#best roth ira accounts

Explore tagged Tumblr posts

Text

A Strategic Approach to College Savings Using Life Insurance for Long-Term Financial Security

Saving for college is a significant financial commitment, and families are constantly seeking strategies to ease this burden. One often overlooked option is saving for college with life insurance. This strategy offers flexibility and financial stability since it not only creates a safety net but also lets cash worth increase with time. Understanding the benefits of a life insurance college fund strategy can help families create a versatile and effective college savings plan.

What is Saving for College with Life Insurance?

Using a permanent life insurance policy—such as whole life or universal life insurance—saving for college with life insurance means building cash worth over time. Permanent life insurance policies generate cash value that is accessible to the policyholder for the duration of their lifetime, whereas term life insurance only offers coverage for a predetermined time. This growing cash value can be borrowed against or withdrawn to help cover the costs of college tuition, books, or other educational expenses.

Why Consider a Life Insurance College Fund Strategy?

A life insurance college fund strategy offers several unique advantages over traditional savings plans. Unlike 529 plans or other college savings accounts, the cash value in a life insurance policy can be used for any purpose, not just education. This flexibility ensures that if your child decides not to attend college, the money can still be utilized for other significant financial goals. Furthermore, the cash value grows tax-deferred, making this strategy a valuable tool for building long-term wealth.

How Does Life Insurance Help with College Savings?

The life insurance college fund strategy is particularly appealing because of the potential for tax-advantaged growth. As premiums are paid into the policy, a portion goes toward building cash value. Over time, this cash value grows, and when it’s time to pay for college, the policyholder can borrow against or withdraw from it. Since loans from life insurance policies are not taxed, it’s a tax-efficient way to access funds for higher education.

Flexibility and Security in College Planning

Unlike traditional college savings vehicles, saving for college with life insurance provides more flexibility. In cases where a child may receive scholarships or choose an alternative career path, the funds in a 529 plan can face tax penalties if used for non-educational purposes. Life insurance, on the other hand, does not have this limitation. The cash value remains available for a wide range of uses, offering financial security beyond education.

Start Early for Maximum Benefits

Starting alife insurance college fund strategy early is crucial for maximizing the benefits. The earlier a policy is purchased, the more time the cash value has to accumulate. By the time college expenses arise, there will be a substantial amount available to cover educational costs. Additionally, starting early ensures lower premiums, making it a more affordable long-term solution for families planning for the future.

Conclusion

Saving for college with life insurance is a flexible and tax-efficient strategy that provides both financial security and peace of mind. With a life insurance college fund strategy, families can build wealth, ensure protection, and fund educational expenses without facing the restrictions of traditional savings plans. Visit retirenowis.com for professional advice to investigate how this strategy might be customized to meet your financial objectives.

Blog Source URL :

#IRA rollover#rollover IRA#401k to IRA rollover#retirement plan rollover#tax-free rollover#rollover retirement funds#retirenow#retire now#Saving for College with Life Insurance#Children’s College Fund Investment#Life Insurance College Fund Strategy#Best Life Insurance for College Savings#College Savings Plans with Life Insurance#Investing in Life Insurance for College#Life Insurance as College Fund#Financial Planning for College with Life Insurance#Tax Benefits of Life Insurance for College Savings#Life Insurance Investment for Education Fund#College Fund Financial Consulting#Life Insurance College Savings Plan#IRA Rollover Guide#Roth IRA Rollover Process#Retirement Account Rollover#How to Rollover 401(k) to IRA#Roth IRA Conversion#IRA Rollover Rules#Rollover IRA vs. Roth IRA#401(k) to Roth IRA Rollover#IRA Rollover Financial Consulting#Best IRA Rollover Options

0 notes

Text

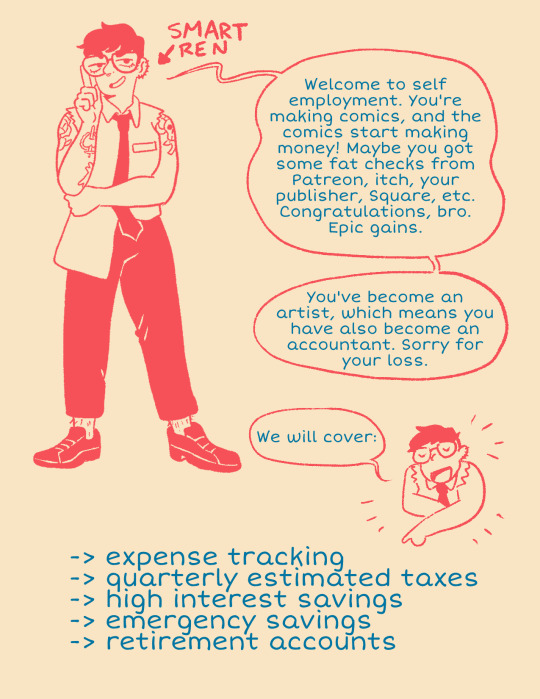

"Basic Money Guide for Comic Artists and Other Freelancers" [PRINT EDITION] is here, available in my shop!

One of the best gifts I gave myself before becoming full time self employed was a Roth IRA, so if you're interested in self employment (or even if you aren't but you want an emergency savings account) check out this zine!

Give a copy to the freelancer in ur life <3

Read for free here <3

Check out Secret Room Press! They printed this zine for me.

282 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about Investing for Beginners

Fundamentals of investing:

What’s the REAL Rate of Return on the Stock Market?

