commitment to supporting growth and efficiency in the IT sector. These innovative solutions help businesses tackle challenges, streamline operations, and embrace digital transformation. By addressing the changing needs of IT professionals and organizations, Scholars Merit aims to foster a more agile and successful future for its clients. Check more about Scholars Merit Online at www.scholarsmerit.com [ad_2] Source link

0 notes

Text

[ad_1] Scholars Merit, a dynamic IT consultancy firm headquartered in Noida, specializing in services such as the i-merit platform and SM360-focused on the professional development of students for a seamless transition into the corporate world-now unveils its suite of innovative solutions designed to empower IT businesses and professionals. TaskOne, WebOne, and CloudOne are set to help organizations scale their operations, address inefficiencies, and drive digital transformation, positioning them for enhanced performance in today's competitive market.Scholars Merit Online At the forefront of this initiative is TaskOne, a unique platform that merges project management with staff augmentation. This innovative approach enables businesses to scale their workforce seamlessly without incurring additional overhead. As companies increasingly turn to outsourcing-57% currently do so to focus on core functions-TaskOne provides a solution that can lead to savings of up to 40% on operational costs. Furthermore, 36% of organizations leverage outsourcing for improved operational flexibility and scalability, allowing them to adapt swiftly to changing market demands. By offering access to a skilled pool of professionals, TaskOne simplifies the process of meeting project needs while ensuring high-quality service delivery and cost efficiency. Complementing TaskOne is CloudOne, which offers comprehensive cloud infrastructure management to help businesses optimize their cloud operations. With Gartner predicting that more than 85% of organizations will adopt a cloud-first strategy by 2025, CloudOne is positioned to facilitate this transition by providing a full range of services-from cloud procurement to optimization. This solutions consumption-based pricing ensures that companies pay only for what they use. A dedicated project manager oversees operations, enabling businesses to focus on innovation and growth while CloudOne manages the technical complexities of cloud services. In addition to these powerful tools, WebOne simplifies website development by offering scalable and customizable solutions that help businesses establish a robust online presence. As 88% of consumers research products online before making a purchase, having a professional and functional website is essential for success. WebOne empowers organizations to create websites that evolve with their needs, providing ongoing support and design expertise throughout the process.Sumit Shukla, CEO of Scholars Merit, stated, "With the launch of TaskOne, WebOne, and CloudOne, we are excited to provide tools that will help businesses in the IT sector grow and become more efficient. Our goal is to make it easier for companies to tackle their challenges, improve their operations, and take full advantage of digital transformation. We understand the changing needs of IT professionals, and we are committed to supporting them in building a successful future." As Scholars Merit introduces TaskOne, WebOne, and CloudOne, it reinforces its commitment to supporting growth and efficiency in the IT sector. These innovative solutions help businesses tackle challenges, streamline operations, and embrace digital transformation. By addressing the changing needs of IT professionals and organizations, Scholars Merit aims to foster a more agile and successful future for its clients. Check more about Scholars Merit Online at www.scholarsmerit.com [ad_2] Source link

0 notes

Text

BHEL Share Price Forecast 2024 , 2025 to 2040

BHEL Stock Forecast: An In-depth Look at Future Expectations for 2024, 2025, 2030, and 2040

Bharat Heavy Electricals Limited (BHEL) plays a crucial role in the growth of India's industrial sector by offering a broad spectrum of engineering and manufacturing solutions. For investors, understanding the worth of BHEL's stocks is vital for their investment plans. In this section, we will delve into the future outlook of BHEL Share Price Target 2024 analyzing market movements, the reasons for its expansion, and projections for the future.

BHEL: A Brief Introduction and Its Future Expectations

Founded in 1964, BHEL stands as a dominant entity in India's engineering and manufacturing fields, delivering services in power generation, engineering, procurement, and construction to various sectors such as power, defense, and oil & gas. Its substantial role in the public sector and participation in government initiatives underscore its critical position in the nation's industrial progress. Despite encountering obstacles such as increased competition and changes in the economic landscape, BHEL Ltd. has maintained its significance through continuous innovation and expansion into new markets.

