#BFSI BPO Services Market

Explore tagged Tumblr posts

Text

#BFSI BPO Services Market#BFSI BPO Services Market Share#BFSI BPO Services Market Size#BFSI BPO Services Market Research#BFSI BPO Services Industry#What is BFSI BPO Services?

0 notes

Text

One Point One Solutions Ltd: A Strategic Play in the Indian BPM Landscape

One Point One Solutions Ltd (OPOS), a leading player in the Business Process Management (BPM) sector, is making significant strides towards establishing itself as a global BPM powerhouse. Catering to sectors such as BFSI, Retail, New Age, and Fintech, OPOS has demonstrated a flexible and effective revenue model, with 82% derived from time and motion and 18% from transactions. This blog delves into the key highlights of OPOS’s recent developments and future prospects, showcasing why it is an attractive investment opportunity.

Key Developments:

1. Strategic Acquisition of ITCube Solutions

In a landmark move, OPOS acquired ITCube Solutions for Rs 840 million. This acquisition not only diversifies OPOS's service portfolio beyond BPM into IT services but also enhances its presence in the US market. ITCube's expertise in healthcare and construction sectors, along with its established client base, positions OPOS for substantial growth and expanded market reach.

2. Leadership Reinforcement

To drive its next phase of growth, OPOS has strengthened its leadership team with the appointments of Rajiv Desai as Global Delivery Head and Ashwini Kumar Rao as Chief Human Resources Officer. Desai brings over 15 years of experience from TCS, particularly in customer experience management and BFSI operations. Rao, with over 24 years of diverse HR experience from Sutherland Global Services, is set to enhance OPOS’s human resource strategies.

3. Global Expansion Strategy

OPOS is aggressively expanding its footprint beyond India into Southeast Asia and Latin America (LATAM). This strategic move is aimed at transforming OPOS into a global BPM player with a diversified revenue mix and improved profit margins. The company is eyeing acquisitions in these regions, which are expected to significantly contribute to revenue and profitability.

Financial Highlights and Projections:

1. Robust Revenue and Profit Growth

OPOS is poised to more than double its revenue to Rs 5.1 billion in FY25, driven by both organic growth and strategic acquisitions. The anticipated acquisition in LATAM is projected to play a crucial role in this growth, contributing significantly to revenues and margins. Despite higher cost pressures, OPOS’s earnings are expected to triple in FY25 and double again in FY26.

2. Compelling Valuation

At a PE ratio of 10x FY26E EPS, OPOS’s stock is considered highly attractive. The company’s strategic focus on global expansion, coupled with a robust trajectory of both organic and inorganic growth, underpins its potential for a substantial rerating from current levels. Consequently, a BUY rating has been initiated with a target price of Rs 120, presenting a potential return of 107%.

Recent Client Acquisitions: OPOS has recently onboarded several high-profile clients across various sectors, highlighting its strong market position and exceptional service offerings.

Notable acquisitions include:

A leading asset management firm.

Razorpay, a prominent payment solutions provider.

A Gurgaon-based startup involved in the Open Network for Digital Commerce (ONDC).

An international wellness and skincare company in the UAE.

Leading private sector banks for credit card collections, including DMI Finance and Kotak Mahindra Bank.

These acquisitions are expected to significantly boost OPOS’s revenue and growth, reflecting its robust business model and strong management team.

Future Outlook - OPOS’s potential expansion into LATAM and Southeast Asia through strategic acquisitions is set to propel its growth and profitability. The company is targeting acquisitions that will enhance its service capabilities, diversify its offerings, and establish a strong presence in key BPO/KPO markets. These moves are expected to increase revenue by USD 30-50 million and improve profitability due to higher billing rates in these regions compared to India.

Conclusion - One Point One Solutions Ltd is strategically positioned to capitalize on its recent acquisitions, robust leadership team, and aggressive global expansion plans. With a compelling valuation and significant growth prospects, OPOS is an attractive investment opportunity. Investors are encouraged to consider the company's stock, currently priced at Rs 58, with a target price of Rs 120, reflecting a potential return of 107%.

0 notes

Text

India is hiring dedicated recruitment team for BFSI Domain.

BFSI Full Form in Banking denotes the comprehensive domain of Banking, Financial Services, and Insurance. This inclusive sector plays a pivotal role in the economy, providing a range of services crucial for financial stability and customer well-being. This sector consists of three major sectors responsible for providing many banking services, financial services, managing risk, payment solutions, KYC verification, etc. The banking part of BFSI may include core banking, retail banking, saving accounts, etc.; the financial part may include share market, payment gateways, mutual funds and insurance products covering both life insurance and general insurance. The growth of information technology led to advancements in online banking, mobile payments, loan methods, and many more. This led to a surge in the BFSI sector in various fields, such as risk management, fraud detection, customer experience, data analytics and many more. When groups of banks and financial institutions collectively provide financial services to the general public, the organization or a country is referred to as a banking system. The banking system provides a common channel for proving and maintaining a payment system, lending, accepting deposits and other investment services. A bank's primary function is to accept deposits from lenders with surpluses and provide them to borrowers who need funds. This maintains the liquidity of money in market and economy. The bank accepts the deposit from the borrower, safeguards it, pays interest and allows withdrawals when required.

Financial services are crucial to the functioning of an economy. Without them, people with money to save may have trouble finding people to borrow from and vice versa. And without financial services, people will be so intent on saving to cover risk that they may not buy many goods and services. The importance of financial services to the economy and the need to foster trust among providers and consumers are among the reasons governments oversee the provision of many financial services. The financial services sector consists of banking, mortgages, credit cards, payment services, tax preparation and planning, accounting and investments. BFSI Recruitment Agency in India that provide services. Financial services are often limited to the activities of firms and professionals, while financial products are the financial instruments these professionals provide to their clients. Financial sector supervisors enforce regulations and license financial service providers. Oversight may include regular reporting and examination of accounts and providers, inspections and investigation of complaints.

BFSI Job Description is a sector that has experienced the most considerable growth in the last few years. The growth increased the chances for recent graduates and freshers. According to recent reports, it is said that by 2050, India and China will cover almost 50 percent of global banking assets. There has been a noticeable growth in job requirements in the banking sector, especially for freshers. MBA (BFSI) is a two-year post-graduate degree course. After completing this course, candidates can work in private banks, government banks, educational institutions, BPOs, finance departments, industries, stock exchanges etc. Admission to this course is usually based on the Management Entrance Test. It is one of the most popular branches of MBA and some of the best MBA in banking and finance colleges in Bangalore offer Master of Business Administration in Banking and Finance degree programs. Best BFSI Recruitment Agency in India that provide services in recruitment sectors.

The BFSI industry is being reshaped by expedited information technology and quickly changing economic situations. Growing customer expectations, along with intense demand and stricter regulatory constraints, are driving digitalization in the sector. Moving forward, digitalization, among other things, will transform the BFSI sector. Customers' purchasing decisions are heavily affected online as the digital horizon expands. As a result, the need for a well-integrated platform that provides access to different channels such as websites, social media, SMS, email, and so on through a single platform has risen. Top BFSI Recruitment Agency in India provides the best services in many ways. The ecosystem expands the distribution network, adds value to the business and enhances the user experience. As the industry transitions to remote employment, digitally enabled interactions become more important than traditional methods. Many organizations, especially BFSI corporations, have started looking at value-generation solutions to scale up their operations, and increase their connectivity, reach and profitability.

0 notes

Text

BPO Market Regulative Landscape, New Strategies, Regional Outlook and Key Players

The “BPO Market Share, Size, and Trends | 2031” is market research by The Insight Partners. The BPO market has perceived tides of change in the recent past. This study offers precise projections after detailed scrutiny of a range of factors impacting the business. Considering the present market scenario, this report brings forward correct predictions on revenue, market size, and CAGR of the BPO market. The novel market research which is based on a fact-based foundation is now accessible for purchase. This report can make a variance in wide decision-making and drive business forward in the right direction.

Business is no longer a game of instincts when it comes to capitalizing on new production lines. In a highly competitive BPO market, companies may face several challenges. Having trusted market research is always endorsed for both veteran and new entrants. BPO Market report presents a thorough analysis of local, regional, and global market scenarios through the following details.

Report Attributes

Details

Segmental Coverage

Services Offered

Human Resources

Procurement and Supply Chain

Knowledge Process Outsourcing

Finance and Accounting

Customer Services

Others

Industry Vertical

BFSI

IT and Telecommunications

Retail

Healthcare

Manufacturing

Others

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

Alorica Inc.

Atento S.A.

Capita PLC

Comdata Group

Concentrix (SYNNEX Corporation)

Genpact Ltd

Sitel Group

Sykes Enterprises, Incorporated

Teleperformance SE

Webhelp (Groep Brussel Lambert NV)

Other key companies

Competitive Landscape

Knowing the state of rivals is a strategically right move to outperform them. This report is the right place to explore key strategies, developments, and recent launches by key BPO market players. This report emphasizes an analysis of business strategies and expected growth opportunities for brands.

Key Coverings:

Current and Future Market Estimates- BPO Market Share, CAGR, and Forecast | 2031

Market Dynamics – Drivers, Challenges, Regional Trends, and Market Opportunities

Market Segmentation – Product, Application, End-use Industries, and Regional Growth Prospects.

Competition Matrix – Key Market Players and Strategies

Recent Developments and Innovation Contributing Market Growth

Need a Customized Market Research Report?

You can always share any specific requirements that you have, and our team will adjust the scope of research offerings as per your needs.

The following are some customizations our clients frequently ask for:

The BPO market report can be customized based on specific regions/countries as per the intention of the business

The report production was facilitated as per the need and following the expected time frame

Insights and chapters tailored as per your requirements.

Depending on the preferences we may also accommodate changes in the current scope.

Key Questions Addressed in the BPO Market Research Include:

What are present BPO market values, and what can be expected in the upcoming decade?

What are the key segments in the BPO market?

What is the regional distribution of the BPO market report?

What are the key players and their recent strategies?

What are the key factors driving BPO market growth?

What are regulatory concerns and requirements businesses have to compel?

Author’s Bio:

Anna Green

Research Associate at The Insight Partners

0 notes

Text

Business Process Outsourcing (BPO) Market Trends and Forecast to 2030

Business Process Outsourcing (BPO) Market analysis report is sure to help boost sales and improve return on investment (ROI). The research and analysis carried out in this Business Process Outsourcing (BPO) Market report assists clients to forecast investment in an emerging market, expansion of market share or success of a new product with the help of global market research analysis. Market drivers and market restraints assessed in this Business Process Outsourcing (BPO) Market report makes attentive about how the product is getting utilized in the recent market environment and also provide estimations about the future usage. This industry report includes market analysis based on regional as well as global level.

Request For Free Sample Report at: https://www.delvens.com/get-free-sample/business-process-outsourcing-bpo-market

Business Process Outsourcing (BPO) Market, by Service Type (Finance & Accounting, Human Resource, KPO, Procurement & Supply Chain, Customer Services, Others), End-use (BFSI, Healthcare, Manufacturing, IT & Telecommunications, Retail, Others), Outsourcing Type (Offshore, Nearshore, and Onshore), region (North America, Europe, Asia-Pacific, Middle East and Africa and South America). The Business Process Outsourcing (BPO) Market size was estimated at USD 285.86 billion in 2023 and is projected to reach USD 527.63 billion in 2030 at a CAGR of 9.15% during the forecast period 2023-2030.

Business Process Outsourcing (BPO) Market Competitive Landscape:

Accenture

ADP, Inc.

Aidey

ALAC ETOILE

AMDOCS

Capgemini

CBRE

Cognizant

Concentrix Corporation

Conduent, Inc.

eNoah

ExlService Holdings, Inc. and Affiliates.

Genpact

H2A

HCL Technologies Limited

Helpware

Humania BPO

IBM Corporation

Infosys Limited

INTERSA

Intetics Inc.

Invensis Technologies Pvt. Ltd.

NCR Corporation

NTT DATA, Inc.

Octopus Tech

OUTSOURCIA GROUP

Plaxonic Technologies

Sodexo

SunTec Web Services Pvt. Ltd.

Tata Consultancy Services Limited

Tech Mahindra Limited

Triniter

TTEC

Unity Communications

Wipro Limited

WNS (Holdings) Ltd.

Business Process Outsourcing (BPO) Market Recent Developments:

In June 2023, the TTEC Digital Innovation Studio has opened in Hyderabad, according to a statement from TTEC Holdings. With the help of prominent CX technology platforms like Amazon, Microsoft, and Google, among others, this development is anticipated to increase TTEC's capacity to provide better customer experiences around the globe.

In June 2023, in order to emphasize the company's dedication on investing and growing its footprint in the nation, Wipro Limited officially opened its new office at Sable Park in Cape Town, South Africa. This is anticipated to hasten the job and skill-development prospects for the rapidly expanding BPO industry in Cape Town, which considerably boosts the local economy, in the near future.

For Purchase Enquiry at: https://www.delvens.com/Inquire-before-buying/business-process-outsourcing-bpo-market

Business Process Outsourcing (BPO) Market Key Findings:

Based on service type, the market is segmented into finance & accounting, human resource, kpo, procurement & supply chain, customer services, others. The customer services segment dominated the market in this segment. The increase in service centers that require offline and online technical help can be ascribed to this category. Businesses that focus on providing customer service are experts at managing requests and questions from customers that come in via social media platforms, chats, phone calls, emails, and other channels. Additionally, the majority of them offer self-service assistance, allowing clients to get answers to their questions whenever they need to.

Based on end-use, the market is segmented into bfsi, healthcare, manufacturing, it & telecommunications, retail, others. The IT and telecommunications segment dominated the market in this segment. A few of the causes driving up demand for business process services among IT and telecommunication organizations include the rise in the number of IT enterprises and the rising industrialization of the world. IT and telecom BPO services meet the rising need for connection, deal with security concerns, and develop fresh products for the newest gadgets and technological advancements.

Based on outsourcing type, the market is bifurcated into offshore, nearshore, and onshore. The offshore BPO dominated the market in this segment. This is due to increasing globalization of businesses and growing demand for BPO services from small and medium-sized businesses.

The market is also divided into various regions such as North America, Europe, Asia-Pacific, South America, and Middle East and Africa. North America is estimated to account for the largest market share during the forecast period. Due to the increasing demand for business process outsourcing services from various regional IT behemoths, the area is predicted to maintain its dominance. Regional expansion is also anticipated to be supported by the customization of service offerings to better fit individual demands and the rising demand for cloud computing.

Business Process Outsourcing (BPO) Market Regional Analysis:

North America to Dominate the Market

North America is estimated to account for the largest market share during the forecast period because of the increasing demand for business process outsourcing services from various regional IT behemoths.

Moreover, the customization of service offerings to better fit individual demands and the rising demand for cloud computing is expected to drive the growth of the market during the forecast period.

Frequently Asked Questions:

What are the years considered to study Business Process Outsourcing (BPO) Market?

What is the compound annual growth rate (CAGR) of the Business Process Outsourcing (BPO) Market?

Which region holds the largest market share in Business Process Outsourcing (BPO) Market?

Which region is the fastest growing in Business Process Outsourcing (BPO) Market?

Who are the major players in Business Process Outsourcing (BPO) Market?

The market for business process outsourcing (BPO) is expanding as a result of factors such as businesses' increasing emphasis on enhancing productivity and organizational agility, cutting costs, and accelerating key capabilities to survive the rapidly changing business dynamics. Additionally, a lot of businesses are concentrating on lowering their operating expenses so they can access global resources to satisfy the rising market needs. These factors have promoted the use of market services by a number of companies that concentrate on utilizing technical developments like cloud computing and Artificial Intelligence (AI) to increase corporate productivity.

In the projected term, security and intellectual property rights worries are anticipated to limit market expansion. The need to lower operating costs drives the outsourcer to locations without a legislative framework in place to guard against confidentiality breaches and infringement of intellectual property rights. Because even a tiny mistake can result in a permanent loss for the company's market position, outsourcing organizations are frequently concerned about how they outsource and handle the information supplied.

Get Direct Order of this Report at: https://www.delvens.com/checkout/business-process-outsourcing-bpo-market

Explore More Reports:

Oil and Gas Process Simulation Software Market

Sports Betting Market

Data Center Construction Market

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-3290-6466

#Business Process Outsourcing (BPO) Market#Business Process Outsourcing Market#Business Process Outsourcing#BPO#BPO Market#consulting company#strategic advisory firm#best market reports#market analysis reports#trending reports#syndicated reports#IT & Telecom

0 notes

Text

0 notes

Text

Transforming Finance: The Dynamics of BFSI Outsourcing in a Digital Era

In 2023, the Global BFSI Outsourcing Market was valued at $107.59 billion, and is projected to reach a market size of $185.59 billion by 2030. Over the forecast period of 2024–2030, market is projected to grow at a CAGR of 8.1%.

The Global BFSI Outsourcing Market has undergone various changes over the years influenced by various long and short-term drivers.

Request free sample copy @ https://virtuemarketresearch.com/report/bfsi-outsourcing-market/request-sample

One of the paramount long-term drivers influencing the BFSI Outsourcing market is the rapid advancement in technology. The adoption of innovative technologies like AI, machine learning, and blockchain has substantially transformed the industry landscape. These technologies have optimized processes, enhanced security measures, and improved overall efficiency within the BFSI sector. However, the onset of the COVID-19 pandemic acted as a pivotal moment, accelerating the integration of these technologies. It propelled a shift towards remote working environments, leading to a surge in demand for outsourcing services to maintain operational continuity. As a result, BFSI institutions had to swiftly adapt to digital solutions, causing a fundamental reevaluation of outsourcing strategies and an increased emphasis on cybersecurity measures.

Amidst the dynamic market conditions, one notable short-term driver is the growing need for cost-efficient solutions. BFSI institutions are increasingly seeking ways to reduce operational costs while maintaining high-quality services. This inclination towards cost optimization has led to the expansion of outsourcing services.

Simultaneously, an opportunity arises with the rise of specialized outsourcing solutions. Service providers are now focusing on offering more customized and niche services tailored to specific BFSI needs, thereby creating a niche market segment with specialized offerings.

One prevailing trend observed in the industry is the heightened emphasis on data security and compliance. With the escalating frequency and sophistication of cyber threats, BFSI institutions are prioritizing stringent security measures. Consequently, outsourcing service providers are integrating robust security protocols and compliance frameworks into their offerings. This trend not only addresses the immediate security concerns but also fosters trust and confidence among BFSI clients.

Segmentation Analysis:

The Global BFSI Outsourcing Market segmentation includes:

By Outsourcing Service Type: BPO (Business Process Outsourcing), KPO (Knowledge Process Outsourcing), IT Outsourcing, and Others

Business Process Outsourcing (BPO) stands as the largest growing segment within the Global BFSI Outsourcing Market due to its fundamental impact on optimizing operational efficiencies. BFSI institutions increasingly leverage BPO services to delegate non-core functions like customer support, back-office operations, and transaction processing to specialized service providers. This strategic outsourcing allows companies to focus on core competencies while benefiting from cost-effective, specialized services. The expanding scope of BPO offerings, including data analytics, risk management, and compliance, has further fueled its growth. Moreover, BPO providers’ ability to adapt to evolving regulatory landscapes and offer scalable solutions has positioned this segment as a pivotal driver in the BFSI outsourcing market’s growth trajectory.

IT Outsourcing stands out as the fastest growing segment within the Global BFSI Outsourcing Market owing to its indispensable role in driving digital transformation within the financial sector. The increasing reliance on technology-driven solutions to address evolving customer needs and regulatory requirements has accelerated the demand for IT outsourcing services. BFSI institutions seek specialized IT outsourcing partners to implement and manage complex IT infrastructures, including cloud services, cybersecurity, application development, and maintenance. The agility and scalability offered by IT outsourcing providers enable BFSI companies to swiftly adapt to technological advancements while ensuring robust security measures. The rapid evolution of fintech solutions and the urgent need for digital innovation have propelled IT outsourcing to the forefront, positioning it as the fastest growing segment within the BFSI outsourcing landscape.

By Enterprise Size: Small and Medium-Sized Enterprises and Large Enterprises

Large enterprises stand out as the largest growing segment in the Global BFSI Outsourcing Market due to their significant operational scale and complex requirements. These enterprises possess expansive operations across various geographies, necessitating the outsourcing of diverse functions to streamline operations and maintain competitiveness. Their inclination towards outsourcing spans across a broad spectrum of services, including IT infrastructure management, customer service, finance and accounting, and regulatory compliance. Additionally, large enterprises have the financial bandwidth to engage in long-term outsourcing contracts and strategic partnerships, contributing significantly to the growth of the BFSI outsourcing market. Their robust demand for comprehensive and specialized services drives the expansion of this segment.

Conversely, Small and Medium-Sized Enterprises (SMEs) represent the fastest growing segment in the Global BFSI Outsourcing Market due to their agile and adaptive nature in embracing outsourcing solutions. SMEs, while facing resource constraints, are increasingly recognizing the value proposition offered by outsourcing. These enterprises often lack the in-house capabilities and resources to manage complex functions such as IT infrastructure management, regulatory compliance, or data analytics. As a result, SMEs are turning to outsourcing to access specialized expertise, reduce operational costs, and gain competitive advantages. The rapid adoption of outsourcing among SMEs is fueled by the emergence of flexible outsourcing models, including pay-as-you-go services and customized solutions tailored to their specific needs. Their nimbleness in embracing outsourcing solutions to level the playing field in a competitive landscape propels SMEs as the fastest growing segment in the BFSI outsourcing market.

Customize This Study According To Your Needs @ https://virtuemarketresearch.com/report/bfsi-outsourcing-market/customization

By Region:

North America stands as the largest growing region in the Global BFSI Outsourcing Market due to its established financial sector and high adoption rate of outsourcing services. The region’s robust economy and the presence of major banking and financial institutions drive the demand for outsourcing solutions. The United States and Canada, in particular, lead this growth, leveraging outsourcing for various functions, including IT services, customer support, and back-office operations. These countries benefit from a mature outsourcing ecosystem, strong regulatory frameworks, and a high level of technological advancement, cementing their position as key players in the BFSI outsourcing market.

Asia Pacific emerges as the fastest growing region in the Global BFSI Outsourcing Market due to several factors, including rapid digitalization, burgeoning economies, and a burgeoning fintech landscape. Countries like India, China, and Singapore spearhead this growth, offering cost-effective outsourcing solutions coupled with a skilled workforce. India, in particular, is a major hub for BFSI outsourcing, renowned for its expertise in IT services, data analytics, and customer support. The region’s focus on technological innovation, coupled with its strategic geographical location, positions it as a burgeoning hub for BFSI outsourcing, driving rapid market growth.

Europe represents a significant market in the Global BFSI Outsourcing landscape, characterized by a strong regulatory environment and a diverse financial sector. Countries such as the United Kingdom, Germany, and Switzerland lead the outsourcing initiatives in this region. These countries leverage outsourcing for various functions, including risk management, compliance, and IT services. The European market emphasizes data security and privacy, driving the demand for specialized outsourcing solutions that comply with stringent regulatory standards.

Latin America showcases a growing presence in the BFSI Outsourcing Market, with countries like Brazil, Mexico, and Colombia emerging as key players. These countries leverage outsourcing services to enhance operational efficiency, particularly in areas such as customer support, finance, and accounting. Latin America’s competitive advantage lies in its multilingual workforce, cost-effective solutions, and proximity to North American markets, making it an attractive destination for BFSI outsourcing.

The Middle East & Africa region exhibits growing potential in the BFSI Outsourcing Market. Countries like the United Arab Emirates (UAE), South Africa, and Nigeria are witnessing increased outsourcing activities. The region focuses on outsourcing IT services, cybersecurity, and back-office operations to improve efficiency and reduce costs. Additionally, the growing emphasis on digital transformation and innovation drives the adoption of outsourcing solutions in this region.

Latest Industry Developments:

· Companies are increasingly engaging in strategic collaborations and partnerships to broaden their service portfolios and enhance their market presence. Collaborations between BFSI outsourcing firms and fintech startups or established tech companies have become prevalent. These alliances allow for the integration of cutting-edge technologies and innovative solutions into outsourcing services, catering to the evolving demands of BFSI clients. Recent developments showcase joint ventures between outsourcing providers and specialized technology firms, aiming to deliver more comprehensive and tech-driven solutions to the market.

· A discernible trend involves a shift towards vertical specialization. BFSI outsourcing companies are honing their expertise in specific verticals within the financial sector, such as banking, insurance, or wealth management. This targeted approach enables them to offer more tailored and industry-specific solutions, catering to the nuanced needs of clients within these sectors. Recent developments highlight companies investing resources to develop specialized teams and dedicated services for distinct BFSI verticals, fostering a competitive edge and enhancing market share within these niches.

· The integration of advanced analytics and artificial intelligence (AI) has emerged as a pivotal strategy to augment market share. Companies are leveraging sophisticated analytics tools and AI-driven solutions to provide data-driven insights and predictive analytics to BFSI clients. This trend signifies a shift towards offering more value-added services beyond conventional outsourcing, empowering clients with actionable insights and enhanced decision-making capabilities. Recent developments showcase BFSI outsourcing firms investing heavily in AI-driven technologies, reinforcing their market positioning as innovators and thought leaders in the industry.

Interested in Purchasing the Full Report? Enquire Before Buying @https://virtuemarketresearch.com/report/bfsi-outsourcing-market/enquire

Contact Us:

Virtue Market Research

E-mail: [email protected]

Phone: +1–917 436 1025

Website: https://virtuemarketresearch.com

About Us:

“Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success.”

0 notes

Text

FirstMeridian Business services IPO Date, Price, GMP, Review, Company Profile, Financials, Risk, Allotment Details 2023

New Post has been published on https://wealthview.co.in/firstmeridian-business-services-ipo/

FirstMeridian Business services IPO Date, Price, GMP, Review, Company Profile, Financials, Risk, Allotment Details 2023

FirstMeridian Business Services IPO: FirstMeridian Business Services Ltd. (FBSL) is a leading Mumbai-based human resource (HR) and staffing company, operating in a booming Indian outsourcing market. They’re the third-largest in terms of revenue (FY21) and offer a wide range of services, including:

General staffing: Temporary and permanent staffing solutions for various industries.

Allied services: Payroll management, training and development, and compliance solutions.

Global technology solutions: IT staffing and recruitment services for MNCs and Indian companies.

Other HR services: Managed services, background verification, and HR consulting.

FirstMeridian Business services IPO Details:

The FBSL IPO was originally planned for May 2022 with an offer size of Rs. 800 crore. However, after reshaping the proposal, the company received SEBI approval in February 2023 for a slightly smaller IPO of Rs. 740 crore. Here’s the updated breakdown:

Issue Size: Rs. 740 crore

Components:

Fresh Issue: Rs. 50 crore

Offer for Sale (OFS): Rs. 690 crore (by promoters and investors)

Price Band: Rs. 277 – Rs. 291 per share

Dates (tentative):

Issue Open: Not yet announced

Issue Close: Not yet announced

Listing: Not yet announced

Recent News Updates:

The FBSL IPO has garnered moderate attention in the market. Recent developments that might impact investor sentiment include:

Positive market sentiment: The Indian markets have rallied over the past few months, creating a favorable environment for IPOs.

Growing HR outsourcing market: The Indian HR outsourcing market is expected to reach USD 5.7 billion by 2027, offering significant growth potential for FBSL.

Competition: FBSL faces stiff competition from established players like ManpowerGroup and TeamLease Services. Additionally, several tech-enabled startups are disrupting the market.

FirstMeridian Business Services IPO Offer Details

Securities Offered:

Equity Shares: The FBSL IPO will only offer equity shares of the company. No bonds or debentures will be issued.

Face Value: Rs. 10 per share

Reservation Percentages:

The total offer size of Rs. 740 crore will be divided among different investor categories as follows:

Retail Individual Investors (RII): 35%

Qualified Institutional Buyers (QIBs): 50%

Non-Institutional Investors (NIIs): 15%

Minimum Lot Size and Investment Amount:

Minimum Lot Size: One lot will comprise 50 equity shares.

Minimum Investment Amount: Based on the price band of Rs. 277 to Rs. 291 per share, the minimum investment amount per lot will range from approximately Rs. 13,850 to Rs. 14,550.

FirstMeridian Business Services Company Profile:

History and Operations:

Founded in 1997, FirstMeridian boasts over 25 years of experience in the Indian HR and staffing space.

Originally known as ‘InnovSource,’ it rebranded to encompass its growing portfolio of established brands:

V5 Global Services: Focuses on IT and non-IT staffing for MNCs and Indian companies.

Affluent Global Services: Specializes in professional recruitment and executive search.

CBSI Global: Offers business process outsourcing (BPO) and managed services.

RLabs Enterprise Services: Provides tech-enabled HR solutions and automation.

Operates through a network of 3500+ branch offices across India, serving 1200+ clients and placing over 126,000 associates annually.

Market Focus: Key sectors include Telecom, Retail, BFSI, IT, ITES, E-Commerce, Manufacturing, Engineering, and Logistics.

Market Position and Share:

Ranked as the 3rd largest Indian staffing company by revenue (FY21) with a market share of approximately 7%.

Faces competition from established players like ManpowerGroup and TeamLease Services, as well as tech-enabled startups.

Prominent Brands and Partnerships:

Collaborates with global brands like Amazon, Microsoft, Samsung, and Coca-Cola.

Partnered with government initiatives like National Skill Development Corporation (NSDC) to upskill the workforce.

Key Milestones and Achievements:

Awarded the “Best Employer Brand Award” by Aon Hewitt in 2018 and 2019.

Featured in the “Great Place to Work® India” list for over 8 consecutive years.

Received the “Fastest Growing Staffing Company” award by Frost & Sullivan in 2020.

Competitive Advantages and USP:

Diversified Service Portfolio: Offers a one-stop solution for diverse HR needs across various industries.

Strong Track Record: Established brand with over 2 decades of experience and consistent growth.

Nationwide Network: Extensive reach through an expansive network of branch offices.

Focus on Technology: Investing in HR tech solutions to enhance efficiency and service delivery.

Social Impact: Committed to skilling the workforce and creating employment opportunities.

FirstMeridian Business Services Financials:

Recent Financial Performance:

Revenue Growth: While the exact figures for FY23 are not yet available, FBSL reportedly achieved significant revenue growth compared to FY22. Sources indicate a year-on-year increase of around 40%, exceeding pre-pandemic levels.

Profitability: The company has shown consistent profitability with operating margins hovering around 4-5% in recent years. However, net profit margins are lower due to finance costs associated with debt.

Debt Levels: FBSL maintains a moderate debt level with a debt-to-equity ratio around 0.7 as of March 2023. While the upcoming IPO aims to further reduce debt, investors should continue to monitor this aspect.

Key Financial Ratios (as of March 2023):

Price-to-Earnings (P/E) Ratio: Not yet available due to pending IPO and lack of post-issue market price.

Earnings per Share (EPS): INR 3.74 for FY23 (estimated).

Debt-to-Equity Ratio: 0.70.

Industry Benchmarks:

The average P/E ratio for staffing companies in India is around 20-25.

The average EPS for comparable companies is in the range of INR 6-8.

The industry standard for debt-to-equity ratio in the staffing sector is typically below 1.

Objectives of the FirstMeridian Business Services IPO:

Reasons for Going Public:

FirstMeridian Business Services (FBSL) has outlined several key reasons for pursuing an IPO:

Capital Raising: The primary objective is to raise Rs. 740 crore, with Rs. 50 crore from a fresh issue and Rs. 690 crore from an offer for sale (OFS) by promoters and investors. This capital will be used to fuel future growth initiatives.

Brand Visibility and Credibility: Public listing can enhance FBSL’s brand image and recognition in the market, potentially attracting new clients and talent.

Improving Liquidity and Shareholder Base: Access to public markets can create investor interest and liquidity for existing shareholders, facilitating easier exits and value realization.

Facilitating Future Acquisitions and Partnerships: Publicly traded status can make FBSL a more attractive partner for potential mergers, acquisitions, or strategic collaborations.

Utilization of Raised Funds:

FBSL plans to utilize the proceeds from the fresh issue as follows:

Debt Repayment: A portion of the funds will be used to reduce existing debt, lowering financing costs and improving financial stability.

Expansion and Investments: The company aims to invest in technology infrastructure, digital initiatives, branch network expansion, and new service offerings to drive organic growth.

Working Capital Requirements: The remaining funds will be used to meet working capital needs and support ongoing operations.

Alignment with Future Growth Strategy:

FBSL’s stated objectives for the IPO clearly align with its future growth strategy, which focuses on:

Organic Growth: Expanding core staffing and allied services businesses, diversifying into adjacent HR solutions like RPO and managed services.

Geographic Expansion: Exploring potential entry into new domestic markets and collaborating with global players for international reach.

Technology Adoption: Investing in AI, automation, and other HR tech solutions to improve efficiency, productivity, and client service.

Enhanced Brand and Talent Acquisition: Leveraging the public company status to attract and retain top talent and strengthen brand reputation.

FirstMeridian Business Services IPO Risks:

While the FirstMeridian Business Services IPO offers promising prospects, it’s crucial to acknowledge and carefully consider the associated risks before investing. Here are some key areas to examine:

Industry Headwinds:

The HR outsourcing industry in India faces potential headwinds like automation and technology replacing some traditional staffing roles.

Dependence on certain sectors like IT and BFSI can expose the company to vulnerabilities if these sectors experience downturns.

Increasing competition from established players and tech-enabled startups could put pressure on market share and profitability.

Company-Specific Challenges:

While FBSL boasts a track record, its reliance on its top management personnel raises concerns about succession planning and potential impact if key individuals leave.

The company’s moderate debt levels, though manageable, should be monitored closely, as high debt can restrict future growth or financial flexibility.

Dependence on temporary staffing services might be impacted by economic fluctuations or changes in labor laws and regulations.

Financial Health Analysis:

While FBSL demonstrates consistent profitability, its net profit margins are lower due to finance costs associated with debt.

The upcoming IPO aims to reduce debt, but investors should monitor the post-issue debt-to-equity ratio to assess financial stability.

The recent financial performance (FY23) is still preliminary, and investors should wait for the final audited reports before making investment decisions.

Red Flags for Investors:

High dependence on specific sectors and limited geographic diversification.

Moderate debt levels and reliance on traditional staffing services.

Lack of clarity on the final lead managers and their track record in similar offerings.

FirstMeridian Business Services Limited – DRHP

Also Read: How to Apply for an IPO?

#Allotment Details#Company Profile#Financial Performance#Financial risks#IPO#IPO date#Lead Managers#Lot Size#UPCOMING IPO#News

0 notes

Text

Revolutionizing Talent Placement: People Prime Worldwide - Your Premier Placement Consultancy in Hyderabad

When it comes to finding the right talent and securing reliable job placements Consultancy in Hyderabad, a placement consultancy like People Prime Worldwide is an excellent choice. With their expertise in talent placement, People Prime Worldwide is a well-known and respected placement consultancy in Hyderabad.

A Trusted Partner in Talent Acquisition:

Hyderabad often hailed as the "City of Pearls" for its rich heritage, has also become a hub for technology, innovation, and business. With a growing economy and a diverse range of industries, the need for a professional placement consultancy in Hyderabad has never been greater. People Prime Worldwide has stepped in to meet this demand and has swiftly emerged as a trusted partner for organizations seeking the best talent.

The People Prime Worldwide Advantage:

What sets People Prime Worldwide apart in the competitive world of placement consultancies in Hyderabad? It's a combination of expertise, dedication, and a deep understanding of the job market that has propelled this consultancy to the forefront.

Industry Expertise: With a focus on various sectors, including Information Technology (IT), IT Enabled Services (ITES), Business Process Outsourcing (BPO), Knowledge Process Outsourcing (KPO), Banking, Financial Services, and Insurance (BFSI), Human Resource Management, Pharmaceutical & Life Sciences, and more, People Prime Worldwide boasts a team of experts who understand the unique staffing needs of each industry.

Comprehensive Solutions: Whether an organization is looking for permanent hires, contract professionals, or executive leaders, People Prime Worldwide offers comprehensive staffing solutions tailored to their specific requirements.

Unwavering Quality: Quality is the cornerstone of this placement consultancy. Each candidate undergoes rigorous evaluation and screening to ensure they meet the highest industry standards. This commitment to quality ensures that clients receive only the most qualified candidates.

Client-Centric Approach: People Prime Worldwide is not just about numbers; it's about building lasting relationships. The consultancy takes a client-centric approach, understanding the culture, values, and goals of the organizations it serves, and matching them with candidates who fit seamlessly.

Candidate Empowerment: Job seekers in Hyderabad have found a reliable ally in People Prime Worldwide. The Placement consultancy in Hyderabad offers career counseling, skill development, and opportunities to help candidates achieve their career aspirations.

Success Stories:

Over the years, People Prime Worldwide has played a pivotal role in the success stories of countless organizations in Hyderabad and beyond. Its dedication to professionalism, ethical practices, and commitment to excellence has made it the placement consultancy in Hyderabad of choice for many.

Looking for a placement consultancy in Hyderabad? Look no further than People Prime Worldwide. As a trusted partner in helping, you achieve your career aspirations, we offer more than just a one-time service. With our repeated support, we are committed to bridging the gap between organizations and job seekers.

Contact us today to see how we can help you find your dream career.

0 notes

Text

Revolutionize healthcare with Radical Minds. Our innovative solutions empower medical professionals and improve patient outcomes. Discover our services today.

0 notes

Text

Recruitment Process Outsourcing Market Unidentified Segments – The Biggest Opportunity Of 2023

Latest study released by AMA Research on Global Recruitment Process Outsourcing Market research focuses on latest market trend, opportunities and various future aspects so you can get a variety of ways to maximize your profits. Recruitment Process Outsourcing Market predicted until 2027*. Recruitment Process Outsourcing (RPO) is when a company transfers all or portion of its permanent recruitment to an outside provider. An RPO provider can act as an expansion of a company’s HR or Resourcing function, sitting on site with the client providing a holistic hiring solution. Recruitment process outsourcing (RPO) has become a vital, adaptable and scalable talent acquisition solution for organizations — of all sizes — designed to progress employer branding, candidate and hiring manager experience, and to make a centralized talent pipeline, in addition to meet hiring demands. RPO isn't just constrained to hiring individuals but moreover includes the management of individuals, processes, technology, and the talent acquisition procedure. RPO offers extraordinary communication experience to the candidate by giving reliable, transparent, and fair feedback that can help the organization's reputation sterling. It moreover helps in intensifying the manager brand of the organization. Some of Key Players included in Recruitment Process Outsourcing Market are:

Seven Step RPO (United States)

Saaki, Argus and Averil Consulting(India)

Zyoin (India)

Randstad Holding Company (Netherland)

Pinstripe Inc. (United States)

Pontoon Solutions (United States)

Futurestep (United States)

Accolo Inc. (United States)

Alexander Mann Solutions (United Kingdom)

Market Trends: Increased Adoption of Analytics

Upsurge in the Growth of Analytics BPO Market

Majority of MNCs are Standardizing and Consolidating Payroll Structure

Drivers: Increasing Attrition Rate

Increasing Number of Fresh Graduates and Post Graduates

Increasing Adoption of Web Based Services

Challenges: Selection of Right Candidate

Opportunities: Digital Transformation in the BFSI and Telecom Sector

The titled segments and Market Data are Break Down by Application (BFSI, Healthcare, Telecom, Manufacturing, Others), Type (Partially Outsourced, Fully Outsourced), Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), Service (On-site, Off-site)

Presented By

AMA Research & Media LLP

0 notes

Text

BPO Business Analytics Market is set for a Potential Growth Worldwide: Excellent Technology Trends with Business Analysis

Latest Report Available at Advance Market Analytics, “BPO Business Analytics Market” provides pin-point analysis for changing competitive dynamics and a forward looking perspective on different factors driving or restraining industry growth. The global BPO Business Analytics market focuses on encompassing major statistical evidence for the BPO Business Analytics industry as it offers our readers a value addition on guiding them in encountering the obstacles surrounding the market. A comprehensive addition of several factors such as global distribution, manufacturers, market size, and market factors that affect the global contributions are reported in the study. In addition the BPO Business Analytics study also shifts its attention with an in-depth competitive landscape, defined growth opportunities, market share coupled with product type and applications, key companies responsible for the production, and utilized strategies are also marked.Some key players in the global BPO Business Analytics market are

Accenture (Ireland)

Capgemini (France)

Genpact (United States)

IBM (United States)

TCS (India)

HP Development Company, L.P. (United States)

Tech Mahindra (India)

Wipro (India)

EXL Service (United States)

NTT DATA (Japan)

Infosys BPM Ltd. (India) The role of big data in customer data analytics is important, only a handful of companies leverage to their complete advantage. Some of these people include retailers who want to increase the sales and profits by more than 60%. When you have more accurate information about your customers, it is easier to understand what is going on within the dedicated customer service department. BPO industry, in the recent years, has indicated an innovative new approach of providing better services to its clients by delivering a less complicated basket of offerings, such as business analytics, IT infrastructure and applications, and business process management (BPM). The service providers are making a shift towards the intellectual capital-oriented models by following automation practice for creating and managing business processes.What's Trending in Market: Modernization of Business Environments and Growing Need for Customer Analytics

Challenges: Data Security and Privacy Concerns Associated to Advanced Analytics

Market Growth Drivers: Increasing Volume of Enterprise Data

Rising Cloud-Based Deployment among SMEs

The Global BPO Business Analytics Market segments and Market Data Break Downby Application (HR, Finance, Customer Care, Logistics, Sales & Marketing, Product Engineering, Business Process Design, Others), Industry Vertical (BFSI, Manufacturing, Healthcare, Retail, Telecom, Others) Presented By

AMA Research & Media LLP

0 notes

Text

Business Process Outsourcing (BPO) Market Size, Share, Trends and Analysis by Region, Service

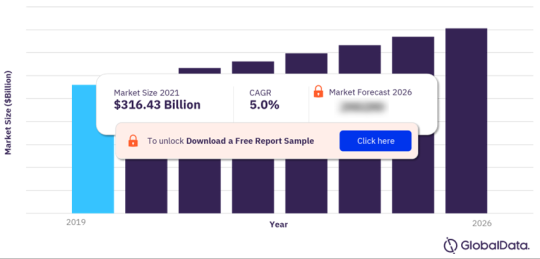

The business process outsourcing market size was valued at US$ 316.43 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% during 2022-2026. Outsourcing of business functions such as bookkeeping, HR activities, finance and accounting, research, sales, and marketing allows businesses to focus on core business activities essential for the growth of the organization. Additionally, outsourcing enables businesses to cut operational costs, gain access to skilled resources, enables diversification, and provide access to innovation, technology, and more, which is anticipated to drive the BPO market. The above-mentioned benefits have increased the demand for BPO services across various end-use industries, including BFSI, IT and telecom, healthcare and pharmaceuticals, manufacturing, and retail, among others.

0 notes

Text

Functions Commonly Outsourced By Banks And Financial Institutions

Functions Commonly Outsourced By Banks And Financial Institutions

Customer Support, Financial Outsourcing, Payroll Outsourcing

Eyeing the increasing competition, consumer demands and expectations of shareholders for cogency, today, BPO or Business Process Outsourcing has become a common practice in many sectors. Like others, the banking sector outsources multiple services to external agencies or call centers to ensure timely delivery of quality outputs, cost-effectiveness, access to the latest technology and maximum reach. Financial organizations, these days, tie-up with finance outsourcing BPO service providers to meet the growing customer care requirements. To offer better sales support to both the valued and potential customers, banks often reach out to call centers, which are usually equipped with a skilled workforce, and modern technologies and are capable of providing 24-hour support along with multilingual assistance.

The world is currently witnessing a digital revolution, where social media platforms like Facebook, Twitter, and Instagram have become one of the primary mediums for communication. Apart from solving queries over phone calls, BPO service providers make sure that the customers, trying to reach out through social media, chats, emails and messaging apps, are instantly attended to. Besides, call centers also offer various requirement-specific packaged services to different customers.

Top 5 Benefits Of Outsourcing Financial Services, For The BFSI Industry:

Saves Times Back office activities and lead generation are time-consuming activities. Hence, outsourcing these functions to a service provider or call center saves a lot of time. Reputed outsourcing providers make sure the banks can invest more time into other core banking activities.

Gives Access To The Latest Technologies And Expertise Call centers are generally rigged with modern technologies and a team of skilled professionals, who are aware of the current market trends, policies and regulations. Hence, outsourcing financial services enables a BFSI company to retain old customers and build new ones by offering efficient customer support.

Saves Overhead Costs Hiring and training customer support, back-office and lead- generating staff often turn out to be a costly affair. Besides, in- house staffs need to be offered employee benefits, like incentives, medical insurance etc., along with fixed monthly remunerations. Hence, outsourcing financial services is quite beneficial. It enables the companies to save overhead costs while ensuring optimum revenue along with customer retention.

Reduces Hardware And Software Costs Hardware and software required for accounting are quite expensive. Therefore, instead of spending money for acquiring these, it is always beneficial for banks to outsource the accounting activity to finance outsourcing companies, who already have access to the latest software to churn out outputs of optimum quality.

Lowers Risk The risk of internal theft or security breaches can be eliminated by outsourcing financial services to a third party. Banks can check the references and history to make sure the outsourcing partner meets all the basic security standards. The encryption method used by the outsourcing partners is often considered and the actions they take are observed by the banks, to monitor data and location.

Commonly Outsourced Financial Services:

Lead Generation Outsourcing lead generation offers a better turnaround time for identifying, delving into qualified leads and scheduling meetings with clients.

Payroll Processing Outsourcing payroll processing fetches a bank ample time to put on the core banking activities and saves a lot of energy, time as well as money.

Customer Support Customer support is one of the critical activities, commonly outsourced by banks and financial service providers. For the BFSI sector, customer support plays a vital role. When it comes to choosing banks, customers often get skeptical, as it is about the safety of their hard-earned money. To thrive in the competitive industry, banks need to offer proper guidance on choosing the right financial services, through efficient customer support. Hence, outsourcing customer support exposes banks to skilled professionals who are capable of understanding the psychology and requirements of the customers and guiding them accordingly.

Back Office In the BFSI sector, data management and CRM(customer relationship management) activities are often considered secondary. However, these activities are crucial, like the others. Effective data management and CRM can ensure transparency in banks and financial service-providing companies. Therefore, financial firms can consider outsourcing back-office activities to make sure the job is done by experts and with maximum diligence.

#outsourcing financial accounting services outsourcing of finance and accounting services#outsourcing financial accounting#finance#merchant finance cash#merchant

0 notes

Text

Front Office BPO Services Market 2022 Outlook, Current and Future Industry Landscape Analysis

Future Market Insights (FMI), in one of its recent research reports, has projected the global front office BPO services market to exhibit a CAGR of 7.4% throughout the forecast period (2017-2022). The global front office BPO services market is estimated to surpass US$ 200,000 Mn in revenues by 2022-end.

Shifting focus towards Non-voice Contact Centre Channel – A Key Trend

The global market for front office BPO services has experienced a significant expansion over the past few years. This can be primarily attributed to robust economic expansion worldwide, and surge in revenues from customer relations management, insurance, human resource, and finance & accounting. Outsourcers bring various competitive benefits, while aiming to tap into new businesses.

Emergence of digital channel management capabilities, and the data protection provisions are one of the major trends being witnessed in the global front office BPO services market. In addition, shifting focus towards non-voice contact centre channels, and digitisation of the customer touch-points are other key trends being observed in the market.

Industries focusing on Expansion by Offshoring their Business Operations to Front Office BPO Services

Several predominant industries from various verticals such as healthcare & pharmaceuticals, BFSI, and manufacturing, are concentrating on expansion of their business, and gaining access to new markets by offshoring their operations to the front office BPO services. These industries are relocating their production base, and service delivery points closer to areas of their end-users. Offshoring the business operations helps industries in mitigating risks, as their business functions, which are difficult to control & manage, are handled by external companies, while realising their benefits.

Key Research Findings from FMI’s Report on Global Front Office BPO Services Market

In terms of revenues, manufacturing will continue to be the most lucrative vertical in the global front office BPO services market. Revenues from manufacturing vertical are estimated to exceed US$ 40,000 Mn by 2022-end. In contrast, education will remain the least lucrative vertical for front office BPO services. Front office BPO services are projected to witness the fastest expansion in BFSI vertical through 2022, followed by healthcare and pharmaceuticals.

On the basis of service type, customer management services are expected to remain dominant in the global front office BPO services market. Customer management services are projected to account for approximately two-third revenue share of the market over the forecast period. Document management services, on the other hand, will remain comparatively less lucrative than customer management services in the market.

Asia-Pacific excluding Japan (APEJ) has been projected to register the fastest expansion in the market, with sales poised to reach nearly US$ 30,000 Mn in revenues by 2022-end. Middle East & Africa (MEA), and Japan will also witness an impressive expansion in the market through 2022. Although North America and Europe will register relatively lower CAGRs through 2022, these two regions are anticipated to remain the largest market for front office BPO services in terms of revenues.

A tremendous surge has been witnessed in the practice adopted by several industries in approaching front office BPO service providers to perform their business functions. Industries are able to save time, and labour & operational costs, with the help of front office BPO services.

These industries, having great expertise in development & design of their products, lack in bandwidth and access to resources when it comes to customer services. These are catered by front office BPO services, which by leverage their global knowledge base to access world class capabilities.

Company Profiles

FMI’s report has offered insights on key companies operating in the global front office BPO services market, which include Xerox Corporation, Hewlett Packard Enterprise Co., Convergys Corp., Sitel Worldwide Corporation, IBM Global Services, Williams Lea Limited, Ricoh USA, Inc., Atento S.A., Alliance Data Systems Corporation, and TeleTech Holdings, Inc.

#size#Future Market Insights (FMI)#has projected the global front office BPO services market to exhibit a CAGR of 7.4% throughout the forecast period (2017-2022). The global#000 Mn in revenues by 2022-end.#Shifting focus towards Non-voice Contact Centre Channel – A Key Trend#The global market for front office BPO services has experienced a significant expansion over the past few years. This can be primarily attr#and surge in revenues from customer relations management#insurance#human resource#and finance & accounting. Outsourcers bring various competitive benefits#while aiming to tap into new businesses.#Emergence of digital channel management capabilities#and the data protection provisions are one of the major trends being witnessed in the global front office BPO services market. In addition#shifting focus towards non-voice contact centre channels#and digitisation of the customer touch-points are other key trends being observed in the market.#Industries focusing on Expansion by Offshoring their Business Operations to Front Office BPO Services#Several predominant industries from various verticals such as healthcare & pharmaceuticals#BFSI#and manufacturing#are concentrating on expansion of their business#and gaining access to new markets by offshoring their operations to the front office BPO services. These industries are relocating their pr#and service delivery points closer to areas of their end-users. Offshoring the business operations helps industries in mitigating risks#as their business functions#which are difficult to control & manage#are handled by external companies#while realising their benefits.#Key Research Findings from FMI’s Report on Global Front Office BPO Services Market#•#In terms of revenues#000 Mn by 2022-end. In contrast

1 note

·

View note

Text

0 notes