#Crypto support number for account recovery

Text

Why Every Crypto User Should Save a Trusted Crypto Support Number

In the rapidly growing world of cryptocurrencies, having quick access to reliable customer support is essential for every user. Whether you're trading Bitcoin, Polkadot, or USDT, technical issues, transaction delays, or account recovery problems can happen at any time. That's why saving a trusted crypto support number can make all the difference.

At bitcryptocaresupport.com, we provide 24/7 crypto helpdesk services to assist users with a wide range of issues, from troubleshooting transaction errors to resolving account recovery concerns. Our team of experts is trained to handle problems across major platforms like BitFinex, ensuring that you can continue your trading activities without unnecessary delays.

Saving our crypto support number means that you can quickly get assistance whenever you encounter an issue. Instead of searching through forums or waiting for slow email responses, you'll have direct access to fast and reliable help. Whether it's a technical glitch, security concern, or wallet problem, our crypto customer service is just a call away.

Ensure a smooth and secure cryptocurrency experience by saving our 24/7 crypto support number. Visit bitcryptocaresupport.com to learn more about our crypto technical support services.

#crypto#Cryptocurrency support#Crypto helpdesk#Crypto customer service#Crypto technical support#Digital currency support#How to contact crypto support number#Best crypto support number for issues#24/7 crypto support number services#Crypto support number for account recovery#Reliable crypto support number contact

0 notes

Text

So I've been away from Genshin for a while. Wish I could say it's by choice but the truth is...

My account got hacked and sold.

Long story. TLDR, I regret not paying attention to account security and learned my lesson the hard way. Genshin's recovery process was...extremely exhausting. Trust me when I say it's a stress-inducing nightmare, all of which could have been avoided if only I were more careful. Hackers have ways of gaining access to our accounts, and staying safe takes more than just avoiding the obvious "free primos" scams and not giving away your login info.

*For updated info about account security and what to do if you get hacked, visit the GenshinHacked subreddit.

*A good read on how to secure your account: Reddit Thread

Some advice:

Never ever save passwords on internet browsers. Configure settings to auto delete cookies after closing tabs or use incognito mode. There are malwares that steal passwords from cookies and that's how your email/genshin gets hacked.

Be wary of sites/links offering free software downloads/primos/genshin private servers. If something is too good to be true it probably is.

Set long passwords with a random combination of upper & lower case/special characters/numbers/letters.

Example: 42fjn&Oq!5v9mvTX3p*fcUxWd-7

Check your password strength here:

https://www.security.org/how-secure-is-my-password/

If you link any 3rd party to Genshin (twitter, facebook etc.), ensure they all have 2fa enabled. The linked email for each 3rd party account should also be different.

Create a brand new email with 2fa enabled and only use it for your Hoyoverse login. Do not use it for anything else to lower chances of it being compromised in a data breach. This email is probably the most important thing to safeguard. It is pretty much GAME OVER if this email gets hacked as the hacker can easily use it to unlink your email and change your Hoyoverse password.

Check if your email was found in a data breach: https://haveibeenpwned.com/

Don't get involved in account trading. Buying and selling accounts is against Hoyoverse's ToS. This is not going to stop people from doing so but just be aware that there are many hacked and stolen accounts on the market. There's always a chance of the original owner recovering it, causing the buyer to get "scammed" by the hacker/seller.

If ever you get hacked, do not trust anyone other than Hoyoverse's support team to retrieve your account. You might get messages asking you to DM "someone" on instagram/twitter for help (see below pic). Do not respond to these lowlife scammers and block them immediately! Also do not attempt to contact the hacker/buyer as they may trash your stuff out of spite.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

NOTE: The following is a retelling of my experience a few months back. Some info about the recovery process may be outdated.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

My Story

It is easy to blame the hacker and Hoyoverse for my predicament but I admit that ultimately it was my fault for getting hacked. And no, I did not fall for any "free primos!!111" or "genshin giveawayyy@#!&" scam, and I have never shared my login credentials with others.

The hacker gained access to my Hoyoverse and the email linked to it. With those alone the hacker was able to unlink my email, change the password and delete all login devices/phone number. How did the hacker get my login details? Well...

My first mistake was saving passwords on my web browser. I was using 2 browsers back then. Firefox was configured to delete cookies after closing and it's what I use on the regular. I set up another browser (Opera) for quick access to my unimportant socials and various sites by storing passwords in the browser and NOT deleting cookies. So really in hindsight, my biggest mistake was being a lazy dumbass. I'm sure that a cookie stealing malware was what got me coz my obscure twitter was spamming crypto tweets and the only place I ever use it on was the Opera browser. I also had my Genshin login saved for redeeming codes (arghhh). Probably had the email linked to Genshin saved on it too since it was the only compromised email.

My second dumb mistake was downloading software from a dodgy site. I think it was when I was looking for a pdf editor and downloaded malware instead. I remember it being a rar file, and extracting it triggered the malware alert of my antivirus. I deleted the file immediately but guess it was too late. This was likely how the cookie-stealing malware found its way onto my PC. Should have known better, really.

My third mistake was ignoring signs of a security breach. The first warning sign was the antivirus alert. The next was the twitter spam. These things happened a day or two before my Hoyoverse actually got hacked. There was time for me to stop it but I failed to do so. What I should have done immediately when there was suspicious activity: scan for malware, change every password and NEVER save passwords on browsers EVER AGAIN!

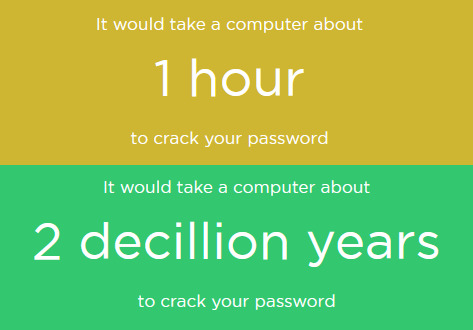

My fourth mistake was setting a bunch of weak passwords for Genshin and emails. Easy to remember, but a risky move since it'll only take an hour for a computer to crack them!

Secure & Recover

After discovering I got hacked, I did everything to secure my PC again like running several anti-virus scans, uninstalling Opera for good, activating 2fa wherever possible and changing every single password to complex ones. Thankfully it seems like nothing else was hacked.

Then I submitted the HoYoverse Pass form (aka "Hacked Form") to recover my account. This is the form you'll need to fill to "prove" you are the true owner of said account. On it are a list of questions like username, email, linked third party, first login method, first and most played devices, registration date, first purchase method and receipts. There's also the option to recover Genshin, Honkai or Tears of Themis but luckily you'll only need to submit the form for one game to get all the others back. Recovering through Honkai or Themis is supposedly faster as the player base is smaller but unfortunately I did not note down the UID of my Themis account so that option was...not an option for me (sighhh).

The CS team forewarned it'll take up to 20 business days for a reply (it was the norm to wait 30-40 days in total). It literally takes a whole month for the recovery process with no guarantee you'll get it back at the end of the long wait.

Meanwhile I kept a close watch on my account through an alt and on Hoyolabs. The hacker deleted my friend list and changed my in-game nick to a number. A few days later it was again changed, this time to a Jp name. It looked like my account got sold.

Whale Watching: The "Buyer"

Based on my observations, I could guess that the buyer was some Japanese dude who likes Kazuha (a lot), not a fan of Tartag (keeps switching out his bow and giving it to others smh), makes questionable choices for abyss, might be a whale or at least a dolphin (character count increased, some new constellations, pulled on the weapon banner yikes), logs in almost everyday and plays the events. I did wonder if I should be relieved about my account being in the hands of an active player who somewhat knows what he's doing as opposed to a bored troll who trashes accounts. But the most frustrating thing about it all was noticing the gradual increase of my chasm exploration % on Hoyolabs and being unable to do anything about it.

