#election result impact on share market

Explore tagged Tumblr posts

Text

How Maharashtra Election Results May Impact Stock Markets

📊 How will Maharashtra's election results shape the stock market this Monday? Investors are eyeing sectors like real estate, infrastructure, and banking for potential gains. 🌟 Get insights on the likely market moves and key opportunities!

📈💼 #StockMarket #MaharashtraElections #InvestmentTips #FinanceNews

#stock market#impact of election results on stock market#2019 election impact on stock market#impact of 2024 election on stock market#election results impact on stock market#impact of elections on stock market#stock market news#election result impact on stock market#maharashtra election 2024#maharashtra election news live#maharashtra election live result#election result impact on share market#maharashtra election#elections impact on stock market

0 notes

Text

B.6 But won’t decisions made by individuals with their own money be the best?

This question refers to an argument commonly used by capitalists to justify the fact that investment decisions are removed from public control under capitalism, with private investors making all the decisions. Clearly the assumption behind this argument is that individuals suddenly lose their intelligence when they get together and discuss their common interests. But surely, through debate, we can enrich our ideas by social interaction. In the marketplace we do not discuss but instead act as atomised individuals.

This issue involves the “Isolation Paradox,” according to which the very logic of individual decision-making is different from that of collective decision-making. An example is the “tyranny of small decisions.” Let us assume that in the soft drink industry some companies start to produce (cheaper) non-returnable bottles. The end result of this is that most, if not all, the companies making returnable bottles lose business and switch to non-returnables. Result? Increased waste and environmental destruction.

This is because market price fails to take into account social costs and benefits, indeed it mis-estimates them for both buyer/seller and to others not involved in the transaction. This is because, as Schumacher points out, the “strength of the idea of private enterprise lies in its terrifying simplicity. It suggests that the totality of life can be reduced to one aspect — profits...” [Small is Beautiful, p. 215] But life cannot be reduced to one aspect without impoverishing it and so capitalism “knows the price of everything but the value of nothing.”

Therefore the market promotes “the tyranny of small decisions” and this can have negative outcomes for those involved. The capitalist “solution” to this problem is no solution, namely to act after the event. Only after the decisions have been made and their effects felt can action be taken. But by then the damage has been done. Can suing a company really replace a fragile eco-system? In addition, the economic context has been significantly altered, because investment decisions are often difficult to unmake.

In other words, the operations of the market provide an unending source of examples for the argument that the aggregate results of the pursuit of private interest may well be collectively damaging. And as collectives are made up of individuals, that means damaging to the individuals involved. The remarkable ideological success of “free market” capitalism is to identify the anti-social choice with self-interest, so that any choice in the favour of the interests which we share collectively is treated as a piece of self-sacrifice. However, by atomising decision making, the market often actively works against the self-interest of the individuals that make it up.

Game theory is aware that the sum of rational choices do not automatically yield a rational group outcome. Indeed, it terms such situations as “collective action” problems. By not agreeing common standards, a “race to the bottom” can ensue in which a given society reaps choices that we as individuals really don’t want. The rational pursuit of individual self-interest leaves the group, and so most individuals, worse off. The problem is not bad individual judgement (far from it, the individual is the only person able to know what is best for them in a given situation). It is the absence of social discussion and remedies that compels people to make unbearable choices because the available menu presents no good options.

By not discussing the impact of their decisions with everyone who will be affected, the individuals in question have not made a better decision. Of course, under our present highly centralised statist and capitalist system, such a discussion would be impossible to implement, and its closest approximation — the election process — is too vast, bureaucratic and dominated by wealth to do much beyond passing a few toothless laws which are generally ignored when they hinder profits.

However, let’s consider what the situation would be like under libertarian socialism, where the local community assemblies discuss the question of returnable bottles along with the workforce. Here the function of specific interest groups (such as consumer co-operatives, ecology groups, workplace Research and Development action committees and so on) would play a critical role in producing information. Knowledge, as Bakunin, Kropotkin, etc. knew, is widely dispersed throughout society and the role of interested parties is essential in making it available to others. Based upon this information and the debate it provokes, the collective decision reached would most probably favour returnables over waste. This would be a better decision from a social and ecological point of view, and one that would benefit the individuals who discussed and agreed upon its effects on themselves and their society.

In other words, anarchists think we have to take an active part in creating the menu as well as picking options from it which reflect our individual tastes and interests.

It needs to be emphasised that such a system does not involve discussing and voting on everything under the sun, which would paralyse all activity. To the contrary, most decisions would be left to those interested (e.g. workers decide on administration and day-to-day decisions within the factory), the community decides upon policy (e.g. returnables over waste). Neither is it a case of electing people to decide for us, as the decentralised nature of the confederation of communities ensures that power lies in the hands of local people.

This process in no way implies that “society” decides what an individual is to consume. That, like all decisions affecting the individual only, is left entirely up to the person involved. Communal decision-making is for decisions that impact both the individual and society, allowing those affected by it to discuss it among themselves as equals, thus creating a rich social context within which individuals can act. This is an obvious improvement over the current system, where decisions that often profoundly alter people’s lives are left to the discretion of an elite class of managers and owners, who are supposed to “know best.”

There is, of course, the danger of “tyranny of the majority” in any democratic system, but in a direct libertarian democracy, this danger would be greatly reduced, for reasons discussed in section I.5.6 ( Won’t there be a danger of a “tyranny of the majority” under libertarian socialism?).

#capitalism#money#anarchy#community building#practical anarchy#practical anarchism#anarchist society#practical#faq#anarchy faq#revolution#anarchism#daily posts#communism#anti capitalist#anti capitalism#late stage capitalism#organization#grassroots#grass roots#anarchists#libraries#leftism#social issues#economy#economics#climate change#climate crisis#climate#ecology

7 notes

·

View notes

Text

Dave Jamieson at HuffPost:

CHATTANOOGA, Tenn. — Roughly 4,000 Volkswagen workers here will decide this week on whether to form a union at their assembly plant. Their votes will shape more than just the future of their jobs — they could mark a turning point for both the United Auto Workers and the auto industry in the South. The election begins Wednesday and runs through Friday. The union previously lost two factorywide elections at the facility, including a stinging 833 to 776 defeat in 2019. Zachary Costello quietly supported that organizing effort. This time he’s made his feelings known to anyone who will listen, throwing himself into the campaign as a member of the organizing committee.

“I don’t want to narrowly lose again. This time, I’m not sitting on the sideline,” said Costello, 34. “To me it feels like the most important thing I’ve ever been a part of, to the point where it doesn’t even feel real.” The UAW already represents Ford and General Motors workers at auto plants in the South, but for decades the union has struggled to organize foreign-owned “transplant” automakers in the region, where union membership tends to be low and politicians are generally hostile to labor groups. As a result, the UAW has lost membership as a share of the industry, forcing the union into a more defensive posture in the places where it represents autoworkers — primarily Midwestern plants run by Ford, GM and Jeep parent company Stellantis. Meanwhile, much of the electric-vehicle boom is expected to take place down South, making the union’s inroads there all the more important.

[...] But organizing the likes of Volkswagen, Mercedes, Toyota and Hyundai would increase the union’s bargaining power across the sector, including in Detroit. Ford, GM and Stellantis like to point to their higher labor costs relative to the foreign automakers and the nonunion, Texas-based Tesla. So the UAW’s power will always be limited as long as the Big Three′s competitors remain nonunion, said Art Wheaton, an expert in labor negotiations at Cornell University. “This is a big deal, since you need to increase market share of the number of plants that are unionized to give you more leverage,” he said. “Really the UAW needs to have more than just the Detroit Three organized if they want to have the same sort of impact to lift wages and benefits.”