BHEL Stock Predictions for 2024

As the year 2023 comes to an end, BHEL's stock prices have experienced fluctuations due to the volatile market and global economic conditions. However, there's a hopeful outlook for the upcoming year, fueled by the government's efforts to enhance infrastructure and energy production. The expected range for BHEL Share Price Target 2024 is estimated to be between ₹190 to ₹275, contingent upon the company's performance in forthcoming projects and the state of the market. An uptick in demand for eco-friendly energy and sustainable materials could also boost BHEL's prospects for the future.

Gurugram Property Guide: Your Reliable Resource for Gurugram Housing Market

Gurugram Property Guide is acknowledged as a leading real estate agency in Gurugram, offering a broad selection of properties, particularly in the Delhi NCR area. Renowned for our reliability in the real estate sector, we provide comprehensive services and expert counsel to clients looking to buy, sell, or invest in properties. Our commitment to assisting our clients in discovering their ideal property, whether for living or business purposes, distinguishes us from our competitors.

Why Opt for Gurugram Property Guide?

At India Property Dekho , we take pride in our comprehensive knowledge of the Gurugram housing market. We cater to a variety of properties, ranging from high-end apartments to prime commercial zones, ensuring we match your requirements. Our skilled team offers tailored advice, making sure each client is well-versed in the latest market trends and potential future developments.

BHEL Share Price Target 2025

In the next five years, BHEL is projected to undergo significant growth, driven by its engagement in environmentally friendly energy projects and the enhancement of existing power stations. Analysts believe that BHEL Share Price Target 2025 could range from ₹242 to ₹297, due to its growing involvement in green energy ventures and the potential for government incentives for companies contributing to India's green energy objectives. Investors seeking reliable, lasting investments might find BHEL's stocks attractive.

BHEL Share Price Target 2030

Looking out to 2030, BHEL's prospects look bright, especially as India's infrastructure expands and modernizes. It is expected that Bhel Share Price Target 2030 will see a significant rise, possibly extending to ₹393 to ₹447 per share. This positive outlook is supported by various factors, including technological advancements, entry into new territories, and an increasing demand for power infrastructure. BHEL's focus on renewable energy and advanced grid technologies is seen as crucial for the growth of its stock value over the next decade.

Expected Trends for BHEL's Stock Price Over the Next Decade

Moving further into the future to 2040, the future of BHEL's stock becomes more uncertain, yet its critical role in the Indian manufacturing sector points to ongoing growth. Assuming steady market conditions and the ability to adapt to new technologies, BHEL's stock could climb to ₹3000 to ₹3600 by 2040. Much depends on how well BHEL manages the changing energy landscape, especially in solar, wind, and nuclear sectors. For investors with a long-term approach, BHEL might represent a profitable investment as long as it continues to innovate and extend its market reach.

Effect on BHEL's Share Prices

Government Assistance: The close relationship between BHEL and government initiatives in areas like infrastructure, power production, and green energy will greatly influence its share values.

Adoption of Green Energy: As nations shift towards more eco-friendly energy solutions, BHEL's role in developing green technologies is crucial for its future prosperity.

Evolving Power Equipment Sector: The market for power equipment is becoming increasingly competitive, yet BHEL's leading market stance and its capacity to explore new markets provide opportunities for expansion.

Innovative Technologies: BHEL's skill in implementing new technologies, such as smart grids and renewable energy systems, is essential for preserving its competitive edge in the future.

To sum up,

BHEL is an essential component of India's industrial and energy landscapes, and its shares are expected to see further growth in the future. While the projected share prices for 2024 indicate immediate expansion, there's a strong possibility for shares to rise to ₹100-₹120 by 2024, ₹130-₹150 by 2025, and potentially ₹400-₹500 by 2040, making it a dependable investment for investors aiming to gain from India's progress in these sectors.

For investors, tracking market movements, government actions, and BHEL's strategies is key to making well-informed decisions about the company's future.

