#William Danko

Explore tagged Tumblr posts

Text

Influential Book Review - "The Millionaire Next Door"

Note: There are affiliate links attached. A startling look at the wealthy among us can be found in The Millionaire Next Door by Thomas J. Stanley. Do you think that people who own expensive cars and lead extravagant lives are the ones who have accumulated substantial wealth? Think again. Have you ever wondered about the people who live in the houses on your street? Dr. Thomas J. Stanley breaks…

#book reviews#business#deca-millionaires#door#economic#finance#financial independence#financial literacy#frugal#high net worth#influential books#investing#millionaire#mind my biz#money#next#outpatient care#personal finance#real millionaires#save#saving for retirement#the millionaire next door#Thomas J Stanley#thrifty living#wealth#wealth accumulation#William Danko

0 notes

Text

If you are wealthy and want your children to become happy and independent adults, minimize discussions and behavior that center on the topic of receiving other people’s money.

The Millionaire Next Door by William D. Danko

0 notes

Text

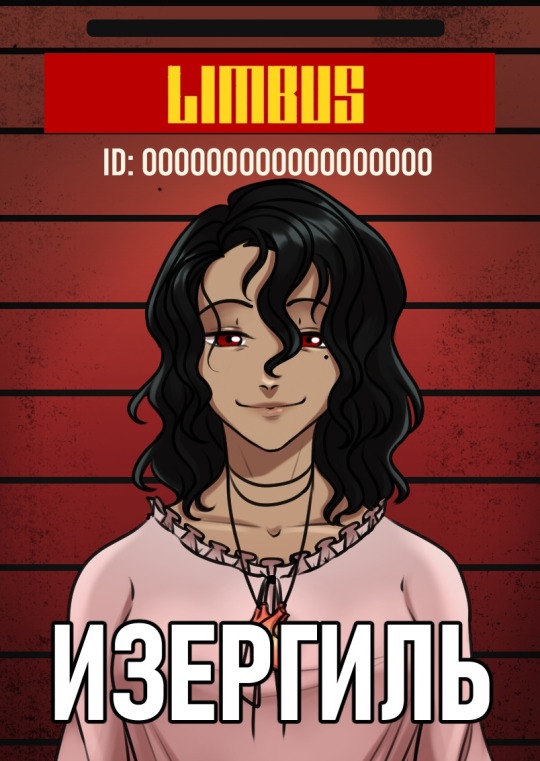

Name: Izergil Weapon name: Old Woman EGO: Danko's Heart Details: Body Age Adjustment, Stockholm Syndrome Age: 43 (according to the organisation providing her with medical body age adjustment services) Height: 183 cm Marital status: widow Biography: A resident of the Nest whose past is shrouded in an impenetrable fog. It is known that she was born in the Backstreets, travelled long and hard to become a high ranking Fixer and move to the Nest. Rumour has it that her path is paved with hundreds of bodies of lovers, by which she reached the very rank of Colour. She herself confirms only the first rumour - she nicknamed herself "The Kiss of Death", as everyone who fell in love with her died tragically sooner or later. Having achieved what she wanted and found a loving soulmate, Fixer Isaac, she stopped on her journey through the Districts and contracted with a certain organisation for the long-term maintenance of her body's youth. Soon she proposed marriage to her lover and bore him a son, William. But since she couldn't sit still, after Will's departure to the Lobotomy Corporation and Isaac's death, she lived alone for a while, and then went on a little wanderlust, which led her to the Limbus Company a couple of years later. Character: Izergil is a romantic and courageous personality. She is determined, proud and does not forgive insults against her for anything, although beatings were not uncommon punishments from her lovers. Many note her tremendous willpower, craving for freedom, lust for life and wisdom. She is also energetic and hardworking, which especially caught on with the team manager and his confidence in her. Facts: -The heart on her pendant belonged to Danko, who almost showed his EGO, but for the sake of saving people from darkness, he ripped his heart out. Later it was found by Izergil, who was travelling at that time, and the fiery heart became a part of her EGO and pendant. She also says that she hears a voice from this heart. -Larra (her eagle) also has a legend of appearance: it is said that he was formerly a man, the son of a cruel man from the Nest, who could not be killed, and a girl he stole from the Backstreets. In the future, the mother and child returned and everyone turned their backs on them. Larra was utterly alone, committing crimes and there was no way he could die. So he became distorted, becoming first a harpy and then a mere eagle. Izergil herself tells this tale to keep the younger members of the crew busy. -Izergil knows a great many legends, which she often tells in the evenings among her colleagues. -Loves wine, fun, song and, according to others, she sometimes smells of sea and sunshine, for which she is nicknamed "Dionysus' wife" among the female part of the crew. -Source: Maxim Gorky - "Old Izergil"