This week, a big union election looms in the VW plant in Chattanooga, Tennessee, as the UAW seeks to unionize the plant. The union lost the last two times, but this time could be different.

#UAW#Tennessee#Unions#United Auto Workers#VW#Chattanooga#Chattanooga Tennessee#VW Chattanooga#Unionization#Workers' Rights

10 notes

·

View notes

Text

Also preserved in our archive

By Don Ford

I’ve heard more folks than I can count say that the risk of COVID exposure has kept them from seeking needed medical care, and it shouldn’t be this way.

On our Twitter Spaces calls we’ve tried our best to build strategies that can help folks through this process, so they can be COVID safe, advocate for themselves, and also while receiving adequate medical care.

But there are so many people, and we could never help everyone if we take it case by case. As with many problems that are laid on the individual, this is a greater institutional problem, and we need that to be reflected in our government.

If that sounds about right, then oh boy, do I have something for you.

A federal agency wants to hear from you if you have had trouble accessing healthcare because of COVID… or rather, realistic concerns of COVID exposure.

x.com/StinkRatsCharms/status/1853117035699487229 Technically, this survey is not COVID specific…

But is there a greater accessibility issue for medical care?

While the framing is identifying barriers for disability access, that should include things that can make you disabled, and as this is the Congressional watchdog group who gathers data for the purpose of “accountability, integrity, and reliability”…

This action could be one of our best opportunities to push for regulatory changes.

The agency behind this has an excellent record of their results being widely accepted.

Here is an additional link —→ gaosurvey.gao.gov/jfe/form/SV_4NqcK4po5BfajZA

I should point out that this is limited to Americans, generally speaking.

Now, this isn’t going to instantly solve our problems, or be the final move in advocating for ourselves, but it is a VERY strong step forward.

The data this group creates is generally considered to be extremely valuable when dealing with Federal regulatory agencies.

We need to reach as many folks as possible to find those affected.

So, please, share this information with your communities.

And, speaking of reaching people…

The election is, of course, on people’s minds. There is going to be an additional call to action soon directed at the FDA, regardless of who wins the election tomorrow…

Hopefully, it’s decided tomorrow and not dragged out.

But regardless of who wins, the fight continues… just in different forms.

However, the President doesn’t actually change until January 20th, 2025.

That means there are two and a half months to advocate before anything officially shifts. So, regardless of who wins, we can push forward for as much as we can before the agencies could potentially change.

No matter what happens, it’s a different President, which means regulatory shifts.

And that means, it’s an excellent time to make some last minute pushes…

Specifically, pediatric Novavax access. The kid’s version is not some separate vaccine; it’s the same vaccine.

It’s tested and safe but the FDA is playing games to restrict market access.

Expect more information on this soon, but the FDA and CBER are making Novavax go in circles to prove their vaccine is functional, while vaccines go unused. Shots that could be protecting our children going to waste because of manipulative regulatory hurdles is extremely frustrating.

So, we’re going to need support from everyone who has needed Novavax or benefited from it, because if only parents who needed it for their kids did it alone, then we would never create the access that parents and society as a whole desperately need.

Until then, we brace for impact for our election results and no matter what happens we will continue pushing forward for that better tomorrow.

#mask up#covid#pandemic#public health#wear a mask#covid 19#wear a respirator#still coviding#coronavirus#sars cov 2

3 notes

·

View notes

Text

The consequences of the 2024 US presidential election will be felt from Washington, DC to Warsaw, Illinois. But they will also be felt in Warsaw, Poland.

The United States is, despite the many pronouncements of its decline, powerful and influential enough for its presidential election result to be felt around the world. Central and Eastern Europe is no exception to this. It is, in fact, a region where this is perhaps particularly true.

The first and most obvious way in which the 2024 presidential election will matter for Central and Eastern Europe is Russia’s war in Ukraine. The Democratic candidate, Vice President Kamala Harris, has essentially said she would continue US President Joe Biden’s policy. She is committed to continuing to provide assistance to Ukraine. The Republican candidate, former US President Donald Trump, has, by comparison, repeatedly questioned US aid to Ukraine, and derided Ukrainian President Volodymyr Zelenskyy as a “salesman” who “walks away” with billions every time he comes to the United States.

Much has been made of Trump’s stated fondness for Russian president Vladimir Putin, but just as salient was the reason for Trump’s first impeachment: he was accused of trying to extort Zelensky by using the carrot of lethal aid to entice his Ukrainian counterpart to open an investigation into his political rival, Biden.

We should expect Trump’s skepticism for NATO to carry into a second term, too. (Harris, in the debate with Trump, warned that if Putin is able to take Kyiv, “Putin would be sitting in Kyiv with his eyes on the rest of Europe. Starting with Poland. And why don’t you tell the 800,000 Polish Americans right here in Pennsylvania how quickly you would give up for the sake of favor and what you think is a friendship with what is known to be a dictator who would eat you for lunch?”)

More broadly, Harris’s record as a senator and as vice president suggests that she would view the countries in the region as allies. She would likely continue to offer some support to those trying to, for example, protect minority rights or advocate for democratic norms in the region.

Trump would be more disruptive. For one thing, Trump is campaigning on the most aggressive tariffs — taxes on imported goods — in almost 100 years, and is, per the Washington Post, “preparing an attack on the international trade order that would probably raise prices, hurt the stock market and spark economic feuds with much of the world.” The new tariffs would likely hurt global trade and financial flows between Europe and the United States. The European Union and the United States could very well find themselves in a trade war, the losers of which would likely be American and European businesses and consumers.

And Trump’s potential changes to immigration could impact families from Central and Eastern Europe, too: he’s proposing making it more difficult for family-based migration and has, in the past, tried to slash not only undocumented, but also legal migration. (Trump has also complained that the United States needs more migration from certain countries, which he has deemed “nice,” like “Denmark” and “Switzerland.”)

When I think about what another Trump term would mean for Central and Eastern Europe, though, the thing I think about the most are outlets like this one. Journalism is under pressure from governments across the region. That is, in my view, something that US leadership has a responsibility to push back on. When you claim to be allies based on shared democratic values, all parties involved should try to push each other to actually uphold those values. I do not think that we can expect this under Trump, who called the press the “enemy of the people” and “just bad people” at a rally in Arizona last week. His first term was marked by attacks on journalists, and particularly women journalists. I think it will be worse for journalists here in the United States and in Central and Eastern Europe, too.

And I think that we can extend this to those who speak up for democratic norms and minorities more generally, like already maligned NGO workers and activists. For example, in 2022 USAID announced that it was “supporting new locally-driven initiatives in Central Europe with the goal of strengthening democratic institutions, civil society, and independent media, which are all pillars of resilient democratic societies.” It is unclear to me that that support would continue in a Trump administration. (This is separate from development assistance to Europe and Eurasia region; Trump made dramatic cuts to foreign assistance the last time he was in office.)

Trump, in his debate with Harris, said, in response to the charge that world leaders were laughing at Trump, that Hungarian Prime Minister Viktor Orban likes him. “Look, Viktor Orbán said it. He said, ‘The most respected, the most feared person is Donald Trump. We had no problems when Trump was president.’” And it is true that Orbán received less criticism from the United States when Trump was president. But whether that is good for Americans and Hungarians is another matter entirely.

Having a president who believes in freedom of the press isn’t enough, of course, to magically make conditions for journalists better. Having a president who believes in liberal democracy in theory doesn’t mean that all its values are always practiced, or that democratic norms in Central and Eastern Europe will be respected. But not having one is enough to make things worse. And, in a way, the same could be said of Harris and Trump’s respective victories for Central and Eastern Europe more generally: On questions ranging from national security to democracy, she won’t magically make everything better, but he can quite quickly make matters worse.

