#Cottonseed Oil Market Sales

Text

Crisco is a vegan cooking fat and an icon of the Ashkenazi-Jewish American Dream.

For over a century, the strange, oily gloop has graced kosher restaurants, holiday cookbooks and hand-scribbled recipe cards in Jewish homes across the nation, becoming a (contested) symbol of Jewish American identity and culinary tradition .

But how did Judaism get to Crisco as America is to apple pie? The answer lies at the intersection of early 20th-century consumerism and Jewish American culture.

First, we need to take a look at the origins of Crisco itself. Debuted in 1911 as a product of Cincinnati’s Procter & Gamble Co., it started as a strange solution to a strange problem. Textile production skyrocketed during the Industrial Revolution, leaving America with a surplus of leftover cotton seeds. No one could figure out what to do with them — until chemists learned to extract the oil and combine it with hydrogen, which created a cheap alternative to animal-based fats like lard and tallow. Initially, Procter & Gamble intended to use the new substance to make candles. But they ended up selling it as a food product, instead.

The public wasn’t totally sold on the idea. Aside from sneaky CEOs cutting costs by substituting it for pricier olive oil, cottonseed oil wasn’t typically used in the food business. It was primarily intended for soap, artificial dyes and explosives. There was even some debate over whether cottonseed oil is really a food (spoiler: it isn’t; Procter & Gamble would later switch to other vegetarian oils).

Eventually it caught on with the help of some clever, if somewhat dishonest, marketing. But sales still weren’t remarkable among established Americans. Given the product’s versatile non-dairy, non-meat nature, Procter & Gamble’s PR team decided to give a hard sell to the nation’s newly minted community of Eastern European Jewish immigrants. One 1913 newspaper advertisement, printed in English and Yiddish and distributed throughout the United States, made the lofty claim that “The Hebrew Race has been waiting 4,000 years for Crisco.”

4,000 years! 4,000 years spent wandering through deserts and across the globe, all for… non-dairy shortening? Shockingly, the ploy worked; American Jews went wild for Crisco — and haven’t looked back since.

There are evident perks: It’s kosher, and pareve, too. That means that, when she has Crisco on hand, the good Jewish housewife doesn’t need to buy both schmaltz — for meat — and butter — for dairy — thus saving money and resources. And, a hundred or so years ago, Crisco was considered (or, at least, marketed as) a healthy alternative to traditional animal-based cooking fats.

But more important was Crisco’s cultural significance. For new immigrants, the feeling of belonging was vital. There was a constant struggle between old and new, religion and nation, and tradition and assimilation. Here was a practical solution that didn’t require compromise. Kosher enough for the rabbi, stylish enough for the all-American woman and economical to boot, Crisco was a tasty, practical reminder that you could be both Jewish and American — and be so with class and tact.

Procter & Gamble’s 1933 cookbook, “Crisco Recipes for the Jewish Housewife,” cemented the product’s popularity within the Jewish community. Each recipe was printed in both English and Yiddish. Offerings ranged from traditional favorites, like kugel, to American icons such as southern fried chicken and macaroni salad — all, of course, with a generous helping of Crisco. Despite the economic hardship of the Great Depression, sales continued to soar. Over the course of a century, Crisco grew from its resourceful beginnings to the heart of American Jewish cooking.

In recent years, though, Crisco has amassed slews of controversy. For one thing, it’s been condemned for ruining the magic of traditional (i.e., schmaltzy) Jewish cooking with its sub-par flavor. Perhaps more shocking is the revelation that Crisco, marketed as an “all-vegetable shortening” doesn’t actually include any vegetables — at all. Even though it’s no longer made from cottonseed oil, Crisco’s modern key ingredients, soybean and palm oil, aren’t derived from vegetables, or even fruits, but from grains. They’re not particularly healthy or environmentally friendly, either. So, while definitely a little more edible, modern Crisco is not exactly a huge improvement on its cottonseed predecessor.

Why do we continue to use Crisco? I think that, like with many Ashkenazi Jewish cultural rites, the answer can be most accurately summed up by Tevye in “Fiddler on the Roof”: TRADITION! So next time you bite into a Crisco-coated latke, or hamantaschen, or maybe even fried chicken, you too can follow in the footsteps of our foremothers and savor the unctuous, oily flavor of Jewish American history.

6 notes

·

View notes

Text

0 notes

Text

Navigating Regulatory Frameworks in the Mayonnaise Market

The Rise of Mayonnaise Market as a Condiment Powerhouse

The Origins of Mayonnaise

Mayonnaise originated in Mahón, Spain in 1764 when it was proposed as a way to stretch eggs for household budgets. Made with just egg yolks, olive oil, vinegar and salt, the emulsion spread quickly gained popularity across Europe. By the early 19th century, French chefs had refined mayonnaise and it became a staple in French cuisine. In this article, we will discuss the history, types, preparation methods and the global mayonnaise market outlook.

The Growth of Commercial Mayonnaise Production

The Industrial Revolution drove mechanization and standardized recipes emerged. In 1906, a cook in Nashville successfully developed a commercial eggless mayonnaise using soybean and cottonseed oils. This allowed large-scale production and opened the floodgates for new brands. Two of the largest players today, Hellmann's and Kraft, were founded in the early 1900s. Sales boomed in the postwar economic growth era of the 1950s as refrigeration made mayonnaise more convenient. Jars outsold bulk at grocery stores.

Health Conscious Trends Drive Innovation

Concerns around artery-clogging saturated fats in the late 20th century took a toll on mayonnaise. Companies responded with new light and fat-free varieties using ingredients like canola oil. As consumers sought cleaner labels, brands ditched artificial preservatives and added unique ingredients like avocado or sriracha to draw interest. Emerging startups met demand for organic, non-GMO, vegan and gluten-free options. Mayo categories now span traditional to specialty flavors and formulations.

Filling a Versatile Role in Global Cuisines

Mayonnaise is used for much more than sandwiches across world cuisines. In Japanese cooking it’s paired with tonkatsu or karaage to add richness. Aïoli garlicky mayo is quintessential in Provençal dishes. Aioli seasonings vary globally from Mediterranean to Spanish to Brazilian varieties. Indonesians created “mayo” recipes with peanuts. Americans slather mayo on everything from chips to coleslaw to potato salads at picnics and barbecues. Versatility makes mayonnaise a top-selling condiment worldwide in grocery stores and restaurants.

The Rise of Artisanal Producers

As with other foods, artisans saw opportunities in mayonnaise’s popularity. Boutique brands crop up emphasizing transparency and high-quality sourcing. Boutique ingredients set specialty mayos apart - Meyer lemon, chipotle peppers, wasabi, porcini mushrooms. Customized flavor profiles appeal to adventurous home chefs and upscale restaurants. Online marketplace growth connects small batch makers to a worldwide audience. While commodity mayo dominates supermarket shelves, artisanal varieties carve profitable niches with affluent consumers seeking locally-made gourmet products.

The Growth of Mayo Imports and Exports

As globalization grows ingredient trades, mayonnaise markets expanded internationally. Germany exports mayonnaise production technology. Asian and Latin American markets proved eager for Western condiments and familiar brands gained footing. Meanwhile, the U.S. imports tons of mayo annually from Mexico, Canada and Europe for various price points. Emerging markets in the Middle East and Africa also represent rising demand. Overall the $2 billion global mayonnaise industry continues scaling up with steady consumption and trade worldwide.

0 notes

Text

0 notes

Text

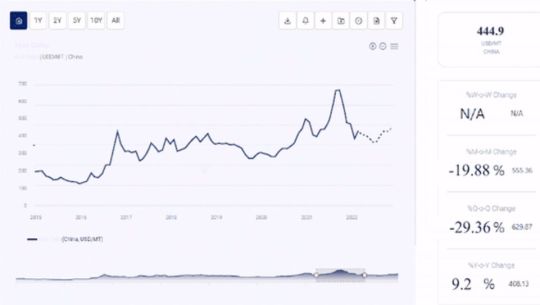

Cotton Lint Prices, Trends & Forecasts | Provided by Procurement Resource

Cotton Lint, derived from cotton plants, is a crucial raw material for textiles and paper. Its price fluctuations are influenced by crop yields, market demand, and seasonal preferences, with higher summer demand due to its comfort.

