#Institute For Fiscal Studies

Explore tagged Tumblr posts

Text

IFS: Labour's Tax Rises Will 'Largely' Fall To Working People News Buzz

Working people will end up paying for Rachel Reeves’ huge tax hike, according to a leading think tank. The chancellor unveiled a plan to raise a record-breaking £40bn in her Budget today, but maintained that she had stuck to her promise not to bring back austerity. Labour also claims to have honoured their manifesto pledge not to increase taxes for “working people”. Although that exact…

0 notes

Text

Labour's First Budget: Navigating Economic Challenges

Labour’s First Budget: Expectations and Challenges As the Labour Party government in Britain gears up to unveil its inaugural budget this week, the prevailing sentiment among Britons has been one of caution and unease. For several months, the narrative has centered around a sobering forecast: the upcoming budget may not resonate well with the public. The budget announcement is set for Wednesday…

#austerity#budget announcement#economic growth#fiscal strategy#G7 nations#Institute for Fiscal Studies#Keir Starmer#Labour Party#public spending#Rachel Reeves

0 notes

Text

There is no "Black Hole" in the UK Public Finances

A theme of my analysis has been that our political class is addicted to spending and we have seen a new outbreak on this front in my home country overnight. From Pippa Crearer of the Guardian. NEW: Rachel Reeves expected to reveal a £20bn hole in government spending for essential public services on Monday, paving the way for potential tax rises in the autumn budget. In fact things went further in…

#business#Chancellor Rachel Reeves#Economic Growth#economy#Finance#fiscal black hole#GDP#Great British Energy#Institute for Fiscal Studies#OBR#Office for Budget Responsibility#UK Public Finances

0 notes

Text

The Best News of Last Week - August 21, 2023

🌊 - Discover the Ocean's Hidden Gem Deep down in the Pacific

1. Massachusetts passed a millionaire's tax. Now, the revenue is paying for free public school lunches.

Every kid in Massachusetts will get a free lunch, paid for by proceeds from a new state tax on millionaires.

A new 4% tax on the state's wealthiest residents will account for $1 billion of the state's $56 billion fiscal budget for 2024, according to state documents. A portion of those funds will be used to provide all public-school students with free weekday meals, according to State House News Service.

2. Plant-based filter removes up to 99.9% of microplastics from water

Researchers may have found an effective, green way to remove microplastics from our water using readily available plant materials. Their device was found to capture up to 99.9% of a wide variety of microplastics known to pose a health risk to humans.

3. Scientists Find A Whole New Ecosystem Hiding Beneath Earth's Seafloor

youtube

Most recently, aquanauts on board a vessel from the Schmidt Ocean Institute used an underwater robot to turn over slabs of volcanic crust in the deep, dark Pacific. Underneath the seafloor of this well-studied site, the international team of researchers found veins of subsurface fluids swimming with life that has never been seen before.

It's a whole new world we didn't know existed.

4. How solar has exploded in the US in just a year

Solar and storage companies have announced over $100 billion in private sector investments in the US since the passage of the Inflation Reduction Act (IRA) a year ago, according to a new analysis released today by the Solar Energy Industries Association (SEIA).

Since President Joe Biden signed the IRA in August 2022, 51 solar factories have been announced or expanded in the US.

5. Researchers have identified a new pack of endangered gray wolves in California

A new pack of gray wolves has shown up in California’s Sierra Nevada, several hundred miles away from any other known population of the endangered species, wildlife officials announced Friday.

It’s a discovery to make researchers howl with delight, given that the native species was hunted to extinction in California in the 1920s. Only in the past decade or so have a few gray wolves wandered back into the state from out-of-state packs.

6. Record-Breaking Cleanup: 25,000 Pounds of Trash Removed from Pacific Garbage Patch

Ocean cleanup crews have fished out the most trash ever taken from one of the largest garbage patches in the world.

The Ocean Cleanup, a nonprofit environmental engineering organization, saw its largest extraction earlier this month by removing about 25,000 pounds of trash from the Great Pacific Garbage Patch, Alex Tobin, head of public relations and media for the organization

7. The Inflation Reduction Act Took U.S. Climate Action Global

The U.S. Inflation Reduction Act (IRA) aimed to promote clean energy investments in the U.S. and globally. In its first year, the IRA successfully spurred other nations to develop competitive climate plans.

Clean energy projects in 44 U.S. states driven by the IRA have generated over 170,600 jobs and $278 billion in investments, aligning with Paris Agreement goals.

---

That's it for this week :)

This newsletter will always be free. If you liked this post you can support me with a small kofi donation here:

Buy me a coffee ❤️

Also don’t forget to reblog this post with your friends.

1K notes

·

View notes

Text

Kamala Harris Will Pay You Not to Work

She has endorsed several measures that resemble Universal Basic Income.

By Matt Weidinger -- Wall Street Journal

A recent study confirms that universal basic income—no-strings-attached benefit checks offered to recipients regardless of need or contribution to the program—discourages work. That’s relevant to the presidential race. Kamala Harris has called more than once for paying UBI-like benefits.

Participants in the UBI program worked nearly 1½ hours less a week on average, and unemployment rose. Other adults in recipient households reduced their work effort, too. Overall, the study found for every dollar in benefits, “total household income excluding the transfers fell by at least 21 cents.”

As vice president, Ms. Harris cast the deciding vote to create a temporary UBI for parents through a significantly expanded child tax credit in 2021. Tens of millions of households collected these payments, which grew to as much as $3,600 a child, even as the program��s work requirement and work incentive features were suspended. A University of Chicago study calculated that if the change were made permanent, it would result in 1.5 million parents exiting the labor force. But the temporary policy lapsed when Sen. Joe Manchin refused to support its extension without a work requirement. The administration’s fiscal 2025 budget would revive the costly 2021 expansion, but they aren’t the only ones flirting with budget-busting proposals. On Sunday, Sen. J.D. Vance called for increasing the child tax credit to $5,000 and making it available to “all American families,” though he didn’t say whether he would make it conditional on work.

As a senator, Ms. Harris proposed two even larger UBI programs that would have displaced more work. In 2019 she introduced her “signature” bill proposing a UBI for lower-income adults, including childless adults. According to a Federal Reserve Bank of Atlanta report, high effective marginal tax rates on modest-income work (due to progressive tax rates coupled with phasing out current benefits) already “effectively lock low-income workers into poverty.” The phaseout of Ms. Harris’s new $3 trillion entitlement would only increase current disincentives to work and advance.

In 2020 she proposed a pandemic UBI program to issue most Americans $2,000-a-month “crisis payments.” That reckless proposal would have doled out a total of $84,000 to each adult and up to three children in households with adjusted gross income under $200,000 (or $150,000 for single-parent households). The total cost would have been $21 trillion.

Most voters, even Democrats, say benefit recipients should engage in work or training if they are able to do so. Ms. Harris obviously cares more about showering Americans with federal cash than the employment disincentives built into her ideas.

Mr. Weidinger is a senior fellow at the American Enterprise Institute.