0 notes

Text

Promotional Products Procurement Intelligence 2024-2030: What You Need to Know

Procurement of promotional products enables a business with enhanced customer loyalty, better exposure, faster brand recognition, and effective and optimized marketing. The global market size was valued at USD 90.5 billion in 2023. A large-scale, multi-media, comprehensive advertising strategy is crucial for businesses, but it can be expensive for small-scale businesses. However, they can still use a low-cost promotional goods campaign to meet their marketing objectives. Start-ups can find numerous inexpensive promotional things available. For large-scale distribution, the majority of promotional product producers maintain extremely economical/low prices. The impact on the receivers is great despite the inexpensive cost of the items. In addition, offering clients promotional goods makes it easier for them to remember and recognize the company. Also, the products can serve as a business card for any enterprise as they typicallly carry the image, logo, and business’s slogan depicting their goal.

Apart from technology and personalization, sustainability plays a major role during the procurement of these products. Customers are becoming more aware of how their purchases affect the environment, and the promotional products sector has been affected by this trend. Sustainable materials like bamboo, organic cotton, and recycled plastics are becoming more and more well-liked. As per a recent report by the U.S.-based promotional products community, business enterprises are substituting traditional industry products with eco-friendly alternatives, aligning their brand with sustainability practices.

Sustainability is no longer just a trend but a fundamental consideration for marketing campaigns; rather, it covers everything from offering biodegradable pens to recyclable bags. Furthermore, the need for promotional goods that work well with virtual and hybrid event formats is rising. Businesses are modifying their tactics to fit the digital environment, from branded items shown in online event platforms to virtual event swag boxes sent to attendees' doorsteps.

Order your copy of the Promotional Products Procurement Intelligence Report, 2024 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Real estate, education, and the financial sectors are among the leading end-users of the products offered in the industry. Professionals in real estate use the procurement of branded merchandise as part of their marketing campaigns. People in the community get to know them by attending events and giving away these entertaining things, and they can be taken into consideration for future real estate needs. In conjunction with social media, it's an ideal approach to building connections.

In the field of education, especially in higher education, promotional products are useful. These things make schools stand out when they attend college fairs, college expos, conferences, seminars, open houses, and other similar activities. Additionally, banks employ branded goods as awards and incentives for events like customer appreciation days and new account openings. Travel mugs, fidget spinners, stress balls, and plastic piggy banks are among the commonly used products.

The global market is dominated by North America, with Asia Pacific and Europe standing in the second and third places, respectively. In the Asia Pacific promotional products procurement arena, it is anticipated that the expenses incurred on marketing and advertising campaigns, such as promotional products, will witness growth of over 5.3% till 2025. Key economies in the region responsible for such growth include India, Japan, South Korea, and China. Notable examples of continuously developing Asian economies are Indonesia and the Philippines (and, to a lesser extent, Burma and Vietnam, where there is a substantial population and great potential for economic advancement). Some products in the Asian promotional product market are more sought after than others, such as personalized tote bags, trucker hats, work-from-home accessories and phone cases. Tote bags have a real hipster vibe because they are simple, practical, and incredibly fashionable. Tote bags are a significantly less expensive way to hold stuff than typical bags, whether a person is traveling to the food market, shopping with friends, or even just going out to a bar.

Promotional Products Sourcing Intelligence Highlights

• The global promotional products market is highly competitive, exhibiting a fragmented landscape with the presence of a large number of regional and global players operating in the industry.

• Suppliers in the industry possess a low capability to negotiate with buyers as the latter have an edge to choose the supplier of their choice due to the availability of a large supply base and low switching cost. Therefore, the suppliers are bound to stay soft in terms of pricing and product range.

• China is the preferred best-cost country for sourcing promotional products. The nation currently produces more manufactured goods than South Korea, Japan, Germany, and the U.S. combined, accounting for one-third of global production.

• Printing and engraving equipment, software tools, cost of the product, labor, marketing, rent and utilities, and others are the key cost components for promotional products. Other costs include storage and transportation, printing ink and toner, maintenance and repair, administrative fees, and tax.

Browse through Grand View Research’s collection of procurement intelligence studies:

• Digital Procurement Systems Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Creative Advertising Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Promotional Products - Key Suppliers

• 4imprint Group plc

• American Business Forms & Envelopes

• BDS Connected Solutions, LLC

• Brand Addition Limited

• HALO Branded Solutions, Inc.