The 2.8 Update: A Depressing Livestream

Days passed (really slowly) with no reply. The buyer was still active on my account when the 2.8 livestream dropped. After losing access, I intentionally avoided genshin-related news to cope with the situation but tbh I really missed the game. So I ended up watching the stream. It announced the return of the summer islands, the new Diluc skin (the one consistent thing i asked for in every survey no kidding T_T), and even had a Sumeru teaser at the end. It was supposed to be exciting but I felt nothing but despair. I was looking forward to Sumeru and dendro but I wasn't sure if I will ever get the chance to experience it.

Day 30: The Response

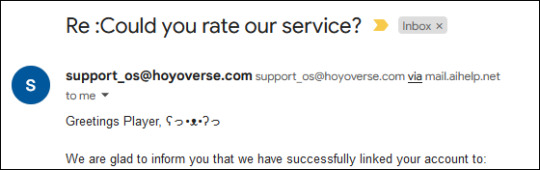

On the 30th day, I received a response from CS.

The recovery attempt was unsuccessful. The information I gave was "incomplete" and "inconsistent". They wouldn't say what was incorrect and I was left guessing.

I thought I had lots of proof and knew everything about my account but somehow still fell short. Felt a mixture of disbelief and sadness. All that time spent waiting, and it was for nothing.

The 2nd Attempt: Persistence & Patience

It was really hard dealing with the rejection after a month-long wait. I even considered moving on to Tower of Fantasy but in the end I decided to keep trying. I wasn't ready to give up on something I was invested in for almost 2 years. I refused to let the hacker/buyer win. On the subreddit I read stories of players who only got their accounts back after one year of continuous rejections. I was ready for that. I was prepared for the worst.

For the 2nd attempt I was a lot calmer and spent some time organizing my info and reviewing the first form to figure out what went wrong. I changed the registration date to my first login date instead. The form lets you use the first login date if you can't remember the registration date so this time I went with the login date which I was confident of. Then I changed the first login device and UID first started platform to my other device. I was in a tricky situation as I wasn't sure if I first logged in with mobile or PC. I had issues with both at the start and was trying them out at the same time (lag and update issues). For most players the registration device would be the same as the login device/UID first started platform but I think it was different for me. So anyway in the second form I wrote down the device I used that successfully played the first cutscene with the unknown god. It was not the same device I used to register for Genshin. I then explained my situation and why I was unsure about the first device in the additional info section.

Those three were the only answers I changed. Then I added every five star pull dates in the additional info (before i only listed the characters, no dates given). Also I used a different email from my first attempt to submit the form. This time the email was the one I used for purchases (this email address was visible on my paypal receipts).

After submitting the form I sent an additional email to support_os with a link to my google drive. Tbh this was prob unnecessary and I don't know for sure if it helped at all but at the time I was eager to provide as much proof as I could. The google drive had excel spreadsheets of the following:

Chronological list of all my five stars and their exact pull dates (including standard banner five star pulls)

Full purchase history in chronological order where I listed the transaction ids/purchase methods/file name of the receipt screenshot on my google drive for reference

Devices I used to play Genshin (again i explained about my first login device "issue" and also listed my latest most played devices and the date I started using them).

I added another folder for screenshots that had every receipt and some early in-game screenshots with my UID visible (including screenshots of my first 20 pulls on beginner banner...the hacker/buyer will never know of this since wish history only shows records from the past 6 months).

Basically I only included things I was sure of and everything was presented in a clear and organized format. Dates were written as YYYY/MM/DD, same as how it is in-game and I clearly stated my country and timezone in big bold font (emphasizing this since I could tell the hacker/buyer was located in another country). Lucky for me (and i'm so glad for this!) I kept records of every banner pull date to keep track of my primos and also had every receipt in a separate email that was not linked to Genshin. Although I had tons of screenshots and video evidence, I didn't include much as they are generally not considered as "good evidence". I can see why since media can easily be stolen off the internet so I only attached the unique event participation ones.

The Waiting Game 2.0

Playing the waiting game 2.0 was a lot tougher than the first. Already 30 plus days have passed since I last logged in, I have missed the Xiao and Itto events, possibly will miss the summer events as well and who knew how much of MY resources the buyer had already spent/squandered or how far he had progressed for the story quests. It didn't help that I was also missing out on the Themis events (my fav Marius' bday and the anniversary sighh). I was constantly checking my Hoyolabs profile, watching the buyer completing events, max refining weapons I do not want refined, switching out Childe's artifacts/weapons (once again Childe was messed with LMAO). It got to a point where the anxiety level was just too much and I had to stop the whale-watching. Instead it became routine every morning, afternoon and evening to check my email and try the "forget password" method (entering the new email I gave to see if it got linked by the CS team). Everyday I got used to the same feeling of disappointment that followed.

In short, the wait was tormenting.

Day 34 of 2nd Form: End in Sight?

It was day 34. Noon time I checked my email and tried the forgot password method. Still nothing as usual. Later that day just as I ended work, I checked my phone and straightaway I noticed the notification for an email from support_os. I jumped to open it and got this:

Nearly two months. It was finally over.

I got my account back!

State of My Account

I was able to login before the summer events ended although the buyer had already completed the story. But just listening to the familiar soundtrack of the islands brought back good memories of the first time I explored the map and I didn't know how much I missed Genshin until that moment.

Thankfully nothing of importance was trashed. Some artifacts were moved around but none of the good ones were destroyed. I found myself with welkin, battle pass, new characters I had no intention of pulling, some constellations including lost 50/50s, two 5-star weapons (1 was a dupe sighh) and some max refined 4-stars (pain). All Archon and character story quests were done and that probably upset me the most since I had plans to record the cutscenes to make videos. Other than that I was surprised to learn the buyer spent some time in my teapot adding random furniture and collecting realm currency (a lot of realm currency, um thanks?). And of course Kazuha was chilling there. I was prob right about maple boy being his fav.

The buyer was some kind of whale who spent quite a lot in 2 months, more than I ever did in a year. Having all this "bonuses" after getting hacked sounds like a win but the buyer might request a refund anytime so I'm feeling really uneasy about having all this "extra" stuff. There's nothing I can do now except to wait it out and hope my primos don't turn negative.

All this time I did not make any contact with the buyer so I will never find out how or why he bought my account. I will also never know if he knew the account he bought was a stolen one. Still, I don't feel sorry for the dude at all, not after what I had gone through for the past two months.

Lesson Learnt

If you are still reading this, don't be like me, please safeguard your account from hackers. Genshin's popularity makes it an attractive target for scumbag hackers and account traders. It is easy to blame Hoyoverse for the lack of security and loopholes but as players we should also do what we can to ensure our info doesn't get stolen that easily. Most importantly, do not download from unreliable sites and do not save passwords in your browsers. Always delete cookies or use incognito browsing mode. And always set a strong password!

Behold. My old password vs current one.

(https://www.security.org/how-secure-is-my-password/)

The End

And that is it for my sob story with a happy(?) ending. Ever since I got my account back I have been spending most of my time exploring Sumeru (soundtrack is gold!). Still some catching up to do as I have missed tons of story stuff (gonna have to watch all of it on youtube sighhh).

It sure is good to be back ( ͒˃̩̩⌂˂̩̩ ͒).

#genshin impact#genshin psa#my genshin got hacked#genshin account security#genshin account recovery#keep your accounts safe#lots of catching up to do#but im glad to be back

9 notes

·

View notes

Text

FTX’s fund allocation draws market attention

1. **FTX’s fund allocation draws market attention**

Recently, FTX is distributing a total of $16 billion in funds, including $12 billion in cash. After this capital flows back into the market, it is expected to drive investors back into the market and trigger a new round of buying.

2. Global Liquidity Index and Market Rebound

The correlation between the cryptocurrency market and global liquidity is becoming increasingly clear. Whenever the global liquidity index reaches current levels, the market usually follows a strong rally.