9 notes

·

View notes

Text

Nurturing Unity and Well-being Over Discord: Lil Boosie’s Struggles Highlight the Importance of Healthy Co-Parenting

Welcome to Afrofusionist! Explore More on Our Home Page.

Introduction

Navigating the intricate terrain of relationships can often give rise to challenging separations, particularly when children become central. The recent spotlight on rapper Lil Boosie’s strained connection with his daughter and her mother brings into focus the intricacies of co-parenting. This article delves into this situation, examining the potential harms of exploiting the child support system and championing the cultivation of healthier co-parenting dynamics, all within the context of nurturing unity and well-being in the black community.

Boosie’s Issues with His Daughter and Her Mother

Last month, Lil Boosie found himself embroiled in a public feud with his daughter, Tori, as reported by XXL. Their conflict escalated when Boosie repossessed a Mercedes-Benz he had gifted her for her 16th birthday, following her decision to leave their shared residence in Atlanta to support her mother. The situation escalated online, with both parties airing their grievances for all to see.

Navigating Co-Parenting Challenges

Lil Boosie’s situation is a prime example of how co-parenting challenges can turn into public spectacles. It’s crucial to recognize that disagreements between parents should not be used as ammunition against one another, particularly within the child support system. Weaponizing child support can not only damage the child-parent relationship but can also perpetuate harmful stereotypes about the intentions of black women.

Avoiding Abandonment: Prioritizing the Well-being of Children

One of the most concerning elements of Lil Boosie’s statements is his threat to cut off his daughter from his life and will. While it’s not uncommon for disputes between parents to strain their relationships with their children, it’s essential to remember that a child’s well-being should always take precedence. Disowning a child due to differences with the other parent is unjust and can have long-lasting emotional consequences for the child involved.

The Impact on Black Men in America

Lil Boosie’s health scare and the parallel drawn to Dr. Dre’s similar experience during his divorce, as reported by Rolling Stone, underscore the challenges black men face in America. The legal and emotional battles these individuals go through can often have profound effects on their physical and mental well-being. Addressing these challenges requires open dialogues within the community about mental health, resilience, and healthy coping mechanisms.

Fostering Healthy Co-Parenting Dynamics

The need for healthier co-parenting dynamics is clear. Instead of leveraging the child support system as a tool of revenge or manipulation, parents should work together to provide a stable environment for their children. Clear communication, empathy, and compromise are crucial components of successful co-parenting. This not only benefits the children involved but also helps to break the cycle of animosity.

Final Thoughts

Lil Boosie’s recent conflicts with his daughter and her mother highlight the importance of maintaining positive co-parenting dynamics. As the black community continues to address societal challenges, nurturing healthy relationships between parents is paramount. Weaponizing the child support system only perpetuates division and hurt, rather than nurturing the emotional and psychological well-being of the children it should protect.

As we conclude this insightful journey, I urge you to persist in your pursuit of enlightenment and empowerment. For a deeper exploration of nurturing unity and well-being, watch our engaging YouTube video, Boosie’s Daughter Tori PRESSURES Him After Car Reversal! and it’s alignment with the concepts from Thomas J. Stanley and William D. Danko book, “The Millionaire Next Door Book.” Your perspective counts, as we together drive positive change.

Let’s strive for unity, understanding, and empathy in our co-parenting efforts. By prioritizing the children and focusing on their well-being, we can create a brighter future for them and pave the way for healthier relationships in the black community.

