#Offshore Foundation Asset Protection

Text

Offshore Foundation Setup

Seychelles Foundations provides expert services for offshore foundation setup. Based in Dubai, we ensure that establishing your offshore foundation is straightforward and efficient. Our team handles the details, making the setup process smooth and hassle-free.

#OffshoreFoundation#FoundationSetup#DubaiBusiness#OffshoreServices#EasySetup#FoundationManagement#DubaiFinance#OffshoreSolutions#FoundationIncorporation#StreamlinedSetup#Offshore Foundation Registration Fast#Offshore Foundation Formation Simple#Offshore Foundation Formation Privacy#Offshore Foundation Asset Protection#Offshore Foundation Simple Administration#Offshore Foundation Formation Cheap#Offshore Foundation Incorporation Fast#Offshore Foundation Setup#Offshore Foundation Set up#Overseas Foundation Asset Protection

0 notes

Text

Optimizing Wealth: International Tax Strategies for Savvy Global Investors

As the world becomes increasingly interconnected, investors seize the opportunity to diversify their portfolios across borders. With international investments, however, comes the need to understand and navigate complex tax systems. Global investors must employ strategic approaches to minimize tax liabilities, ensure compliance, and maximize wealth. A sound understanding of international tax strategies is essential for achieving these goals.

Determining Tax Residency

One of the first factors to consider when investing globally is tax residency. Tax residency defines where an individual or entity is regarded as a taxpayer, and it is crucial for determining how much tax is owed and to whom. Countries have different criteria for establishing tax residency, which may include time spent within the country, the location of assets, or the source of income.

Some investors seek residency in low-tax jurisdictions or countries with favorable tax treaties to reduce their overall tax burden. However, maintaining compliance with residency rules can be complex. Failure to meet the residency requirements may result in dual residency or even unexpected tax liabilities. Investors need to work with tax professionals to clarify their residency status and the tax obligations in each jurisdiction where they are active.

Leveraging Double Taxation Agreements (DTAs)

International investors often face the risk of double taxation, where income earned in one country is taxed in both the source country and the country of residence. To mitigate this risk, many countries have entered into Double Taxation Agreements (DTAs), outlining how cross-border income should be taxed to prevent paying twice on the same earnings.

DTAs allow investors to enjoy relief from double taxation by allocating taxing rights between the two countries involved. For example, if an investor earns capital gains in a foreign country, a DTA might allow only one country to tax that income. Alternatively, it may provide credits for taxes paid abroad, reducing the overall tax burden. To fully benefit from DTAs, investors should familiarize themselves with the agreements relevant to the countries where they invest.

Implementing Tax-Efficient Structures

Global investors can optimize their tax positions by utilizing tax-efficient structures like offshore companies, trusts, and foundations. These vehicles can provide several advantages, including asset protection, estate planning benefits, and reduced taxation on international income.

Offshore companies, for instance, are often established in jurisdictions with low or no corporate tax rates, allowing investors to minimize their tax obligations. Similarly, trusts and foundations can be used to manage wealth transfer and inheritance tax exposure. However, it’s important to remain mindful of the legal and ethical considerations surrounding these structures. Governments worldwide have increased their focus on transparency and offshore structures, so investors must ensure that these tools are used legally and in full compliance with international tax regulations.

Maximizing Foreign Tax Credits

For global investors subject to taxation on worldwide income, foreign tax credits can help reduce the impact of taxes paid abroad. Foreign tax credits allow taxpayers to offset taxes paid in another country against their tax liability in their home country, thus preventing double taxation on the same income.

For example, if an investor earns dividends from a foreign corporation and pays tax on those earnings in the source country, they can often claim a credit for the foreign taxes paid when filing in their home country. This strategy ensures that income earned abroad is not taxed twice, improving the overall return on investment. However, the rules governing foreign tax credits vary by country, so investors should consult tax experts to determine their eligibility.

Navigating Transfer Pricing Rules

Investors involved in multinational business operations or those owning subsidiaries in different countries should pay close attention to transfer pricing regulations. Transfer pricing refers to pricing goods, services, or intellectual property between related entities in other jurisdictions. Governments worldwide scrutinize these transactions to ensure that profits are fairly allocated and taxed in each country.

To avoid penalties or tax disputes, multinational companies must follow internationally accepted guidelines for transfer pricing, such as those established by the OECD (Organisation for Economic Co-operation and Development). This often involves documenting that intercompany transactions are conducted at arm’s length, meaning they reflect market value as if conducted between unrelated parties. Failure to adhere to transfer pricing rules can result in substantial fines, so global investors must ensure compliance in their cross-border transactions.

Taking Advantage of Tax Treaties and Withholding Taxes

International tax treaties also play a key role in reducing withholding taxes levied on income paid to foreign investors. Withholding taxes can significantly impact the profitability of investments, as they are typically applied to dividends, interest, and royalties. Tax treaties often provide reduced withholding tax rates or eliminate them, depending on the countries involved.

For instance, an investor receiving interest payments from a foreign country may be able to reduce the withholding tax rate by claiming treaty benefits, thus improving the net return on their investment. However, investors must file the appropriate paperwork and documentation to claim these benefits, as failure may result in unnecessarily high withholding tax rates.

Staying Compliant with Changing Regulations

International tax laws constantly evolve as governments seek to close loopholes and increase transparency in global financial transactions. To stay compliant, global investors must keep abreast of these changes and adjust their strategies accordingly. Regular consultation with international tax advisors is essential to ensure investments remain tax-efficient and comply with the latest regulations.

For example, the OECD’s Base Erosion and Profit Shifting (BEPS) initiative aims to prevent tax avoidance strategies that exploit gaps in tax rules across different countries. As more countries implement BEPS-related measures, investors must adapt their tax strategies to comply with new requirements.

Investing across borders offers exciting opportunities for diversification and growth, but it also brings complex tax challenges. Global investors can minimize their tax burdens and maximize returns by understanding key international tax strategies, such as managing tax residency, leveraging DTAs, using tax-efficient structures, maximizing foreign tax credits, and navigating transfer pricing rules. Engaging with qualified tax professionals specializing in international taxation is essential for developing a customized strategy that meets individual financial goals while ensuring compliance with ever-changing regulations.

0 notes

Text

Top Benefits of Offshore Company Formation

Offshore companies are business entities that function outside their home country. They protect your assets, maintain confidentiality, and optimize taxes. For this reason, entrepreneurs prefer doing business in Seychelles, the British Virgin Islands, Belize, and more. To proceed with offshore business registration in these jurisdictions, you must learn about the benefits.

Tax Incentives

Taxes can be a significant burden for any individual. Most business owners choose offshore companies to reduce their taxes. Offshore companies are exempt from income tax, corporate tax, and withholding taxes. Any revenue generated outside these offshore jurisdictions is also tax-free.

