#Mobile Money Market Forecast

Explore tagged Tumblr posts

Text

#Mobile Money Market#Mobile Money Market Share#Mobile Money Market Size#Mobile Money Market Forecast#Mobile Money Market Report#Mobile Money Market Growth

0 notes

Text

ERP Software: Revolutionizing Businesses with Advanced ERP Solutions in India

In today’s competitive market, businesses in India are under constant pressure to improve efficiency, streamline operations, and make data-driven decisions. This challenge becomes more manageable with the adoption of ERP software—a solution that has transformed the way businesses operate. ERP (Enterprise Resource Planning) software integrates core business processes, ensuring seamless communication and data sharing across departments.

If you're exploring the world of ERP solutions, this blog will guide you through their benefits and why they are essential for businesses in India.

What is ERP Software?

ERP software is an integrated system that allows businesses to manage various processes such as inventory management, finance, HR, supply chain, and customer relationships through a unified platform. Unlike standalone software tools, ERP brings all these functions together under one umbrella, ensuring real-time collaboration and centralized data storage.

Whether you're running a small startup or a large enterprise, adopting an ERP solution can revolutionize your operations, saving time, reducing costs, and improving productivity.

Why Businesses in India Need ERP Software

India is home to a dynamic business environment, with enterprises spanning sectors like manufacturing, retail, healthcare, education, and IT services. The rapid growth of businesses here has increased the demand for robust systems that can handle complex operations and ensure compliance with local regulations.

1. Streamlined Operations

Indian businesses often deal with diverse challenges, including fragmented workflows and manual inefficiencies. ERP solutions eliminate redundancies, automate repetitive tasks, and streamline operations. For example, manufacturers in India can use ERP software to manage inventory, track production schedules, and forecast demand—all from a single platform.

2. Regulatory Compliance

Compliance with India’s tax structure, such as GST (Goods and Services Tax), is a significant concern for businesses. Many ERP software in India come pre-configured to handle local tax laws and financial reporting standards, ensuring accurate filings and reducing the risk of penalties.

3. Scalability for Growth

As businesses in India expand, their operational complexities grow. A well-implemented ERP system can scale alongside your business, ensuring that your processes remain efficient as you add more products, services, or locations.

4. Data-Driven Decision-Making

ERP systems provide detailed reports and analytics, helping Indian business owners make informed decisions. From tracking sales trends to identifying cost-saving opportunities, ERP software equips you with the insights needed to stay ahead in a competitive market.

Key Features of ERP Solutions

When selecting an ERP solution in India, it's essential to focus on features that align with your business goals. Here are some must-have functionalities:

Integrated Financial Management: Real-time tracking of income, expenses, and budgets.

Inventory and Supply Chain Management: Efficient stock management and logistics tracking.

Human Resource Management (HRM): Employee attendance, payroll processing, and performance tracking.

Customer Relationship Management (CRM): Improved customer service and retention strategies.

Mobile Access: The ability to monitor and manage operations on the go.

Choosing the Right ERP Software in India

The Indian market offers a wide range of ERP software options, from global players like SAP:

Understand Your Needs: Assess your business size, industry, and operational challenges.

Budget Considerations: Choose a solution that offers the best value for money without compromising on features.

Scalability: Opt for an ERP solution that grows with your business.

Vendor Support: Ensure the provider offers reliable support for implementation, training, and maintenance.

Benefits of Using ERP Software

Increased Productivity

Automation of repetitive tasks frees up employee time, allowing them to focus on strategic goals.

Improved Accuracy

ERP systems minimize errors in data entry and processing, ensuring more reliable business insights.

Enhanced Collaboration

With centralized data, employees across departments can access real-time information, fostering collaboration.

Competitive Edge

In a rapidly evolving market, ERP solutions help businesses adapt quickly and maintain an edge over competitors.

Conclusion

The adoption of ERP software in India is no longer a luxury but a necessity for businesses looking to thrive in a fast-paced and competitive landscape. With the right ERP solution, you can streamline operations, enhance productivity, and make data-driven decisions that drive growth.

Whether you're a small enterprise or a large corporation, embracing ERP software is a step toward unlocking your business's full potential. Explore the best ERP solutions today and empower your organization for a brighter, more efficient future.

0 notes

Text

Fraud Detection And Prevention Market Leading Players Updates and Growth Analysis 2030

The global fraud detection and prevention market size is anticipated to reach USD 90.07 billion by 2030, growing at a CAGR of 17.6% from 2023 to 2030, according to a recent study by Grand View Research, Inc. The proliferation of smartphones and the continued rollout of high-speed internet networks has triggered the adoption of mobile banking practices. Mobile banking helps reduce the crowds at banks and allows users to transact irrespective of location. According to a GSMA report, nearly 300 million individuals got connected for the first time to mobile internet in 2018, thereby taking the total global connected population to over 3.5 billion. While mobile-based payment applications, such as Paytm, Apple Pay, Google Pay, and PayPal, among others, gained traction in line with the rising number of smartphone users, these applications also emerged as the major targets of fraudsters, thereby prompting banks to offer online banking services and payment services companies to opt for fraud detection and prevention solutions to counter fraudsters’ intrusion threats and save the users from monetary losses.

The outbreak of the COVID-19 pandemic in 2020 has triggered the adoption of mobile banking services as banking service users prefer to avoid travel and human contact within bank premises. MX, a digital transformation platform for credit unions, banks, and fintech, revealed new research findings related to consumer spending and mobile banking adoption amid the economic uncertainty stemming from the COVID-19 pandemic. The data released in April 2020 has revealed a 50% increase in mobile banking engagement to control finances and plan the individual economic future. While the adoption of mobile banking is rising significantly, mobile banking is also getting potentially vulnerable to fraudulent activities, such as account takeovers, carrier data breaches, call center fraud, subscription fraud, and phishing, among others, thereby driving the demand for fraud detection and prevention solutions over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Fraud Detection And Prevention Market

Fraud Detection And Prevention Market Report Highlights

The service segment of the market by component is projected to witness the highest growth rate over 2023-2030. Organizations in developing economies are increasingly implementing robust fraud prevention strategies. Organizations require integration, consulting, training, and support services from fraud prevention service providers to implement a robust framework. The need for such professional consulting and other third-party services to detect fraud in real-time is expected to drive the segment growth over the forecast period

The fraud analytics segment of the market by solution is projected to witness the highest growth rate over 2023-2030. Applications of such predictive and preventive analytical tools help enterprises take essential remediation measures. The potential benefits offered by the solutions are expected to drive the segment’s growth over the forecast period

The managed services segment of the market by service is projected to witness the highest growth rate over 2023-2030. Managed service providers monitor business transactions and mines unusual user behavior in real-time across big data generated across all touchpoints driving its adoption

The identity theft segment is projected to have the highest growth rate over the forecast period. Identity theft practices increase as criminals adapt to the foiling authentication process, thereby driving its growth

The large enterprise segment is projected to occupy the largest share of the market by 2030, holding more than 70%of the market share. Fraudulent activities ranging from phishing and money laundering to distributed denial-of-service are prevalent among large enterprises, and such attacks could negatively impact business profit

By vertical, the retail & e-commerce segment is projected to witness the highest growth rate over the forecast period, owing to an increasing need to protect customer information, including financial information such as credit card details and bank account details, among others. This has resulted in the broader adoption of fraud detection and prevention among retail & e-commerce vertical

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

High Frequency Trading Market: The global high frequency trading market size was valued at USD 10.36 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030.

