#Atomic Layer Deposition Market research

Explore tagged Tumblr posts

Text

Synthetic Diamond Market, Key Players, Market Size, Future Outlook | BIS Research

Synthetic diamonds for jewelry are gemstones crafted in laboratories to mimic the chemical composition, crystal structure, and optical characteristics of natural diamonds. Synthetic diamonds are manufactured using sophisticated technological methods and provide an ethical and environmentally sustainable option compared to mined diamonds. These diamonds are precisely engineered to showcase outstanding clarity, color, and brilliance, rendering them virtually identical to natural diamonds to the unaided eye.

The global synthetic diamond market for jewelry is projected to reach $21,779.8 million by 2030 from $13,026.5 million in 2023, growing at a CAGR of 7.62% during the forecast period 2023-2030.

Synthetic Diamond Overview

Synthetic diamonds, often referred to as lab-grown or man-made diamonds, are created using advanced technology that replicates the natural processes occurring deep within the Earth.

High Pressure High Temperature- This technique mimics the high-pressure and high-temperature conditions that form natural diamonds in the Earth’s mantle. A small diamond "seed" is placed in carbon, and under extreme pressure and temperature (often exceeding 1,500°C and 1.5 million pounds per square inch), carbon atoms crystallize around the seed to form a diamond.

Chemical Vapour Deposition- In this method, a carbon-rich gas such as methane is introduced into a chamber with a diamond seed, where it breaks down under heat. Carbon atoms then settle on the seed and grow layer by layer, forming a diamond.

Advantages of Synthetic Diamond Market

Ethical and Environmental Considerations

Cost Efficiency

Quality Control

. Ethical and environmental concerns surrounding traditional diamond mining practices enhance the allure of synthetic diamonds, appealing to eco-conscious consumers. Additionally, synthetic diamonds offer cost competitiveness compared to natural ones, attracting price-conscious buyers without compromising quality or aesthetics. This combination of factors drives the synthetic diamond market forward, establishing it as a compelling alternative in the jewelry sector. Furthermore, ongoing innovations in manufacturing processes present significant market opportunities, promising further improvements in production efficiency, quality, and cost-effectiveness. As demand rises and technological capabilities advance, the market continues to flourish, embracing sustainable manufacturing practices and reinforcing its growth trajectory in alignment with global sustainability goals.

Demand – Drivers, Restraints, and Opportunities

Market Demand Driver - Ethical and Environmental Concerns Regarding Natural Diamond Mining

Ethical and environmental concerns linked to natural diamond mining are driving shifts in consumer preferences and industry dynamics within the synthetic diamond market for jewelry. Concerns over the negative impacts of traditional mining methods, such as habitat destruction and human rights abuses, are prompting consumers to seek more sustainable options.

Natural diamond extraction often involves destructive practices such as open-pit mining, leading to habitat loss and environmental degradation. Moreover, issues such as forced labor and unsafe working conditions in diamond mining regions raise ethical red flags. These concerns have spurred demands for greater transparency and accountability in the industry.Synthetic diamonds, crafted in controlled lab environments using eco-friendly processes, offer a transparent and traceable supply chain, circumventing the ethical and environmental challenges of traditional mining. Increasingly, socially conscious consumers are opting for synthetic diamonds, prioritizing sustainability and ethical sourcing in their jewelry purchases.

Grab a look at our report page click here!

Market Segmentation

By Application

By Type

By Carrot Size

By Region

Grab a look at our sample for the report click here!

Visit our Advanced Materials Chemicals and Fuel Vertical Page !

Conclusion

The rise of synthetic diamonds marks a significant shift in the gemstone industry, offering an ethical, environmentally friendly, and cost-effective alternative to natural diamonds. While there are challenges in terms of market acceptance and resale value, the benefits of lab-grown diamonds—particularly for socially conscious and budget-conscious consumers—are undeniable.

0 notes

Text

0 notes

Text

The Graphene Industry: An In-Depth Market Analysis

Introduction to Graphene

Graphene, a single layer of carbon atoms arranged in a two-dimensional honeycomb lattice, has gained significant attention since its discovery in 2004. Renowned for its exceptional electrical, thermal, and mechanical properties, graphene is poised to revolutionize various industries, including electronics, energy, aerospace, and materials science.

Market Overview

The graphene market has witnessed substantial growth over the past few years, driven by increasing investments in research and development, rising demand for advanced materials, and the growing commercialization of graphene-based products. According to recent market research, The graphene market is projected to reach approximately USD 0.93 billion in 2024 and is expected to grow to about USD 4.77 billion by 2029, achieving a CAGR of 38.64% during the forecast period from 2024 to 2029.

Key Drivers of Market Growth

Technological Advancements: Continuous innovation in graphene production methods, such as chemical vapor deposition (CVD) and liquid-phase exfoliation, is lowering production costs and enhancing quality.

Increasing Demand in Electronics: The demand for lightweight, flexible, and high-performance materials in the electronics industry is fueling the adoption of graphene in applications such as touchscreens, batteries, and sensors.

Energy Storage Solutions: Graphene's high conductivity and large surface area make it ideal for applications in supercapacitors and batteries, particularly lithium-ion batteries, where it can enhance performance and lifespan.

Healthcare Applications: Graphene’s biocompatibility and antimicrobial properties are driving research into its use in drug delivery systems, biosensors, and other medical applications.