Request for Real-Time Cotton Lint Prices: https://www.procurementresource.com/resource-center/cotton-lint-price-trends/pricerequest

In the Chinese market, prices rose in H1 2023, driven by Chinese New Year shopping and summer consumption, despite a temporary dip during New Year holidays. Reduced supplies from adverse weather conditions further contributed to price increases.

Definition

Cotton Lint is the natural, unprocessed fibre obtained from cotton plants (Gossypium species). It consists of the fluffy, white, or off-white fibres that envelop cotton seeds. These fibres are extensively used in textile manufacturing to create a wide range of products, including clothing, fabrics, and various industrial materials.

Key Details About the Cotton Lint Price Trends:

Procurement Resource does an in-depth analysis of the price trend to bring forth the monthly, quarterly, half-yearly, and yearly information on the Cotton Lint in its latest pricing dashboard. The detailed assessment deeply explores the facts about the product, price change over the weeks, months, and years, key players, industrial uses, and drivers propelling the market and price trends.

Each price record is linked to an easy-to-use graphing device dated back to 2014, which offers a series of functionalities; customization of price currencies and units and downloading of price information as Excel files that can be used offline.

The Cotton Lint Prices, including India Cotton Lint price, USA cotton lint price, pricing database, and analysis can prove valuable for procurement managers, directors, and decision-makers to build up their strongly backed-up strategic insights to attain progress and profitability in the business.

Cotton Lint finds crucial applications in various industries. It serves as the primary raw material for textile manufacturing, producing garments, fabrics, and home textiles. Additionally, Cotton Lint is used in papermaking processes, creating high-quality paper products. Its versatility extends to non-textile sectors, where it's employed in the production of items like cottonseed oil, cellulose-based plastics, and medical supplies like cotton balls and swabs.

Key Players:

Balaji Cotton Linter

Anant Agro Industries

Grafax Holdings Pvt. Ltd.

G & P Cotton Ginners S.A.

Cherokee Fabrication Company, Inc

Toyota Industries Corporation

About Us:

Procurement Resource offers in-depth research on product pricing and market insights for more than 500 chemicals, commodities, and utilities updated daily, weekly, monthly, and annually. It is a cost-effective, one-stop solution for all your market research requirements, irrespective of which part of the value chain you represent.

We have a team of highly experienced analysts who perform comprehensive research to deliver our clients the newest and most up-to-date market reports, cost models, price analysis, benchmarking, and category insights, which help in streamlining the procurement process for our clientele. Our team tracks the prices and production costs of a wide variety of goods and commodities, hence providing you with the latest and consistent data.

To get real-time facts and insights to help our customers, we work with a varied range of procurement teams across industries. At Procurement Resource, we support our clients, with up-to-date and pioneering practices in the industry, to understand procurement methods, supply chain, and industry trends, so that they can build strategies to achieve maximum growth.

Contact Us:

Company Name: Procurement Resource

Contact Person: Chris Byrd

Email: [email protected]

Toll Free Number: USA & Canada - Phone no: +1 307 363 1045 | UK - Phone no: +44 7537 132103 | Asia-Pacific (APAC) - Phone no: +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA

1 note

·

View note

Text

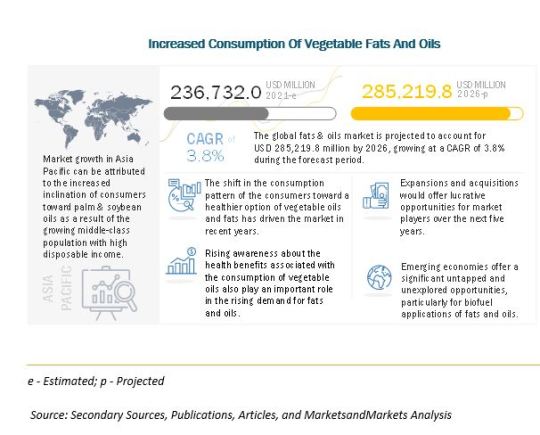

Fats and Oils Market Growth Opportunities by 2026

The fats and oils market is estimated to be USD 236.7 billion in 2021; it is projected to grow at a CAGR of 3.8% to reach USD 285.2 billion by 2026. The global fats & oils market is being highly driven by robust demand dynamics emanating from both the food and non-food application sectors. Although country-level dietary guidelines advocate a switch to unsaturated fats, the sales of butter and all the other vegetable oils are witnessing decent growth because they are perceived as being more natural. The fats & oils market is also driven by non-food utilization, particularly for the production of oleochemicals and biofuels. Mandatory blending targets for biofuels have encouraged the uptake of these commercially important lipid compounds in Western markets, which were soon adopted by developing countries.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=6198812

The fats and oils market has been growing steadily in developed countries and emerging countries, such as the US, Brazil, China, India, and Indonesia. Among vegetable oils, palm oil remained the most popular with around 30% of the market share. Animal fats find major applications in pet food, animal feed, and other industrial purposes such as biodiesel and oleochemicals. Oils of plant origin have been predominantly used for food-based applications. The fats & oils market, by form, is estimated to be dominated by the liquid segment in 2021.

On the basis of type, the vegetable oil is projected to be the largest segment during the forecast period.

The health benefits, easy availability, and cost-effectiveness are some of the factors that has driven the market for fats & oils. Within vegetable oils, the palm oil segment has dominated the market, as it is easily available and is relatively more stable than other oils.

On the basis of source, vegetable segment is expected to retain its dominance in the foreseeable period.

Vegetable oils from sunflower, rapeseed, soybean, palm, cottonseed, and coconut are highly used in food applications, which has driven the market for vegetable-sourced oils. The qualities associated with vegetable oils, such as low-fat, low-cholesterol, and low-calories content, are registering growth in the segment. Also, the variety of uses of vegetable oils in food as well as other industries such as pleo-chemical industries, animal feed, and the energy & biomass industries has also driven the market for vegetable oils.

Request for Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=6198812

Asia Pacific is projected to be the fastest-growing region in the fats and oils market.

The Asia-Pacific region is projected to be the fastest-growing market for fats & oils. The region is home to two important palm and palm kernel oil-producing countries, namely Malaysia and Indonesia, and two major fats and oil-consuming countries, namely China and India. This is one of the significant factors that ensures that the Asia-Pacific region is the largest as well as the fastest-growing market in fats & oils.

Key Market Players:

Key global market players offer wide range of fats & oils products in the retail chain. While prominent palm oil producing companies are present in Asia pacific region. The soybean oil producing companies capture the North American market. The key companies in the fats and oils market are Associated British Foods PLC (UK), Archer Daniels Midland Company (US), Bunge Limited (US), Wilmar International Limited (Singapore). Various strategies, such as expansions, mergers & acquisitions, and new product launches, were adopted by the key companies to remain competitive in the fats and oils market.

#Fats and Oils Market#Fats and Oils#Fats and Oils Market Size#Fats and Oils Market Share#Fats and Oils Market Growth#Fats and Oils Market Trends#Fats and Oils Market Forecast#Fats and Oils Market Analysis#Fats and Oils Market Research Report#Fats and Oils Market Scope#Fats and Oils Market Overview#Fats and Oils Market Outlook

0 notes

Text

Shortening Fats Market - Forecast 2022 -2027

Shortening Fats Market Overview

Shortening Fats Market size is estimated to reach $5.7 billion by 2027, growing at a CAGR of 4.2% during the forecast period 2022-2027. The term “shortening” technically applies to any kind of fat that is solid at room temperature, inclusive of butter, margarine, and lard. Shortening can be prepared from either animal fat or vegetable oil, but most shortening accessible presently is prepared from vegetable oils like soybean, cottonseed, or palm oil. Typical sources of shortening utilized in baked products include soybeans and canola. Sunflower seed is recognized in trail mix, multi-grain bread, and nutrition bars, and for snacking straight from the bag. It is abundant in healthy fats, advantageous plant compounds, and numerous vitamins and minerals. Foods soaring in trans fatty acids like margarine, shortening, and commercially fried food are likely to increase cholesterol levels in the blood. Palm and palm kernel oils have evolved into the primary sources for zero-trans alternative shortenings. Margarine and butter can both be utilized as an alternative for shortening, although their moisture contents need to be taken into scrutiny prior to making the exchange. Confectionary fat is utilized in the confectionary industry for preparing chocolate, candies, and baked goods. Fats serve as shortening agents averting the growth of toughness of gluten, as per the technique and the quantity, and therefore, are shortening agents.