3. Future Potential of Ethereum ETF

Although the Ethereum ETF is progressing slowly, its prospects are still exciting. As time goes by, this field is expected to achieve a faster pace of development.

4. BlackRock’s BUILD Fund Outlook

In addition to ETFs, the optimistic attitude of BlackRock, the world's largest asset management company, towards blockchain technology cannot be ignored. The BUILD fund is a reflection of this attitude, and it is only the beginning of its layout in this field.

5. Goldman Sachs’ Tokenization Plan

Not only BlackRock, but other large institutions such as Goldman Sachs are also actively embracing tokenization technology. This trend shows the growing recognition of blockchain technology by traditional financial institutions.

6. The impact of the US election on the crypto market

Trump’s campaign dynamics have a potentially positive impact on the cryptocurrency market. Due to his administration’s support for the crypto industry, the market is paying close attention to his campaign performance.

7. Market expectations of rate cuts

The market generally expects that there may be three interest rate cuts this year, among which the probability of a 25 basis point rate cut in September is as high as 90%.

8. Ordinary investors remain on the sidelines

Despite the gradual recovery in the market, Google search volume for “cryptocurrency” and “Bitcoin” remains at low levels. In addition, the Coinbase application is only ranked 416th, showing that ordinary investors still have a strong wait-and-see mood.

9. **Key Support Level for US Dollar Index**

The U.S. Dollar Index (DXY) has continued to trend lower over the past few months and is now close to a key support level. If this support level is breached, it could have a significant positive impact on the cryptocurrency market.

10. **Bearish factors fading**

The main reasons for the previous market sell-off, such as the MtGox incident, the German Bitcoin sell-off, Jump Trading’s market operations, recession concerns and geopolitical conflicts, seem to be gradually subduing, which has brought more optimistic expectations to the market.

How to buy BTC

How to buy cryptocurrency on an exchange

Invest in BTC It has never been easier! Registering on an exchange, verifying your account, and paying by bank transfer, debit or credit card, with a secure cryptocurrency wallet, is the most widely accepted method of acquiring cryptocurrencies. Here is a step-by-step guide on how to buy cryptocurrency on an exchange.

Step 1: Register OKX (click the link to register)

You can register by email or phone number, then set a password and complete the verification to pass the registration.

Step 2: Identity verification - Submit KYC information to verify your identity

Please verify your identity to ensure full compliance and enhance your experience with full identity verification. You can go to the identity verification page, fill in your country, upload your ID, and submit your selfie. You will receive a notification once your ID has been successfully verified, bind your bank card or credit card and start transactions.

How to exchange USDT with a credit card and then convert it to BTC

Step 1: Click Buy Coins, first select your country , then click Card

Step 2: Click My Profile in the upper right corner

Step 3: Select Add Payment Method in the lower right corner and select a credit card that is suitable for you to fill in the information and bind, such as Wise, Visa, etc.

Step 4: Click P2P transaction again, select the corresponding payment method and choose the appropriate merchant to complete the transaction.

Step 5: After the transaction is completed, your amount will be converted into USDT (USDT is a stable currency of US dollar, 1:1 with US dollar) and stored in your account. Click on the transaction and search for BTC , buy its tokens.

0 notes

Text

Can I Transfer My Coinbase to Robinhood? How to Get Help from Coinbase’s Support Number

As cryptocurrency continues to gain mainstream adoption, many users are exploring different platforms to manage their assets. Coinbase and Robinhood are two of the most popular platforms for buying, selling, and managing cryptocurrencies. However, users often wonder whether it's possible to transfer their crypto directly from Coinbase to Robinhood. This article will explore this question in detail, provide a step-by-step guide for transferring crypto, and explain how to get help from Coinbase’s support team.

Understanding Coinbase and Robinhood

Overview of Coinbase

Coinbase is one of the largest cryptocurrency exchanges in the world, known for its user-friendly interface and extensive selection of cryptocurrencies. It allows users to buy, sell, and store various cryptocurrencies like Bitcoin, Ethereum, and more.

Overview of Robinhood

Robinhood is a popular investment app that offers commission-free trading of stocks, options, and cryptocurrencies. While Robinhood is primarily known for its stock trading platform, it has also gained traction in the crypto space by offering a limited selection of cryptocurrencies.

Key Differences Between Coinbase and Robinhood

One of the key differences between Coinbase and Robinhood is that Coinbase is a full-fledged cryptocurrency exchange, while Robinhood is primarily a brokerage platform with a crypto trading feature. This distinction plays a crucial role when considering the possibility of transferring crypto between the two platforms.

Can You Transfer Crypto from Coinbase to Robinhood?

Explanation of Direct Transfers

Unfortunately, direct transfers of cryptocurrency from Coinbase to Robinhood are not possible. Robinhood does not provide wallet addresses for its users, meaning you cannot send crypto from one platform to another directly.

Alternatives to Direct Transfers

Since direct transfers are not an option, users who want to move their crypto from Coinbase to Robinhood must first liquidate their assets on Coinbase (sell the crypto for fiat currency) and then use those funds to buy the same assets on Robinhood.

How to Transfer Crypto Using an External Wallet

Another workaround is to transfer your crypto from Coinbase to an external wallet and then deposit the fiat equivalent into your Robinhood account to repurchase the cryptocurrency. This method, however, involves multiple steps and may incur additional fees.

Step-by-Step Guide to Transfer Crypto Using an External Wallet

Setting Up an External Wallet

Choose a Wallet: Select a trusted external wallet compatible with the cryptocurrency you wish to transfer.

Set Up the Wallet: Follow the instructions to set up your wallet. Ensure you securely store your recovery phrase and private keys.

Transferring Crypto from Coinbase to the External Wallet

Log into Coinbase: Access your Coinbase account and navigate to your wallet.

Select the Crypto: Choose the cryptocurrency you wish to transfer and click "Send."

Enter the Wallet Address: Input the address of your external wallet and confirm the transaction.

Moving Crypto from the External Wallet to Robinhood

Convert to Fiat Currency: Once the crypto is in your external wallet, convert it to fiat currency.

Deposit to Bank Account: Transfer the fiat currency from your wallet to your linked bank account.

Fund Robinhood Account: Use the funds in your bank account to purchase the desired cryptocurrency on Robinhood.

Coinbase and Robinhood Fees

Fees Associated with Coinbase Transactions

Coinbase charges various fees depending on the transaction type, including trading fees, withdrawal fees, and deposit fees. These can vary based on the cryptocurrency and transaction method.

Fees Associated with Robinhood Transactions

Robinhood offers commission-free trading for cryptocurrencies, but there are hidden fees in the form of spread (the difference between the buy and sell price). Additionally, converting crypto to fiat currency may incur a fee when withdrawing to a bank account.

Comparing Fees Between Coinbase and Robinhood

While Coinbase fees are more transparent, Robinhood's fee structure can be more complex due to the spread. Users should compare the total costs of transactions on both platforms before deciding on their approach.

Security Considerations

Security Features of Coinbase

Coinbase is known for its robust security measures, including two-factor authentication (2FA), biometric logins, and insurance coverage for assets held in online storage.

Security Features of Robinhood

Robinhood also offers security features like 2FA and biometric logins, but it does not provide the same level of insurance coverage as Coinbase for crypto assets.

Best Practices for Secure Transfers

To ensure the security of your assets during transfers, always double-check wallet addresses, enable 2FA, and avoid using public Wi-Fi networks when conducting transactions.

Common Issues and Troubleshooting

Troubleshooting Transfer Issues

Common issues during transfers include delays, incorrect wallet addresses, and network congestion. Ensure all details are accurate and consider network conditions before initiating a transfer.

How to Avoid Common Mistakes

Avoid common mistakes by carefully reading instructions, confirming wallet addresses, and being aware of potential fees and delays.

