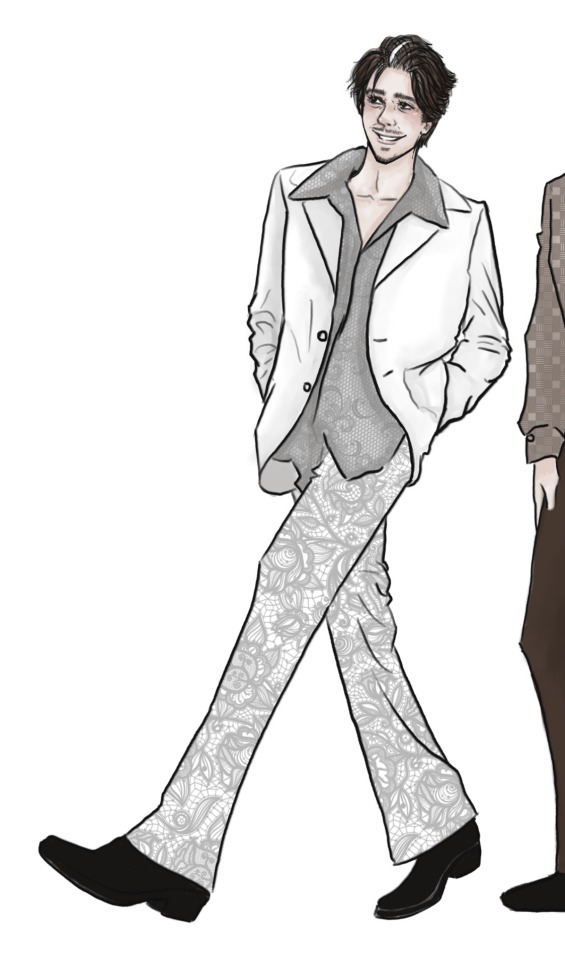

#did you see my ideas Boj??

Text

yoooo it only just clicked with me but did I actually predict something??? Even the hair????

#I'm fucking SHOOKETH#did you see my ideas Boj??#did you enjoy my shagadelic outfit ideas????#I'm honored#the offer still stands#I'm available for future designs#bojan cvjetićanin#joker out

49 notes

·

View notes

Note

Every bundle of joy addition for any given hashira makes my heart explode :((( also seeing how surprised and striken each man is so far :') like lol. LMAO even. Serves you right (LOOKIN AT YOU, TENGEN) But it makes me wonder..... Would a BOJ au for like.... Glances left and right.... For like Obanai per say... Is it also low-key a Mitsuri one too... Stands between them and holds both of their hands :))) bc I love them both and want them to squish me between them. THIS ALSO MAKES ME THINK in regards to Tengen's BOJ how the reader and the wives will interact. Will they fall in love too :( my husband and my three wives who I love very much. (On anon cos I'm a lil coward but ONE DAY.....) - 🐭

BESTIEEEEEE 😭😭😭 thank you!!!

I’ve not really toyed with the idea of Obanai’s BoJ but if I did, it probablyyyy wouldn’t be with Mitsuri?? NOT BC I DON’T LOVE THEM!! The BoJs though are all secret pregnancy AUs — sometimes the secret is kept from the MMC, sometimes the secret is kept from other Hashira/Corps members, and I just don’t see how either of those work with ObaMitsu 😭 I am always open to changing my mind, however!!!

With Tengen’s BOJ — okay so don’t hate me please but…

The wives are not in this one 😭 I’m sorry!! It doesn’t mean that I won’t do fics with them in the future — but I think it’ll make sense why I’ve omitted them once you read the story. None of the drama/angst would have happened had the girls been present because I think they would’ve ripped Tengen a new one.

I hope that’s okay and it’s not too much of a disappointment!!!

And never be afraid to drop by and say hi, it makes my day when y’all do!!

32 notes

·

View notes

Text

About the blogger meme

Thanks @moodyeucalyptus and @doubleappled for the tag and thanks apple for the fic shoutout! 🤠 Nice to read your answers 🤗

Star Sign(s): cancer sun (boooo 👎), libra moon, leo rising

Favourite Holidays: gotta say christmas for the food and festive cheer

Last Meal: i just made a chicken sausage and white bean stew thing for my dad

Current Favourite Musician: Right now probably Little Simz

Last Music Listened To: my last listened song on spotify was Modern Love by David Bowie

Last Movie Watched: The Wicker Man 1973 lol! Feels kinda wrong at this time of year but I'm dreaming of summer ig

Last TV Show Watched: Taskmaster UK, new season!! Recommend to all, highly silly and light-hearted

Last Book/Fic Finished: I recently reread American Psycho by Brett Easton Ellis (PB was my halloween costume this year and I wanted to get into a yuppie mood heheh)

Last Book/Fic Abandoned: The last book I DNF'ed was I'm Glad My Mom Died by Jennette McCurdy, which I had to read for a book club. The subject matter is obviously pretty heavy and it was sadly a little much for me at the time, although I could still see it being a good read if I'd been in a more robust mental state lol

Currently Reading: Just started reading Where the Crawdads Sing by Delia Owens.

And my current festive reading is this! Such a good magazine if you're into your folk horror (which I am, if that wasn't glaringly obvious)

Last Thing Researched for Art/Writing/Hyperfixation: I've been watching quite a few vids about homesteading and of people building their own log homes for my Appalachian Sydcarmy fic! It's super interesting and such a cool lifestyle, it would be cool if more people lived that way!

Favourite Online Fandom Memory: My first fandom on here was Queen/Borhap. I miss those days! That was such a lovely community and it made Covid lockdown days a lot brighter :')

Favourite Old Fandom You Wish Would Drag You Back In/Have A Resurgence: Borhap fandom for sure!

Favourite Thing You Enjoy That Never Had an Active or Big "Fandom" but You Wish It Did: Ben Howard is my longest running favourite musician and there isn't really an online community around him which makes me sad. I'm in his subreddit but it's kinda boring there lmao, it's not really like fandom vibes. I wish more people would make art and stuff

Tempting Project You're Trying to Rein In/Don't Have Time For: you know what, I'm being rly good lately and not starting too many things!!!

I do intend to return to my sydcarmy fic Sagittarius Season in the new year, but first I need to finish my baby BOJ and put it to rest 🤗

I do have A TON more supernatural sydcarmy au ideas up my sleeve but i think i'm just gonna enjoy them in my head :))

This was rly fun thank you!!! Tagging some The Bear babes: @angelica4equity @lunasink @sennenrose and some hellcheer babes who have tagged me in other things recently I believe : @hangon-silvergirl @erythromanc3r (pls accept this as a response I am forgetful and I lose track)

6 notes

·

View notes

Text

How did Heidegger not fall back in “ontotheology” that he criticized by virtually equating true Being with an apophatic God?

Yes, given his defense of the apophatic god of both Calvinism and the anti0christ of Hitlerism against Hegel/s Historic Gestalt. Connect the dots between Hegel’s Field of the Phenomenology of Spirt with Kurt Lewin’s political FOrce Field Analysis and you’s see what I mean

COMMENTARY:

don’t think I understand your question and, to the degree I might plumb the subtlety of your thinking, I think your premise is probably wrong.

Your question has help me clarify my own understanding of Heidegger in his context from my perspective. Newton, Kant and Hegel just blew up conventional wisdom between Aristotle and Spinoza. Both sides, idealists and empericists. Among other things, they achieved the synthesis of thought that had been put into motion about the time of Melchizedek and about 1400 years after the Boj of Job was writted. The Bible starts with the Book of Job and proceeds directly to the, which the theological code of law collided with the Roman secular rule of las arising from the ethical basis of Socrates’ example of civil law as the fundamental of a just society. The Romans had a better idea for the most efficacious of self-aware social contract. The critical path of mankind took a 90 degree re-orientation from the Law of Moses as the unique society that believed that history was going some place. Judaism was aesthe pleasing social contract, but, like the Pharoash’s, they were headed into the ozone, sort of like Jew Haley’s new tax burden on the American middleclass in the warfare of the January 6 republicans. The Roman Republic, which connected to the Roman SPQR at Socrates’ civic duty and was a creature of the roman secular rule of law and this form of government was headed to Sace, the Final Frontier. The Critical Pat oof both Jerusalem and the Roman Jesus ult originated with Geneasis 15:5 in terms of what we would call a Mission Statement, like Domino’s Mission Statement, which is my choice as the the best mission statement in the Fortune 500 and, unlike the Harvard MBA program, is based on the smal unit leadership model of the USMC. Jut like the Roman legions.