• HH Global Group Limited

• IGC Global Promotions

• iPROMOTEu

• Prominate Limited

• Smidt-imex

• Total Merchandise Ltd.

• VistaPrint

Promotional Products Procurement Intelligence Report Scope

• Growth Rate: CAGR of 3.75% from 2024 to 2030

• Pricing Growth Outlook: 5% - 10% increase (Annually)

• Pricing Models: Cost-plus pricing, Fixed pricing, Competition-based pricing

• Supplier Selection Scope: Cost and pricing, Past engagements, Productivity, Geographical presence

• Supplier Selection Criteria: Industries served, years in service, geographic service provision, revenue generated, employee strength, key clients, types of products (office supplies / drinkware / clothing / mugs / bags / others), customization options, eco-friendly options, customer support, lead time, and others

• Report Coverage: Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

#Promotional Products Procurement Intelligence#Promotional Products Procurement#Procurement Intelligence#Promotional Products Market#Promotional Products Industry

0 notes

Text

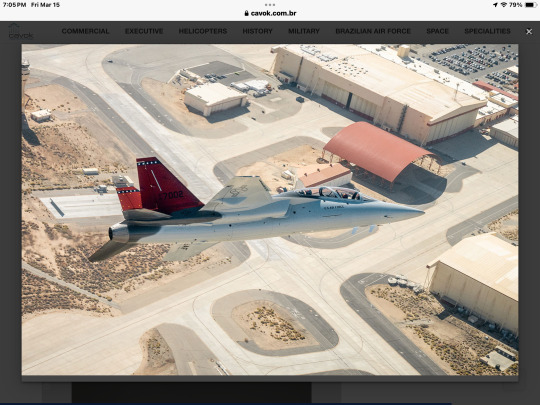

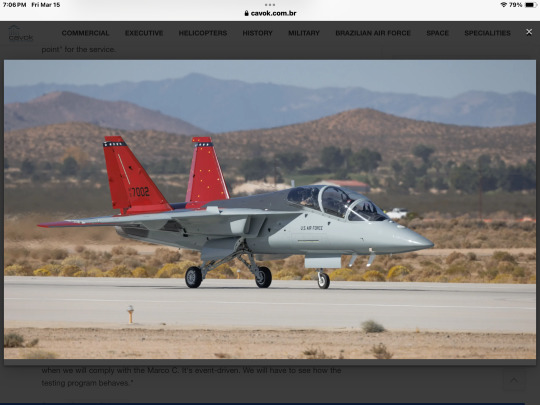

USAF: Boeing's KC-46A and T-7A face more delays

Fernando Valduga By Fernando Valduga 03/14/2024 - 11:00 in Military

The Air Force's head of acquisitions, Andrew Hunter, noted possible future problems for the KC-46A and said that production of the T-7A could start “a little later” than previously predicted, but he remained confident about the future of the two aircraft.

For years, the fixed price agreements that Boeing has signed for programs such as the air refueling plane KC-46A Pegasus and the coach T-7A Red Hawk have been headaches for the aerospace giant amid billions in losses due to delays, supply chain restrictions and development problems. And now, according to the U.S. Air Force acquisition leader, more delays for both efforts may be coming.

Testifying before the Chamber's Armed Services Maritime Power and Projection Forces Subcommittee on Tuesday, Andrew Hunter said that an update to the long-problematic vision system of the KC-46A would probably arrive in 2026, surpassing a projected field date already 19 months late, from October 2025. After the hearing, he told reporters separately that the service would "probably" approve the production of coach T-7A later than previously expected.

“There is some scheduling pressure,” Hunter told lawmakers about the implementation of a new vision system for the KC-46A, called RVS 2.0. "And depending on the completion of the airworthiness certification process of the Federal Aviation Administration (FAA), I cannot guarantee that we would be in a position to enter the field in 25. It could be '26. And that's really likely - I think it will probably take the field in 26."

After the hearing, Hunter explained to reporters that a possible Pegasus delay is linked to the FAA certification process, arguing that when RVS 2.0 is integrated, “you need to make sure that this will not affect anything else on the plane. Therefore, this makes the airworthiness process more complex than it may seem, because it is essentially more than just the cameras you are dealing with."