Dealing with Delayed or Stuck Transfers

If a transfer is delayed or stuck, check the status on the blockchain explorer, and contact customer support if necessary. Delays are often due to network congestion or incorrect transaction details.

How to Get Help from Coinbase Support

Overview of Coinbase Support Channels

Coinbase offers various support channels, including a help center, email support, and live chat. They also provide a phone support line for urgent issues.

How to Contact Coinbase via Phone

To contact Coinbase via phone, call the support number provided on their website. Be prepared with your account information and details about the issue you're facing.

Other Ways to Reach Coinbase Support

In addition to phone support, you can reach Coinbase through their online help center, email, or social media channels like Twitter for quick responses.

Expert Insights on Crypto Transfers

Quotes from Cryptocurrency Experts

Experts in the field emphasize the importance of understanding platform limitations before attempting transfers and recommend using external wallets for flexibility.

Common Misconceptions About Crypto Transfers

A common misconception is that all platforms allow direct crypto transfers. Users should always verify platform capabilities and understand the associated risks.

Future of Crypto Transfers between Platforms

Emerging Trends in Crypto Transfers

As the crypto market evolves, we may see more seamless integrations between platforms like Coinbase and Robinhood, enabling easier transfers in the future.

Future Integrations Between Coinbase and Robinhood

There are ongoing discussions in the industry about potential partnerships or integrations that could simplify crypto transfers, making it easier for users to manage their assets across platforms.

Conclusion

Transferring crypto between Coinbase and Robinhood requires careful planning due to the lack of direct transfer options. By understanding the process, associated fees, and security considerations, you can successfully navigate the transfer process. Remember to contact Coinbase support if you encounter any issues and stay informed about future developments in the crypto space.

FAQs

Can I Transfer My Crypto Directly from Coinbase to Robinhood?

No, direct transfers from Coinbase to Robinhood are not possible due to platform limitations.

What Are the Fees Involved in Transferring Crypto?

Fees vary depending on the platform and transaction type, including trading fees, withdrawal fees, and spreads.

Is It Safe to Transfer Crypto Between Platforms?

Yes, but it requires careful attention to security measures such as enabling 2FA and verifying wallet addresses.

What Should I Do If My Transfer Is Delayed?

Check the status on a blockchain explorer and contact customer support if the delay persists.

0 notes

Text

Cryptocurrency Wallets: Essential Tools for Digital Asset Management

In the dynamic world of cryptocurrency, wallets play a crucial role in managing, storing, and transferring digital assets securely. As cryptocurrencies gain popularity, understanding the purpose and benefits of crypto wallets is vital for anyone looking to participate in this financial revolution.

What is a Crypto Wallet?

A crypto wallet is a digital tool that enables users to connect with blockchain networks. Unlike traditional wallets that hold physical currency, crypto wallets store the private and public keys required to manage and access cryptocurrencies. The public key functions as an address for receiving funds, while the private key is used for signing transactions and proving ownership.

Importance of Crypto Wallets

Crypto wallets are essential for several reasons:

Security: They offer a secure way to store cryptocurrencies, protecting them from theft and unauthorized access.

Control: Wallets provide users with full control over their digital assets, unlike exchanges which are susceptible to hacking.

Convenience: Wallets streamline the process of sending and receiving cryptocurrencies, making transactions quick and efficient.

Types of Crypto Wallets

Crypto wallets come in various types, each with its unique features and use cases:

Hot Wallets

Connected to the internet, hot wallets are more accessible but also more vulnerable to cyber-attacks.

Web Wallets: Hosted by online platforms and accessible via web browsers (e.g., Coinbase, Binance).

Mobile Wallets: Smartphone apps that allow mobile access (e.g., Trust Wallet, Mycelium).

Desktop Wallets: Installed on personal computers, balancing security and accessibility (e.g., Exodus, Electrum).

Cold Wallets

Not connected to the internet, cold wallets offer enhanced security and are less prone to hacking.

Hardware Wallets: Physical devices that securely store private keys offline (e.g., Ledger, Trezor).

Paper Wallets: Physical documents containing both public and private keys, providing offline storage solutions.

How Crypto Wallets Work

Crypto wallets operate using cryptographic keys:

Public Key: Shared with others to receive funds, similar to an account number.

Private Key: Kept secret and used to sign transactions, ensuring ownership and authenticity.

When a transaction is made, the wallet uses the private key to sign it, and the signed transaction is then sent to the blockchain for verification.

Factors to Consider

When choosing a cryptocurrency wallet, consider the following factors:

Security Features: Look for wallets with strong security measures like two-factor authentication and encryption.

User Experience: Select a wallet with an intuitive interface that matches your expertise level.

Supported Cryptocurrencies: Ensure the wallet supports the cryptocurrencies you intend to store.

Setting Up a Crypto Wallet

Setting up a crypto wallet typically involves these steps:

Choose a Wallet: Select a wallet type based on your preferences (hot or cold).

Download or Purchase: Download the app for software wallets or buy the device for hardware wallets.

Create an Account: Follow the setup instructions, including creating a secure password.

Backup Your Wallet: Write down your recovery seed phrase and store it safely offline.

Security Measures

To safeguard your cryptocurrency, implement these security practices:

Use Strong Passwords: Create complex, secure passwords for your accounts.

Enable Two-Factor Authentication (2FA): Add an extra layer of security to your wallet.

Regularly Backup Your Wallet: Backup your keys and recovery phrases and store them securely.

Beware of Phishing: Stay vigilant against suspicious emails or websites attempting to steal your information.

Conclusion

Cryptocurrency wallets are indispensable tools for anyone engaging in the cryptocurrency space. By understanding the different types of wallets, their importance, and how to secure them, users can effectively manage their digital assets and confidently navigate the evolving world of cryptocurrency.

For more information on cryptocurrency, visit Cryptolenz.

0 notes

Text

The Next Phase of Crypto Adoption: Mainstream Integration and Education

Crypto adoption is at an inflection point driven by improved technologies, broader demographic engagement and a more supportive regulatory environment. The next phase of this transformation will see cryptocurrencies reshape global financial systems in ways we haven’t even dreamed of yet.

The rapid expansion of digital assets has been fueled by new cryptocurrencies, the maturation of existing blockchain infrastructure and the proliferation of governance and utility tokens. Non-fungible (NFT) tokens have been a particular focus, with investors rushing to invest in multibillion dollar companies funded in a decentralized manner using governance and utility tokens as proxies for traditional shares. NFTs are also popular with younger generations, indicating that this is not simply a passing fad.

In addition to maturing infrastructure, the development of layer-2 scaling solutions is boosting the speed of transaction processing, increasing the tech ogle capacity of blockchains and enabling a wide variety of new applications. This is making the blockchain a more viable platform for institutional use and opening up a whole new set of investment opportunities.

Despite these advancements, crypto still faces several barriers to mainstream adoption. These range from concerns about scalability and volatility to ongoing risks for consumers and financial stability. In addition, some geos lack the regulatory frameworks to enable a smooth integration of these technologies. This can lead to currency mismatches, funding challenges and solvency issues that impact consumers and institutions.

A key challenge is the need to make crypto more user friendly and accessible. Managing a wallet and all of its associated features and functions is not easy for many users, especially those without prior experience with crypto. This has been a major focus for the industry, and progress in this area is encouraging. New wallets and apps that simplify crypto management have been introduced, while improvements in account abstraction will help to further reduce the learning curve and increase user retention. The introduction of smart contracts that incorporate a range of self-governing functions will also help to reduce the burden on end users, as will robust recovery mechanisms that create failsafes against simple human errors like losing private keys.

As a result of these technology news developments, a growing number of institutions are integrating crypto into their strategies and operations. According to a survey by Broadridge, one-third of financial institutions have already begun to prepare for the digital asset era by implementing at least preliminary crypto-related strategies. This trend will accelerate as the infrastructure improves, investor adoption grows and the underlying markets stabilize.