#kamala harris#Tim Walz#Democrats#Obama#Biden#Schumer#Pelosi#AOC#malaise#lazy#losers#failure#corrupt#hunter biden#thief#trump#trump 2024#president trump#ivanka#repost#america first#americans first#america#donald trump#art#hunger#landscape#insta#instagram#instagood

27 notes

·

View notes

Text

Understanding the Southern Perimeter’s Republican Lean: A Multi-Factor Analysis

The political landscape of the United States is often discussed in terms of blue and red states, with certain regions consistently leaning Republican or Democrat. However, the southern perimeter of the continental U.S.—stretching from California to Florida—presents a unique case study. Despite cultural diversity, varying industries, and demographic shifts, this region generally leans Republican. This alignment, which includes border states with Mexico and those along the Gulf Coast, emerges from a complex interplay of geography, economics, historical values, and cultural attitudes.

1. Geographical and Climatic Influences

The southern perimeter is defined by its warmer climates, which attract specific demographics, most notably retirees. States like Florida have become retirement havens, drawing older populations from traditionally Democratic northern regions. This migration brings a demographic that often prioritizes conservative values such as lower taxes, property rights, and fiscal conservatism, aligning well with Republican ideologies. The subtropical to desert-like climate also shapes industries in these states, favoring agriculture, tourism, and energy sectors that lean conservative due to their reliance on limited government intervention and favorable regulatory policies.

Additionally, the shape and layout of these states play a role. California’s extensive north-south reach and diverse climate foster a mix of political ideologies, making it more complex, though its highly populated coastal cities tend toward Democratic dominance. By contrast, Arizona and Texas, with expansive rural and desert regions along the border, amplify conservative values centered on self-reliance and individualism, often associated with frontier mentality.

2. Historical and Cultural Factors

Southern states, including those on the southern perimeter, have a strong cultural legacy of conservatism rooted in a combination of frontier independence, skepticism of federal oversight, and a tradition of states’ rights. This tradition resonates with Republican ideology, which emphasizes limited government, individual liberties, and a cautious approach to social change. While California may stand as an exception due to its urban liberal hubs, the states from Texas through Florida reflect this traditional conservatism that has persisted over decades, reinforced by political institutions and local values.

Texas, in particular, embodies this “frontier spirit.” The state’s long history as a republic, combined with its emphasis on rugged individualism and suspicion of centralized power, aligns with Republican principles. Arizona, with its substantial rural population and similar desert environment, mirrors this mindset. The “frontier mentality” persists in these areas, where local culture values autonomy and self-reliance—traits that naturally dovetail with conservative ideologies.

3. Economics and Industry Patterns

Economic structures in these states contribute heavily to their conservative leanings. Texas, for example, is a major oil producer, while Florida’s economy is driven by tourism and agriculture. These industries often thrive under conservative economic policies, which typically favor deregulation, low taxes, and minimal government interference. Republican economic policies are seen as beneficial by stakeholders in these sectors, making the party an appealing choice for many business owners and workers.

Moreover, certain industries in these states feel the impact of immigration more directly, leading to support for stricter border policies and a more conservative stance on national security. Agriculture and construction in Arizona, Texas, and Florida rely heavily on immigrant labor but also face challenges from undocumented immigration, shaping local attitudes toward Republican policies that prioritize border enforcement and immigration control.

4. Proximity to the Mexican Border and the “Diversity Paradox”

For border states like Texas and Arizona, proximity to Mexico brings border security and immigration issues to the forefront of local politics. This isn’t just about geographical closeness; it’s about the daily reality of cross-border dynamics that influence attitudes toward national security, cultural integration, and economic impacts. The southern perimeter’s conservative alignment is often reinforced by a sense of “us vs. them,” a cultural boundary that shapes perceptions of national identity and sovereignty.

Counterintuitively, the high diversity in these border states does not automatically translate to liberal leanings. Instead, the influx of new populations can sometimes trigger a conservative backlash, as local communities respond to perceived cultural and economic shifts. This “diversity paradox” suggests that in some cases, increasing diversity can actually entrench conservative ideologies as groups seek to preserve traditional values in the face of demographic changes. California and New Mexico differ here, as both have deeply rooted Hispanic and Native American populations that pre-date current immigration concerns, leading to a multicultural identity that integrates rather than reacts to diversity.

5. Rural-Urban Divide and Population Distribution

The rural-urban divide is a significant factor in understanding Republican dominance in the southern perimeter states. Urban centers in Texas (Austin, Houston, and Dallas), Arizona (Phoenix), and Florida (Miami) tend to lean Democratic, but the vast rural areas and smaller towns remain conservative strongholds. Given that these rural and suburban regions often have disproportionate legislative influence due to gerrymandering and districting practices, Republican preferences are amplified politically.

In these rural areas, the appeal of Republican ideology is tied to a distrust of federal intervention and a commitment to traditional social values. The conservative emphasis on “law and order” and the right to bear arms resonates with rural populations who prioritize self-sufficiency and often feel culturally alienated from urban liberalism. This dynamic creates a political landscape where urban and rural values clash, but the rural-dominated districts sustain Republican influence at state and federal levels.

6. Geopolitical Significance and National Policy

Border security, immigration, and national security are not merely abstract political issues in the southern perimeter states; they are local realities. The Republican party’s stance on border control and immigration resonates with communities directly impacted by these policies. For residents in states like Texas and Arizona, issues of border security are personal and immediate, influencing their political alignment. The southern perimeter’s exposure to these cross-border dynamics fuels support for policies that emphasize strict immigration enforcement, contributing to the region’s Republican leanings.

Furthermore, the high visibility of national debates on immigration and security in these states places them in a unique geopolitical position. Residents of the southern perimeter often view federal immigration policies through the lens of local impact, which can heighten conservative stances on enforcement and sovereignty, particularly during times of political polarization on these issues.

The southern perimeter’s Republican alignment, spanning from California to Florida, is a product of interwoven geographical, economic, cultural, and historical factors. From the lure of warm climates drawing conservative-leaning demographics to the economic structures that benefit from conservative policies, each element reinforces the region’s political leanings. The combination of rural influence, frontier mentality, and proximity to the Mexican border creates a unique political identity that sustains Republican dominance.

While California and New Mexico serve as exceptions due to their own unique geographic and cultural compositions, the southern perimeter as a whole demonstrates the impact of physical geography and local demographics on political identity. This analysis underscores how politics in border states cannot be reduced to simple assumptions about diversity or proximity to Mexico; instead, it is the product of complex, localized dynamics that shape conservative values and Republican support across the region.

#south#southern border#souther states#border#southern perimeter#border states#border patrol#republican#conservatives#geography#history#analysis#political science#mexico#california#arizona#texas#new mexico#louisiana#mississippi#alabama#florida#georgia#south carolina#politics#united states#america#north america

7 notes

·

View notes

Text

On August 1st 1967 Queen's College in Dundee became a fully fledged university in its own right and was renamed the University of Dundee.