Dispatch Console Market: The global dispatch console market size was valued at USD 1.95 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030.

Fraud Detection And Prevention Market Segmentation

Grand View Research has segmented the global fraud detection and prevention market based on component, solution, service, application, organization size, vertical, and region:

Fraud Detection And Prevention Component Outlook (Revenue, USD Billion, 2018 - 2030)

Solution

Service

Fraud Detection And Prevention Solution Outlook (Revenue, USD Billion, 2018 - 2030)

Fraud Analytics

Authentication

Governance, Risk and Compliance (GRC)

Fraud Detection And Prevention Service Outlook (Revenue, USD Billion, 2018 - 2030)

Professional Services

Managed Services

Fraud Detection And Prevention Application Outlook (Revenue, USD Billion, 2018 - 2030)

Identity Theft

Money Laundering

Payment Fraud

Others

Fraud Detection And Prevention Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

SMEs

Large Enterprises

Fraud Detection And Prevention Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

BFSI

Government & Defense

Healthcare

IT & Telecom

Industrial & Manufacturing

Retail & E-commerce

Others

Fraud Detection And Prevention Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

Order a free sample PDF of the Fraud Detection And Prevention Market Intelligence Study, published by Grand View Research.

0 notes

Text

Fraud Detection And Prevention Market Segmentation, Application, Trends, Opportunity & Forecast till 2030

The global fraud detection and prevention market size is anticipated to reach USD 90.07 billion by 2030, growing at a CAGR of 17.6% from 2023 to 2030, according to a recent study by Grand View Research, Inc. The proliferation of smartphones and the continued rollout of high-speed internet networks has triggered the adoption of mobile banking practices. Mobile banking helps reduce the crowds at banks and allows users to transact irrespective of location. According to a GSMA report, nearly 300 million individuals got connected for the first time to mobile internet in 2018, thereby taking the total global connected population to over 3.5 billion. While mobile-based payment applications, such as Paytm, Apple Pay, Google Pay, and PayPal, among others, gained traction in line with the rising number of smartphone users, these applications also emerged as the major targets of fraudsters, thereby prompting banks to offer online banking services and payment services companies to opt for fraud detection and prevention solutions to counter fraudsters’ intrusion threats and save the users from monetary losses.

The outbreak of the COVID-19 pandemic in 2020 has triggered the adoption of mobile banking services as banking service users prefer to avoid travel and human contact within bank premises. MX, a digital transformation platform for credit unions, banks, and fintech, revealed new research findings related to consumer spending and mobile banking adoption amid the economic uncertainty stemming from the COVID-19 pandemic. The data released in April 2020 has revealed a 50% increase in mobile banking engagement to control finances and plan the individual economic future. While the adoption of mobile banking is rising significantly, mobile banking is also getting potentially vulnerable to fraudulent activities, such as account takeovers, carrier data breaches, call center fraud, subscription fraud, and phishing, among others, thereby driving the demand for fraud detection and prevention solutions over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Fraud Detection And Prevention Market

Fraud Detection And Prevention Market Report Highlights

The service segment of the market by component is projected to witness the highest growth rate over 2023-2030. Organizations in developing economies are increasingly implementing robust fraud prevention strategies. Organizations require integration, consulting, training, and support services from fraud prevention service providers to implement a robust framework. The need for such professional consulting and other third-party services to detect fraud in real-time is expected to drive the segment growth over the forecast period

The fraud analytics segment of the market by solution is projected to witness the highest growth rate over 2023-2030. Applications of such predictive and preventive analytical tools help enterprises take essential remediation measures. The potential benefits offered by the solutions are expected to drive the segment’s growth over the forecast period

The managed services segment of the market by service is projected to witness the highest growth rate over 2023-2030. Managed service providers monitor business transactions and mines unusual user behavior in real-time across big data generated across all touchpoints driving its adoption

The identity theft segment is projected to have the highest growth rate over the forecast period. Identity theft practices increase as criminals adapt to the foiling authentication process, thereby driving its growth

The large enterprise segment is projected to occupy the largest share of the market by 2030, holding more than 70%of the market share. Fraudulent activities ranging from phishing and money laundering to distributed denial-of-service are prevalent among large enterprises, and such attacks could negatively impact business profit

By vertical, the retail & e-commerce segment is projected to witness the highest growth rate over the forecast period, owing to an increasing need to protect customer information, including financial information such as credit card details and bank account details, among others. This has resulted in the broader adoption of fraud detection and prevention among retail & e-commerce vertical

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

High Frequency Trading Market: The global high frequency trading market size was valued at USD 10.36 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030.

Dispatch Console Market: The global dispatch console market size was valued at USD 1.95 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030.

Fraud Detection And Prevention Market Segmentation

Grand View Research has segmented the global fraud detection and prevention market based on component, solution, service, application, organization size, vertical, and region:

Fraud Detection And Prevention Component Outlook (Revenue, USD Billion, 2018 - 2030)

Solution

Service

Fraud Detection And Prevention Solution Outlook (Revenue, USD Billion, 2018 - 2030)

Fraud Analytics

Authentication

Governance, Risk and Compliance (GRC)

Fraud Detection And Prevention Service Outlook (Revenue, USD Billion, 2018 - 2030)

Professional Services

Managed Services

Fraud Detection And Prevention Application Outlook (Revenue, USD Billion, 2018 - 2030)

Identity Theft

Money Laundering

Payment Fraud

Others

Fraud Detection And Prevention Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

SMEs

Large Enterprises

Fraud Detection And Prevention Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

BFSI

Government & Defense

Healthcare

IT & Telecom

Industrial & Manufacturing

Retail & E-commerce

Others

Fraud Detection And Prevention Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

Order a free sample PDF of the Fraud Detection And Prevention Market Intelligence Study, published by Grand View Research.

0 notes

Text

Investments in The Fintech Sector: Insights from Josip Heit

The fintech sector has emerged as one of the most innovative and fast-paced industries, reshaping the financial services landscape. From digital banking and mobile payments to blockchain technology and AI-driven financial analytics, fintech companies are transforming how people manage, invest, and transact money. Josip Heit, a visionary entrepreneur and investor, is one of the leading figures driving advancements in this sector. In this blog, we’ll explore the potential of fintech, examine current trends, and discuss Josip Heit’s investments and insights into the fintech revolution.

The Growing Influence of Fintech

Fintech, or financial technology, refers to innovative technology used to support, enhance, and automate financial services. Its influence is growing, with fintech companies offering consumers and businesses faster, more convenient, and cost-effective ways to manage finances. According to industry forecasts, the global fintech market is expected to continue growing at a rapid rate, with billions in venture capital investment flowing into startups and established companies alike.

The appeal of fintech lies in its ability to cater to the digital-first world. Consumers today demand services that are instant, accessible, and transparent. With this shift in consumer behavior, traditional financial institutions are increasingly partnering with or acquiring fintech firms to keep up with changing trends.

Key Areas of Investment in Fintech

Josip Heit investment strategies in fintech focus on areas that hold the most potential for disruption and growth. Here are some of the primary areas where he sees promising investment opportunities:

Digital Banking and Neo-Banking Digital banks, or neo-banks, operate entirely online, without physical branches, offering streamlined services for consumers who prefer digital convenience. Heit recognizes that digital banking can address various pain points in traditional banking by offering lower fees, better interest rates, and user-friendly apps. Neo-banks are especially popular among younger, tech-savvy customers who value ease of use and lower overhead.

