#Mortgage Sales Manager

Text

Microphones used by popular artists.

"RØDE NT1 5th Gen: Your Ultimate Mic for Studio and Podcasting"

Buy Now

Components1 x Dust Cover, 1 x 6m XLR Cable (red), 1 x NT1 5th Generation - Black, 1 x SM6 Shock Mount & Pop Filter, 1 x SC29 USB-C to USB-C Cable (3m)1 x Dust Cover, 1 x 6m XLR Cable (red), 1 x NT1 5th Generation - Black, 1 x SM6 Shock Mount & Pop Filter, 1 x SC29 U… See morePolar PatternUnidirectionalAudio Sensitivity45 dBItem Weight308 Grams

About this item

Extremely Low-noise Large-diaphragm Cardioid Condenser Microphone with XLR/USB Output

SM6 Combination Shockmount Pop Screen - Black

Report incorrect product information.

Note: Products with electrical plugs are designed for use in the US. Outlets and voltage differ internationally and this product may require an adapter or converter for use in your destination. Please check compatibility before purchasing.

#homebuyers#mortgage#property for sale#investmentopportunity#luxuryliving#propertyinvestment#propertyforsale#realestatemarket#property management#dreamhome#microphone#hypnosis microphone

2 notes

·

View notes

Text

Ideal Unit|Facing Mangroves and Pool|Yours To Own

View On WordPress

#2 bedrooms#2 Sunlit bedrooms#3 bathrooms#apartment#consulting services#Dubai#Ideal Unit#living room#mortgage brokerage#property management#Real estate Dubai#rentals#sales#spacious kitchen#Swimming Pool#United Arab Emirates

9 notes

·

View notes

Text

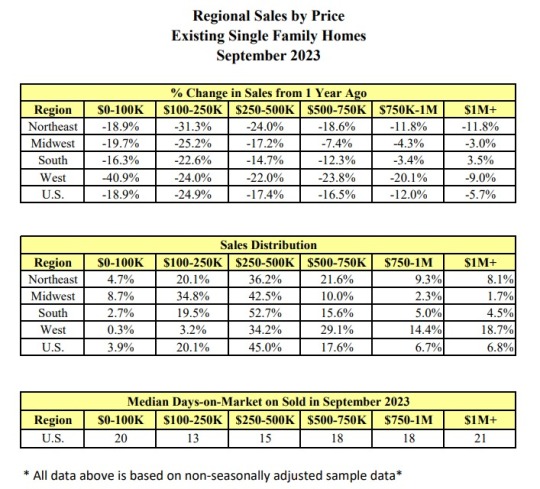

Real Estate Sales Report - News Worsens for CCRCs/Life Plan Communities

With occupancy rebounding to pre-pandemic levels and demand remaining strong, CCRCs/Life Plan Communities continue to face economic headwinds from capitalizing on improving market conditions.

Capital costs continue to rise making borrowing money a challenge or alternatively, perhaps adding additional debt service costs if existing debt is variable.

Accessing capital is nearly imperative for…

View On WordPress

#CCRC#Economics#Fitch Ratings#Home Sales#Industry Outlook#Interest Rates#Life Plan Community#Management#mortgage#mortgage rates#National Association of Realtors#real estate#Senior Housing#Trends

0 notes

Text

Mortgage Broker Melbourne Australia

Are you a first-time homebuyer or looking for a better deal on your mortgage? Look no further than Liberty, the Best Mortgage Broker Melbourne. Our knowledgeable team of experts will guide you through the process, ensuring that you understand your options and find the best possible deal for your unique situation. With our extensive knowledge of the industry and access to a wide range of lenders, we can help you secure a loan with competitive rates and favourable terms. Don't let the stress of finding the right Mortgage Broker Perth hold you back from owning your dream home. Contact Liberty today and take the first step towards a brighter financial future.

#personal loans#Brokers#mortgage#companies#investments#investors#credit#rates#Loans#management#sales#finance

0 notes

Video

undefined

tumblr

Ping Tree Systems is a lead distribution software having realtime Ping and Post functionality. It pings to more than one buyer parallel and then posts to the highest bidder buyer. Each lead transaction log is created with ping and post detail of each buyer and affiliate. Different types of Lead and Revenue reports are available.