Hunter added that he is "confident" that USAF and Boeing "have the right project" and that the team "will go through the entire process of airworthiness in the near future".

So far, Boeing has reported losses of more than $7 billion in the Pegasus program due to its fixed price structure, although it is not clear whether more losses could be associated with an additional delay for RVS 2.0. Boeing has defured the questions to the U.S. Air Force, but the company had already praised the capabilities of the new vision system as providing marked improvements over the basic version.

Despite the problems in the vision system, the aircraft has been released for combat deployment and can refuel most of the U.S. fleet, except the A-10, due to a separate problem with an actuator on the tanker's boom, which should be resolved by fiscal year 26. Hunter suggested last year that the service was inclined to buy more tankers as part of a new strategy to continue the retirement of the service's former KC-135 refuelers, although a service official later said that a procurement strategy had not yet been decided.

Europe's Airbus positioned itself as an alternative if the U.S. Air Force decided to participate in a competition, after its partner Lockheed Martin announced that it was giving up.

In his testimony this week, Hunter said that autonomous capabilities could be incorporated into the future of air refueling, but told journalists that this would not be a requirement for the next installment of the acquisition of tankers.

"I think this would be something that we would consider as an independent effort and potentially put into practice in the future," he said about autonomous replenishment.

In a written statement on Tuesday [PDF], Hunter additionally said that the service would slightly expand its current contract with Boeing, adding four KC-46As for a total registration program of 183.

T-7A 'A little later than we expected'

Meanwhile, budget documents confirmed the decision of the U.S. Air Force to halve the 2025 fiscal acquisition of the T-7A Red Hawk training aircraft, intended to replace the former T-38 Talon, from 14 to seven, and indicate that delays in the program are also near.

This program was reformulated last year to reflect a delay of more than two years. A subsequent surveillance report found that problems with the flight control software and the jet's escape system continued to pose risks to the already delayed schedule, especially when the jet moved to enter flight tests, where the U.S. Air Force could discover new flight control deficiencies.

Now, it seems that the coach's schedule may be a little longer. According to the Fiscal Year 2025 budget documents released by the service on Monday night, a decision of the Marco C - or the point at which the service officially approves a program to go into production - is projected for May 2025. Previously, authorities planned the C-Mark for February 2025, although the program allocated a full year of schedule margin for the decision.

To help mitigate delays, Boeing began buying long-term parts to start making an eventual production decision. This approach required a special agreement between the U.S. Air Force, Boeing and the Defense Contracts Management Agency to oversee initial production, which the service said last year had been achieved.

In addition, as Aviation Week previously noted, budget documents also suggest that the initial operational capacity of the jet may be postponed for one year, from the second quarter of Fiscal Year 2027 to the second quarter of Fiscal Year 2028. So far, Boeing has reported losses of about $1.3 billion in the Red Hawk program, and it is not clear whether further delays could result in more charges. As with the KC-46, the company transferred questions about the T-7A to USAF, which did not immediately respond to a request for comment.

Speaking to reporters after Tuesday's hearing, Hunter explained that the decision to halve the purchase of T-7A in Fiscal Year 25 was mainly the result of high-level fiscal pressures. Still, he said that the size of the seven Red Hawks batch "is a good starting point" for the service.

He said that delays in the start of the flight test program may mean that the coach will be approved for production later than expected. The first USAF T-7A landed at Edwards Air Base in November.

“We entered the flight test program a little later than we expected, so we will probably start production a little later than we expected,” Hunter said. “At the moment, the flight test program is doing relatively well. If we don't discover something unexpected, I believe we will go into production in fiscal year 2025."

Asked if the date of the Marco C of February 2025 is at risk, he replied: "To define when we will comply with the Marco C. It's event-driven. We will have to see how the testing program behaves."