Government Initiatives: Various governments are investing in graphene research and development to bolster their position in the global market, leading to increased funding and collaboration opportunities.

Challenges Facing the Industry

Despite its potential, the graphene market faces several challenges:

Production Scalability: While lab-scale production of graphene has been successful, scaling up to meet industrial demands remains a challenge.

High Production Costs: Current methods of graphene production can be expensive, which limits widespread adoption in cost-sensitive applications.

Lack of Standardization: The absence of standardized testing and quality control methods can hinder market growth, as companies may struggle to ensure product consistency.

Regulatory Hurdles: The introduction of new materials in various sectors often faces stringent regulatory scrutiny, which can delay commercialization.

Regional Insights

North America: The region is a major player in the graphene market, driven by robust research initiatives and a strong presence of key players.

Europe: Significant funding from the European Union for graphene research has accelerated market growth, with many startups emerging in the region.

Asia-Pacific: Rapid industrialization and increasing investment in nanotechnology are propelling the growth of the graphene market in countries like China and Japan.

Future Outlook

The future of the graphene market looks promising, with anticipated advancements in production techniques and increased adoption across various industries. As more companies explore the potential applications of graphene, the market is likely to expand, leading to new opportunities for innovation and collaboration.

Conclusion

The graphene industry stands at the forefront of technological innovation, promising a multitude of applications across diverse sectors. While challenges remain, the continued investment in research and development, coupled with the growing interest from various industries, suggests that graphene could become a cornerstone material in the near future. Stakeholders should remain vigilant to the evolving landscape and prepare to leverage the opportunities that arise in this dynamic market. For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence: https://www.mordorintelligence.com/industry-reports/graphene-market

#Graphene Industry#Graphene Market#Graphene Market Size#Graphene Market Share#Graphene Market Analysis#Graphene Market Report

0 notes

Text

Wet Chemicals Market Outlook, Size, Growth, Price, Latest Trends & Industry Forecast 2032

Wet chemicals are integral to the semiconductor manufacturing process, playing a vital role in various stages of wafer fabrication, including cleaning, etching, and surface modification. These chemicals are used to prepare semiconductor surfaces for subsequent processing steps, ensuring that impurities and contaminants are removed and that surface properties are optimized for device performance. The formulation and application of wet chemicals are critical for maintaining the yield and reliability of semiconductor devices.

The semiconductor industry is characterized by stringent cleanliness standards, and wet chemicals must meet specific purity and performance criteria. These chemicals typically include solvents, acids, bases, and surfactants, each designed for particular applications. As technology progresses, the need for specialized wet chemical formulations that can address the requirements of advanced manufacturing techniques, such as atomic layer deposition (ALD) and extreme ultraviolet (EUV) lithography, is growing.

The Wet Chemicals Market is experiencing increased demand driven by their critical role in semiconductor manufacturing processes, including etching, cleaning, and surface preparation, essential for achieving high-quality results.

Future Scope

The future of wet chemicals in semiconductor manufacturing is poised for growth, driven by the increasing complexity of semiconductor devices and the demand for higher performance. As semiconductor technologies evolve, manufacturers will require advanced wet chemical solutions that can effectively clean and prepare surfaces for next-generation devices. This demand will necessitate ongoing research and development to create innovative formulations that enhance cleaning efficiency and minimize environmental impact.

Moreover, the rise of sustainable manufacturing practices will drive the development of eco-friendly wet chemical solutions. As regulations surrounding chemical usage become more stringent, manufacturers will seek wet chemicals that are both effective and environmentally friendly, paving the way for the adoption of greener alternatives.

Trends

Several trends are shaping the wet chemicals market in semiconductor manufacturing. One significant trend is the increasing focus on process automation. Manufacturers are adopting automated chemical delivery systems that improve consistency and precision in wet chemical applications. This trend enhances the efficiency of cleaning and etching processes while reducing the risk of contamination.

Another notable trend is the customization of wet chemical formulations to meet the specific needs of advanced manufacturing processes. As new materials and technologies emerge, manufacturers are collaborating with chemical suppliers to develop tailored solutions that enhance performance and yield. This collaboration is essential for addressing the unique challenges posed by the evolving semiconductor landscape.

Application

Wet chemicals are utilized in various stages of semiconductor manufacturing, including wafer cleaning, photoresist stripping, and etching. In wafer cleaning, wet chemicals remove contaminants and particles from the surface of wafers, ensuring optimal conditions for subsequent processing. Effective cleaning is crucial for achieving high yields and preventing defects in final devices.

During the etching process, wet chemicals are employed to selectively remove material from the wafer surface, creating the desired patterns for integrated circuits. This step is essential for defining the intricate features of semiconductor devices. Additionally, wet chemicals are used in photoresist stripping to remove the protective layers after lithography, preparing the wafer for further processing.

Key Points

Integral to various stages of semiconductor manufacturing, including cleaning and etching.

Driven by the need for higher performance and advanced manufacturing techniques.

Future growth expected with innovations in eco-friendly formulations.

Trends include process automation and customization of chemical solutions.

Applied in wafer cleaning, photoresist stripping, and etching processes.

Read More Details: https://www.snsinsider.com/reports/wet-chemicals-market-for-electronics-and-smiconductor-applications-4539

Contact Us:

Akash Anand — Head of Business Development & Strategy

Email: [email protected]

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

0 notes

Text

Atomic Layer Deposition (ALD) Equipment Market: Trends, Growth, and Opportunities

The atomic layer deposition (ALD) equipment market is expected to grow significantly over the forecast period, driven by the increasing demand for high-speed, reliable connections in data centers and telecommunications networks. The market is expected to reach USD 6.2 billion by 2028, growing at a CAGR of 10.0% during the forecast period.