The history of what would become Dundee University stretches back to 1881 when University College Dundee was founded. Its creation owed much to the wealth gathered in Dundee through the jute and textile industry. The prospect of establishing a university in Dundee had been under discussion since the 1860s. It was made a reality with a donation of £120,000 from Miss Mary Ann Baxter, of the hugely wealthy and influential Baxter family. Her cousin, John Boyd Baxter, the Procurator Fiscal for Dundee District of Forfarshire, was heavily involved in the discussions and also donated monies. As the main benefactor and co-founder, Miss Baxter had definite ideas about how she would like the college to run and took an active role in ensuring her wishes were fulfilled. The deed establishing University College stated that it should promote “the education of persons of both sexes and the study of Science, Literature and the Fine Arts”. As well as promoting the education of both sexes, Miss Baxter insisted it should not teach Divinity, and was adamant that those associated with the university did not have to reveal their religious leanings. Baxter’s role in establishing University College, Dundee was noted at the time by Scotland’s most notorious poet, who has always had an association with the city, William Topaz McGonagall who wrote: Good people of Dundee, your voices raise And to Miss Baxter give great praise; Rejoice and sing and dance with glee Because she has founded a College in Bonnie Dundee University College, Dundee became part of St Andrews University in 1897, under the provisions of the Universities Scotland Act of 1889. This union served to “give expression to local feeling that there should be a vital connection between the old and the new in academic affairs.” Initially, the two worked alongside each other in relative harmony. Dundee students were able to graduate in science from St Andrews, despite never having attended any classes in the smaller town. However, over time relations became strained, particularly over the issue of the Medical School and whether chairs of anatomy and physiology should be established in Dundee, St Andrews or both, setting the stage for the tensions that would place some strain on the relationship between the two institutions in the decades ahead. By the mid-1900s separation was being proposed. A 1954 Royal Commission led to University College being given more independence, being renamed Queen’s College, and taking over the Dundee School of Economics. In 1963, the Committee on Higher Education under the chairmanship of Lord Robbins recommended in its report to Parliament that ‘at least one, and perhaps two, of its proposed new university foundations should be in Scotland’. The government approved the creation of a university in Dundee, and in 1966, the University Court and the Council of Queen’s College submitted a joint petition to the Privy Council seeking the grant of a Royal Charter to establish Dundee University. This petition was approved and, in terms of the Charter, Queen’s College became Dundee University on this day in 1967. To mark the event and the University’s independence the people of Dundee witnessed an unusual event as hundreds of students filed up the Law dressed in red academic gowns. At the top they admired the stunning views – “an arresting vision in crimson” – before heading back down to the newly designated Dundee University. Fifty years on, and Dundee and St Andrews universities enjoy a warm relationship, very much in the spirit of friendly rivalry. Both are in the world’s top 200 universities and are among the top ranked in the UK for student experience. The combined strengths of Dundee and St Andrews have been recognised as an “intellectual gold coast” on Scotland’s east side. Other highlights in Dundee University’s history include the formal merger of Duncan of Jordanstone College of Art with the university in 1994 and the Tayside College of Nursing and Fife College of Health Studies becoming part of the university from September 1, 1996.

And in December 2001 the university merged with the Dundee campus of Northern College to create the Faculty of Education and Social Work.

13 notes

·

View notes

Text

“To put political power in the hands of men embittered and degraded by poverty is to tie firebrands to foxes and turn them loose amid the standing corn; it is to put out the eyes of a Samson and to twine his arms around the pillars of national life.” – Henry George

The underlying cause of the current civil unrest on British streets can be summed up in one word – POVERTY.

Poverty and inequality in Britain has been rising since Margaret Thatcher came to power in 1979. In an article in The English Historical Review titled, ‘Poverty, Inequality Statistics and Knowledge Politics Under Thatcher', 08/04/22, the author argues:

“Under the premiership of Margaret Thatcher, economic inequality and poverty in the United Kingdom rose dramatically to high levels that have remained one of the lasting legacies of Thatcherism, with far-reaching implications for social cohesion and political culture in Britain.”

Tony Blair, a man who embraced Thatcher’s neo-liberal free-market philosophy claimed that while he was prime minister New Labour

“...made the UK more equal, more fair and more socially mobile” (Tony Blair Institute for Global Change, 14/07/2019)

This is not true for the population as a whole. It is true that more was spent on public services, and on pensioners and those poorer working age adults with dependent children, both groups seeing their economic position improve. However:

“By contrast, the incomes of poorer working-age adults without dependent children - the major demographic group not emphasised by Labour as a priority - changed very little over the period. As a result they fell behind the rest of the population and relative poverty levels rose.( Institute For Fiscal Studies: Labours Record on poverty and inequality’, 06/06/2013)

Not only that, but income inequality also continued to rise under Blair as the already wealthy saw ’their incomes increase very substantially.’ (ibid)

We all know that the last 14 years of Tory government have only made matters worse: homelessness up; NHS waiting lists up; income inequality up; public services starved of cash; benefits cut; rents up, mortgages up. I could go on

Ordinary working people are suffering a cost of living crisis. The already poor have been pushed over the brink, especially in the North where the promised “levelling up” was just an empty election slogan to get Boris Johnson elected to power. Describing the neglected North one commentator said:

“Other countries have poor bits. Britain has a poor half”. (The Economist, ‘Why Britain is more geographically unequal than any other rich country’ , 30/06/20

Poverty led to the UK Food Riots of 1766. Poverty led to the French revolution in 1789. The Swing Riots, caused by rural poverty swept southern England in 1830. Poverty led to the Russian Revolution in 1917. Poll Tax riots hit the streets of Britain in 1990 and a report on the London riots of 2011 blamed “deprivation".

The point is, poverty causes feelings of hopelessness, abandonment, anger and resentment. Sometimes the victims of poverty correctly identify the people or class responsible for their plight, sometimes they don’t. The poverty and inequality experienced in Britain today is not directly the fault of immigrants. It is the result of deliberate policies by previous Conservative and Labour governments, but mass immigration does exacerbate already existing conditions of inequality and poverty.

There are not enough houses, the health system cannot cope with demand, there are not enough teachers or schools, and unemployment is rising, as is the day-to-day cost of living, while the already wealthy become richer still.

The far-right channel the anger that ordinary working people justifiably feel about this situation towards an easily identifiable target – immigrants and the children of immigrants, especially non-whites.

The most obvious example of this cynical political strategy in recent history is Hitler’s rise to power in Germany during the economic crisis of the early 1930’s, which saw runaway inflation, and a cost-of-living crisis. Hitler used the Jews as scapegoats, playing on existing prejudices and turning them into hatred, not only of Jews but of homosexuals, gypsies, black people, those with disabilities, Poles and even some Christian groups.

Our fathers and grandfathers fought against such racial tyranny and we should do the same but we will not be successful in that fight until our governments subscribe to the goal of a fairer and more equal society, a society where poverty is falling rather than rising.

There is a conversation to be had about acceptable immigration levels in relation to the economy and social cohesion, but that cannot be conducted in isolation to the need to raise the general standard of living for ALL our citizens and not just the few at the top. Martin Lewis warned politicians of this in 2022.

“We need to keep people fed. We need to keep them warm. If we get this wrong right now, then we get to the point where we start to risk civil unrest. When breadwinners cannot provide, anger brews and civil unrest brews – and I do not think we are very far off,” (independent: 10/04/22)

No one listened and now that day has arrived.

7 notes

·

View notes

Text

George Monbiot: TAX THE RICH, TAX THEM HARD (Labour is already failing)

We need a genuine levelling up, across regions and across classes. The austerity inflicted on us by the Conservatives was unnecessary and self-defeating and Labour has no good reason to sustain it.

The new government insists it is ending austerity. It isn’t. As the Institute for Fiscal Studies (IFS) pointed out in June, Labour’s plans mean that public services are “likely to be seriously squeezed, facing real-terms cuts”. Similarly, the Resolution Foundation has warned that, with current spending projections, the government will need to make £19bn of annual cuts by 2028-29. However you dress it up, this is austerity.

We are constantly told: “There’s no money.” But there is plenty of money. It’s just not in the hands of the government. The wealth of billionaires in the UK has risen by 1,000% since 1990. The richest 1% possess more wealth than the poorest 70%. Why do they have so much? Because the state does not; they have not been sufficiently taxed.