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Dark Magic of Financial Horcruxes: How and Why to Diversify Your Assets

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Booms, Busts, Bubbles, and Beanie Babies: How Economic Cycles Work

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch series:

Investing Deathmatch: Managed Funds vs. Index Funds

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Stocks vs. Bonds

Investing Deathmatch: Timing the Market vs. Time IN the Market

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

Investing Deathmatch: What Happens in a Bull Market vs. a Bear Market

Now that we’ve covered the basics, are you ready to invest but don’t know where to begin? We recommend starting small with micro-investing through our partner Acorns. They’ll round up your purchases to the nearest dollar and invest the change in a nicely diversified portfolio of stocks, bonds, and ETFs. Easy as eating pancakes:

Start saving small with Acorns

Alternative investments:

Small Business Investing: A Kinder, Gentler Alternative to the Stock Market

Bullshit Reasons Not to Buy a House: Refuted

Investing in Cryptocurrency is Bad and Stupid

So I Got Chickens, Part 1: Return on Investment

Twelve Reasons Senior Pets Are an Awesome Investment

How To Save for Retirement When You Make Less Than $30,000 a Year

Understanding the stock market:

Ask the Bitches Pandemic Lightning Round: “Did Congress Really Give $1.5 Trillion to Wall Street?”

Season 3, Episode 2: “I Inherited Money. Should I Pay Off Debt, Invest It, or Blow It All on a Car?”

Money Is Fake and GameStop Is King: What Happened When Reddit and a Meme Stock Tanked Hedge Funds

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Season 4, Episode 1: “Index Funds Include Unethical Companies. Can I Still Invest in Them, or Does That Make Me a Monster?”

Retirement plans:

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over

How to Painlessly Run the Gauntlet of a 401k Rollover

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

Workplace Benefits and Other Cool Side Effects of Employment

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

Got a retirement plan already? How about three or four? Have you been leaving a trail of abandoned 401(k)s behind you at every employer you quit? Did we just become best friends? Because that was literally my story until recently. Our partner Capitalize will help you quickly and painlessly get through a 401(k) rollover:

Roll over your retirement fund with Capitalize

Recessions:

Season 1, Episode 12: “Should I Believe the Fear-Mongering about Another Recession?”

There’s a Storm a’Comin’: What We Know About the Next Recession

Ask the Bitches: How Do I Prepare for a Recession?

A Brief History of the 2008 Crash and Recession: We Were All So Fucked

Ask the Bitches Pandemic Lightning Round: “Is This the Right Time To Start Investing?”

#investing#how to invest#stock market#finance#personal finance#investing in stocks#retirement fund#retirement account#investing for beginners#investing 101

143 notes

·

View notes

Text

I see a disturbing number of people, mostly millennials, these days, who have significant incomes and are starting to amass significant savings, who have terrible financial management skills. People who live at home with parents and get a full time job can accumulate money really fast. A lot of people are letting huge amounts of money, like sometimes as much as $20,000 or more, accumulate in checking accounts where it is earning either no interest or negligible interest.

Because inflation is high (over 3% these days), you are effectively losing money when it sits there. Also you're allowing the bank to profit off it; it's lending your money out to other people, often at interest rates as high as 6-7% or more, and it's not paying you for it.

If you have more than maybe around $3000 dollars in an account, you want that money earning interest. Here are things you can do to earn more from your money:

Open a savings account at a higher yield. Go to a different bank if necessary. CIT Bank has rates around 5% these days.

Pay off high interest rate debt but not low-interest rate debt. If the interest rate is above about 7-8% definitely make it a priority to pay it off ASAP. If it is above 5% it is still better to pay it off than to sit on your money. If it is much below 5%, pay it off as slowly as possible (minimum payment only) because there are risk-free ways to earn more interest on your money.

If you don't need the money in the short-term, consider a CD (Certificate of Deposit) which offers a fixed interest rate over a certain time. Often you can get a slightly higher rate by tying your money up for 3 months or 6 months or sometimes even longer. These are good options if you have a specific expenditure in your future, like perhaps moving or buying a home, but you know it won't happen until after a certain date.

Open a brokerage account. Brokerage accounts allow you to buy and sell investments such as stocks, mutual funds, or bonds, which include CD's from banks as well as treasury and municipal bonds and corporate bonds. You get more options for buying CD's (i.e. you can compare many different banks side-by-side, buy CD with the best rate, and manage multiple CD's within a single interface.) Most brokerage accounts have no fees and typically no or very low minimum investments. There is no reason not to have one if you have a few thousand dollars.

In a brokerage account, buy a money market mutual fund. Look for one with no load and no transaction fee, a high yield, and a low expense ratio, and a fixed share price of $1 per share. My two favorite are SWVXX and SNSXX. SWVXX has a higher yield (about 5.19%) whereas SNSXX has a lower yield (just over 5%) but is non-taxable on state income taxes, so SNSXX is a better choice if you have a high state tax rate, otherwise SWVXX is better.

Consider opening a Roth IRA if you haven't, and then, if able, contribute the maximum amount each year. You are allowed to make a contribution that counts towards the previous year, up until the tax filing deadline of the current year. So for example today it is Mar. 14th, 2024, so you can open a Roth IRA today and contribute the max ($6,500) for the 2023 year and also the max ($7,000) for 2024, for a total of $13,500. The main advantage of a Roth IRA is that the money in them can grow tax-free. Roth IRA's benefit anyone able to have one (the richest people are not allowed to contribute to them) and are especially important for people who are self-employed, change jobs a lot, or never work full-time, so they don't have a consistent employee-provided retirement plan.