Confidentiality

Investors consider offshore companies for their confidentiality. When you incorporate your business, the details of shareholders and directors are kept private.

Wide Range of Offshore locations

There are more than 30 offshore locations available globally. Each jurisdiction is unique and offers different opportunities. A business advisor will guide you in choosing the best location for your company.

Ease of Company Incorporation

Offshore companies are known for their ease of business registration. The ideal duration for offshore company registration is 2-3 working days.

Access to Worldwide Markets

An offshore presence helps you access global markets, especially regions with favourable trade agreements or investment opportunities.

Offshore Banking Facilities

An offshore bank account is necessary to conduct business transactions. Several jurisdictions offer banking facilities. You must opt for the best bank that meets your business requirements.

Affordable Business Setup Cost

Entrepreneurs and business investors prefer offshore companies for their affordable company setup costs. The cost of each jurisdiction differs according to your business demands. It is best to do a competitive analysis before setting up your company.

Business Flexibility

Offshore jurisdictions offer flexibility in choosing business structures, reporting obligations, and meeting shareholders’ requirements.

Asset Protection

People choose offshore as their favourable destination because of asset protection. Offshore companies protect their assets from any legal actions or creditors.

Minimal Reporting Requirements

Offshore jurisdictions are known for minimal reporting requirements. Contact our offshore experts to learn in-depth about the reporting requirements and the jurisdictions.

Access to Different Legal Structures

Most companies use the International Business Company (IBC) as a standard business structure. Other legal entities are Limited Liability Companies, trusts, and foundations.

Stable Business Environment

Entrepreneurs prefer doing business in offshore locations due to the supportive governmental policy and stable business environment.

Privacy in Maintaining Banking Details

Most offshore jurisdictions have strict banking secrecy laws, which help protect account holders' privacy. These privacies ensure that your transactions are maintained and protected from further misuse.

These are the top benefits of doing business offshore. If you want to start or expand your business, get in touch with Business Setup Worldwide. Our experts will assist you with providing information about every step of the process.

0 notes

Text

Rising Marine Construction Projects: The Dawn of Marine Industry is Presenting Protective Relays manufacturers with great opportunity

The global marine construction industry witnessed a surge in activity, with 85 major projects initiated across the globe representing a substantial opportunity for the protective relay market. As these mega-projects progress, the demand for advanced protection and automation systems is probably to grow, imparting a window of possibility for players in the protective relay space. Protective relays play a critical role in ensuring the smooth operation of electrical infrastructure, particularly in high-risk environments like marine construction sites. One of the primary factors driving the growth of the protective relay market is the increasing attention to safety and reliability in the marine construction industry. As projects turn out to be more complex and expensive, operators are under pressure to ensure that their assets are protected against unexpected failures. protective relays provide a robust layer of protection against electrical risks, helping to prevent accidents and maintain uptime. Moreover, as projects move beyond traditional coastal areas and into deeper waters, the urge for advanced protection systems grows. Offshore wind farms, oil rigs, and other offshore structures require robust protective relay systems to safeguard their electrical infrastructure from the harsh marine environment.

According to the Universal Data Solutions analysis, the surge in addition of renewable energy capacity and associated surge infrastructure spending in grids and substations will drive the global scenario of the protective relays and as per their “Protective Relay Market” report, the global market was valued at USD 2,686 billion in 2022, growing at a CAGR of 5.8% during the forecast period from 2023 - 2030 to reach USD XX billion by 2030.

Market Is instigated by the high value marine projects ongoing worldwide: In 2021, almost 84 marine projects commenced the development, where cost of construction is estimated around USD 39 billion, and since the start of 2022, 85 major marine construction projects have laid the foundation stone at a total cost of somewhere around USD 45 billion.

Request Free Sample Pages with Graphs and Figures Here https://univdatos.com/get-a-free-sample-form-php/?product_id=38859

Further, in 2022, The Angola Ministry of Transport in partnership with Toyota Tsusho Corporation and TOA Corporation has undertaken one of the most expensive marine development projects called Namibe Bay Port Integrated Development in Namibe, Angola and total cost to be incurred comes around USD 643 million. The project aims to revive the economy in the south of the country, create employment, and diversify industry; at the same time, it will expand the potential of the port for becoming a pathway for imports and exports from landlocked countries in the African continent.

Additionally, in 2022, Voies Navigable De France (VNF), is commencing the development of the Seine Nord Europe Canal between Oise and Aubencheul-au-Bac, in France easily one of the most expensive marine construction projects undertaken with expected capital expenditure of around USD 6.1 billion. The project involves the development of a 107.4km long canal with 54m width and 4.5m depth, seven water locks, three canal bridges, 61 roads and rail bridges, two loading docks, one water reservoir, four platforms, five-grain docks, access roads, and other facilities. The project will be developed in four phases and will be constructed on 2,450 hectares of land and includes the construction of two railway bridges at Creil-Jeumont and Amiens

Conclusion

Despite the hurdles, the future of protective relays as an important component of all electrical energy related infrastructures is undeniably bright. The remarkable investment interest, the promising results of ongoing innovations in the space, and product launches from the key market players are fuelling a revolution.

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website -www.univdatos.com

0 notes

Text

Setting Up a Business in Dubai: A Comprehensive Guide

Understand the Market and Business Opportunities

Before diving into the setup process, it's essential to conduct thorough market research. Dubai's economy is diverse, with strong sectors in real estate, tourism, finance, and trade. Identify your target market, understand the competitive landscape, and evaluate the demand for your product or service. This foundational knowledge will inform your business strategy and help you make informed decisions.

Choose the Right Business Structure

Dubai offers various business structures, each with its own advantages and regulatory requirements:

Mainland Company: Allows you to operate anywhere in Dubai and the UAE. Business Setup Dubai It requires a local sponsor who holds 51% of the shares.

Free Zone Company: Provides 100% foreign ownership, tax exemptions, and simplified import/export procedures. However, operations are restricted to the specific free zone or international markets.

Offshore Company: Ideal for businesses looking to benefit from Dubai’s tax-free environment without a physical presence. It's primarily used for international trade, asset protection, and holding companies.

Select a Business Name and Register It

Choosing a unique and appropriate business name is a crucial step. Ensure the name complies with the UAE’s naming conventions and is not offensive or blasphemous. Once you've selected a name, it must be registered with the Department of Economic Development (DED) or the relevant free zone authority.

Obtain the Necessary Licenses

Depending on the nature of your business, you will need to obtain the relevant licenses:

Commercial License: For trading activities.

Industrial License: For manufacturing or industrial activities.

Professional License: For service-oriented businesses, such as consulting or healthcare.