The surging processed food sector which may involve palm kernel is set to drive the Global Shortening Fats Market. The proliferating recognition of shortening fats as feed products owing to the health advantages offered to poultry and cattle is set to propel the growth of the Global Shortening Fats Market during the forecast period 2022-2027. This represents the Global Shortening Fats Industry Outlook.

Report Coverage

The report: “Shortening Fats Market Forecast (2022-2027)”, by Industry ARC, covers an in-depth analysis of the following segments of the Global Shortening Fats Market.

By Source Type: Palm And Palm Kernel, Sunflower Seed, Soybeans, Animal Based (Butter, Tallow, Lard), Others.

By Application: Confection1ry, Ice Cream, Snacks, Bakery, Others.

By Geography: North America (U.S, Canada and Mexico), Europe (Germany, France, UK, Italy, Spain, Russia and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia & New Zealand, and Rest of Asia-Pacific), South America (Brazil, Argentina, Chile, Colombia, Rest of South America), and Rest Of The World (Middle East, Africa).

Inquiry Before Buying

Key Takeaways

Geographically, North America Global Shortening Fats Market accounted for the highest revenue share in 2021 and it is poised to dominate the market over the period 2022-2027 owing to the well-entrenched bakery and confectionary industry including confectionary fat in the North American region.

Global Shortening Fats Market growth is being driven by their practical predominance, enhanced formulations of shortening fats, and extensive applications of specific shortened fats and confectionary fat. However, the switching inclination of consumers from bakery and confectionary to functional meals and drinks, influencing demand and sales of shortening goods is one of the major factors hampering the growth of the Global Shortening Fats Market.

Global Shortening Fats Market Detailed Analysis of the Strength, Weaknesses, and Opportunities of the prominent players operating in the market will be provided in the Global Shortening Fats Market report.

Shortening Fats Market Segment Analysis – By Source Type:

The Global Shortening Fats Market based on source type can be further segmented into Palm And Palm Kernel, Sunflower Seed, Soybeans, Animal-Based, and Others. The Soybeans Segment held the largest market share in 2021. This growth is owing to the heightened application of soybean shortenings inclusive of high oleic soybean and traditional soybean shortenings for an assortment of applications needing solid and semi-solid shortenings. Typical sources of shortening utilized in baked products involve soybeans and canola. The surging production of soy-based shortenings by the process of interesterification is further propelling the growth of the Soybeans segment.

Furthermore, the Animal Based segment is estimated to grow with the fastest CAGR of 5.4% during the forecast period 2022-2027 owing to the surging necessity of animal fats for cell development and the safeguarding of organs in the body apart from soybeans being a typical source of shortening used in baked products.

Request Sample

Shortening Fats Market Segment Analysis – By Application:

The Global Shortening Fats Market based on the application can be further segmented into Confectionary, Ice Cream, Snacks, Bakery, and Others. The Bakery segment held the largest market share in 2021. This growth is owing to the surging demand for bakery products on a daily basis owing to the altering lifestyles, expanding population, and economic enhancements. Fully hydrogenated soybean oil derived from soybeans, which includes no trans fats may be utilized as a hard fat for the development of bakery shortenings. The proliferating urbanization and the soaring demand for ready-to-eat or fast food are further propelling the growth of this segment.

Furthermore, the Confectionary segment is estimated to grow with the fastest CAGR of 5.6% during the forecast period 2022-2027 owing to the extensive application of shortening fats in confectionary conferring their typical flavor and shortening features apart from roasted whole soybeans and their flour being utilized as constituents of conventional confectionary products and snacks in China, Japan, Korea, and Indonesia.

Shortening Fats Market Segment Analysis – By Geography:

The Global Shortening Fats Market based on geography can be further segmented into North America, Europe, Asia-Pacific, South America, and Rest of the World. North America (Global Shortening Fats Market) held the largest share with 33% of the overall market in 2021. The growth of this region is owing to the well-entrenched bakery industry in the North American region. Supply and demand in conjunction with technology resulted in the use of soybean oil derived from soybeans as the principal oil source for shortenings in the U.S. The surging inclination of customers towards “healthy-eating” specifically the freshly baked goods like bread, cake, pies, and more are further propelling the growth of the Global Shortening Fats Market in the North American region.

Furthermore, the Asia-Pacific region is estimated to be the region with the fastest CAGR rate over the forecast period 2022-2027. This growth is owing to factors like considerable intake of confectionary products and the compelling share of the confectionary industry in the region in comparison with other regions. The soaring production and intake capacity together with the existence of India and China as the fastest-growing consumer markets for shortening fats with China being a big consumer of soybeans are further fuelling the progress of the Global Shortening Fats Market in the Asia-Pacific region.

Schedule a Call

Shortening Fats Market Drivers

Surging Applications Of Shortening Fats Are Projected To Drive The Growth Of the Shortening Fats Market:

Shortening is any fat that raises the tenderness of a baked product by averting the cohesion of gluten strands at the time of blending. A tablespoon (12 grams) of Crisco all-vegetable Shortening includes 110 Calories, 12 grams of total fat, 3.5 grams of Unsaturated fat, 2.5 grams of Saturated fat, and 0 grams of protein and 0 grams of Carbs. Shortening is utilized in baking to confer tenderness and enhance flavor. The functional dominance, enhanced formulations of shortening fats, and amplifying applications of shortened fats are fuelling the growth of the Global Shortening Fats Market. Shortening fats offer a lubricating outcome in food matrices and also affects the sensory characteristics, specifically the texture and flavor attributes. Shortening is utilized to avert the formation of a gluten matrix in baked goods, permitting the establishment of non-elastic pastries like cakes. Lard, hydrogenated solidified oils, and butter may be utilized as shortening. For food applications that need high-stability alternatives, high oleic soybeans shortening surpasses most additional solutions, making it a perfect constituent. The surging applications of Shortening Fats are therefore fuelling the growth of the Global Shortening Fats Market during the forecast period 2022-2027.

Soaring Innovations In Shortening Fats Are Expected To Boost The Product Demand:

Specialty fats are utilized at distinct levels in different types of bread. When fats are utilized at higher levels in additional kinds of bread, it will avert surplus gluten development in the dough. This will provide a shorter bite, effortless melt-in-mouth, which is the reason fats utilized in bread making are also termed “shortening”. Furthermore, fats act as a “carrier” of flavors which benefits the leavening of added flavors. In November 2017, IOI Loders Croklaan Europe introduced Presdough 270 SB, the next-generation sea-based palm oil option, for superiority in bakery products. This non-hydrogenated shortening can reduce saturated fats in dough products by up to 40% and total fat by up to 20% while maintaining appropriate flavor and texture and accomplishing extra volume in puff pastry. Presdough 270 SB is greatly acceptable for laminated dough products and has the rare characteristic of making extra “puff” and a crispier crust, while the shea adds to a golden brown color. Soybean shortenings – inclusive of high oleic soybeans and traditional soybean shortenings – are approved solutions for an assortment of food applications that need solid and semi-solid shortenings. They help food firms with their extensive temperature series and superior melting characteristics. A serving size of 1 tbsp (12.8 g) of Multipurpose, soybean (hydrogenated), and palm (hydrogenated) include 113.2 calories with calories from fat being 115.2 (101.8%). Soy-based shortenings, which are frequently established through interesterification, are the U.S. developed, sustainable constituents. Functionality tests demonstrate that soy-based shortenings are the best performers in an assortment of bakery applications. The soaring innovations in Shortening Fats are therefore driving the growth of the Global Shortening Fats Market during the forecast period 2022-2027.

Buy Now

Shortening Fats Market – Challenges

Disadvantages Of Shortening Fats Are Hampering The Growth Of The Shortening Fats Market:

The most typically utilized shorteners presently are produced with vegetable oils like soybeans, cottonseed, or refined palm oil. Applying the procedure of hydrogenation, these oils are created to become solid at room temperature. Though it relies on a particular type, shortening is almost 100 percent pure fat. As per the United States Department of Agriculture, one tablespoon of vegetable/lard shortening includes around:

115 calories

13 grams fat (including a mix of unsaturated, saturated and sometimes trans fat)

2.75 milligrams vitamin K (up to 8 percent DV)

3 milligrams choline

0.12 milligrams vitamin E

Apart from offering fat and some vitamin K, it fundamentally does not include any additional vital nutrients. An enormous amount of proof from the decades gone by has demonstrated that intake of products including trans fats and partially hydrogenated oils presents numerous health hazards. Investigations indicate that the adverse health outcomes linked with partially hydrogenated/trans fats are inclusive of raised hazard of heart ailment, heart attack, stroke, and elevated hardening/calcification of the arteries among other outcomes. These issues are thus hampering the growth of the Global Shortening Fats Market.