One of the things I love about Quora is that it allows me to think about things I didn’t have time for in colege. Philosophy and Literature, generally. And ROTC. I couldn’t major in ROTC, in literature because it was easy for me: I loved to read and I like things about the stuff I had read the way you do in the study of literature as cocktail party foreplay. One of the easiest ways to get laid in the 60s was to be able to discuss literature seriously with any woman and unloose the libido engaged. Getting a hard=on reading the Bible is a trope of the Total Depravity Gospel of the Pro-Life Jesus Freaks and, even reading Song of Songs does nothing for me and the Bishop, if you get my drift. But talking about scripture is how a lot of religious professionals get into the habit of sex with parishioners. Most of the good parts of sex happen in the personal psychosis and talking about literature, generally, can go straight to the ID.

What Hegel demonstrates conclusively is that the TULIP doctrine is an instrument of the anti-Christ. It is a subversive element of the strategy The Satan employed to trick God into letting The Satan to fuck with Job for no other reason that to indulge God’s pride of authorship in Job. Twice. And then God jump’s in Job’s shit a third time for impotence. Three time’s God betrayed Job with the same prideful boasting as Peter before he denied Christ three times before the cow crowed twice.

That, buy the say, is an example of the Holy Spirit at work, making the cock crow the second time on cue, if you are keeping score.

Jesus was sent by The One as atonement for fucking with Job 3 times. God promised Noah He wouldn’t destroy Israel by flood, but He didn’t stipulate against fire. Synagogue Socialism was God’s intent for Israel, al along This is the premise of process theology: The Book of Job is God’s promise of perfect Free Will to all born of woman. A consequence of Free Will is that we al emerge from magical thinking into innocent atheism, Hegel is correct about Reason: it is an acquired capacity of consciousness and begins with potty training, when pull-ups give way to the calibration of the Pucker Factor and self-actualization

Total Depravity ends when the mystery of Santa Claus is dispelled. . . The TULIP doctrine of Calvinism is grounded firmly on the Total Depravity of Eve without mitigation of the Cross. It is an excuse by the force of the anti-Christ to violate Free Will with the agony of the stake. The Total Depravity Gospel is a big part of the Jesus Inc business plan based on the Tax Free status of religious organizations as the primary money pump. Hate and Fear are big crowd pleasers in the Fire and Brim Stone branding of American Evangelicals. like Campus Crusade for Christ. .

Hegel bows it out of the water. Which is why people at Yale pretend they don’t understand Hegel when they understood Hegel exactly like William F. Buckley. It is part of the subversive agenda to conceal the shere analytic power of Hegel D-Day is a product of people who employed Hegel to wipe their butts by the numbers.

In any event, I have come to see Heidegger was engaged in a all out defense of Christianity. Hegel and Kant don’t reject Christianity in the least: they, in fact validate the natural divinity of humanity in the Categorical Imperative, with the metaphysically necessary atheism of Hume to ground Reason firmly on the unknowable essence of existence. His rules of evidence proceed from that existential benchmark. In an age when the TULIP doctrine was still hanging witches in America, thanks to the TULIP bias of thePuritans, it was safer to be a Skeptic than an atheist. It was an effective defense against the charge of heresy Kant and Hegel were accused of.

From my point of view, The Old Testament was an rough draft. Jesus was the final product process theology that began with Job. Jesus revises the Ghema to include Plato in the attributes of righteousness with “mind” and then He added the Atheist Clasue “Love Thy Neighbor as Thy Self”, the syntehsis of which abrogates the 624 Lws of the Mishnah and Talmud and justifies the Free Will of atheism as an an ethical behavior. KISS: Keep It Simple. God is perfectly content with atheist who live by the ethic of the Golden Rule, no matter where they heard it first. It is the Tao of the Logos.

All the glossary of Heidegger's inquiry from Being and Ime to his 1043 retranslation of the Greek before Socrates was chosen to refute Hegel., For example, the logos of Dasein was chosen as a deliberate allusion to John 1″1. An you can follow the trajectory of his narrative from an examination of the person in his environment although he didn’t employ that particular linguistic register which would develop out of his narrative. His most important insight alogh the way was the relationship of the mastrr carpenter to his/Her hamer. Again this is a transparent Reference to Jesus the Carpenter and the nature of allegory in Heidegger’s argument. Transparency is the operative word, The hammer represents the authority of the carpenter just as the transparency of the relationship of Jesus to the authority o The One is evident throughout His ministry and is established existentially by He Resurrection from the instrument of the Cross, the instrument of unambiguous due process of the Roman secular rule of law. The Death of Jesus is beyond confusion within the context of Hume’s roles of evidence Pilate’s report of his Resurrection to Rome is simply beyond the slight probability that it didn’t happen: Christianity would have happened without Mark 15, which is a consequence of the entry of the authority of The Noe into history as a consequence of a mundane bureaucratic method of systematic feedback.

The trajectory of logos from being in the world through transparency to metaphor basically validates the Figure of Hegel’s Historic Gestalt. Jesus, as the living, breathing authority of The One , is the logos at the leading edge of the narrative of the Gospel of Mrk. Go on YouBube and pull up an audio video of the Gospel of Mark and play it and wathc the dot of the time—stamp advance from left to right underneath the optics. That dot is the leading edge of the narrative drama paying out in your imagination and is the logos of Heidegger’s Dasein The logos is the point where Heidegger and Hegl are joind at the hp in regards to the divine nature of Jesus. And the Categorical Imperative is the chematic for the Bing in the world of the logos in an “all humans are created equal” andthe individual is creaed in the image of The one in that the gestalt of Human Perception reflects the Gestalt of the Mind of The One.

Heidegger was engaged in what Carl Rogers called “becoming a person”> and his narrative arc defines the epistemological intent of the US Army Ranger School. Heidegger’s problem, in answer to what I think your question infers, was that, by 1943, he was trying to justify Nazi Racial theory by pre=Socratic soial contract He was like Bart Ehrman, motivated by a desire to be popular with the Nazis who made fun of his theology. Like everybody after Newton, Kant and Hegel and before Kurt Lewin stumbled over Group Dynamics., they had no way of reconciling the idealism of Plato with the empiricism of Locke. It’s why linguistics became so important \. There was a great intellectual spasm between Spinoza and Locke and Kurt Lewin that made it possible to put man on the moon

So, in a very real sense, Heidegger was defending the apophatic god of of the TUPIP doctrine, but his ture emphasis, in his heart, was coincident with the irresistible grace of the logos of Jesus. If you understand Hegel like william F. Buckley understood Hegel, the moral confusion that plagued Heidegger evaporates. The thing to rememberis that all metaphor ultimately arils and that Paradox occurs where Metaphor fails. Heidegger’s Dasein runs logos straight into Paradox in 1843, which is exactly who Jesus was: Paradox. Heidegger was the New Age guru of Nazi Germany, but the simply didn’t have the linguistic register to complete the synthesis. His flirtation with Nazi Racial Theory was his defense of the anti-Christ of the apophatic god of Hitlerism.

0 notes

Text

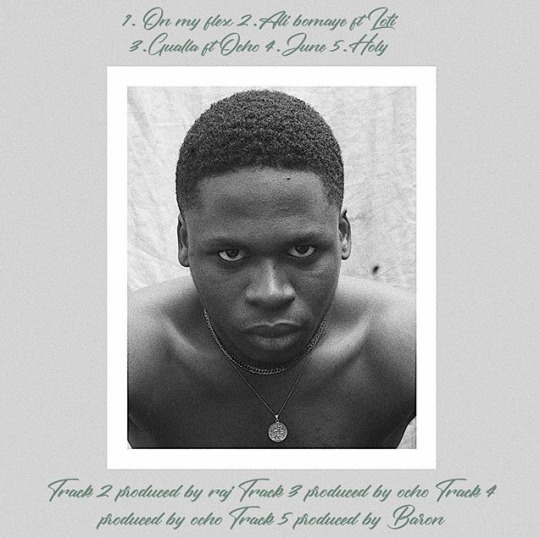

The Beautiful Zoo X Jibola

Meet Jibola. A 20-year-old rapper from Lagos, Nigeria. His first ever body of work titled “Truss Me” recently just dropped. We caught up with him to talk about his musical background, inspirations and his experience working on the project.