Source: Breaking Defense

Tags: Military AviationKC-46A PegasusT-7A Red HawkUSAF - United States Air Force / U.S. Air Force

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

MILITARY

Russia releases video of destruction of Ukrainian helicopters in Donetsk

14/03/2024 - 09:00

SMOKE SQUADRON

IMAGES: Smoke Squadron holds demonstrations in Pernambuco

14/03/2024 - 08:21

MILITARY

USAF's NGAD program will receive US$ 3.4 billion in the 2025 budget

13/03/2024 - 18:43

MILITARY

Taiwan acquires additional MQ-9B SkyGuardian drones from the US

13/03/2024 - 18:18

HELICOPTERS

Bell receives contract to manufacture the AH-1Z attack helicopters for Nigeria

13/03/2024 - 16:00

ARMAMENTS

US approves sale of JASSM-ER, AMRAAM and Sidewinder missiles to Poland

13/03/2024 - 14:00

12 notes

·

View notes

Text

Salasar Techno Engineering Limited: A Comprehensive Overview of Q1 FY25 Financial Results

Salasar Techno Engineering Limited, a prominent player in the infrastructure sector, recently presented its financial results for the first quarter of the fiscal year 2025. The company, with its diverse operations ranging from telecom towers to power transmission solutions, continues to demonstrate robust performance and strategic growth.

Headquartered in New Delhi with multiple facilities across India, Salasar Techno Engineering is a key enabler in the development of national infrastructure. Their facilities are strategically located to optimize raw material procurement and production efficiency. The company's operations span across three major units, equipped with state-of-the-art machinery including CNC machines, plasma cutting tools, and beam welding equipment.

For the first quarter of FY25, Salasar Techno Engineering reported a revenue of ₹2,940 million, marking a 12.3% increase from the same period last year. This growth reflects the company's successful expansion in its core areas of telecom infrastructure, power transmission, and EPC (Engineering, Procurement, and Construction) projects. The EBITDA for the quarter improved to ₹282 million, showcasing a margin of 9.6%, driven by operational efficiencies and high-margin project execution. However, the PAT (Profit After Tax) saw a modest increase of 3.4%, reaching ₹104.9 million.

The company’s strategic focus on expanding its footprint in telecom and power transmission sectors has bolstered its order book, which stood at ₹24,019 million by the end of Q1 FY25. This strong order book underscores Salasar's market leadership and ability to secure significant projects across diverse segments. Noteworthy orders include projects related to telecom towers, power transmission lines, and renewable energy solutions.

Salasar Techno Engineering's management is optimistic about the company's future, attributing its strong performance to a combination of strategic initiatives and favorable market conditions. The company's vision to contribute significantly to national infrastructure development and its mission to deliver advanced technological solutions remain central to its growth strategy. The emphasis on technological advancements and strategic partnerships, such as the tie-up with Ramboll for manufacturing high-performance tower structures, continues to enhance Salasar’s competitive edge.

The company is also poised to benefit from the substantial investments planned in India's power transmission sector. With the Central Electricity Authority's vision of integrating 500 GW of renewable energy by 2030, Salasar Techno Engineering is well-positioned to capitalize on the opportunities arising from this massive infrastructure upgrade. Additionally, the growth in the telecom sector, with government plans to expand mobile tower infrastructure, presents further opportunities for Salasar.

In conclusion, the first quarter of FY25 has been a period of notable progress for Salasar Techno Engineering Limited. The company’s strategic focus, operational efficiencies, and market expansion efforts have set a solid foundation for continued growth. As Salasar moves forward, it remains committed to leveraging its strengths to drive future success, supported by a strong order book and an optimistic outlook on industry developments. The company expresses gratitude to its stakeholders for their unwavering support and looks forward to building on its achievements in the upcoming quarters.

0 notes

Text

More than a decade ago, the German government made the deliberate decision to kill the ability of the Bundeswehr, Germany’s military, to fight a conventional land war in Europe and strip it of the equipment, manpower, and resources to do so. In 1990, as the Cold War was ending, the then-West German Bundeswehr alone was still able to field 215 combat battalions in a high state of readiness. Today, Germany has around 34 battalions, and the word “combat” is a bit of a misnomer. They are at such a low state of military readiness that when the 10th Tank Division conducted an exercise late last year, its entire deployed fleet of 18 Puma infantry fighting vehicles broke down.