The next stage of crypto evolution will involve the gradual digitization of traditional securities, including equities and bonds, through the tokenization of physical and virtual assets. This could result in a shift of power away from the financial services intermediaries and toward end users through decentralized trading, clearing and settlement infrastructure that increases direct ownership and expands liquidity. In addition, this phase may see the introduction of central bank-issued digital currencies to provide stability and resiliency. These developments could ultimately lead to a fully integrated crypto future.

1 note

·

View note

Text

How to Create a Crypto Wallet

In the dynamic world of cryptocurrencies, a crypto wallet acts as a digital gateway, giving a secure and convenient way to store, manage, and deal with digital assets. Whether you're a beginner exploring the possibilities of digital currencies or an experienced investor looking to diversify your portfolio, knowing how to build a crypto wallet is a critical step toward engaging in the booming crypto ecosystem. In this detailed guide, we'll walk you through the steps of building a crypto wallet, highlight the necessity of security measures, and look at tactics for protecting your digital assets. By mastering the technique of making a crypto wallet, you'll be well-prepared to begin your adventure into the world of digital assets and capitalize on chances given by New token launch, upcoming crypto tokens, and the best crypto for 2024.

Understanding Crypto-Wallets

Before we go into the intricacies of constructing a crypto wallet, let's first define what it is and how it works. A crypto wallet is a software application or hardware device that allows users to securely store, send, and receive cryptocurrency. It comprises a public address, which serves as your unique identity on the blockchain, and a private key, which allows you to access your funds. Consider your public address to be your account number, and your private key to be your password; it is critical to maintain your private key secure and discreet to avoid unwanted access to your cash.

Types of CryptoWallets

Crypto wallets exist in a variety of styles, each with varying levels of security, accessibility, and convenience. Some common types of crypto wallets are:

Software wallets: are computer or mobile device-based programs. They are further classified as desktop wallets (installed on your computer), mobile wallets (loaded on your smartphone), and online wallets (accessed through a web browser). Software wallets are useful for everyday usage, but they might be vulnerable to hacking or virus assaults if sufficient security measures are not in place.

Hardware wallets: are physical devices that hold cryptoc offline, adding an additional degree of security against internet dangers. They are regarded as one of the most secure methods for keeping significant quantities of crypto because they are not connected to the internet when not in use. Cryptocurrencies are unconnected to the internet when not in use.

Paper wallets: are physical documents that include your public address and private key, typically in the form of QR codes or alphanumeric strings. Paper wallets are fully offline and thus immune to hacking assaults; however, they must be handled with care to avoid loss or damage.How to Create a Crypto Wallet

Now that we've covered the basics, let's walk through the steps of creating a crypto wallet:

Choose a Wallet Provider: Conduct research and select a reliable wallet provider that offers the wallet type you prefer (software, hardware, or paper). Consider the security features, user interface, supported cryptocurrencies, and customer support

Download or Buy the Wallet: If you use a software wallet, get the app from the official website or app store. Buy hardware wallets from an authorized retailer or manufacturer. Set up your wallet according to the instructions provided, then generate your public address and private key.

Secure Your Private Key: Your private key is the most important piece of information in your crypto wallet because it allows you to access your coins. Protect your private key and never share it with anybody. Consider utilizing a secure password manager or hardware device to handle and safeguard your private key.

Back-Up Your Wallet: Make a backup of your wallet's private key or recovery phrase and store it in a secure location. This backup allows you to recover your funds if your wallet is lost, stolen, or damaged.

Test Your Wallet: Before transferring any funds into your wallet, run a test transaction with a tiny amount of crypto to confirm that everything works properly. Before sending any transactions, double-check your public address to ensure that you may send and receive cash.

Best Practices in Wallet SecurityEnsuring the security of your cryptocurrency wallet is critical for safeguarding your digital assets. Here are a few excellent practices to follow:

Use Strong Passwords: Create a strong and unique password for your wallet that combines letters, numbers, and special characters. Avoid using readily guessable passwords or reusing them on several accounts.

Enable Two-Factor Authentication (2FA): Two-factor authentication adds an extra degree of security when accessing your wallet. This usually entails inputting a one-time code provided to your mobile device or email address in addition to your password.

Keep Your Software Up to Date: You should update your wallet software on a regular basis to guarantee that you have the most recent security patches and bug fixes. Outdated software may have weaknesses that attackers can exploit.

Beware of Phishing Scams: Avoid phishing scams and bogus websites that try to steal your private keys or login information. Always double-check URLs and only access your wallet via official channels.

Consider Multi-Signature Wallets: These wallets require multiple private keys to authorize transactions, offering an extra degree of security. Consider utilizing a multi-signature wallet to store large quantities of cryptocurrency.

Conclusion

To recap, creating a cryptocurrency wallet is a necessary step for anyone looking to get involved in the world of digital assets. Whether you use a software wallet, a hardware wallet, or a paper wallet, you must prioritize security and follow best practices to protect your money. You may secure your digital assets from potential attacks by using a trusted wallet provider, keeping your private key safe, and installing additional security measures such as two-factor authentication. Have piece of mind knowing your money is safe. With your cryptocurrency wallet set up and secure, you'll be ready to capitalize on the exciting prospects presented by the new token launche, upcoming crypto tokens, and the best crypto for 2024.

FQA

What is a cryptocurrency wallet, and why is it necessary for handling digital assets?

A cryptocurrency wallet is a software application, hardware device, or physical document that allows users to safely store, send, and receive cryptocurrencies. It acts as a digital gateway for managing digital assets, giving users a unique public address and private key to access monies on the blockchain.

What are the many types of cryptocurrency wallets, and how do they differ in terms of security and usability?

Crypto wallets can be software wallets (desktop, mobile, and web), hardware wallets, or paper wallets. Software wallets are convenient but may be vulnerable to hacking, whereas hardware wallets give increased security by holding funds offline. Paper wallets are completely offline and impervious to online dangers, but they must be handled carefully to avoid loss or damage.

What stages are required in constructing a cryptocurrency wallet, and why is it critical to adhere to best practices for wallet security?

To create a cryptocurrency wallet, follow these steps: select a trusted wallet provider, download or purchase the wallet, secure the private key, backup the wallet, and test the wallet with a tiny transaction. Following best practices for wallet security, such as choosing strong passwords, activating two-factor authentication, updating software, and being wary of phishing scams, is critical for protecting digital assets from theft or loss.

How can users maintain the security of their crypto wallets, and what steps can they take to protect their digital assets?

Users can secure their crypto wallets by using strong passwords, enabling two-factor authentication, updating software, being wary of phishing schemes, and considering additional security measures such as multi-signature wallets. Prioritizing security and adhering to best practices is critical for protecting digital assets from potential threats and ensuring that funds are secure.

0 notes

Text

bitengecko contact number

In the ever-evolving world of cryptocurrency, finding a reliable and secure platform is of paramount importance. Bitengecko is one such platform that has gained attention in recent times. In this review, we will explore Bitengecko to determine its legitimacy, address common complaints, and discuss how to recover your money from Bitengecko if the need arises.

Bitengecko: A Legit Company or a Scam?

Bitengecko, despite being a relatively new player in the crypto market, has garnered some attention. To ascertain its legitimacy, it’s important to delve into various aspects of the company. First and foremost, Bitengecko operates through the domain bitengecko.net. While the change from bitengecko.com to bitengecko.net may raise questions, it is not uncommon for businesses to update their domain addresses for various reasons.

Bitengecko boasts a user-friendly interface, allowing both beginners and experienced traders to access its services. The platform offers a variety of cryptocurrency options for trading and investment, which is a promising sign. Additionally, the company maintains active communication channels, including email and contact numbers, to assist users with their inquiries and concerns.