A personal listen of the Truss Me tape gives a sonic insight into a mix of well-prepared, genre-diverse, lyrically mature and yet youthful and fresh songs. Jibola proves himself to be a very versatile and adept entertainer, we can’t wait to see more from him. The album features Loti and Ocho as guest appearances, production credits go to Tobi Baron and Ocho again, a star-studded collaborators list in a few years to come certainly. The 5-track rap tape is available on Apple Music and you should do get it. This is the interview, read about it.

1. Give an introduction about yourself.

My name is Jibola Oduwole. I’m an independent recording artist.

2. What is your musical background?

I think that’s based on watching a lot of Michael Jackson videos, also listening to Lagbaja as a kid really made me want to be on stage, but it wasn’t up until secondary school I started battle rapping, and I knew I had flow too so.

3. Who are your influences, in music and in life?

In music, of course the goat, Wizkid, Michael Jackson, Lagbaja, I listened to a lot of Drake also over the years. I feel like any artist I really fuck with now has at least a little impact on me, even with the beats I use and all that. Daniel Caesar, PND, Amine, Boj, Prettyboydo, the list is long.

In life, my family, friends and relating with people influence me. I’ve noticed that if you’re influenced by someone or something, it means you’ve learnt or you’re learning from them, so when I talk to people, I always look out for what I can pick up. I also watch a lot of stuff from all fields just to feed myself.

4. What are your best 5 songs of the year? Of course, excluding your own music.

It’s tough but I’ll say;

Pan Fried – Kano Ft. Kojo Funds

Cyanide – Daniel Caesar (best song ever)

John Redcorn – SiR

Hell and Back – Bakar

Mafo – Naira Marley

5. The Truss Me EP is your first musical project. What was the experience like working on it?

It was great. I found out that I really enjoy making music and there’s a lot to it, so hopefully I can grow in my craft. In general, it was a crazy good feeling.

6. How did you figure out producers and featured artists you collaborated with on the project?

I actually didn’t know I was gonna put out a body of work, I just wanted to do more than I was doing at that moment. So I called Ocho over and he played some beats for me and my guy Raj who also makes beats. He sent me a short pack and once I heard the Ali Bomaye beat, I fucked with it. I had like 3 songs and just felt like putting out an EP. I later hit up Baron and he sent me the Holy beat. Actually, I didn’t know he made the On My Flex beat so shout out Baron, got that beat from Kenny.

I wasn’t really keen on features, I only wanted to work with dope artists so shout out Loti also for that cold verse on Ali Bomaye.

7. Ocho clearly worked extensively with you on this project as he got featured and also produced a track. How did that come about and what was the experience like?

Ocho actually produced 2 tracks on the tape; June and Gualla which he’s featured on. I believe in energy; we had worked on a song before but I didn’t release it. So I was already familiar with his work ethic. He’s a beats when it comes to this music thing so yeah we exchange ideas and hopefully the world will see and hear.

8. The international and worldwide recognition of Nigerian music in the past few years have helped to popularise more artists especially young and upcoming, also with the help of social media and the internet. How do you feel being a new age artist?

I think it’s a good time for upcoming artists. Social media in the end is people and if you can get your work out to the people and they fuck with it, nobody can come in your way. That has really helped our African artists reach the far ends of the world and represent. Also with collaborating with other international artists, it’s incredible. One of my best songs this year is the Bas and Kiddominant joint.

9. What’s the future like for Jibola?

I just have to keep working on myself and the music and dropping to show progress till no one can deny it.

10. If you weren’t into music, what else?

Probably a DJ or an actor or something artsy.

11. Describe your ideal Lagos cruise?

I don’t know if I have an ideal one but I just want to say that unplanned rocks are always the best, like when you just go out to see someone and then they suggest a motive and it’s lit, yeah those kinds of nights are calm.

12. Drake – Scorpion // Playboi Carti – Die Lit. Choose one.

I’ll say Scorpion just cause it has Non Stop on it.

3 notes

·

View notes

Text

No Need For Pessimism

Why is everyone so pessimistic? After all…

IMF has raised its forecast for global growth from 3.1 % in 2016 to 3.5 % for 2017 and inflationary expectations remain muted. 2018 is projected to be even better than 2017.

Monetary authorities remain accommodative, interest rates remain amazingly low, and the financial system is awash in liquidity.

Earnings are accelerating with first-quarter gains the best reported so far in 7 years.

Trump’s pro-growth, pro-business agenda is on the horizon.

Global trade tensions have eased and fear of trade wars have diminished.

The U.S. has shown itself willing to defend human rights and long-term relationships rather than being an isolationist as many feared.

The U.S. is working well with China while becoming a growing adversary of Russia, North Korea, Syria and Iran.

OPEC and non-OPEC members are working together to maintain stability in the oil markets.

Change is everywhere creating opportunities for profitable investing yet investor sentiment is as negative as I have seen in some time. Virtually everyone is calling for a 5-10% correction at a minimum or saying that we have entered the next bear market. Few are calling for another leg up. I like those odds, as the majority is rarely right.

The preconditions for a market top are just not evident. And yes, corrections can come at any time but rarely happen when everyone is looking for it. Markets make tops when there is excessive optimism/exuberance and bottoms occur when pessimism is at its maximum.

I constantly review my core set of investing beliefs to see if and where I may need to make some adjustments. A successful hedge fund manager always has a bearish tendency thinking that the glass is half full. We always doubt ourselves looking for that missing fact(s) or perception that may alter our view. While we recognize that there are always global tensions and political uncertainties in the world, it is difficult to know when and if ever it will occur, so it is difficult to hedge.

How do you hedge against a possible “accident” with North Korea? It certainly appears that China is working hard to defuse the situation. After all, North Korea counts on China for virtually everything that it consumes including its energy. Did you hedge the Brexit vote? If so, how did that work out? France is up next, followed by Italy. I still expect that the Eurozone will need to make major changes or not survive.

The economic surprise so far this year is that China’s growth accelerated in the first quarter to 6.9%, the best performance since the fall of 2015 while the U.S. decelerated from a strong fourth quarter. IMF forecasts global growth of 3.5% in 2017. Here is a breakdown by region: U.S. growing 2.3% in 2017 up from 1.6% in 2016; China growing by 6.6% in 2017 versus 6.7% in 2016 and developing nations accelerating to a 4.5% gain in 2017 as compared to 4.1% in 2016. Global trade volume, an indicator of health in the global economy, is projected to rise by 3.8% in 2017 and 3.9% in 2018 versus 1.8% in 2016. What I find important is that the IMF has not factored much, if any, of Trump’s pro-growth agenda in its forecasts.

Comments last week out of key members of the ECB, BOJ and also our Fed supported the notion that monetary policy will remain accommodative. Both the ECB and BOJ specifically mentioned that their bond buying programs would be extended well into 2018 with no intentions to let any of the debt on their balance sheets run off. Stanley Fischer and other members of the Fed went out of their way to assure the markets that there may be only 2 more rate hikes this year and any roll off of debt, if it begins this year, will be very minor and won’t impact the markets as many pundits fear.

Germany’s 10-bunds finished the week at 0.25%; Japan’s 10-year JGB closed at 0.01% and the U.S. 10-year treasury at 2.25%. Finally did you notice the improved capital and liquidity ratios of all the major U.S. banks reported last week? As Jimmy Dimon said on JPM’s earnings conference “the economy is primed to accelerate, and we are ready to supply all the capital needed.” Other bank chairmen echoed his comments. One of our core beliefs remains that the supply of capital exceeds the demand for capital, which is good for financial assets.

First-quarter earnings calls have been excellent so far with revenues, volumes, margins and profits expanding at a faster pace than in the fourth quarter, which happened to have been the best overall earnings report in 4 years. I suggest that you listen to as many of these calls as possible to gain a sense of comfort that, in fact, the global economic environment, including the U.S. is improving. The chairman of Nucor, the best run and most profitable steel company in the world, commented that construction and infrastructure spending has already begun to pick up. By the way, Nucor had a sensational quarter and forecasted even better days ahead. The stock still sells at only 60% of the market multiple and remains undervalued. It is one of our core holdings. I continue to believe that second-quarter U.S. economic growth will snap back from a slow first quarter and the U.S. will expand by at least 2.3% in 2017 even before Trump’s agenda to “Make America Great Again” is enacted.