The application process involves submitting various documents, including your business plan, passport copies, and proof of address. Fees vary depending on the business type and location.

Secure Office Space

For mainland companies, renting office space is mandatory, and the lease agreement must be submitted during the licensing process. Free zone companies can choose from a range of office solutions, including flexi-desks, executive offices, or warehouses, depending on their business needs.

Open a Corporate Bank Account

A corporate bank account is essential for conducting business transactions. Dubai boasts a robust banking sector with numerous local and international banks offering tailored business banking solutions. Requirements typically include the company’s incorporation documents, a business plan, and proof of identity for the shareholders and directors.

Hire Staff and Apply for Visas

Once your business is set up, you’ll need to hire staff. Start A Business in Dubai Dubai's labor laws ensure a balanced employer-employee relationship, covering aspects such as working hours, leave entitlements, and termination procedures. Employers are also responsible for applying for residence visas for their employees, which involve health checks and sponsorship.

Stay Compliant with Local Regulations

Dubai's business environment is well-regulated, with strict adherence to local laws and international standards. Regularly update yourself on changes in regulations to ensure compliance. This includes renewing your business license annually, maintaining accurate financial records, and adhering to tax obligations.

0 notes

Text

Are there specialized legal services available for startups in Dubai?

Yes, there are specialized legal services available for startups in Dubai. Law firms in Dubai offer a comprehensive range of services tailored to the unique needs of startups, ensuring they navigate the legal landscape effectively from inception to growth. These services are crucial for startups aiming to establish a strong foundation and operate within the legal frameworks of the UAE.

1. Company Formation and Structuring: One of the primary services law firms in Dubai offer to startups is assistance with company formation and structuring. They guide entrepreneurs through the various options available, such as free zones, mainland companies, and offshore entities, helping them choose the most suitable structure based on their business model, target market, and regulatory requirements. This includes preparing and filing all necessary documentation, ensuring compliance with local laws and regulations.

2. Intellectual Property Protection: Startups often have unique products, services, or innovations that need protection. Law firms in Dubai provide specialized intellectual property (IP) services, including trademark registration, patent filings, and copyright protection. These services help startups safeguard their innovations, brand identity, and proprietary information, which are critical assets for their growth and competitive edge.

3. Contract Drafting and Review: Entering into agreements and partnerships is a routine part of business for startups. Legal experts in Dubai offer contract drafting and review services to ensure that all agreements are legally sound and protect the startup's interests. This includes drafting employment contracts, supplier agreements, partnership contracts, and non-disclosure agreements (NDAs).

4. Compliance and Regulatory Advisory: Navigating the regulatory environment in Dubai can be complex. Law firms in Dubai assist startups in understanding and complying with local laws and regulations, including licensing requirements, labor laws, data protection regulations, and industry-specific standards. This ensures that startups operate legally and avoid potential fines or legal issues.

5. Funding and Investment: Securing funding is a critical step for many startups. Legal services include assistance with preparing investment documents, conducting due diligence, and negotiating terms with investors. Lawyers also provide advice on structuring investment deals, equity distribution, and shareholder agreements.

6. Employment Law: As startups grow and hire employees, understanding and complying with employment laws becomes essential. Law firms provide guidance on employment contracts, employee rights, benefits, and termination procedures, ensuring that startups maintain fair and legal employment practices.

7. Dispute Resolution: In the event of disputes, whether with partners, clients, or employees, law firms in Dubai offer dispute resolution services, including mediation, arbitration, and litigation support. These services help startups resolve conflicts efficiently and minimize disruption to their business operations.

Conclusion: Law firms in Dubai are equipped to provide specialized legal services that cater to the diverse needs of startups. From company formation and IP protection to compliance, funding, and dispute resolution, these services are designed to support startups at every stage of their development. Engaging with experienced legal professionals ensures that startups can focus on innovation and growth while navigating the legal complexities of operating in Dubai.

0 notes

Text

[ad_1]

Intro

With regards to selecting a dependable offshore devoted server supplier, Offshorededicated stands out from the gang. With a legacy of belief, a dedication to championing freedom of speech, and unwavering dedication to defending the privateness of its purchasers, Offshorededicated.web presents unparalleled providers you can host with confidence.

A Legacy of Belief and Reliability

Offshorededicated.web, since its inception in 2013, has quickly advanced right into a beacon of belief and reliability within the offshore devoted servers business. This shocking tour is supported by an unfaltering obligation to guaranteeing the safety and privateness of consumer info. This degree of belief is not simple. The groundwork of this belief relies on thorough safety methods and a dedicated solution to take care of maintaining with secrecy, selecting it a go-to resolution for purchasers worldwide. The that means of such a standing within the current computerized age could not presumably be extra important, notably in a site the place info breaks and safety considerations are uncontrolled.

The reliability of Offshorededicated is additional solidified by its operational excellence. Purchasers take pleasure in peace of thoughts understanding their digital belongings are managed by a supplier that stands agency in opposition to exterior pressures and prioritizes their privateness above all else. This practical respectability stretches out to all features of their administration providing, together with server uptime, security efforts, and the affirmation that consumer info stays immaculate by unjustifiable outdoors impacts.

Moreover, this inheritance is not nearly maintaining with the state of affairs however about pushing limits. OffshoreDedicated.web ceaselessly places assets into cutting-edge improvements and foundations to stay on the entrance line of the enterprise, guaranteeing they provide essentially the most reliable and safe internet hosting preparations that anybody may hope to search out. This obligation to greatness is the rationale they've became a believed confederate for purchasers in search of a protected harbor for his or her information in an undeniably turbulent digital sea. Their legacy of belief and reliability is not only a historic footnote however an ongoing promise to their purchasers.

Championing Freedom of Speech with DMCA Ignored Internet hosting

Within the digital panorama, the place content material is king, the specter of censorship looms giant. Offshorededicated.web units itself aside by boldly supporting the appropriate to free expression, making it a stalwart defender of digital freedom. This dedication is exemplified by their distinctive stance on DMCA complaints. In contrast to many suppliers who might capitulate to strain, Offshorededicated firmly ignores DMCA notices and complaints in opposition to client-hosted websites. This coverage is not only about defying norms; it is a testomony to their perception in upholding the precept of freedom of speech on the web.

This method presents a haven for content material makers, writers, activists, and different individuals who get themselves habitually in battle with prohibitive computerized methods. By guaranteeing that hosted content material stays unaffected by DMCA complaints, Offshorededicated.web engages its purchasers, permitting them to articulate their ideas with out the apprehension about outlandish evacuation or ignorance of their information. This technique makes them a priceless confederate for the individuals who esteem the chance to share and disperse information brazenly and with out restrictions.