Bitengecko Complaints and Concerns

Like many businesses in the crypto space, Bitengecko has had its share of complaints and concerns. It’s essential to address these issues transparently to help users make informed decisions.

One common complaint is related to account access and withdrawal delays. Some users have reported difficulties in accessing their accounts or withdrawing their funds promptly. While such issues can be frustrating, they do not necessarily indicate a scam. It’s important to contact Bitengecko’s support team to resolve these concerns.

Bitengecko Address and Contact Information

Bitengecko provides its registered address, typically located in a cryptocurrency-friendly jurisdiction. To ensure transparency and accountability, the company’s address is often publicly available. It’s recommended to verify the accuracy of the provided address and contact information on the Bitengecko website.

For any inquiries or concerns, users can reach out to Bitengecko through email or the provided contact number. The responsiveness of the support team can vary, so it’s advisable to be patient when seeking assistance.

Recovering Your Money from Bitengecko

If you find yourself in a situation where you need to recover your money from Bitengecko, follow these steps:

Contact Bitengecko Support: Reach out to the Bitengecko support team via email or the contact number. Clearly explain the issue you’re facing and request assistance with your funds.

Document Everything: Keep records of all your communication with Bitengecko, including emails, phone calls, and support ticket numbers. This documentation may be crucial in case of disputes.

Seek Legal Advice: If your attempts to recover your money are unsuccessful, it might be necessary to consult with a legal professional who specializes in cryptocurrency disputes. They can guide you through the legal process.

In conclusion, Bitengecko is a cryptocurrency trading platform that, like many in the industry, has both satisfied customers and those who’ve encountered issues. While the change in domain from .com to .net may raise eyebrows, it does not necessarily indicate a scam. If you plan to invest with Bitengecko, exercise caution, conduct thorough research, and be prepared to address any issues promptly through their available support channels. In case of any problems, follow the recommended steps for money recovery and consult with legal professionals when necessary.

bitengecko contact number

0 notes

Text

Total Value Locked (TVL), one of the metrics used to know the robustness of a blockchain in the Decentralized Finance (DeFi) sector, has recently been put at the forefront to compare Coinbase’s newcomer second-layer blockchain Base, and Cardano, a veteran in the Crypto scene.

For perspective, Cardano has been part of the blockchain ecosystem since 2017. It has had years to establish its foothold, earn its reputation, and attract investments. While Base, on the other hand, which is barely a month old, is now reportedly surpassing Cardano’s TVL by a notable margin.

Base Vs. Cardano: By The Numbers

On September 4th, Parul Gujral, a Decentralized Finance (DeFi) enthusiast, shed light on the matter. Gujral noticed that Base’s TVL is already three times that of Cardano’s. Gujral presented a screenshot supporting this claim, highlighting the TVL of both platforms.

Base is already three times bigger than Cardano, but the difference is Cardano has been here since 2017, while Base is only 1 month old.$ADA is the flop nobody talks about. pic.twitter.com/8m3A0ITM1v

— Parul Gujral 🦇🔊 (@whoisparul) September 4, 2023

While Cardano locked in $163 million, Base towered with a TVL of $422.3 million. This difference isn’t just a passing observation as it poses profound questions about Cardano’s standing in the DeFi space, with Gujral referring to ADA as the “flop nobody talks about.”

Data further complements this narrative. Recent statistics from Token Terminal, a trusted platform aggregating blockchain financial data, reveal that Cardano’s market cap has taken a hit of more than 10% in the last month.

It translates to a nearly $5 billion decline, leaving the blockchain’s fully diluted market cap at $11.5 billion, contrasting with its circulating market cap of $9 billion.

Cardano’s fully diluted and circulating daily market cap in the past month. | Source: Token Terminal

A fully diluted market cap represents the total market value of all available tokens circulated. In contrast, a circulating market cap only accounts for the tokens currently in the market.

Base’s Short-lived Glitch And Prompt Recovery

It’s worth noting that Base’s journey, though commendable, hasn’t been devoid of challenges. Merely a month after its launch, Base’s blockchain experienced a glitch for the first time after its public unveiling on August 9th.

According to details on the Base status site, block production halted unexpectedly for about 45 minutes on September 5th.

However, the Base team was quick to respond. They diagnosed the issue at 9:36 PM UTC and took swift action to rectify it. The glitch was traced back to a delay in block production, attributed to part of their internal infrastructure needing a refresh.

After implementing the necessary fix, normalcy was restored, with block production resuming its pace.

Earlier today we had a delay in block production due in part to our internal infrastructure requiring a refresh.

The issue has been identified and remediated. No funds are at risk.

To stay updated, check

— Base 🛡️ (@BuildOnBase) September 5, 2023

Alongside Cardano’s plunge in market cap, the blockchain’s native token ADA has also recorded a loss of 3.2% over the past week, with a current trading price of $0.25 at the time of writing.

Cardano (ADA)’s price is moving sideways on the 4-hour chart. Source: ADA/USDT on TradingView.com

Featured image from Unsplash, Chart from TradingView

0 notes

Text

How Pig Butchering Crypto Scam Victim Recovered His $1 Million

A pig butchering crypto scam victim lost over $1 million and was able to recover it by filing a report with reportscammedbitcoin.com. This gives hope of funds recovery to all victims of pig butchering scams as well as other types of scams relating to cryptocurrency that it is possible to recover all your stolen funds.

We have all heard horror stories of rug pulls, pump and dump crypto scam, the crypto investment scam that usually leaves the victim's bank account high and dry. But there is a new type of fraud that is becoming popular nowadays which is called “pig butchering.” This is something you are definitely going to have to avoid at all costs.

What is a Pig Butchering Crypto Scam?

The new type of scam craftily combines a romance scam and an investment scheme. Dating and romance scams have been around since the early days of the Internet. On the other hand, cryptocurrency came into being in 2009 and became very popular a couple of years ago. However, the emergence of cryptocurrencies was also accompanied by scams such as pig butchering.

Pig butchering blends romance, scam and investment schemes. It is a calculated game of manipulation that targets lonely people and sucks them dry. It began in Southeast Asia, and got its name from the way hogs are “fattened up” before being slaughtered and consumed. The victim (or the pig) is “slaughtered” when the fraudsters successfully convince them to invest in a fake platform, then disappear with their money.

Pig Butchering Crypto Scam is on the Rise

According to an FBI report, reports of these scams have been on the increase. According to secret service special agent Shawn Bradstreet, law enforcement and global anti-scam organizations have received so many lately that, earlier this year, it put out a PSA warning people about them.

Reportscammedbitcoin.com also put out a list of cryptocurrency scammers to make people aware of this common feature of the scam. One strange thing about this trend is that many scams are being pushed by crime syndicates. Fortunately, authorities are making people aware of this trend through media coverage.

How to Avoid Pig Butchering Crypto Scam

Considering the fact that estimated billions of dollars have been lost to this scam already, we want to help people to avoid falling for the pig-butchering crypto scam. Here are steps to avoid pig-butchering crypto scams.

Don't respond to any random text/message

Be careful when using social media/dating apps

Avoid investment opportunities that sound too good to be true

How a Man Recovered $1 Million He Lost to Pig Butchering Crypto Scam

Cyril received a WhatsApp message out of the blue.

“Jessy" told him she'd found his number in her phone contacts and was reaching out because she thought they might be old colleagues. Cyril, a man living in the Bay Area of San Francisco, did not remember her.

But he felt at ease with her since she appeared to be nice, cool and interesting. She even shared pictures of what she was eating, leading to the discussion of their mutual love of sushi. Cyril enjoyed the conversation enough to continue the conversation with her the following day.

How a Man Became a Victim of Pig Butchering Scam

The exchange of text messages quickly became more personal. And Cyril now felt comfortable enough to tell Jessy about how he was struggling to support his family, about his ailing father and how the decision to send his father to hospice care was affecting him financially.