The next point is that it appears that Trump is about to re-introduce his healthcare bill, and surprisingly, will also announce his plan to cut both corporate and individual taxes next week. Clearly he would not come back with a rejiggered healthcare program unless it had sufficient support within his own party to pass the House. While the devil is in the details, I remain confident that Trump and his team learned from the last fiasco and won’t come forth with this or any major programs unless there was sufficient support to pass his own party. I fully expect changes in the Senate and then in committee will make these bills more palatable to both parties and eventually pass.

And then there is the infrastructure program, which I am most confident will pass Congress this year with only minor changes. The surprise will be that it won’t impact the federal budget much, if at all, as it will be publicly and privately funded. All of these programs, once passed, will accelerate U.S. growth into 2018 and 2019, which has not been factored into anyone’s numbers.

Trade has become a two-way bargaining chip with all our trade partners. China is the perfect example as we asked for China’s help in easing tensions with North Korea and offered “better” trades deals if successful. I remember all too well that the pundits biggest fear was that the U.S. would become isolationists no longer supporting our long-term partnerships like NATO and cause trade wars to erupt.

Clearly our actions show differently, which has benefited our relations abroad. Also, I am glad that is appears that a border tax will not be part of Trump’s tax reduction program. It looks like Trump’s trade team will do everything in its power to promote a level playing field and enact punitive tariffs if dumping can be proven to protect our industries from unfair, illegal competition. Steel may be the poster child, but it will extend to aluminum and other industries too.

I am not surprised that OPEC and major non-OPEC nations are working to maintain stability in the energy markets holding oil prices above $45/barrel while aiming for $60/barrel. The Mideast countries could not support their domestic spending needs with oil below $45/barrel so they had to work together or go down together. And this includes Russia! The fly in the ointment is that U.S. shale production has recovered much faster than expected therefore the benefit of OPEC cutting production has been muted. OPEC has had no choice but to extend the cuts into the high demand summer months too. Oil prices should stay range-bound between $45-$60 per barrel which is good for both businesses and the consumer. Have you noticed that the price at the pump remains below $2.30 per gallon?

I want to end by elaborating on my belief, which is that all this change is creating tremendous opportunities to profit. Whether it's government, business or the consumer, the status quo is not a recipe for peace and prosperity. Technology is progressing at an amazing pace and disrupters are rising everywhere providing more services with better distribution at lower costs. You must always look towards the future.

Paix et Prospérité continues to outperform. We do not accept the status quo as fact and recognize that change is a dynamic and evolving process making passive management passé. If you don’t change along with it, you fall behind. We also know that change won’t happen overnight, so patience is a key virtue. We know how hard it is to stay conscious and present as the news bombards you throughout each day, but you must not react.

Don’t be pessimistic. The best is yet to come!

Review all the facts; step back, reflect and consider mindset shifts; adjust your asset composition and risk controls if needed; and finally, do in-depth independent research on each idea and…

Invest Accordingly!

Bill Ehrman

Paix et Prospérité LLC

2 notes

·

View notes

Text

Mading Patches On Bike Leather-made Vests As Well As Jackets

Scottsdale, an urban area which possesses an acreage from more than 180 founded virtually in the heart of the State from Arizona, was included in 1951. For the complete year 2017 our government and also scholarly category grew an incredibly solid 6% though as our company have consistently stated this company is a much smaller component of our mix and also purchases usually be lumpy quarter-to-quarter.

Therefore to begin with, on the mid-contract change, I am actually definitely positive this was actually the correct trait to accomplish. Our experts told you at that time you are actually not going to see it. You must only elevate your costs coming from just what your estimate was actually if all you prefer to do is appear at a spread sheet.

Therefore i delivered every thing and also Exactly on the third day, my ex-spouse enthusiast contact me incredibly as well as exactly what surprised me most was that a business i looked for over four months earlier phoned and also claimed I ought to resume work as soon as incredibly thankful to DOCTOR Inibokun.

Now, as Doug discussed, also on decision with me today are actually Patrick Vaughan, Head Of State of our Institution Transportation Team as well as Tom Kominsky, our Chief Growth Policeman, that is actually heading up our Managed Companies Team and brand-new company ventures.

At that point they told me that they have to designate a spell on him that are going to make him come back to me as well as the little ones, they appointed the incantation as well as after 1 full week my hubby named me and he told me that i ought to eliminate him, he began to apologize on phone and stated that he still reside me that he did unknown what happen to him that he left me. it was the incantation that he traditionalspellhospital appointed on him that produce him rebound to me today, me and my family members are currently pleased once again today.

Keeping an eye out more advanced condition, with considerable provider and also field news as Growlife constructs out its company design, the company needs to have the capacity to hold a market hat from $500 million, or regarding $0.70 cents an allotment, potentially more if the market costs keeps.

Dan Andrews of the Lifestyle Business Podcast nailed it when he stated 'you have actually reached discover your 5 hours.' All 4-Hour Workweek imaginations apart, if you would like to build one thing you would certainly much better locate that five hours (or even even more) every day.

God Melbourne, Queen Victoria's 1st prime minister, was actually listened to murmuring one Sunday morning on his way out of be-fit-maxblog.pt Congregation, Religion is all quite possibly, however that is actually going a little bit much when it states to disrupt a person's private lifestyle." This is our very most recurring and also usual technique from limiting God.

It's my adventure that you'll frequently get better results through focusing on today time favorable considering that this allows your husband to willingly want to spend even more opportunity with you without fretting that you're visiting attempt to dredge up recent or reveal his qualms.

Tidy Power Durham is actually continuouslying move its own community energy cost savings plan, Pete Road, across the country, and that is by means of this Southern best that neighbors must aid neighbors that the United States are going to find more electricity discounts on a neighborhood amount.

Simultaneously, the BOJ has been gradually paring back its own asset buy from its ¥ 80 mountain yearly guideline (photo listed below), though the idea of a BOJ placed" (i.e., requirement that the BOJ are going to properly bail out markets if they drop as well dramatically) is actually still a largely kept belief.

0 notes

Text

Marc Faber: Currencies To Collapse Against Precious Metals - Seeking Alpha

New Post has been published on https://tradegold.today/marc-faber-currencies-to-collapse-against-precious-metals-seeking-alpha/

Marc Faber: Currencies To Collapse Against Precious Metals - Seeking Alpha

Marc Faber: Currencies To Collapse Against Precious Metals Seeking AlphaThe gold market finally broke away from the $1300 level, where it had been ranging for several weeks. Gold hit a slight new low for the year on Thursday. Altho. […]

Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up the one and only Marc Faber joins me for a tremendous conversation on debt, the global economy and the future of the dollar. Marc tells us how much he believes the average investor should have in gold and silver right now and reveals which precious metal he favors most going forward. Don’t miss a must-hear interview with Marc Faber, Dr. Doom, coming up after this week’s market update.

Well, the gold market finally broke away from the $1,300 level, where it had been ranging for several weeks. Unfortunately for the bulls, it broke to the downside.

Gold hit a slight new low for the year on Thursday. With the markets closed today for Good Friday, the gold spot price will end the week at $1,276 per ounce, registering a 1.2% weekly decline.

Although gold is showing some technical weakness, it is not seeing a massive liquidation in the futures markets.

Well now, without further delay, let’s get right to this week’s exclusive interview.

Mike Gleason: It is my privilege now to be joined by a man who needs little introduction, Marc Faber, editor and publisher of the Gloom, Boom and Doom Report. Dr. Faber has been a long-time guest on financial shows throughout the world and is a well-known Austrian school economist and investment advisor, and it’s a tremendous honor to have him back on with us today.

Dr. Faber, thank you so much for joining us again, and how are you?

Dr. Marc Faber: Fine, and that it’s a pleasure for me to participate in this interview.

Mike Gleason: Well Marc, we’ll start out today with everyone’s favorite topic, that being Fed policy and what’s happening there because it continues to be such a key driver for everything, much to our dismay. The markets have been so addicted to Fed stimulus and cheat money since the Great Recession a decade ago, so is it possible that they can withdraw this stimulus? Or did we just learn over the last few months… going back to, say, November and December when we saw the equity market suffer dramatically over the idea of the Fed moving forward with those three to four planned rate hikes for 2019, after which the Fed has reversed course and completely backed off on any rate hikes this year… are we just looking at never-ending stimulus from the central banks now, Marc? What are you thinking as you’ve watched the events unfold over the last few months with respect to monetary policy and this apparent sea change?