3 notes

·

View notes

Text

Saudi Arabia's Oil Gambit: A Potential Blow to Putin's War Chest

The global oil market faces potential upheaval as Saudi Arabia contemplates a strategic shift that could significantly impact the Russian war economy. Experts suggest that Riyadh's frustration with uncoordinated production cuts among oil-producing nations may lead to a dramatic increase in Saudi crude output. This move aims to secure market share and profits, even at the cost of lower oil prices. The ramifications of such a decision could prove detrimental to Moscow's financial stability. For the past decade, oil and gas revenues have been the primary source of income for the Russian state, accounting for up to half of its budget. The Russian war economy heavily relies on these funds to sustain its military operations in Ukraine. Energy analyst Mikhail Krutikhin warns of the "enormous risk" this poses to Russia's state budget. He emphasizes the unpredictability of various factors, including the upcoming U.S. presidential election, that could further complicate the situation for Moscow.

Oil market experts have little doubt that Saudi Arabia has the enormous production and export capacity to change tactics and gun for market domination through volume instead. | Fayez Nureldine/AFP via Getty Images Economist Alexandra Prokopenko projects that a $20 drop in oil prices could result in a substantial loss of revenue for Russia, equivalent to approximately 1% of its GDP. This financial squeeze would force the Kremlin to make difficult choices between reducing expenditures – an unlikely option during wartime – or accepting inflationary pressures and high interest rates. The potential Saudi strategy shift comes in response to persistent quota violations by some OPEC+ members, including Russia. Despite agreeing to production limits, Moscow has consistently exceeded its allocated quota, currently set at 8.98 million barrels per day. This overproduction has contributed to keeping oil prices well below the $100 per barrel target sought by Saudi Arabia and other producers. Ajay Parmar, an oil markets expert at ICIS, explains that Saudi Arabia's move could serve as a warning to other producers. By prioritizing market share over high prices, Riyadh aims to compel compliance with agreed-upon production limits. Despite Western sanctions imposed due to the Ukraine conflict, Russia's fossil fuel profits have increased by 41% in the first half of this year. The country has employed various tactics to circumvent restrictions, including the use of a "shadow fleet" of aging vessels to transport crude oil and exploiting loopholes that allow for the sale of refined products. While a drop in oil prices would undoubtedly strain Russia's finances, experts like Heli Simola from the Bank of Finland caution that it may not immediately halt the country's military operations. The Russian war economy has demonstrated resilience, and the Kremlin appears determined to continue its campaign in Ukraine despite growing economic challenges. As the situation unfolds, the global community watches closely to see how Saudi Arabia's potential oil strategy shift will reshape the energy market and impact Russia's ability to finance its ongoing military activities. Read the full article

2 notes

·

View notes

Text

Rep. Alexandria Ocasio-Cortez, D-N.Y., is firing back at "rumors" from left-wing activists that she is hosting a high school military recruitment fair, claiming on Instagram that "large accounts" were making up lies about a recent event whose guests included military personnel from service academies.

Ocasio-Cortez co-hosted a "students service fair" with Rep. Adriano Espaillat, D-N.Y., Monday for high schoolers in the Bronx to "learn about the resources available to students" through the district office and connect them with service academies, according to a flyer for the event.

At the event were guests from the U.S. military, Marines, Naval Academy, Air Force and Coast Guard, prompting backlash toward the progressive representative who proposed a ban on certain forms of military recruitment in 2020.

"Politics is so crazy because people can just wake up and make up whatever they want to say about you," Ocasio-Cortez said on her Instagram account Monday evening. "Today, someone made up a rumor that I, me, was hosting a military recruitment fair for high schoolers. Does that sound like something I would do? No… But Somebody started a rumor that that’s what was going on. Everyone just believed it and accepted it. And the problem is when large accounts start platforming this, then is starts spreading like a wildfire and results in demands to cancel this event or for me to not show up to it."

AOC, TOP DEMOCRATS ISSUE STINGING REBUKE OF BIDEN OVER FAILED CLIMATE PROMISES

The congresswoman said that spreading false rumors is "not just a right wing thing" and those who made claims regarding the event should take down the posts.

"For doing this today, I was subject to a lot of really vile rhetoric and attacks all day today, because of a rumor. And I can’t stress how much this is not just a right wing thing," the progressive representative said. "And then even worse, after some of these accounts started platforming and spreading this completely false claim, it circulated big. There was one account where twelve thousand people like it… It leads to real safety issues and I just think it's an opportunity for all of us to pause and take a breath, because it's not all it looks like sometimes."

Ocasio-Cortez explained that when students are applying to military college universities, such as West Point, there is an application requirement for a federal nomination from a member of Congress, a senator or other federal elected official.

"We have a responsibility to inform people of that process and there were a couple of people there to talk about that," Ocasio-Cortez said trying to set the record straight regarding the military guests involvement at the event. "And even that was such a small fraction of the tables and what was there."

‘SAD DAY’: AOC, DISAPPOINTED DEMOCRATS GO AFTER BIDEN FOR OPPOSING DC LAW REDUCING PENALTIES ON VIOLENT CRIME

She went on to say that large accounts, "especially for activists and left leaning spaces, are going to get it wrong. And if they just pretend that they never get it wrong, how are they any different from other positions of power and how people operate when they get that."

"If you’re trying to impact the decisions that are made, but you have lied in the past about the decision makers, then why should people believe anyone with a track history of sharing misinformation and not owning up to it after the fact?" Ocasio-Cortez added.

In 2020, Ocasio-Cortez introduced an amendment to a House Committee on Appropriations bill that would ban military recruitment on live-streaming platforms such as Twitch, after arguing that military recruitment efforts target kids and young adults.

"Children should not be targeted in general for many marketing purposes in addition to military service," Ocasio-Cortez said on the House floor. Despite her efforts, the measure lacked the support needed to pass the amendment in the House.

Upon news of the event, the congresswoman was accused of hypocrisy for co-hosting an event that connected high schoolers with academies for military recruitment.

"Hey @AOC what's up with this? This is frickin' gross. You were sent to DC to fight against imperialism & fight for the poor & working class, NOT THE WAR MACHINE! What are you doing? Stop it," one user, who identify in their bio as an eco-socialist, wrote alongside a photo of the event flier.

8 notes

·

View notes

Text

Friday, November 22, 2024

Bomb Cyclone Hits Northwest (1440) Two people have died in Seattle, as a bomb cyclone impacts the Pacific Northwest. Nearly 600,000 customers have lost power. A bomb cyclone occurs when a storm system undergoes bombogenesis, with its central pressure dropping rapidly within 24 hours. This particular storm system has been fueled by an atmospheric river, a band of moisture in the sky with water vapor levels comparable to average flow levels at the mouth of the Mississippi River. The resulting weather system has unleashed hurricane-level winds in parts of Oregon and Canada, with Vancouver Island witnessing winds as high as 101 mph—the equivalent of a Category 2 storm. Heavy winds, rain, and snow are expected to continue impacting the region in the coming days. A separate storm is due to hit the Northwest as the current storm moves east.

How Trump’s tariffs could spark a trade war and ‘Europe’s worst economic nightmare’ (Washington Post) The prospect of a trade war ignited by the Trump administration is looming over European capitals. The European Union—which counts the United States as its largest export market and one of its closest strategic allies—could be among those hardest hit if President-elect Donald Trump follows through on his tariff plans. Already, Europe’s major economies are lagging behind the United States in their post-pandemic recovery. Economists say that protectionist policies imposed by Trump after taking office in January could trigger further contraction on the continent, while straining alliances. There is talk of “Europe’s worst economic nightmare” and “full-blown recession.” Some economic models estimate that, faced with an across-the-board 10 percent tariff, euro zone exports to the United States could fall by nearly a third. That would be a big deal, because Europe is so export-dependent, and its largest economies are already facing sluggish growth and rising debt. Goldman Sachs calculates that trade conflict with the United States could subtract 0.9 percent from the euro zone economy.