Consider investing in stocks. Stocks are riskier (in that their price changes, and you can lose money when investing in them), but tend to have a higher yield than savings and money market accounts and funds. The simplest way to buy stocks is to buy an ETF (exchange-traded-fund). I recommend buying one that follows the S&P 500 and has a low expense ratio like SPY or VOO. Whatever you buy, reinvest the dividends and let it grow, contribute a little money every year so are putting in money even in years the market is down. On average you get about a 10% return in the market but it is unpredictable and you will lose in some years, but that's okay, you're not retiring for many decades and the money will have grown a lot by then.

There are options regardless of your risk profile. It is throwing your money away to let a lot of money sit in a checking account. At a bare minimum, go for a high-yield savings account, CD, or better yet get a brokerage account, put it in high-yield money market funds like SWVXX, shop around for CD's or other bonds with the highest rates, and if you are able to tolerate some risk and want a higher return, consider putting some money in more aggressive investments like stocks.

I am 100% for tax reform and other reform to curb the extreme concentration of wealth in the hands of a few, but it's also important to take your financial situation into your own hands. Get financially comfortable. Get a stake in the US economy. Empower yourself so you can live better and help your family, friends, and the causes you care about.

12 notes

·

View notes

Note

I want to FIRE! Do you have any tips for that ;)

Hi love! While I'm not committed to their FIRE movement per se, here are some of my best tips to set yourself up for financial success:

Diligently keep track of your income and expenses. Audit every week or month to give yourself an honest look at your financial activity

Create financial goals and a realistic budget to help you achieve them

Prioritize saving up a 6-month emergency fund, maxing out your Roth IRA (or backdoor Roth IRA) and HSA account (if in the U.S.)

Purchase high-quality, timeless items that are built to last; It's cheaper in the long run to maintain items vs. constantly repurchasing items if you have the option

Create multiple sources of income: A 9-5 job, investments, side hustle, digital products, etc. Find ways to monetize activities you would enjoy doing without earning a dime

Focus on building a strong network and high-value, transferable skills: Even if you plan on working as an employee forever (no shame in that – it's a great way to get a steady paycheck), always strategize your career in a way that would leave you equipped to make it on your own. You need to be in the driver's seat of your career and financial life at all times

Make food at home, take care of your health, and take advantage of preventative medical testing, screenings, and procedures. Losing your health (physical and mental) is the easiest way to ruin your life satisfaction and your finances

Hope this helps xx

#finance#moneymindset#financial planning#savings tips#personal investments#female entrepreneurs#femme fatale#dark femininity#dark feminine energy#successhabits#success mindset#goal setting#it girl#queen energy#dream girl#female excellence#female power#femmefatalevibe#fire movement

76 notes

·

View notes

Text

Here are just two of the corporate giveaways hidden in the rushed, must-pass, end-of-year budget bill

Yesterday, Congress finally voted through the must-pass, end-of-year budget bill. As has become routine, this bill was stalled right until the final moment, so that Congressjerks could cram the 4,000-page, $1.7 trillion package with special favors for their donors, at the expense of the rest of the country.

This year’s budget package included a couple of especially egregious doozies, which were reported out for The American Prospect by Lee Harris (who covered a grotesque retirement giveaway for the ultra-rich) and Doraj Facundo (who covered a safety giveaway to Boeing and its lethal fleet of 737 Max airplanes).

Let’s start with the retirement scam. The budget bill includes Rep Richie Neal’s [DINO-MA] SECURE Act 2.0, which gives savers with retirement funds until age 75 to cash out their retirement savings — netting an extra three years of tax-free growth for the lucky, tiny minority with substantial retirement savings. This follows on Neal’s SECURE Act 1.0 of 2019, when the age was raised from 70.5 to 72.

The tax-exempt retirement savings account is a Carter-era bargain that replaced real pensions — ones that guaranteed that you wouldn’t starve or freeze to death when you retired — with accounts that let people gamble on the stock market, to be the suckers at Wall Street’s poker table:

https://pluralistic.net/2020/07/25/derechos-humanos/#are-there-no-poorhouses

The market-based gambler’s pension is a catastrophic failure. Half of Americans have no retirement savings. Of the half that have any savings, the vast majority have almost nothing saved:

https://www.federalreserve.gov/econres/scf/dataviz/scf/chart/#series:Retirement_Accounts;demographic:all;population:all;units:have

All in all, America has a $7 trillion retirement savings shortfall:

https://crr.bc.edu/wp-content/uploads/2019/10/IB_19-16.pdf

But for a tiny minority of the ultra-rich, tax-free savings accounts like ROTH IRAs are a means of avoiding even the paltry capital gains tax that you have to pay if you own things for a living, rather than doing things for a living. Propublica’s IRS Files revealed how ghouls like Peter Thiel avoided tax on billions in “passive income” by abusing tax-free savings accounts that were supposed to benefit the “middle class”:

https://pluralistic.net/2021/06/26/wax-rothful/#thiels-gambit

Meanwhile, Social Security is crumbling, thanks to a sustained attack on it by the business lobby and its friends in both parties. Progressive Dems had sought to amend SECURE Act 2.0 by inserting some clauses to shore up Social Security, and none of these were included in the final bill.