Blockchain and Cryptocurrencies Blockchain technology and cryptocurrencies are transforming the way we think about currency and transactions. Heit has invested in blockchain projects that focus on secure, transparent, and efficient transactions. Blockchain technology offers benefits for cross-border payments, data security, and asset tokenization. For Heit, blockchain’s potential goes beyond cryptocurrencies; it represents a new way to facilitate trust and security in digital transactions.

Payment Solutions and Digital Wallets With digital wallets and payment solutions like Apple Pay, Google Pay, and others, traditional cash transactions are being replaced by seamless digital options. Heit is particularly interested in the potential of digital wallets and payment processors to reach unbanked or underbanked populations. Payment platforms that offer low fees and fast transactions are also attractive to both consumers and businesses, driving the rapid growth of this fintech sub-sector.

Artificial Intelligence in Financial Services Artificial intelligence (AI) is increasingly used in the financial sector for fraud detection, personalized financial advice, credit scoring, and predictive analytics. AI-based solutions provide enhanced security, efficiency, and customer service, all of which are vital for today’s financial institutions. Heit’s investment interest in AI-driven fintech solutions stems from the technology’s ability to reduce costs and improve customer satisfaction through automation and data analysis.

Regtech (Regulatory Technology) As financial regulations grow more complex, regtech solutions are designed to help companies comply with rules more efficiently and cost-effectively. Regtech uses AI, machine learning, and big data to monitor regulatory changes, manage compliance, and reduce risk. Heit recognizes the significant demand for regtech in the fintech sector, as companies must balance innovation with strict regulatory requirements.

Josip Heit’s Vision for Fintech

Josip Heit GSPartners approach to fintech investments is strategic and forward-thinking. He believes that fintech is not just a trend but a fundamental shift in how financial services are delivered. His investments focus on high-potential areas within fintech, with an emphasis on sustainability, security, and accessibility. Here are some key aspects of his vision for the sector Josip Heit Reviews:

Democratization of Finance One of Heit’s primary motivations for investing in fintech is to make financial services accessible to everyone, regardless of location or income level. By backing fintech projects that provide low-cost financial solutions, Heit supports efforts to democratize access to banking and investment opportunities worldwide.

Innovating for a Cashless Future The shift towards a cashless society is underway, with mobile payments and digital currencies leading the charge. Heit is enthusiastic about this trend, particularly in emerging markets, where mobile payment adoption is growing rapidly. His investments aim to accelerate this shift by supporting companies that offer secure, user-friendly payment solutions for a global audience.

Prioritizing Security and Transparency In a sector where digital transactions are becoming the norm, security and transparency are paramount. Heit’s investments often focus on companies that prioritize data security, encryption, and transparent operations. By ensuring that fintech solutions are secure, he helps build consumer trust, which is crucial for the long-term growth of the sector.

Encouraging Sustainable Financial Solutions Sustainability is another critical element of Heit’s fintech strategy. He supports companies that adopt environmentally friendly practices, whether through digital processes that reduce paper waste or by financing projects that align with sustainable development goals. For Heit, sustainability in fintech not only benefits the environment but also appeals to consumers who prioritize ethical finance.

Opportunities and Challenges in the Fintech Sector

While fintech offers many opportunities, GS Partners it also presents certain challenges that investors like Heit carefully consider. Here are some of the primary benefits and risks:

Opportunities

Expanding Market Reach Fintech enables financial services to reach underserved markets, including individuals who lack access to traditional banking services. With mobile banking and digital wallets, millions of unbanked individuals now have access to secure financial services, offering immense growth potential.

Data-Driven Insights Fintech firms rely heavily on data analytics, which provides insights into consumer behavior and helps companies make informed decisions. For investors, this data-driven approach means more reliable returns as fintech firms can quickly adapt to changing market demands.

High Scalability Potential Fintech solutions are designed for scale, allowing companies to expand quickly and cost-effectively. Investors see value in this scalability, as fintech businesses can rapidly grow their customer base and enter new markets.

Challenges

Regulatory Hurdles As fintech disrupts traditional financial systems, regulators are developing new rules to govern the sector. Fintech companies often face challenges in navigating these regulations, which can vary widely across countries. Investors must consider the regulatory landscape before committing to fintech projects.

Cybersecurity Risks With fintech comes the risk of cyber threats and data breaches. Heit, like other investors, carefully evaluates the security measures of fintech companies to ensure they have robust systems in place to protect sensitive data.

Market Saturation The rapid growth of fintech has led to a highly competitive market, with many companies offering similar services. This saturation can make it difficult for new entrants to stand out, leading investors to focus on companies with unique value propositions and innovative approaches.

Conclusion

The fintech sector presents exciting opportunities for both consumers and investors. With advances in digital banking, blockchain, AI, and more, fintech is fundamentally reshaping how people engage with financial services. Josip Heit’s investments in the fintech space reflect his commitment to supporting projects that offer accessibility, security, and sustainable growth.

As fintech continues to expand, Heit’s insights and investments will likely contribute to shaping the future of this industry. For those looking to enter the fintech market or understand its potential, studying the strategies of investors like Josip Heit can provide valuable perspectives on navigating this dynamic landscape. With continued innovation, the fintech sector promises to revolutionize finance for the better, opening new doors for consumers and investors alike.

0 notes

Text

How Financial Tools Can Help Keep Your Books in Order

Financial management is a vital function for businesses of all sizes, across all industries. Leveraging the right financial tools can streamline bookkeeping, enhance accuracy, and save both time and money. In this article, we’ll explore essential financial tools available in today’s market that support accounting and financial management, along with some best practices for maintaining organized financial records.

Essential Financial Tools for Bookkeeping

1. Accounting Software

Accounting software is the foundation of efficient financial management for any organization. These programs handle tasks like transaction recording, account preparation, and invoice processing. Popular choices include QuickBooks, Xero, and FreshBooks, all of which offer features tailored to different business needs, such as cloud-based systems and mobile access. These platforms also integrate with other financial tools, making them versatile.

Benefits of Accounting Software:

Time Efficiency: Automates repetitive tasks like data entry.

Real-Time Monitoring: Tracks income and expenses instantly, aiding quick decision-making.

Customizable Reporting: Generates detailed sales and financial reports based on specific business needs.

Scalability: Expands functionality as the business grows, handling more complex accounting tasks.

By using accounting software, businesses reduce manual errors and enjoy real-time insights into revenue and expenses. These tools allow customizable reporting systems, offering a comprehensive view of a company’s financial status.

2. Expense Tracking Tools

Expense tracking tools are essential for businesses that need to closely monitor expenditures, including travel, meals, and entertainment. While many accounting software platforms offer expense tracking features, standalone tools like Expensify or Zoho Expense provide more robust solutions.

Key Features:

Receipt Scanning: Easily capture receipts with photos, eliminating manual data entry.

Categorization: Organize expenses into categories for easier analysis.

Integration: Seamlessly sync with accounting software, reducing manual data input.

Policy Compliance: Ensure spending stays within company-set guidelines.

Mobile apps make it easy for employees to capture expenses on the go, improving record-keeping and reducing paperwork. Automatic submission of expenses ensures that no costs are overlooked.

3. Budgeting Tools

Budgeting is key to controlling spending and planning for the future. Budgeting tools, often included in accounting software, allow businesses to track income and expenses, ensuring efficient resource allocation.

Advantages of Budgeting Tools:

Goal Setting: Helps set realistic, measurable financial targets based on historical data.

Variance Analysis: Compares actual spending against the budget to identify discrepancies.

Forecasting: Uses trends to predict future income and expenses.

Collaboration: Allows multiple team members to participate in budget creation and adjustment.