As well as, this obligation to the appropriate to talk freely of discourse stays carefully linked with areas of power for his or her preparations and the association of unknown administrations. It is an all-encompassing solution to take care of internet hosting that safeguards purchasers from pointless management in addition to defend their identification and proper to safety.

In a world the place digital rights are more and more underneath risk, Offshorededicated's dedication to DMCA ignored internet hosting stands as a beacon of hope without cost expression on-line.

Unwavering Privateness Safety for Purchasers

For individuals who prioritize their privateness above all else, they presents an unparalleled degree of safety. Understanding the fundamental concept of anonymity within the current surveillance-heavy superior local weather, this platform ensures that each one providers could be accessed with no need private identification. This characteristic is very useful for individuals and associations who want to preserve a low profile positions on-line whereas participating in actions that may very well be delicate in nature.

The supply for signing up anonymously is complemented by the choice to make use of cryptocurrency for funds. This method upgrades safety by clouding financial exchanges in addition to traces up with the ethos of purchasers who lean towards decentralization and safety of their cash associated dealings. The combo of those utilization selections means their devotion to providing a stable, personal internet hosting expertise that fulfills the wants of even essentially the most safety in search of purchasers.

By underscoring the importance of secrecy and providing parts to defend it, they continue to be a stronghold for safety. The mix of those safety pushed highlights the stage's obligation to make a protected, safe, and categorized on-line area for its purchasers. This give attention to privateness safety is a cornerstone of the belief that purchasers place within the firm, solidifying its place as a pacesetter within the discipline of safe offshore devoted server options.

Superior Efficiency and Uptime

At OffshoreDedicated.web, the excellence of service extends far past simply privateness and safety measures. One other specialty of their providers is the superior efficiency and spectacular uptime that purchasers have come to anticipate. This can be a actually aggressive market of offshore devoted server, the place challenges abound in sustaining persistently excessive ranges of service availability. By means of the deployment of cutting-edge expertise and infrastructure meticulously designed for resilience, offshorededicated.web ensures that consumer web sites and functions are all the time up and working, minimizing disruptions and downtime, and maximizing uptime.

Understanding the fundamental significance of uptime within the current speedy on-line atmosphere, their firm has invested closely within the server developments and company system. This ensures quick associations in addition to the dependability that's important for on-line companies, content material makers, and superior corporations that may't stand to face downtime. The group's obligation to execution is clear of their proactive checking and fast response to any points, it's rapidly addressed and steadily acquired to make sure that any anticipated private time.

This accentuation on execution and uptime is a main instance of their devotion to giving a constant internet hosting expertise. Purchasers can give attention to creating their on-line presence and carrying out their targets, safe within the info that their superior assets are hosted on levels designed for maximized execution. This diploma of dependability is an important a part of the belief that purchasers place in Offshorededicated, making it a primary piece of their conclusion within the aggressive market of offshore devoted server.

Customizable and Scalable Options

Recognizing the various wants of its clientele, OffshoreDedicated.web presents a collection of customizable and scalable internet hosting options, tailor-made to match the exact calls for of every challenge or enterprise. This flexibility is a trademark of their service, guaranteeing that whether or not you're simply beginning out with a starter weblog or managing

a fancy community of on-line providers, there is a internet hosting plan designed to cater to your particular state of affairs.

The scalability of their options implies that as your on-line presence expands or your necessities develop into extra advanced, your internet hosting plan can develop and adapt alongside your online business. This flexibility is crucial for organizations hoping to scale with out the issue of exchanging suppliers or managing the difficulties that always accompany development.

Their method to internet hosting options just isn't a one-size-fits-all; it is a dynamic, client-focused technique that emphasizes the supply of precisely what you want, once you want it.

They're a a versatile confederate ready to assist your digital enterprise, it doesn't matter what its heading or greatness. This devotion to tailor-made options underscores their job as a specialist co-op, nonetheless an confederate within the final result of organizations and other people exploring the intricacies of the digital panorama.

Distinctive Buyer Help

Within the dynamic world of offshore devoted server suppliers, accessing responsive and educated customer support is basically vital to 1 planning to host it’s subsequent enterprise.

OffshoreDedicated.web separates itself on this primary but advanced division by providing glorious buyer assist that units an unique requirement for the enterprise. This duty to taking good care of consumer is obvious in entrance of their proficient assist group, who're ready to handle consumer requests and resolve points every day and in minimal time.

This clever assist ensures that paying little thoughts to time area or geological space, purchasers can depend upon getting fast and detailed assist. Whether or not it is coping with complexities, tending to specialised difficulties, or offering assist for scaling organizations, the assist group at Offshorededicated is supplied with the flexibility to assist efficiently.

Moreover, OffshoreDedicated.web's relentless dedication to buyer satisfaction is highlighted by its completely different communication channels, together with e mail, dwell chat, assist tickets, skype, and so forth. This number of selections permits purchasers to attract in with the stage based on their very personal preferences, guaranteeing consolation and availability in in search of assist.

The distinctive buyer assist supplied by them not solely mitigates the challenges typically related to internet hosting but in addition elevates the general internet hosting expertise. Purchasers can have peace of thoughts understanding they've a reliable ally prepared to help them at each flip of their digital journey, guaranteeing that their internet hosting necessities are met with professionalism and dedication.

This elevated commonplace of buyer assist performs an vital function in working with the constant exercise and success of purchasers' on-line companies, additional solidifying their standing as one of many prime suppliers of safe, dependable, and client-driven offshore devoted server options.

[ad_2]

Supply hyperlink

0 notes

Text

Offshore Accounting Unveiled: Maximizing Global Opportunities and Tax Efficiency with More Than Numbers CPA, the Best Accounting Firm in Mississauga

Offshore accounting, often associated with multinational corporations, is not solely reserved for large enterprises. Even small and medium-sized businesses can reap significant benefits from offshore accounting practices. In this comprehensive guide, we'll delve into the advantages of offshore accounting, exploring how it can enhance financial management, optimize tax efficiency, and facilitate global expansion.

Unlocking Global Opportunities

Offshore accounting opens doors to global opportunities for businesses of all sizes. By establishing offshore entities, companies can access international markets, diversify their revenue streams, and tap into new customer bases. According to the United Nations Conference on Trade and Development (UNCTAD), foreign direct investment (FDI) flows to offshore financial centers totaled $368 billion in 2020. This highlights the substantial economic activity and investment opportunities present in offshore jurisdictions. With guidance from the best accounting firm in Mississauga, such as More Than Numbers CPA, businesses can navigate offshore expansion effectively and capitalize on global growth prospects.

