#Individual Finances

Explore tagged Tumblr posts

Text

Financial Harmony: Navigating Pre-Marital Financial Planning for a Smooth Marital Journey

A key, yet frequently disregarded, component of pre-wedding preparations is financial planning. Let’s highlight its importance and detail essential financial considerations for couples preparing for marriage. Gaining a complete understanding of each partner’s financial situation is a critical initial step. Each individual should honestly disclose their earnings, debts, assets, and financial…

View On WordPress

#Asset Disclosure#Budgeting#Couple Finances#Debt Management#Emergency Fund#Financial Communication#Financial Education#Financial Goals#Financial Management#Financial Security#Financial Transparency#Individual Finances#Joint Accounts#marriage preparation#Personal Finance#Pre-Marital Financial Planning#Prenuptial Agreement#Relationship Advice#Savings

1 note

·

View note

Text

before it ends do you guys have any recommendations for games in the steam winter sale that you think are an absolute steal rn?

(also if youre looking for a rec frictional games' SOMA is 80% off at £5, definitely worth a play, especially if you like robots, genuinely harrowing moral decision making and existential dread ;^D)

#not that i have the finances to splurge but i could get a game as a treat lol#i think the bio/shock games are all below £5 too. individually that is#i cant rest until everyone in the world has played bioshuck 1

27 notes

·

View notes

Text

WHY AM I SO USEELESS /vent

#I'm sorry everyone sometimes I just can't#Hold it in anymore#I mean it's not like my tears ever mattered IRL#SO atleast I can scream abt it online#I fucked up a taxi ride#Had to pay double#And it just reminded me how fucking stupid I am#I don't know how to cook#Or manage finance#Or manage a house#Or do lot of work like laundry thru every individual cloth#Or even going to grocery for vegetables#I'm so stupid lol I probably couldn't even live alone#All I do is read poems and make art#I'm so stupid#I just want to kill myself#Again#I say#Txt#Negative tw#Suicidal tw#Vent#Please do NOT take this as directed at you

5 notes

·

View notes

Text

🥷🏻🥷🏻🥷🏻

#nato#invasion#planned destruction of individual cultures#planned wars#financed wars#financed racism#financed violence#organised crimes#destruction of family union#corruption#greed#crimes against humanity#infiltration#planned parenthood#forced immigration#patriots#soldiers#freedom fighters#justice seekers#speak up#standup#speaktruth#these people are evil#depopulation agenda#genocide#scam artists#criminals#fight for justice#please share#wwg1wga

3 notes

·

View notes

Text

I have to take my econ exam in a different room from my favorite business boy. whyyyy. why though.

#his last name is A-L mine is M-Z :-/#its ok tho me and him and this other girl who was in our business group last semester r getting coffee this weekend <3#i have two favorite business boys btw i reference them both as my favorite theres this guy from my BA team#and my stats partner from last semester#me + the boys are all taking finance and me + this girl + this other business girl im friends w are all taking marketing#so maybe I'll study for the finance exam w both the boys and the mkt exam w both the girlies#(i dont study alone im too pretty)#all the business sophomores take the same accounting class this semester so all five of us could potentially study for the next acc exam#at that point they would have met most of my other business friends individually and then we could all hang out perhaps

4 notes

·

View notes

Text

The thing that drives me mental about this is okay, if the action the term is referring to is so harmless, so normal and common then why is it called 'girl math' to begin with? It's about not feeling bad about your monetary habits? it's about justifying expenses, yes? Why not call it 'cheat math' or 'treat math' or anything else. Why does it have to be a gendered term?

Could it be that just maybe, just maybe, we hold subconscious biases about gender? Biases that might link silly, trivial indulgences with women? That maybe their is a cultural trend towards infantalising women? Why are all of these harmless trends 'girl x' and not 'women x'? Why are there no 'boy x'?

Why do these trends have to involve gender at all?

saw someone refer to not knowing how to keep track of your money as "girl math" ......why are we in this weird era of treating women like idiots but repackaging it to sound cute and quirky. We All Need To Stop

#this stuff fucking pisses me off#It is so fucking infantalising#this is BASIC feminism#hmmmmmmm why are we making a common practice something unique to one gender?#is their a pattern to how these trends are presented?#Nah! There's no problem here!#And it's not the individual trends that are the problem so much as the fact that it's a pattern#You must see that it's a pattern? It's so obvious#Feminism doesn't mean women are competent at everything. It means that behaviours/abilities are not gendered#and it is not empowering to reclaim being bad at maths or bad at finance management#It's not bad or wrong to be bad at either of them but feminism isn't saying that it is wrong to be a woman bad at maths either#this is incoherent. I'm just very upset#I'm sorry