How Science Lost America’s Trust and Surrendered Health Policy to Skeptics (WSJ) The rise of Robert F. Kennedy Jr. from fringe figure to the prospective head of U.S. health policy was fueled by skepticism and distrust of the medical establishment—views that went viral in the Covid-19 pandemic. Lingering resentment over pandemic restrictions helped Kennedy and his “Make America Healthy Again” campaign draw people from the left and the right, voters who worried about the contamination of food, water and medicine. Many of them shared doubts about vaccines and felt their concerns were ignored by experts or regarded as ignorant. Doctors, scientists and public-health officials are asking themselves how they can win public trust back. Among their postelection revelations: Don’t underestimate or talk down to those without a medical degree. Much of Kennedy’s popularity reflects residual pandemic anger—over being told to stay at home or to wear masks; the extended closure of schools and businesses; and vaccine requirements to attend classes, board a plane or eat at a restaurant. “We weren’t really considering the consequences in communities that were not New York City,” the places where the virus wasn’t hitting as hard, former National Institutes of Health Director Francis Collins said at an event last year. Authorities focused on ways to stop the disease and failed to consider “this actually, totally disrupts peoples’ lives, ruins the economy and has many kids kept out of school,” Collins said. In October 2023, 27% of Americans who responded to a Pew Research Center poll said they had little to no trust in scientists to act in the public’s best interests, up from 13% in January 2019.

Nicaragua’s Ortega proposes reform to make him and his wife ‘copresidents’ (AP) Nicaragua’s President Daniel Ortega on Wednesday proposed a constitutional reform that would officially make him and his wife, current Vice President Rosario Murillo, “copresidents” of the Central American nation. While the initiative has to pass through the country’s legislature, Ortega and Murillo’s Sandinista party control the congress and all government institutions, so it is likely to be approved. The proposal also looks to expand the presidential term to six years from five. Ortega put forward another bill Wednesday that would make it illegal for anyone to enforce sanctions from the United States or other foreign bodies “within Nicaraguan territory.” Nicaragua’s government has imprisoned adversaries, religious leaders, journalists and more, then exiled them, stripping hundreds of their Nicaraguan citizenship and possessions. Since 2018, it has shuttered more than 5,000 organizations, largely religious, and forced thousands to flee the country.

Residents in Haiti’s capital stand with police in a battle to repel gang attack (AP) Gangs launched a new attack on Haiti’s capital early Tuesday, targeting an upscale community in Port-au-Prince where gunmen clashed with residents who fought side by side with police. At least 28 suspected gang members were killed and hundreds of munitions seized, according to Lionel Lazarre, deputy spokesman for Haiti’s National Police. The turmoil in Port-au-Prince deepened late Tuesday, when Doctors Without Borders announced it was suspending critical care across the capital as it accused police officers of violence and threats against its staff, including rape and death. The aid group will halt patient admissions and transfers to its five medical facilities, a blow to a country with extremely limited medical care. MSF said one of its ambulances was attacked by police last week, resulting in the killing of at least two patients and physical harm to its staff. The aid group reported four other recent violent incidents in one week alone, including one in which it accused an officer of saying that police would start executing and burning its staff, patients and ambulances.

Swooping In On The Lame Duck (AP/Reuters) As the Biden White House enters its lame-duck phase, China is looking to capitalize on the U.S.’s shaky diplomatic standing. At the recent G20 summit in Rio de Janeiro, Chinese President Xi Jinping shook hands with Argentinian President Javier Milei and Brazilian President Luiz Inacio Lula da Silva, securing deals with two of the most important leaders in South America. Meanwhile, Xi and Lula agreed that the China-Brazil relationship had become a “Community with a Shared Future for a More Just World and Sustainable Planet”—Chinese government jargon for “best buds.” On top of that friendship announcement, the pair announced 40 cooperation agreements across various sectors to drive over $150 billion in bilateral trade between their two countries.

Landmines in Ukraine (1440) President Joe Biden announced yesterday the US will send antipersonnel landmines to Ukraine, reversing a ban in place since 2022. Officials suggested the devices will shore up Ukraine’s defenses against Russia’s deployment of small squads across its lines; rights groups say the mines will endanger civilians. More than 160 countries are signatories to the 1997 Ottawa Convention banning the mines designed to detonate on contact. Russia and the US are not party to the treaty, with Russia deploying mines since the start of the conflict. Ukraine—a signatory—manufactures them.

Ukraine says Russia launched an intercontinental missile in an attack for the first time in the war (AP) Ukraine says Russia launched an intercontinental ballistic missile overnight targeting Dnipro city in the central-east of the country, which, if confirmed, would be the first time Moscow has used such a missile in the war. In a statement Thursday, Ukraine’s air force did not specify the exact type of missile, but said it was launched from Russia’s Astrakhan region, which borders the Caspian Sea. It said an intercontinental ballistic missile was fired at Dnipro city along with eight other missiles, and that the Ukrainian military shot down six of them. While the range of an ICBM would seem excessive for use against Ukraine, such missiles are designed to carry nuclear warheads, and the use of one would serve as a chilling reminder of Russia’s nuclear capability and a powerful message of potential escalation.

ICC arrest warrants (BBC) The announcement of arrest warrants by the International Criminal Court (ICC) for Israel's Prime Minister Benjamin Netanyahu and former Defence Minister Yoav Gallant has triggered a furious response in Israel. Hamas has welcomed the decision, without commenting on the warrant for its own military commander, Mohammed Deif. The announcement is a major blow to Israel’s international standing, to the two individuals named, and most specifically to Israel’s ongoing efforts to present its military campaign in Gaza as a fight between the forces of good and evil. Israelis are appalled that, in their eyes, the world seems to have already forgotten or overlooked the atrocities committed by Hamas on 7 October last year. Palestinians, especially Gazans, feel vindicated that their accusations of Israeli war crimes have now been echoed by an international body with some weight. But international lawyers have expressed doubts over whether either Netanyahu or Gallant will ever be brought to The Hague for trial.

Gaza death toll nears 44,000 (ABC News) After ordering policies leading to the displacement of 90% of all Gazans, the deaths of almost 44,000 people (70% of them women and children), and the destruction of 80% of the area’s health facilities, Israeli Prime Minister Benjamin Netanyahu finally stepped foot in the Palestinian enclave, where he recorded a video telling Palestinians that the IDF would hunt down and kill anyone who harmed the Israeli hostages and offered a $5 million bounty for the return of each hostage.

Virtually no aid has reached besieged north Gaza in 40 days, UN says (BBC) Palestinians are “facing diminishing conditions for survival” in parts of northern Gaza under siege by Israeli forces because virtually no aid has been delivered in 40 days, the United Nations has warned. The UN said all its attempts to support the estimated 65,000 to 75,000 people in Beit Hanoun, Beit Lahia and Jabalia this month had been denied or impeded, forcing bakeries and kitchens to shut down. Earlier this month, a UN-backed assessment said there was a strong likelihood that famine was imminent in areas of northern Gaza. Hundreds of people have been killed and between 100,000 and 130,000 others have been displaced to Gaza City, where the UN has said essential resources like shelter, water and healthcare are severely limited. Meanwhile, the US vetoed a draft UN Security Council resolution that demanded an immediate ceasefire between Israel and Hamas in Gaza. The 14 other Security Council members voted in favour, but the US said the text did not explicitly call for the immediate release of the hostages being held by Hamas as part of a ceasefire.