Shortening Fats Industry Outlook

Product innovation, strategic partnerships, collaborations, novel product launches, novel service launches, joint ventures, and contracts are key strategies adopted by players in the Global Shortening Fats Market. Key companies in this market are:

Bunge North America, Inc.

Yildiz Holding

Namchow Chemical Industrial Co., Ltd.

Cargill, Inc.

NMGK Group Of Companies

Fuji Oil Co., Ltd.

Conagra Foodservice

COFCO Group Co. Ltd.

Wilmar International Ltd

IFFCO INGREDIENTS

Recent Developments

In October 2021, Reddi-wip® extended offerings with novel Keto-Friendly*, Zero Sugar Whipped Topping. Reddi-Wip Zero Sugar (not a low-calorie food) is a creamy, delectable, keto-friendly whipped topping prepared with real cream, with zero grams of sugar, zero carbs, and 15 calories per serving. It includes no artificial flavors and is gluten-free.

In January 2020, it was reported that Cargill Brazil introduced a novel fat that can minimize the saturated fat content in ice cream, creams, and dairy drinks by up to 30%, as per DairyReporter. Introduced in December, Lévia+c was a mixture of vegetable oils (principally soyabean oil) and emulsifiers that had the identical physical structure as a conventional fat but a saturated fat content of 35% and an utmost trans fat content of 2%. It could be included in a recipe without altering the product formulation and also impeded melting, left no residual fat in the mouth and averted recrystallization and lumps from forming, pronounced Cargill.

In February 2020, Cargill declared a $6.4 million investment in its North American Pilot Development Center in Savage, Minnesota. As per the firm, the extension to the facility will authorize its consumers to boost their speed to market with novel products. The extended facility will permit Cargill to plan multi-scale, continuous piloting from cleansing novel vegetable oils and mixtures to creative shortening solutions for cakes, bread, cookies, and more.

For more Food and Beverage Market reports, please click here

#Shortening Fats Market Share#Shortening Fats Market Size#Shortening Fats Market price#Shortening Fats Market Forecast

0 notes

Text

Global Cotton Processing Market Growth Rate and Regional Analysis

Global Cotton Processing Market was valued at USD 76.43 billion in 2021 and is slated to reach at USD 109.99 billion by 2027 at a CAGR of 5.01 % from 2022-2027.

Cotton is the process of refining or vacuuming cotton into tubular structures to minimise moisture and improve fibre quality. This method is frequently employed in a variety of applications, including textiles, surgery, and others.

Get a Sample Copy of this Report @ https://qualiketresearch.com/request-sample/Cotton-Processing-Market/request-sample

Market Drivers

The growing knowledge of the benefits of cotton will accelerate the market's growth rate. The key driver driving market expansion is the increasing use of cotton in the medical sector. Surgical cotton can also be referred to as absorbent cotton or cotton wool. Because of their high fluid absorbency, they are mostly employed in medical settings such as hospitals, clinics, and others. Apart from being utilised as a dressing material, it is also used as padding for garments, comforters, and other products. Cotton's demand in the medical industry is increasing as a result of these variables and applications. Rising urbanisation and rising disposable income levels will boost market value expansion. Additionally, rising infrastructure investments and increased cotton use as a result of increased knowledge about the benefits of hygiene following the pandemic will boost the market's growth pace. Another important aspect driving the market's growth rate is people's growing health consciousness.

The increased quantity of research and development activities will raise new market opportunities for the market's growth rate. Cotton has the potential to be a valuable food source for both humans and animals. It contains 40% fibre and 60% seed by weight. Cottonseed is derived from cotton, which is abundant in protein and oil, and is a common component in cookies, potato chips, salad dressings, and baked goods. Furthermore, tightening pesticide laws on cotton have raised sales and demand for organic cotton, boosting market growth. Furthermore, an increase in strategic collaborations and emerging new markets would work as market drivers, boosting positive chances for the industry's growth rate.

Market Restraints

Reduced cotton export rates across the globe, particularly in the United States, are the key factor impeding market expansion over the anticipated period. According to U.S. export and import figures, cotton exports have declined from 3.7% to 13.7% over the last seven years, representing the greatest decline in cotton sales. The high costs of capital and manufacturing plants, as well as infrastructure-related equipment, would function as market restraints, further challenging the market growth rate.

Market Segmentation

Global Cotton Processing Market is segmented into Product Type, Equipment, Operation, Application. By Product Type such as Lint, Cottonseed, Others. By Equipment such as Ginning, Spinning. By Operation such as Automatic, Semi-Automatic. By Application such as Textiles, Medical and Surgical, Feed, Consumer Goods, Others.

Regional Analysis

Global Cotton Processing Market is segmented into five regions North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. In terms of market size and revenue, Asia-Pacific dominates the cotton processing industry and will maintain its dominance during the projection period. This is attributable to the expanding textile, consumer products, and feeding industries. North America is predicted to develop during the forecasted period as a result of rising technological advancements to boost production and the increasing prevalence of many market participants within the region.

Get Discount on this Report@ https://qualiketresearch.com/request-sample/Cotton-Processing-Market/ask-for-discount

Key Players

This report includes a list of numerous Key Players, namely Lummus Corporation (U.S.), Bajaj Steel Industries (India), NIPHA EXPORTS PRIVATE LIMITED (India), Shandong Swan Cotton Industrial, Machinery Stock Co. (China), Cherokee Fabrication (U.S.), Rieter (Switzerland), TOYOTA INDUSTRIES CORPORATION. (Japan), Mitsun Engineering (India), BALKAN S.A. (India), Camozzi Automation S.p.A. (Italy).

Market Taxonomy

By Product Type

• Lint

• Cottonseed

• Others

By Equipment

• Ginning

• Spinning

By Operation

• Automatic

• Semi-Automatic

By Application

• Textiles

• Medical and Surgical

• Feed

• Consumer Goods

• Others

By Region

• North America

• Latin America

• Europe

• Asia Pacific

• Middle East & Africa.

Browse Full Report https://qualiketresearch.com/reports-details/Cotton-Processing-Market

0 notes

Text

Pet Food Flavors Market Seeking Excellent Growth | Sensient Technologies, Kerry Group, Givaudan

New Post has been published on https://petnews2day.com/pet-industry-news/pet-travel-news/pet-food-flavors-market-seeking-excellent-growth-sensient-technologies-kerry-group-givaudan/

Pet Food Flavors Market Seeking Excellent Growth | Sensient Technologies, Kerry Group, Givaudan

Worldwide Pet Food Flavors Market In-depth Research Report 2021, Forecast to 2028 is latest research study released by AMA evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Worldwide Pet Food Flavors Market. Some of the key players profiled in the study are Kerry Group plc (Ireland), Givaudan (United Kingdom), Firmenich SA (Switzerland), Sensient Technologies Corporation (United States), Symrise AG (Germany), Frutarom Industries Ltd. (Israel), Hasegawa Co. Ltd (Japan), Wild Flavors Inc (United States), Takasago International Corporation (Japan), Sensient Technologies Corporation (United States), International Flavors & Fragrance Inc. (United States).

Get Free Access to Sample Report @ https://www.advancemarketanalytics.com/sample-report/9978-global-pet-food-flavors-market

According to the 2017-2018 American Pet Products Association’s National Pet Owners Survey, there are more than 94 million dogs and nearly 90 million cats in United States. Food products designed for dogs, cats or other household pets are prepared mostly from meat, meat by-products, fish, fish by-products, cereals and grains and may also include vitamins and minerals. Flavoring system of Pet Food is based on a non-aqueous liquid flavor additive composition that may be topically applied to a dry or moistened pet food that already has one or more pet food flavorants. The composition comprises 80%-97% oil, by mass, selected from the group consisting of safflower oil, soybean oil, olive oil, flaxseed oil, cottonseed oil, corn oil, canola oil and sunflower oil and combinations. A common pet food addition available includes savory or meaty flavor profiles, offered by some Pyrazines and Sulfur Compounds, as well as Natural Extracts, such as onion and garlic. The Pet Owners are gaining awareness about the harmful preservatives and other additives used in packaged food are driving the Global Pet Food Flavors Market.