By regularly comparing actual expenses to budgeted amounts, businesses can adjust strategies to prevent overspending and ensure efficient financial management.

4. Payroll Management Systems

Payroll management can be complex, especially as businesses grow. Tools like Gusto and ADP automate payroll processes, including wage calculation, tax withholding, and employee benefits, reducing the risk of costly errors.

Features of Payroll Management Systems:

Automated Tax Calculations: Ensures compliance with tax laws, minimizing errors.

Direct Deposit: Simplifies employee payments.

Employee Self-Service Portals: Enables staff to access payroll information independently.

Integration: Syncs with accounting software for comprehensive financial reporting.

These systems integrate seamlessly with accounting software, ensuring that labor costs are accurately reflected in financial reports and improving the efficiency of financial management.

5. Inventory Management Software

For businesses that sell physical goods, inventory management software is crucial. This software tracks stock levels, sales, and orders, ensuring that inventory is well-managed.

Benefits of Inventory Management Software:

Real-Time Tracking: Provides up-to-date inventory levels to avoid overstocking or stockouts.

Demand Forecasting: Helps predict future stock needs based on sales trends.

Supplier Management: Facilitates smooth ordering processes with suppliers.

Reporting: Generates detailed reports on stock turnover and product performance.

Good inventory management reduces cash flow issues and enhances customer satisfaction by ensuring products are always available when needed.

Tips for Maintaining Organized Financial Records

1. Choose the Right Accounting Method

Selecting the appropriate accounting method—cash basis or accrual basis—is key to maintaining accurate books. Cash accounting records transactions when money is exchanged, while accrual accounting records transactions when they occur, regardless of payment.

For most businesses, accrual accounting provides a clearer picture of long-term profitability and performance.

2. Separate Personal and Business Finances

Mixing personal and business finances complicates bookkeeping and tax filing. Keep separate accounts to ensure accurate financial reporting and improve cash flow management.

3. Regular Reconciliation

Reconcile your financial records with bank statements at least once a month. This ensures that any discrepancies are identified and corrected promptly, maintaining the accuracy of your books.

4. Periodic Review of Financial Reports

Review financial reports—such as income statements, balance sheets, and cash flow statements—regularly, either monthly or quarterly. This allows businesses to make informed decisions, allocate resources wisely, and identify areas where cost-cutting can boost profitability.

Conclusion

Financial tools like accounting software, expense trackers, and payroll systems are essential for businesses to maintain accurate records and manage finances effectively. By incorporating these tools and following best practices like regular reconciliation and report reviews, businesses can save time, reduce costs, and position themselves for sustainable growth in today’s competitive landscape. Embracing financial technology is no longer optional—it’s a necessity for staying competitive and profitable.

0 notes

Text

Cellecor Gadgets Limited Announces Strategic Partnership with Sathya Agencies to Expand South India Presence

In a significant move to bolster its presence in the southern region of India, Cellecor Gadgets Limited, one of India's leading consumer electronics brands, has officially announced a partnership with Sathya Agencies Pvt. Ltd. The collaboration is poised to significantly enhance Cellecor's retail footprint across key southern states including Tamil Nadu, Puducherry, and Andhra Pradesh.

Founded in 1983 in Tuticorin, Tamil Nadu, Sathya Agencies has evolved from a modest retail enterprise into one of South India's largest large-format retailers, boasting over 330 showrooms and mobile stores. Sathya Agencies has established itself as a household name for home appliances, electronics, kitchenware, and mobile gadgets, with an impressive annual turnover of approximately Rs 2500 crore. Renowned for its wide range of products, competitive pricing, and excellent customer service, Sathya is well known for offering consumers attractive deals such as no-cost EMI options, exchange offers, and seasonal gifts, making it a trusted name in the region.

Cellecor Gadgets Limited, an emerging powerhouse in India's consumer electronics space, has set its sights on expanding its reach through this partnership. The collaboration will enable customers in Tamil Nadu, Puducherry, and Andhra Pradesh to access a diverse array of Cellecor’s products, including Smart TVs, Smart Gadgets, Mobile Phones, and Home Appliances, directly at Sathya's retail outlets. The company's strong reputation for delivering high-quality, affordable products will now be further bolstered through Sathya's expansive and highly respected retail network.

This strategic alliance has already garnered tangible success, with Cellecor receiving its first purchase order from Sathya Agencies valued at INR 25 million. With a forecasted business volume of INR 600-800 million over the coming 12 months, this partnership marks a pivotal chapter in Cellecor’s growth story. The collaboration aims to offer customers an enhanced shopping experience, particularly those who prefer to explore products firsthand in a retail environment before making a purchase. This will create a unique and immersive retail experience across South India, catering to the evolving needs of modern consumers.

Cellecor’s collaboration with Sathya Agencies underscores its commitment to expanding its market share while providing consumers with affordable, value-for-money electronic gadgets and home appliances. Through this partnership, Cellecor not only aims to grow its business but also to enrich everyday life for customers by delivering technology-driven, user-friendly products. It is a testament to the company's unwavering dedication to enhancing the customer experience through innovation and accessibility.

The growth trajectory of Cellecor Gadgets Limited reflects its origins as a modest venture under the leadership of Mr. Ravi Aggarwal, who founded M/s Unity Communications in 2012. The company, now rebranded as Cellecor Gadgets Limited, has since become a key player in the consumer electronics sector, offering a vast range of products such as mobile phones, Smart TVs, speakers, smartwatches, and home appliances. This impressive evolution from its humble beginnings is a result of its enduring business strategy of sourcing, producing, and marketing quality products at affordable prices, while constantly innovating to meet the needs of modern consumers.

As the company continues to grow, its listing on the NSE EMERGE platform highlights its rising prominence in the market. Investors, partners, and stakeholders alike are keenly watching Cellecor’s next moves, as it carves out an increasingly significant place in India's electronics landscape.

For further details, individuals can visit Cellecor’s official website or contact Ms. Bindu Gupta, the Chief Financial Officer at Cellecor Gadgets Limited.

Cellecor Gadgets Limited would like to remind its stakeholders that certain forward-looking statements within this release are subject to risks and uncertainties. These statements, while based on projections, can be affected by various factors such as government actions, local and political developments, and technological risks. The company assumes no responsibility for actions taken based on these statements.

0 notes

Text

Mobile Wallet And Payment Market Forecast and Analysis Report (2023-2032)

The global demand for mobile wallet and payment was valued at USD 4515.9 billion in 2022 and is expected to reach USD 26067.48 billion in 2030, growing at a CAGR of 24.50% between 2023 and 2030.

Mobile wallet and payment technology has revolutionized the way people conduct transactions, offering a convenient, fast, and secure alternative to traditional cash and card payments. Mobile wallets, accessed through apps on smartphones and other devices, allow users to store digital versions of their credit and debit cards, as well as loyalty cards, coupons, and other payment methods. These wallets facilitate contactless payments using technologies such as Near Field Communication (NFC), QR codes, and even biometrics for enhanced security. Mobile payment solutions are widely adopted by both consumers and merchants due to their ease of use, increased security features, and the growing acceptance of digital payments globally. Additionally, mobile wallets are often integrated with rewards programs, making them attractive to users who can earn points, cash back, or discounts on purchases. Popular mobile wallet providers like Apple Pay, Google Pay, and Samsung Pay continue to innovate with added features such as peer-to-peer payments, bill splitting, and seamless online checkout. As e-commerce grows and consumers seek more flexible, touchless payment options, mobile wallets and payment technologies are expected to play an even larger role in the digital economy.