Key Drivers and Restraints

Driver: Rising Number of 3D NAND SSDs The growing trend of miniaturization in electronic devices, coupled with advancements such as 3D NAND memory and FinFET-based transistor devices, has generated a heightened demand for the precise deposition of conformal thin films. Therefore, ALD plays a crucial role in the miniaturization of electronic devices as it enables the deposition of materials with exceptional conformality even at temperatures around 400°C. Moreover, ALD provides a valuable means to achieve high-quality thin films, essential for optimizing the performance and efficiency of these cutting-edge technologies. Therefore, the increasing number of 3D NAND SSDs is expected to drive the market growth for ALD equipment.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=96683066

Restraint: Shortage of Trained Workforce The increasing demand for semiconductor devices from many end user industries, such as consumer electronics and automotive, has created several opportunities for the market players. However, the shortage of skilled technicians for such complex processes has not enabled the market players to utilize these opportunities to the fullest. So, the need for highly skilled workers to carry out these complicated tasks is a big problem that may restrain ALD equipment market growth.

Market Trends and Insights

Rising Technical Challenges and Process Complexities Manufacturing semiconductors demands an extremely clean environment and equipment. Even a tiny speck of dust can disrupt the process and lead to significant financial losses. If there are manufacturing mistakes that cause supply delays, it can result in more losses and even canceled orders. Common problems in semiconductor manufacturing involve issues with the materials, mechanical strength, and the chips. Therefore, the increasing technical difficulties and process complexities in semiconductor manufacturing may impede the market growth of ALD equipment.

Escalating Need for Photovoltaic Systems Photovoltaics are integrated into solar cells; the growing demand for solar cells contributes to the growing deployment of photovoltaics, which is expected to drive the market growth for ALD equipment. ALD films are also used in solar cells as surface passivation layers, buffer layers, window layers, absorber layers, and hole/electron contact, which can further drive the market growth of ALD equipment. Moreover, the health and environmental advantages of adopting photovoltaic power are particularly significant in densely populated areas heavily reliant on coal power, in contrast to sparsely populated regions abundant in clean hydropower or wind energy. Consequently, the surging demand for photovoltaics has led to an increased deployment of ALD equipment, which is expected to drive the market growth of ALD equipment in the future.

Market Analysis and Forecast The ALD equipment market is expected to grow at the highest CAGR in the Asia Pacific region during the forecast period. The Asia Pacific region has witnessed significant growth in data center infrastructure due to the rising demand for cloud computing, digital services, and e-commerce. With the deployment of 5G networks in the Asia Pacific countries, high-speed, low-latency communication links are essential.

Competitive Landscape The prominent players in the ALD equipment market are ASM International N.V. (Netherlands), Tokyo Electron Limited. (Japan), Applied Materials, Inc. (US), LAM RESEARCH CORPORATION. (US), and Veeco Instruments Inc. (US). These companies perform organic and inorganic growth strategies such as product launches, partnerships and acquisitions, to expand themselves globally by providing new and advanced ALD equipment solutions.

0 notes

Text

Global Top 5 Companies Accounted for 83% of total Atomic Layer Deposition (ALD) Diaphragm Valves market

Atomic Layer Deposition (ALD) is a method of applying thin films to various substrates with atomic scale precision. As chip node dimensions are continuously shrinking, traditional deposition techniques have reached their limits. Depositing ultra-thin layer at the nanoscale requires Atomic Layer Deposition (ALD) technology, which allows materials to be deposited one atomic layer at a time. Atomic Layer Deposition (ALD) Diaphragm Valves are used to deliver precise doses of gases during the deposition process.

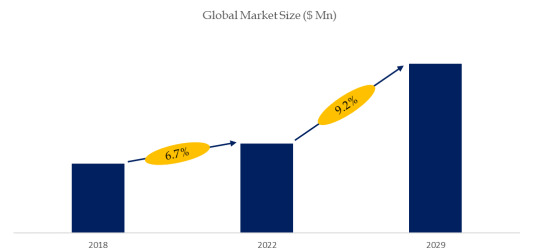

According to the new market research report “Global Atomic Layer Deposition (ALD) Diaphragm Valves Market Report 2023-2029”, published by QYResearch, the global Atomic Layer Deposition (ALD) Diaphragm Valves market size is projected to reach USD 0.12 billion by 2029, at a CAGR of 9.2% during the forecast period.