The decrepit state of the Bundeswehr now stands in the way of the German government’s stated intention to play a greater role in European security and deterrence against future Russian aggression. Berlin’s offer last month to permanently deploy a full combat brigade in Lithuania may reflect the beginnings of a shift in German strategic culture, but it is unclear whether the Bundeswehr can pull even this task off. It took the German military two years of preparation for one such brigade just to be ready for exercises in Norway in 2019, when Germany led NATO’s Very High Readiness Joint Task Force, the alliance’s first responder to any military crisis. Germany’s pledge in 2022 to be able to deploy an entire division, or up to 30,000 soldiers, for NATO’s territorial defense by 2025 also remains doubtful. Even stripping other Bundeswehr units of equipment will likely be insufficient to adequately outfit an entire division.

There is, however, one bit of good news that might help Germany overcome this epic security debacle. While Germany just about killed the Bundeswehr, it did not kill the German defense industry. One of the world’s largest and most technologically advanced, Germany’s defense sector would have the products, technology, and manufacturing know-how to meet many of the Bundeswehr’s modernization demands over the coming decades. But to realize the modernization of the Bundeswehr through the German defense industry would require Berlin to have tenacious political will, a strong commitment to long-term financing plans, and a willingness to slash bureaucratic red tape in order to expedite and professionalize procurement processes.

With 135,000 workers inside Germany alone and some $30 billion in annual revenues, German defense companies are already among the world’s most important producers—and could indeed close many of the Bundeswehr’s existing capability gaps. The German defense sector’s key products include air defense systems (mobile, short-range, and medium-range); ground-based electronic warfare systems; loitering munitions; precision-guided munitions of all ranges and advanced artillery rounds; artillery systems, main battle tanks, armored personnel carriers, and next-generation armored vehicles; diesel-electric submarines (and perhaps large uncrewed underwater vehicles in the not-so-distant future); digitally encrypted communications; and networking and cloud capabilities for modern battle management. All these are systems the Bundeswehr desperately needs.

Rheinmetall, for example, is not only one of Europe’s largest makers of munitions, capable of producing up to 450,000 rounds of heavy artillery shells per year—a crucial capability even in a 21st-century war, as Russia’s invasion of Ukraine war has shown. The company has also developed a host of high-tech systems needed in a future high-intensity war. This includes the mobile Skyranger air defense system fitted onto a Boxer armored fighting vehicle, as well as a new main battle tank, the Panther KF51, which the company wants to sell to and even manufacture in Ukraine. Rheinmetall has also developed a whole family of autonomous ground vehicles that can be armed under its Mission Master program. A Rheinmetall subsidiary has also developed a precision loitering munition system, the HERO, which the Bundeswehr has not yet ordered.

When it comes to enhancing the Bundeswehr’s ability to conduct precision strikes, two German defense contractors are currently working with the German subsidiary of MBDA, the French-British-Italian missile-maker, on ground-based cruise missile and support systems. Their Joint Fire Support Missile will have a range of around 300 kilometers (about 186 miles) and may be procured by the Bundeswehr, but no contract has been signed.

Although the German defense bureaucracy has been slow, some modernization efforts are already going on. Rohde & Schwarz, an electronics group, is in the process of equipping the Bundeswehr with digitally encrypted communications, while Blackned is providing the technology for ground forces to link multiple platforms and weapons systems into battle networks. German artificial intelligence defense company Helsing has been working with the Bundeswehr to integrate existing platforms, such as armored vehicles, into AI-enabled battle networks to enhance their combat capabilities.

Furthermore, the Bundeswehr is also in the process of procuring a number of U.S.- and European-made systems, such as drones, fighter jets, transport planes, maritime patrol aircraft, helicopters, and anti-ship and land attack missiles, to meet its modernization demands. German companies are important component suppliers in all of these products. The Bundeswehr also funds a number of joint European research and development programs, including the Main Ground Combat System and the Future Combat Air System, both of which involve leading German defense companies.

If the potential to harness Germany’s world-class defense industry is there, Berlin is not exploiting it to the extent it could. There are four main obstacles holding back the German government and Bundeswehr.