The mobile wallet and payment market is evolving rapidly, with innovative trends shaping the future of digital transactions. Here are some key trends driving growth and innovation in this market:

1. Integration with Financial Services

Mobile wallets are expanding beyond basic payments to offer additional financial services, such as savings accounts, investment options, insurance products, and loans. By providing a more comprehensive suite of financial tools, mobile wallet providers are transforming into full-service digital banks, catering to a broader range of customer needs.

2. Biometric Authentication for Enhanced Security

With increasing concerns about security, mobile wallets are incorporating biometric authentication methods such as fingerprint scanning, facial recognition, and voice recognition. These features not only offer a higher level of security but also make transactions faster and more convenient for users, reducing the need for PINs and passwords.

3. QR Code Payments and Contactless Solutions

QR code payments have gained popularity, especially in regions like Asia, where mobile wallets like Alipay and WeChat Pay have made QR codes a preferred payment method. Contactless payments using Near Field Communication (NFC) technology are also on the rise, allowing consumers to pay quickly and securely by tapping their smartphones at the point of sale.

4. Integration with Wearable Devices

Mobile payment technology is being integrated into wearable devices, such as smartwatches and fitness trackers, allowing users to make payments directly from their wearables. This trend enhances convenience and appeals to consumers looking for hands-free payment options, especially for activities like exercising or commuting.

5. Peer-to-Peer (P2P) Payment Features

Mobile wallets increasingly offer peer-to-peer (P2P) payment capabilities, allowing users to easily send and receive money with friends and family. Features such as bill splitting, group payments, and instant transfers are popular, especially among younger users. Many mobile wallets are expanding these services to support cross-border P2P payments as well.

6. Reward and Loyalty Program Integration

Mobile wallets are enhancing their value by integrating rewards programs, loyalty points, and cashback offers directly into their platforms. Users can earn rewards for purchases, access personalized offers, and track loyalty points all within the app. This trend strengthens user engagement and encourages frequent use of mobile payment solutions.

7. Expansion of Mobile Wallet Acceptance in Retail and E-commerce

More retailers and e-commerce platforms are accepting mobile wallets as a payment option, both in-store and online. This expanded acceptance is driving growth as consumers increasingly prefer the speed and convenience of mobile payments over traditional methods. Many retailers are also adopting in-app payments and mobile order-ahead capabilities to enhance the shopping experience.

8. Cryptocurrency and Digital Asset Integration

Some mobile wallets now support cryptocurrencies and digital assets, allowing users to buy, sell, and store assets like Bitcoin, Ethereum, and other cryptocurrencies. As interest in digital currencies grows, mobile wallets are expanding their capabilities to support crypto transactions, making it easier for users to manage both fiat and digital currencies within a single app.

9. AI and Machine Learning for Personalized Experiences

Mobile wallet providers are leveraging artificial intelligence (AI) and machine learning to offer personalized experiences, such as recommending nearby deals, optimizing rewards, and analyzing spending patterns. These insights help users manage their finances more effectively, while also increasing engagement with the wallet app.

10. Adoption in Emerging Markets and Financial Inclusion

Mobile wallets are playing a key role in financial inclusion, especially in emerging markets where traditional banking infrastructure may be limited. By providing easy access to digital payment tools, mobile wallets are helping underserved populations participate in the digital economy, facilitating remittances, bill payments, and even small business transactions.

11. Voice-Activated Payments

Voice-activated payments, enabled by digital assistants like Siri, Google Assistant, and Alexa, are becoming increasingly popular. This trend allows users to make payments through simple voice commands, adding convenience and expanding the functionality of mobile wallets, particularly in hands-free scenarios.

12. Blockchain for Enhanced Security and Transparency

Blockchain technology is being explored by some mobile wallet providers to enhance transaction security and transparency. By leveraging decentralized ledgers, mobile wallets can offer secure, tamper-proof transaction records, which may be particularly valuable for high-value payments, international transfers, and business transactions.

13. Instant Credit and Buy Now, Pay Later (BNPL)

Mobile wallets are integrating instant credit and Buy Now, Pay Later (BNPL) options, allowing users to finance purchases directly through the app. This trend is growing in popularity, especially among younger consumers who prefer flexible payment options. BNPL integrations help mobile wallets become a one-stop solution for both payments and financing.

14. Enhanced Analytics and Expense Management Tools

Many mobile wallets now offer expense tracking and budgeting tools, helping users monitor their spending, set financial goals, and receive insights on their spending habits. These features provide added value by turning mobile wallets into personal finance management tools, appealing to users who want a better understanding of their financial activities.

Access Complete Report - https://www.credenceresearch.com/report/mobile-wallet-and-payment-market

Key Players

American Express Co

Apple Inc.

Mastercard Inc.

AT&T Inc.

Samsung Electronics Co., Ltd.

Google LLC

First Data Corporation

Sprint Corporation

Others

The future outlook for the mobile wallet and payment market is highly promising, with continued growth anticipated as technology advances and consumer preferences evolve. Here are some key trends and developments expected to shape the future of this market:

1. Expansion of Contactless Payments and NFC Technology

Contactless payments, supported by Near Field Communication (NFC) technology, are expected to become the standard in physical retail environments. As more merchants and consumers adopt NFC-enabled devices, mobile wallets will increasingly replace cash and cards for in-person transactions, offering speed, convenience, and enhanced security.

2. Increased Integration with Digital Banking Services

Mobile wallets are likely to expand their capabilities to include more comprehensive financial services, such as savings accounts, investment options, and lending products. This trend will enable mobile wallets to function as full-service digital banks, providing users with a complete financial ecosystem that extends beyond payments alone.

3. Growth of Cryptocurrency and Digital Asset Support

As digital currencies become more widely accepted, mobile wallets are expected to offer greater support for cryptocurrency transactions, storage, and even DeFi (decentralized finance) capabilities. This development will make it easier for users to manage both fiat and digital assets within a single platform, contributing to the mainstream adoption of cryptocurrencies.

4. Advanced AI and Machine Learning for Personalized User Experiences

Mobile wallet providers will increasingly leverage AI and machine learning to offer personalized services, such as spending insights, savings recommendations, and customized rewards. These intelligent features will improve user engagement by offering tailored experiences, making mobile wallets more valuable as financial management tools.

5. Proliferation of Peer-to-Peer (P2P) Payment Solutions

P2P payments are expected to become even more seamless and widely used, particularly for international money transfers and cross-border transactions. As mobile wallet providers enhance their P2P capabilities, users will benefit from real-time transfers, low fees, and the ability to transact across currencies, driving the global adoption of mobile wallet platforms.

6. Expansion into Emerging Markets and Financial Inclusion

Mobile wallets will play a critical role in increasing financial inclusion, particularly in regions with limited banking infrastructure, such as Africa, Latin America, and Southeast Asia. By providing a simple, accessible means of managing money, mobile wallets can bring financial services to underserved populations, helping to drive economic growth and reduce poverty in these areas.

7. Voice-Activated Payments and Biometric Security

Innovations in voice recognition and biometric security are expected to enhance the functionality of mobile wallets. Voice-activated payments will allow for hands-free transactions, while biometric authentication methods like fingerprint and facial recognition will offer greater security, making mobile wallets more convenient and trustworthy for users.

8. Adoption of Blockchain for Enhanced Security and Transparency

Blockchain technology may play a larger role in mobile payments by offering decentralized, secure, and transparent transaction records. This could be especially valuable for international transfers, high-value transactions, and business payments, where users require increased trust and verifiability.