Dr. Marc Faber: Well, it’s a complex issue. It’s particularly complex at the present time because the global central banks, I mean the major central banks, they can argue, well, there is little inflation in the system, and so we can continue to print money or to purchase assets, which, either way, is true. There is little consumer price inflation, partly because the economy of ordinary people is not particularly good. We have a split economy. The economy of the well-to-do or extremely well-to-do people is doing well, and the economy of the ordinary people in Europe, in Japan, in the U.S., is not doing well. And so there is little inflationary pressure, but there is a lot of inflation, or has been a lot of inflation in asset prices. Stocks are at highs in the U.S. essentially, not the oil industries but several industries. And we have now 10 trillion-dollar worth’s of bonds in the world that have negative interest rates, it’s in some kind of a bubble, or a big bubble.

And so we have this asset inflation, and in my view, the central banks and the policy makers, they realize that if the asset bubble really breaks, if the stock market drops 20%, if home prices drop 20%, if bond prices go down 20% or so, the whole world is in a depression. So, I think that when they started actually in 2008, with QE1 in December 2008, and I was asked at the time, “How do you think it will end?” I said, “They just started QE unlimited. I think they will continue to print money until the system breaks.” And that can take another few years.

But I think, yeah, it’s likely, if you were to look at the political landscape, you have on the one end the Republicans, at the present time under the leadership of Mr. Trump. He wants to spend on defense and on his wall and on all kinds of things. And the Democrats, they also want to spend on all kinds of things. So, you can be sure that the deficit in the U.S. will remain around a trillion dollars a year for the foreseeable future. And in my view it’s more likely that this deficit will go up, and possibly quite substantially. So, the money printing, in my view, will continue.

Now could you have QE, and at the same time the Fed raising interest rates? That is a possibility. But in the current environment, where the economy has been slowing down, I think they will rather do nothing, especially also under the pressure from the White House, which essentially accuses, or tells the world that if the Fed hadn’t raised interest rates, the stock market would be much higher. So, I think they will not increase rates further. I think they will not cut the rates, as Trump and Kudlow would suggest, to simply show them that they’re independent, and that they don’t need Mr. Trump and Mr. Kudlow to tell them what to do.

Mike Gleason: Despite what the Fed has been doing, we are still seeing a strong dollar because the Fed has been a bit more hawkish than the ECB and the BOJ – the Bank of Japan – and other major central banks throughout the world. Do you see this reversing at some point? We know Trump doesn’t want a strong dollar, so how do you see things playing out in the currency markets? Because for the most part, gold, if we relate it to gold, is going to trade off the U.S. dollar in many respects. As long we see strength in the dollar, it’s likely going to be difficult for gold to really catch fire. Give us your comments on the dollar and what you see ahead for the greenback.

Dr. Marc Faber: Well, I think the dollar is strong because many investors argue that the economy in the U.S. is either better conditioned than European economies. Who knows? But one reason the dollar has been strong is you have all these negative interest rates in Europe. In Germany the 10-year yield is now negative, and in Japan as well, in Switzerland as well. And in Spain you have interest rates on the 10-year government bonds of 1%, whereas in the U.S. it’s 2.58%. So, I could argue it’s logical that if you get more than twice as much interest in U.S. Treasuries than in Spanish bonds, and you’re an insurance company in Europe, or sovereign fund in the world, you rather buy U.S. Treasuries than Spanish bonds. I think it’s quite logical. So, I think that has supported the dollar.

But I personally, I think the dollar should in due course weaken, and as the dollar weakens it could also trigger weakness in the stock market.

Mike Gleason: As usual, when you’re a guest on our podcast, we like to get your take on what’s happening globally. In particular, we are interested in what you expect from Asia. There seems to always be talk in the U.S. media about China slowing down. Perhaps the tariffs are having an impact. However, the U.S. trade deficit doesn’t appear to be budging very much. What are you expecting with regards to the possibility of recession in China? And where do you see the global economy headed in the near term?

Dr. Marc Faber: Well as you know, the Chinese had all this excessive credit growth. Now you could argue, well, they have this excessive credit growth because they have also a very high propensity, or rate of capital spending to build apartment buildings and bridges and roads, and the whole infrastructure. This is very costly. And so the borrowings are very high. But whether China will go into recession or not is a question also, can in China some sectors be in a recession, like car sales are down this year, and other sectors continue to expand? It’s a huge country. It’s actually almost a continent with 1.3 billion people. So, different sectors will perform differently. But since I live in Asia, my observation is that there has been a slowdown in economic activity. We’re not in a recession, but we’re in a very low-growth phase. There’s very little growth at the present time, and if there is growth it is because of borrowings… but that is also the case in the U.S. Without a trillion-dollar deficit and the debt build-up, student loans and car loans and everything, and credit card loans, the U.S. economy wouldn’t be growing either.

Mike Gleason: We saw back in, I believe it was late summer 2015 when the Chinese economy really hit the skids there temporarily, and it almost started a massive global panic there in the equities markets. Is China still a key linchpin when it comes to how they’re doing, so goes the world to some respect? And do you see maybe some doom coming down the road for China that could find itself manifesting in other economies and other markets?

Dr. Marc Faber: Well, China consumes approximately 50% of all industrial commodities in the world. So if there is a recession in the manufacturing sector in China, yeah, of course the world feels it. Or if there is less demand for smart phones in China, and also, I have to mention here that India has also become a large market. So, if there’s less demand for these toys, or for these very sophisticated mobile phones, then obviously the world feels it because it affects Taiwan and South Korea. And in turn it affects American semiconductor companies and so forth and so on. So, it goes through like a bush fire. And if China travels less, if there are less international travelers, then you’re talking about 140 million Chinese, and if they drop by 10%, then it’s 14 million Chinese that will no longer travel. And that, every market will feel. So they have a huge impact on the global economy undoubtedly.

Mike Gleason: Marc, how about this move towards socialism that we’re seeing, whether we’re talking about monetary policy or when we look at the landscape of the Democrat presidential candidates who will challenge Trump in next year’s election here in the U.S., what do you make of this movement that does seem to be gaining steam in many respects throughout the world? And how might this impact financial markets and investment opportunities in your view?

Dr. Marc Faber: Well, I just wrote an essay about monetary inflation and the social impact of monetary inflation, because depending how the monetary inflation works through the system… in the case of hyperinflation, Germany in 1922, 1923, the middle class was essentially eliminated. They lost basically most of their savings one way or another. But the rich people made a lot of money. And I’m comparing it to the current time, where the middle class hasn’t lost money per se, but because the rich people became so rich, the middle class has kind of been pushed down relative to the super rich people. That creates then an unfriendly environment.

The people that vote, they don’t understand a lot. But it’s very easy for a politician to go to people and say, “You know why you’re not doing well? It’s because of Jeff Bezos, he’s got so much money, and because of Warren Buffet, he’s got so much money, and Bill Gates, and so forth. And because of these hedge fund managers, they don’t pay any tax or they don’t pay much tax,” which is actually true. The corporate world in America pays very little tax compared to individuals. If you look at the composition of tax revenues by the government, the bulk is paid by individuals, not by the corporate sector.

And so, through destroying wealth and income inequalities, the mood is in favor of taking money away from the wealthy people and distributing money to the ordinary people. And then they see, the ordinary people, how much is being spent on defense, in the case of the U.S., close to 750 billion dollars a year. And a lot of it is not accounted for. And they say, “Well, this money shouldn’t be spent on defense. It should be spent on social programs,” and so forth and so on. So the mood, towards socialism, especially we have surveys that showed the millennials, about 60% of the millennials, they are in favor of more government interventions.

Mike Gleason: Yeah, definitely something we’ll be keeping an eye on here over the next year or so, especially as we get close to the election season, we’ll see what happens there.

Well Marc, as we begin to wrap up here, give us some more of your thoughts on the precious metals. For instance, do you see better value in one of the PMs over the others perhaps? And given everything that we’ve been talking about here today, with all of the debt in the system and the potential of never-ending stimulus and perpetual money printing, do you envision it being a strong environment for the metals moving forward? And basically, how do you see the sector performing overall, say this year and next? And then what will it take for them to sustain a rally to the upside finally?