Figure. Global Atomic Layer Deposition (ALD) Diaphragm Valves Market Size (US$ Million), 2018-2029

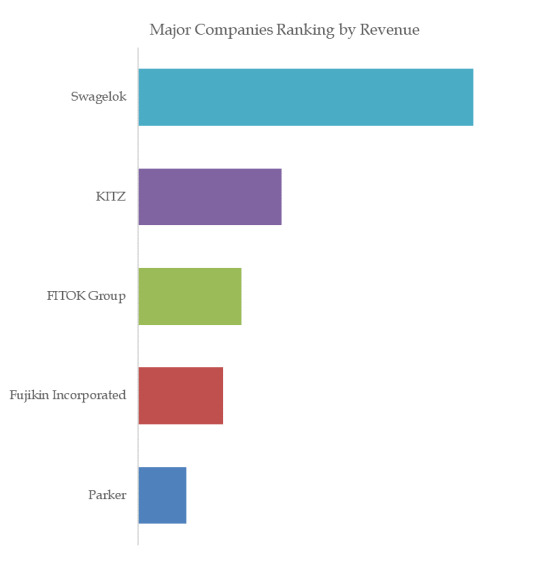

Figure. Global Atomic Layer Deposition (ALD) Diaphragm Valves Top 5 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

The global key manufacturers of Atomic Layer Deposition (ALD) Diaphragm Valves include Swagelok, KITZ, FITOK Group, Fujikin Incorporated, Parker, etc. In 2022, the global top four players had a share approximately 83.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

For more information, please contact the following e-mail address:

Email: [email protected]

Website: https://www.qyresearch.com

0 notes

Text

Thin-Film Encapsulation Market Predictive Size and Share Analysis 2023-2030

In the ever-evolving landscape of electronics, flexibility is the new frontier. From bendable smartphones to rollable displays, the demand for flexible electronic devices is on the rise, promising a future where technology seamlessly integrates into every aspect of our lives. At the heart of this revolution lies thin-film encapsulation (TFE), a critical technology that enables the fabrication of flexible, lightweight, and durable electronic devices. In this unique blog, we delve into the fascinating world of the thin-film encapsulation market, exploring its importance, innovations, and the transformative impact it holds for the future of electronics.

1. The Foundation of Flexibility: At its core, thin-film encapsulation (TFE) is a technique used to protect electronic devices from moisture, oxygen, and other environmental contaminants while maintaining flexibility and durability. By depositing ultra-thin layers of protective materials, such as polymers or inorganic compounds, TFE creates a barrier that shields delicate electronic components from damage without compromising their flexibility or performance. This breakthrough technology is paving the way for a new generation of bendable, foldable, and stretchable electronic devices that were once thought impossible.

Request Sample Report: https://www.snsinsider.com/sample-request/3189

2. Applications Across Industries: The applications of thin-film encapsulation are as diverse as they are revolutionary. In the consumer electronics sector, TFE enables the development of flexible displays, wearable devices, and electronic textiles, offering unparalleled convenience and comfort to users. In the healthcare industry, it facilitates the creation of flexible medical devices, such as biosensors and implantable electronics, revolutionizing patient monitoring and healthcare delivery. In the automotive and aerospace sectors, TFE is driving innovation in flexible displays, smart surfaces, and lightweight sensors, enhancing safety, efficiency, and sustainability.

3. Innovations Driving Market Growth: The thin-film encapsulation market is experiencing rapid growth, fueled by advancements in materials science, manufacturing techniques, and device design. Researchers and engineers are exploring novel materials, such as organic polymers, graphene, and metal oxides, to improve the flexibility, transparency, and barrier properties of thin-film encapsulation layers. Additionally, innovations in deposition techniques, such as atomic layer deposition (ALD) and plasma-enhanced chemical vapor deposition (PECVD), are enabling the scalable production of high-quality TFE films with precise thickness and uniformity.

4. Addressing Challenges and Opportunities: Despite its immense potential, the thin-film encapsulation market faces certain challenges, including cost, scalability, and compatibility with existing manufacturing processes. However, these challenges also present opportunities for innovation and market growth. Collaborative research efforts between academia and industry are focused on developing cost-effective TFE solutions that can be seamlessly integrated into existing fabrication processes, paving the way for mass adoption of flexible electronics.

5. Embracing the Future: As we look to the future, the potential of thin-film encapsulation technology is boundless. From flexible smartphones and e-readers to wearable health monitors and smart clothing, TFE is reshaping the way we interact with technology and the world around us. However, with great power comes great responsibility, and it is essential that we prioritize sustainability, recyclability, and ethical manufacturing practices in the development and deployment of thin-film encapsulation solutions.

In conclusion, thin-film encapsulation is the cornerstone of flexibility in the world of electronics, enabling the creation of innovative devices that seamlessly integrate into our lives. As we continue to push the boundaries of what's possible, let us embrace the transformative potential of TFE technology, driving innovation, sustainability, and progress in the quest for a more connected and flexible future.

Access Full Report Details: https://www.snsinsider.com/reports/thin-film-encapsulation-market-3189

0 notes

Text

HPHT CVD diamond

Advancements in Diamond Synthesis: HPHT and CVD Techniques

Introduction:

In recent years, the diamond industry has witnessed significant technological advancements in the synthesis of diamonds, particularly through two prominent methods - High Pressure High Temperature (HPHT) and Chemical Vapor Deposition (CVD). These techniques have revolutionized the production of diamonds, offering new possibilities in industrial applications, jewelry, and beyond.

High Pressure High Temperature (HPHT) Diamond Synthesis:

HPHT is a traditional method that mimics the natural diamond formation process within the Earth's mantle. In this technique, a small diamond seed crystal is exposed to extremely high temperatures (about 1,400 to 1,800 degrees Celsius) and pressures (around 5 to 6 GPa), replicating the conditions found deep beneath the Earth's surface. Carbon source materials, often graphite or a carbon-rich gas, are then subjected to these conditions, causing the carbon atoms to crystallize and form a diamond around the seed crystal.

HPHT diamonds exhibit remarkable hardness and transparency, making them suitable for various industrial applications such as cutting, drilling, and grinding. Additionally, these diamonds have found their way into the jewelry market, offering an alternative to naturally occurring diamonds.