9. Increased Adoption of Buy Now, Pay Later (BNPL) and Micro-Financing

Mobile wallets are likely to integrate more flexible payment options like Buy Now, Pay Later (BNPL) and micro-financing features. These services cater to consumers looking for affordable financing options, particularly for large purchases or recurring expenses, and are expected to expand access to credit for users in various financial situations.

10. Focus on Sustainability and Eco-Friendly Transactions

As consumers become more environmentally conscious, mobile wallet providers may focus on sustainability, offering features like digital receipts, eco-friendly rewards, and carbon footprint tracking. This will appeal to users who prioritize sustainable practices and reduce the need for paper-based transactions.

11. Enhanced Security Measures and Fraud Prevention

With the growth of mobile payments, security will remain a top priority. Providers will continue to invest in advanced fraud detection and prevention technologies, such as AI-driven algorithms that monitor for unusual activity, multi-factor authentication, and tokenization to protect users’ sensitive information.

12. Greater Acceptance Among Small Businesses and E-commerce

As small businesses and e-commerce merchants increasingly accept mobile payments, mobile wallets will become a more integral part of the retail experience. Mobile wallets may incorporate additional features for business users, such as inventory management, customer insights, and invoicing, enhancing their value as a payment solution for entrepreneurs.

13. Growth in Cross-Border Payments and Remittances

The mobile wallet market is expected to play a significant role in cross-border payments and remittances, offering a cost-effective alternative to traditional banks and money transfer services. This growth will be driven by the need for fast, affordable, and convenient international payment solutions, especially among migrant workers and global freelancers.

14. Collaboration with Financial Institutions and Fintechs

Mobile wallet providers are likely to collaborate more with banks and fintech companies to enhance their offerings and reach a wider audience. These partnerships can lead to innovative financial products and services, such as integrated credit and savings products, leveraging the strengths of both traditional financial institutions and digital platforms.

15. Increasing Role in the Internet of Things (IoT) Ecosystem

As IoT technology advances, mobile wallets may become integrated with various connected devices, enabling payments from cars, smart home devices, and wearables. This integration will further simplify transactions, making it possible to pay for goods and services without needing a smartphone in hand.

Segmentation

By Type of Mobile Payment Solution

Mobile Wallet

Mobile Money

Mobile Banking Apps

Mobile Point of Sale (mPOS)

By Technology Platform

Near Field Communication (NFC)

QR Code-based

Bluetooth Low Energy (BLE)

Tokenization

By Payment Mode

Contactless Payment

Remote Payment

In-App Purchases

Mobile Web Payment

By End User

Consumers

Merchants and Businesses

Financial Institutions

Government

By Payment Application

Retail Payment

E-commerce Payment

Peer-to-Peer (P2P) Payment

Bill Payment

Transportation Payment

Entertainment and Ticketing

By Security Features

Biometric Authentication

PIN-based Authentication

Tokenization

Multi-Factor Authentication (MFA)

Encryption

Browse the full report – https://www.credenceresearch.com/report/mobile-wallet-and-payment-market

Contact Us:

Phone: +91 6232 49 3207

Email: [email protected]

Website: https://www.credenceresearch.com

0 notes

Text

Examining the Competitive Landscape of Travelers Identity Protection Services Market

The travelers identity protection services global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Travelers Identity Protection Services Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The travelers identity protection services market size has grown strongly in recent years. It will grow from $8.64 billion in 2023 to $9.36 billion in 2024 at a compound annual growth rate (CAGR) of 8.4%. The growth in the historic period can be attributed to increasing demand for mobile-based solutions, rising trends among travelers, rising online transactions, rising adoption of mobile devices, and growing business travel spending. The travelers identity protection services market size is expected to see strong growth in the next few years. It will grow to $12.96 billion in 2028 at a compound annual growth rate (CAGR) of 8.5%. The growth in the forecast period can be attributed to growing social illness, growing use of cybersecurity, growing digitalization initiatives, increasing use of online security services, and growing demand for personalized services. Major trends in the forecast period include the adoption of AI and machine learning, demand for comprehensive solutions, integration with mobile and digital wallets, expansion of services to emerging markets, and a focus on consumer education.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/travelers-identity-protection-services-global-market-report

Scope Of Travelers Identity Protection Services Market The Business Research Company's reports encompass a wide range of information, including:

Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

Drivers: Examination of the key factors propelling market growth.

Trends: Identification of emerging trends and patterns shaping the market landscape.

Key Segments: Breakdown of the market into its primary segments and their respective performance.

Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The growing number of online scams and frauds is expected to significantly boost the demand for travelers' identity protection services in the near future. Online scams and frauds encompass deceptive practices conducted over the internet aimed at stealing money, personal information, or other assets from individuals or organizations. The prevalence of these scams is on the rise due to increased digital activity and the evolving sophistication of cybercriminal tactics. Travelers' identity protection services help mitigate the effects of these online scams and frauds by offering tools and support to safeguard personal information and detect fraudulent activities. For instance, in March 2023, the Internet Crime Complaint Center (IC3), a U.S.-based central hub for reporting cybercrime, reported that investment fraud complaints surged by 127%, escalating from $1.45 billion in 2021 to $3.31 billion in 2022. Additionally, cryptocurrency investment fraud witnessed an even more significant rise of 183%, increasing from $907 million to $2.57 billion during the same period. Thus, the rising incidence of online scams and frauds is driving the demand for travelers' identity protection services, with continued growth projected through 2024 and into 2028.

Market Trends - Major companies operating in the traveler identity protection services market are focusing on developing advanced solutions, such as biometric technology, to enhance passenger identification and improve security. Biometric technology refers to the use of unique biological traits, such as fingerprints, facial recognition, or iris scans, to verify and authenticate a traveler's identity efficiently and securely. For instance, in January 2022, Idemia, a France-based cryptography and biometrics technology company, launched ID2Travel, an innovative traveler identity platform, in North America. This platform enhances the travel experience by using identity management and biometric identification, ensuring efficient, secure, and frictionless travel. ID2Travel can be integrated into various travel infrastructures, including airports and airlines, and uses Idemia's patented biometric capture technologies recognized by the National Institute of Standards and Technology (NIST). Passengers can enroll in the system using their mobile devices from home by scanning their state ID or passport and taking a selfie for verification. Once enrolled, travelers can use biometrics to navigate through the airport seamlessly, from check-in to boarding.

The travelers identity protection services market covered in this report is segmented –

1) By Type: Credit Card Fraud, Bank Fraud, Phone Fraud 2) By Booking Type: Online Booking, Direct Booking, Phone Booking 3) By Age Group: Below 15 Years, 16 To 25, 26 To 35, 36 To 45, 46 To 55, Above 55 4) By Consumer Orientation: Men, Women, Children 5) By Tourist Type: Domestic, International

Get an inside scoop of the travelers identity protection services market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=18761&type=smp

Regional Insights - North America was the largest region in the travelers identity protection services market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the travelers identity protection services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies in the market are Costco Wholesale Corporation, USAA Identity Theft Protection, TransUnion LLC, NortonLifeLock, Kroll Identity Monitoring, Aura, Credit Karma Identity Monitoring, Bankrate LLC, ID Experts, Zander Insurance, Credit Sesame, PrivacyGuard, Sontiq Inc, ID Watchdog, IDShield, ProtectMyID, ID Theft Assist, Cyberscout, IdentitySecure, ReliaShield, IDStrong, IdentityIQ, IdentityHawk

Table of Contents

Executive Summary

Travelers Identity Protection Services Market Report Structure

Travelers Identity Protection Services Market Trends And Strategies

Travelers Identity Protection Services Market – Macro Economic Scenario

Travelers Identity Protection Services Market Size And Growth …..