There are two reasons for taxing the rich and taxing them hard. The first is to generate revenue: this is the one everyone thinks about. But the second is even more important: to break the spiral of patrimonial wealth accumulation. Unless you stop the very rich from becoming even richer, it’s not just their economic power that continues to rise, but also their political power. Democracy gives way to oligarchy, and oligarchy is intensely hostile to everything Labour governments seek to achieve, including robust public services and a strong economic safety net. When oligarchs dominate, you can kiss goodbye any notion of the public good.

Last year, I tried to estimate how much it would cost to restore a viable, safe and inclusive public realm after 14 years of Tory vandalism. While my effort was very rough, the sum came to between £65bn and £100bn of extra spending a year: between seven and 10 times more than Labour’s total. It’s a lot, although it’s dwarfed by the money the previous government spent on the pandemic: between £310bn and £410bn over two years.

While these sums are ambitious, and would require expanded borrowing (which Labour has foolishly ruled out) as well as taxation, there are plenty of opportunities to raise taxes on the rich. The government could, for example, replace inheritance tax with a lifetime gifts tax kicking in at £150,000, a level that would affect only wealthy people. This would increase revenue while ending a major form of tax avoidance. The government should raise capital gains taxes: it’s perverse that unearned income is taxed at a lower rate than earned income. It should close the carried-interest loophole, which ensures that private equity bosses pay less tax than their cleaners: a pledge on which it already seems to be backtracking.

The government could also levy a wealth tax, a luxury goods tax and a tax on second homes and holiday homes. It could make the windfall tax on fossil fuel revenues permanent. It could replace business rates with land value taxation, and council tax with a progressive property tax based on contemporary property values: both shifts would be fairer and would raise more money. But the only extra taxes the government propose are, as the IFS remarks, “trivial”.

By seeking to raise revenue through economic growth rather than redistribution, Labour avoids the necessary confrontation with economic power. Not only is the strategy uncertain of success (economic growth here is subject to global forces); not only does growth load even more pressure on the living planet; but this approach also fails to break the grip of the ultra-rich. Isn’t this the whole damn point of a change of government, after 14 years of Tory appeasement? Unless you seek to change the structures of power and redistribute wealth, the rich will continue to harvest the lion’s share of growth while using some of their money to buy the politics that expands and fortifies their dominion.

8 notes

·

View notes

Text

Today, President Joe Biden signed the continuing resolution that will give lawmakers another week to finalize appropriations bills. Lawmakers will continue to hash out the legislation that will fund the government.

Republicans have been stalling the appropriations bills for months. In addition to inserting their own extremist cultural demands in the measures, they have demanded budget cuts to address the fact that the government spends far more money than it brings in.

As soon as Mike Johnson (R-LA) became House speaker, he called for a “debt commission” to address the growing budget deficit. This struck fear into the hearts of those eager to protect Social Security and Medicare, because when Johnson chaired the far-right Republican Study Committee in 2020, it called for cutting those popular programs by raising the age of eligibility, lowering cost-of-living adjustments, and reducing benefits for retirees whose annual income is higher than $85,000. Lawmakers don’t want to take on such unpopular proposals, so setting up a commission might be a workaround.

Last month, the House Budget Committee advanced legislation that would create such a commission. The chair of the House Budget Committee, Jodey C. Arrington (R-TX), told reporters that Speaker Johnson was “100% committed to this commission” and wanted to attach it to the final appropriations legislation for fiscal year 2024, the laws currently being hammered out.

Congress has not yet agreed to this proposed commission, and a recent Data for Progress poll showed that 70% of voters reject the idea of it.

This week, a new report from the Institute on Taxation and Economic Policy (ITEP), a nonprofit think tank that focuses on tax policy, suggested that the cost of tax cuts should be factored into any discussions about the budget deficit.

In 2017 the Trump tax cuts slashed the top corporate tax rate from 35% to 21% and reined in taxation for foreign profits. The ITEP report looked at the first five years the law was in effect. It concluded that in that time, most profitable corporations paid “considerably less” than 21% because of loopholes and special breaks the law either left in place or introduced.

From 2018 through 2022, 342 companies in the study paid an average effective income tax rate of just 14.1%. Nearly a quarter of those companies—87 of them—paid effective tax rates of under 10%. Fifty-five of them (16% of the 342 companies), including T-Mobile, DISH Network, Netflix, General Motors, AT&T, Bank of America, Citigroup, FedEx, Molson Coors, and Nike, paid effective tax rates of less than 5%.

Twenty-three corporations, all of them profitable, paid no federal tax over the five year period. One hundred and nine corporations paid no federal tax in at least one of the five years.

The Guardian’s Adam Lowenstein noted yesterday that several corporations that paid the lowest taxes are steered by chief executive officers who are leading advocates of “stakeholder capitalism.” This concept revises the idea that corporations should focus on the best interests of their shareholders to argue that corporations must also take care of the workers, suppliers, consumers, and communities affected by the corporation.

The idea that corporate leaders should take responsibility for the community rather than paying taxes to the government so the community can take care of itself is eerily reminiscent of the argument of late-nineteenth-century industrialists.

When Republicans invented national taxation to meet the extraordinary needs of the Civil War, they immediately instituted a progressive federal income tax because, as Representative Justin Smith Morrill (R-VT) said, “The weight [of taxation] must be distributed equally, not upon each man an equal amount, but a tax proportionate to his ability to pay.”

But the wartime income tax expired in 1872, and the rise of industry made a few men spectacularly wealthy. Quickly, those men came to believe they, rather than the government, should direct the country’s development.

In June 1889, steel magnate Andrew Carnegie published what became known as the “Gospel of Wealth” in the popular magazine North American Review. Carnegie explained that “great inequality…[and]...the concentration of business, industrial and commercial, in the hands of a few” were “not only beneficial, but essential to…future progress.” And, Carnegie asked, “What is the proper mode of administering wealth after the laws upon which civilization is founded have thrown it into the hands of the few?”

Rather than paying higher wages or contributing to a social safety net—which would “encourage the slothful, the drunken, the unworthy,” Carnegie wrote—the man of fortune should “consider all surplus revenues which come to him simply as trust funds, which he is called upon to administer…in the manner which, in his judgment, is best calculated to produce the most beneficial results for the community—the man of wealth thus becoming the mere trustee and agent for his poorer brethren, bringing to their service his superior wisdom, experience, and ability to administer, doing for them better than they would or could do for themselves.”

“[T]his wealth, passing through the hands of the few, can be made a much more potent force for the elevation of our race than if distributed in small sums to the people themselves,” Carnegie wrote. “Even the poorest can be made to see this, and to agree that great sums gathered by some of their fellow-citizens and spent for public purposes, from which the masses reap the principal benefit, are more valuable to them than if scattered among themselves in trifling amounts through the course of many years.”

Here in the present, Republicans want to extend the Trump tax cuts after their scheduled end in 2025, a plan that would cost $4 trillion over a decade even without the deeper cuts to the corporate tax rate Trump has called for if he is reelected. Biden has called for preserving the 2017 tax cuts only for those who make less than $400,000 a year and permitting the rest to expire. He has also called for higher taxes on the wealthy and corporations, which would generate more than $2 trillion.