One of the fixes that died was the Savings Penalty Elimination Act, introduced by Senators Sherrod Brown [D-OH] and Rob Portman [R-OH]. This act would have tweaked the means-testing for Supplemental Security Income, which supports 8m low-income disabled adults and kids. Right now, you can’t collect SSI if you have $2k in the bank, a limit that hasn’t been adjusted for inflation since the 1980s (adjusted for inflation, $2k in 1980 is $7226.00 in 2022).

The $2k savings cap means that you have to be substantially below the poverty level to receive $585/month in SSI assistance — this being the only source of income for the majority of SSI recipients. Means-testing is a self-immolating fetish for corporate Dems and in retrospect, this betrayal seems inevitable:

https://pluralistic.net/2022/05/03/utopia-of-rules/#in-triplicate

(Notice how no one proposes means-testing billionaires when they get PPP loans or hundreds of millions in IRS “refunds” — like Trump, who paid substantially less tax than you did:)

https://www.cnbc.com/2022/12/21/trump-income-tax-returns-detailed-in-new-report-.html

And it was a betrayal: progressive Dems bargained with Neal and co not to publicly condemn SECURE Act 2.0 if they could get some concessions for the 8 million poorest disabled people in America. In the end, Neal rug-pulled them. Of course he did! This is Richie Fucking Neal, the best friend the Trump tax giveaway ever had:

https://pluralistic.net/2020/07/13/youre-still-the-product/#richie-neal

As with everything Neal touches, this screws poor people in multiple ways. First, it leaves the SSI cap intact. But it also creates a giant unfunded liability in the federal budget. Technically, there’s no reason this should lead to cuts. The US Treasury can’t run out of dollars, and giveaways to the rich are only mildly inflationary, since rich people put their money in the bank and mostly spend it on buying politicians, not goods.

But because of the delusion that currency producers like the US Treasury have the same constraints as currency users like you and me, Congress will need to come up with “Pay Fors” in future budgets to “make up for” the money they’re giving to rich people with SECURE Act 2.0. Dollars to toenail clippings, they’ll do that by hacking away at the tattered remains of the US social safety net.

Fear not, you don’t need to be a desperately poor disabled person or child to get fucked over by late additions to a 4,000 page must-pass bill! If you can afford to get on an airplane, Congress has something for you, too!

Remember when Boeing (the monopoly US airplane manufacturer that squandered $43b on stock buybacks and had to borrow $14b from the US public to survive the pandemic) told the FAA that it could self-certify its 737 Max airplanes, and then killed hundreds and hundreds of people with its defective planes?

https://pluralistic.net/2020/03/12/boeing-crashes/#boeing

The 737 Max was unsafe for many reasons, but one glaring factor was the fact that Boeing sold some of its core safety as “extras” — like they were downloadable content for your Fortnite character — leading to multiple crashes in which all lives were lost:

https://apnews.com/article/ethiopia-indonesia-accidents-ap-top-news-international-news-140576a8e9d4449eae646c8c479fdc3a

Boeing was forced to take the 737 Max out of service, but it eventually brought the plane back, “fixing” the problems by renaming the “737 Max” to the “737 8”:

https://pluralistic.net/2020/08/20/dubious-quantitative-residue/#737-8

Supposedly, Boeing has been diligently working on fixing the problems with its defective jets that can’t be addressed by a rebranding campaign. This wasn’t voluntary: the 2020 Aircraft Certification, Safety, and Accountability Act required Boeing — and every other manufacturer whose aircraft were certified by the FAA — to meet new minimum safety standards by December 27, 2022.

Every manufacturer met that deadline, except Boeing, and someone amended the budget bill to give the company three more years to meet these security standards. Critically, the new security measures, when they come, will be certified by an FAA that Republicans will control, thanks to the House changing hands.

https://prospect.org/infrastructure/transportation/government-spending-bill-waives-aircraft-safety-deadline/

Boeing is slated to ship 1,000 new 737 Maxes, which will fetch $50b for the company. Many of these planes will fly directly over my house, which is on the approach path for Burbank airport. Southwest Air flies dozens of 737 Maxes right over my roof every single day.

As Facundo points out, the FAA can ill afford any more hits to its credibility. It was once the case that if the FAA certified an aircraft, every other country in the world would waive any further certification, so trusting were they of the FAA’s judgment. That is no longer the case: today, the European Aviation Safety Agency does its own aircraft testing, holding jets that enter EU airspace to a higher standard than the FAA does for US planes.

It’s just another reminder that the US doesn’t have “corporate criminals” because the US doesn’t have any meaningful enforcement for corporate crimes. In America, we love our companies like we love our billionaires: too big to fail and too big to jail:

https://pluralistic.net/2021/10/12/no-criminals-no-crimes/#get-out-of-jail-free-card

Image: Ryan Lee (modified) https://www.flickr.com/photos/190784293@N05/50862532686

CC BY 2.0 https://creativecommons.org/licenses/by/2.0/

Henry Wadey (modified) https://commons.wikimedia.org/wiki/File:Flames_%2858765896%29.jpeg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A living room scene, featuring a sofa in the background and a sofa in the foreground. A man's hand reaches into the frame to lift up the corner of the sofa. A broom enters the frame to sweep a pile of dirt under the rug. Mixed in with the dirt are a crashed WWI biplane with Southwest Airlines livery, and an old lady in a rocking chair.]