Influencing Market Trend

Increasing Focus on Nutrition of Companion Animals

Growing Hypermarkets with Pet Speciality Stores

Market Drivers

Growing Demand for Pet Food Products

Rising Pet Humanization

Changing Lifestyle and Increasing Disposable Income

Opportunities:

Rising Consumer Willingness to Spend on Pet Care

Innovations in Packaging of the Pet Food Products

Challenges:

Cost Factor associated with Pet Food Flavours

The Complexity of Pet Food Flavours and its Effects on Animals Health

For more data or any query mail at [email protected]

Enquire for customization in Report @ https://www.advancemarketanalytics.com/enquiry-before-buy/9978-global-pet-food-flavors-market

Furthermore, the years considered for the study are as follows:

Historical year – 2017-2021

Base year – 2021

Forecast period** – 2022 to 2027 [** unless otherwise stated]

Highlighted of Global Pet Food Flavors Market Segments and Sub-Segment:

Market by Key Players: Kerry Group plc (Ireland), Givaudan (United Kingdom), Firmenich SA (Switzerland), Sensient Technologies Corporation (United States), Symrise AG (Germany), Frutarom Industries Ltd. (Israel), Hasegawa Co. Ltd (Japan), Wild Flavors Inc (United States), Takasago International Corporation (Japan), Sensient Technologies Corporation (United States), International Flavors & Fragrance Inc. (United States)

Market by: by Type (Natural Flavors, Artificial Flavors), Application (Cat Food, Bird Food, Fish Food, Dog Food), Sales Channel (Online, Offline), Flavours (Natural Flavours (Poultry Flavours), Artificial Flavours (2-Methyl-3-Furanthiol))

Regional Analysis for Worldwide Pet Food Flavors Market:

• APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)The study is a source of reliable data on: Market segments and sub-segments, Market trends and dynamics Supply and demand Market size Current trends/opportunities/challenges Competitive landscape Technological innovations Value chain and investor analysis.

Buy the Full Research report of Global Pet Food Flavors Market@: https://www.advancemarketanalytics.com/buy-now?format=1&report=9978

Key Growths in the Market: This section of the report incorporates the essential enhancements of the marker that contains assertions, coordinated efforts, R&D, new item dispatch, joint ventures, and associations of leading participants working in the market.Key Points in the Market: The key features of this Pet Food Flavors market report includes production, production rate, revenue, price, cost, market share, capacity, capacity utilization rate, import/export, supply/demand, and gross margin. Key market dynamics plus market segments and sub-segments are covered.

Points Covered in Table of Content of Global Pet Food Flavors Market:

Chapter 01 – Pet Food Flavors Executive Summary

Chapter 02 – Market Overview

Chapter 03 – Key Success Factors

Chapter 04 – Covid-19 Crisis Analysis on Global Pet Food Flavors Market

Chapter 05 – Key and Emerging Countries Analysis in Global Pet Food Flavors Market

Chapter 06 – Global Pet Food Flavors Market – Pricing Analysis

Chapter 07 — Global Pet Food Flavors Market Segmentation

Chapter 08 – Global Pet Food Flavors Market Background

Chapter 09 – Global Pet Food Flavors Market Structure Analysis

Chapter 10 – Global Pet Food Flavors Market Competitive Analysis

Chapter 11 – Assumptions and Acronyms

Chapter 12 – Research Methodology

Examine Detailed Index of full Research Study at@: https://www.advancemarketanalytics.com/reports/9978-global-pet-food-flavors-market

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Contact US :

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (551) 333 1547

[email protected]

0 notes

Text

Lecithin Market Set for Rapid Growth and Trend by 2030

Lecithin is an essential fatty substance present in the tissues of the body. It can be naturally found in egg yolk, soybeans, marine food, rapeseed, milk, cottonseed, and sunflower oil. It has a variety of medical and commercial benefits. Lecithin possesses excellent lubricant, emulsification, and medicinal properties, which makes it suitable in multiple applications across food & beverages, industrial, animal feed, cosmetics, and pharmaceutical sectors.

Rising health concerns have led to the grown interest of consumers towards nutrient-rich foods and dietary supplements. Lecithin contains phosphatidylcholines and is considered a rich source of choline, which is an essential nutrient. Lecithin benefits in acne, improving liver function, and lowering cholesterol.

According to a new research report by Global Market Insights Inc., Lecithin Market size is estimated to surpass USD 3.4 Billion by 2030.

Request a sample copy of this research report @ https://www.gminsights.com/request-sample/detail/2875

Food Application: Lecithin is a mixture of phospholipids in oil and is widely used by food manufacturers as a food additive. The compound’s emulsification effect allows its utilization in non-stick cooking spray. Cooking sprays are further used in many ready-to-eat products such as bakery & confectioneries, packaged foods, and others. Consumers prefer these foods due to higher shelf life and convenience.

As per the Centre for the Promotion of Imports from developing countries (CBI), the retail food sales in the U.K. rose by 11% in 2020, owing to the shift in consumer preference towards packed and hygienic foods amid the COVID-19 pandemic.

In Pharmaceuticals: The lecithin industry share from the pharmaceutical application segment is slated to spring up considerably by 2024. As lecithin holds exceptional surfactant, stabilizer, and dispersing properties, it experiences strong demand in the manufacture of drugs. Lecithin-containing drugs are used in the treatment of dementia, Alzheimer’s disease, and in diseases associated with gallbladder, liver, depression, high cholesterol, anxiety, and skin.

With the growing prevalence of chronic diseases worldwide, the demand for lecithin and its various applications in pharmaceuticals is predicted to boom over the coming years. Soy lecithin has widespread applications in the pharma sector due to several health benefits.

Request for customization of this report @

https://www.gminsights.com/roc/2875

Soybean sourced lecithin contributes to raising good cholesterol (HDL) and lowering bad cholesterol (LDL) in the blood. Such benefits make it one of the most used ingredients in lecithin supplement. People with high cholesterol levels and cardiovascular diseases prefer soy-rich lecithin products.

Cosmetics sector in North America: North America lecithin industry is slated to witness substantial progress in the coming years, on account of the high consumption of cosmetics and personal care products. A significant rise in disposable income and the necessity to achieve desired aesthetic appearance, especially among women, is the prime factor propelling demand for cosmetics. Hydrogenated lecithin is widely used as an emollient in skin care products which restore hydration in the skin and make it feel smoother.

Browse the complete summary of this report @

https://www.gminsights.com/industry-analysis/lecithin-market

SOYA, GIIAVA, Haneil Soyatech, Cargill, ADM, and a few others are some prominent providers of lecithin globally. These companies are eyeing on partnerships, mergers, new product development, and business expansion to upgrade their share and consolidate their position in the global market.

Lecithin-rich animal feed is experiencing significant demand from the growing number of pet owners globally. Lecithin in pet feed enriches protein & fat and enhances palletization. With the versatile application range, the substance provides ample growth opportunities to the manufacturers of lecithin based products.

About Global Market Insights:

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider offering syndicated and custom research reports, along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Aarshit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Phone: 1–302–846–7766

Toll-Free: 1–888–689–0688

Email: [email protected]

0 notes

Text

Global Cottonseed Oil (COVID-19 Imapact Analysis) Market Size, Share, Growth, Trends 2020-2026 ~https://bit.ly/32vjlAp

The "Cottonseed Oil Market" report includes an in-depth analysis of the global Cottonseed Oil market for the present as well as forecast period. The report encompasses the competition landscape entailing share analysis of the key players in the Cottonseed Oil market based on their revenues and other significant factors.

0 notes

Text

Edible Oil Industry

India Was Stripped of Its Atmanirbharta in the Edible Oil Industry The rise and fall of the biggest importers of edible oil in the world. Nov 04, 2020 | B.M. Vyas and Manu Kaushik A man loads empty containers of edible oil onto a tricycle at a roadside in Kolkata, India, August 27, 2015. Photo: Reuters/Rupak De Chowdhuri

‘Freedom is the greatest fruit of self-sufficiency’

– Epicurus

The COVID-19 pandemic has been detrimental for globalisation and has led to a clamour for protectionism.

India’s national strategy is also in line with this trend with calls for ‘Atmanirbharta’ and ‘vocal for local’ increasing.