Chemical Vapor Deposition (CVD) Diamond Synthesis:

CVD is a more contemporary method that has gained popularity for its versatility and the ability to produce large, high-quality diamonds. In the CVD process, a carbon-rich gas, typically methane, is introduced into a vacuum chamber along with a substrate material, often a thin slice of diamond or silicon. Radio frequency energy or microwaves are then used to break down the carbon-containing gas, allowing carbon atoms to deposit onto the substrate, forming a crystalline diamond layer.

One of the key advantages of CVD diamond synthesis is the ability to control the growth process at a molecular level, resulting in diamonds with tailored properties. This method allows for the production of large, high-purity diamonds with fewer impurities compared to some HPHT diamonds. CVD diamonds are increasingly being utilized in cutting-edge technologies, including optics, electronics, and even quantum computing.

Comparative Analysis:

Both HPHT and CVD techniques have their unique advantages and applications. HPHT diamonds tend to be larger in size and are often employed in the industrial sector for applications that require extreme hardness. On the other hand, CVD diamonds are favored for their purity, size control, and the ability to integrate seamlessly into advanced technological applications.

Applications and Impact:

The impact of HPHT and CVD diamond synthesis extends beyond the jewelry industry. HPHT diamonds are widely used in industrial tools, such as cutting and grinding tools, due to their exceptional hardness. CVD diamonds, with their high purity and controlled growth, find applications in electronics, optics, and thermal management.

In the electronics industry, CVD diamonds are being explored for use in high-power electronic devices and as a substrate material for semiconductors. The optical properties of diamonds make them ideal for applications such as laser optics and high-performance sensors. Additionally, the use of diamonds in quantum computing is an exciting frontier that could potentially revolutionize information processing.

Conclusion:

The advancements in HPHT and CVD diamond synthesis have opened new avenues in various industries, from traditional applications in jewelry and industrial tools to cutting-edge technologies in electronics and quantum computing. Each technique offers unique advantages, and ongoing research and development continue to enhance their capabilities. As these synthetic diamonds become more accessible and cost-effective, their impact on technology, industry, and innovation is poised to grow, ushering in a new era of diamond applications.Read More

0 notes

Text

2 D Materials Market, Market Size, Market Share, Key Players | BIS Research

2D materials are substances that are just a few atoms thick, usually one layer. The most famous 2D material is graphene, discovered in 2004 by physicists Andre Geim and Konstantin Novoselov, which led to a Nobel Prize in Physics in 2010. Graphene is a single layer of carbon atoms arranged in a hexagonal lattice, with incredible mechanical strength, electrical conductivity, and thermal properties.

The 2D materials market is projected to reach $4,000.0 million by 2031 from $526.1 million in 2022, growing at a CAGR of 25.3% during the forecast period 2022-2031.

2 D Materials Overview

2 D Materials focus on addressing the environmental, social, and economic challenges associated with mining activities while ensuring long-term resource availability.

Key components of Sustainable Mining

Reducing energy consumption

Minimizing greenhouse gas emissions

Conserving water

Market Segmentation

1 By Application

• Metallic Minerals

Industrial Metals

Precious Metals

Iron Ore

• Non-Metallic Minerals

Coal

Others

By Process

Underground Mining Surface Mining

By Mining Equipment

• Drill Rigs

• Bolters

• Dozers

• Loaders

By Energy Source

1 Battery

Lithium-Ion Battery

Lead Acid Battery

Others

2 Hydrogen Fuel Cell

3 Bio-Fuel

By Region

North America - U.S., Canada, and Mexico

Europe - Germany, Russia, Sweden, Spain, and Rest-of-Europe

China

U.K.

Download the report and get more information @ 2 D Materials Market

.Major Key Players

• NanoXplore Inc.

• Cabot Corporation

• Thomas Swan & Co. Ltd.

• Ossila Ltd

• ACS Material LLC

Download the sample page click here @ 2 D Materials Market

Demand – Drivers and Limitations

The following are the demand drivers for the global 2D materials market:

• Growing adoption of 2D materials in energy storage • Strong growth of 2D materials in the healthcare industry • Growing demand for transparent conductive films in electronics industry

The market is expected to face some limitations as well due to the following challenges:

• Lack of large-scale production of high-quality graphene • High cost of production

Recent Developments in the Global 2D Materials Market

• In September 2021, Colloids Limited introduced a new infrastructure for customized polymeric materials using its ground-breaking graphanced graphene masterbatch advanced technologies. Due to its extraordinary qualities, graphene has attracted a lot of attention. Additionally, it has exceptional mechanical characteristics as well as superior thermal and electrical permeability.

• In December 2021, Black Swan Graphene Inc. signed a legally enforceable letter of intent to purchase Dragonfly Capital Corp., in a backward merger agreement for $31.5 million. On December 13, 2021, Black Swan Graphene Inc. and Dragonfly Capital Corp. agreed to exchange shares in an opposite merger transaction. Stockholders of Black Swan would then obtain 15.2 consideration shareholdings for every ordinary Black Swan share they own.

Challenges in the 2D Materials Market

Despite the excitement surrounding 2D materials, there are notable challenges that the industry must overcome:

Scalability of Production: Producing high-quality 2D materials at scale remains a challenge. Researchers are exploring various methods, such as chemical vapor deposition (CVD), but the cost and complexity of manufacturing must be addressed for widespread adoption.