How Students Can AI-Proof Their Careers (WSJ) The current generation of college students is facing a challenge that those who came before never had to worry about: They’ll be competing with AI for jobs. What can they do to get ready? One consensus: It’s important to master skills not easily matched by machines, such as human-style communications and the ability to understand and work smoothly with people who have different perspectives and personalities. “In many ways the human skills are going to be more fundamental than they are now,” as machines take over some routine tasks, says Joseph E. Aoun, president of Northeastern University. A survey of 255 employers by the National Association of Colleges and Employers last year found that the three top “competencies” they sought in job candidates were communication, teamwork and critical thinking. Communication and teamwork rely on emotional intelligence, or EQ. “AI has probably won the IQ battle,” says Tomas Chamorro-Premuzic, chief innovation officer at Manpower Group and professor of business psychology at Columbia University, “but the EQ battle is up for grabs.”

Duct-taped banana artwork fetches US$5.2m at New York auction (Guardian) Maurizio Cattelan’s viral artwork was bought by Chinese-born crypto entrepreneur Justin Sun on Wednesday evening at Sotheby’s New York, besting initial estimates of between $1 million and $1.5 million. “I never thought I’d say ‘$5 million for a banana,’” the auctioneer quipped as the bid was approaching its climax. Sun said he plans to eat the banana “as part of this unique artistic experience.”

0 notes

Text

Is Trump’s Influence Pushing Bitcoin towards the $100K Milestone?

Key Points

Bitcoin’s price nears the $100,000 milestone, fueled by post-election optimism and investor interest.

Crypto-related stocks and ETFs have also seen significant inflows, reflecting the broader impact of Bitcoin’s ascent.

The price of Bitcoin (BTC) has experienced a notable surge, nearing the $100,000 mark. This increase follows the recent US election, with the cryptocurrency market buoyed by optimism for a more crypto-friendly regulatory environment.

The Impact of the Election on Bitcoin

The rise of Bitcoin’s price also aligns with the election of several pro-crypto lawmakers, sparking hope for regulatory changes that could further boost the cryptocurrency market. IG Markets analyst Tony Sycamore noted that Bitcoin is being drawn towards the $100k level. However, some experts believe that factors beyond the election results are driving Bitcoin’s surge.

Jesse Myers, co-founder of OnrampBitcoin, suggested that we are witnessing the effects of the halving event that took place six months ago. Regardless of the causes, the Bitcoin rally is undeniable and is having a wide-reaching impact on the market.

Bitcoin ETFs and Crypto Stocks Benefit

Bitcoin ETFs have seen a significant increase in inflows following the election, indicative of heightened investor interest. According to Farside Investors, Bitcoin ETFs recorded $773.4 million in inflows as of November 20th. Furthermore, U.S.-listed Bitcoin ETFs have attracted over $4 billion since the election.

Crypto-related stocks are also benefiting from Bitcoin’s rally. Shares of MARA Holdings, a Bitcoin mining firm, surged nearly 14% overnight. Additionally, MicroStrategy, known for its aggressive Bitcoin acquisitions, saw its shares climb 10%, pushing its market capitalization past the $100 billion mark. These trends underscore the broad impact of Bitcoin’s price rise on the wider crypto market and associated equities.

Tom Lee, a strategic investor and analyst at Fundstrat, expressed confidence in Bitcoin’s continued growth, stating that a price comfortably over $100K makes sense before the end of this year.

0 notes

Text

Launch Your Own Prediction Market Platform with Polymarket Clone Script

In the fast-evolving world of blockchain and decentralized finance (DeFi), prediction markets are making a significant impact. These platforms enable users to forecast outcomes on various events while earning rewards for accurate predictions. One of the standout platforms in this domain is Polymarket, which has set a benchmark for prediction markets. For entrepreneurs aiming to replicate its success, the Polymarket clone script is the ultimate solution. Let’s dive into the details of prediction markets, how the Polymarket clone script works, its features, revenue streams, and why it’s an excellent business opportunity.

What is a Prediction Market?

Prediction markets are platforms where users can speculate on the outcome of future events, such as election results, sports events, or economic trends. These platforms leverage crowd wisdom to predict outcomes with surprising accuracy. Participants purchase shares based on their beliefs about the likelihood of an event, and the market adjusts dynamically as users trade these shares.

The rise of blockchain technology has revolutionized prediction markets, introducing transparency, decentralization, and trust. Blockchain-powered prediction platforms ensure data integrity, eliminate third-party interference, and offer users greater control over their transactions.

Polymarket Clone Script: A Smart Business Opportunity

A Polymarket clone script serves as a pre-built solution intended to emulate the essential features of the Polymarket platform. This tool enables entrepreneurs to establish their own blockchain-driven prediction market while significantly reducing both development time and expenses. Furthermore, the clone script is adaptable, allowing for modifications to the platform’s design, features, and functionalities to align with specific business requirements.

By leveraging a Polymarket clone script, you can tap into the growing demand for prediction markets and attract a global user base. Whether you want to focus on political predictions, entertainment events, or even niche markets, this clone script offers flexibility and scalability to suit your vision.

White-Label Polymarket Clone Software

Should branding be a key focus, utilizing white-label Polymarket clone software represents the optimal choice. With a white-label solution, you can launch your prediction market under your unique brand name and identity. This approach ensures a faster time-to-market while giving you complete control over customization and user experience.

White-label software eliminates the challenges of developing a platform from scratch, allowing you to focus on marketing and growing your user base. With advanced blockchain integration, smart contract deployment, and secure payment gateways, the software provides a robust foundation for your prediction market business.

Key Features of Polymarket Clone Script

A Polymarket clone script comes equipped with advanced features to ensure a seamless user experience:

Decentralized Infrastructure: Built on blockchain for enhanced transparency and security.

Smart Contracts: Automates the execution of trades and payouts without human intervention.

Multi-Category Predictions: Covers various sectors such as sports, politics, technology, and more.

Accessible Interface: A straightforward design that facilitates effortless navigation and rapid transactions.

Crypto Wallet Integration: Supports multiple cryptocurrencies for deposits and withdrawals.

Real-Time Market Updates: Provides dynamic insights into market trends and predictions.

Secure Transactions: Ensures data encryption and protection against fraudulent activities.

Revenue Streams from a Polymarket Clone

Launching a prediction market platform is not only innovative but also highly profitable. Here are some primary revenue streams:

Transaction Fees: Charge a small fee on every trade executed on your platform.

Listing Fees: Earn revenue by allowing event organizers or users to list new prediction markets.

Advertising: Partner with brands and display targeted advertisements on your platform.

Premium Features: Offer exclusive features or services to users through subscription plans.

Affiliate Programs: Generate income through partnerships with affiliates who bring more users to your platform.

Conclusion

The popularity of prediction markets is soaring, making it the perfect time to enter this lucrative space. By launching your own platform using a Polymarket clone script, you can capitalize on this trend while offering users an engaging and transparent platform to speculate on future events. With its robust features, flexibility, and high revenue potential, the Polymarket clone script is an ideal solution for entrepreneurs.