Contact us at +91 (903) 387-9840

🌐 www.pingtreesystems.com

#realtime Lead Distribution Software#Lead Distribution Software#Data management system#Ping Tree Service#Ping Post Mortgage Leads#Ping Post Solar Leads#Ping Post Home improvement Leads#Best Lead Distribution Software#Lead System#Sales Leads Management Software

0 notes

Text

0 notes

Text

youtube

🌟🏦 Raja Iqdeimat describes an occasion when she worked at a bank and participated in a goal-setting activity led by the management. Raja indicated a wish to buy an apartment in Manhattan within five years. The manager took liberties and shifted the purpose to merely purchasing property in New York City, which Raja found offensive. Despite the setback, Raja was determined to fulfill her initial goal, drawing inspiration from her ambition.

🏙️🏠 Raja eventually purchased a condominium on Manhattan's Upper West Side. They used the opportunity to contact the manager, requesting assistance in concluding the transaction through a mortgage officer at her institution. Despite the manager's initial misgivings, their move demonstrated their capability and drive, serving as a motivational example. By accomplishing their aim, Raja displayed their capacity to express their desires and refuse to be underestimated, inspiring others through their actions.

💼💪 Raja's activities not only achieved her own objectives but also helped to demonstrate her abilities and self-worth. By approaching the manager for aid in concluding the sale of the Manhattan flat, Raja effectively challenged the manager's previous doubts and showed their own determination and competency. This emphasizes the necessity of perseverance, self-belief, and refusing to allow others' doubts to derail one's goals, serving as an inspirational lesson. Ultimately, Raja's accomplishment demonstrates their perseverance and ability to overcome adversities, motivating others to pursue their dreams.

234 notes

·

View notes

Text

Intuit: “Our fraud fights racism”

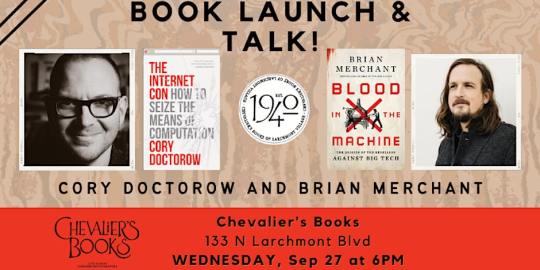

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

If you’re one of the millions of Americans worried about your pocketbooks and the general cost of living, you might have picked up on some good news recently: Inflation has really been cooling off this summer, as long-sticky (and long-lamented) food and energy prices continue to moderate. Some economic indicators remain stubborn, however—and they aren’t likely to abate anytime in the near future, no matter how long the Federal Reserve keeps interest rates high, what tweaks President Joe Biden makes to his trade policy, whether corporations decide themselves to slash prices on certain products, or whether Covid-battered supply chains finally get some long-needed fixes.

Other, grimmer recent headlines help to explain why. Hard rains from a tropical disruption in the Gulf have been battering Florida’s southern regions for days, leading to a rare flash-flood emergency. Another batch of storms is swirling near Texas at the moment and could form into a tropical depression, according to forecasts from the National Hurricane Center. Even if both states end up missing bigger storms now, it’s likely only a matter of time before they’re threatened again: The National Oceanic and Atmospheric Administration predicts that the United States will see its worst hurricane season in decades this summer.

Meanwhile, the heat waves that have enveloped Phoenix are intensifying to the point that some analysts are deeming its latest conditions “a Hurricane Katrina of heat.” Spanning outward, the Midwest and Northeast are projected to get their own extreme heat warnings as early as next week, with energy demand set to skyrocket as people turn on their air conditioners. The country has already seen 11 “billion-dollar disasters” this year, including the tornadoes that slammed Iowa just weeks ago. Meanwhile, the already strapped Federal Emergency Management Agency faces a budgetary crisis, and sales of catastrophe bonds are at an all-time high.

Now, let’s look back at the inflation readings. One of the categories remaining stubbornly high while other indicators shrink? Shelter and housing, natch, as rents and insurance stay hot—and still-elevated interest rates make construction and mortgage costs even more prohibitive. On the energy front, motor fuel may be cheapening, but fuel and electricity for home use are still pricey. Auto insurance remains a driving outlier, as I noted back in April, not least because of insurers hiking premiums for cars in especially disaster-vulnerable regions—like the South, the Southwest, and the coasts.