#pluralistic#secure 2.0#ssi#means testing#irsleaks#fidelity#vanguard#regulatory capture#faa#retirement crisis#retirement#finance#social security#pensions#corruption#congress#aviation#boeing#737 max#must-pass#irs files

84 notes

·

View notes

Text

My New Years Resolutions 2024

(that no one asked for)

Not buying any new clothing/jewelry/accessories which I do not absolutely need (i.e. running shoes need to be changed every 500ish miles)

Less waste! Switching to reusable items such as washable cotton pads, tissues, towels, etc. Focus on longevity over convenience when able to afford.

Try to sell before donating. A lot of donated items actually end up in landfills, etc. Cleaning up and reselling helps ensure items (like an air fryer) goes to a home it will be used in, and i make a few bucks back (instead of Goodwill getting the profit).

Maintain a 3.0 GPA!

Use the Uni gym and cancel outside gym membership, even though I hate being around the college athletes (buncha d*cks with the equipment even though I pay 500$ a quarter for the facility).

More handcrafted gifts for the waifu! (I have a ton of crochet  supplies, I’m gonna do my best and make a scarf or hat!)

Max out Roth IRA and invest money in proper index funds (even tho I want to die everytime I’m forced to stare at them).

Start using a High Yield Savings account (so the spirit of a finance bro stops haunting me).

#let me know y’all’s goals!#they don’t gotta be strict lol#they can be fun too!#I’m trying to be more conscious of waste and consumerism#I’m also trying to be more financially responsible#even tho I suck and will fail at times#cuz coffee#my lil treat#anyway

5 notes

·

View notes

Text

How you should invest in your 20s – housesofinvestors

Introduction

Investing is one of the most important things you can do for your future. It helps build wealth and gives you a chance to really see how much money you’re making over time. But it’s not always easy—especially when you’re young! Here are some tips so that you can invest in your 20s:

Get rid of any high-interest debt

High-interest debt is the worst kind of debt, and it’s one of the biggest threats to your financial future. If you have high-interest debt, it’s time to get rid of it (or at least pay off as much as possible).

Here are some tips for paying off high interest rates:

Only use credit cards when absolutely necessary. If there’s anything about credit cards that makes me want to vomit—and I mean vomit—it’s their exorbitant interest rates. The average APR on a 30 day introductory balance is around 19%. That means if you carry a $10,000 balance with an 18% APR, then every month alone adds up to almost $1,200 in interest charges! And who wants those kinds of monthly payments? No thanks! Instead make sure all purchases are made cash or debit card so that no one has access to any information about them except themselves (this goes double if they’re trying buy something expensive).

Avoid taking out new loans until after graduation day because even though borrowing money now doesn’t seem like much trouble now since everyone else seems so successful at doing this stuff without owing anyone anything back yet either end up paying huge amounts later down road when things go wrong due lack knowledge about how best manage finances during early twenties years where risk taking behavior may increase significantly due lack experience gained beforehand.”

Invest in what you know

Once you’ve completed your high school education, it’s time for the next step in your journey: investing. This may sound like a daunting task, but there are plenty of ways that you can invest in yourself and make sure that you’re doing things that are right for your interests and goals.

Investing in yourself means investing in what makes you happy—whether that’s dancing or playing tennis; volunteering at an animal shelter or helping out at an art gallery; collecting antiques or making music with friends. It also means putting down roots (literally) by moving out of home or getting married so that one day when those kids come along they don’t have to move away from their family again because their parents had big dreams but couldn’t follow through on them due to financial constraints.”

Buy term life insurance

Term life insurance is the best way to protect yourself and your family, since it protects you against the death of someone else.

Look into a Roth IRA

If you’re worried about paying taxes on your income when you invest, a Roth IRA is a great way to keep the money in your pocket—and out of the hands of Uncle Sam.

A Roth IRA can be opened by anyone who has earned income and reaches age 59½ (or 60 if they are disabled). The maximum contribution limit is $6,000 per year ($5,500 if married filing jointly). The IRS lets you contribute more than this amount if you have earned income above that threshold; however, there won’t be any tax deduction for doing so.

The advantage of opening an individual retirement account (IRA) is that once it’s open, contributions made into them don’t count toward taxable income until withdrawn or used for other purposes—so long as they aren’t withdrawn within five years after being deposited into an account

Don’t chase returns or hot stocks

When you start investing early, it’ll pay off later on in life

When you start investing early, it’ll pay off later on in life.

Investing early helps build a good foundation for your retirement. You can start with a small amount of money, and it will grow over time. This means that if the market goes up or down during the years that follow, you won’t lose everything because of bad timing or an ill-timed purchase (such as buying high and selling low).

Having more time to make up for mistakes is great! If something doesn’t work out as planned—like trying out an investment strategy that doesn’t pan out well—you’ll have more time before having to get rid of all those investments so they don’t take away from other things like rent/mortgage payments or student loans repayment plans..

My Opinion

When you start investing early, it’ll pay off later on in life. It’s important to remember that most of these ideas are things you can do today while still working a job and having fun! If nothing else, this article should give you an idea of what type of investments might be right for your specific situation.

#Tagsearly investing#invest money#invest money in your 20s#investment strategies#investment tips#writers on tumblr#finance#blogger

7 notes

·

View notes

Text

August 14, 2023

Went to Target, noticed that many of the decorations on sale were deep greens and pale purples, realized that maybe I'm not quite as original with my ideal room colors as I'd anticipated. What is life but a series of events in which I realize that I'm not as special as I thought I was (I am being dramatic and hyperbolic but still).