At Plurance, we focus on creating advanced Polymarket clone scripts customized to meet the specific requirements of your business. As a leading provider, we deliver scalable, secure, and feature-rich solutions to help you build a thriving prediction market platform. Let us empower your business journey with our expertise and innovation. Get started today! For more info:

Call/Whatsapp - +918807211181

Mail - sales@plurance. com

Telegram - Pluranceteck Skype - live:.cid.ff15f76b3b430cccWebsite - https://www.plurance.com/polymarket-clone-script

0 notes

Text

Bitcoin Price Hits Fresh Record High of $88K Following Trump’s Election Victory

Bitcoin Price Hits Fresh Record High of $88K Following Trump’s Election Victory Bitcoin soared to a new record high of $88,000 on Monday, continuing a rally that began last week, fueled by positive sentiment surrounding Donald Trump’s victory in the 2024 presidential election. This surge in Bitcoin’s value also coincided with a broader increase in cryptocurrency prices, including a significant rise in meme token Dogecoin, which reached a three-year high. Factors Driving Bitcoin's Surge The world’s largest cryptocurrency traded at approximately $86,117 by 14:59 ET (19:59 GMT) before hitting its record high. The recent gains in Bitcoin are largely attributed to traders betting that Trump will implement more crypto-friendly policies during his next term. Trump had campaigned on a pro-crypto platform, promising to make America the crypto capital of the world. This anticipation has led traders to believe that the Securities and Exchange Commission (SEC) may soften its stance on cryptocurrency regulation, thus increasing the legitimacy of the crypto market as an investment vehicle. Record Inflows into Crypto ETFs Optimism surrounding Trump’s presidency has resulted in substantial inflows into cryptocurrency exchange-traded funds (ETFs). Last Thursday, Bitcoin ETFs recorded a remarkable $1.38 billion in inflows, with BlackRock’s iShares Bitcoin Trust (NASDAQ: IBIT) receiving the majority. This fund has now surpassed BlackRock’s gold ETF in total assets, reaching $34.1 billion compared to gold's $33 billion. The launch of spot Bitcoin ETFs in U.S. markets earlier this year has significantly contributed to increased institutional interest in cryptocurrencies, driving recent price gains. Analyst Predictions and Market Outlook Analysts at Bernstein have declared that Trump’s victory signals the start of a new crypto bull market, encouraging investors to "buy everything you can." They anticipate a crypto-friendly regulatory environment under Trump, particularly from a pro-crypto SEC. Bernstein analysts noted that several members of Trump’s transition team are explicitly supportive of cryptocurrency, bolstering expectations for favorable policies. Bitcoin’s price has surged over 91% so far in 2024, with Bernstein maintaining a bullish 2025 price target of $200,000. They believe that even at $81,000 per Bitcoin, the risk-reward ratio remains favorable over the next 12 months. Impact on Bitcoin Miners and Broader Crypto Markets The surge in Bitcoin prices is also benefiting publicly traded Bitcoin miners, who are now experiencing increased profits as prices stay well above their average production costs. Additionally, AI-driven mining companies are also seeing positive outcomes. In contrast, while Bitcoin has soared, other major altcoins have experienced mixed results. Dogecoin was an exception, rising approximately 29% to reach a peak of $0.2912, primarily driven by speculation regarding Elon Musk’s potential involvement in the Trump administration. However, many other altcoins retreated, with Ether falling 1% to $3,170.31. Other cryptocurrencies such as XRP, ADA, and MATIC saw declines between 2% and 4.6%, while Solana (SOL) gained more than 5%. Thank you for taking the time to read this article! Your thoughts and feedback are incredibly valuable to me. What do you think about the topics discussed? Please share your insights in the comments section below, as your input helps me create even better content. I’m also eager to hear your stories! If you have a special experience, a unique story, or interesting anecdotes from your life or surroundings, please send them to me at [email protected]. Your stories could inspire others and add depth to our discussions. If you enjoyed this post and want to stay updated with more informative and engaging articles, don’t forget to hit the subscribe button! I’m committed to bringing you the latest insights and trends, so stay tuned for upcoming posts. Wishing you a wonderful day ahead, and I look forward to connecting with you in the comments and reading your stories! Read the full article

1 note

·

View note

Text

Trump's Return: What It Means for America Immerse yourself in the dramatic political landscape as we unravel the implications of Trump's remarkable return. This video delves into the seismic shift in America's direction following his unexpected victory over Vice President Harris. Embark on a voyage through the intricate reactions of world leaders, the volatile stock market, and the profound division within the United States. Discover how Trump's message resonated powerfully across key swing states, flipping the script of previous elections. Uncover the social media frenzy, global interpretations, and potential impacts on social programs and health policies. Join us as we explore this pivotal moment in history, where every twist and turn in the political realm raises questions about the future of democracy. Engage in the conversation by leaving comments and sharing your thoughts. Your feedback is invaluable as we continue to navigate these unfolding stories. Subscribe👇: https://sub.dnpl.us/AANEWS/ - Want some Great Buys check out our List: https://viralbuys.vista.page #donaldtrump #foxnews #kamalaharris #uselection #trumpvsharris CHAPTERS: 00:00 - Intro 00:38 - Election Results Analysis 01:24 - Global Reactions to Election 02:31 - Stock Market Impact 03:16 - Washington Politics Overview 04:28 - Election Interference Issues 05:26 - Legal Challenges Ahead 06:00 - Expectations for Second Trump Term 07:57 - Insights on American Politics 11:38 - Conclusion and Wrap Up

0 notes

Text

U.S. Election Results Could Trigger 10% Swing in Bitcoin Price, Say Analysts

Share Post:

LinkedIn

Twitter

Facebook

Reddit

As the United States gears up for its presidential election on November 5, analysts and traders are forecasting substantial impacts on Bitcoin’s (BTC) price movement. According to Daan Crypto Trades, a pseudonymous trader, Bitcoin price could fluctuate by at least 10% depending on which candidate emerges victorious. Sharing his insights with over 389,000 followers on the platform X (formerly Twitter), he noted that Bitcoin’s recent weekly close might appear unstable but suggested that election results would be the primary driver for its next move. Bitcoin price currently sits around $68,682, down 0.5% over the past 24 hours.

In the days leading up to the election, Bitcoin’s volatility index surged to a three-month high, according to data from the crypto derivatives exchange Derebit. This heightened volatility was exemplified last week when Bitcoin nearly broke its all-time high, hitting $74,649 on October 29 before retracting amid election uncertainties. The anticipation around the election has led to cautious sentiment in the market as traders await clearer signs on Bitcoin’s direction, especially with the potential for both gains and losses depending on the election outcome.

Key Price Levels to Watch Amid Volatile Market

Amid this period of heightened uncertainty, Tony Sycamore, an analyst at IG Markets, issued an investment note stating that Bitcoin needs to break past the $74,000 resistance level to initiate a clear uptrend. A move above this mark, he said, could propel the cryptocurrency toward $80,000. However, Sycamore also urged caution, emphasizing that if Bitcoin dips below its $65,000 support level, this could mark a failed rally, potentially driving the cryptocurrency back into a prolonged downward trend seen over the past seven months.

This resistance level is especially significant given the prevailing optimism in the market about Bitcoin’s trajectory in the near term. Many analysts view risk assets like Bitcoin positively, with an uptrend likely to follow as market sentiment improves regardless of the election results. Still, Sycamore’s cautionary note highlights that Bitcoin’s future hinges on maintaining its current support level, as a breakdown could lead to renewed selling pressure and a return to recent lows.

Election Outcome and Policy Promises Could Influence Crypto Market

The U.S. election could be pivotal for Bitcoin’s short-term trajectory, with each candidate’s stance on cryptocurrency influencing investor sentiment. Former President Donald Trump, known for his pro-crypto position, has made various promises to support innovation within the U.S. crypto sector. This stance has led many to believe that his win could drive Bitcoin prices higher in the short term. Conversely, Vice President Kamala Harris has not extensively discussed cryptocurrency but indicated on September 22 that her administration would promote investments in digital assets and artificial intelligence. This comment, though brief, suggests a potential openness toward blockchain and digital finance under her leadership.