Look at what else is happening in those very regions when it comes to home insurance: Providers are either retreating from or dramatically heightening their prices in states like California, Texas, Florida, and New Jersey, thanks to their unique susceptibility to climate change. These states have seen supercharged extreme weather events like floods, rain bombs, heat waves, and droughts. National lawmakers fear that the insurance crises there may ultimately wreak havoc on the broader real estate sector—but that’s not the only worst-case scenario they have to worry about.

Agricultural yields for important commodities produced in those states (fruits, nuts, corn, sugar, veggies, wheat) are withering, thanks to punishing heat and soil-nutrition depletion. The supply chains through which these products usually travel are thrown off course at varying points, by storms that disrupt land and sea transportation. Preparation for these varying externalities requires supply-chain middlemen and product sellers to anticipate consequential cost increases down the line—and implement them sooner than later, in order to cover their margins.

You may have noticed some clear standouts among the contributors to May’s inflation: juices and frozen drinks (19.5 percent), along with sugar and related substitutes (6.4 percent). It’s probably not a coincidence that Florida, a significant producer of both oranges and sugar, has seen extensive damage to those exports thanks to extreme weather patterns caused by climate change as well as invasive crop diseases. Economists expect that orange juice prices will stay elevated during this hot, rainy summer.

(Incidentally, climate effects may also be influencing the current trajectory and spread of bird flu across American livestock—and you already know what that means for meat and milk prices.)

It goes beyond groceries, though. It applies to every basic building block of modern life: labor, immigration, travel, and materials for homebuilding, transportation, power generation, and necessary appliances. Climate effects have been disrupting and raising the prices of timber, copper, and rubber; even chocolate prices were skyrocketing not long ago, thanks to climate change impacts on African cocoa bean crops. The outdoor workers supplying such necessities are experiencing adverse health impacts from the brutal weather, and the recent record-breaking influxes of migrants from vulnerable countries—which, overall, have been good for the U.S. economy—are in part a response to climate damages in their home nations.

The climate price hikes show up in other ways as well. There’s a lot of housing near the coasts, in the Gulf regions and Northeast specifically; Americans love their beaches and their big houses. Turns out, even with generous (very generous) monetary backstops from the federal government, it’s expensive to build such elaborate manors and keep having to rebuild them when increasingly intense and frequent storms hit—which is why private insurers don’t want to keep having to deal with that anymore, and the costs are handed off to taxpayers.

When all the economic indicators that take highest priority in Americans’ heads are in such volatile motion thanks to climate change, it may be time to reconsider how traditional economics work and how we perceive their effects. It’s no longer a time when extreme weather was rarer and more predictable; its force and reasoning aren’t beyond our capacity to aptly monitor, but they’re certainly more difficult to track. You can’t stretch out the easiest economic model to fix that. And you can’t keep ignoring the clear links between our current weather hellscape, climate change, and our everyday goods.

Thankfully, some actors are finally, belatedly taking a new approach. The reinsurance company Swiss Re has acknowledged that its industry fails to aptly factor disaster and climate risks into its calculations, and is working to overhaul its equations. Advances in artificial intelligence, energy-intensive though they may be, are helping to improve extreme-weather predictions and risk forecasts. At the state level, insurers are pushing back against local policies that bafflingly forbid them from pricing climate risks into their models, and Florida has new legislation requiring more transparency in the housing market around regional flooding histories. New York legislators are attempting to ban insurers from backstopping the very fossil-fuel industry that’s contributed to so much of their ongoing crisis.

After all, we’re no longer in a world where climate change affects the economy, or where voters prioritizing economic or inflationary concerns are responding to something distinct from climate change—we’re in a world where climate change is the economy.

13 notes

·

View notes

Text

How to Find the Best Deals When Buying Villas in Dubai

Securing the best deals on villas in Dubai requires a combination of market knowledge, strategic planning, and effective negotiation. Here’s how you can find the best deals when buying villas in this vibrant city.

1. Conduct Thorough Market Research

Understanding the market dynamics is crucial for finding the best deals.