#lil boosie#co parenting#millionaire next door#child support#dre dre#black fathers#black men#black women#black tumblr#boosie badazz#black children#black teens

8 notes

·

View notes

Text

Top 5 Books to Master Money - A Reading List for Financial Success

Financial success is a goal shared by many. These books are eye-opening and offer many views on the subject of wealth and management. Looking for story-driven explanations of important money lessons? Clason's stories will help readers create a healthy connection with money. The advice he offers is useful for anyone wanting to make the most of their financial situation. 1. The Millionaire Mind It is a book anyone who is interested in learning how to handle their money effectively should be reading. Kiyosaki utilizes the tale of his own childhood and two fathers, one who was wealthy and one who was struggling to help readers understand the financial mindset and mentality necessary for building a life filled with wealth and happiness. You will learn how to invest and save, as well as strategies for financial freedom and making smart decisions. The Millionaire Mind explains how self-made millionaires accumulation of wealth did not do it by living an ordinary life, and how they make use of their expertise to invest smartly even during times of recession. This book will help you establish an abundance mindset that will propel your financial success. 2. The Richest Man in Town This book offers a refreshing alternative to many other personal finance books that are extremely technical. This timeless classic provides timeless wisdom on how to accumulate wealth preservation, sharing and preserving. Learn important concepts like being mindful of your spending, seeking advice, and investing to earn a profit. The book is the culmination of Tony Robbins' decade-long research. He spoke with some of the world's leading billionaire investors and then compiled their top tips for ordinary people to secure financial freedom. This guide is practical for people of every income level that is easy to comprehend and apply. The book is easy to read an ideal resource for anyone who wants to be able to manage money without sacrificing leisure and lifestyle. Ramit Sethi outlines a no-guilt ethos and a comprehensive six-week plan that covers banking, saving, budgeting and debt. 3. The Millionaire Next Door This book challenges preconceived assumptions about wealthy Americans. Through decades of study as well as case studies Thomas J. Stanley and William D. Danko show that millionaires live in average neighborhoods and drive older cars. They also avoid excessive usage of credit cards and place a greater emphasis on financial savings over spending. This classic book teaches the principles of real wealth accumulation. The importance of prudence is at the core of the FIRE (Financial Independence Retire Early) movement. This book demonstrates how living below your means can enable anyone to reach their goal of financial independence and a quick retirement. This is a must read for anyone wanting to accumulate wealth and lead an enjoyable life. However, it's not so helpful for people looking for practical budgeting and investment guidance. The first edition of this book had a tendency to be a victim of the survivorship bias and focused on people who already achieved the status of millionaires. The Next Millionaire Next Door by Sarah Fallaw, a follow-up to the original book deals with this issue by using more of a sample to limit the amount of survivorship. 4. The most wealthy woman in town If you are looking for a little inspiration to get over financial stress This book will provide it in abundance. Instead of offering an elaborate plan, it suggests to look within and set financial goals aligned with your personal values. George Clason’s faux-biblical stories have inspired investors since the 1920s. This book follows his suggestions. This book shows you how to increase your wealth by making charitable donations and avoiding debt.

youtube

Tony Robbins spent ten years researching the book and speaking to billionaire investors about their best strategies for building wealth. This book is for anyone who wishes to attain their financial goals, no matter if they are seasoned investors or need some basic advice. The book also provides tips for overcoming obstacles such as unemployment or health crises. 5. The Most Rich Girl in the World It is essential to know how to manage your money, whether you're looking to retire with ease, begin an entrepreneur-driven business, or even give more generously your family and friends. There are numerous books that provide practical tips and inspiring stories that will help you along your journey. Kiyosaki's book that has caused controversy questions the American dream of homeownership. The book focuses on how to become financially intelligent by focusing on the things that matter most in your life. He also provides tips for making savings and avoiding credit card debt. This book offers a practical guide for creating a budget as well as a financial plan that is in line with your own goals. Readers say Singletary's advice is a great tool for newcomers to the field of finance, as well as for seasoned investors seeking a refresher course. It's like having someone who knows how to guide you through the complexities of money management. All credtis to YouTube