Travelers Identity Protection Services Market Competitor Landscape And Company Profiles

Key Mergers And Acquisitions

Future Outlook and Potential Analysis

Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Future of Synthetic Lubricants Industry

The report "Synthetic Lubricants Market by Type (Polyalphaolefins (PAOs), Esters, Poly Alkyne Glycols (PAGs), Group III), Product Type (Engine Oils, Hydraulic Fluids, Metalworking Fluids, Compressor Oils, Turbine Oils), & Region - Global Forecast to 2028" market size of Synthetic Lubricants is estimated at USD 41.2 billion in 2023 and is projected to reach USD 48.0 billion by 2028, at a CAGR of 3.1%.

Download PDF Brochure at https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=141429702

Browse 315 market data Tables and 56 Figures spread through 297 Pages and in-depth TOC on "Synthetic Lubricants Market by Type (Polyalphaolefins (PAOs), Esters, Poly Alkyne Glycols (PAGs), Group III), Product Type (Engine Oils, Hydraulic Fluids, Metalworking Fluids, Compressor Oils, Turbine Oils), & Region - Global Forecast to 2028"

View detailed Table of Content here - https://www.marketsandmarkets.com/Market-Reports/synthetic-lubricant-market-141429702.html

When it comes to performance, synthetic lubricants are better to traditional mineral-based oils. They offer greater resistance to oxidation, thermal stability, and viscosity, which improves efficiency and extends the life of equipment. Synthetic lubricants are becoming more and more popular in industries like manufacturing, aerospace, and automotive that demand high-performance lubricants. Synthetic lubricants are used in a wide range of specialized applications, including high-temperature environments, extreme pressure conditions, and harsh operating conditions. Their ability to perform reliably in such environments makes them indispensable in industries such as aerospace, marine, and heavy manufacturing.

The PAOs segment to account for largest share in the Synthetic Lubricants market, in terms of value, during the forecast period.

PAOs segment accounted for the largest share in the global Synthetic Lubricants market in 2022, in terms of value. Because of their exceptional oxidation stability, PAOs withstand deterioration and continue to function for prolonged periods of time. Because of this, PAOs are used in lubricant applications where high temperatures and oxidative conditions are present. Since it has low volatility, PAOs are less likely to evaporate in hot conditions. In high-temperature situations, this feature aids in lowering oil consumption and pollutants.

Engine oil segment to lead Synthetic Lubricants market in product type segment, during the forecast period, in terms of value.

The engine oil segment accounted for the largest share of the Synthetic Lubricants market in 2022, in terms of value. The service intervals for synthetic engine oils are longer than those for conventional oils. They can sustain their performance characteristics for longer thanks to their improved oxidative and thermal stability, which enables longer drain intervals. Because fewer oil changes are required, this may save money and have a less negative effect on the environment.

Request For FREE Sample of Report at https://www.marketsandmarkets.com/requestsampleNew.asp?id=141429702

Asia Pacific is expected to be the fastest-growing region, in the overall Synthetic Lubricants market, during the forecast period.

Asia Pacific is the leading consumer of Synthetic Lubricants. Many countries in the Asia Pacific region are investing heavily in infrastructure development, including transportation networks, energy facilities, and construction projects. Synthetic lubricants are used in various construction and industrial equipment, such as excavators, cranes, and generators, to ensure smooth operation and longevity. The Asia Pacific region offers substantial prospects for producers and suppliers of synthetic lubricants because of its strong economic growth, burgeoning automobile industry, rising infrastructure expenditures, rising public awareness, and kind regulatory framework.

The key players profiled in the report include Shell plc (UK), BP p.l.c (UK)., Exxon Mobil Corporation (US), TotalEnergies SE (France), FUCHS (Germany), Chevron Corporation (US), Idemitsu Kosan Co., Ltd. (Japan), China Petroleum & Chemical Corporation (China), LUKOIL (Russia), and Petroliam Nasional Berhad (PETRONAS) (Malaysia).

Don’t miss out on business opportunities in Synthetic Lubricants Market. Speak to our analyst and gain crucial industry insights that will help your business grow.

1 note

·

View note

Text

Spectrum Analyzer Market: Current Analysis and Forecast (2024-2032)

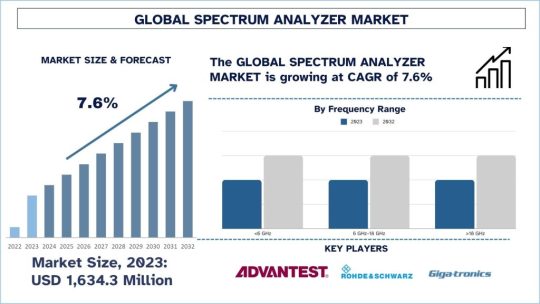

According to the UnivDatos Market Insights analysis, the expansion of 5G networks, the rising demand for IoT devices, and continuous advancements in spectrum analysis technology are driving the Spectrum Analyzer market's growth in the global scenario of the Spectrum Analyzer market. As per their “Spectrum Analyzer Market” report, the global market was valued at USD 1,634.3 Million in 2023, growing at a CAGR of 7.6% during the forecast period from 2024 – 2032.

A spectrum analyzer is a special-purpose electronic device that is used to analyze the different signal frequencies and bandwidths of input signals and also signal distortions. It is most applicable in areas such as telecommunication, electronics manufacturing and assembling, automobile, aerospace, and defense industries that need accurate measurement of signals. The main drivers for the market of spectrum analyzers are the growing wireless communication networks drastically, the increasing demand for portable and handheld devices, and the evolvement of signal complexities because of the growing number of IoT devices. Also, the transition from 4G to 5G, and the continuous developments in the RF and microwave technology are other factors that have a positive impact on the growth of the specific market category.

The findings related to market size and trends highlight the importance of spectrum analyzer market evolution in terms of business investment and technology development as well as the potential shifts in the market supply and demand balance. More and more, businesses are committed to spending money on spectrum analyzers’ new generations with better precision, broader coverage, plus even improved interfaces to meet particular sectors’ demands. Such factors as the use of machine learning algorithms for automatic analysis of signals and the growing popularity of multi-functional analyzers are also contributing to the formation of the market. Further, there has been signing of such strategic mergers & acquisitions like Aeroflex has entered into an asset purchase agreement to acquire the spectrum analyzer assets of LIG Nex1 as it goes in tandem with the trend to consolidate the markets and expand the product offerings. In addition, the breakthrough remains in the defense and telecommunications industries where large-scale signals require accurate monitoring and testing, indicating that the market is growing and becoming more competitive.

Therefore, future global advancement of the spectrum analyzer is expected in areas such as Asia-Pacific since countries like China and India are rapidly growing their communication networks. These countries are also heavily investing in 5G systems and for these one needs sophisticated testing and monitoring tools such as spectrum analyzers.

Expansion of 5G Networks

The fast growth and market penetration of 5G networks are also seen as a major force behind the spectrum analyzer market. While the evolution and expansion of the telecom operators in the markets are around 5G, there is a need for a more sophisticated spectrum analyzer to operate, monitor, and analyze the high-frequency and complex 5G signals. These analyzers enable the confirmation that the network is running up to the optimum as well as the set performance levels by providing a correct display and analysis of the spectrum employed by 5G technologies.