Dr. Marc Faber: Well, the one thing I want to say, that everybody who lived through the monetary inflation of Germany – which ended up in kind of a hyperinflation, but I just want to explain – in the case of Germany, the hyperinflation was also made possible because the other countries didn’t inflate. And so the mark depreciated against the foreign currencies, which then added to inflationary pressures. In the present state of monetary policy around the world, because everybody prints money, currencies don’t collapse against each other, with very few exceptions like the Turkish lira and the Argentine peso and so forth. But basically, the major currencies, they trade against each other.

So where will the collapse of the currencies come from? In my opinion, they’ll all collapse against precious metals. And it is conceivable, and this is something we just don’t know, it is conceivable that they’ll also collapse against some cryptocurrencies. Now, I think there is a chance, we’re not sure – this is a kind of a theory – it is conceivable that Bitcoin becomes the standard, the gold standard of cryptos. But I’m not sure.

All I want to say, investors, in an environment such as we have of money printing, they need to diversify. They need to own some equities. We don’t know whether these monetary inflations will end up with a deflationary bust, in which case you may want to own some U.S. Treasuries, or it could lead to high inflation, consumer price inflation, in which case you want to own maybe a farm or some properties overseas. Or you may wish to own some precious metals. I think in any scenario, you should own some precious metals. Or the question is, should you own 3% of your money in precious metals or 90%? That everybody has to decide for himself. I recommend about 20, 25% of your assets in precious metals.

And as to the question, which one is (likely to perform) best? I think platinum is the cheapest at the present time of the precious metals. And I think it has actually a favorable outlook. I think there will be a supply shortage, and that the price could significantly outperform gold and silver.

Mike Gleason: Yeah, we agree. Lots of geopolitical dynamics involved in platinum there, and that’s going to be an interesting market to follow.

Dr. Marc Faber: Yes, exactly.

Mike Gleason: Well, Dr. Faber, thanks so much for your time and for staying up late with us there in Thailand. It was certainly real joy to have you back on and get your insights on the state of things. And before we let you go, please tell folks how they can subscribe to the Gloom, Boom and Doom Report so they can get your great commentaries on a regular basis.

Dr. Marc Faber: Thank you. Well there’s a website, GloomBoomDoom.com. And there all the information it contained.

Mike Gleason: Again, it was a real privilege to speak with you, Dr. Faber. I hope we can do it again before too much longer. And have a great weekend. Thanks for joining us again.

Dr. Marc Faber: Yes, you too. Bye-bye. Thank you.

Mike Gleason: Well that will do it for this week. Thanks again to Dr. Marc Faber, editor and publisher of the Gloom, Boom and Doom Report. Again, the website is GloomBoomDoom.com. Be sure to check that out.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read More

0 notes

Text

My 2019 Financial Market Outlook – According to My Current Portfolio

“People ask me my forecast for the economy when they should be asking me what I have in my portfolio. Don’t make pronouncements on what could happen in the future if you’re immune from the consequences. In French, they use the same word for wallet and portfolio.”

–Nassim Nicholas Taleb

Over the next few days and weeks, you’ll see many year-in-review stories and predictions about what will happen in 2019.

I thought about doing something similar, but then I stumbled upon a better idea: instead of writing predictions that have no consequences, I’ll share my current portfolio.

After all, people reveal their preferences and beliefs through their actions.

Look at someone’s bank statements, brokerage accounts, and a time log of his/her activities each week, and you’ll get infinitely more information about the person than you would gain from surveys, conversations, job interviews, or Instagram.

This article does not directly relate to winning a job in the finance industry, but sometimes I like to write about other topics. And I suspect that sometimes you get bored reading about networking, interview questions, and exit opportunities.

So, here goes:

My Current Portfolio

First, I am not going to give dollar amounts because it’s a bit tacky and I don’t feel comfortable disclosing that information – so these will all be percentages of total investable assets.

Second, these figures are across a wide array of accounts (Vanguard, Fidelity, Wealthfront, etc.), and some are in tax-advantaged accounts such as SEP IRAs, while others are in taxable accounts.

This is important because tax-advantaged accounts make assets like corporate bonds, real estate loans, and even dividend stocks far more attractive.

Some accounts are completely automated (Wealthfront), while others are “passive” but with allocations I select (Vanguard), and still others are a mix of automated and manual (real estate).

Finally, this is not “investment advice.” I am not suggesting that you follow anything here – in fact, for reasons I’ll explain below, you probably shouldn’t follow anything here.

Here’s my current breakout:

Cash & Savings: 40%

U.S. Treasuries: 12%

Real Estate – Senior Secured Loans: 12%

Equities: 10%

Angel Investments: 8%

Municipal Bonds: 5%

Real Equity – Equity in Individual Properties: 5%

Miscellaneous (Risk Parity Fund): 3%

Crypto (Bitcoin, Ethereum, Others): 2%

“Investment Grade” Corporate Bonds: 2%

I have an extremely high allocation to Cash & Savings and Treasuries, and it’s there because I sold a lot of positions in the second half of 2018 and am sitting on funds right now.

You could view this portfolio as following the “barbell strategy,” where you invest mostly in safer, lower-yielding assets, and then put the rest in higher-risk, higher-potential-return assets.

However, my total percentage in “safer” assets (~60%) is probably too low to meet the traditional definition.

Unfortunately, I can’t change my allocation much at the moment because many higher-risk assets are also illiquid (real estate, angel investments, etc.).

If there’s an actual market crash and the S&P drops by, say, 30-50%, I would start increasing my Equities allocation to 30-40%.

Portfolio = Market View + Personal Circumstances

I mostly agree with Taleb’s quote at the top – ask someone what’s in their portfolio if you want to know what they think about the economy and the markets.

But I would add one point: your personal circumstances also factor in quite heavily.

As an extreme example, even if you’re very bullish, it would be crazy to invest 100% in high-growth stocks if you’re 70 years old, retired, and need to stay alive for another 10-20 years.

And if you have irregular income, or you just earned a huge windfall from selling your company, it would also be crazy to put everything into high-risk assets right away.

In general, I think people tend to place too much faith in the financial markets and overlook several factors:

The timing of contributions and withdrawals makes a huge difference – this is why you can’t take those online “returns calculators” seriously. Does anyone actually put $1 million in an S&P index fund at age 30, never touch it for 30-40 years, and then withdraw all the funds?

There is no way to know your “risk tolerance” until you start losing large amounts of money. A lot of people say they’re fine with losing 40-50%, but when it happens, they panic and immediately start selling. I still remember the markets in 2007-2009 when everyone thought the world was ending.

Government policy (QE, QT, interest rates) now affects the markets more than ever, so future performance is likely to diverge significantly from historical performance.

I’m not saying that you shouldn’t invest, but I don’t think it’s a wise idea to rely 100% on an index fund to pay for your retirement.

My Current Market View

Over the last few months, everyone turned bearish as the S&P experienced a big sell-off and as stock markets in places like the U.K., Germany, and China fell by 10-20%+ for the year.

Nothing seemed to work, as ~90% of asset classes posted negative total returns for the year.

Many news stories have pointed to trade wars, political instability, doubts about global growth, and rising interest rates to explain the poor market performance and volatility in 2018.

I am also quite bearish, but for somewhat different reasons.

Put simply, the Federal Reserve and other central banks have massively distorted financial markets since the 2008-2009 crisis by injecting over $12 trillion of liquidity into the system with quantitative easing.

The Fed also dropped interest rates to ~0%, and banks in Europe and Japan followed, with some eventually setting negative rates.

These policies led to a big increase in stock markets worldwide, but barely affected the “real economy”; they also explain why the wealthy have become even wealthier over the past ~10 years and the middle class is on its deathbed.

Take a look at the charts, and you’ll see how much of a stretch it is to say that QE had any impact on GDP growth in the U.S., EU, U.K., or Japan.

I like this graph from the Federal Reserve Bank of St. Louis on the Fed’s Total Assets vs. the S&P 500:

Or, for even more fun, take a look at this one from Yardeni Research about the S&P 500 vs. the Total Assets of the Fed + ECB + BOJ:

Now that the Fed is enacting “quantitative tightening” by letting the bonds on its Balance Sheet mature, it’s only logical to expect market declines as it reverses its policy.

Yet the central bankers want us to believe that “everything will be OK” as they tighten monetary policy and reduce their Balance Sheets.