Integration into Existing Technologies: For 2D materials to be fully integrated into mainstream applications, they must seamlessly work with existing materials and processes. Compatibility issues with traditional manufacturing methods could slow down the transition.

Cost of Raw Materials and Processing: Currently, the cost of producing 2D materials is relatively high. Developing cost-effective manufacturing techniques is crucial for making these materials economically viable.

The Future of 2D Materials

As the 2D materials market continues to evolve, we are likely to see a wave of disruptive innovations across multiple sectors. With ongoing research, improved production techniques, and increasing investment, these materials could fundamentally reshape industries ranging from electronics to energy and healthcare.

While challenges remain, the unique properties of 2D materials offer unprecedented opportunities for technological advancement. The next few years will be crucial in determining how quickly and effectively these materials can be integrated into real-world applications, but one thing is certain: 2D materials are poised to revolutionize the future of advanced materials.

Key Questions

Q What are the main bottlenecks for scaling up 2D materials, and how can they be overcome?

Q Where do you see the greatest need for additional R&D efforts?

Q How does the supply chain function in the global 2D materials market for end users?

Q What are the key business and corporate strategies of 2D material manufacturers involved in the global 2D materials market?

Q What are the advantages of the emerging 2D materials that are entering the market, and how are they used in various applications?

Q Which applications (by end user) and products (by material type) segments are leading in terms of consumption of the 2D materials market, and which of them are expected to witness high demand growth during 2022-2031?

Q Which regions and countries are leading in terms of consumption of the global 2D materials market, and which of them are expected to witness high demand growth during 2021-2031?

Q What are the most promising opportunities for furthering the efficiency of 2D materials?

Q How has COVID-19 impacted the 2D materials market across the globe?

Q How the semiconductor crisis impacted the 2D materials market?

Conclusion

The 2D materials market is set to grow exponentially as more industries recognize the potential of these atom-thin materials. With ongoing advancements in production techniques, new discoveries of 2D materials, and innovative applications across sectors, the future looks incredibly promising.

0 notes

Text

Nano-Coating the World: Atomic Layer Deposition Market Outlook

Atomic layer deposition market is a deposition technique that uses thin film that is based on sequential use in gas phase process. The global materials industry has a 38.5% CAGR and is expected to reach $400 million in 2015.One of the major factors for the growth of this market can be the growing use of component miniaturization. The market for component miniaturization is expected to grow to $21.1 billion till 2016.The high investment cost acts as a restraining factor for growth of Atomic layer deposition market. Many manufacturing companies prefer ALD technique to produce smaller components.

The Atomic Layer Deposition (ALD) market is experiencing significant growth and innovation as it continues to play a pivotal role in the semiconductor industry and beyond. ALD is a precise and versatile thin-film deposition technique that allows for the controlled growth of ultra-thin films with atomic-level precision. This technology finds applications in semiconductor manufacturing, advanced materials development, and emerging fields such as energy storage and biomedical devices.

The market is witnessing increasing demand driven by the ever-shrinking dimensions of semiconductor devices, leading to the need for precise and conformal thin films. Additionally, ALD is gaining prominence in research and development for next-generation technologies, pushing the boundaries of materials science. As industries continue to embrace nanoscale engineering and materials innovation, the ALD market is expected to expand and evolve, offering a wide range of opportunities for growth and technological advancement.

KEY BENEFITS

Provides information about current market situation, changing market dynamics, expected trends and market intelligence

It gives a projection for next eight years by considering values for 2012 as reference.

Porter’s five forces and SWOT analysis would help in making strategic decisions

Micro level analysis based on construction types, applications and geographies.

Competitive strategy analysis for effective planning and execution of business plan.

Key Market Players : Adeka Corp, Applied Materials Inc, ASM International N.V.,ATMI Inc. Beneq Oy, Cambridge NanoTech Inc, Hitachi Kokusai Electric Inc, Kurt J. Lesker Co, Metryx Ltd, Novellus Systems Inc,Oxford Instruments plc, Picosun Oy, Praxair Technology Inc, Sigma-Aldrich Co. LLC and others.

0 notes

Text

The Origin of lab grown Diamonds: A Sparkling Innovation

Diamonds, with their breathtaking beauty and enduring allure, have fascinated humans for centuries. Traditionally, these precious gems were unearthed through the arduous process of diamond mining. However, a remarkable transformation has occurred in recent years with the advent of lab grown diamonds. In this blog, we embark on a journey to explore the origins of lab grown diamonds, tracing their evolution from a scientific curiosity to a thriving industry that offers ethically sourced and environmentally friendly gems.

The Early Beginnings: A Scientific Curiosity

The story of lab grown diamonds begins not in the realm of jewelry but in the world of science. Early experiments with synthetic diamonds date back to the late 19th century. However, it was not until the mid-20th century that significant progress was made in the creation of diamonds in a laboratory setting.

In 1955, General Electric (GE) made a groundbreaking discovery by successfully synthesizing diamonds using the High-Pressure High-Temperature (HPHT) method. This method involves subjecting carbon to immense pressure and temperature conditions, replicating the natural processes that occur deep within the Earth's mantle.

The Diamond Race: Advancements in Technology

Following GE's breakthrough, a race to perfect the art of growing diamonds in a controlled environment began. Various research institutions and private companies dedicated their efforts to improving the quality and efficiency of lab grown diamonds. These advancements led to the development of the Chemical Vapor Deposition (CVD) method, another successful technique for creating diamonds.

In CVD, a carbon-rich gas is heated, and carbon atoms are deposited onto a diamond seed, layer by layer, resulting in the growth of a diamond crystal. This method offers greater control over the diamond's characteristics, such as size, shape, and impurity content.

Diamonds Go Commercial: The Birth of an Industry

The 21st century marked a turning point for lab grown diamonds. As technology improved and production costs decreased, lab grown diamonds began to enter the commercial market. The ethical and environmental concerns associated with traditional diamond mining further fueled the interest in lab grown diamonds.

Companies specializing in the production of lab grown diamonds emerged, and the gems found their way into the world of jewelry. Jewelry designers and manufacturers embraced these ethical and sustainable alternatives, recognizing their potential to redefine the industry.

The Present and Beyond: lab grown Diamonds Flourish

Today, lab grown diamonds have firmly established themselves as a valuable and sustainable option for consumers. These gems are created with remarkable precision and are virtually identical in appearance and composition to their natural counterparts. They are celebrated for their ethical and environmental credentials, offering a guilt-free choice for those who wish to adorn themselves with these timeless gems.

The Future of lab grown Diamonds

As we peer into the future, the outlook for lab grown diamonds appears even more promising:

Increased Market Share: lab grown diamonds are projected to gain a larger share of the diamond market. Their affordability and ethical appeal make them an attractive choice for a broader range of consumers.

Technological Advancements: Ongoing research and development will likely lead to further improvements in the quality and size of lab grown diamonds. As technology evolves, we may witness lab grown diamonds surpassing natural diamonds in certain aspects.

Innovative Applications: Beyond jewelry, lab grown diamonds have diverse applications. They are used in cutting-edge technologies, such as laser technology, high-performance electronics, and even medical devices.

Conclusion

The origin of lab grown diamonds is a fascinating journey that started as a scientific curiosity and evolved into a burgeoning industry. These gems represent a compelling alternative to traditionally mined diamonds, offering ethical sourcing, environmental sustainability, and remarkable quality. As technology continues to advance, lab grown diamonds will undoubtedly play a more prominent role in the world of jewelry and beyond, shaping a future where beauty, ethics, and innovation coexist in sparkling harmony.

0 notes

Text

Atomic Layer Deposition Market Dynamics: Drivers, Challenges, and Opportunities

Atomic Layer Deposition (ALD) is a cutting-edge thin film deposition technique employed in various industries, including semiconductor manufacturing, electronics, energy storage, and more. This process enables precise control over thin film thickness and composition, making it indispensable in the development of advanced materials and nanotechnology applications. The ALD market has witnessed significant growth in recent years, driven by the increasing demand for miniaturized electronic devices and the need for high-performance coatings in various industries.

The Atomic Layer Deposition market growth can be attributed to its versatility and precision in depositing ultra-thin films on a variety of substrates, such as silicon wafers, glass, and polymers. This capability allows for the production of semiconductor devices with smaller dimensions and enhanced performance, making it a vital technology in the semiconductor industry.

Furthermore, the market is experiencing continuous expansion due to the burgeoning demand for ALD in emerging industries like photovoltaics and energy storage. ALD's ability to improve the efficiency and durability of solar cells and battery materials has made it a pivotal player in the clean energy sector.

In terms of atomic layer deposition market trends, is witnessing a growing emphasis on developing novel ALD precursors and processes to enhance film quality and deposition rates. Researchers and manufacturers are actively exploring new materials and chemistries to meet the evolving demands of the market. Additionally, there is a growing interest in exploring the potential of ALD for applications in healthcare, where precise coatings on medical devices can offer improved biocompatibility and functionality.

The ALD market's future appears promising as it continues to advance in parallel with the ever-evolving technology landscape. As industries strive for miniaturization, improved performance, and enhanced sustainability, the role of ALD in enabling these goals is expected to become even more prominent. With ongoing research and development efforts, the atomic layer deposition market is poised to play a crucial role in shaping the future of numerous high-tech industries.

#Atomic Layer Deposition Market#Atomic Layer Deposition Market Growth#Atomic Layer Deposition Market Trends

0 notes

Text

Epitaxy Deposition Market Size, Share & Trends Analysis Report

Global Epitaxy Deposition Market: Global Size, Trends, Competitive, Historical & Forecast Analysis, 2020-2025

Scope of Global Epitaxy Deposition Market:

The latest business intelligence report on the Epitaxy Deposition Market offers a comprehensive overview of the pivotal aspects pertaining to this industry vertical. It incorporates an accurate assessment of historical records, projections, growth drivers, opportunities, challenges, and restraints, among others.

Epitaxy deposition is a specialized technique used in the field of materials science and semiconductor fabrication. It involves the growth of a crystalline film or layer on a substrate with a well-defined crystal structure and orientation. Epitaxy deposition plays a crucial role in the development and production of advanced electronic devices, such as integrated circuits, optoelectronic devices, and high-performance transistors.

The scope of epitaxy deposition is broad and encompasses various applications and material systems. It enables the precise control of material properties, such as crystal structure, thickness, composition, and doping concentration. Epitaxy deposition techniques, such as molecular beam epitaxy (MBE) and metal-organic chemical vapor deposition (MOCVD), allow the growth of thin films with atomic-level precision, ensuring the desired material characteristics and performance.