Took out my mini twists (finally); in loveeee with the ultra-defined fro. Game-changing style for sure, but I can't wait this long in the future to take them out bc the twists were majorly raggedy.

In this day and age, and into the future, I can imagine personal branding becoming more and more important in landing academic jobs. And by that I specifically mean having some sort of online presence that connects who you are to what you do. That one old friend of mine, probably the person I've known the longest outside my family even if we really don't ever speak, she is very successfully building an online brand doing just that, and it's pretty incredible to watch, actually.

Speaking of branding, I'm trying to come up with pseudonyms to change my name to. Mostly to minimize the effect of this blog on any personal branding I may decide to do (I recognize that the internet is forever and that the damage is therefore already done, but no one needs to know that I have a deeply and perhaps inappropriately personal tumblr whatsoever). Genuinely, I'm the kind of person to grow unreasonably attached to the first thing I come up with (floralfountainpens), but I want to spend some time considering several options. I give myself a month max to think on it.

Oh also I'm normally a matte lipstick girlie but my mom convinced me to try the maybelline lifter gloss and I think I actually kind of like it?? It's really buttery, non-sticky, and, best of all, works well with my skin tone even though it looks crazy pink. I've been a little inspired by Barbie, I guess. I dig it.

I'm watching phd vlogs on youtube (because of course I am), and this small vlogger I'm watching right now talked about how she was a commenter on some papers at a conference for the first time. As she was describing this role (and I've seen this done once or twice I think at the national conference I went to the past two years), I was horrified at first by how daunting the task seemed. I really struggle with trying to sound appropriately intelligent (...to prove that I am capable of being in a situation and not raise anyone's doubts which I now recognize is not a particularly healthy attitude), so coming up with meaningful commentary/critique, especially if on the spot, sounds horrific. Then, I realized how similar it is to something I did in my last two years of undergrad. For the last two years, I was a moderator for what is essentially a conference for my humanities program, and I had to perform a fairly similar task: asking insightful and coherent questions to panelist presenters whose work I was seeing for the first time. I actually received compliments on my moderation. So I'm not as fully unprepared for that kind of thing as I might think. Which is a little cool. [edit: I think one of the biggest takeaways from my experiences as a moderator is that coherent and simple but interesting questions are better than rambly and intelligent-sounding questions. Of course, I'd like to go to more talks and symposia in grad school to really dissect this kind of role so that I may be prepared for it, just in case.]

And you know while I'm far from being a crypto bro, I'm starting to like,,,, lowkey get into investing???? In the simplest ways possible, really, with a Roth IRA and a CD (and medium-yield savings account I guess), but the idea of getting started early, making regular contributions, and then possibly not having to worry about retirement (assuming we survive as a species long enough for me to get there) is kinda sick ngl. Most of my money isn't really liquid, I guess, which is a little nerve-wracking, but The Market generally seems to be headed upward, so I'm not pressed in the slightest right now. The FDIC can't hold my hand forever if I wanna see real gains. At least, that's how rich wealthy people see it.

Last thing: I liked Barbie for its obnoxious femininity. The first two-thirds or so felt like a release. It was silly, it was goofy, it made me smile. The last quarter or third or so in its seriousness did have a real message which I could relate to on some level, but it felt fairly didactic, especially the whole monologue on what it was like to be a woman or whatever. Like yeah, the message was there, but I felt like the movie beat me over the head with that bit out of fear that the audience wouldn't get it maybe? I think They Cloned Tyrone did a better job at having a clear overtone message without being as in-your-face with it (or maybe they just balanced the message with the plot a bit better idk). There are certainly other criticisms of Barbie that I've encountered, and while they have merit, I feel like I can just accept this movie as its own new thing. [edit: To add, a """seminal work""" [edit 2: isn't it peculiar, calling a movie like this "seminal" ... what about ungendered terms for the same thing... alternatives include influential, groundbreaking, formative, innovative. I like the term, generally, but I sort of wish there was a feminine equivalent.] doesn't need to be flawless, in my opinion. It merely needs to exist and set in motion some sort of change in thought as a result of its reception (whether that change is how the audience approaches media or how creators approach media or something else entirely). I think Lost is another example of an imperfect work that changed media and still deserves recognition despite its shortcomings. Time will tell whether Barbie is the start of some wave or if it merely remains a one-of-a-kind event.]

TODAY IM THANKFUL FOR THE STAR TREK STRANGE NEW WORLDS MUSICAL EPISODE???? Never in my life did I think that this serious sci-fi franchise would be able to pull such a thing off, but that error's on me because this franchise switches between silly and serious at the drop of a hat. Like,,,,, "Apologies, the most confounding thing: I appear to be singing; most unusual, so peculiar" LITERALLY CRYING AAAAAAAA THE WHOOOOooOOoOoOOooOLE THING (vocals, orchestration(!!!!!), plot, ensemble, choreo, technobabble) WAS SO STINKING FUN

((in two weeks im flying away.))

[edit: this post was all over the place (even more than usual) because it's more of a collection of thoughts from the past several days rather than a single entry written all at once]

2 notes

·

View notes

Text

Bills on autopay. No debt. Emergency fund.

Investments + assets. Long term savings account. Retirement fund + Roth IRA.

Donating to charity. Living below my means.

Vacations every month. Not feeling guilty about splurging on myself.