Current Market Trends: Stay updated with the latest market trends and property prices in different areas of Dubai. This will help you identify the right time to buy.

Historical Data: Analyze historical data on property prices to understand the market’s performance over the years. This can give you insights into potential future trends.

For comprehensive market insights, visit Dubai Real Estate.

2. Choose the Right Time to Buy

Timing your purchase can significantly impact the deal you get.

Buyer’s Market: Look for periods when there is a surplus of properties on the market. This can drive prices down and provide better negotiation opportunities.

Seasonal Trends: Consider buying during off-peak seasons when the demand is lower. Sellers may be more willing to negotiate during these times.

Explore more options at Off-Plan Projects in UAE.

3. Work with Experienced Real Estate Agents

A knowledgeable real estate agent can be invaluable in finding the best deals.

Reputable Agents: Choose agents with a strong track record and good knowledge of the Dubai villa market. They can provide valuable insights and help you navigate the buying process.

Negotiation Skills: An experienced agent can negotiate better deals on your behalf and help you understand the intricacies of the market.

For expert advice, check out Mortgage Broker Dubai.

4. Consider Off-Plan and Under-Construction Properties

Off-plan and under-construction properties can offer attractive pricing and payment plans.

Early Bird Discounts: Developers often offer discounts for early buyers. These discounts can be substantial and provide good value for money.

Flexible Payment Plans: Off-plan properties typically come with flexible payment plans, making it easier to manage your finances.

Learn more about off-plan properties at Under-Construction Properties in Dubai.

5. Negotiate Effectively

Effective negotiation can help you secure a better deal.

Be Prepared: Do your homework and know the market value of the property. This will give you a strong negotiating position.

Stay Flexible: Be open to compromises and alternative solutions. Sometimes, a small concession can lead to a significant overall saving.

For more negotiation tips, visit Best Mortgage Services.

6. Utilize Online Property Portals

Online property portals can be a great resource for finding deals.

Comprehensive Listings: Use reputable online portals that offer comprehensive listings of properties. This can help you compare prices and features.

Direct Deals: Some portals facilitate direct deals between buyers and sellers, potentially eliminating agent fees and providing better deals.

For more property listings, check out Property For Sale in Dubai.

7. Attend Property Exhibitions and Events

Property exhibitions and events can provide opportunities to find exclusive deals.

Developer Discounts: Many developers offer special discounts and promotions at these events.

Networking Opportunities: These events provide an opportunity to network with developers, agents, and other buyers, which can lead to valuable insights and deals.

Explore more at Rent Your Property in Dubai.

Conclusion

Finding the best deals when buying villas in Dubai involves a combination of thorough research, strategic planning, and effective negotiation. By staying informed about market trends, choosing the right time to buy, working with experienced agents, and considering off-plan properties, you can secure the best deals and make a smart investment in Dubai’s vibrant real estate market.

For more information and assistance with buying villas in Dubai, visit Home Loan UAE.

9 notes

·

View notes

Text

Partial Sea View| Fully Furnished| Fully Upgraded

3,750,000 AED

1,020,100 USD

986,300 EUR

Would you like to invest in a nice apartment that is fully furnished and upgraded?

Fond of a partial sea view from your home?

Don’t think twice this is for sure the perfect property for you.

Welcome to a new life. This is precisely the kind of en-vogue 3-bedroom flat that energizes souls.Invest in this cracking deal because jaw-droppingly incredible…

View On WordPress

#consulting services#mortgage brokerage#Penthouse.ae by Metropolitan Premium Properties#property management#rentals#sales

0 notes

Text

Palace of the Lopukhin

Located on an island in the middle of the Ros River. City of Korosten.Ukraine.

It was built in 1789 by Prince Stanisław Poniatowski, its architecture, in the neo-Gothic style, looks stunning. Of particular note are the entrance gates, executed in the spirit of French defensive architecture. Many contemporaries note that the palace (along with the adjacent territory, park) was long considered one of the richest in Europe.

Founded in 1782 and intended as his own summer residence. In fact, the building was erected on the remains of a fortress of Polish princes, which was built on the Ancient Rus' hillfort of the town of Korosten. Initially, talented architects named Lindsay and Muntz worked on the building project. With the participation of Prince Lopukhin, the exterior of the building was significantly transformed – separate features of romanticism, classicism, supplemented with elements of Gothic, appeared. Fortunately, the revolutionary events of those times did not affect the integrity and present beauty of the palace. To this day, it has survived practically in its original form. The history of the property is controversial.