Well… sort of.

At least one central banker admitted the truth before ascending to his current position:

“Right now, we are buying the market, effectively, and private capital will begin to leave that activity and find something else to do. So when it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response.”

-Jerome Powell, October 2012 FOMC Meeting

My Personal Circumstances

Beyond just my bearish views, I’ve also allocated very little to Equities for another simple reason: at this stage, I have more downside than upside from investing.

Put differently, if my net worth increased by 50%, my life would barely change. But if it fell by 50%, that would be a catastrophic loss.

Also, it’s highly unlikely that I will be earning the same level of income from this business far into the future.

I anticipate much lower income when I’m older, which means that I can’t take huge risks and then make up for next year’s giant loss 10 years from now.

It’s similar to a startup founder who ran his/her company for ~10 years, sold it, and earned a windfall from the sale: nicely done, but who knows if it will happen again.

My Current Portfolio

Now I’ll go through the different categories and explain my reasoning for each one:

Cash & Savings (40%)

I am parking cash here to earn 2-3% interest while I wait for the markets to drop further.

The 2-3% interest rates currently offered by high-yield savings accounts and CDs in the U.S. are not great, but a 2-3% yield is a whole lot better than losing ~6%, as the S&P 500 did in 2018.

And this yield at least lets me keep pace with inflation – unlike the rates offered several years ago before the Fed began hiking interest rates.

I am thinking of shifting some Cash into physical Gold or putting more into Treasuries or Municipal Bonds, but I don’t plan to make big changes until the end of the year.

U.S. Treasuries (12%)

I own a mix of short-term and long-term Treasuries, held in various low-fee funds.

The short-term ones are less sensitive to interest rates because of their short durations, while the long-term ones are much more sensitive.

I don’t own 100% short-term Treasuries because, contrary to expectations, I think there’s a decent chance that the Fed could slash interest rates if there’s a market crash or recession.

If that happens, 30-year Treasury prices should jump up, just as they did at the end of 2008.

I don’t plan to hold Treasuries long-term because I assume that QT and the massive deficits the U.S. is running will eventually make a very negative impact on prices.

Real Estate – Senior Secured Loans (12%)

Following the JOBS Act in 2012, dozens of real estate crowdfunding sites have sprung up.

I experimented with some of the more credible ones (Fundrise, PeerStreet, RealtyShares), but RealtyShares announced it was shutting down a few months ago, so maybe it wasn’t so credible.

So far, my debt investments have yielded about what I expected, with interest rates above those offered by savings accounts, CDs, and Treasuries, and no defaults.

I prefer senior real estate loans to P2P lending because the loans are all backed by collateral, and I can pick the types of loans more easily.

For example, I almost always avoid single-family owned homes because I don’t like the risks.

I like commercial real estate, especially multifamily and student housing properties, with occasional office/retail/industrial ones mixed in.

I don’t plan to increase my allocation here because I want to see how the loans perform over several years, especially if prices fall by 30%+ in the next recession.

Equities (10%)

These are a mix of growth and value-oriented stocks, divided between the U.S. and international markets.

I have these mostly because I experimented with Wealthfront, and it allocated a certain percentage automatically based on my “Risk Score.”

Most financial advisors would say that someone in my age range should have a much higher Equities allocation, such as 60% or 80%.

But there’s no way I’m willing to risk losing 30% or 40% of everything if global stock markets decline by 50%.

So, this one is “wait and see” until QT finishes, markets decline by 50%+, or something even worse happens.

Angel Investments (8%)

Back in 2014-2015, when the Fed finished QE3, I thought the markets were overvalued and that everything would come crashing down.

I was a few years early on that one, but as a result of this thinking, I started looking into alternative investments that weren’t as correlated with the stock market – such as early-stage tech startups via AngelList.

I’ve had a few exits, a few shutdowns, and a few cases where I doubled down on companies that were doing well.

This one is in the “too soon to say” category because it might take 5-10 years to see the full results of these deals, and there’s no liquidity until exit or shutdown.

I’m not planning to put much more into this category because 8% is more than enough for my highest-risk, least-liquid asset.

Also, individual investors are at a disadvantage in angel investing due to dilution in later funding rounds.

And I do not live in Silicon Valley and do not have special insight into most startups, so maybe I shouldn’t even be here in the first place.

Municipal Bonds (5%)

Wealthfront automatically allocated this one due to my relatively low Risk Score.

I might put more into this category and buy a muni bond fund; unlike Treasuries, they do have credit risk, but in my tax bracket, the favorable tax treatment makes a big difference.

Real Equity – Equity in Individual Properties (5%)

I like real estate as an asset class for many reasons, but a big one is psychological: I’m not tempted to check prices every 5 seconds and flip out when there’s a decline.

Also, there are many different ways to invest, including different strategies (core, core-plus, value-added, opportunistic), different property types, and different geographies.

Prices of coastal real estate in the U.S. have been “elevated,” to say the least, so I’ve focused on multifamily and student housing properties and eREITs in less expensive regions like the Midwest and South.

This one is in the “too soon to say” category because some of these deals have multi-year holding periods.

I don’t plan to allocate much more here because I’m afraid that more of these crowdfunding sites will shut down or otherwise not survive.

Miscellaneous (Risk Parity Fund) (3%)

This is another one in the “Wealthfront automation” category. The intent was to imitate AQR’s “Risk Parity” fund, but it did not work so well – and it didn’t work so well for AQR, either.

I probably should have disabled this setting in Wealthfront, but I’ll leave it for now and see if it improves this year at all.

Crypto (Bitcoin, Ethereum, Others) (2%)

Ah, crypto.

I bought (some) Bitcoin for under $1,000 back in 2013, held on for years as the price fell, and then sold it for $15,000 – $20,000 in late 2017 and early 2018, earning almost 20x.

Then, I put a portion of the proceeds into altcoins and lost around 70%.

Thus, crypto has the distinction of delivering both my best returns and my worst returns of the past year.

I don’t plan to put more into this category because 2% is more than enough for something that is, essentially, pure speculation.

I think blockchain as technology is promising, but I have less confidence in cryptocurrencies as “assets.”

There’s a chance that Bitcoin could reach $100,000, and there’s an equally good chance that it could fall to $0.

“Investment Grade” Corporate Bonds (2%)

These are here because of a Vanguard fund that invests in conservative stocks and corporate bonds.

I have no interest in increasing my allocation here because I’m very bearish on corporate bonds.

The credit quality of most corporate bonds is overstated (see: the percentage of “covenant-lite” loans), and high corporate leverage is one of the biggest risks for the entire economy right now.

Up Next in This Series

Over the next few weeks, I’ll cover a few related topics and outlooks in different areas:

The Bull Case and the Bear Case for the economy and markets as a whole.

Which finance jobs look appealing going into 2019 (and beyond), and which ones you should avoid.

And how recruiting might change in coming years.

Stay tuned.

And feel free to laugh at my ultra-bearish views, especially if the market is up 30% this year.

The post My 2019 Financial Market Outlook – According to My Current Portfolio appeared first on Mergers & Inquisitions.

from ronnykblair digest https://www.mergersandinquisitions.com/2019-financial-market-outlook/

0 notes

Text

Day 4 - Romantic beach walks

Another morning, and another nine plus hours of sleep. I think that being on holidays definitely agrees with me, though after all of the drinking yesterday, both of us are a little slower to rise this morning. Which was a shame really, given that by the time we got to the breakfast buffet, most of the good stuff was gone and we had to wait for everything to be restocked in island time.

Demolishing a few pastries and some toast while we waited for the bacon and eggs to get done was a worthwhile food investment. We tried to make a bit of conversation, but were too hungry to speak for any real length of time. With breakfast out of the way, it was time for the usual ritual of malaria tablets and figuring out what to do for the day. We were incredibly excited at the prospect of seeing some sunshine poke through the clouds and promptly decided that a nice and long romantic walk on the beach would be a great way to pass the time and certainly go a long way to help get rid of all the excess calories consumed at breakfast.

Being the responsible travellers that we are, we lathered ourselves in sunscreen then went to town on deet, our mosquito repellent friend. Hat, sunglasses and no thongs for me were the order of the day as we would be walking along the stunning beaches of Vanuatu.