Traditionally, India was an exporter of edible oil before Independence, became self-sufficient post-Independence (till the early 1970s), floundered in 1970s and 80s and regained self-sufficiency in the early 90s (1991-94). We are currently the biggest importers in the world!

India imports around US $ 10 billion of edible oil (15 MT) annually which constitutes nearly 70% of our annual edible oil requirement of 23 million tonnes. Thus, whether you eat a roadside samosa, matthi, dosa or chola bhatura, branded biscuit or namkeen, or even aloo puri or sabzi at home, there is almost a 70% chance that it is made using oil which is not from India.

Furthermore, imported palm oil or its derivatives are used as ingredients in soaps, shampoos, shaving creams and other cosmetics too. This is not an industry that comes across as a shining example for ‘atmanirbhar’ India. An analysis of the last five decades will help us understand how we reached here.

From Independence until the mid-1970s, we averaged 95% self-sufficiency in edible oil, except for the war years and its aftermath when self-sufficiency fell down to early 90s in percentage. The cuisine, cropping patterns and climatic conditions had led to the preference of mustard oil in north and east India, coconut oil in south India, groundnut or cottonseed oil in west India, and sesame oil in Rajasthan.

This regional preference for indigenous edible oils had evolved over centuries and had become a part of our culture. In 1973-74, groundnut, mustard and cottonseed oil had a whopping 96% share of the total consumption of edible oils in India. The oil seeds were traditionally extracted by cold pressing and then filtered; a technology suited to small scale processing leading to employment for generations. It also encouraged localised procurement and distribution networks having a smaller carbon footprint. Thus, it was an ecologically sustainable system and a virtuous cycle.

The 1971 India-Pakistan war compounded by the drought in 1972, led to inflation and food shortages. The per capita edible oil availability, which was 5 litres per annum in 1971 fell down to 3.9 litres per annum in 1973 (its 19 litres now). There were acute shortages in milk and consequently ghee. The shortage of oil and ghee combined with slick marketing led to the demand for vanaspati – which was marketed as a healthier alternative to ghee.

Also read: ‘Agriculture and Atmanirbharta’ Is a Noble Vision, but Needs Hard Decisions and Political Consensus

Edible oil was hydrogenated – by adding hydrogen to convert ‘unsaturated’ liquid fats into ‘saturated’ solid fats – and made into vanaspati. The vanaspati thus formed was ghee-like not just in appearance but also had a higher melting point than oil and was thus more suited for deep frying. Dalda was the flagship brand in the industry.

Dalda vegetable ghee. Photo: Wikimedia Commons, CC BY-SA

This further reduced the edible oil available for consumption as oil per se. Vanaspati consumption essentially took away one fifth of the availability of edible oils during the 1970s-80s. This led to groundnut oil or mustard oil being banned for making vanaspati from 1976-77 to 1987-88, and imported palmolien became the mainstay of the vanaspati industry.

The popularity of vanaspati had a detrimental effect on the growth of domestic edible oils as it pushed the price of edible oil down, making oilseed crop a losing proposition for farmers. Its production stagnated – staying around 10 million tonnes of oilseeds from 1970 to 1986 – while the growing population pushed demand up, forcing the government to import more edible oil. Thus, a vicious cycle was in place.

The public resentment transformed into action on December 20, 1973, when students protested against the hike in their mess bills leading to the Navnirman movement, in Gujarat. This, in turn, inspired Jayaprakash Narayan’s Total Revolution leading to the emergency and the formation of the Janta Party’s Morarji Desai government in 1977. While everyone remembers George Fernandes for having kicked out Coca Cola, the Janta Party government also opened the import gates for edible oil. The 95% reliance on domestic edible oils maintained in the 1960s and 1970s, fell down to 70% during 1977-80.

In 1977, the then finance minister, H.M. Patel – father of Amrita Patel, who later became chairperson of the NDDB – suggested to Dr Verghese Kurien an “Operation Flood” like project for edible oils via a farmers cooperative network based on the Amul model. The objective was self-reliance in edible oils through increased productivity, effective distribution and price stability through Market Intervention Operations (MIO) by NDDB, leading to improved farmer livelihoods. The intent of MIO was to handle 15% of the edible oil produced in the country to manage price fluctuations.

The project was named Operation Golden Flow. Central to the operation was the brand ‘Dhara’, which was created to build a market for the Indian oilseed grower. It was inspired by the wordmark of Dalda in green on a yellow background, the leader in vanaspati. This was a part of the market intervention operation. Dhara was launched in Delhi on August 23, 1988. Dhara pricing was kept low due to economies of scale and blending with the donated oil from CLUSA (Cooperative League of the USA), a strategy taken from the ‘pump priming’ of donated SMP and butter-oil during Operation Flood.

Thus, Dhara brought prices of domestic oil at par with cheaper imported edible oil. NDDB and GCMMF worked as one team and launched several varieties of oil such as filtered and refined mustard oil, cottonseed oil and double filtered groundnut oil. While NDDB handled the cooperatives, procurement and production, GCMMF was the distribution partner. The established Amul distribution network helped launch Dhara in a blitzkrieg. It took the market by storm. By 1991-92, Dhara had achieved sales of 1,32,000 MT pa, which was around 50% of the organised market share.

In a coordinated attempt the then PM Rajiv Gandhi created a Technology Mission on Oilseeds (TMO) in 1986. Headed by Sam Pitroda, it took concrete steps to boost domestic production of edible oils. The area under oilseed cultivation which had stagnated between 15-18 million hectares between 1970-85 increased to 25 million hectares by 1991 and oilseed production which was stuck at around 10 million tonnes (1970-85) went up to 18 million tonnes in this timeframe. India was producing 98% of its edible oil requirement by 1990-91. A true atmanirbhar success story!

Also read: With Palm Oil Expansion, India is Blazing a Trail to a Parched Future

The period between 1990-94 could be considered the golden era of the Indian edible oil industry.

This self-sufficiency continued till the Narsimha Rao government signed the WTO agreement in 1994 and edible oil was put under OGL (Open General License) with 65% duty. By 1998 we were again importing around 30% of our edible oil. We could never foresee then, what was in store in the near future.

A woman works in a field of mustard plants. Photo: Reuters

Under the Vajpayee government, the import duty on edible oil was further reduced to 15% in July 1998 and coincidentally the Argemone adulteration Dropsy case took place in August 1998. Sixty people died and around 3,000 got sick in Delhi and caught the nation’s attention. All of a sudden, all domestic brands selling mustard oil became outcasts and even loose mustard oil was banned. NDDB had to release advertisements to inform consumers not to buy its trusted Dhara Mustard Oil. Out of fear consumers shifted to ‘purer’ aromaless, colourless, tasteless oils or solvent extracted refined oils, as we know them. Over the next few years, that black swan event, led to a shift in the socio-cultural cooking and consumption patterns of edible oil in the country.

Industry followers consider it deliberate sabotage to discredit indigenous and loose oils and promote imports. Mustard oil contaminated with argemone (essentially weed seed contamination) is an ancient occurrence, but adulteration is never more than 1%. In these cases, adulteration was up to 30%, with argemone, diesel and waste oil as contaminants. The adulteration was therefore done in such a way that it would kill, and do so conspicuously and rapidly. Thus, the tragedy was seemingly not a result of the normal business of adulteration.

As the then Delhi health minister Harsh Vardhan stated, this is not possible without an organised conspiracy. NDDB had always faced opposition to Operation Golden Flow since its inception from the local telia rajas, oil kings. Its Bhavnagar Vegetable Products (BVP) plant had suffered eight mysterious fires between 1977-1982 and senior executives like A.A. Cholani and G.M. Jhala suffered serious accidents while travelling. Even now, it appears as if to set an example, the officers of NDDB and GCMMF till date attend court hearings of the dropsy case. While the mill owner from whom the said lot was bought, and was the main accused, was acquitted in 2006 due to lack of evidence.

After this incident, the Vajpayee government imported a controversial consignment of a million tonnes of soybean seeds from the US, previously rejected by the EU. Prices of indigenous oils fell and farmers protests fell on deaf ears. The area under oilseed cultivation started falling as farmers abandoned the crop. The area under mustard cultivation fell from 7.04 million hectares in 1997-98 to 4.5 million hectares in 2003-04. While edible oil imports increased from 2 million tonnes in 1997-98 to 4.5 million tonnes in 1998-99 and five million tonnes in 2002-03.