Lopukhin, in 1799, purchased the estate from the Polish leader Stanisław Poniatowski, giving him 10,000 rubles in silver. A corresponding decree was separately prepared. It stated that along with the palace, trees, lands, crockery, library, and garden were transferred. One of the heirs of the estate was the most enlightened Prince Nikolai Petrovich Demidov. If the former owners of the object had enough income not only for living but also for maintaining the entire economy, then the newly minted owner began to experience significant financial difficulties. The situation was exacerbated by the abolition of serfdom, the improper lifestyle of Nikolai Petrovich. Even the work of two sugar factories of his own did not save the situation, despite the fact that other industrialists made good money on similar enterprises. It got to the point that by 1897, Lopukhin-Demidov was forced to take out a loan of 2.5 million rubles. The estate, which was estimated at that time at 4,167 thousand rubles, was mortgaged. Such significant "infusions" did not change the situation. Therefore, the prince decided to transfer his debts to the state. In 1901, he applied for guardianship of the estate in order to reduce the total debt. The historical importance of the palace, its integrity played a positive role in this matter.

By 1902, the unfavorable condition of the estate served as an impetus for its sale, transfer to the state balance. The lack of working capital, excessive indebtedness, the obligations of the Lopukhin-Demidov family contributed to the activation of this process. Numerous efforts did not allow getting rid of debts. Again, in 1907, the palace was laid down for another 66 and a half years. The composition of the guardianship management changed several times, while the total debt continued to grow. The situation began to get out of control, and Nikolai Petrovich turned to the emperor for help. It turned out that the cause of all the troubles was the manager, whom they did not prosecute after proving his guilt. Nikolai Petrovich planned that within the next three to four years, he would be able to settle private debts, a little later – with the rest. At the end of 1910, the Most Enlightened One died. His wife applied for the preservation of guardianship over the inheritance. The descendants of Lopukhin-Demidov (sons) rarely visited the estate, preferring other countries.

The estate went through a difficult time during World War II, in 1944. In Korosten, the 80-thousand-strong army of German invaders was based, who were successfully "knocked out" from their positions .For this operation, the city was awarded the Order of the 1st degree. By February 14, the city was completely liberated from the fascists. Today, there is a thematic museum in the estate dedicated to the Great Battle.

#architecture#ukrainians on tumblr#beautiful architecture#beautiful places#historic architecture#ukraine#ukrainians#castle#ukrainian castle#ukraine history#architectural heritage

8 notes

·

View notes

Note

hi bitches!! just wanted to share the absolute insanity of my last 12 days!

day 0: found out we are being evicted because the landlord wants our house back. we have done nothing wrong and broken no rules but turns out he can still do that! we have 2 months to get out.

day 0.5: decide we are going to try and buy a house. luckily our savings can scrape into a small deposit already!

day 3: mortgage agreement in principle achieved on the second phone call. first house viewing

day 5: fourth house viewing. offer made!

day 6: find out we are one of six offers and some are much higher. can't up our budget to match. continue to view houses. select and instruct solicitor in preparation (using local recommendations)

day 8: saturday afternoon. a new house comes on the market. it is GORGEOUS. viewing request sent within 3 minutes.

day 9-10: easter bank holiday weekend. try not to lose mind while waiting.

day 11: offer on fourth house officially rejected. viewing on Gorgeous House. immediate discussion of how far we can push the budget to secure it FAST. offer made + essay written to seller on why we are the perfect buyers and they should immediately take the house off the market and cancel all their other viewings.

day 11.5: cannot sleep. this house is IT for us.

day 12, 9:38am:

OFFER ACCEPTED!!!!!!

so yes. that has been the last 12 days of my life. we will probably still not manage it within the two months but we have friends we can stay with while waiting for the sale to complete.

HOLY SHIT WE ARE BUYING A HOUSE!!!!!

Holy shit baby, this took us on a JOURNEY. What a wild ride!

This is exciting news and we're absolutely thrilled for you. Fuck your uncaring landlord and hell yeah to those sellers who saw your inherent brilliance!