0 notes

Text

Top 5 Books to Master Money - A Reading List for Financial Success

Many people are striving to achieve financial success. These books offer a wide variety of perspectives on wealth and money management. You're seeking a narrative-based explanation of key money lessons. Clason's tales help readers create a healthy connection with money. His advice is applicable for anyone wanting to improve their finances. 1. The Millionaire Mind This book is a must-read to anyone trying to understand how they can manage their money. Kiyosaki employs his childhood memories with two fathers, one of them wealthy, the other less fortunate - to help readers build a life full of financial freedom and wealth. You'll be taught the value of investing and saving strategies to live debt-free and the best way to make mindful spending choices. The Millionaire's Mind shows how self-made millionaires did not make their money through a simple life. They utilized their understanding of investing to make savvy choices, even during recessions. The book will assist you in developing a powerful abundance mindset that will propel the way to financial prosperity. 2. The Richest Man In Town This book offers an appealing alternative to other books on personal finance which are highly technical. This classic offers timeless financial wisdom regarding wealth accumulation, preservation, and sharing. Learn important concepts such as being mindful of your spending soliciting advice, and investing to earn a profit. This book is the culmination of a decade-long study by multimillionaire businessman Tony Robbins. He sat down with the world's top billionaire investors and then compiled their most effective tips for everyday people to attain financial freedom. It's a practical guide for people of every income that's easy to grasp and implement. This book is perfect for those who want to learn how to manage their finances without having their lifestyle or leisure diminished. Ramit Sethi's philosophies are no-nonsense and a comprehensive six-week program that covers savings, banking budgeting, debt and investing. 3. The Millionaire Next Door This book challenges the conventional notions of wealthy Americans. Through years of research and case studies, Thomas J. Stanley and William D. Danko show that millionaires reside in average communities have older vehicles, avoid excessive usage of credit cards and place a greater emphasis on financial savings over spending. This classic book is a guide towards accumulating wealth. Frugality is the core of the FIRE movement (Financial Independence and Retirement Early). This book shows how staying within your means can assist you in attaining financial freedom and a early retirement. This is a must read for anyone who wants to build wealth and achieve a comfortable life. However, it is not so helpful for people looking for practical advice on budgeting and investing tips. The original edition of this book was prone to a bias of survivorship, focusing on people who have already become millionaires. Sarah Fallaw's follow-up book, The Next Millionaire Next Door addresses this issue with a wider sample to lessen the influence of survivorship bias. 4. The Most Rich Girl in Town If you need some inspiration to get over financial stress the book has it in spades. Rather than presenting you with the complete plan, it will encourage you to examine your values and formulate financial goals that reflect your beliefs. George Clason’s faux-biblical stories have attracted investors since the 1920s. The book is based on his advice. It explains how reducing expenses can help you to build wealth, while also teaching you to avoid debt and focus on charitable giving.

youtube

Tony Robbins dedicated ten years to research for the book, interviewing billionaire financiers on the best strategies for building wealth. This book is aimed at anyone who would like to meet their financial goals, whether they are seasoned investors or simply need a little guidance. It also provides tips for getting through challenges like unemployment and health crises. 5. The Most Rich Girl in the World Understanding how to save money is important, whether you're looking to retire with ease, begin an enterprise, or just give more to family and friends. There are plenty of books with practical tips and inspiring stories to help you on your journey. Kiyosaki’s controversial book challenges the American dream of owning the home of your dreams and is focused on how you can become financially smart by focusing on what is the most important in life. The author also gives tips on saving and avoiding credit card debt. This book provides a guide to develop a financial plan and budget that's aligned with your individual objectives. Singletary's advice has been praised by readers as an effective resource for both new and experienced investors who are looking to refresh their knowledge. It's as if you have a knowledgeable partner to walk you through the maze of managing money. Video from YouTube

1 note

·

View note

Text

The Millionaire Next Door: The Surprising Secrets of America's Wealthy by Thomas J. Stanley and William D. Danko is a classic personal finance book that challenges common stereotypes about millionaires. Here's a look at its strengths and weaknesses to help you decide if it's a good fit for you:

Strengths

Debunks Myths: The book challenges the idea that millionaires are all high-income earners who live lavish lifestyles. Instead, it highlights the importance of frugality, saving, and smart investing habits.

Research-Backed: The book is based on extensive research conducted by the authors, providing data and statistics to support its claims.

Focus on Behavior: It emphasizes the behavioral traits and practices that contribute to building wealth over time.

Practical Tips: While not a strict "how-to" book, it offers actionable strategies for budgeting, saving, and building wealth.

Focus on Accumulation: The book highlights the concept of "prodigious accumulators of wealth" (PAWs) who prioritize saving and investing over keeping up with appearances.

Weaknesses

Repetitive at Times: Some readers find the writing style repetitive, especially when emphasizing the importance of frugality.

Outdated Statistics: Since it was published in 1996, some of the data and statistics may not reflect the current economic landscape entirely.

Limited Investment Advice: The book doesn't offer in-depth investment strategies, focusing more on general principles of saving and living below your means.

Doesn't Address Complex Situations: The book primarily focuses on middle-class earners and may not address the challenges faced by those with lower incomes or significant debt.

Overall:

The Millionaire Next Door is a valuable book that can shift your perspective on wealth creation. It emphasizes the importance of hard work, living frugally, and prioritizing saving and investing for the long term. While some aspects might be dated and the writing repetitive, the core message of responsible financial habits and delayed gratification remains timeless. If you're looking for a wake-up call to challenge your spending habits and develop a wealth-building mindset, this book is worth checking out. However, keep in mind that it may not provide specific investment guidance or address complex financial situations.

Click and read more :-

0 notes

Link

Check out this listing I just added to my Poshmark closet: El Millonario de la Puerta de Al Lado (Spanish Edition)! 💰.

0 notes

Text

The Ultimate Guide to Books on Building Wealth

In the journey towards financial independence and wealth building, knowledge is not just power—it's profit. Understanding the nuances of personal finance, investment strategies, and economic trends can significantly impact your ability to grow and manage your assets. This guide introduces you to the top books on building wealth, each offering unique insights into creating lasting financial success. Whether you're a budding investor, an entrepreneur, or someone looking to revamp their financial health, these books are invaluable resources that promise to guide you every step of the way.

1. "Rich Dad Poor Dad" by Robert Kiyosaki

Robert Kiyosaki's "Rich Dad Poor Dad" is a cornerstone in wealth-building literature, challenging conventional wisdom on personal finance. It contrasts the mindsets of two fathers: one, a highly educated but financially unstable man (the "Poor Dad"), and the other, a savvy investor who understands the value of creating passive income and assets (the "Rich Dad"). This book is essential for anyone looking to shift their perspective on money and investment.

2. "The Intelligent Investor" by Benjamin Graham

Benjamin Graham's "The Intelligent Investor" is heralded as the bible of the stock market. Focused on the principles of value investing—a strategy emphasizing investments in undervalued stocks that offer long-term benefits—this book is a must-read for anyone aiming to navigate the stock market's complexities with grace and profitability.

3. "Think and Grow Rich" by Napoleon Hill

Napoleon Hill's "Think and Grow Rich" goes beyond mere financial advice, delving into the psychological foundation of wealth. Based on Hill's study of over 500 self-made millionaires, the book presents thirteen steps to success that anyone can apply to their lives. It's an invaluable guide for those looking to understand the wealth mindset.

4. "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko

This book reveals that the typical millionaire is not the one flaunting their wealth but the one living right next door who opts for a lifestyle of frugality and disciplined investment. "The Millionaire Next Door" offers insight into the common traits and habits that can lead to accumulating wealth over time.

5. "Your Money or Your Life" by Vicki Robin and Joe Dominguez

"Your Money or Your Life" is a transformative read that encourages readers to look at their relationship with money in a new light. This book provides practical strategies for managing finances in a way that enhances life quality, promoting financial independence and personal fulfillment.

Conclusion

Building wealth is a journey that requires patience, discipline, and, most importantly, knowledge. The books mentioned above offer a solid foundation for anyone looking to understand the principles behind wealth creation and financial success. By applying the lessons learned from these wealth-building manuals, you can set yourself on a path toward financial freedom and security. Remember, the key to building wealth lies not just in making money but in making smart decisions with the money you have. Happy reading, and here's to your financial future!

0 notes

Text

Discipline and initiative can’t be purchased like automobiles or clothing off a rack.

The Millionaire Next Door by William D. Danko

0 notes

Text

50 Best personal finance books

Understanding how to handle your money is super important, and that's what personal finance education is all about. It's like having a guide that helps you make smart decisions with your cash. Learning about personal finance isn't just about numbers; it's also about seeing things from different angles. Different people have different ways of dealing with money, and that's what makes learning from diverse perspectives so cool. It's like getting advice from various friends who've been through different money adventures. Now, why are we making a list of the 50 best personal finance books? Well, think of it as putting together a collection of super helpful tools. Books are like treasure chests of knowledge, and with this list, we're giving you a bunch of these treasures in this best personal finance books guide. No matter if you're a money pro or just starting, these books are here to share tips, tricks, and wisdom from lots of smart people. So, let's dive into the world of money wisdom and see how these books can help you on your financial journey! Here are 50 of the best personal finance books available today: - "The Richest Man in Babylon" by George S. Clason - "Think and Grow Rich" by Napoleon Hill - "Your Money or Your Life" by Vicki Robin and Joe Dominguez - "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko - "Rich Dad Poor Dad" by Robert T. Kiyosaki - "The Total Money Makeover" by Dave Ramsey - "Nudge" by Richard H. Thaler and Cass R. Sunstein - "Predictably Irrational" by Dan Ariely - "The Intelligent Investor" by Benjamin Graham - "A Random Walk Down Wall Street" by Burton G. Malkiel - "Broke Millennial" by Erin Lowry - "I Will Teach You to Be Rich" by Ramit Sethi - "The Bogleheads' Guide to Investing" by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf - "The Automatic Millionaire" by David Bach - "The Lean Startup" by Eric Ries - "The $100 Startup" by Chris Guillebeau - "The Budgeting Habit" by S.J. Scott and Rebecca Livermore - "Smart Women Finish Rich" by David Bach - "The Index Card" by Helaine Olen and Harold Pollack - "The ABCs of Real Estate Investing" by Ken McElroy - "Rich Bitch" by Nicole Lapin - "The Four-Hour Workweek" by Timothy Ferriss - "The Little Book of Common Sense Investing" by John C. Bogle - "Money: Master the Game" by Tony Robbins - "The Simple Path to Wealth" by J.L. Collins - "Women & Money" by Suze Orman - "The Behavior Gap" by Carl Richards - "The Millionaire Fastlane" by MJ DeMarco - "The Wealthy Barber" by David Chilton - "The Millionaire Real Estate Investor" by Gary Keller - "The 5 Mistakes Every Investor Makes and How to Avoid Them" by Peter Mallouk - "You Are a Badass at Making Money" by Jen Sincero - "The One-Page Financial Plan" by Carl Richards - "The Power of Broke" by Daymond John - "Your Score: An Insider's Secrets to Understanding, Controlling, and Protecting Your Credit Score" by Anthony Davenport - "The Money Book for the Young, Fabulous & Broke" by Suze Orman - "The Art of Money" by Bari Tessler - "The Million-Dollar, One-Person Business" by Elaine Pofeldt - "The Millionaire Mind" by Thomas J. Stanley - "The Millionaire Real Estate Agent" by Gary Keller - "The Truth About Money" by Ric Edelman - "The Soul of Money" by Lynne Twist - "The Millionaire Messenger" by Brendon Burchard - "The Financial Diet" by Chelsea Fagan and Lauren Ver Hage - "The Little Book of Value Investing" by Christopher H. Browne - "The Elements of Investing" by Burton G. Malkiel and Charles D. Ellis - "Money Rules" by Jean Chatzky - "The Automatic Customer" by John Warrillow - "The Millionaire in the Mirror" by Gene Bedell - "The Millionaire Real Estate Mindset" by Russ Whitney" Read the full article

1 note

·

View note

Text

Birthdays 12.29

Beer Birthdays

August A. Busch, Sr. (1865)

Michael D. Lewis (1936)

Kurt Widmer (1951)

Five Favorite Birthdays

Alison Brie; actor (1982)

Pablo Casals; Spanish cellist (1876)

Dave McKean; comic book artist (1963)

Ray Nitschke; Green Bay Packers MLB (1936)

Mary Tyler Moore; actor (1936)

Famous Birthdays

Robert C. Baker; chicken nugget inventor (1921)

Vera Brittain; poet, writer (1893)

Patricia Clarkson; actor (1959)

Ronald Coase; British economist (1910)

Rick Danko; rock bassist (1942)

Ted Danson; actor (1947)

Jennifer Ehle; actor (1969)

Yvonne Elliman; actor, singer (1953)

Marianne Faithfull; English rock singer (1946)

Ed Flanders; actor (1934)

William Gaddis; writer (1922)

William Gladstone; British politician (1809)

Charles Goodyear; vulcanized rubber inventor (1809)

Andrew Johnson; 17th U.S. president (1808)

Jude Law; English actor (1972)

Danny McBride; actor, comedian (1976)

Paul McCracken; economist (1915)

Jim Murray; writer (1919)

Paula Poundstone; comedian (1959)

Inga Swenson; Swedish actor (1932)

Ray Thomas; rock woodwind player (1941)

Jon Voight; actor (1938)

Andy Wachowskis; film director (1967)

1 note

·

View note

Text

Danko Jones I Came Here To Fuck Shit Up And Have A Good Time shirt

Queen Camilla, King Charles, Prince William and Kate Middleton attend a diplomatic reception on December 5, 2023. Chris Jackson/Getty Images Kamala Harris set a new record by finishing tied for 32nd and 33rd in the Danko Jones I Came Here To Fuck Shit Up And Have A Good Time shirt besides I will buy this U.S. vote on Tuesday, making Senate history twice. Harris’ move broke a nearly 200-year-old record set by Vice President John C. Calhoun in 1832. In addition to the historic nature of the vote, Calhoun was known for his fierce defense of the abolition of slavery and white supremacy. , and the 59-year-old Harris broke the record with 31 votes and became the first black person to become vice president. Kamala Harris talks her marriage, what keeps her up at night, and the Beyoncé song she calls her national anthem (Exclusive)

Buy it: https://tiktotees.com/product/danko-jones-i-came-here-to-fuck-shit-up-and-have-a-good-time-shirt/

Home: Tiktotees Fashion

0 notes

Text

Books on building wealth

In a world where financial stability and independence are highly sought after, there is an abundance of knowledge waiting to be tapped into. A valuable resource that can guide you on your journey to financial prosperity is books on building wealth. This comprehensive guide will introduce you to some of the most insightful and influential books in the realm of wealth creation. Whether you're a seasoned investor or just starting to explore the world of personal finance, these books can provide invaluable wisdom and strategies to secure your financial future.

Why turn to books on building wealth?

Books have long been a source of wisdom and knowledge, and when it comes to building wealth, they are no exception. Here's why books on building wealth are a valuable resource:

Expert insights: Many of these books are authored by financial experts and successful entrepreneurs who have firsthand experience in creating wealth.

Comprehensive information: Books offer in-depth coverage of wealth-building strategies, from saving and investing to entrepreneurial endeavors.

Self-paced learning: you can read and absorb the information at your own pace, allowing you to implement strategies gradually.

Time-Tested Wisdom: Many of the principles outlined in these books have stood the test of time and are still applicable in today's financial landscape.

Top books on building wealth

Let's delve into some of the most influential books on building wealth that have helped countless individuals achieve their financial goals:

1. "rich dad poor dad" by robert kiyosaki

Robert Kiyosaki's "Rich Dad Poor Dad" is a classic in the world of personal finance. It explores the fundamental difference in mindset and approach to money between the author's "rich dad" and "poor dad." The book emphasizes the importance of financial education and understanding assets versus liabilities.

2. "the millionaire next door" by thomas j. Stanley and william d. Danko

In "The Millionaire Next Door," the authors uncover the habits and traits of ordinary individuals who accumulate extraordinary wealth. This book provides a unique insight into the lives of millionaires and highlights the significance of frugality and smart financial decisions.

3. "think and grow rich" by napoleon hill

Napoleon Hill's "Think and Grow Rich" is a timeless classic that delves into the power of one's thoughts and beliefs in achieving financial success. It emphasizes the importance of setting clear goals and having a burning desire to attain them.

4. "the richest man in babylon" by george s. Clason

Set in ancient Babylon, this book offers timeless financial principles through parables and stories. "The Richest Man in Babylon" imparts wisdom about saving, investing, and living within one's means.

5. "the total money makeover" by dave ramsey

Dave Ramsey's "The Total Money Makeover" is a practical guide to financial fitness. It outlines a step-by-step plan to get out of debt, build an emergency fund, and invest for the future.

6. "the millionaire fastlane" by mj demarco

"The Millionaire Fastlane" challenges conventional financial wisdom and advocates for entrepreneurship as the path to wealth. It emphasizes the importance of creating businesses and systems that generate income quickly.

7. "your money or your life" by vicki robin and joe dominguez

"Your Money or Your Life" offers a holistic approach to personal finance. It encourages readers to consider the true value of money in relation to their life goals and provides a practical framework for financial independence.

8. "the automatic millionaire" by david bach

David Bach's "The Automatic Millionaire" introduces the concept of paying yourself first and automating your finances. The book emphasizes the power of consistent, automatic contributions to savings and investments.

Additional topics in wealth-building books

Wealth-building books cover a wide array of topics related to personal finance. Some additional subtopics and concepts you'll encounter in these books include:

Investing Strategies: Books often delve into various investment options, such as stocks, bonds, real estate, and mutual funds. They provide insights into how to grow your wealth through strategic investments.

Debt Management: Effective strategies for managing and reducing debt are often discussed in wealth-building books. They offer guidance on how to eliminate high-interest debt and become debt-free.

Budgeting and Saving: Creating a budget and cultivating a habit of saving are essential for building wealth. Many books offer practical advice on budgeting techniques and methods to increase your savings.

Entrepreneurship: Some wealth-building books focus on the entrepreneurial path, providing insights into starting and growing a successful business.

Retirement Planning: Planning for retirement is a key aspect of wealth-building. Books offer guidance on retirement accounts, savings goals, and strategies for a financially secure retirement.

Books on building wealth are a treasure trove of knowledge and wisdom for anyone looking to secure their financial future. Whether you're just starting your journey to financial success or seeking to refine your existing strategies, these books offer valuable insights and actionable advice. By reading, learning, and applying the principles outlined in these books, you can take significant steps toward building wealth, achieving your financial goals, and attaining the financial freedom you desire.

0 notes

Text

🔥 Three Books About Business and Money That Everyone Should Read

💥 "Rich Dad Poor Dad" - Robert Kiyosaki. This book teaches financial literacy and offers a new perspective on money management, the difference between assets and liabilities, and investing strategies. 💥 "Trilogy of desire: Three novels (The Financier, The Titan, The Stoic)" - Theodore Dreiser. Trilogy of Desire explores themes of business, financial success, ambition, and moral dilemmas in the world of business and politics. 💥 "The Millionaire Next Door: The Surprising Secrets of America's Wealthy" - Thomas J. Stanley, William D. Danko. This book explores millionaires' lifestyles and financial habits, demonstrating how frugal habits can lead to wealth accumulation.

0 notes

Link

Check out this listing I just added to my Poshmark closet: El Millonario de la Puerta de Al Lado (Spanish Edition)! 💰.

0 notes