Beyond the election, Bitcoin investors are also monitoring U.S. Federal Reserve policy closely. The Fed’s recent decision to cut interest rates by 50 basis points on September 18 has been perceived as a positive signal for crypto, as lower rates make traditional investments less attractive, potentially drawing more investors to riskier assets like Bitcoin. Analysts are now watching to see if the Fed will continue on this path, which could provide additional tailwinds for Bitcoin as investors seek higher returns amid a low-interest-rate environment.

0 notes

Text

Sinus Dilation Devices Market Outlook, Share, Opportunities and Forecast to 2030

The global market for sinus dilation devices was valued at approximately USD 2.74 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.6% from 2023 to 2030. Several factors are driving this growth, including a strong preference for minimally invasive procedures, favorable reimbursement policies, and an increase in awareness of the advantages of balloon sinuplasty compared to conventional treatments. Chronic sinusitis prevalence also contributes significantly to market demand. The development of advanced surgical techniques that replace traditional sinus procedures is boosting market dynamics, further enhancing growth.

One major contributor to these advancements is the introduction of cutting-edge technologies, such as surgical laser systems in sinus surgery, which allow for minimal tissue removal and result in fewer side effects. Additionally, these innovations reduce the procedure time, making it possible for many surgeries to be performed on an outpatient basis, which is highly convenient for patients and efficient for healthcare systems. An example of innovation in laser treatment includes the National Health Service's (NHS) introduction in 2022 of a new laser therapy for epilepsy patients. This treatment utilizes lasers to precisely target and address brain areas responsible for seizures, offering a new approach to epilepsy management that significantly improves patient quality of life. Such technological advances serve as a model for innovation in sinus surgery as well.

Gather more insights about the market drivers, restrains and growth of the Sinus Dilation Devices Market

The COVID-19 pandemic disrupted routine patient care, leading to a temporary halt in elective surgeries and regular clinic visits to free up healthcare resources and staff for intensive and inpatient care. This reallocation of resources impacted treatment options for patients with chronic rhinitis, who turned to teleconsultations and temporary care solutions for sinus-related issues.

In Canada, for instance, the pandemic led to a significant decline in the number of surgeries. During the first 31 months of the pandemic, there were approximately 937,000 fewer surgeries performed (a 14% reduction) compared to pre-pandemic levels. These figures are based on a comparison with 2019 surgery volumes, excluding factors such as population growth. The sharpest decline in surgeries occurred during the initial four months of the pandemic (March to June 2020) as both scheduled and non-urgent procedures were canceled or delayed in line with public health guidelines.

Application Segmentation Insights:

The adult patient segment dominated the sinus dilation device market in 2022, generating more than 65% of total revenue. This is primarily due to the high incidence of sinusitis in adults. According to the Centers for Disease Control and Prevention (CDC), over 28 million adults in the U.S. have been diagnosed with sinusitis, representing approximately 11.6% of the adult population. Sinusitis, a condition in which the air-filled spaces in the facial bones become inflamed, often results in symptoms such as nasal congestion, facial pain, and headaches. Proper management of sinusitis is crucial for alleviating these symptoms and enhancing overall health.

The pediatric segment is expected to exhibit the fastest CAGR, growing at 10.2% over the forecast period. This growth can be attributed to an increase in sinusitis cases among children. According to the National Center for Biotechnology Information (NCBI), around 6-13% of children in the U.S. developed chronic or acute rhinosinusitis by age three. Additionally, approximately 7.5% of upper respiratory infections, commonly known as colds, can lead to acute bacterial sinusitis (ABS) in children. ABS, however, is often underdiagnosed in young children, making it difficult to manage in primary care.

Several companies in the sinus dilation device market are focusing on developing products specifically designed for pediatric patients, further solidifying their market position. The NCBI provides updated guidelines to help healthcare providers better diagnose and treat bacterial sinus infections in children. These guidelines are designed to equip doctors with information on recognizing and managing bacterial sinus infections in young patients, which can improve outcomes and the quality of pediatric care.

Order a free sample PDF of the Sinus Dilation Devices Market Intelligence Study, published by Grand View Research.

0 notes

Text

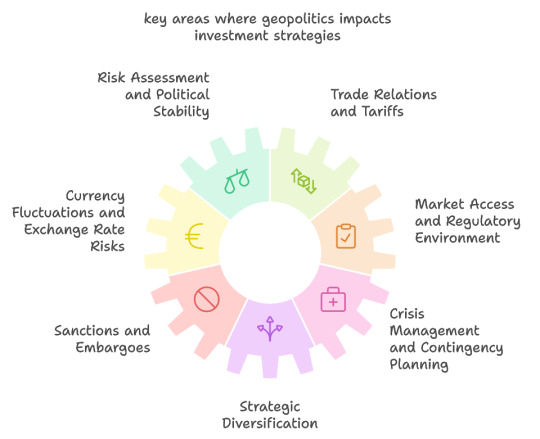

How Geopolitics Impact Investment Strategies in International Finance

In today’s contemporary globalized environment, international finance is to a very large extent influenced by geopolitics. Encompassing everything from trade wars, and diplomatic relations to national policies, and conflicts. They change constantly, affecting world financial markets to a very large extent. These factors are important for students pursuing international finance because they help them analyze the various international investment risks involved and available opportunities in the global context. For example, recent data shows that political factors have a significant impact on world stock markets. For instance, in the 2016 U.S. presidential election, the subsequent shift to Donald Trump’s administration boosted the S&P 500 by 11% in the first year reflecting the concrete impact of politics on share market investment. Also, the COVID-19 crisis deepened geopolitical tension, and FDI dropped by 42% in 2020 because of an increase in uncertainties and economic disruptions.

For students who choose the area of global finance as their research topic, these geopolitical factors provide valuable insights into complex international relations and financial implications. At times, students may struggle with the amount of analysis that they are expected to deliver, and, in such scenarios, choosing international finance assignment help is beneficial. Such assistance can help students discover new perspectives, grasp the technicalities of the topic, and assist in relating the theories learned in class to real-life scenarios.

Decoding of the Effects of Geo-Political Risk on Investment Management

As investment strategies in international finance are directly affected by the geopolitical environment, geopolitical factors play an important role in financial decision-making. These strategies have to be very flexible and adaptable to change because of the volatile nature of geopolitics directly affecting asset prices, currency fluctuations, trade regulations, and even market sentiments. Let's discuss some key areas where geopolitics impacts investment strategies:

1. Risk Assessment and Political Stability

Potential investors look at the political stability of a country before making any investment. A stable political system means that investors are assured of high returns on their investments, whereas an unstable political position creates a highly uncertain environment. For example in Venezuela, the deteriorating economy that the country faced in the recent past due to political instability and external forces led to extremely high inflation rates and a mass exodus of businesses and investors. Venezuela witnessed political volatility, which significantly decreased FDI, and greatly affected the global companies investing there.

As for students, understanding political risks and their impact by analyzing such cases helps build a detailed understanding of how these risks may result in financial benefits or losses. Global agencies such as Moody’s, Fitch, and Standard & Poor’s often change the credit rating of countries due to political risks which invariably influence the cost of borrowing and investment inflows. For instance, when the United Kingdom decided to leave the European Union (Brexit), credit rating companies lowered the United Kingdom’s rating which caused borrowing costs to rise and the pound’s value to drop.

2. Trade Relations and Tariffs

International trade policy and tariffs have a major impact on global financial markets and investment strategies. The current trade conflict between the United States and China is an excellent example of the impact that politics might have on investments. Since 2018, the US levied tariffs of billions of dollars on Chinese goods, and China responded with the same on American products. This led to increased volatility in the stock markets and companies operating in both countries faced reduced profitability and increased insecurity.