Losing the revenue part of the budget equation and focusing only on spending cuts seems to reflect a society like the one the late-nineteenth-century industrialists embraced, in which a few wealthy leaders get to decide how to direct the nation’s wealth.

[LETTERS FROM AN AMERICAN: MARCH 1, 2024]

Heather Cox Richardson

+

“The crucial disadvantage of aggression, competitiveness, and skepticism as national characteristics is that these qualities cannot be turned off at five o'clock.” —Margaret Halsey, novelist (13 Feb 1910-1997)

#poverty#trickle down economics#corrupt GOP#Letters From An American#heather cox richardson#ecoomy#wealth#“debt commission”#corporations#Margaret Halsey#government for the people

13 notes

·

View notes

Text

By: Szu Ping Chan

Published: Mar 31, 2024

Britain has a boy problem. If you are born male today, you are increasingly likely to struggle in school, in the workplace and at home.

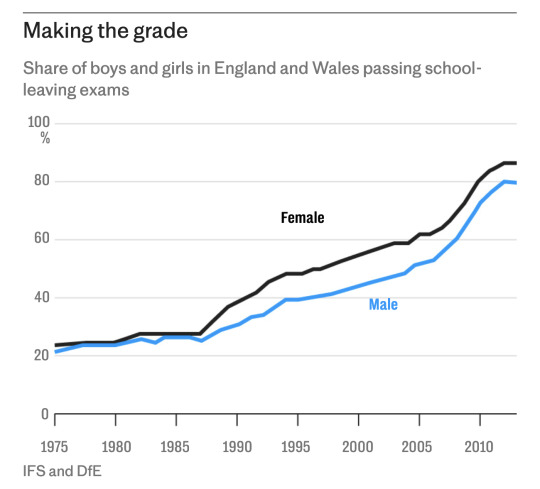

The gender attainment gap is not new – girls have been outperforming boys at GCSE level for over three decades now, while the number of women completing degrees has exceeded the number of men since the 1990s.

But solving the problem of underachievement among boys has never been more crucial. Economic growth is stalling, productivity is flatlining and public finances are creaking under the strain of growing benefits bills.

At a time when businesses are struggling to hire, more and more men are dropping out of the workforce. Everyone in society must achieve their fullest potential if we are to fix our economic problems.

There is a political dimension too – William Hague earlier this month raised the alarm about the growing numbers of disaffected young men who, with little offered or promised to them in life, were turning to far-Right politics.

There is nothing innate about boys’ underachievement. There is no fundamental reason why outcomes should be getting worse.

Yet without a concerted effort to close the attainment gap, it seems destined to widen. Ever more men and boys will find themselves unwittingly consigned to life’s scrapheap.

The problem is clear – where are the solutions?

Deepening development gap

Before children even step a foot inside the classroom, boys are already behind.

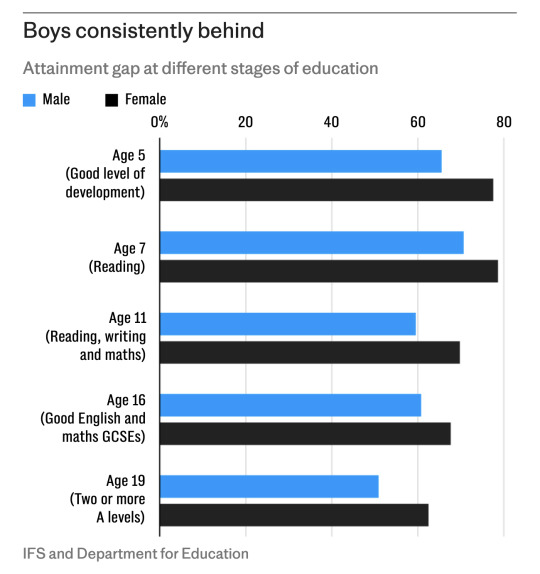

The Institute for Fiscal Studies (IFS) notes that “a significant gender gap in both cognitive and socio-emotional development” emerges by the age of three.

By the time children start primary school, two-thirds of girls have reached a “good level of development”, suggesting they are able to write a simple sentence or count beyond 20.

Just under two-thirds of boys have hit that same milestone. For children eligible for free school meals, the disparity is even larger.

This gap that opens up at three never completely closes, according to the Institute for Fiscal Studies’ (IFS) analysis of Department for Education data.

“There’s a silent crisis brewing among boys and men in our classrooms, workplaces and communities,” says Richard Reeves, academic and author of Of Boys and Men, which explores the male malaise from cradle to career.

“Boys now lag behind girls and men lag behind women at almost every level of education. That’s true in nearly every rich economy.”

Reeves, a former adviser to Nick Clegg, the former deputy prime minister, says biology is behind some of this gap.

All the academic evidence suggests that the prefrontal cortex – or in Reeves’s words “the part of the brain that helps you get your act together” – develops around a year or two faster in girls than boys.

Girls are not smarter, they just mature faster, Reeves says. “Anyone who spends any time with teenagers knows exactly what I’m talking about.”

His conclusion is that there are simply some “natural advantages of women and girls in the education system”.

Rather than recognise and compensate for this, the system has in fact evolved in ways that favour girls. A switch to more coursework at GCSE level benefitted girls more than boys, according to the IFS, which noted that the gap in performance first emerged in the 1980s when exam-based O levels were replaced by GCSEs in England, Wales and Northern Ireland.

“The shake-up brought a move towards more continuous assessment, which seems to have benefitted girls,” the IFS said in a recent paper.

This idea is “quite hard to get this across because many people say: well if girls and women always had this natural advantage, why didn’t we see it 40 years ago?” Reeves says. “The answer is sexism.

“There is no doubt my mum would have gone to university if she was born 50 years later, but it wasn’t considered to be a thing. But now having taken the lid off, that potential for women in education just keeps going. There’s nothing wrong with that, it’s just that along the way a lot more men have fallen behind.”

Woes of the white working class

Of course, it would be wrong to suggest women were doing better than men in the working world. A median gender pay gap of 7.7pc still shows women are being shortchanged.

After graduation, men are more likely to get a “highly skilled” job than women and average earnings for a male graduate are around 9pc higher than a female a year after they leave university, according to the IFS.

That gap rises to 31pc a decade later.

However, what is worrying academics, politicians and teachers is that attainment among men and boys seems to be declining while for women it improves.

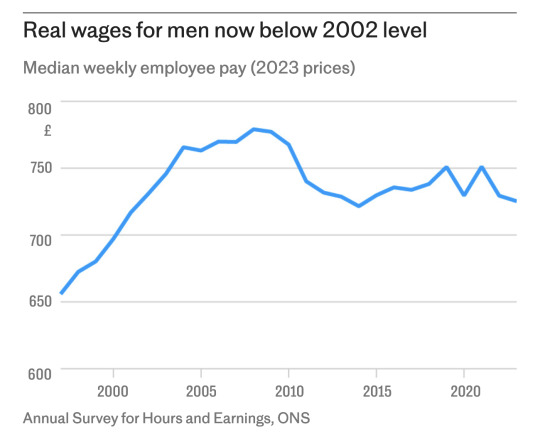

Average pay adjusted for inflation has fallen by 6.9pc for men since 2008, according to ONS data. Among women, it has climbed 2.2pc. In fact, men’s wages are no higher in real terms today than they were in 2002.

Men have been behind the fall in average hours worked since the pandemic, while women are working more.