They started communicating in October 2021. And by early 2022, Cyril had been conned out of more than $1 million dollars. The worst part was that over a quarter of it was borrowed money. His finances were in ruins. Cyril, who asked us not to use his real name, realized that he had been a victim of “pig butchering crypto scam.”

How a Man Recovered $1 Million He Lost to Pig Butchering Crypto Scam by Reporting

Luckily for Cyril, he quickly filed a report with reportscammedbitcoin.com, immediately it dawned on him that he had been scammed. Although, he did not have much hope to recover his stolen money. They took all his report, worked on it and Cyril was lucky they had the resources and crypto technology to help him get recover his funds.

To Cyril's surprise, he was really glad when ReportScammedBitcoin was able to recover and return the total sum of $1.17 million dollars that he had lost to the pig butchering crypto scam back to him. Like Cyril, you too can recover your scammed bitcoin and cryptocurrency by reporting scammed bitcoin.

Report and Recover Your Money if You are a Victim of Pig Butchering Crypto Scam

A victim of Pig Butchering scam never realizes they have been scammed until they make an attempt to withdraw their funds. This is when they are told they must pay a fee before their money can be released. Often, the scammers simply disappear with the stolen funds, which are nearly impossible to get returned.

Crypto and blockchain do allow very advanced ways of tracing stolen funds through risk monitoring firms like ours, but once the funds are lost, there is no guarantee they will be recovered. You can try recovering from the Pig Butchering scam by reporting to RSB.

Originally Posted Here - https://cryptonews.com/news/how-pig-butchering-crypto-scam-victim-recovered-his-1-million.htm

#got scammed#scammeralert#scam#bitcoinscam#cryptocurrency#cryptocurrency news#btc latest news#bitcoin latest news#bitcoin#cryptocurrency scam#pig butchering

1 note

·

View note

Text

How Cryptocurrencies Are Adding Complexity to the Separation Refine

If you do not personally buy cryptocurrency, after that it's likely that at this moment you have pals, family members, or coworkers who do. Cryptocurrencies have increased from a really niche market to coming to be almost fully conventional, and they've done so in a really brief amount of time. Since they're so ubiquitous, there's a brand-new concern to wrangle with, and that's the issue of exactly how cryptocurrencies are managed in the separation procedure.

Identifying and distributing financial properties, as well as identifying alimony repayments, are central concerns to be solved during most of divorce proceedings. There are lots of tools at a lawyer's disposal for the disclosure of financial properties, nevertheless when you integrate Bitcoin and divorce, you're entrusted to something totally new.

Handling Bitcoin as well as divorce is various from handling other economic properties for a number of huge reasons. One is the large volatility of their worth. Bitcoin as well as other cryptocurrencies have been known to undertake absolutely wild swings, both backwards and forwards, in value. For that reason, worth either requires to continue to be tracked and updated on the fly, or set at a specific time, when it might end up deserving something much different down the line. In either circumstances, it's a less than ideal condition for determining as well as distributing possessions or establishing spousal support.

Take a look at right here :- Cryptocurrency wallet recovery

Another vital problem to understand in between cryptocurrency and also divorce is that these markets as well as their transactions were made to be both anonymous and secure. Searching for the holdings, accounts, or deals of an individual is not the like considering a savings account, retirement account, or stock profile. The traceability of an individual's crypto accounts will certainly be challenging at best, as well as whether or not the courts put any subpoena power behind that remains uncertain currently.

Plainly this is just the beginning of the concern of Bitcoin and separation, since all cryptocurrencies are still on the rise. As even more individuals start or remain to utilize them, and also they come to be a lot more common and also approved, how they're handled as monetary assets throughout separation process will continue to remain in the limelight. It's the reality that they increased so promptly to start with that has left lots of people unsuspecting today with how to treat them in such matters. Keep in mind, Bitcoin was released less than a years earlier.

As constantly, be sure to talk to a seasoned professional in your local area. While there's still much uncertainty regarding exactly how Bitcoin as well as divorce will be treated, and also what sorts of judgments may await us in the future, a knowledgeable separation lawyer will have the ability to direct you with the process, and offer understanding into the areas of monetary discovery and all elements of a pending case.

Go here for additional information :- Recover your lost funds with expert

0 notes

Text

In an effort to collect money to repay the creditors of its bankrupt lending arm, the crypto behemoth Digital Currency Group has started to sell shares in many of its most coveted cryptocurrency funds at a significant discount.

According to US securities filings, SoftBank-backed DCG has begun to sell off its stakes in a number of investment vehicles managed by its subsidiary Grayscale.

The decision to sell the assets highlights DCG's financial challenges as it works to raise money to maintain the defunct lending businesses operated by cryptocurrency broker Genesis while attempting to protect its most cash-generative divisions.

Connecticut-based DCG, established in 2015 by former banker Barry Silbert, is one of the biggest and most experienced investors in cryptocurrency projects and companies. SoftBank, Singapore's government wealth fund GIC, and Alphabet's venture arm CapitalG are among the investors who support it.

The asset management division of DCG, known as Grayscale, is crucial because it generates hundreds of millions of dollars in annual revenue from lucrative fees for managing sizable pools of bitcoin, ether, and other cryptocurrencies in funds that investors can invest in and purchase shares of through their brokerage accounts.

Even though the shares have dropped to significant discounts from the underlying value of the cryptocurrency they hold over the previous two years, DCG is selling ownership in one of Grayscale's largest trusts.

It is looking to raise capital after the lending divisions of Genesis, its cryptocurrency broker, filed for bankruptcy in January, becoming the most significant enterprise to fail in the space since Sam Bankman-FTX Fried's exchange rocked the market in digital assets.

The US group has been making efforts to pay back its creditors more than $3 billion, and it has been engaged in a public fight with the Winklevoss twins' Gemini exchange on the debts. The business hired bankers from Lazard last month to assist in the sale of its trading news website CoinDesk in order to generate additional capital. The Financial Times earlier reported that it is also looking to sell off some of its $500 million venture portfolio.

After months of discussions, DCG and Genesis' principal creditors, including Gemini, came to an arrangement on Monday. According to Cameron Winklevoss, This strategy is a crucial step towards a considerable recovery of assets.

Grayscale's ethereum fund has been the subject of DCG's most recent share sales, where the company sought to sell approximately a quarter of its stock to raise as much as $22mn in various trades since January 24, per the filings. Despite each share purporting to contain $16 worth of ether, the company is trading at around $8 per share.

Simply put, this is a part of their ongoing portfolio rebalancing, according to DCG.

For the fiscal year that ended in September, Grayscale made $209 million from the 2.5 percent management fee it received on the 3 million ether held in trust. According to documents given by The Washington Service, DCG last sold Ethereum Trust shares in 2021, when the investment vehicle traded almost exactly at its net asset value. The shares currently trade for only 50% of the value of the ethereum coin they represent.

About 3% of all bitcoin, worth $14.7 billion, are held in its flagship bitcoin trust, from which Grayscale receives a 2% fee. According to securities filings, it made $303 million in fees on the bitcoin trust in the first nine months of 2022.

According to the documents, DCG has also taken action to sell off smaller blocks of shares in Grayscale's Litecoin Trust, Bitcoin Cash Trust, Ethereum Classic Trust, and Digital Large Cap Fund.

The group forbids investors from exchanging their shares for the coins held in the trusts, which would aid in bridging the significant differences in net asset values. The US Securities and Exchange Commission is being sued by Grayscale for preventing

the development of a spot bitcoin ETF, which it claims would benefit investors and permit redemptions.

Ram Ahluwalia, CEO of Lumida Wealth, stated that DCG faces a trade-off: they could allow redemptions and offer liquidity at par value, including for their own holdings, but they're better off not doing it because they make so much money from the management fees. Closing the discount would mean sacrificing this source of income.