53 notes

·

View notes

Note

I couldn’t find the post I first saw sharing the minutes on coverture laws (it’s actually more dowery related it seems) but I managed to find the actual section! Along with Camille and Danton, I forgot Couthon also speaks on the proposal.

https://sul-philologic.stanford.edu/philologic/archparl/navigate/73/0/0/0/0/0/0/0/677/

(The proposal starts at the link but they start talking on page 674)

Thank you so much for sharing! Fun to know where these guys stood on the matter.

Thuriot — I believe that the husband alone should have right to the administration of property, and also be solely responsible for it. Very few women are going to be in a position to manage this administration. However, I would not like the right to be given explicitly by law to the husband; this law would cause discord between the spouses; and the property of women is sufficiently secured, by the mortgage of their dowry, and by the provision of the law which requires their consent for the sale of immoveables.

Lacroix — Citizens, I maintain on the contrary that the common administration must result from the community itself, and that in a free country one cannot keep women in slavery any longer. It is ridiculous that in the society of marriage a single member exclusively administers the family, and that a husband can squander at will the fortune he obtains from his wife

Merlin de Douai — If the Convention adopts the article presented to it by the committee, it would do an absurd and unjust thing, and would introduce perpetual disputes into families. I think that the woman is generally incapable of administering, and that the man has a superiority over her: nature must preserve it…

Danton — I ask that the committee above all tells us what it wants to say by its article.

Cambacérès — The committee means to say that the husband can not dispose of the property of the community without the consent of the wife.

Danton — Well, nothing is more natural.

Garnier — I ask that this proposal be enacted, and, if it has any disadvantages, that they are corrected by the law of divorce.

Camille Desmoulins — I agree. I do not want marital power, which is a creation of despotic governments, to be preserved any longer. In support of my opinion comes this political consideration: it is important to make women love the Revolution, and you will achieve this goal by making them get to enjoy their rights

Couthon — It suffices to have made a few reflections on the nature of man to be convinced that women is born with as much capacity as men; if until now that has been shown less, it is not the fault of nature, but that of our ancient institutions. I further observe that it is ridiculous to refuse the common administration of property to two spouses who can only sell it by common consent.

Thuriot — This law would be so contrary to principles, and so dangerous in its results, that foreigners would no longer wish, as long as it existed, to have commercial transactions with the French. This law would enslave and degrade the man by putting him under the guardianship of the woman. The administration of trust given to her by her husband honors her more than the right she would hold from this law. Moreover, it is important to deeply meditate upon this question. I therefore ask that it be adjourned for three days.

The adjournment is decreed.

#still can’t tell if Danton is for or against…#desmoulins#couthon#danton#camille desmoulins#georges danton#georges couthon

33 notes

·

View notes

Text

Top Tips for Choosing a Mortgage Consultant in Dubai

Choosing the right mortgage consultant is crucial for securing the best mortgage terms and making informed decisions. This guide provides top tips to help you select the best mortgage consultant in Dubai.

For more information on Dubai real estate, visit Dubai Real Estate.

Importance of a Mortgage Consultant

A mortgage consultant can provide expert guidance, save you time, and help you find the best mortgage products. Their role includes:

Assessing Your Financial Situation: Understanding your financial health and mortgage needs.

Exploring Mortgage Options: Identifying and comparing different mortgage products.

Negotiating Terms: Securing the best rates and terms from lenders.

Managing Paperwork: Handling all necessary documentation and processes.

For property purchase options, explore Buy House in Dubai.

Top Tips for Choosing a Mortgage Consultant

Research and Recommendations: Start by researching online and seeking recommendations from trusted sources. Use online platforms to read reviews and gather information about various mortgage consultants.

Verify Credentials: Ensure the consultant is licensed and has a proven track record. Look for certifications from recognized institutions and membership in professional organizations.

Experience Matters: Choose a consultant with extensive experience in the Dubai mortgage market. Experienced consultants are more likely to have established relationships with lenders and a deeper understanding of the market.

Client Reviews: Read client reviews and testimonials to gauge satisfaction and service quality. Look for patterns in feedback to identify the consultant’s strengths and weaknesses.