Louise Murphy at the Resolution Foundation says the worsening prospects for boys and men reflect structural factors.

“The industrial structure of the UK has changed. Some of these manufacturing jobs that existed don’t exist in the same way now.”

Reeves says: “It used to be true that men with relatively modest levels of education do OK in the labour market. And that is not always the case anymore.”

The experience of boys in schools has led them to “underperform in the labour market” more broadly, he adds.

Achievement has become a particular issue among one subset of boys in particular: the white working class.

“Too many people in society just see these boys as the people on mopeds with a balaclava on their head,” says Andy Eadie, assistant headteacher at Cardinal Langley school in Rochdale. “Actually, that’s only a tiny minority.”

Eadie has taught at the mixed comprehensive school of 1,200 pupils since 2016. A fifth of his pupils are eligible for free school meals.

Many have already been “written off” by teachers as soon as they enter the classroom, Eadie says, particularly if they are white working class boys.

“There is a perception that some boys are already signed off and have no hope,” he says.

“The danger is that people aren’t bothered about these gaps. They’re just bothered about keeping them quiet so they can get on with other things.”

Just 14.6pc of white working class boys went into higher education in 2021. This was the lowest figure of any ethnic or socio-economic group and a third of the overall average, according to research published by the House of Commons Library.

Eadie says: “A lot of young people in the white working class background actually have really low self-esteem.

“And so you’ve got a lot of young people who potentially all underachieve and not feel very good about themselves.”

There are signs that this malaise is adding to Britain’s worklessness crisis. One in three 18 to 24-year-old boys were classed as economically inactive – meaning they’re not in work or looking for a job – in the three months to January, a record high.

The figure is up by more than five percentage points since the end of 2019, before the pandemic. Inactivity among 50 to 64-year-old men has climbed five times slower over the same period.

The inactivity rate among young men has roughly doubled since the early 90s, with almost two million now out of the labour force.

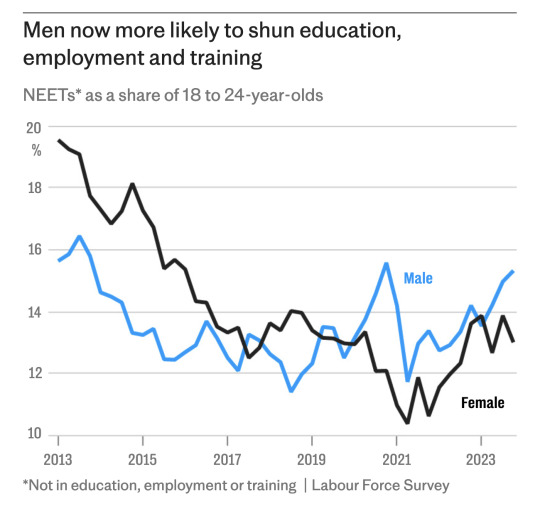

Some are choosing to stay on in education but the share of men not in employment, education or training (NEET) is climbing back towards financial crisis rates at 15.3pc. For women, it has remained on a bumpy but downward path.

“I think it goes back to the idea that we just don’t expect our boys to do well. So they don’t do well,” says Conservative MP Nick Fletcher, who leads the All-Party Parliamentary Group (APPG) for men and boys.

Caroline Barlow, headteacher at Heathfield Community College, has submitted evidence to the APPG suggesting there was a culture of low expectations for male students.

“In the early days, there was a tendency to almost just be grateful if boys were there and they were doing some work,” she said.

By shifting teachers’ expectations of their pupils, results improved and Heathfield was also able to close the gender gap.

Fletcher says: “We expect our boys to behave badly, so they behave badly. We are letting our boys down and unless we actually recognise we have a problem, then we won’t really start searching for the solution.”

Where does the problem start? Some think it is in the home.

Family circumstances have changed dramatically over the past few decades, with a sharp rise in lone parent households as divorce becomes more common or people don’t even get married in the first place. The vast majority of children in these circumstances grow up with their mothers.

In part, this reflects the economic empowerment of women: they can afford to be a single parent.

However, it raises the question of where male role models are coming from. Research conducted jointly by the Fatherhood Institute found that fathers who read to their children every day are contributing to their development and can help to address early attainment gaps.

The Conservative peer Lord Willetts writes in his book, The Pinch: “A welfare system that was originally designed to compensate men for loss of earnings is slowly and messily redesigned to compensate women for the loss of men.”

This too can leave men rudderless in mid-life.

As Reeves puts it in his book: “Economically independent women can now flourish whether they are wives or not. Wifeless men, by contrast, are often a mess. Compared to married men, their health is worse, their employment rates are lower, and their social networks are weaker.”

‘Crisis in masculinity’

The underachievement of men and boys was once seen as almost taboo.

“There have been people who have sniggered when I stood up and asked for a minister for men and a men’s health strategy,” says Fletcher.

“I genuinely believe some of the problems we face are down to the lack of interest in young boys and men, who we’ve always assumed are going to be fine.”

However, politicians have now started to notice.

Wes Streeting, the shadow health secretary, has announced that Labour is looking at introducing a men’s health strategy to address what he describes as a “crisis in masculinity” that is costing lives.

It is understood that Labour’s forthcoming review into mental health by Luciana Berger will include a chapter that focuses on male suicide. It remains the biggest killer of British men aged under 35.

William Hague, the former Tory leader, believes the issue is reshaping politics. He recently highlighted that a majority of men now believe they are being discriminated against, which is fuelling support among young men for extreme parties.

Fletcher is calling for a dedicated minister for men to match the minister for women, Kemi Badenoch, who is also part of the Cabinet as Business Secretary.

Despite overwhelming evidence that boys are falling behind, some colleagues still treat the idea of a dedicated minister with ridicule.

Fletcher says: “I think one of the problems that we’ve had as a society is there’s a lot of reluctance to speak up for men. We’ve noticed it in parliament over the years.”

Reeves wants to challenge the longstanding assumption that gender gaps only run one way.

He takes particular issue with the World Economic Forum (WEF), which looks at progress on gender equality across the world.

Countries are scored on a scale from zero to one, with the former representing no equality and the latter signalling full equality. The problem, says Reeves, is that the index itself assumes that only women have any catching up to do.

For example, it “assigns the same score to a country that has reached parity between women and men and one where women have surpassed men”.

This is a deliberate choice. However, as a result the UK’s educational attainment score stands at 0.999 despite the fact that girls have clearly outperformed boys for decades.

Reeves believes continuing to publish the index in this way is damaging and leads “to a lack of policy attention to the problems of boys and men”. In short, he says: “It makes no sense to treat gender inequality as a one-way street.”

The Government insists it is making progress, with a Department for Education spokesman saying the gender gap “across most headline measures is narrowing across all key phases.

“Education standards have risen sharply across the country, with 90pc of schools now rated good or outstanding by Ofsted, up from just 68pc in 2010.”

Reeves offers some radical solutions to closing the attainment gap in his book, including starting boys a year later in school. Many teachers and academics believe this is not practical and Reeves himself says the idea was designed to spark a debate.

Reeves says the evidence also suggests children should take more frequent breaks at school because boys find it harder than girls to sit still. He himself was put in a special class for English because his teachers felt he lacked focus.

At Balcarras secondary school in Cheltenham, headteacher Dominic Burke felt the only way to tackle what used to be a 15pc gender gap in the GCSE results was to level with his students.