Living my best life, all praise to God

#girlblogger#girlblogging#girlhood#girly things#just girly things#this is a girlblog#this is what makes us girls#tumblr girls#girl

0 notes

Text

Investing for Long-Term Wealth: The Key to Building a Secure Financial Future

When it comes to building wealth, one of the most powerful strategies is investing. While saving money is important, investing allows your money to grow and work for you over time. If you’re looking to build long-term wealth and achieve financial security, understanding the basics of investing is essential.

Here’s a guide to help you get started with investing for long-term wealth.

Why Invest for the Long-Term?

The primary reason to invest is to take advantage of the power of compound growth. Simply put, compound interest is when your investment earnings (interest, dividends, etc.) are reinvested, and you earn returns on both your initial investment and the accumulated earnings. Over time, this snowball effect can significantly increase your wealth.

Investing also helps your money outpace inflation. Inflation erodes the purchasing power of cash, meaning that $1 today will be worth less in the future. Investing in assets like stocks, bonds, or real estate has historically outperformed inflation, making it a smart way to protect and grow your wealth over time.

Types of Investments for Long-Term Wealth

There are several investment options to consider, each with its own benefits and risks. Here's a quick rundown of some of the most popular long-term investment options:

Stocks (Equities): Investing in individual stocks or stock index funds is one of the most common ways to build wealth. Over the long term, stocks have historically offered high returns, though they come with more volatility in the short term. The key is to choose companies with strong growth potential and hold onto them for the long haul.

Bonds: Bonds are less volatile than stocks and offer more predictable returns. Government bonds, municipal bonds, and corporate bonds all offer different levels of risk and return. Bonds are a good option for those looking for a stable income stream, though they typically provide lower returns than stocks.

Mutual Funds and ETFs (Exchange-Traded Funds): If you’re not comfortable picking individual stocks or bonds, mutual funds and ETFs can offer a diversified approach. These funds pool money from multiple investors to buy a range of assets. Index funds, a type of ETF, track the performance of a specific market index (like the S&P 500), and are a popular choice for long-term investors looking for low-cost, diversified exposure to the stock market.

Real Estate: Investing in real estate—whether through rental properties or real estate investment trusts (REITs)—can be a powerful way to build wealth. Real estate offers the potential for both long-term appreciation and regular rental income. However, real estate also requires a larger upfront investment and more management than stocks or bonds.

Retirement Accounts (401(k) & IRA): One of the best ways to invest for the long term is through retirement accounts. Contributions to tax-advantaged accounts like 401(k)s and IRAs grow tax-deferred (or even tax-free in the case of a Roth IRA). These accounts help you build wealth for retirement while offering tax breaks along the way.

How to Get Started with Investing

Start Early and Be Consistent: The earlier you start investing, the more time your money has to grow. Even small amounts can add up over time due to the power of compounding. Make investing a habit by contributing regularly to your investment accounts—whether it’s once a month or once a paycheck.

Set Clear Goals: Whether you’re saving for retirement, a home, or your child’s education, it’s important to have clear financial goals. Your investment strategy should align with these goals. For example, if you’re investing for retirement, you may want to take on more risk early in your life, and reduce risk as you near retirement age.

Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversification helps spread risk by investing in different asset classes (stocks, bonds, real estate, etc.). A well-diversified portfolio can protect you from market fluctuations and ensure steady growth over time.

Understand Your Risk Tolerance: All investments carry some level of risk, and it’s important to know how much risk you’re comfortable taking. Younger investors often have a higher risk tolerance because they have time to recover from short-term market dips. However, as you near your financial goals, you may want to take a more conservative approach.

Keep Costs Low: Investment fees can eat into your returns over time. Look for low-cost index funds or ETFs, and be mindful of management fees or transaction costs associated with buying and selling investments.

Review and Adjust Your Portfolio Regularly: While long-term investing requires patience, it’s important to regularly review your portfolio to ensure it still aligns with your goals. As your financial situation changes, or as you approach your goal, you may need to rebalance your portfolio to manage risk and optimize returns.

The Power of Patience: Let Your Investments Grow

Investing for long-term wealth isn’t about trying to time the market or making quick profits. It’s about being patient and allowing your investments to grow over time. The stock market and other asset classes will experience ups and downs, but historically, they’ve trended upwards in the long run.

Staying focused on your long-term goals, sticking to a consistent investment strategy, and avoiding the temptation to react to short-term market volatility will put you in a strong position to build lasting wealth. KVR?

Conclusion:

Investing for long-term wealth is one of the best ways to secure your financial future. By starting early, diversifying your investments, and staying consistent, you can harness the power of compounding to build wealth that lasts. Remember, there’s no one-size-fits-all approach to investing, so take the time to educate yourself, develop a strategy that works for you, and be patient as you watch your wealth grow over the years.

The earlier you start, the more time your money has to work for you—and that’s the key to building long-term financial success.