Clear Communication: Ensure the consultant communicates clearly and keeps you informed throughout the process. Good communication is essential for a smooth and transparent mortgage process.

For mortgage options, consider home mortgage uae.

Questions to Ask a Mortgage Consultant

When interviewing potential mortgage consultants, ask the following questions:

What is your experience in the Dubai mortgage market? Understanding their level of experience can give you confidence in their ability to handle your case.

What types of loans do you specialize in? Some consultants may have more experience with certain types of loans, such as first-time homebuyer programs or refinancing.

How do you help clients secure the best mortgage rates? This question helps you understand their approach to negotiating with lenders.

What are your fees, and how are they structured? Transparency about fees is crucial to avoid any surprises later on.

Can you provide references from previous clients? References can provide insight into the consultant's reliability and effectiveness.

For rental options, visit Rent Your Property in Dubai.

Evaluating Your Options

When evaluating mortgage consultants, consider the following factors:

Experience and Reputation: Choose a consultant with extensive experience and a strong reputation in the industry. Experienced consultants are more likely to have established relationships with lenders and a deeper understanding of the market.

Communication Skills: Ensure the consultant communicates clearly and promptly. Good communication is crucial for a smooth mortgage process.

Transparency: Look for transparency in fees and terms. The consultant should provide a clear breakdown of their fees and any potential additional costs.

Customer Reviews: Check online reviews and testimonials to gauge client satisfaction. Look for patterns in the reviews to identify strengths and weaknesses in the consultant's services.

For property sales, visit Sell Your Property in Dubai.

The Role of a Mortgage Consultant

A mortgage consultant's primary role is to act as a bridge between you and potential lenders. They help you understand your financial situation, identify suitable mortgage products, and guide you through the application process. Here are some specific tasks they perform:

Financial Assessment: Evaluating your financial situation, including your income, expenses, credit score, and debt-to-income ratio, to determine your mortgage eligibility.

Exploring Mortgage Options: Identifying and comparing different mortgage products from various lenders to find the best fit for your needs.

Rate Negotiation: Negotiating the best mortgage rates and terms with lenders on your behalf.

Paperwork Management: Handling all necessary documentation and ensuring compliance with regulations.

Closing Assistance: Assisting with the final steps of the mortgage process and closing the deal.

Benefits of Working with a Mortgage Consultant

Working with a mortgage consultant offers several advantages, including:

Access to a Wide Range of Products: Mortgage consultants have access to a broad range of mortgage products from different lenders, increasing your chances of finding the best deal.

Expert Guidance: Consultants provide expert advice on the best mortgage options based on your financial situation.

Time Savings: By handling the research, paperwork, and negotiations, consultants save you time and effort.

Stress Reduction: Managing the complexities of the mortgage process can be stressful. A consultant can alleviate this stress by guiding you through each step.

Customized Solutions: Consultants offer personalized mortgage solutions tailored to your specific needs and goals.

Real-Life Success Story

Consider the case of Maria, a first-time homebuyer in Dubai. By following these tips, she found a highly recommended mortgage consultant who helped her navigate the mortgage process, resulting in a favorable mortgage rate and a smooth home purchase.

Maria was initially overwhelmed by the various mortgage options and the paperwork involved. She decided to seek the help of a mortgage consultant based on recommendations from friends and online reviews. The consultant assessed Maria's financial situation, explained the different mortgage products available, and helped her choose the best one for her needs.

Throughout the process, the consultant handled all the paperwork, negotiated with lenders to secure a competitive rate, and kept Maria informed at every step. This personalized service made a significant difference, reducing Maria's stress and ensuring a smooth and successful home purchase.

For more resources and expert advice, visit Dubai Real Estate.

Conclusion

Choosing the right mortgage consultant in Dubai can make a significant difference in your home-buying experience. By following the tips outlined in this guide and conducting thorough research, you can find a consultant who meets your needs and helps you secure the best mortgage deals. For more resources and expert advice, visit Dubai Real Estate.

2 notes

·

View notes

Text

Your Guide to Securing Luxury Properties for Sale in Dubai

Securing luxury properties for sale in Dubai requires careful planning and a thorough understanding of the market. This blog provides a comprehensive guide to help you secure the best luxury properties in Dubai.