75K notes

·

View notes

Text

Brazil's Proposal for Taxing Billionaires Faces G20 Challenges

Brazil’s Initiative for Taxing the World’s Wealthiest Faces Challenges Brazil’s ambitious proposal for a new tax targeting the world’s wealthiest billionaires is encountering unexpected resistance during a crucial two-day meeting of G20 finance ministers being held in Rio de Janeiro. In comments made to the press prior to the gathering, Brazil’s Environment Minister, Marina Silva, acknowledged…

#billionaires#Brazil#COP29#economic growth#finance ministers#G20#Javier Milei#Marina Silva#Oxfam#tax#ultra-high-net-worth individuals#wealth inequality#wealth redistribution

0 notes

Text

Make money daily by trading and investing intelligently. At WealthSpikes, we provide expert guidance in managing wealth and finance for both individuals and businesses.

We recognize that managing wealth and finances is crucial for both individuals and businesses. Effective financial management goes beyond just saving and investing; it involves strategic planning, risk assessment, and informed decision-making to ensure long-term financial stability and growth.

For individuals, this means creating a balanced plan for saving, investing, and preparing for future needs, such as retirement or education. For businesses, it includes optimizing cash flow, making sound investment decisions, and leveraging financial resources to support business expansion and sustainability.

#Make money daily#Trade intelligently#Invest intelligently#Wealth management#Finance for individuals#Finance for businesses#Portfolio management#Portfolio review#Market watch#Global markets#Trading services#Investing strategies#Financial stability#Wealth growth#Trading consultation#Online trading platform#Money management#Stock market strategies#Financial success#Trading education

0 notes

Text

Asian Wealth Managers Expand Crypto Exposure, Predict $100K Bitcoin by Year-End

Asian private wealth managers are increasingly embracing cryptocurrencies, with 76% of family offices and high-net-worth individuals (HNWIs) already investing in digital assets. A recent report by Aspen Digital highlights a surge in crypto adoption across Asia, driven by the region’s growing recognition of digital assets as a strategic investment. Among these investors, 31% expect Bitcoin to…

#$100K prediction#Asian wealth managers#Asian Wealth Managers Expand Crypto Exposure#Aspen Digital#Bitcoin#cryptocurrency investments#decentralized finance#digital assets#ETFS#expand crypto exposure#family offices#high-net-worth individuals#institutional-grade custody solutions#Predict $100K Bitcoin by Year-End#regulatory uncertainty

0 notes

Text

A very similar post could be made about maths education.

I feel like people can be overly harsh on it. People that struggle with it and find it boring go on to depict it as boring and abstract in media, which sort of primes the next generation to see it that way. But at the same time, we could be doing a lot more to help people connect the theorems and logical techniques they're learning to real life.

We use those techniques to work out the dimensions of (and materials needed for) a wall we're painting or garment we're sewing or the parts of a furniture piece so they can fit together. We use them to work out how much money we'd get through interest over X years if we save Y per month and can use that to compare the outcomes of different financial decisions. We use them to critique whatever new scientific study journalists are hyping up beyond its original conclusions. We use them in philosophy to check whether our arguments are genuinely airtight.

As a biology student it especially pains me how people are failed wrt statistics and the scientific method. Everyone should be taught things like what variance is, and what makes results statistically significant, and the effect of small sample sizes on the conclusions we can draw from results, and better societal understanding of those things (plus general principles of good experiment design)

And as someone who wants to not starve in the future, on top of the importance of teaching people maths so they can make proper financial decisions I feel like we should be taught more about investing. Actual long-term investment strategies that most people should follow to grow savings over decades, not YOLOing everything into Tesla.

When you understand that kids and teenagers being salty about literary symbolic analysis comes from a very real place of annoyance and frustration at some teachers for being over-bearing and pretentious in their projecting of symbolism onto every facet of a story but you also understand that literary analysis and critical thinking in regards to symbolism is extremely important and deserves to be not only taught in schools, but actively used by writers when examining their own work to see if they might have used symbolism unintentionally and to make sure that they are using symbolism effectively:

#i saw that poll that was like 'would you take [huge amount] now or £1000 installments for life' and the way most people went for the latter#and op overly justified the latter kinda got to me#but i didn't want to start an argument when i'm not even a finance expert lol#but still- interest is a thing. those £1000 paychecks will be less and less in real terms unless it increases with inflation#and if you took everything up front and invested it in something with dividends you get regular payments anyway! on top of that!#an individual company could tank and lose you everything but that's where index funds and other methods of diversifying investments come in#as long as you have enough savings outside of that to endure economic crises (which you would in this scenario unless you were dumb with it#they've always turned into temporary blips before things return to the previous trajectory in the long run#unless capitalism as a whole collapses and stays down in which case we likely have much more pressing issues than our savings accounts

95K notes

·

View notes

Text

Customized Tax Services for Individuals -Accounts NextGen

At Accounts NextGen, we’re here to help individuals like you manage your finances and get the most from your tax returns. Our team works hard to make taxes easy and stress-free, helping you find every possible deduction and credit to increase your refund. We handle the details, so you stay compliant with tax laws without any extra effort.

But our support doesn’t stop at tax filing. We offer personalized advice to help you plan for a stronger financial future, whether you're a full-time worker, freelancer, or small business owner. With our expert guidance, you can feel confident that you’re making the best financial choices for today and tomorrow. Let us make tax season easier and more rewarding for you.

#Tax Services for Individuals#tax accountant#online tax return#tax return melbourne#finance#tax accountant programs

0 notes

Text

How to solve tax debt: A step-by-step guide

Facing tax debt can be overwhelming, but taking the right steps can ease the burden. Here’s how to manage your tax debt effectively, and how Latita Africa can assist you throughout the process.

Step 1: Assess Your Tax Situation

First, gather all relevant tax documents. This includes previous tax returns, payment receipts, and any correspondence from SARS. After organising your records, take the time to review your debt to determine the total amount owed, including penalties and interest.

Step 2: Explore Your Rights and Options

As a taxpayer, it is crucial to know your rights. You have the legal right to challenge assessments and request explanations from SARS. Additionally, consider your options; you might qualify for a payment plan or could negotiate a reduced amount. Applying for tax clearance is another valuable step worth exploring.

Step 3: Seek Professional Help

Consulting with a tax expert can significantly ease your burden. A tax advisor will guide you through complex tax laws and SARS regulations. Latita Africa offers professional services designed to assist you at every step of the way.

Step 4: Communicate with SARS about your Tax Debt

Initiating communication with SARS is essential. Openly discussing your debt can lead to the best resolution. Furthermore, Latita Africa can help you draft clear and professional correspondence to facilitate this process.

Step 5: Arrange a Payment Plan

If paying the full amount is not feasible, evaluating payment plans is critical. Inquire about setting up a plan that suits your financial situation. By allowing Latita Africa to negotiate on your behalf, you may secure more favorable terms and ensure compliance.

Step 6: Stay Compliant with Future Tax Obligations to avoid Tax Debt

To prevent future tax issues, staying on top of your filings and payments is vital. Latita Africa provides ongoing services that help you maintain compliance with SARS, ensuring you remain informed about your obligations.

Step 7: Make use of Tax Debt Services

Finally, relying on expert assistance can make a significant difference. Latita Africa offers a range of services, such as tax assessments, debt negotiation, and legal support, which can simplify the process for you.

Conclusion

Managing tax debt doesn’t have to be a stressful experience. By following these steps and leveraging Latita Africa’s expertise, you can regain control of your finances and ensure future compliance.

This guide is for informational purposes only. Please consult a tax professional for personalised advice.

#legal & advisory#personal finance#south africa#How to#financetips#blog#tumblr fyp#fyp#high net worth individuals#lawyer#healthcare