Enhancing Tax Efficiency

One of the primary motivations for offshore accounting is tax efficiency. Offshore jurisdictions often offer favorable tax regimes, including lower corporate tax rates, tax exemptions, and incentives for foreign investors. For example, according to the Tax Foundation, the average corporate tax rate in offshore financial centers is significantly lower than the global average. By strategically structuring their operations offshore, businesses can minimize their tax liabilities and maximize their after-tax profits. The expertise of the best accounting firm in Mississauga, More Than Numbers CPA, ensures that businesses comply with international tax regulations while optimizing their tax efficiency through offshore strategies.

Protecting Assets and Privacy

Offshore accounting also provides asset protection and privacy benefits for businesses. Offshore jurisdictions typically offer robust legal frameworks that safeguard assets from political instability, economic turmoil, and legal disputes. Additionally, offshore structures often provide greater confidentiality and anonymity, protecting sensitive financial information from public disclosure. This level of privacy can be particularly beneficial for high-net-worth individuals, entrepreneurs, and businesses seeking to shield their assets from prying eyes. With guidance from the best accounting firm in Mississauga, businesses can establish offshore structures that safeguard their assets and preserve their privacy effectively.

Facilitating International Trade and Investment

Offshore accounting plays a vital role in facilitating international trade and investment. By establishing offshore entities, businesses can streamline cross-border transactions, mitigate currency exchange risks, and optimize supply chain operations. Offshore jurisdictions often offer simplified regulatory frameworks, making it easier for businesses to conduct international business activities. According to the World Trade Organization (WTO), merchandise exports from offshore financial centers totaled $1.3 trillion in 2020, highlighting their significant contribution to global trade. With expertise from the best accounting firm in Mississauga, such as More Than Numbers CPA, businesses can leverage offshore structures to expand their international footprint and capitalize on global market opportunities.

Mitigating Regulatory Compliance Burdens

In addition to tax benefits, offshore accounting can help businesses mitigate regulatory compliance burdens. Offshore jurisdictions often have less stringent regulatory requirements compared to onshore jurisdictions, reducing administrative complexities and compliance costs for businesses. However, it's essential to note that offshore activities must comply with international regulations, such as anti-money laundering (AML) and know-your-customer (KYC) rules. With guidance from the best accounting firm in Mississauga, businesses can navigate regulatory compliance effectively and ensure adherence to global standards.

In conclusion, offshore accounting offers a multitude of benefits for businesses seeking to expand internationally, optimize tax efficiency, protect assets, and streamline operations. With the expertise of the best accounting firm in Mississauga, such as More Than Numbers CPA, businesses can leverage offshore strategies to achieve their financial objectives and thrive in an increasingly globalized economy. Whether it's tapping into new markets, reducing tax liabilities, or safeguarding assets, offshore accounting presents compelling opportunities for businesses to succeed on a global scale.

0 notes

Text

Setting Up Your Dream Venture: Company Formation in the UAE

The UAE's vibrant economy and strategic location have made it a fertile ground for ambitious entrepreneurs to cultivate their dream ventures. If you're brimming with a groundbreaking idea and seeking to plant the seeds of your business in the UAE, this guide will serve as your roadmap to a successful company formation process.

Building a Strong Foundation: Market Research and Planning

Before delving into legalities, solidify your business concept through meticulous market research:

Understanding the Competition: Conduct a thorough analysis of existing businesses in your chosen sector. Identify their strengths and weaknesses to carve out a unique niche for your company and ensure your product or service fills a gap in the market.

Target Market Analysis: Define your ideal customer. Analyze demographics, purchasing habits, and unmet needs to tailor your product or service effectively. This ensures you're targeting the right audience and maximizing your potential customer base.

Developing a Business Plan: Construct a comprehensive business plan that outlines your company's goals, strategies, financial projections, and marketing plan. This roadmap will be instrumental in attracting investors and securing funding, acting as a blueprint for your business's growth.

Choosing the Right Pot for Your Plant: Selecting Your Business Structure

The UAE offers a variety of legal structures, each catering to specific needs:

Limited Liability Company (LLC): Popular amongst small and medium-sized businesses, LLCs limit owner liability. However, on the mainland, foreign ownership is capped at 49%, requiring a local partner (unless in specific circumstances). Free zones often offer 100% foreign ownership.

Sole Proprietorship: Ideal for single-owned businesses, it offers a simple setup but no liability protection, meaning the owner's personal assets are at risk.

Branch Office: An existing foreign company can set up a branch in the UAE to operate under the parent company's license.

Planting the Seeds: The Company Formation Process

Once you have a solidified plan and chosen structure, it's time to navigate the legalities involved in company formation:

Define Your Business Activities: Clearly define the core activities your company will undertake. This will determine the licenses and permits you need to operate legally.

Location, Location, Location: Decide on your business location: mainland UAE, a Free Zone, or an offshore company. Each has distinct advantages (like tax benefits in Free Zones) and limitations (like geographical restrictions). Consider factors like business activity restrictions and ease of operation when making your choice.

Pick a Memorable Name: Select a unique and appropriate business name that complies with UAE naming regulations and reflects your brand identity.

Company Registration: Register your company with the Department of Economic Development (DED) for the mainland or the relevant Free Zone authority. This typically involves submitting required documents and paying registration fees.

Licensing and Permits: Obtain the necessary licenses and permits to operate legally. The specific licenses required will depend on your chosen activity and location.

Corporate Banking: Open a dedicated corporate bank account in the UAE to manage your company's finances.

Securing Visas: If you plan to employ foreign workers or reside in the UAE for business purposes, apply for the appropriate visas.

Nurturing Growth: Beyond the Paperwork

While completing the legalities is crucial, successful business growth requires additional steps:

Building Relationships: The UAE business community thrives on connections. Network with local businesses, government entities, and potential partners. Building trust and fostering positive relationships can pave the way for future success and open doors to valuable opportunities.

Cultural Awareness: The UAE has a rich culture with specific business etiquette. Understanding and respecting these cultural nuances is essential for fostering positive interactions with colleagues, clients, and partners.

Assembling Your Team: Recruiting a skilled and dedicated team is vital for your company's growth. Leverage the UAE's diverse talent pool to find the right individuals who share your vision and possess the skills necessary to propel your business forward.

Harvesting Your Success: Embrace the Journey

Set up a company in UAE is a rewarding journey filled with challenges and triumphs. By conducting thorough research, choosing the right legal structure, navigating the legalities efficiently, and building a strong foundation, you can transform your dream venture into a thriving business in this dynamic and opportunity-rich environment. Remember, the UAE offers a supportive ecosystem for entrepreneurs. Embrace the journey, cultivate your business with dedication, and watch your dream venture blossom into a flourishing reality.