Men work on palm fruits at a palm oil factory. Photo: Reuters/Thierry Gouegnon/Files

By 2018, 20 years since the dropsy incident, the situation transposed and 70% of edible oil consumed in India was imported. It is primarily palm and soybean oil both non-indigenous to the country, the cuisine and its people. Palm oil in itself is 50% of the oil consumed in India, one of the unhealthiest oils on the planet.

Thus, one single policy decision, and one suspected sabotage, devastated not just the entire domestic oil cooperative network built over 20 years with painstaking effort but also the cropping pattern of the country which had evolved over centuries. Domestic edible oil prices stagnated and all cooperative federations wound up like a pack of cards. Most cooperative oil mills were forced to shut down. Even today some are lying defunct and vacant.

The NDDB and GCMMF parted ways and distribution of Dhara was taken over by NDDB in 2003. The country which had doubled its oil seed production from 108 lakh tonne to 221 lakh tonne in just a decade (1986-96), was left in a lurch. Today, that very country has become the world’s largest importer of vegetable oil, in spite of having the land, the resources, willing farmers, a ready market and the ability to achieve this self-sufficiency earlier!

Also read: Expanding Oil Palm Plantations in the Northeast Could Exact a Long-Term Cost

This vacuum left the door open for the ‘ABCD quartet’– the big four Agri commodity companies of the world – Archer Daniel Midlands (ADM), Bunge, Cargill and Louis Dreyfus and other American multinationals to enter India. Cargill did a JV with Parakh Foods in 2004. Bunge bought over Dalda from HLL in 2003. Conagra bought a majority stake in Agrotech from ITC in 1997 and the brand ‘Rath’ in 2000. ADM’s was one of the earliest ones and its route was through Malaysia. In 1999, Adani did a 50-50 joint venture with Wilmar to launch Fortune Oil, which in turn has Archer Daniel Midlands (ADM) as a shareholder since 1994 (present stake 24.9%). Wilmar International itself faces a lot of criticism from organisations like Greenpeace & Friends of the Earth for deforestation of tropical Indonesian forests. Amnesty international accuses it of using child labour in plantations.

ADM, in the 1990s, was the poster boy of corporate lobbying in America. It’s then CEO Dwayne Andreas was famous for being a political campaign donor for Nixon, Ronald Regan, Bill Clinton, George Bush and Bod Dole. Allegedly his contribution to Nixon’s re-election campaign was the $25,000 found in the possession of the Watergate burglar Bernand Barker. The ADM Board included Howard Buffet (son of Warren Buffet) and Brian Mulroney, former Canadian PM. Yet in 1999, ADM was fined USD 100 million for price fixing in the international lysine market and Dwayne Andreas’s son, Michael Andreas was sentenced to 24 months in prison. ADM also perfected the art of cultivating senior politicians by flying them in ADM corporate jets. Bob Dole, in his 1988 presidential campaign flew ADM corporate jets 29 times. As recently as 2005, Obama flew twice.

Today Adani Wilmar accounts for one-third of the total edible oil imported in India. The early bird does get the worm.

If one parks aside the balance of trade and the self-sufficiency angle, studies have shown that every additional kg of palm oil consumed per capita annually leads to ischemic heart disease (IHD) mortality rates of 68 per 100,000 in developing countries. India consumes some 7.2 litres per capita of Palm oil. Just replacing it with indigenous oil shall not just save lives but also reduce overall medical costs in the country. Similarly, soybean oil has also more than its fair share of negative reports on health.

Additionally, when oilseed production grows, the country produces not only edible oil but also oil cakes and extraction which is the raw material for dairy (cattle feed) and poultry industry (poultry feed). When we go for more edible oil imports, we are depriving protein supply to dairy and poultry and have to resort to importing corn and maybe soya eventually. In the end, our agriculture is shifting to other countries and so is rural employment and farmer incomes.

The website of the US Department of State in its Agriculture Policy states that “The office of Agricultural Policy (AGP) boosts prosperity of American farmers and ranchers by opening foreign markets to American farm products, promoting transparent, predictable, and science based regulatory systems overseas; and reducing unnecessary trade barriers around the world.”

While we may debate whether we have been ‘opened’ or not, by dismantling technology missions like the TMO and adopting extra liberal import policies at the cost of rural economy we are certainly not helping our cause. We are satisfying urban consumer demands by imports at the cost of the rural economy, thus leading to rural unemployment and rural migration towards cities in search of ‘labour’ work.

Is the dream of doubling farmers income, going to be achieved by reducing the number of farmers by half?

In the light of this history, we are better placed to evaluate the advice received by the PM from agricultural scientists and economists, which he shared while laying the foundation stone of Manipur Water Supply Project on July 23, 2020, regarding cultivating palm oil in North East. The follies of the last two decades can still be overcome by reverting back to the traditional cropping patterns for oilseeds and promoting traditional edible oil as ingredients for food and non-food FMCG. It will take a missionary zeal and the strategic intent of the government, but the self-sufficiency status-quo ante of 1994 in edible oil can still be achieved. By taking up palm oil plantation in the North Eastern States we will not just accept the LAC as LOC, but as the international border.

Also read: How ‘Dirty’ is India’s Palm Oil and What Should We Do About It?

On January 8, 2020, the India Directorate General of Foreign Trade had put palm oil from the ‘Free’ to ‘Restricted’ List in what appeared to be a reaction to the criticism by the Malaysian Prime Minister Mahathir Mohammed regarding the Citizenship Amendment Act and India’s action regarding the reading down of Article 370 in Kashmir. Around 40% of the palm oil imported to India, or 17% of the total edible oil consumed, is from Malaysia.

This led to a spike in palm oil prices and consequentially of other edible oils, making their cultivation more appealing. Improved MSP this year also contributed to the cause. The Ministry of Agriculture’s CWWG report as on September 4, 2020, reported that kharif oilseeds cultivation showed a growth of 12% compared to a growth of 6% for all kharif crops. The edible oil industry is resilient and has the potential for being atmanirbhar. The question would remain- do we really want that?

B.M. Vyas is the former managing director of GCMMF Ltd and had been instrumental in the launch of Dhara. Manu Kaushik is a management professional and has also been associated with GCMMF Ltd.

For more information , visit our website : https://www.punjabenggworks.com

#oil plant machine manufacturers#oil extraction machines#oil expeller machines#oil mill machinery suppliers

2 notes

·

View notes

Text

Brad's Rules Suggestions for Cast Iron

GAaaaaahh!!!!!

Do I have your attention? 😄

Good. Now that all the purists, who never actually COOK using their cast iron but who love to dole out cast iron commandments, have all had a heart attack... You and I can talk a little bit about care of cast iron stuff.

There's a couple of pointers that I can give you if you've never used cast iron stuff to cook with before. These are all methods that work for me. There may be better ways to do them and usually there are at least a couple of ways to do anything that are equally as effective.

1. Experts will tell you :

THOU SHALL NOT USE SOAP AND WATER TO CLEAN THINE CAST IRON!!

Bullshit.

Look, avoid soap and water, yes. Unless you need to use soap and water. And then understand what it will mean when/if you do. Most of the time, if you develop good habits, you won't need soap and water to clean your stuff. Soap will remove the (wonderful) almost microscopic "seasoning" layer of oil that makes good skillets virtually non stick. So if you have to resort to soap and water you'll have to re-season your cookware.

But that's the worst of it. To hear people go on about it you'd think the introduction of soapy water to cast iron is the third sign of the apocalypse or something.

There are times when you will need to resort to soapy water, like I have done with the chicken fryer pictured above. So, I figured this would be a good time to explain how I handle seasoning cast iron, since I get messaged about it A LOT.

The fryer I recently bought is in excellent shape. No rust at all, no pitting, perfectly level and flat on the bottom (not warped) and smoooooth as glass on the cooking surface. Most modern stuff is roughly textured because they don't take the time to sand it down smooth when it comes out of the mold at the foundry. I like that smooth, glass like surface, which is one of the reasons that I seek out older pieces.

Anyway, the only issue with this old girl is one commonly found with pieces bought at flea markets and other outside sales. Cast iron is prone to rust when exposed to the elements, so sellers often coat their pieces with heavier amounts of oil as a rust preventative. A lot of times this ends up being a thick, sticky layer of funkiness that grosses me out. The same 'sticky layer' can result from poor seasoning techniques - but more on that later.