“We got the boys together en masse and said to them: ‘You’re going to underachieve. The girls are going to beat you hands down’. And then we showed them the evidence. Their ability profiles were the same. But we said the reality is girls are going to get better results than you and we challenge you to be the first year group to stop that. We called it the ‘effort challenge’.”

It worked. Competition and the offer of cold, hard cash was enough to encourage many to put the effort in. Boys who were judged to have done so received £20 at the end of term. The school managed to close the gender gap and a few years ago, the boys beat the girls for the first time.

“Competition does work I think, and it’s a good tactic for teaching because it becomes a rewarding experience to meet the challenge,” says Burke. “If you make something more engaging and enjoyable, people are more likely to do it.”

Healing

No survey of the state of boys and men in Britain today can ignore the changing ideas of masculinity.

Whereas men were once seen as breadwinners, American sociologists Kathryn Edin and Maria Kefalas point out that many women in poor US neighbourhoods have come to see them “as just another mouth to feed”. This is disorientating.

Yet perhaps the way to survive as a man in the job market of the future is to junk ideas of traditional masculinity altogether. Many of the jobs of the future will be in things like caring and education.

Reeves wants governments to spearhead a drive to get more men into health, education, administration, and literacy jobs – which he brands HEAL – just as they have ploughed efforts into getting more women into science, technology, engineering, and mathematics – or STEM roles.

Increasing the number of male teachers would also raise the number of role models for boys in class. Three-quarters of state school teachers are women, according to data published by the Department for Education.

The share of men working in state-funded nurseries is even lower, at just 14pc. Around 30pc of primary schools have no male teachers at all.

“I did actually get some funny looks when I first started,” says one male nursery worker who does not wish to be identified.

“Even now I tend to leave the cuddles to my female colleagues as I think there’s still a stereotype that any man who wants to work with young kids has to be some kind of pervert.”

Encouraging more men into these types of jobs would be no small undertaking. Perceptions that men are not suited to caring or creative professions are deep-seated.

Florence Nightingale, who in the 19th century established the principles of modern nursing, insisted that men’s “hard and horny” hands were “not fitted to touch, bathe and dress wounded limbs, however gentle their hearts may be”. The Royal College of Nursing did not even admit men as members until 1960.

Edward Davies, policy director at the Centre for Social Justice think tank, cautions: “It’s absolutely right to remove cultural, perceived and real barriers that keep men from certain careers, especially caring and teaching professions. But we also need to be careful not to pretend men and women are exactly the same.

“At a blunt population level women seem more interested in people and men in things. You would expect to see that reality play out in the jobs they do too. Imposing quotas or expectations that all professions should be evenly split between men and women will probably drive some people into careers they are not suited to.”

Fixing Britain’s boy problem may be harder than even experts think.

[ Via: https://archive.today/AFaiR ]

==

The people who talk endlessly about "equality" and "equal rights" are strangely silent when it comes to areas where boys and men fall behind: education, health and lifespan, and life satisfaction.

https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0205349

[ The Basic Index of Gender Inequality (BIGI, x-axis) as a function of the Human Development Index (HDI, y-axis).

BIGI is the average of 3 components: Ratio in healthy life span, ratio in overall life satisfaction, and ratio in educational opportunities during childhood (see Materials and Methods for details). Deviation from zero implies the extent of gender inequality. The plot shows the largest contributor to the overall score for each nation: Purple dots indicate healthy life span is the most important component, green dots indicate educational opportunities, and red dots indicate overall life satisfaction. The Ns indicate for each level of HDI how many nations have a BIGI score greater than 0, and how many less than 0. ]

Almost like it isn't "just about equality."

14 notes

·

View notes

Text

When Kristin Batykefer fell ill with a headache, sore throat and body aches, the other women in her house baked her cookies, served her homemade vegetable soup and took her four-year-old daughter to the park so she could rest.

“Support system like no other,” Batykefer, 33, wrote on a TikTok post that has since been viewed more than one million times. “Shoulda moved into a mommune a long time ago.”

Batykefer had no idea that her video — and the concept of mommunes, a group of single mothers sharing a house, bills, childcare and support, seen in the US for the past decade or so — would go viral. When last year she split from her husband and lost her job, an old family friend with grown-up children invited her to move into her house in Jacksonville, Florida, while she found her feet. Then Batykefer was contacted by an old college roommate, Tessa Gilder, 32, who was also going through a divorce, with two children, aged five and one. “Tessa was, like, ‘I can’t do it any more.’ I said, ‘Come here. You’ll be welcomed with open arms.’ Originally our plan was we’d get our own place together, but once she arrived we became like a little family unit and it’s just awesome. Our friends said, ‘Stay as long as you guys want.’ ”

The 1960s and 1970s saw the rise of communes where like-minded souls joined together to raise families in capitalism-defying self-sufficiency. In a 21st-century version, more and more women are channelling the age-old spirit of sisterhood to establish mommunes, to tackle the ever-rising cost of living and everyday motherhood grind. “We just help each other out,” Batykefer explains over Zoom. “It’s not ‘You do the dishes, I’ll take out the trash,’ it’s more when we see something needs to be done we just do it. As a mother that’s just what your instincts are. It’s so nice having three minds in a house thinking like that.”

Indeed, as the thousands of comments on Batykefer’s posts make clear, many women in relationships — even happy ones — are envious of her mommune’s roll-up-your-sleeves environment. “There are some comments saying, ‘My husband does all this for me,’ but about 95 per cent say, ‘Wow, how do I get part of this?’ So many are from married women asking, ‘Where do I drop my husband off? I’m joining!’ ” Batykefer says, laughing. “It resonates because there are so many what we call ‘single married women’ out there who are not getting the kind of help with the physical, mental and emotional labour of being a parent that we have. I definitely didn’t get this support in my marriage, it all fell on me. If I was sick, I still had to cook for us and make sure my daughter was fed and taken care of and entertained.”

Batykefer, who before her break-up was documenting on TikTok her family’s itinerant life on a renovated bus, is also revelling in living in an environment free of marital bickering. “Whenever I would be driving our bus when I was married, it was such a stressful, anxiety-inducing experience because of the negative energy, but I’ve just been on a bus trip with a girlfriend, driving the whole time, and it was so peaceful and amazing.”

There are 2.5 million single-mother families in the UK, according to the Office for National Statistics, a figure that has more than tripled since the 1970s, as the stigma about divorce has decreased and women have gained more financial independence. But several international studies show that single mothers are at greater risk of physical and mental health disorders compared with their married counterparts, mainly as a result of lack of support — with many women living far away from their extended families.

Financial stresses can also be overwhelming, with a recent marked rise in lone-parent families using food banks or relying on benefits. A report last month by the Institute for Fiscal Studies showed that half of such families are now living in relative poverty.

While there are no official, large-scale mommunes in the UK or US, many single mothers are turning to local mommune groups on platforms such as Facebook (the London branch has 700-plus members) to find others to team up with.

Sara Memba, 34, a restaurant worker from Barcelona who has a one-year-old son, is sharing a house with a friend with four children aged between one and eleven in south London after finding that landlords were reluctant to have her as a tenant. “Many don’t trust single mothers to pay the rent on their own or they think your kid is going to destroy their house,” she says. Memba loves her situation. “We can go to work knowing our children are well cared for and it’s great to find a person with whom to talk and share concerns, joys and different, sometimes contradictory, emotions. It’s fun for the children too — they have more playmates and adventures.”