0 notes

Text

#Offshore Foundation Registration Fast#Offshore Foundation Formation Simple#Offshore Foundation Formation Privacy#Offshore Foundation Asset Protection#Offshore Foundation Simple Administration#Offshore Foundation Formation Cheap#Offshore Foundation Incorporation Fast#Offshore Foundation Setup#Offshore Foundation Set up#Overseas Foundation Asset Protection

0 notes

Text

BVI bank account

Numerous well-known international banks and organizations operate in the British Virgin Islands, contributing to the stability of the country's financial sector. These organizations offer various offshore banking services, including investment options, personal and company accounts, and BVI bank accounts. Here are the benefits of a banking account:-

Stability: With a legal foundation rooted in English Common Law, the British Virgin Islands (BVI) boasts enduring political stability and attractive opportunities for offshore businesses. The region maintains a consistent political and economic environment, establishing it as a secure destination for offshore investments.

Privacy: The BVI upholds strict regulations safeguarding privacy, ensuring the confidentiality of your financial information within the country.

Asset Protection: Through offshore banking in the BVI, your assets are shielded from legal disputes and financial uncertainties, providing an additional layer of security.

Tax Efficiency: The BVI offers favorable tax systems, including tax incentives and reduced rates for specific types of offshore activities.

Prompt Action: The BVI government offers sufficient flexibility for swiftly relocating assets or facilitating quick money transfers on your behalf.

No Requirement for a Personal Visit: While the process of opening an BVI bank account can be intricate and demanding, there is no obligatory need for an in-person visit to the financial institution, streamlining the overall procedure.

0 notes

Text

Guide to Registering Your Business in the British Virgin Islands

Nestled amidst the turquoise waters of the Caribbean Sea, the British Virgin Islands (BVI) have long served as a haven for international business. Their stable government, robust legal system, and commitment to tax neutrality have made them a top choice for entrepreneurs and investors seeking a secure and efficient environment to establish and operate their companies.

Company Registration in British Virgin Islands in the BVI is a relatively straightforward process, particularly when compared to other offshore jurisdictions. This guide provides a comprehensive overview of the key steps involved, from choosing the right business structure to obtaining the necessary documentation and navigating the registration process.

Step 1: Selecting the Optimal Business Structure

The BVI offers various business structures, each with its unique advantages and considerations. Here are the two most common options:

Business Company: This is the most flexible and popular choice, ideal for international trade, asset holding, and various commercial activities. It offers limited liability protection to shareholders, anonymity through nominee services, and streamlined reporting requirements.

International Society: This structure is preferred for non-profit organizations, foundations, and trusts. It provides tax exemptions, asset protection, and a high degree of confidentiality.

Step 2: Reserving your Company Name

Once you've chosen your preferred structure, the next step is to reserve your desired company name. The BVI Registry maintains a strict policy against duplicate names, so ensuring exclusivity is crucial. You can conduct a preliminary name search online through the Registry's website or consult your registered agent for assistance.

Step 3: Appointing a Registered Agent

BVI law mandates that all registered companies have a local agent who acts as a liaison with the government and facilitates official communications. The agent's responsibilities include accepting legal documents, maintaining statutory records, and assisting with annual filings.

Step 4: Preparing and Submitting Documents

The specific documents required for registration may vary depending on your chosen structure and business activities. However, some standard documents are generally needed, including:

Memorandum and Articles of Association outlining the company's purpose, powers, and internal governance.

Register of Directors and Shareholders disclosing the identities and pertinent details of all involved parties.

Evidence of registered agent appointment.

Payment of prescribed registration fees.

Step 5: Opening a Corporate Bank Account

Maintaining a separate corporate bank account is essential for demonstrating financial transparency and adhering to anti-money laundering regulations. BVI offers a wide range of reputable international and local banks to choose from, each catering to specific business needs.

Additional Considerations

Nominee Services: To maintain anonymity and privacy, BVI allows the appointment of nominee directors and shareholders. These individuals hold shares and directorships in trust for the ultimate beneficial owners, shielding their identities from public disclosure.

Compliance Requirements: All registered BVI companies must comply with annual reporting obligations, including filing audited financial statements and submitting any necessary tax declarations, even if they are tax-exempt.

Benefits of Registering a Company in the BVI

Tax Neutrality: The BVI boasts a zero-corporate tax policy on most international business income, making it an attractive option for optimizing tax efficiency.

Political and Economic Stability: The BVI enjoys a long history of political stability and a robust economy, offering investors and businesses a secure and predictable environment.

Flexibility and Efficiency: The BVI's streamlined registration process, coupled with its diverse range of business structures, caters to a broad spectrum of entrepreneurial needs.

Confidentiality and Privacy: The BVI is renowned for its commitment to client confidentiality and offers robust legal frameworks to protect sensitive business information.

Conclusion

Registering a company in the BVI can be a strategic move for businesses seeking to expand globally, optimize their tax footprint, and operate with greater flexibility and confidentiality. While navigating the registration process may seem daunting at first, enlisting the support of experienced professionals, such as legal counsel and registered agents,

0 notes

Text

Navigating Financial Horizons: The Advantages of an Offshore Bank Account in the Bahamas

The allure of offshore banking has gained prominence in recent years, with individuals and businesses seeking strategic financial solutions. Among the plethora of offshore destinations, the Bahamas stands out as a premier choice, offering a unique blend of financial stability, privacy, and a tropical paradise setting. In this article, we'll explore the advantages and considerations of opening an offshore bank account in the Bahamas.

A Tropical Haven for Financial Security

The Bahamas, renowned for its pristine beaches and turquoise waters, is equally esteemed as a financial haven. The jurisdiction's commitment to financial stability, a robust regulatory framework, and adherence to international standards make it an attractive destination for offshore banking. Opening an offshore bank account Bahamas provides account holders with the assurance of a secure and well-regulated financial environment.

Privacy and Confidentiality

One of the key draws of offshore banking in the Bahamas is the emphasis on privacy. The jurisdiction maintains strict confidentiality laws, safeguarding the financial information of account holders. This commitment to discretion appeals to individuals and businesses looking to protect their assets and financial affairs from undue scrutiny.

Diversification of Assets

Diversifying assets across different jurisdictions is a prudent strategy for risk management and financial planning. An offshore bank account in the Bahamas offers an opportunity to diversify holdings, providing a degree of insulation against economic and geopolitical uncertainties. This strategic approach allows individuals to mitigate risks and optimize their financial portfolios.

Currency Options and Global Access

The Bahamas, with its stable currency pegged to the U.S. dollar, provides a reliable financial foundation. Offshore bank accounts in the Bahamas often offer multi-currency options, allowing account holders to hold funds in various currencies. This flexibility not only facilitates international transactions but also positions account holders to take advantage of favorable exchange rates.