#LongTermInvesting#WealthBuilding#FinancialFuture#InvestSmart#FinancialIndependence#InvestmentStrategy#WealthManagement#RetirementPlanning#PassiveIncome#StockMarketInvesting

1 note

·

View note

Text

Comment by rgj95 on Reddit

It takes time. The more you contribute the more you will feel the effects bc of the magic of averaging costs. I have seen my portfolio size 4x since i started in May 2020. Its been a large mixed of intrest, dividends and significant contributions. My best recommendations is to stick to 2-3 etfs that are tried and true like VOO, VTI and SCHD. Your $100k in FTYPX would yield more growth and dividends in VOO. It could even average you $3300/yr in dividends with SCHD if you wanted to go that route. I tried to find the specific holdings information for FTYPX and i couldn’t find the data even thru Fidelity website, which is a major red flag imo. However, the fund shows it holds 53% us equities which is essentially an overlap with VOO since you already get that exposure. I dont want to cast judgement on your top stock pick, but generally speaking VOO is the go-to holding for the majority of all retirement accounts. Even my Roth IRA is just VOO

0 notes

Text

One way to deal with well meaning but perhaps not the best financial advice from family and friends is to meet with your bank's free advisors. They'll usually recommend something like setting up a Roth IRA account. Which is generally safe advice. But then when people give you other advice you just say "I'm working with my financial advisor on this" and they leave you alone.

Check with your bank if you just need a little help understanding things and planning.

sorry I just remembered when someone sent me an ask the last time i mentioned my mom talking to her financial advisor being like "you have a financial advisor how fucking rich are you wtf?" you know your bank offers meetings with financial advisors for free right.. you can just walk in and ask to speak to someone and they'll give you advice... like you need to know that is something most people can access... help

13K notes

·

View notes

Text

Tax Advantages of Debt Market Investments

Debt market investments offer a range of benefits, including the potential for stable returns and lower volatility compared to equities. Among these advantages, the tax benefits associated with debt investments are a significant draw for investors seeking efficient ways to grow their wealth. Understanding the tax treatment of various debt instruments, such as bonds, municipal securities, and government debt, can enable investors to make tax-smart decisions, ultimately enhancing the net returns on their investments. Tax benefits in the debt market can vary based on the type of debt instrument, the investor's tax bracket, and the specific tax laws of their country.

One notable tax advantage of debt market investments comes from municipal bonds, which are often exempt from federal income tax. In many cases, municipal bonds issued by state and local governments are also exempt from state taxes, provided the investor resides in the same state as the bond issuer. This double tax exemption makes municipal bonds particularly attractive to high-income investors seeking tax-efficient income. The predictable income generated by these bonds allows investors to maximize their returns without incurring heavy tax obligations. For investors who might need help recovering missed payments, a collection agency may step in to manage delinquent accounts, providing an added layer of security for those concerned with default risk on certain debt investments.

Corporate bonds also offer potential tax benefits through deductible interest expenses, which can lower a corporation’s taxable income. This allows corporations to issue debt at lower costs while providing investors with steady income in the form of interest payments. Although interest from corporate bonds is typically subject to federal and state income tax, the predictable income stream and relatively favorable tax treatment make these bonds appealing, especially in a diversified portfolio. Additionally, corporate bonds can offer higher yields compared to municipal bonds, which might appeal to investors prioritizing higher returns over tax-exempt income. Depending on an investor's tax bracket, the after-tax returns of corporate bonds may still be favorable, making them a valuable component of a tax-efficient investment strategy.

Another tax-efficient option for debt market investors is investing in government securities, such as U.S. Treasury bonds or Treasury Inflation-Protected Securities (TIPS). Treasury bonds are generally exempt from state and local taxes, which makes them advantageous for investors seeking reliable, tax-advantaged income. Although federal taxes still apply, the state tax exemption can lead to substantial tax savings, particularly for investors residing in high-tax states. TIPS also offer a unique tax benefit: they provide inflation protection by adjusting the principal based on inflation rates. However, investors should note that the inflation-adjusted principal increases are taxable as income, so TIPS are often best suited for tax-advantaged retirement accounts.

For investors in high-income brackets, tax-deferred and tax-exempt accounts, such as IRAs and Roth IRAs, provide a valuable tool for debt market investments. Holding bonds and other debt instruments in a tax-deferred account allows interest income to grow without immediate tax implications, potentially compounding wealth over time. In a Roth IRA, qualified withdrawals are tax-free, making it an attractive option for long-term investors looking to minimize taxes on their interest income. By using these accounts, investors can reduce their taxable income while benefiting from the consistent income that debt investments offer.

Tax-loss harvesting is another strategy that can enhance the tax advantages of debt market investments. In cases where bond prices decline due to rising interest rates or other market factors, investors may sell the bonds at a loss, which can be used to offset capital gains from other investments. This strategy allows investors to reduce their overall tax liability while rebalancing their portfolios. Tax-loss harvesting can be especially beneficial in a volatile interest rate environment, where bond prices fluctuate, providing opportunities to optimize tax outcomes.

For many, the key to maximizing the tax benefits of debt market investments is understanding how to balance tax-exempt and taxable debt instruments in their portfolios. High-income investors may benefit from holding a mix of municipal bonds, corporate bonds, and Treasuries, depending on their tax situation and income needs. By strategically selecting debt investments, investors can tailor their portfolios to reduce tax obligations and increase after-tax income. Municipal bonds may offer tax-free income, while government and corporate bonds contribute stability and yield, creating a balanced, tax-efficient portfolio.

In conclusion, debt market investments come with various tax advantages that can be highly beneficial for investors seeking steady returns and tax efficiency. From tax-exempt municipal bonds and state-tax-free Treasuries to tax-deferred retirement accounts and tax-loss harvesting, there are multiple ways to make debt investments more tax-advantageous. By understanding these benefits and integrating tax-smart strategies into their portfolios, investors can enhance their returns, preserve wealth, and achieve financial goals more efficiently in the debt market.

0 notes