Anyway, I'm not going to say some antique cast iron dealers coat their wares with motor oil.... but it's probably best not to eat out of the sticky, gross skillets until they've been properly cleaned and re-seasoned.

So, into the hot soapy water the Old Girl went and scrubbing with a no-scratch scrubber commenced. I used this one. Doesn't it look cheerful?

I scrubbed and rinsed until the gunk was off, then dried the fryer and lid as dry as I could get them using towels.

They will look bone dry, but don't fall for that shit.

There is microscopic water hiding in the pores of the iron just waiting to rust. So the iron goes onto a stove burner on medium low heat for a bit. You don't want to get her smoking hot. Just heat to the point that it's not comfortable to handle bare handed. This will evaporate the remaining water 👍.

Now take the piece off the heat and rub a thin layer of some type of fat all over, inside and out. You can find TONS of recommendations online for seasoning agents with DIRE predictions of what will happen if you don't follow the author's advice...

I use Crisco. It's a cooking shortening that is solid at room temperature, has a low melting point, a pretty decent smoke point, and has been around forever.

Some folks swear by olive oil. Some people won't use anything but grapeseed oil or cottonseed oil or flaxseed oil. Some people will sell you expensive specially made seasoning stuff that comes in what looks like a can of snuff or a tube of deodorant. All have their pros and cons and defenders and detractors, including my beloved Crisco.

You use what you want.

The piece should be hot enough so that the crisco (or whatever) liquefies immediately on contact, but not so hot that it starts to smoke or burn. Rub the stuff all over in a thin layer and then turn your oven on its lowest setting.

Take a clean towel and rub the seasoning agent (crisco) off the piece being seasoned. Lint free towels are best so you don't leave little bits of paper towel on your skillet.

You will be tempted to not wipe it all off and leave a visible layer.

Don’t.

You want to build up multiple thin microscopic layers of oil/fat on the surface of the cast iron. Any more than that super thin layer can result in the tacky sticky mess I mentioned before. Its the most common mistake that I made when first learning to season and re-season my cast iron. I’d leave too much behind and the next time I got my skillet out to cook with it I found a sticky mess.

So give the piece a good rub down and have faith :)

Turn the oven heat off and put the cast iron piece inside the oven on the rack upside down. You will read in some instructions that you should "put down a layer of foil underneath the skillet to catch the oil drippings"... but you won't have to worry about that because you wiped ALL the excess oil/crisco out like I told you.

Didn't you ? 😊

When the item has cooled off take it out of the oven. Put it back on the stove top on a low/medium burner to warm up and then apply another super thin layer of seasoning agent inside and out. Then wipe ALL of it off the piece again.

You can leave out the oven part this time if you like. I've found that it makes no difference for me in the process after the first round. In either case, let the item cool and repeat seasoning for a total of at least three times.

You're done!

Beautiful!

Glass like surface that's ready to go. If you care for it, the seasoning will just get better over time. Here's some hints for preserving it easily.

1. Don't use your cast iron to boil water (like when making pasta), unless that's all you are going to use it for. Boiling water will remove the microscopic seasoning layer like soap does. Stews and chili are fine since there is usually enough oil/fat in the food to maintain the seasoning.

2. If you are done with dinner and are ready to clean up, warm up the skillet a bit first if it has cooled off. Not super hot, just warm. Warm food comes off easier.

3. Depending on what I am cooking, often my clean up consists of just wiping out the skillet with paper towels. But if more cleaning is required you usually dont have to resort to soap.

Instead of soap to clean with, I usually put my (warm, not hot) skillet in the sink. Add several tablespoons of water and instead of soap add about 1/4 cup of salt. I use a soap free scrubby pad and the salt acts as an abrasive. Usually any stuck on bits come right off. The pan gets dried off and goes back in the stove top to evaporate any residual moisture and to warm up. Then I wipe on a maintenance micro thin layer of crisco and wipe it all off afterward.

Done! Takes less time than it takes me to clean a steel pan and cast iron is much nicer to work with.

4. The best thing you can do to improve your cast iron stuff is to USE IT. Repeated uses with the little re-season treatment at the end will soon have your cast iron just as non stick as teflon - without all the nasty chemicals.

5. The VERY best thing you can do to improve your cast iron is to deep dry something in it. All that oil heated to 350°F for a typical cooking session really does wonders for getting the iron to soak up the oil into its pours.

6. If you mess up and have to use soap and water to clean your stuff, don’t panic!! Just start at the beginning and do the initial three rounds of seasoning again and you’ll be back on track.

#the first rule of cast iron is TALK ABOUT CAST IRON#cast iron#skillets#antiques#seasoning cast iron#castiron#skillet#dutch oven#chicken fryer#cleaning cast iron

466 notes

·

View notes

Text

Cottonseed Oil Market Set to Grow Exponentially During the Forecast 2017-2022

Cottonseed Oil Market Set to Grow Exponentially During the Forecast 2017-2022

Fact.MR’s report on Global Cottonseed Oil Market

Widely used as a cooking oil in most parts of the world, the market for cottonseed oil is expanding steadily. There are various reasons to the popularity of cottonseed oil, and the chief reason among them is that cottonseed oil is relatively cheaper oil as compared with other organic oils like olive oil or canola oil. Besides this, cottonseed…

View On WordPress

0 notes

Text

Cottonseed Oil Driven by Snack Food Manufacturing Industry and Rising Number of Restaurants, Market Growth By 2024

Cotton is used primarily in fiber and textile industries. The cottonseed is used to produce oil for oilseed cake and for human consumption. Oilseed cake is used as an animal feed. Cottonseed oil is usually pale yellow in color. Cottonseed oil is edible oil extracted from cotton plant seeds of various species, primarily Gossypium hirsutum and Gossypium herbaceum. It possesses low cholesterol, vitamin E, and antioxidant property. It is employed in manufacturing industries such as paints. It is also used in cooking to enhance the food taste. It is also used in salad dressings, mayonnaises, and salad oil owing to its flavor, stability, and high oxidation property.

Growth of snack food manufacturing industry and rising number of restaurants are likely to drive the global cottonseed oil market during the forecast period. Cottonseed oil is less expensive than other oils such as canola oil and olive oil. Increasing demand for fats and oils from cosmetics and soap manufacturing industries is estimated to augment the cottonseed oil market in the next few years. Light texture of cottonseed oil is projected to make its adoption preferable over other alternatives. Increasing environmental concerns regarding the use of pesticides are projected to propel the cottonseed oil market in the near future. Availability of various edible oils including coconut oil, soya bean oil, palm oil, corn oil, peanut oil, rapeseed oil, sesame oil, safflower oil, and sunflower oil is expected to restrain the market growth during the forecast period.

Browse Market Research Report @ http://www.transparencymarketresearch.com/cottonseed-oil-market.html

The cottonseed oil market has been segmented on the basis of application and region. Based on application, the market has been segmented into personal care products, food, and others. The food segment accounts for a major share of the cottonseed oil market and is estimated to expand at a significant rate during the forecast period, due to growth of the food industry across the globe. Based on region, the market has been segmented into North America, Asia Pacific, Europe, Latin America, and Middle East & Africa.

North America is a key market for cottonseed and is expected to witness significant growth during the forecast period. The U.S. contributes a major share of the market in North America, due to abundant availability of raw materials. Worldwide increase in demand for cosmetic products and introduction of new products by FMCG (fast-moving consumer goods) manufacturers are some of the factor responsible for substantial growth of the global cottonseed market. The factors are estimated to drive the market in the near future also.

Globally, the production of cottonseed oil is lower as compared to other, internationally traded edible oils. Two vegetable oils viz. palm oil and soybean oil accounted for more than 50% and 70% of the global oil output and exports, in 2015, respectively. In the Middle East, countries such as Uganda and Tanzania process the cottonseed oil, mostly for human consumption and as an animal feed. Therefore, Middle East & Africa is likely to offer lucrative opportunities for the cottonseed oil market during the forecast period.

Make an Enquiry @: http://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=20657

In 2009, restructuring scheme was introduced to support the investment in the ginning industry and promote the farmers’ participation in cotton quality scheme. Europe accounts for about 1% of the total cotton production across the globe in 2009. Although, in Europe, stringent regulations have been introduced to make the cotton sector economically viable, which is expected to positively influence the cottonseed oil market in the region from 2016 to 2024.