We got onto the sand at our resort and saw our friends perched on the beach chairs with a drink in hand waving us goodbye and wishing us good luck. The sand felt extremely soft and nice to walk on, and I was told that this is very good for my feet. It was only about fifty meters up the beach that our first challenge came through where the beach changed from soft sand to being hard gravel.

Gritting my teeth and moving at the speed of a ninety year old man, we walked past what seemed like an old and abandoned resort. We took some nice photos and continued the painful experience of walking on gravel with the view of getting close to the second beach where soft sand would once again welcome us. After what seemed like an eternity of fifteen minutes of walking barefoot on gravel, we finally got to the second beach that had the soft sand. Problem at this stage was that it looked like an old abandoned ship wreck where there were old boats there, glass along the beach and remains of several old bonfires.

We both realised that this entire experience was very far removed from the usual romantic beach walks that you see in all the movies and imagine yourself doing, so we decided to head back along the main street to our resort. Feeling like a true local as I walked along the road barefoot, it wasn’t long before we were back at our resort desperately craving a drink. We went back to our cottage and cracked open the last two Coronas that we had and proceeded to relax on our balcony while reading and having a cold beer in hand.

Unlike yesterday where I was able to crack open the Coronas with no issues, these ones did not want to play ball and ended up cutting my knuckles when trying to pop the lids. While only tiny, the cuts are right on the joint which means that I feel them every time I open or close my hands. Michelle being the super planner and packer that she is, packed a full first aid kit, and was smiling with glee at the fact that she got to use it, but not so much at the fact that she had to put her beer down for a few minutes and help me to apply antiseptic cream, because you know, we are safe travellers and a little cut can go a long way. Finally then, it was time to sit back down and enjoy a few hours reading on the balcony with a mildly warm beer in hand.

That is how we spent the afternoon, until we decided it was time to have some food, and we headed out to town. Getting on a bus proved to be a harder experience today as two of the drivers had no idea where we wanted to go, or they just pretended not to speak English. Either way, the third guy seemed to understand that we wanted to go to the centre of the city, and off we were on our merry way.

We pulled up at the Brewery, ordered the nice chicken wings that we had yesterday and a few beers to help wash it all down with. We spent a few hours like this, chatting away and watching the traffic go past, absolutely stunned and confused by the fact that there was no locals or tourists drinking at one of the few bars in Port Villa. On our travels yesterday, a barkeep at the Warhorse told us that they host karaoke nights on a Thursday, so we figured we would go there, because if singing badly in front of other people while drunk doesn’t pull a crowd, we didn’t know what would.

We got some bottled water and some beer for later, and this time a bus was easy to get, so before we knew it we were entering through the doors of the Warhorse.

To our surprise and delight, there were all of five other people seated there drinking, all who looked like expats, and we were incredibly happy to see someone else at a bar apart from us. We sat down, ordered a jug of the local beer and a kilo of beef ribs, with beef being the speciality around this part of town, and sat down to see how the vibe of this place would build.

Sure enough, by about 6:30pm there were a few families that had made their way down, as well as a few tourists, and the place started to get busy and have that buzz of conversation and clinking glasses that one comes to expect from a pub. We played a few games of pool quite badly, with both of us blaming the bad pool queues and the lack of chalk, especially when two out of the three games one of us had sunk the black 8 ball within two shots of starting the game. We had fun though, and finished off our jug just as the karaoke was about to start. On our way out the door we ran into our newly found resort friends who persuaded us to stay a while longer and listen to the local singing talent.

This meant ordering a few more drinks and claiming a spot at the bar, before the most over the top, stereotypical American cowboy grabbed the microphone and got the proceedings under way. White long sleeved, collared shirt, wide brimmed cowboy hat, old jeans, and white cowboy boots with red flames all over them is what he was wearing, all whilst holding a cigarette and beer in one hand with a microphone in the other. It was truly a stereotypical masterpiece of Americana.

So, the party got started. First up was a young girl who was probably no older than fourteen and she was determined to rock the stage. If I had my eyes closed I would have imagined that it was a voice of a rough and tumble thirty year old lumberjack who was keen to let loose for the night, but no, it was a fourteen year old white girl dressed in a local island dress that was up on stage. The assault on the ears thankfully finished, but our interest was piqued when we were told it was her brother up next. Looking slightly like an island cross between Eminem and Post Malone, her brother then continued the assault on our ears with what can only be described as a consistent pitch with absolutely no variation. It was like listening to radio static that was out of tune and out of time, and it would just not stop.

Thankfully, the next five or so songs were sung by enthusiastic expats who were barely average, but it felt like I was listening to the opera compared to what had come before. Not to be outdone in terms of effort, the brother and sister duo each had three more goes, just in case we had forgotten how badly they had sounded the first time. It was through one of the performances that I noticed that they were both wearing a cochlear implant, which made me feel like a right old twat for about a millisecond. I am all up for inclusion and good on them for having fun, but it made me realise that having tough conversations with your children is something that needs to be done at a very early age.

It was somewhere at this stage that my darling angel Michelle decided to take the stage with a Whitney Houston classic of I Want To Dance with Somebody. She was fired up and took to the mic and the stage with the gusto and zeal of a true performer. The first few verses she was a bit behind on, but that’s ok because she was doing her best to imitate Pink on stage and get the crowd involved. Walking up and down the stage and throwing her arms around everywhere unfortunately did nothing to get the crowd on her side, and after our post show debrief, we concluded that this was what made the microphones go dodgy and not allow her to do her best performance. The crowds and I were certainly well entertained, and I am glad that she proof reads these blogs before I post them up otherwise I could end up in a lot of trouble.

With that done, we decided it was time to head home, and it was probably the first time on our trip that we had to wait for about five minutes to get a bus. We arrived home safe, and feeling tired from the day’s exploits, we headed straight to bed. Tomorrow is our last full day of our holiday, so let’s see if sunshine rears it’s head through the clouds to give us the impression that we have been on a tropical island holiday. Until tomorrow, wishing you plenty of drinks and karaoke from the islands of Vanuatu.

Your performers,

Boj and Michelle

0 notes

Text

Event-Driven Weekly - Week Ending 20 July 2018

This week in Asia Event-Driven Land we have a slew of interesting updates and a couple of interesting deals.

In some of the event pieces, there is considerable data below the fold and they may be worth the time for those involved or looking to get involved.

M&A

Itochu Corp (8001 JP) Partial TOB for FamilyMart UNY Hldgs (8028 JP)

On Friday the 13th after the close, Itochu finally announced the receipt of approvals and the imminent launch of its Partial Tender Offer to buy 10,880,400 shares (~8.6%) of FamilyMart UNY in a Tender Offer which commenced 17th July and closes 16th August, designed to get Itochu to a stake above 50%.

Despite the expectations some may have had ITochu would bump because the price had extended beyond the originally proposed price of ¥11,000/share, the Tender Offer price was not lifted. There is no minimum but Itochu makes it clear in the document that if it does not get all the shares it needs, it will buy shares in the market or by other means to eventually get to 50.1%. Presumably that could mean purchasing shares directly from the company at some point, which might dilute minorities.

¥11,000 had proven to be a floor since it powered through a few days after the announcement in what looked like a short squeeze. It then came back down as it looked like the squeezers got squeezed.

While the theoretical minimum proration is 14.9%, actual results will likely come in much higher. There will be follow-on index effects as MSCI, FTSE, TOPIX, and JPNK400 trackers sell some shares as float drops, but real float will drop more than calculated float. Fundamentals against peers suggest FamilyMart is a short. And there is another reason it might be - discussed in the BOJ-Nikkei 225 piece noted below.

After the price fall this week, the event has become a fair bit more interesting to play as an arb, but one must be highly aware of the risks of one's own estimates of the register structure and tendencies. Much more detail in the link below.

Travis' most recent piece on the subject is ITOCHU Tender for Familymart - Going Ahead As Planned But Remember - Greedy Bears Get Stuck. The history of this event is covered in the insights below.

Date Title 20 April 2018 Itochu Tender For FamilyMart - Winnie Sees a Hunny Pot But Greedy Bears Get Stuck 20 April 2018 Itochu's Tender Offer Provides an Attractive Profit-Taking Opportunity 30 April 2018 Did Itochu & BOJ Buying of FamilyMart-UNY in the Past Year Squeeze It Vs Comps? 16 June 2018 FamilyMart UNY Tender - Will It Go As Planned?

Alps Electric (6770 JP) / Alpine (6816 JP) Merger