Streamlined International Business Operations

For businesses engaged in international trade or those with a global presence, an offshore bank account in the Bahamas streamlines financial operations. The jurisdiction's strategic location, coupled with efficient banking services, makes it an ideal hub for businesses looking to optimize their financial transactions and capitalize on the benefits of international trade.

Considerations and Compliance

While the advantages of an offshore bank account in the Bahamas are evident, it's crucial for individuals and businesses to navigate the process with awareness. Understanding the regulatory requirements, compliance standards, and tax implications is paramount. Seeking guidance from financial professionals well-versed in offshore banking practices can ensure a seamless and compliant experience.

Click here for more information :-

Switzerland Offshore Bank accounts

Offshore Bank Account dubai

0 notes

Text

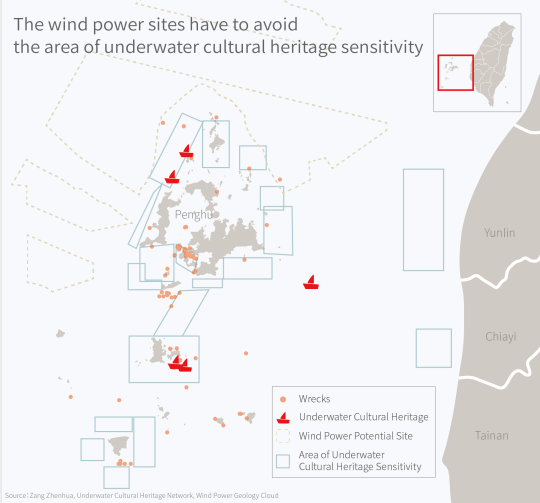

Gone with the Wind? Underwater Cultural Heritage and Wind Power Dilemma in Penghu

By Shannon Chang, Emma Shen, Wendy Lo, and KC Yang

Penghu, located at the heart of the Taiwan Strait, has historically been surrounded by major navigational routes. From the 16th to the 18th centuries, vessels traveling between the Chinese mainland and Taiwan often used Penghu as a stopover on their route.

In the 19th century, international trade routes also passed through the northern waters of Penghu. A large number of merchant and fishing vessels traversed this area over centuries. However, the waters near Penghu are affected by strong winds and unpredictable currents, along with many hidden reefs, making it a perilous area for vessels. Some of these distressed vessels were salvaged, while others sank to the sea floor, becoming a rich part of the underwater cultural assets.

As Taiwan pushes forward in its quest for renewable energy, the government is actively developing offshore wind power. Penghu presents optimal conditions for wind power development, luring companies to invest in harnessing the gusts that blow over the strait. As turbines prepare to nestle amidst the waves, a pressing issue emerges from the depths - the delicate equilibrium between energizing the future and preserving the past.

Swept by the Southwest and Northeast monsoons, Penghu harbors a high potential for wind energy generation. According to Central Weather Bureau’s data, the annual average wind speed is 6.3 meters per second, with the average wind speed in November and December reaching up to 8.4 meters per second. Currently, the Geological Survey and Mining Management Agency of the Ministry of Economic Affairs is conducting surveys in the waters of Penghu. Wind turbine manufacturers have taken interest in the northern waters off Jibei Island in Penghu, designating four offshore wind farm sites, including the “Huanpeng No.1 to No.3 Offshore Wind Power Projects” led by Taiya Renewable Energy, and the “Guofeng Offshore Wind Power Project” announced by the Spanish energy company Iberdrola.

Additionally, the “Hailong No.2 and No.3 Projects” along with the “Xufeng Project” in the Changhua waters are under construction, and they overlap with Penghu shipwrecks. Among them, the “Hailong No.2 and No.3 Projects” have passed the review process and secured financing, aiming for completion and commercial operation before 2026.

The “Underwater Cultural Heritage Preservation Act” stipulates that before undertaking any aquatic development, developers must conduct an investigation of underwater cultural assets. If suspected underwater cultural assets are discovered, development activities must cease immediately, and the Ministry of Culture must be notified. Zang Zhenhua, an academician at the Institute of History and Philology of the Academia Sinica, pointed out that wind turbine manufacturers indeed adhere to the regulations set by the Ministry of Economic Affairs, steering clear of regions potentially rich in underwater cultural assets. However, the current progress in the detection and identification of underwater cultural assets in Taiwan is quite slow, casting a shadow of uncertainty of whether there are yet undiscovered valuable assets in the potential development areas.

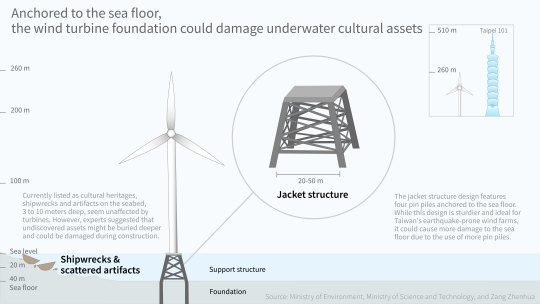

The wind turbines to be used in “Huanpeng No.1 Offshore Wind Power Project” are expected to have a height of 260 meters and will be installed on the seabed at depths of 20 to 40 meters, with a “jacket structure” used for the underwater foundation, anchored to the seabed with three or four pin piles. Presently listed as cultural heritages, shipwrecks and scattered artifacts lie on the seabed 3 to 10 meters deep and seem unlikely to be directly affected by the wind turbines. However, Zang points out that a large number of target objects are not yet listed for protection. Moreover, there might be more undiscovered cultural assets buried deeper under the sea floor, all of which could be damaged during the construction of the wind turbines.

As of the end of December in 2019, the underwater archaeology team from the Academia Sinica discovered a total of 90 suspected shipwreck sites in the waters around Taiwan, with 20 of them confirmed as shipwrecks or other target objects. Zang stated that currently, eight sites have been completed for the underwater cultural assets registry, of which six are in Penghu (with one location not disclosed). The known five shipwrecks include: (1) a Qing Dynasty wooden boat from the mid to late Qing period, sunken in the southwest waters of Kongque Island; (2) the “Jiangjyun No.1,” which sank near Wang’an Tanmen Harbor during the Qianlong reign of the Qing Dynasty; (3) the S.S. Bokhara merchant ship that ran aground north of Gupo Island in 1892; (4) the Warship Guang Bing that sank in the southeast waters of Jiangjun Island in 1895; and (5) the Yamafuji Maru, which was sunk by torpedoes from an American submarine at the Six Feet Reef on the west side of Penghu in 1942.

Zang believes that ancient navigational routes could serve as pointers for locations of shipwrecks. However, vessels might have deviated from their courses due to typhoons, encounters with reefs, and other factors. To pinpoint more precise locations of shipwrecks, it’s crucial to gather information from local chronicles, news reports, oral histories from local fishermen, and other documents, Zang added.