The students of international finance can further go deep into this example to understand how trade policies have an immediate impact on corporate revenues and how strategic investors may transfer their earnings to the markets that are less uncertain. Furthermore, students can be able to assess the outcomes of ongoing trade conflicts to predict possible currency fluctuations and learn how firms might transition to “near-shoring,” which means shifting production closer to home to avoid supply chain interruptions.

3. Currency Fluctuations and Exchange Rate Risks

Currency fluctuations are often stimulated by geopolitical tensions, which affect international investments. This is true because once the political relations between two countries are not favorable then their balance of trade will define the circulation of each country’s currency in the trade. For example, due to economic sanctions by Western countries in the year 2014, after the annexation of Crimea; the Russian ruble declined sharply. The ruble’s decline forced investors with significant Russian holdings to reconsider their investment strategies or hedge against currency risk.

For students, understanding currency fluctuations due to geopolitical tensions is crucial. Many of these risks can be managed through using currency futures or options. Books from authors such as Jeff Madura in “International Financial Management” provide students with a deeper understanding of currency markets, exchange rate forecasting, and hedging strategies — critical skills for any international finance student..

4. Market Access and Regulatory Environment

Regulatory policies may be influenced by geopolitical dynamics, which can restrict or facilitate foreign investments. For example, the Chinese government raised restrictions on outbound investment--curbing capital outflow--in 2017, thus inhibiting Chinese companies from investing abroad. This has affected global real estate and hospitality, where Chinese investment has been very important.

These types of regulations show how governments use instruments of economic policy to control the flow of these investments. Students who are specializing in international finance should read such regulations to gain knowledge on how they can shift the dynamics for MNCs. Academic resources such as "The International Political Economy of Investments" by Eric Helleiner would be useful in understanding how government regulations affect the flow of international investments.

5. Sanctions and Embargoes

The most popular and direct tools through which political interactions within the geopolitical context affect international finance are sanctions and embargoes. For example, the restrictions on Iran’s access to the world’s financial systems made by the US and several European countries have brought about serious financial consequences. Due to these sanctions, Iran was shut off from the internal financial systems impacting companies all around the region. Local European firms that invested in Iranian markets had to either pull their operations or face penalties imposed by the United States.

This example also helps the students to apprehend the idea that political actions can definitely interfere with the stability of markets internationally, as well as ruin the profits of multinational organizations. Understanding sanctions, their effects on economies, and compliance risks is valuable information for students interested in financial professions. One useful textbook “Global Political Economy” by John Ravenhill provides a section devoted to the role of sanctions in the context of international finance.

6. Crisis Management and Contingency Planning

Investors need to respond swiftly to rapidly changing events such as wars, economic downturns, etc. As such conflicts have great influences on the investment strategy. Recently, the Russia-Ukraine War has largely affected worldwide energy prices, food security, and performance in world markets. Along with other big businesses, the oil-and-the-gas price surge affected companies in various sectors - transportation, and manufacturing - across the globe.

This situation shows how geopolitical crises entail investors responding with contingency plans and portfolio diversification, as well as high levels of risk exposure management. By learning about contingency planning and thereby dealing with crisis management case studies, students acquire insightful knowledge on maneuvering the complex international financial environment. Resources like the Handbook for International Crisis Management offer more perspectives into what companies should do at times of financial and geopolitical crises.

7. Strategic Diversification

In this case, the investors tend to adopt strategic diversification as a way of managing the risks that are caused by geopolitical tensions. Political stability in some parts of the world creates a favorable climate for international investments while instability in other parts of the leads to capital outflows. For instance, during the Greece debt crisis, investors pulled out money and invested in other stable European countries while Greece’s economy struggled due to capital flight.

For students, diversification is another robust strategy taught in international finance to mitigate country-specific risks. Through examining portfolio management, the students will be able to examine the risks and returns on the different markets. Books such as Bruno Solnik’s “International Investments” where more attention is given to diversification and other strategies for managing international portfolios.

How our Expert Guidance helps you grasp the Geopolitical Impacts on Investments

Availing of our international finance assignment help service provides finance students with valuable assistance to grasp complex topics in global finance and assistance in solving difficult case studies and assignments. International finance is a complex subject involving different dimensions and to understand how political changes affect the global financial systems, one must understand underlying theories, political dynamics, and risk assessment techniques. Our tutors provide students with different perspectives, drawing from current trends and historical data, which is immensely helpful in coursework assignments and research papers.

Our tutors familiarize the students with the current developments in geopolitics, trade policies, and exchange rates giving them a new perspective on how these aspects affect international finance. Through case discussions involving current events including the trade dispute between the US and China, Brexit, and the Russo-Ukrainian War and Crisis we guide the students to learn how these events impact investment decisions.

Besides geopolitics, we also help in other major aspects of international business and finance such as exchange risk, international diversification, regulatory issues on internationalization of investments, and crisis management. Our experts assist the students in explaining hedging currency risk, financial derivatives, and credit risk assessment so that they master practical skills for the global finance industry. Recognizing such issues, students acquire a practical understanding of how theory can be implemented and develop confidence in solving complex tasks and case tasks.

Our service also helps students to be innovative in terms of critical thinking and developing new perspectives to be able to stand out in their finance courses. Whether it is about structuring a thesis, analyzing a specific geopolitical case, or mastering investment strategies, our international finance assignment help experts are always helpful for struggling students.

Conclusion

Understanding political risks affecting investment decisions is important in today’s developing global economy. For the students, learning these dynamics provides them with foundational knowledge on how to manage global investments. It is important to know that globalization increases the integration of countries meaning geopolitical events will always impact international finance. Any student in need of assistance may benefit from engaging in these topics with the Help with International Finance Assignments expert because we offer a practical understanding of the subject that will help them map the theories to real scenarios.

#InternationalFinanceAssignmentHelp#HelpWithInternationalFinance#InternationalFinancialManagement#InternationalFinanceHomework#GlobalFinanceHelp#InternationalFinanceTutors#FinanceAssignmentHelp#FinanceHelpOnline#GlobalFinanceTutoring#InternationalFinanceSupport

0 notes

Text

Wall Street shrugs off election nerves, Oil crashes

Wall Street shrugged off pre-election nerves and impending mega-cap earnings to close higher overnight; the US dollar was steady, while oil slumped on receding Middle East tensions.

The Dow Jones rallied 0.65%, the S&P 500 rose 0.27 %, and the Nasdaq gained 0.26%. The US Dollar index (DXY) saw intraday volatility but closed almost unchanged at 104.30.

Oil prices plummeted overnight as markets priced in that Israel's strikes in Iran would send both nations back to the sidelines, reducing Middle East tensions. Brent crude gapped lower in Asia, with Brent futures finishing 6.12% lower at $71.20 a barrel.

Fears remain that Saudi Arabia may be about to engage in a price war to regain Asian market share. The September lower nears $68.60 a barrel is now within sight, and a daily close below that level would be a technical signal of deeper losses.

USOIL H1

The ruling LDP's loss of its Lower House majority was confirmed yesterday in Japan. USD/JPY closed 0.65% higher at its 153.20 resistance line, but the Nikkei 225 ignored political turmoil, rising 1.15% as the Yen weakened. Further USD/JPY consolidation at these levels could set the stage for a test of resistance at 155.30, as Japan's futures market prices have zero chance of a Bank of Japan rate hike this week.

USDJPY H1

Today's calendar in Asia is very quiet, with Japan's Unemployment Rate unlikely to have any impact. In the US, markets will follow the JOLTS Jobs Opening (7.99m exp), searching for clues about Friday's US Non-Farm Payrolls.

Attention will be reserved for the tech mega-cap Alphabet's quarterly earnings release.

Disclaimer: The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions. Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us. The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes