#What is TDS

Explore tagged Tumblr posts

Video

youtube

TDS ki कक्षा|Part 3|Interest, Fees, Penalty, Prosecution, Expense Disallowance under TDS|Income Tax

TDS ki कक्षा TDS Knowledge series Part 3 @cadeveshthakur #tds #incometax #cadeveshthakur #trending #viral TDS compliance and the consequences associated with it. In this video, we’ll explore various sections of the Income Tax Act related to TDS (Tax Deducted at Source) and discuss the implications for defaulting taxpayers. Here’s the content breakdown: 📌 Timestamps 📌 00:00 to 00:56 Introduction 00:57 to 02:46 Content Part3 02:47 to 03:54 Example 03:55 to 08:48 Assessee in default 08:49 to 11:00 example 11:01 to 17:07 late fees 17:08 to 23:40 interest 23:41 to 31:51 how to calculate interest & fees 31:52 to 37:00 penalties 37:01 to 38:30 prosecution 38:31 to 39:43 disallowance 1. Section 201: Assessee in Default o Explanation of what constitutes an “assessee in default.” o Consequences for failure to deduct or pay TDS. o Key points: Interest (Section 201(1A)): When a deductor fails to deduct tax at source or doesn’t deposit it to the Government’s account, they are deemed an assessee in default. They become liable to pay simple interest: 1% per month (or part of a month) on the amount of tax from the date it was deductible to the date of deduction. 5% per month (or part of a month) on the amount of tax from the date of deduction to the date of actual payment. Interest as Business Expenditure: Clarification that interest paid under Section 201(1A) cannot be claimed as a deductible business expenditure. Penalty (Section 221): If a person is deemed an assessee in default under Section 201(1), they are liable to pay penalty under Section 221 in addition to tax and interest under Section 201(1A). The penalty amount cannot exceed the tax in arrears. Reasonable Opportunity: The assessee has the right to be heard and prove that the default was for good and sufficient reason. 2. Section 234E: Late Fee for TDS/TCS Returns o Explanation of late fees for non-filing or late filing of TDS/TCS returns. o Due dates for filing TDS/TCS returns. o Late fee calculation: INR 200 per day until the default continues (not exceeding the TDS/TCS amount). o FAQs on Section 234E. 3. Section 276B: Prosecution for Failure to Deduct TDS o Overview of prosecution provisions for non-compliance with TDS obligations. 4. Disallowance of Expenses (Section 40(a)(i)/(ii)) o Explanation of disallowance of expenses if TDS is not deducted or paid. #youtubevideos #youtube #youtubeviralvideos #tdsfreecourse #freecourse #taxdeductedatsource #TDSCompliance #IncomeTax #TaxDeduction #TCSReturns #LateFiling #Penalty #BusinessExpenditure #TaxLiabilities #FinancialCompliance #TaxPenalties #TaxationLaws #AssesseeInDefault #InterestPayment #TaxProcedures #LegalObligations #TaxAwareness #TaxEducation #FinancialLiteracy #TaxPlanning #TaxConsultancy #TaxAdvisory #TaxProfessionals #TaxUpdates #TaxGuidance #TaxTips #TaxAccounting #TaxFiling #TaxReturns #TaxPolicies #TaxChallenges #TaxSolutions #TaxExperts #TaxCompliance #TaxAware #TaxMistakes #TaxConsequences #TaxPenalties #TaxKnowledge #TaxRules #TaxRegulations #TaxBestPractices #TaxManagement #TaxUpdates #TaxNews #TaxInsights #TaxGuidelines #TaxCode #TaxEnforcement #TaxEnforcementActions #TaxPenaltyProvisions #TaxPenaltyLaws #TaxPenaltyGuidance #TaxPenaltyExplained #TaxPenaltyFAQs #TaxPenaltyCompliance #TaxPenaltyAvoidance #TaxPenaltyMitigation #TaxPenaltyResolution #TaxPenaltyAdvice #TaxPenaltyConsulting #TaxPenaltyExperts #TaxPenaltyHelp #TaxPenaltyTips #TaxPenaltyEducation #TaxPenaltyAwareness #TaxPenaltyPrevention #TaxPenaltyManagement #TaxPenaltyStrategies #TaxPenaltyUpdates #TaxPenaltyNews For more detailed videos, below is the link for TDS ki कक्षा TDS Knowledge series https://www.youtube.com/playlist?list=PL1o9nc8dxF1RqxMactdpX3oUU2bSw8-_R

#youtube#what is tds#tax deducted at source#how to file tds return#how to issue tds certificate#tds due dates fy 2024-25#tds due dates fy 2023-24#tds free course#cadeveshthakur

0 notes

Text

youtube

#income tax act 2023#income tax#how to calculate tax and vat from supply bill#tax rate#tax calculator#vatcalculation#vat calculation#vat consultants in uae#tds rate#tds & vds#what is tds#tds2#tds#contractorbill#contractor#Youtube

0 notes

Text

Folks talking about Game Devs dropping Unity or how it won't hurt small indie devs with under 200,000. Are missing the point.

Some of these Unity games can't change to another engine because they have years of code piled on top of each other at this point. aka POKEMON GO. They'd basically have to rebuild the game from scratch.

Not to mention Unity is mostly used by phone app games or Indie's that are lucky enough to get picked up by console. Indie games on Mobile easily pass 200,000 downloads. Temple Run 1 and 2 are in Unity, Crossy Road, Angry birds 1 and 2, and Hearthstone. All of these past 200,000 downloads years ago but aren't bringing in money now except hearthstone.

The Developers will do what happened to the first Angry birds app. They'll take it down, build it in a new engine for "HD", and add a shit ton of micro transactions. We are about to lose countless original versions of the OG pre lootbox mobile games.

We are also about to lose some of the biggest Indie games of the last decade. Among Us, Plague Inc., 7 Days to die, the original Slenderman game and it's sequel, I am Bread, Ori and the Blind Forest, Dream Daddy, Overcooked 1 & 2, Pathfinder online, Cup Head, Bendy and the Ink Machine, Oxygen Not Included, Bloons Tower Defense 6, Beat Saber, Subnautica, The Stanley Parable, Untitled Goose Game, Power Washing Simulator, Fall Guys, Inscryption, Phasmophobia

And the big one FUCKING HOLLOW KNIGHT. Silk song has already been pushed back out of this year specifically because it's being made by a team of like 3 people. It is so close to being finished and now they are being told they have to start over from scratch basically. Hollow Knight got over 200,000 downloads from being on playstation and was eventually put on Playstations subscription service. Every cent they made from hollow knight has gone back into making silk song. Which might now be delayed by multiple years and oh they are going to have to use some of that funds to pay unity now. Or find a way to get out of a contract with playstation. Because folks will keep downloading Hollow Knight for free and Unity will send the Hollow Knight team the bill.

oh and there's one more teeny tiny game made in Unity that you guys might not want to suddenly disappear. One with almost 3 years of monthly code updates, one with 139 million downloads to date, and 4.8 million monthly users.

Genshin. Guys Genshin Impact is made completely in Unity and that's not a game that can have it's code just copy and pasted to another engine.

#unity#genshin impact#genshin#indie games#pokemon go#hollow knight#bendy and the ink machine#bloons td 6#the stanley parable#untitled goose game#angry birds#hearthstone#pathfinder#dream daddy#among us#phasmophobia#i don't even know what to tag#just google unity games#and understand it is literally thousands of games#from the last decade#douglitheories

9K notes

·

View notes

Text

True Detective | 1x08 Form and Void

#truedetectiveedit#true detective#rust cohle#marty hart#rustmarty#td 1x08#tor gifs#old man love hits different#i don't know what to tell u

2K notes

·

View notes

Text

erm…yuri ⁉️⁉️⁉️⁉️

#my art#total drama#total drama island 2023#td spoilers#td julia#td mk#this is all i got from s2 ep8#haha no one got eliminated wdym what r u talking about shut up

2K notes

·

View notes

Text

Wild that total drama is dragging out the most consistent uploads in a while out of me

Starting w coloured sketches and then,, did anybody say,, Sierra redesign?

Decided to go in hard on the fandoms that would have been prevelant back when td started airing,, that is to say, Dr Who + Supernatural ((Sierra is a heller don't @ me))

#total drama#total drama world tour#td heather#td alejandro#alejandro burromuerto#total drama world tour fanart#total drama fanart#td sierra#td cody#td gwen#td courtney#td duncan#td noah#td tyler#td trent#td lindsay#td izzy#td eva#td bridgette#tdi fanart#tdi#tdwt fanart#tdwt#total drama redesign#ill be back on the aleheather grind soon#in fact i have multiple sketchpages full of them that have yet to see the light of day#i dont have favourites wdym#team escope#what would Bridgette nd Courtneys ship name be thats the real question

699 notes

·

View notes

Text

She loves her wife guys!

#total drama#total drama reboot#tdi 2023#total drama 2023#td julia#td mk#td mkulia#I had so much spare time today so I made mkulia art#This is what boredom does to someone

802 notes

·

View notes

Text

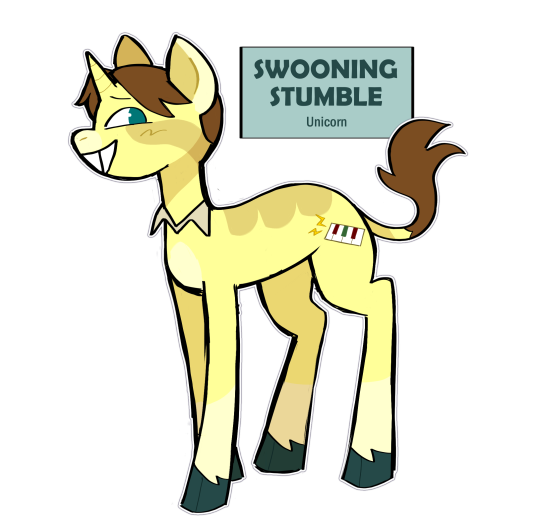

alas, motivation granted me more ponies as was promised yesterday. A joyous occasion this is indeed

#total drama#td dakota#td ezekiel#td cody#mlp#my little pony#mlp au#all were requests!#tumblr user mary-kasexual follows through with what they say they're going to do in a previous post (shocking) (impossible)#Camera Action's half-dragon half-pony but the draconic features show up later in life when she molts#she has no magic but vaguely resembles a unicorn in appearance minus the horn#Hay Fever's from a rock farm similarly to Pinkie Pie#later becomes a bat pony during WT after he's bit by a vampire bat while hiding in the cargo hold#Swooning Stumble's very naturally gifted at magic but tends to be unfocused and overconfident#he likes to cast advanced spells to impress ponies only for them to inevitably backfire on him#my art

404 notes

·

View notes

Text

so um... you guys know that one episode of action where duncan goes insane and it gives him pupils.

what does that say about this guy? you know, justin? the one who ALWAYS HAS PUPILS???

#total drama#total drama action#tdi#td duncan#td justin#this post is a joke#i know he only has pupils because he’s insanely hot#what does that say about duncan though… /j

494 notes

·

View notes

Text

the duo of all time

1K notes

·

View notes

Text

2015-2024

#jon stewart#the daily show with jon stewart#my gifs#jon#tds#im so happy today#sorry the quality sucks ASS im kinda using a tv monitor as a pc screen so i cant see what im doing!! its a long and very funny story

697 notes

·

View notes

Video

youtube

What is TDS??| TDS ki कक्षा | A Comprehensive Guide to Tax Deduction at Source| Part 1| Basics 2024 "CA Inter Direct Taxation | May/Nov 2024 Attempt | Ultimate Exam Prep Playlist" Description: 🎓 Welcome to the ultimate guide for CA Inter students, accountants, and professionals gearing up for the May/Nov 2024 attempt! Dive into our comprehensive playlist focused on Direct Taxation, curated to enhance your understanding and boost your exam preparation. 📚 Uncover in-depth explanations, practical examples, and expert insights on key Direct Tax topics crucial for success in the CA Inter examination. Whether you're a student aiming to ace the upcoming exams or a professional seeking to stay updated, this playlist is your go-to resource. 🔍 Playlist Highlights: 1️⃣ Income from Salary & House Property: Master the nuances of income computation, exemptions, and deductions to confidently navigate these critical sections. 2️⃣ Income from Business & Profession: Explore detailed discussions on taxation aspects related to business income, including special provisions, depreciation, and more. 3️⃣ Capital Gains & Other Sources: Gain a thorough understanding of capital gains taxation, as well as insights into income from other sources, ensuring a solid foundation for exam success. 4️⃣ Clubbing of Income & Set-Offs: Decode the complexities of clubbing provisions and set-off mechanisms, crucial for accurate tax planning and compliance. 5️⃣ Assessment Procedures & Appeals: Navigate through the assessment process, learn effective strategies for handling appeals, and stay ahead of the curve in tax compliance. 🚀 Elevate your exam readiness with our expert-led videos, designed to simplify complex concepts and provide a comprehensive understanding of Direct Taxation. Hit play now and gear up to conquer the CA Inter May/Nov 2024 exams! 🔗 Don't forget to subscribe for regular updates, and share this invaluable resource with your peers to create a community of empowered learners! Best of luck on your journey to success! 🌟 🔥 #cainter #directtaxation #caexampreparation #caexamprep #caintermediate #MayNov2024 #TaxationTips #examsuccess #accountancy #cajourney #professionaldevelopment #taxlaw #cainterdirecttax #studywithme #cadeveshthakur #directtaxrevision #directtaxrevisionlectures #directaxcainter #directaxclasses #tds #salary #businessincome #pgbp #setoff #capitalgaintax #castudents #castudent #castudentlife Understand the Basics of TDS [Tax deducted at source] What is TDS? Why is there a requirement to deduct tax at source? When TDS is required to be deducted? Who is required to deduct TDS? Who is payer? Who is payee? Who is deductor? Who is deductee? When to deduct tax? When to deduct TDS? What is PAN? What is TAN? Who is required to obtain TAN? Penalty for failure to apply TAN Quoting false TAN Amount on which TDS is required to be deducted? Interest for non deduction of TDS? Multiple employment Two or more employer How to avoid TDS? Form 15G Form 15H No deduction of Tax Lower deduction of Tax TDS return process TDS credit process What if PAN is not provided? Follow me on: Pinterest: https://in.pinterest.com/cadevesht LinkedIn: https://www.linkedin.com/in/cadeveshthakur/ Instagram: https://www.instagram.com/cadeveshthakur/ Twitter: https://twitter.com/cadeveshthakur Tumblr: https://www.tumblr.com/blog/cadeveshthakur Youtube Channel: https://www.youtube.com/c/cadeveshthakur Reddit: https://www.reddit.com/user/cadeveshthakur E-Commerce Accounting: https://www.facebook.com/groups/ecommerceaccountingsolutions #cadeveshthakur https://www.cadeveshthakur.com/

#youtube#what is tds#tax deducted at source#who is required to deduct#when tds is required to be deducted#who is deductor#who is payer#who is payee#who is deductee#what is tax deducted at source

0 notes

Text

#how to calculate tax and vat from supply bill#tax calculator#tax rate#tax#what is tds#tds rate#vds#vatcalculation#vat calculation#vat consultants in uae#supply bill#tds & vds

0 notes

Text

doodled my gwen and bridgette designs :)

#total drama#total drama island#total drama gwen#td gwen#total drama bridgette#td bridgette#idk why i chose these two in particular they're just fun to draw#gwen probably wears a lot less during the actual game this is just what she'd wear normally#imagine having to do a challenge in full trad goth like that'd suck#jay art

518 notes

·

View notes

Text

Guys this MIGHT be nj

Dj u have terrible taste in men

#djnoah#dj total drama#noah total drama#td noah#td dj#they make me so happy#yes i drew noah a tad smaller for the funsies#what r yall going to do about it.#this is second time i attemp to draw dj btw#total drama

439 notes

·

View notes

Text

last entry!!! alenoah week day 7 (free day)!!!!

#alenoahweek2024#total drama#total drama island#tdi#td noah#total drama noah#td alejandro#alejandro burromuerto#total drama alejandro#tdwt#alenoah#this one's a little old from what i remember#my (sh)art#i can’t believe i’m sitting here now just realizing how inconsistent my art is

476 notes

·

View notes