For more information on real estate, visit Dubai Real Estate.

Why Invest in Luxury Properties in Dubai?

High ROI: Dubai's luxury real estate market offers high returns on investment due to its desirability and robust demand.

Tax Benefits: Dubai offers a tax-free environment, making it an attractive destination for real estate investment.

World-Class Amenities: Luxury properties in Dubai come with world-class amenities, including private pools, gyms, and concierge services.

Prime Locations: Many luxury properties are located in prime areas, offering stunning views and easy access to key attractions.

Security: Dubai is known for its safety and security, providing peace of mind for property owners.

For property purchase options, explore Buy Residential Properties in Dubai.

Steps to Securing Luxury Properties in Dubai

Determine Your Budget: Establishing a clear budget is the first step. Consider all costs, including property price, taxes, maintenance, and any additional fees.

Research the Market: Understand the current market trends, prices, and types of luxury properties available. This will help you make informed decisions.

Choose the Right Location: Prime locations for luxury properties in Dubai include Palm Jumeirah, Downtown Dubai, Emirates Hills, Dubai Marina, and Jumeirah Beach Residence.

Hire a Real Estate Agent: A reputable real estate agent can provide valuable insights, show you suitable properties, and handle negotiations.

Visit Properties: Schedule visits to potential properties to assess their condition, amenities, and overall appeal.

Legal Considerations: Ensure all legal aspects are covered, including property registration, contracts, and compliance with local regulations.

Financing Options: Explore mortgage financing options to determine the best way to finance your purchase.

Make an Offer: Once you find the perfect property, make a competitive offer. Your agent can help negotiate the best terms.

Finalize the Purchase: Complete the necessary paperwork, pay the required fees, and finalize the purchase.

For mortgage financing options, visit Commercial Mortgage Loan in Dubai.

Popular Areas for Luxury Properties

Palm Jumeirah: Known for its iconic palm-shaped island, Palm Jumeirah offers luxurious villas and apartments with stunning views.

Downtown Dubai: Home to the Burj Khalifa and Dubai Mall, Downtown Dubai offers upscale living in the city's heart.

Emirates Hills: Often referred to as the "Beverly Hills of Dubai," Emirates Hills features luxurious villas with golf course views.

Dubai Marina: Known for its vibrant nightlife and waterfront properties, Dubai Marina is a popular choice for luxury living.

Jumeirah Beach Residence (JBR): This beachfront community offers a mix of luxury apartments and penthouses with stunning sea views.

For rental property management services, visit Rent Your Property in Dubai.

Tips for Securing Luxury Properties

Set a Budget: Determine your budget before you start looking at properties. This will help narrow down your options and prevent overspending.

Research the Market: Understand the current market trends and property values in the areas you're interested in.

Work with a Realtor: A reputable realtor with experience in the luxury market can help you find the best properties and negotiate the best deals.

Inspect the Property: Ensure the property is in good condition and meets your standards. Consider hiring a professional inspector.

Consider Future Value: Think about the property's potential for appreciation and its resale value.

For property sales, visit Sell Your Apartments in Dubai.

Real-Life Success Story

Consider the case of Sophia, an investor from the UK who decided to invest in a luxury penthouse in Downtown Dubai. With the help of a local realtor, Sophia found a stunning property that met all her requirements. The realtor guided her through the buying process, ensuring all legalities were handled smoothly. Today, Sophia enjoys a high return on her investment, with the penthouse's value appreciating significantly.

Future Trends in Dubai's Luxury Real Estate Market

Sustainable Living: There is a growing demand for eco-friendly and sustainable luxury properties.

Smart Homes: Properties equipped with smart home technology are becoming increasingly popular.

Wellness Amenities: Luxury properties are now offering wellness-focused amenities such as spas, gyms, and yoga studios.

Flexible Spaces: There is a trend towards properties with flexible living spaces that can be adapted to different needs.

Branded Residences: Collaborations with luxury brands to create branded residences are on the rise.

Conclusion

Securing luxury properties for sale in Dubai requires careful planning and a thorough understanding of the market. By following the steps outlined in this guide and working with a reputable realtor, you can find and secure the perfect luxury property in Dubai. For more resources and expert advice, visit Dubai Real Estate.

2 notes

·

View notes