Zang also highlighted that at present, the predominant methods used to identify underwater cultural assets are acoustic and magnetic signal detections, just like the Chinese idiom “finding a needle in the sea.” He said that the most direct and effective method is having detection personnel dive into the sea for visual identification, yet the shortage of personnel poses a challenge, hindering the pace of exploration and resulting in slow progress.

The challenges encountered in exploring underwater cultural assets may not be resolved in the short term, while the development of wind power is advancing rapidly. Zang hopes that through education and advocacy, the public will recognize the value of underwater cultural assets, emphasizing that “once the assets are damaged, the loss is permanent.”

As Penghu embarks on the journey of wind power development, finding a balance between the pursuit of sustainability and the preservation of history will be the compass guiding it towards smooth sailing.

0 notes

Text

Old money families often use various legal and financial structures to manage and preserve their wealth, including trusts and foundations. These structures are not necessarily about hiding wealth but rather about safeguarding and managing it efficiently. Here's a brief overview of how they may create trusts and foundations:

1. Family Trusts : Old money families may establish family trusts to protect and manage assets across generations. These trusts can provide for family members' financial needs and inheritance. By setting up a trust, the family can maintain control and confidentiality over their assets.

2. Private Family Foundations : Instead of hiding wealth, many old money families choose to create private family foundations. These foundations have a philanthropic purpose and can be used to support causes and charitable activities. While they enjoy tax benefits, their primary purpose is not to hide wealth but to give back to society.

3. Offshore Trusts and Entities: Some families may use offshore trusts or entities for various reasons, such as tax planning, asset protection, and privacy. These can be legitimate financial tools but have also been criticized for enabling financial secrecy.

4. Estate Planning: A significant part of wealth preservation involves careful estate planning. This may include wills, trusts, and other legal mechanisms to pass on assets to heirs while minimizing estate taxes.

5. Legal and Financial Advisors: Old money families often work with experienced legal and financial advisors who help them navigate complex wealth management strategies. These advisors provide guidance on tax-efficient structures and compliance with relevant laws.

It's important to note that the use of trusts and foundations is not inherently illegal or unethical. Many wealthy families use these structures to ensure their assets are managed responsibly and to provide for future generations. However, the degree of privacy and the specific strategies employed can vary widely and may sometimes raise ethical and legal questions, especially if they are used to evade taxes or engage in illicit activities.

The level of secrecy around wealth and the motivation for using certain structures can differ from one family to another. Some prioritize maintaining privacy, while others emphasize transparency and giving back to society through philanthropy.

1 note

·

View note

Text

Navigating Offshore Development Centers: Key Lessons Learned from Implementation and Management

In today's interconnected world, businesses are continually seeking ways to enhance their operational efficiency and drive innovation. One strategy that has gained significant traction is establishing Offshore Development Centers (ODCs).

These centers, often located in countries like India, provide a cost-effective solution for accessing skilled talent, accelerating product development, and expanding market reach. In this blog, we delve into the valuable lessons learned from implementing and managing Offshore Development Centers, with a focus on the Indian landscape.

Lesson 1: Strategic Alignment Is Paramount

Before venturing into establishing an Offshore Development Center, it's crucial to align your business goals, objectives, and project requirements. The success of an ODC heavily relies on ensuring that both your onshore and offshore teams are on the same page. A clear understanding of the project scope, expectations, and desired outcomes fosters collaboration and sets the foundation for a successful partnership.

Lesson 2: Partner Selection Requires Careful Consideration

Choosing the right partner for your Offshore Development Center is a pivotal decision. Look for a partner that not only possesses technical expertise but also shares your values and culture. When considering Offshore Development Centers in India, conduct thorough due diligence, evaluate their track record, and assess their ability to understand your business nuances.

Lesson 3: Communication Bridges the Gap

Effective communication is the glue that holds your onshore and offshore teams together. Bridge time zone differences by establishing regular communication channels, such as video conferences and messaging platforms. Encourage open dialogues, clarify expectations, and ensure that all team members are well-informed about project progress, challenges, and milestones.

Lesson 4: Cultural Sensitivity and Understanding

Cultural differences can influence work dynamics and communication styles. Recognize and respect these differences to build strong working relationships. For example, Offshore Development Centers in India might operate with a different set of cultural norms and holidays. Embrace diversity, invest time in understanding each other's work cultures, and foster an inclusive environment.

Lesson 5: Clearly Defined Processes and Workflows

Establishing well-defined processes and workflows is essential for maintaining consistency and efficiency in project execution. Outline roles and responsibilities, define the development lifecycle, and ensure that everyone is familiar with the tools and methodologies being used. This clarity minimizes misunderstandings and streamlines collaboration.

Lesson 6: Continuous Monitoring and Feedback Loops

Regular monitoring of project progress is essential to identify potential roadblocks and address them promptly. Implement feedback loops that encourage both positive reinforcement and constructive criticism. Regular performance reviews and retrospectives foster a culture of continuous improvement and help maintain the quality of deliverables.

Lesson 7: Data Security and Intellectual Property Protection

Security considerations are of utmost importance when working with Offshore Development Centers. Ensure that proper data security measures are in place, and intellectual property rights are clearly defined in your agreements. Collaborate with legal experts to safeguard your company's assets and ensure compliance with relevant regulations.

Lesson 8: Flexibility and Adaptability

Agility is key when managing an Offshore Development Center. The ability to adapt to changing project requirements, technology trends, and unforeseen challenges is essential for success. Embrace a flexible approach that accommodates evolving needs and encourages innovative thinking.

Lesson 9: Regular Onsite Visits Foster Relationships

While the digital age allows for virtual collaboration, periodic onsite visits can strengthen relationships and build trust. Visiting your Offshore Development Center in India can provide valuable face-to-face interactions, enhance team bonding, and deepen mutual understanding.

Lesson 10: Celebrate Achievements Together

Acknowledging milestones, achievements, and successful project deliveries is essential to maintain team motivation and morale. Whether it's a small win or a major accomplishment, take the time to celebrate together as a unified team.

Conclusion

Establishing and managing Offshore Development Centers, particularly in countries like India, presents both challenges and opportunities. By following these lessons learned, you can navigate the complexities, build strong partnerships, and leverage the advantages of skilled offshore talent to accelerate your business growth. From strategic alignment to embracing cultural diversity, effective communication to continuous improvement, each lesson contributes to a successful Offshore Development Center journey that drives innovation and business excellence.

#digital marketing services#it staff augmentation#offshore development center in india#it staff augmentation gurgaon#offshore development centre#infrastructure setup#it infrastructure services#build operate transfer#office infrastructure setup#hiring services

0 notes