In an ideal world she’d love to see flats built specifically for single mothers. “There’d be common areas and spaces adapted for children to facilitate socialisation between neighbours. It would make a very difficult experience so much easier.”

The author Janet Hoggarth, from East Dulwich, south London — whose latest novel is Us Two — struggled after her divorce from her husband of 11 years, when she was left to bring up her three children, aged five, three and one. When she discovered that her friend Vicki Hillman, who had a newborn, had split from her fiancé, she invited her to move into her attic bedroom. Another single mother of two who lived around the corner frequently joined them in the evenings and stayed at weekends.

“I was feeling utterly bereft. I was navigating a divorce that took ages while juggling the kids and we were all feeling quite traumatised. It was so nice to have another adult there who knew how you felt, who could help me fill out forms, talk to lawyers and bounce ideas off. Plus, when the kids are in bed at night and you’re rolling around the house alone, you have company, which was such a relief because most of my contemporaries were busy with their own families. It stopped my constant feeling of a racing heart and feeling sick in my stomach. It was like a weird miracle drug.”

After two years Hillman moved out because she wanted a bedroom for her daughter but the women are still close friends. “We rubbed along really well without any bitchiness. It was very reassuring, like being in a family, just a different version of it. It really did stop me feeling broken. There’s definitely a different energy in an all-mothers house — there’s no weird bouncing of egos and someone expecting a medal for having wiped down the sides or polishing their halo because they’ve taken the bins out. Everyone just gets on.”

Not all mommunes are so successful. Elizabeth (surname withheld), 34, tried briefly sharing a flat with an old friend in Liverpool, when both had baby daughters. “We thought it would be perfect, but even though we got along well, our babies’ sleeping schedules were completely incompatible, which made it impossible for them to do anything together. I had no child support and had to work crazy hours with a long commute and my baby in a nursery, while she had a generous settlement from her ex and didn’t work. The imbalance made life so much more stressful than it would have been living alone. I felt guilty I couldn’t be around to do more babysitting. I still think mommunes are a brilliant idea, not least because being a single mum is so horribly expensive, but just as with any housemate, you have to find the right person.”

Victoria Benson, chief executive of Gingerbread, a charity for single-parent families that offers local networks for single parents to connect, agrees that mommunes are one “creative solution to a big problem. But we need to see a better welfare system, an increase in flexible work, and more affordable and available childcare that works for all single-parent families.”

Batykefer’s mommune keeps on giving, as demonstrated by the TikToks of her and Gilder enjoying concerts, karaoke and home-spa days together on weekends when their children are with their fathers. Now they’re in discussions about filming a reality show about their set-up, with the hope of bringing in more income but also inspiring more mommunes.

“I just fell into this but it’s such an obvious idea,” Batykefer says. “Women have always helped women. Let’s make it even easier for them.”

28 notes

·

View notes

Text

Challenges Ahead for Britain's Labour Party Government

As the Labour Party government of Britain gears up to present its inaugural budget this week, the prevailing sentiment among officials has been one of cautious forewarning for the citizens. For the past several months, the public has been prepared for the possibility that they may not find the upcoming financial announcement to their liking. The much-anticipated budget will be disclosed in…

#austerity#budget#economic growth#fiscal strategy#Group of 7#Institute for Fiscal Studies#Keir Starmer#Labour Party#public services#Rachel Reeves

0 notes

Text

https://english.almayadeen.net/news/Economy/-israel--paying-heavy-price-for-its-widening-aggression--cnn

In late September, as "Israel's" almost year-long genocide in Gaza spread and its credit rating was reduced once more, Israeli Finance Minister, Bezalel Smotrich, claimed that, while under stress, the economy remained robust.

"Israel's economy bears the burden of the longest and most expensive war in the country's history," Smotrich said on September 28.

Karnit Flug, a former governor of "Israel’s" central bank, told CNN that a more intense war will "take a heavier toll on economic activity and growth."

The war has drastically deteriorated the situation in Gaza, driving it into an economic and humanitarian disaster long ago, while the West Bank is "undergoing a rapid and alarming economic decline," according to a UN study released last month.

The Lebanese economy, meanwhile, might shrink by much to 5% this year as a result of cross-border strikes between the Lebanese Resistance - Hezbollah - and "Israel", according to BMI, a market research organization owned by Fitch Solutions.

According to a worst-case scenario developed by Tel Aviv University's Institute for National Security Studies, "Israel's" economy might contract much worse.

Prior to the war on Gaza, the International Monetary Fund predicted the GDP of "Israel" would increase by 3.4% this year in contrast to the current predictions of 1% to 1.9%.

In addition, "Israel's" central bank cannot decrease interest rates to revive the economy since inflation is growing, fueled by rising salaries and ballooning government expenditure to support the war.

Related News

The Bank of Israel estimated in May that war costs could total $66 billion, including military outlays and civilian expenses, such as housing for thousands of Israeli settlers evacuated from the north. This is roughly 12% of "Israel's" GDP.

While Smotrich claimed that the economy will bounce back, economists are concerned the damage will far outlast the war.

Flug, the former Bank of Israel governor, says there is a risk the Israeli government will cut investment to free up resources for war, reducing the growth moving forward.

Researchers at the Institute for National Security Studies say a potential full withdrawal from Gaza and Lebanon would have "Israel" in a weaker position than before October 7, 2023.

“Israel is expected to suffer long-term economic damage regardless of the outcome,” they wrote.

High-income taxpayers leaving the occupation en masse would also make things worse. The occupation government has postponed releasing a budget for next year due to competing demands that make it difficult to balance the accounts.

The battle has doubled "Israel's" budget deficit — the gap between government expenditure and income, primarily from taxes — to 8% of GDP, up from 4% before the war.

Government borrowing has increased and become more costly, as investors seek greater returns on Israeli bonds and other assets. Multiple downgrades to "Israel's" credit ratings by Fitch, Moody's, and S&P are expected to hike the country's borrowing costs even higher.

In late August, the Institute for National Security Studies estimated that just one month of "high-intensity warfare" in Lebanon against Hezbollah combined with "intensive attacks" in the opposite direction that damage Israeli infrastructure could cause "Israel's" budget deficit to rise to 15% and its GDP to contract by up to 10% this year.

The Israeli government faces a growing fiscal crisis, unable to rely on stable tax revenues as many businesses collapse amid the ongoing war. Coface BDi estimates that 60,000 Israeli firms will shut down this year, significantly higher than the average of 40,000.

Avi Hasson, CEO of Startup Nation Central, warned that the Israeli tech sector will not sustain the blows and the government's “destructive” economic policies. The war has led many tech companies to register overseas despite local tax incentives, exacerbating an existing trend.

Other sectors like agriculture and construction are also suffering, struggling with labor shortages and rising prices. Tourism has seen a sharp decline, resulting in an estimated loss of 18.7 billion shekels ($4.9 billion) in revenue since the war began.

#palestine#free palestine#gaza#free gaza#jerusalem#current events#yemen#tel aviv#israel#palestine news

3 notes

·

View notes

Text

3 notes

·

View notes

Text

Sky News: General Election 2024: Five things the main parties aren't talking about this election

Remember, the money is there!

Tax wealth over £10 million, at 1%. That's £50 billion plus in tax income. Every single year!

#politics#uk politics#uk news#nasty party#tory crisis#corruption#uk economy#economic crisis#tax increases#taxes

3 notes

·

View notes