0 notes

Photo

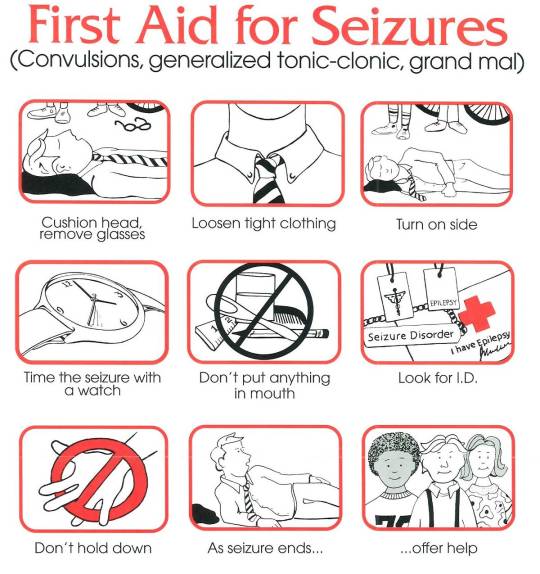

Another addition from someone in the USA with epilepsy: the first time I had a seizure it was in my sleep. At the time I lived with my kid’s dad. He woke up, called the ambulance, and when I came to they were already in the house. I was standing in the bedroom, trying to put on clothes that were too small (I hadn’t been able to wear clothes from that particular drawer since before I had kids) and holding a handful of jewelry that I would have never worn... all while he was urging me to just fucking go with the EMTs. I was not consciously aware of what was happening until that moment even though I was standing, speaking, and moving around. I did not remember anything prior to that moment. It was very, very weird to “wake up” when I was already standing up with too-small jeans halfway up my thighs, and it was even worse because he was terrified so I was immediately terrified.

Please, please familiarize yourself with the above steps (including the stroke symptoms and noting the length of the seizure), NEVER call police, and do not force someone to go with an ambulance unless something is abnormal (stroke symptoms or hitting their head during a fall or if the seizure lasts an excessive amount of time, etc.). In the USA, many people with epilepsy end up with outrageous ambulance and hospital bills when the only thing the ER will do is keep them for observation for 24 hours (unless something else is wrong). If the person is actively conscious and insists they are okay and do not need an ambulance, respect that.

To an outsider, a seizure is terrifying. To someone who lives with epilepsy, it is usually an inconvenient part of life. Knowing the difference between a normal seizure and emergency red flags is huge in the USA because you may unknowingly help contribute to a financial crisis if the person doesn’t actually need the EMT/ER.

Just in case

#epilepsy#i really fucking hate that i have to say that#but from both myself and my bff with epilepsy#please don't call an ambulance unless it's more than a normal seizure#if you've never seen one before they are terrifying to witness#not gonna lie#but please keep calm#most of us have google at our fingertips 24/7#in the us knowing the difference between a normal seizure and a medical emergency (the irony lol) can have a huge impact on finances#insured or not#our healthcare system is a joke and this is just another reason why#$5k ambulance bill for a 2 mile ride and an oxygen mask#multiple bills from the ER (hospital - individual doctor - CTI - MRI if they have a machine and perform one - you don't get one bill from#an ER visit in the US - you get a dozen)#usually for an overnight stay and a shrug from the dr/neuro that sees you the next morning#if that upsets you as much as it does me#advocate for change and vote for politicans that want to better our healthcare system

440K notes

·

View notes

Text

Annual income meaning in Marathi

Annual income meaning in Marathi - Annual income refers to the total income earned by an individual or an entity during a specific year.

Annual income meaning in Marathi Annual income meaning in MarathiWhat is Annual Income?Annual income meaning in Marathi ContextHow to Calculate Annual IncomeImportance of Knowing Your Annual Income What is Annual Income? Annual income meaning in Marathi – Annual income refers to the total income earned by an individual or an entity during a specific year. This concept is pivotal in both…

#annual income#Annual income meaning in Marathi - Annual income refers to the total income earned by an individual or an entity during a specific year.#finance#finance 101#finance bro#finance bros#finance degree#finance major#finances#personal finance#yahoo finance#yahoo finance premium

0 notes

Text

Concerns about Goldberg began to circulate late in 1989 and between Christmas and New Year 1990 his bankers appointed KPMG Peat Marwick to look at the company. Sykes recounts:

What [KPMG] uncovered was one of the biggest rats' nests of the 1980s. The Goldberg empire comprised a web of companies, trusts, partnerships and individuals. Money had been shuffled around in it untraceably. The total debt was far larger than anyone had thought – to the horror of the banks – and was hopelessly in excess of the value of the assets. The Godfather of the rag trade was broke several times over. On 24 January 1990 the bankers voted to appoint receivers to Linter Group. It was the end.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#concern#abe goldberg#80s#1980s#90s#1990s#20th century#christmas#new year#bankers#kpmg peat marwick#kpmg#linter group#rat nest#company#trust#partnership#individual#money#debt#banking#finance#loans#textiles#january 24

1 note

·

View note

Text

Self-Directed IRAs: Taking Control of Your Investments

Discover the benefits of self-directed IRAs, which allow for alternative investments beyond traditional options. Take control of your retirement portfolio.

#best financial planning services in ct for indians#financial advisor in connecticut#indianfinancialadvisor#finance#indianfinancialadvisorinct#financialplanning#indianfinancialadvisorma#financial advisor for indian families in ct#financial advisor in massachusetts#indianfinancialadvisorny#individual retirement account

0 notes