#Claim stimulus credit

Explore tagged Tumblr posts

Text

#Recovery Rebate Credit#IRS non-filer alert#Claim stimulus credit#Tax rebate for non-filers#COVID-19 financial assistance#Filing for rebate credit#IRS tax deadline#Non-filer rebate eligibility#IRS 1040 Form#Stimulus rebate for small businesses

0 notes

Text

How the Biden-Harris Economy Left Most Americans Behind

A government spending boom fueled inflation that has crushed real average incomes.

By The Editorial Board -- Wall Street Journal

Kamala Harris plans to roll out her economic priorities in a speech on Friday, though leaks to the press say not to expect much different than the last four years. That’s bad news because the Biden-Harris economic record has left most Americans worse off than they were four years ago. The evidence is indisputable.

President Biden claims that he inherited the worst economy since the Great Depression, but this isn’t close to true. The economy in January 2021 was fast recovering from the pandemic as vaccines rolled out and state lockdowns eased. GDP grew 34.8% in the third quarter of 2020, 4.2% in the fourth, and 5.2% in the first quarter of 2021. By the end of that first quarter, real GDP had returned to its pre-pandemic high. All Mr. Biden had to do was let the recovery unfold.

Instead, Democrats in March 2021 used Covid relief as a pretext to pass $1.9 trillion in new spending. This was more than double Barack Obama’s 2009 spending bonanza. State and local governments were the biggest beneficiaries, receiving $350 billion in direct aid, $122 billion for K-12 schools and $30 billion for mass transit. Insolvent union pension funds received a $86 billion rescue.

The rest was mostly transfer payments to individuals, including a five-month extension of enhanced unemployment benefits, a $3,600 fully refundable child tax credit, $1,400 stimulus payments per person, sweetened Affordable Care Act subsidies, an increased earned income tax credit including for folks who didn’t work, housing subsidies and so much more.

The handouts discouraged the unemployed from returning to work and fueled consumer spending, which was already primed to surge owing to pent-up savings from the Covid lockdowns and spending under Donald Trump. By mid-2021, Americans had $2.3 trillion in “excess savings” relative to pre-pandemic levels—equivalent to roughly 12.5% of disposable income.

So much money chasing too few goods fueled inflation, which was supercharged by the Federal Reserve’s accommodative policy. Historically low mortgage rates drove up housing prices. The White House blamed “corporate greed” for inflation that peaked at 9.1% in June 2022, even as the spending party in Washington continued.

In November 2021, Congress passed a $1 trillion bill full of green pork and more money for states. Then came the $280 billion Chips Act and Mr. Biden’s Green New Deal—aka the Inflation Reduction Act—which Goldman Sachs estimates will cost $1.2 trillion over a decade. Such heaps of government spending have distorted private investment.

While investment in new factories has grown, spending on research and development and new equipment has slowed. Overall private fixed investment has grown at roughly half the rate under Mr. Biden as it did under Mr. Trump. Manufacturing output remains lower than before the pandemic.

Magnifying market misallocations, the Administration conditioned subsidies on businesses advancing its priorities such as paying union-level wages and providing child care to workers. It also boosted food stamps, expanded eligibility for ObamaCare subsidies and waved away hundreds of billions of dollars in student debt. The result: $5.8 trillion in deficits during Mr. Biden’s first three years—about twice as much as during Donald Trump’s—and the highest inflation in four decades.

Prices have increased by nearly 20% since January 2021, compared to 7.8% during the Trump Presidency. Inflation-adjusted average weekly earnings are down 3.9% since Mr. Biden entered office, compared to an increase of 2.6% during Mr. Trump’s first three years. (Real wages increased much more in 2020, but partly owing to statistical artifacts.)

Higher interest rates are finally bringing inflation under control, which is allowing real wages to rise again. But the Federal Reserve had to raise rates higher than it otherwise would have to offset the monetary and fiscal gusher. The higher rates have pushed up mortgage costs for new home buyers.

Three years of inflation and higher interest rates are stretching American pocketbooks, especially for lower income workers. Seriously delinquent auto loans and credit cards are higher than any time since the immediate aftermath of the 2008-09 recession.

Ms. Harris boasts that the economy has added nearly 16 million jobs during the Biden Presidency—compared to about 6.4 million during Mr. Trump’s first three years. But most of these “new” jobs are backfilling losses from the pandemic lockdowns. The U.S. has fewer jobs than it was on track to add before the pandemic.

What’s more, all the Biden-Harris spending has yielded little economic bang for the taxpayer buck. Washington has borrowed more than $400,000 for every additional job added under Mr. Biden compared to Mr. Trump’s first three years. Most new jobs are concentrated in government, healthcare and social assistance—60% of new jobs in the last year.

Administrative agencies are also creating uncertainty by blitzing businesses with costly regulations—for instance, expanding overtime pay, restricting independent contractors, setting stricter emissions limits on power plants and factories, micro-managing broadband buildout and requiring CO2 emissions calculations in environmental reviews.

The economy is still expanding, but business investment has slowed. And although the affluent are doing relatively well because of buoyant asset prices, surveys show that most Americans feel financially insecure. Thus another political paradox of the Biden-Harris years: Socioeconomic disparities have increased.

Ms. Harris is promising the same economic policies with a shinier countenance. Don’t expect better results.

#Wall Street Journal#kamala harris#Tim Walz#Biden#Obama#destroyed the economy#america first#americans first#america#donald trump#trump#trump 2024#president trump#ivanka#repost#democrats#Ivanka Trump#art#landscape#nature#instagram#truth

166 notes

·

View notes

Text

I’m not sure how reliably I’ll be able to keep up with it, but I’ve been wanting to start posting weekly or monthly Good News compilations, with a focus on ecology but also some health and human rights type stuff. I’ll try to keep the sources recent (like from within the last week or month, whichever it happens to be), but sometimes original dates are hard to find. Also, all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.

Anyway, here’s some good news from the first week of March!

1. Mexican Wolf Population Grows for Eighth Consecutive Year

““In total, 99 pups carefully selected for their genetic value have been placed in 40 wild dens since 2016, and some of these fosters have produced litters of their own. While recovery is in the future, examining the last decade of data certainly provides optimism that recovery will be achieved.””

2. “Remarkable achievement:” Victoria solar farm reaches full power ahead of schedule

“The 130MW Glenrowan solar farm in Victoria has knocked out another milestone, reaching full power and completing final grid connection testing just months after achieving first generation in late November.”

3. UTEP scientists capture first known photographs of tropical bird long thought lost

“The yellow-crested helmetshrike is a rare bird species endemic to Africa that had been listed as “lost” by the American Bird Conservancy when it hadn’t been seen in nearly two decades. Until now.”

4. France Protects Abortion as a 'Guaranteed Freedom' in Constitution

“[A]t a special congress in Versailles, France’s parliament voted by an overwhelming majority to add the freedom to have an abortion to the country’s constitution. Though abortion has been legal in France since 1975, the historic move aims to establish a safeguard in the face of global attacks on abortion access and sexual and reproductive health rights.”

5. [Fish & Wildlife] Service Approves Conservation Agreement for Six Aquatic Species in the Trinity River Basin

“Besides conserving the six species in the CCAA, activities implemented in this agreement will also improve the water quality and natural flows of rivers for the benefit of rural and urban communities dependent on these water sources.”

6. Reforestation offset the effects of global warming in the southeastern United States

“In America’s southeast, except for most of Florida and Virginia, “temperatures have flatlined, or even cooled,” due to reforestation, even as most of the world has grown warmer, reports The Guardian.”

7. Places across the U.S. are testing no-strings cash as part of the social safety net

“Cash aid without conditions was considered a radical idea before the pandemic. But early results from a program in Stockton, Calif., showed promise. Then interest exploded after it became clear how much COVID stimulus checks and emergency rental payments had helped people. The U.S. Census Bureau found that an expanded child tax credit cut child poverty in half.”

8. The Road to Recovery for the Florida Golden Aster: Why We Should Care

“After a five-year review conducted in 2009 recommended reclassifying the species to threatened, the Florida golden aster was proposed for removal from the Federal List of Endangered and Threatened Plants due to recovery in June 2021, indicating the threats to the species had been reduced or eliminated.”

9. A smart molecule beats the mutation behind most pancreatic cancer

“Researchers have designed a candidate drug that could help make pancreatic cancer, which is almost always fatal, a treatable, perhaps even curable, condition.”

10. Nurses’ union at Austin’s Ascension Seton Medical Center ratifies historic first contract

“The contract, which NNOC said in a news release was “overwhelmingly” voted through by the union, includes provisions the union believes will improve patient care and retention of nurses.”

This and future editions will also be going up on my new Ko-fi, where you can support my art and get doodled phone wallpapers! EDIT: Actually, I can't find any indication that curating links like this is allowed on Ko-fi, so to play it safe I'll stick to just posting here on Tumblr. BUT, you can still support me over on Ko-fi if you want to see my Good News compilations continue!

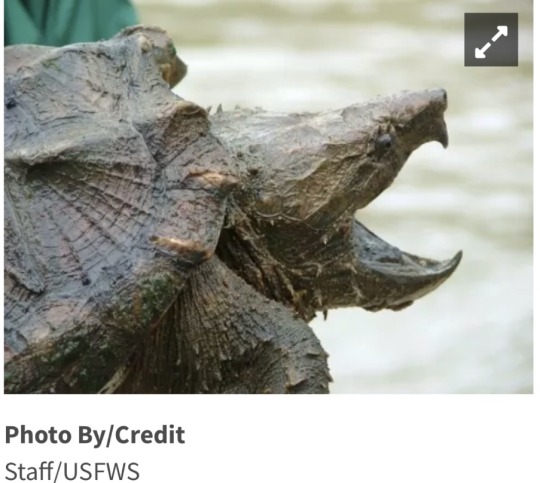

#hopepunk#good news#wolf#wolves#mexican wolf#conservation#solar#solar power#birds#abortion#healthcare#abortion rights#reproductive rights#reproductive health#fish and wildlife#turtles#alligator snapping turtle#snapping turtle#river#reforestation#global warming#climate change#climate solutions#poverty#social safety net#flowers#endangered species#cancer#science#union

16 notes

·

View notes

Photo

Having a president who isn’t exciting is underrated. The president is the chief executive of the United States; essentially that’s like a federal CEO. A dull Tim Cook has done far more for Apple than an exciting Elon Musk has done for Twitter.

Gerald Ford, though younger, was probably the closest GOP equivalent of Joe Biden. Like Biden, he spent decades on Capitol Hill before becoming VP and then president. Ford was the last truly moderate Republican president. Except for his pardon of Richard Nixon, his record doesn’t look terrible.

Ford appointed one of the best SCOTUS justices of the late 20th century – John Paul Stevens.

The inflation rate the year he took office (1974) was 11.03%. In 1976, Ford’s last full year in office, it was down to 5.75%.

Under Ford, the US negotiated and signed the Helsinki Accords which recognized the integrity of international boundaries in Europe. This treaty was the basis for peace between countries* in Europe for 47 years – until it was violated by Putin’s invasion of Ukraine.

Like Ford, Biden restored calm and decorum to the presidency after succeeding an impeached wacko president.

Joe Biden may personally be even less flashy than Gerald Ford. But he has brought the country back into scientific normalcy on climate change and has put the federal government firmly on the side of LGBTQ rights and reproductive freedom. And even before Russia’s illegal invasion, he placed the United States on the side of supporting the independence and freedom of pro-democracy Ukraine.

Dull but competent trumps exciting but catastrophic.

This is from a piece by Dylan Matthews published at Vox in March prior to Biden’s announcement.

Joe Biden is pretty good at being president. He should run again.

Biden deserves a lot of credit for that state of affairs — more than the credit or blame that presidents usually deserve for the state of the economy.

Learning from the overly tepid fiscal stimulus enacted by the Obama administration in response to the 2007-2009 recession, at the start of his term Biden ushered through a massive $1.9 trillion package, the American Rescue Plan, that kept progress on jobs and wages from stalling out as Trump-era measures faded.

The package overshot significantly; he made the opposite mistake that Obama made in 2009. But his was the better direction in which to err: the inflation that resulted, while painful, was less painful than the many years of excess unemployment and depressed demand that resulted after 2009. In the meantime, the measure plunged child poverty to a record low by expanding the child tax credit.

Much has been made of the ways in which moderate Sens. Joe Manchin (D-WV) and Kyrsten Sinema (I-AZ) frustrated Biden’s grander ambitions. It’s certainly true that Sinema blocked his plans to tax high earners more heavily, and Manchin kept the child tax credit improvements from being made permanent.

But looking at what actually did pass during Biden’s first two years, one gets a different picture. Biden signed the largest investment in R&D and deployment of clean energy in US history into law; the head of the International Energy Agency termed it the world’s most important climate action since the Paris accords.

Separately, Biden signed into law hundreds of billions in new science funding, passed on a bipartisan basis as part of an effort to strengthen semiconductor manufacturing. After the Trump administration’s famous failure to pass an infrastructure bill, Biden did it.

Looking abroad, the administration’s handling of the Ukraine war has been outstanding. Choosing to release intelligence showing Russia’s invasion plans in the weeks leading up to the attack was a masterstroke, denying Russian President Vladimir Putin any ability to claim that Ukraine provoked him. Biden has kept his G7 counterparts aligned in imposing sanctions on Russia, denying it oil revenue, and supplying weapons to Ukraine.

The result is a war that is already vastly more costly than Putin bargained for, without US or NATO troops being dragged into the conflict, and backdoor progress on something US presidents had been fruitlessly pursuing for years: increased European military spending.

[ ... ]

Taking the good with the bad, Biden looks like a fairly successful president, overseeing an unusually good economy without US troops in danger. That’s not normally someone you want stepping aside.

As for age, I don’t care if Biden is 80 or 180. His mind is working fine and he has successfully coped with a stutter since childhood. Having thrived despite a disability is a sign of strength rather than weakness.

There have been a number of leaders who have done just fine in old age.

Konrad Adenauer became chancellor of (then) West Germany at age 73 and remained in that position until age 87. Adenauer was one of the founders of the EU. Dr. Mahathir Mohamad stepped down as prime minister of Malaysia in 2003 at age 78; BUT he later came out of retirement and served again as prime minister from 2018 to 2020 when he left office at age 94. Queen Elizabeth II was carrying out her constitutional duties to the very end. Just two days before her death at age 96 she met with Liz Truss to formally appoint her as prime minister.

People in their 80s and 90s may be a bit slower, but that makes them less impulsive too. Does being a sprightly 45 years old automatically make Ron DeSantis somebody we’d trust with his finger on the nuclear button?

________________________________ * The Balkan Wars of the 1990s were primarily internal.

#joe biden#biden administration#re-elect biden#unexciting is a virtue#lgbtq rights#reproductive freedom#gerald ford#konrad adenauer#mahathir mohamad#elizabeth ii#ageism#election 2024#steve greenberg

28 notes

·

View notes

Note

I want to hear more of your takes about May Welland from the age of innocence. Archer does her so dirty with his unreliable narration, justice for May

truly be careful what you wish for because i have so many thoughts on this. so many, in fact, that i legit presented a paper on this topic at a graduate seminar on modernism last may. i essentially argued that wharton created may to critique high society’s obsession with infantilizing young women. i'm copy and pasting a little piece of my essay that hits on some of my key points!:

In her reflections on her life, essays, and other works of fiction, Wharton was particularly outspoken about America’s preference for child-women. In Wharton’s New Year's Day, she refers to young women as simply being “passed from the nursery to marriage as if lifted from one rose-lined cradle into another”. Her argument continues in her book French Ways and Their Meaning where she claims that compared with the women of France the average American woman is “still in the kindergarten”. She justifies such a bold claim by elaborating that the function of kindergarten is to let children develop in a regulated bubble. Like a kindergartener, American women develop within the confines of a strict social sphere that monitors their every move. She writes that the average American woman never fully develops intellectually because she is “developing…in the void” without the “checks, the stimulus, and the discipline” of the dominant masculine world because the society that she belongs to does not place an equal intellectual value on men and women

Such a sentiment is supported in The Age of Innocence when Newland transitions from reading poetry to history in the evenings to thwart May’s attempts to offer her own opinions on the poems, something he finds “destructive” to the reading experience. Newland rejects May’s attempt to converse with him about poetry because he does not believe her to be his intellectual equal. Scholar Gwendolyn Morgan argues that Newland is unable to see May’s latent intelligence because he keeps May in a “doll house” which is where society has taught him she belongs. It is here that Wharton solidifies May Welland’s status as a tragic heroine. The poetry incident is just one example of Newland underestimating May because of the way she was raised; the moment when May catches Newland in his lie about developments in a patent case so that he can visit Ellen comes to mind. May is more aware than other characters, especially Newland, give her credit for. However she is too enmeshed in the Old New York society that created her for her to reach her full intellectual potential. To me, the real tragic character in The Age of Innocence is not one of the star-crossed lovers but the young woman who was set up to fail by her own family and her own society before the events of the book even began.

i am so happy to meet another may supporter!! legit dm me any time i have so many thoughts about her!!

#may!! my girl my bestie i will defend you with my last dying breath#the age of innocence#may welland#edith whatrton#answers

6 notes

·

View notes

Text

Understanding Research and Development Tax Credits

Research and Development tax credits are government incentives designed to encourage innovation and technological advancement by providing financial benefits to companies that invest in qualifying R&D activities. This guide explores the fundamentals of Understanding Research and Development Tax Credits, eligibility criteria, benefits, and how businesses can claim these credits to support their innovation efforts.

What are Research and Development Tax Credits?

Research and Development (R&D) tax credits are tax incentives offered by governments to companies that undertake eligible R&D activities. These credits aim to stimulate innovation, boost economic growth, and enhance competitiveness by reducing the after-tax cost of R&D investments.

Eligibility Criteria for R&D Tax Credits

Eligibility for R&D tax credits varies by country, but generally, companies must meet certain criteria:

1. Qualifying R&D Activities

The R&D activities must involve systematic, investigative activities that seek to achieve scientific or technological advancement.

2. Technical Uncertainty

There must be technical uncertainty, meaning that the knowledge or capability to achieve the desired outcome is not readily available or deducible by a competent professional in the field.

3. Process of Experimentation

The activities must involve a process of experimentation to resolve the technical uncertainty. This could include testing hypotheses, prototyping, or developing new materials or processes.

4. Innovative Nature

The activities should aim to create new or improve existing products, processes, or services.

5. Documentation

Companies typically need to maintain documentation that demonstrates the nature of the R&D activities, the technical challenges faced, and the steps taken to overcome them.

Benefits of R&D Tax Credits

Source – Easy Digital Filing

1. Financial Incentive

R&D tax credits provide a direct financial benefit to eligible companies by reducing their tax liability. This allows businesses to reinvest savings into further innovation and R&D activities.

2. Enhanced Cash Flow

Companies can benefit from improved cash flow as a result of reduced tax payments or refunds. This liquidity can be crucial for funding ongoing R&D projects or other business operations.

3. Competitive Advantage

Access to R&D tax credits can enhance a company’s competitiveness by facilitating innovation and enabling the development of new products, processes, or technologies ahead of competitors.

4. Support for Growth

By reducing the cost of R&D investments, tax credits support business growth and expansion. They encourage companies to invest in innovation, which can lead to increased productivity, market share, and profitability.

5. Economic Stimulus

R&D tax credits contribute to economic growth by promoting investment in research and development, which drives technological advancements and job creation.

How to Claim R&D Tax Credits

1. Understand Eligibility Criteria

Review the specific eligibility criteria and requirements for R&D tax credits in your country or jurisdiction. Consult with tax advisors or R&D specialists to ensure your activities qualify.

2. Identify Qualifying Activities

Identify and document all eligible R&D activities conducted within your organization. This may include research projects, experimental developments, and innovation initiatives.

3. Calculate R&D Expenditures

Determine the eligible R&D expenditures incurred during the tax year, such as wages for R&D personnel, costs of materials used in experiments, and overhead expenses directly attributable to R&D activities.

4. Prepare Documentation

Gather supporting documentation, including project plans, technical reports, timesheets, and financial records that demonstrate the nature and scope of your R&D activities.

5. Submit Claim

File your R&D tax credit claim with the relevant tax authority according to their guidelines and deadlines. Include all required documentation and calculations to support your claim.

6. Review and Follow Up

Monitor the progress of your claim and respond promptly to any requests for additional information or clarification from the tax authority. Keep detailed records of all communications related to your claim.

Examples of Qualifying R&D Activities

Development of new products or processes

Improvement of existing products or processes

Prototyping and testing of new concepts

Software development involving technical challenges

Applied research to advance scientific knowledge

Development of innovative materials

Conclusion

Research and Development tax credits are valuable incentives that encourage companies to innovate, invest in technological advancements, and drive economic growth. By reducing the cost of qualifying R&D activities, these credits provide financial benefits, enhance cash flow, and support business competitiveness. Understanding the eligibility criteria, documenting R&D activities effectively, and preparing a comprehensive claim are essential steps for businesses looking to leverage R&D tax credits to fuel their innovation strategies and achieve long-term success in a rapidly evolving global economy.

Also Read: Securing Your Financial Future: Understanding Tax-Free Retirement Accounts

0 notes

Text

“For the past three decades, China has been on the upswing of a supercycle that saw an almost uninterrupted expansion of the country's capacity to manufacture, appetite to consume, and ability to project power across the world economy. The Chinese Communist Party relentlessly pursued economic development over all else, even when that single-mindedness pushed the party to make debilitating policy mistakes — creating a massive bubble in the property market, saddling provinces with loads of debt, and failing to transition away from an overreliance on investment. There was no time to stop for corrections while China's mind was on money alone.

(…)

President Xi Jinping has shifted the CCP's raison d'être to national security over the economy. Getting rich isn't China's big project anymore; the project is power. As a result, both the government's priorities and behavior have changed. In the past, whenever it seemed like a recession was on the horizon, the CCP came to rescue. There's no hefty stimulus coming this time. Nor will the explosive growth that experts once expected from China return. Beijing's relationship with the outside world is no longer guided by the principles of economic rationality, but rather its yearning for political power.

"This isn't about the economy anymore, it's all about advanced technology and weaponry," Lee Miller, the founder of the Chinese economic surveyor China Beige Book, told me.

(…)

The Chinese economy has been bending under the weight of its structural problems for almost a decade now, but since the end of Xi's COVID-lockdown policy, it's become clear that its growth model is well and truly broken. Beijing's story so far has been to claim that, like other economies on the mend from the pandemic, China will in time resume its normal growth pattern. Instead, it looks like the economy is falling behind.

Let's start with the country's real-estate market, the importance of which cannot be overstated. Not only is it the biggest source of wealth for Chinese households, real estate is also the mechanism through which local governments are financed. Instead of property taxes, municipalities sell large swaths of land to property developers and then use the revenue for basic social services like fixing roads and paying out pensions. Cities like Shanghai and Beijing get a lot of attention, but they make up just a fraction of the property market. Property firms did the most building in third-tier cities where people aren't as wealthy. This is where you'll find China's infamous ghost cities.

It's been clear for years that the Chinese real-estate market has been in trouble. China has a population of 1.4 billion, but it has built housing for a population of 3 billion, according to expert estimates. Many of the mega-developments became empty monuments to Beijing's insatiable desire for growth. In Shenyang, farmers have taken over a development of empty mansions for cattle grazing.

Worried that the sector would implode, Beijing attempted on multiple occasions to limit the credit that was fueling the bubble. But because real estate played such a vital role as a government-funding mechanism, China had to keep building, despite these troubles. Authorities didn't want to change the way local governments funded themselves or allow Chinese household finances to crumble, so they could not let prices fall. That credit addiction remains.

But this system, supported by speculation and easy money, is starting to break down. Country Garden, China's largest real-estate developer, is on the brink of collapse. In a sign that Beijing has grown tired of this game, Xu Jiayin, the chairman of Evergrande, another embattled real-estate behemoth, has been detained by authorities. Money-starved provinces are being forced to ask for bailouts — which the federal government doesn't want to give — and sell assets that the local governments claim are illiquid. The country's massive, opaque shadow-banking sector, which served as the backbone for the real-estate boom, is also under pressure. At least one $87 billion money manager, Zhongrong Trust, skipped payments to investors this summer, sparking protests.

(…)

Official data has shown relatively modest price declines so far, but like a lot of official economic data coming from Biejing these days, it's hard to take those numbers seriously. Private data shows prices falling by 15% in metropolises like Shenzhen and Shanghai. In tier-two and tier-three cities, prices have fallen by as much as 50%, according to Bloomberg. "Eighty percent of all sales by area are in tier-three and below cities," Chu said, adding that many of these places are facing long-term structural problems. "If their market doesn't come back, the entire market doesn't come back."

The real-estate sector is the most visible sign of China's fading star, but other key parts of the economy are showing strain as well. While the rest of the world is battling inflation, China is still in deflationary mode. August CPI came in at 0.1%, up from minus-0.3% the month before, showing an overall lack of domestic demand. Exports — which make up 40% of the country's GDP growth — hit their lowest level in three years in July, falling 14% from the same time a year before. August export figures showed some improvement but still came in down 8.8% from the year before.

Overall, Autonomous expects China's exports to slow 8% compared to last year. Chu — who has been called the "rock star" of Chinese debt analysis — told me that this weakness is not just a result of a cyclical downturn; it's a part of a more permanent shifting of supply chains caused by trade tensions with Europe and the US. These are powerful forces that are not easily reversed. Once multinational corporations no longer see China as a source of steady growth, they could begin changing their plans to invest. At the same time, domestic anxiety about shrinking employment may change the basic consumer behavior that powered China's rise. This can create a vicious, self-reinforcing cycle that keeps investment out and spending low.

Chu started the year with one of the weakest growth outlooks for China on Wall Street, and the second half is looking worse. Autonomous' proprietary growth index for China, the Real Autono Economic Activity Composite, projects the country's economy to grow by 3.8% for all of 2023, down from its original 4.2% projection in January — and worse than Autonomous projected during the depths of China's COVID lockdown. Beijing is projecting 5% growth — and given how tightly the CCP likes to manage expectations, officials will stick to that number come hell or high water. It's a far cry from the double-digit growth policymakers used to demand and a signal to the Chinese people that Beijing is not going to direct its banks to spew credit to get the economy moving faster again.

(…)

Plus, Beijing may need to conserve its firepower for other concerns coming down the pipeline. In the long-term, the CCP has to worry about China's demographics. Thanks to government mandates like the one-child policy, the country's population is rapidly aging — and even started to decline in 2022. The workforce will soon begin shrinking: Right now there are three working-age adults for every retired person in China, according to data compiled by J Capital Research, and by 2050, that ratio will hit one to one. Without booming property prices or continued growth, the growing pool of retirees will put a heavy burden on China's threadbare social safety net. GDP per capita is currently about $12,800. When Japan started struggling in 1991 with a similar dynamic — aging population, sky-high debt, and slowing growth — its GDP per capita was more than triple that amount, at $41,266 in today's dollars. China will get old before it gets rich, placing the task of growing the economy on fewer and fewer people as time goes on.

(…)

"All the policies are now determined by Xi Jinping himself, and his priorities are spending money to engage in a technology and national-security race with the US," Shih explained.

Once upon a time, infrastructure and property were the big beneficiaries of Beijing's largess, now it's the military. US government estimates put China's annual defense budget at about $700 billion, much higher than independent NGO estimates of about $290 billion and just shy of what the US spends on defense annually, $800 billion.

(…)

China has never been a big consumer of American imports, but certain sectors will get hurt as our trade relationship is reset. A faltering Chinese economy will suppress demand for commodities like oil seeds and grain, hitting US farmers especially hard. It will also eat into corporate profits for companies such as Nike and Starbucks that made large bets on Chinese consumers. US restrictions on technology exports — created to counter new national-security concerns — threaten the more than $50 billion of revenue that US chipmakers generate selling to China. Wall Street doesn't have to go home, but it can't stay here. The WSJ reported that foreign executives are jittery about visiting China, afraid they'll never be allowed to leave. The great traveling circus that is hot money and adventure capitalism is already scouring the world for its next opportunity in countries like Mexico and Vietnam. These are forces bigger than Beijing.

Earlier this month, the House Select China Competition Committee held a hearing in New York City, calling on witnesses to describe what risk looks like with a Chinese Communist Party that's less committed to the free flow of capital and more concerned with flexing its muscles within its region. In her testimony, Anne Stevenson-Yang, the founder of J Capital Research, said that the US — especially its Midwest industrial heartland — isn't invested in China because of market demand. It's invested there for the outsourcing of mechanical goods and labor. For the US economy, China as a workshop is much more important than China as a consumer. Companies will need to scour their supply chains for potential vulnerabilities and consider their exposure accordingly. When Beijing is focused on national security, rules can change at the drop of a dime. Foreign businesspeople who once sought efficiencies going in may find it cumbersome to get out.

(…)

It's time to imagine a future where China does not become rich but may remain powerful — building its army and continuing to develop its domestic technological capabilities. History has shown that economic privation need not impede China's technological achievement. During the depths of the Maoist purges, the CCP was still able to develop the atomic bomb, the hydrogen bomb, and its own intercontinental ballistic missiles. Xi has warned China to prepare for "great struggles" on the road to glory. Now that China's economic supercycle is over, that may be the cycle we're about to witness. It will be a painful adjustment.”

1 note

·

View note

Text

...."

While Republicans on the campaign trail and in Congress regularly bash the law — which Biden signed a year ago Wednesday — as big-government overreach by Democrats bent on killing off fossil fuels, its benefits are disproportionately landing in their communities. And as the measure supercharges efforts to combat climate change, it’s also rekindling economies where people have felt forgotten, potentially softening how some voters view Biden as he seeks reelection.

“We always knew that it would fall across America, not in one particular state or another,” Senate Majority Leader Chuck Schumer said in an interview. “We know that rural areas have been neglected, we know that rural areas have fallen behind, and we wanted to help those rural areas. And if some of those rural areas are red, so be it.”

For the companies that are hoping to reap federal tax incentives as well as state and local sweeteners, Republican parts of the country often look more attractive. Of the 200 project locations that have been announced through July, more than 60 percent are in GOP-held districts, according to a POLITICO analysis.

“Companies are building projects where they will be the most effective and generate the most resources,” said Jason Grumet, CEO of the American Clean Power Association, a clean energy industry trade group. “It is no surprise in the Southeast, Upper Midwest, where you have significant amounts of manufacturing capacity, much of which has been idled and left the country.”

As the IRA hits its first anniversary, POLITICO traveled across the nation to examine how the law is playing out in Oklahoma (where the Republican governor is claiming credit for the state’s booming clean energy sector), Michigan (where multibillion-dollar battery projects will generate jobs but are provoking uproars over Chinese ties) and upstate New York (where Republican congressmembers in Biden districts are trying to navigate the politics of the IRA)."

0 notes

Text

Did you know about the Employee Retention Credit, or ERC? It's a government stimulus program established by the CARES Act to provide support to businesses that kept their employees on payroll during Covid-19. The ERC is designed as a refundable tax credit that businesses can claim to offset the costs of retaining employees.

Get in touch to schedule a consultation today! (800) 452-8485

Helping American Businesses reinvest in themselves. http://surl.li/jasmo

1 note

·

View note

Text

#Recovery Rebate Credit deadline#Claim stimulus payments#IRS non-filer credit#Economic Impact Payment recovery#Tax filing for non-filers#Unclaimed stimulus rebate#IRS rebate credit claim#Non-tax filers 2020 stimulus#Pandemic relief credit filing#IRS refund for missed payments

0 notes

Text

The Best ERC Services

We have the best and high rich standard of employee retention credit services and we might help you get your stimulus tax credit without all the effort. Employers who perceive how to correctly and precisely calculate their very own employee retention credit amount turn out to be one step nearer to taking half in a component in efficiently revitalizing their companies. It's important to supply quite so much of perks that your group can benefit from, similar to well-being assistance, credit help, or employee retention - ERC in USA

They give a variety of self-limiting recruitment, employee retention, and more of the trade as discussed throughout this report, the scope for the development of revolutionary practices is wide. It is critical for the industry to know the relationship between recruitment and retention

The employee retention tax credit can be a beneficial part of helping companies rebuild their post-pandemic operations, with employers capable of calculating of their eligible wages as a tax credit score. Employers ought to take care to accurately calculate their credit quantity and remain compliant with regulations to make sure everything stays above board, to have the ability to maximize the influence of this chance - Employee Retention Credit

These employers are allowed to claim up per employee as a payroll tax credit score in opposition to their quarterly federal employment taxes. In recruitment and retention strategies, employers need to contemplate these characteristics. For more information, please visit our website https://ercpaymentgroups.com/

0 notes

Text

The Effects of the Pandemic on Taxes and Tax Filing

Introduction

The COVID-19 pandemic has had a profound impact on nearly every aspect of our lives, including the way we file our taxes. The government has implemented several measures to provide relief to individuals and businesses affected by the pandemic, and it’s important to understand how these changes may affect your tax situation. In this blog post, we’ll take a look at some of the key changes to taxes and tax filing as a result of the pandemic.

Economic Impact Payments

One of the most significant changes to taxes as a result of the pandemic is the distribution of Economic Impact Payments (EIPs), also known as stimulus checks. These payments were issued to eligible individuals to provide financial assistance during the pandemic. The first round of payments, which were issued in April 2020, were based on 2019 tax returns. The second round, issued in December 2020, were based on either 2019 or 2020 tax returns, depending on which was most recently filed. It’s important to note that these payments are not taxable income and do not need to be reported on your tax return.

Unemployment Benefits

Another change to taxes as a result of the pandemic is the increased number of individuals receiving unemployment benefits. These benefits, which are typically provided by state governments, are taxable income and must be reported on your tax return. However, the federal government has temporarily expanded the amount of unemployment benefits available, and the first $10,200 of these benefits will be tax-free for those with adjusted gross income (AGI) of less than $150,000.

Charitable Contributions

Small Businesses

Small businesses have been particularly hard hit by the pandemic, and the government has implemented several measures to provide relief. One of the most significant changes is the Paycheck Protection Program (PPP), which provides forgivable loans to small businesses to help cover payroll and other expenses. The PPP loan forgiveness is not taxable, but the expenses paid for with the loan are still tax-deductible. Additionally, the Employee Retention Tax Credit, which is worth up to $5,000 per employee, is available to businesses that have experienced a significant decline in gross receipts.

Deadline Extension

The IRS has extended the deadline to file and pay federal income taxes from April 15, 2021 to May 17, 2021. Taxpayers will have until July 15, 2021 to pay any taxes owed. This extension applies to all taxpayers, including those who file self-employed or business income tax returns.

Changes in deductions and credits

The pandemic has also brought some changes in the deductions and credits that can be claimed in your tax return. For example, the CARES act increased the limit on deductions for business meals from 50% to 100% for the year 2020. Additionally, the act also allows eligible taxpayers to claim a refundable credit of up to $5,000 for employee retention.

Impact on Self-Employed

Self-employed individuals have been hit hard by the pandemic, and the government has implemented measures to provide relief. The CARES Act includes a new tax credit, the Credit for Sick and Family Leave, which allows eligible self-employed individuals to claim a credit of up to $5,110 for leave taken due to the pandemic. Additionally, the Act also allows self-employed individuals to claim a refundable credit against their self-employment tax for a portion of their net earnings from self-employment that have been impacted by the pandemic.

Impact on Retirement savings

The pandemic has also brought changes to the rules surrounding retirement savings. The CARES Act has temporarily increased the limit on tax-favored withdrawals from qualified retirement plans to $100,000 for distributions made in 2020. Additionally, the act also allows for the suspension of required minimum distributions from certain retirement plans for 2020.

Impact on Estate and Gift Tax

The pandemic has also brought changes to the rules surrounding estate and gift tax. The CARES Act temporarily increased the estate and gift tax exclusion for 2020 to $11.58 million per individual, up from $11.4 million in 2019. Additionally, the act also allows for the postponement of the filing of estate tax returns and the payment of estate taxes for certain estates of decedents who died in 2020 until January 1, 2022.

Impact on Education Tax

The pandemic has also brought changes to the rules surrounding education tax. The CARES Act temporarily suspended the requirement to file a Form 1098-T for the 2020 tax year, and it also allows for the distribution of up to $10,000 of qualified education expenses tax-free from a 529 plan for elementary, secondary, or vocational schools.

Conclusion

The COVID-19 pandemic has had a significant impact on taxes and tax filing, with changes to Economic Impact Payments, unemployment benefits, charitable contributions, small business relief, deductions and credits, self-employed, retirement savings, estate and gift tax, and education tax. It’s important to be aware of these changes and how they may affect your tax situation. If you have any questions or concerns, it’s always a good idea to consult with a tax professional. It is crucial to stay informed about the updates and changes in the tax laws, so you can take advantage of the relief measures and avoid any penalties.

#CARES Act changes.#COVID-19 pandemic#retirement savings#taxes and tax filing#unemployment benefits#blogger#finance#writers on tumblr#business

0 notes

Text

ERC With Bottom Line Concepts

What is ERC? ERC is a stimulus program designed to help those businesses that were able to retain their employees during the Covid-19 pandemic. Established by the CARES Act, it is a refundable tax credit – a grant, not a loan – that you can claim for your business. The ERC is available to both small and mid-sized businesses. It is based on qualified wages and healthcare paid to employees. Who…

View On WordPress

0 notes

Text

I Didn't Come this Far Just to Die!

Thursday, February 16th, 2023

Waves. That’s what I’m experiencing right now. Waves of “maybe” glimpses of hope, waves of anxiety, waves of sleeplessness, waves of heart palpitations.

I just read a chapter of 20,000 Leagues Under the Sea in which one of the main characters is soooo close to attempting an escape from the Nautilus. And then, right before the attempt, the Nautilus dives to the bottom of the ocean.

Ned Land, who was to lead the attempted escape, curses at the sky vehemently, of course.

That’s how I feel right now. I’m trying to fight back the feelings of having the weight of the world on my shoulders, of feeling like I can escape this seemingly inescapable situation I’m in right now.

I spent a good deal of today just sleeping and reading.

I woke up too many times last night to feel anything close to rested today.

But I am glad that I took time away from the computer, all the same. I even mustered up the strength to walk down the road and sit on a bench by the lake. I was glad to have finally left the house for once, but the overcast skies still reflected my inner state all too well.

This isn’t just about me. This about my sibling. This is about what’s going to happen to ALL of us in the next six months to a year. Those who try to claim we’re “in an age of prosperity” are delusional. The Fed and the government in their handling of “the illness” have majorly tanked our economy, inflated the dollar, screwed up supply chains, and just basically done all they can to destabilize everything. The price of fuel going down? What fuel? That’s from our fastly diminishing reserves. Joblessness at all-time low? It’s a bubble. Look at layoffs.fyi (site). So many companies are laying off for good reason. They know what’s coming. Soon, even those who finally woke up and realized that “stimulus checks” (hello sky rocking inflation and backdoor Socialism) aren’t going to save them won’t have jobs to go to. Credit debt is at an all-time high, and delinquent mortgages are even worse than in the housing crash of 2008.

So, understandably, I don’t want to waste any more time! Again, this isn’t just about saving myself, or even just my family. We NEED to be creating more jobs. That is part of addressing the homelessness. People can’t find stability if they don’t have an income. And don’t I know it!

I’m still going to go down fighting, either way. Figuratively, of course. With only a week left till that impending date, I still don’t really know the way forward, and I’m not going to waste my time or yours trying to list what I’m doing in an attempt to avert it.

But I am trying. This may end with me on the street, or in jail, or maybe the hospital. But I can’t just lay down and do nothing.

I apologize for the seemingly pessimistic outlook of this post. This is just me being blunt, being honest. If anything, my lesson to you is, DON’T burn down bridges recklessly, come to compromises with those around you if you have to, and don’t stop fighting until you basically are about to drop dead.

I think that the reason that the opening scene of The Last of Us hits me every single time is because the concept of having your entire world altered, of having all you've known and loved suddenly taken away from you hits home for me very hard. And now...even more so. These stories are far more than just stories to me, all the more. Down to the detail of having somebody you care about being part of your driving force to stay alive and press onwards.

youtube

This music^ = the state of my heart right now.

0 notes

Text

slams my hands on the desk opens up turbotax and files my tax return the second my w2 touches my fingers to pre-empt any kind of bullshit my mother might do this year

it’s sad that she fucked me over twice, the initial stimulus checks and then again last year when there was a chance to claim the stimulus credit but she went and claimed me as a dependent. she was told she couldn’t but it still kept me from being able to file my own taxes bc it says i was claimed by someone else

it’ll be neat to get like 300 bucks, i will use it well (zelda, underwear, finishing what i started with the teacher assistant thing so it’s not a complete wash)

1 note

·

View note