The shares in Grayscale's trusts traded at a significant premium to the value of the coins they held before cryptocurrency was widely exchanged through reliable exchanges, encouraging holders of bitcoin and ethereum to convert their coins for stakes in the Grayscale vehicles.

Source link

0 notes

Text

[ad_1]

It appears the NFT market is slowly getting back on its feet. Trading volumes rose for two months straight, with January scoring the highest volumes since June last year, according to the Dapp Industry Report: January 2023.

The growth in January marked a stark difference from the trend of the past few months — October saw trading volumes dip to a low of $662 million — but in November, the market halted the downward trend to stay at $662 million, per the report.

Volumes then recovered in December, rising slightly to $683 million, and increasing 38.5% from that number to $946 million in January.

A number of blockchains allow traders to buy and sell NFTs, but Ethereum has held the leading position with over $36 billion in all-time sales, data from NFT aggregator CryptoSlam showed. In comparison, Ronin and Solana — the second and third largest blockchains by NFT sales volume in total — had about $4.2 billion and $3.7 billion, respectively.

January was strong for both Ethereum and Solana, which saw trading volumes of $659 million and $85 million, respectively.

Image Credits: DappRadar (opens in a new window)

February is showing signs of continued strength as well — at least so far. As of February 3, the Ethereum blockchain had $26.5 million sales across more than 25,500 unique buyers, according to CryptoSlam data.

While Ethereum accounts for the lion’s share of trading volumes, with more than 78% of all trades on the blockchain, Polygon had the biggest influx of traders in January, the report showed.

Polygon’s trading volume grew 124% to $46 million in January from $20 million in December. In the past week, NFT sales volume on the blockchain grew 43.5% to reach $2.8 million, indicating continued interest in the blockchain.

In late December, two large Solana NFT projects, DeGods and y00ts, said they would leave the blockchain in 2023, which stirred up conflicting sentiments across the community. DeGods said it would migrate to Ethereum, and y00ts plans to move to Polygon.

“At the beginning of the year, we noticed that much of the creator economy’s attention was focused on ETH and Solana,” Ryan Wyatt, CEO of Polygon Studios, previously told TechCrunch. “Therefore, we decided to go against the trend and focus on the untapped potential of web3 by onboarding large enterprise brands, DeFi platforms and gaming companies. We did this successfully through ecosystem fund investments and white-glove partnership support.”

As big NFT collections like DeGods and y00ts diversify their alliances to blockchains, it could also draw in other holders who are seeking new opportunities or see value elsewhere.

The consecutive growth of the past couple months could also point to a broader upward trend across the crypto market. It could also potentially help drive creators and projects to form new use cases in the NFT world as they look to capitalize on the bullish marketplace.

[ad_2]

#NFT #market #shows #signs #recovery #January #trading #volumes #hit #7month #high #TechCrunch

Source link

0 notes

Photo

New Post has been published on https://primorcoin.com/binance-launches-billion-dollar-crypto-industry-recovery-fund-to-restore-confidence-after-ftx-meltdown-finance-bitcoin-news/

Binance Launches Billion-Dollar Crypto Industry Recovery Fund to Restore Confidence After FTX Meltdown – Finance Bitcoin News

Binance has committed $1 billion to a crypto industry recovery initiative to restore confidence following the collapse of crypto exchange FTX. Several other crypto companies have joined Binance’s efforts and committed capital for the recovery fund.

Crypto Industry Recovery Initiative Launched

Cryptocurrency exchange Binance unveiled Thursday some details of its Industry Recovery Initiative (IRI), which the crypto firm described as “a new co-investment opportunity for organizations eager to support the future of web3.”

The announcement states:

Initially, Binance will commit USD 1 billion to IRI-themed investment opportunities with an intent to ramp up that amount to USD 2 billion in the near future if the need arises.

“So far, Jump Crypto, Polygon Ventures, Aptos Labs, Animoca Brands, GSR, Kronos, and Brooker Group have also committed to participating with an initial aggregate commitment of around USD 50 million, and we expect more participants to join soon,” Binance added. Each participant has set aside committed capital in stablecoins or other tokens.

Binance explained that it will be looking for projects characterized by “innovation and long-term value creation,” “a clearly delineated and viable business model,” and “a laser focus on risk management.”

The global crypto exchange noted:

What makes this initiative unique is the collaborative approach to restoring confidence in web3.

The CEO of Binance, Changpeng Zhao (CZ), first revealed that his company is setting up a crypto industry recovery fund last week. The executive explained at the time that the purpose of the recovery fund is “to reduce further cascading negative effects of FTX” by helping projects that “are otherwise strong, but in a liquidity crisis.” CZ has compared the FTX fiasco to the 2008 financial crisis, warning of “cascading effects.”

FTX filed for Chapter 11 bankruptcy on Nov. 11 and former CEO Sam Bankman-Fried stepped down. The company is under investigation in multiple jurisdictions. In the U.S., a number of authorities are investigating the exchange for mishandling customer funds.

Binance explained that the IRI is not an investment fund. “We have already received around 150 applications from companies seeking support under the IRI,” the exchange noted, elaborating:

The mandate of this new effort is to support the most promising and highest quality companies and projects built by the best technologists and entrepreneurs that, through no fault of their own, are facing significant, short term, financial difficulties.

The announcement further details that the initiative is expected to last about six months and “will be flexible on the investment structure — token, fiat, equity, convertible instruments, debt, credit lines, etc — as we expect individual situations to require tailored solutions.”

What do you think about Binance setting up a crypto industry recovery fund? Let us know in the comments section below.

Kevin Helms

A student of Austrian Economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open-source systems, network effects and the intersection between economics and cryptography.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

More Popular News

In Case You Missed It

Source link

#Binance #Bitcoin #BNB #Crypto #CryptoExchange #DEFI #DEFINews

#Binance#Bitcoin#BNB#Crypto#CryptoExchange#DEFI#DEFINews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#Finance

0 notes

Text

How to Use Your Crypto Wallet

In this article I will discuss how to use your crypto wallet. This is a very important topic because if you don't know how to use your crypto wallet, then you can lose all of your crypto coins and even worse, you can lose your crypto wallet itself!

So first let me tell you what a crypto wallet is. A crypto wallet is simply an application that stores your crypto coins in a secure place on your computer or mobile device. It is not like a traditional bank account where you have to keep your coins in a safe place at all times. You can store your coins anywhere you want. The main purpose of a crypto wallet is to make it easy for you to transfer your coins from one place to another. For example, if you want to buy a new pair of shoes, you can just transfer your coins from your crypto wallet to your merchant's crypto wallet. The merchant will give you your new shoes and you can then transfer your coins back into your crypto wallet.

How to Use Your Crypto Wallet

First thing you need to do is download a crypto wallet onto your computer or mobile device. There are many different wallets available on the market today. Some of them are free while others are paid. You can also choose between a desktop or mobile version. Once you have downloaded your wallet, you need to set up your account. You will be asked to create a username and password. You can also create a recovery phrase to access your wallet in case you forget your username and password.

Now that you have your wallet set up, you can start transferring your coins to your crypto wallet. To transfer your coins from one place (such as your merchant's wallet) to another (your crypto wallet), you will need to go to the settings page of your wallet. From there you will be able to see your transaction history. Simply click on the transaction you wish to send and then click on the "send" button. You will then be prompted with a message asking for confirmation. Click "confirm" and your transaction will be sent. You can also click "receive" to receive coins from other people.

You can also find many other features in your crypto wallet. For example, you can create a paper wallet by generating a series of random numbers and letters. This will allow you to store your coins offline in case you lose your crypto wallet. You can also set up a watch-only address to receive payments from merchants. You can also set up two-factor authentication so that only you can access your wallet. If you have any questions about using your crypto wallet, you can always check out the support section of the site.

https://popscrypto.com/index.php/2022/11/28/how-to-use-your-crypto-wallet-2/

0 notes

Photo