Example: This driver is represented by the current implementation of 5G by large telecom operators such as Verizon and China Mobile among others. These companies are also spending a lot of money on spectrum analyzers that will help them prove their new 5G networks before the higher bandwidth demands kick in.

Rising Demand for IoT Devices

The extensive number of IoT devices produces a dense web of wireless signals that have to be monitored and catered for appropriately. The growth rate of the connected devices in different segments such as smart home and industrial automation necessitates the availability of spectrum analyzers that can support myriad frequencies and signals to guarantee optimized performance and little interference.

Example: This driver is evident in the increased adoption of smart home devices including; smart thermostats, security cameras, and voice assistant devices. Some of the applications of the spectrum analyzer include; Amazon and Google partnering with IoT device manufacturers to secure communication spectrum, and to determine the best wireless band for IoT operation hence acquiring spectrum analyzers.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=65755

Technological Advancements in Spectrum Analysis

Technological innovation is an important parameter that fosters market growth through attributes such as accuracy, broader frequency spectra, and newer features among others about spectrum analyzers. Features like real-time analysis, integration with artificial intelligence, and enhanced portability offer higher functionality and market interest for the innovative spectrum analyzers that can fulfill the requirements of modern industries including telecommunications, aerospace, and defense.

Example: One of the drivers can be illustrated through Keysight Technologies’ recent release of the MXA X-Series Signal Analyzer. Some of the features include real-time analysis, high accuracy, and effectiveness in spectrum analysis, unlike the basic application that the SA helps to achieve therefore the MXA is richer in features as detailed below.

Conclusion

The spectrum analyzer market is stimulated by the growth of 5G networks, increasing IoT device demand, and the fulfillment of the constant technological progress. 5G networks are being deployed at breakneck speed and this has made the need to get accurate spectrum analysis to ensure that the network is efficient and has high performance clear. Technological developments in spectrum analyzers include improved accuracy and additional innovations which in turn create a strong demand from various fields hence enhancing the market growth. Using examples of leading telecom operators’ investments in 5G testing, the growth of the number of connected smart home devices, and achievements of KeySight Technologies, it is possible to describe the influence of the enumerated drivers. There is much growth and advancement for the spectrum analyzer market as further applications continue to be introduced as technology advances.

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website -www.univdatos.com

0 notes

Text

Zoho Inventory Trends to Watch in October 2024: AI, Mobile Integration, and Sustainability

In today’s hyper-competitive marketplace, how you manage your inventory can define your business success.

It’s not just about knowing what’s in stock but staying ahead of trends, keeping up with customer expectations, and aligning with sustainability goals.

Falling behind in these areas? That’s a problem — and one that Zoho Inventory in 2024 is well-positioned to solve.

With cutting-edge features like AI-driven automation, mobile-first inventory management, and sustainability tools, Zoho Inventory is evolving to meet the needs of businesses of all sizes.

Let’s explore how these trends are reshaping inventory management in 2024 and why adopting them is critical for staying competitive.

Quick Tip

Zoho Experts and Zoho Consultants such as Evoluz Global Solutions offer tailored services by leveraging their expertise to drive 3x business growth.

1. AI-Driven Inventory Management: Smarter Decisions, Fewer Errors

In 2024, artificial intelligence (AI) is taking center stage in inventory management. Zoho Inventory harnesses the power of AI to help businesses make faster, smarter decisions with minimal manual input.

AI-Powered Forecasting: By analyzing historical data and current market trends, Zoho’s AI predicts future demand, so you’ll know exactly when and how much stock to reorder. This prevents overstocking and stock outs.

Automated Reordering: Instead of relying on staff to track stock levels manually, Zoho Inventory uses AI to automatically trigger reorders when inventory dips below a certain threshold.

Smart Transfers: Managing multiple warehouses? AI-driven smart transfers help balance inventory across locations, ensuring you always have stock where it’s needed most.

Why It Matters: Businesses that automate inventory management processes with AI save time and money, reduce human error, and ensure they always have the right products in the right quantities.

2. Mobile-First Inventory Management: Flexibility at Your Fingertips

Today’s business world is mobile, and so is inventory management. Zoho Inventory’s mobile-first approach means you can manage your entire operation — whether it’s checking stock, processing orders, or managing shipments — right from your smartphone or tablet.

Real-Time Inventory Tracking: Stay on top of your stock levels anytime, anywhere. You’ll get real-time data on what’s available, what’s selling, and what needs restocking.

Mobile Barcode Scanning: Using just your phone, you can scan barcodes to update stock levels, reducing errors and speeding up operations.

Push Notifications: Get instant updates on low stock levels, incoming orders, or shipment delays, ensuring you’re always in the loop.

Why It Matters: Managing inventory on the go provides flexibility. Whether you’re at a meeting or off-site, you can still stay in control of stock levels and operations.

3. Multi-Channel Inventory Syncing: Stay Consistent Across All Platforms

For businesses selling across multiple platforms — be it Amazon, Shopify, or eBay — keeping your inventory in sync can be a headache. Zoho Inventory solves that by ensuring all your sales channels are updated in real time.

Real-Time Syncing: Whether a sale happens on Amazon, Shopify, or any other platform, Zoho Inventory updates your stock across all channels in real time.

Unified Dashboard: Manage your entire operation from one place, keeping your orders, shipments, and stock organized across platforms.

Warehouse Mapping: Zoho Inventory allows you to allocate stock from specific warehouses to different sales platforms, helping ensure faster order fulfillment.

Why It Matters: When your inventory syncs automatically across platforms, you eliminate stock discrepancies, preventing issues like overselling or running out of stock.

4. Sustainability Tools: Reducing Waste, Improving Efficiency

Sustainability isn’t just a buzzword anymore; it’s a must. Consumers expect businesses to operate responsibly, and Zoho Inventory’s sustainability tools help you do just that.

Waste Reduction Analytics: Track slow-moving products and avoid overproduction, helping to minimize unsold stock and reduce waste.

Eco-Friendly Disposal: Partner with eco-conscious services to dispose of un-sellable items in an environmentally friendly way.

Carbon Footprint Tracking: Monitor your logistics and warehouse emissions to identify opportunities to reduce your environmental impact.

Why It Matters: By optimizing your stock to reduce waste and tracking your carbon footprint, you’ll not only cut costs but also build a reputation as a responsible, sustainable business.

5. Automated Shipping and Fulfillment: Speed Up Deliveries

Fast, accurate delivery is a customer expectation you can’t afford to ignore. Zoho Inventory’s automated shipping and fulfillment features help streamline the entire process, from packing to delivery.

Split Shipments: Reduce delivery times and costs by fulfilling orders from the nearest warehouse or multiple locations.

Real-Time Shipping Rates: Get real-time quotes from carriers like FedEx, UPS, and DHL, automatically selecting the most cost-effective option for each order.

Automated Shipping Labels: Generate shipping labels automatically, reducing the chance of errors and speeding up fulfillment.

Why It Matters: Automating the shipping process helps you get products to customers faster, enhancing their experience and encouraging repeat business.

6. Warehouse Automation: Optimize Stock Across Locations

If you’re managing multiple warehouses, keeping track of stock can be a logistical nightmare. Zoho Inventory’s warehouse automation features make managing multiple locations simple and efficient.

AI-Suggested Stock Transfers: Let AI analyze stock levels and recommend the best locations to transfer products based on demand.

Centralized Warehouse Management: Monitor all your warehouses from a single dashboard, with real-time updates on stock movements, orders, and shipments.