In the field of electronics, epitaxy deposition is used to fabricate high-quality semiconductor materials, including silicon, gallium nitride (GaN), indium gallium arsenide (InGaAs), and other compound semiconductors. These materials serve as the building blocks for advanced electronic devices, such as transistors, light-emitting diodes (LEDs), laser diodes, and solar cells. By controlling the epitaxial growth process, researchers and engineers can tailor the properties of these materials to meet specific device requirements, such as enhanced electrical conductivity, improved light emission, and higher power efficiency.

Browse In-depth Market Research Report (300 Pages) on Epitaxy Deposition Market:

Epitaxy Deposition Market Companies:

Tokyo Electron

IQE

Applied Materials

Hitachi Kokusai Electric

Canon Anelva Corporation

ASM International

AIXTRON

LAM Research

Veeco Instruments

Others

Regional Insights:

The regions covered in this Global Epitaxy Deposition Market report are North America, Europe, Asia-Pacific, and Rest of the World. Based on country level, the market of Managed security service is subdivided into the U.S., Mexico, Canada, U.K., France, Germany, Italy, China, Japan, India, Southeast Asia, Middle East Asia (UAE, Saudi Arabia, Egypt) GCC, Africa, etc.

Global Epitaxy Deposition Market Segmentation:

By Product Type:

Homoepitaxy Deposition

Heteroepitaxy Deposition

By Application:

IDMs

Memory Manufacturers

Foundries

0 notes

Text

From Laboratory to Luxury: The Evolution of Lab-Grown Diamonds

Diamonds are a girl's best friend, or so the saying goes. But what if we told you that there is an option for diamonds that not only looks and feels just like the real thing but also comes without any ethical concerns? Enter lab grown diamonds - a fascinating alternative to traditional mined diamonds that have been gaining popularity in recent years. From their history to how they're made, as well as where to buy and how to care for them - this article will take you through everything you need to know about lab-grown diamonds!

Lab-grown diamonds are created using two main methods: High Pressure-High Temperature (HPHT) and Chemical Vapor Deposition (CVD). The HPHT method involves placing a small diamond seed in a chamber with carbon material and subjecting it to extreme heat and pressure. The carbon melts and forms around the seed, causing it to grow into a larger diamond. On the other hand, CVD production begins with a thin slice of diamond placed inside a sealed chamber filled with gas. By heating the gas to extremely high temperatures, plasma is formed which breaks down molecules in the gas. This results in atoms bonding together on top of the original diamond slice, forming new layers of crystal until it becomes an entire gemstone. Both methods produce identical diamonds that can range from colourless to fancy-colored diamonds such as pink or yellow. Lab-grown diamonds have become popular among consumers due to their affordability compared to natural diamonds while still maintaining similar quality standards.

If you're in the market for a lab-grown diamond, there are several options available. You can purchase them from jewellery stores that specialize in lab grown diamonds or online retailers. Here's what to consider when deciding where to buy: Firstly, do your research before purchasing from any retailer. Look for reviews and feedback from previous customers to ensure that you're buying from a reputable source. Secondly, check out various retailers' selections of lab grown diamonds and compare prices. It's important to note that while lab-grown diamonds are generally less expensive than their natural counterparts, the price can still vary depending on factors such as size and quality. Thirdly, consider the customer experience offered by each retailer. Do they have knowledgeable staff who can answer your questions? Do they offer warranties or return policies? Decide whether you want to purchase in-person at a brick-and-mortar store or online. Purchasing online may be more convenient but it also carries risks such as not being able to inspect the diamond in person before making your purchase. Take time researching different options so that you can feel confident with your decision on where to buy your lab grown diamond.

Lab-grown diamonds are an affordable and ethical alternative to natural diamonds. While they share the same physical and chemical properties as mined diamonds, they require slightly different care.

0 notes

Text

Optical Properties of Anti-Reflective Coatings on P-N Silicon and their Response to Gamma-Irradiation

Authored by: Henaish AMA

Abstract

The dc-pulsed plasma magnetron sputtering was used for depositing TiO2, ZrO2, and Ti50-Zr50 anti-reflection coating with thickness of 40 nm on p-n junction wafers and glass substrates. Furthermore, the antireflective properties of silicon nitride deposited elsewhere using plasma enhanced chemical vapor deposition (PECVD) were compared with those of metal oxide films. X-ray structural analysis reveals amorphous nature of the prepared films. The optical transmittance and reflectance measurements were investigated at room temperature in the wavelength range from 250 to 2500 nm. At long wavelengths, ZrO2 has a slightly higher transparency than that of TiO2 and Ti50-Zr50 oxide. On the other hand, the transparency at short wavelengths has different behavior. At about 300nm, a sharp decrease in the transparency of the three coatings was found. On the other hand, reflectance measurements show a decrease in reflectivity at 600 nm for ZrO2 and Ti50-Zr50 oxide as compared toTiO2. Samples irradiated with gamma rays at a dose of 5 kGray show different behavior in reflectivity due to displacement damage in Si-based cells.

Keywords: p-n Si cell; Dc-pulsed plasma magnetron sputtering; Anti-reflection coatings (ARC); TiO2; ZrO2; Ti50-Zr50 oxide

Abbreviations: PECVD: Plasma Enhanced Chemical Vapor Deposition; SCs: Solar Cells; ARC: Anti-Reflection Coatings

Introduction

Si-based solar cells (SCs) account for 90% of the current photovoltaic market. However, high production cost attitudes as an obstacle to their widespread performance [1]. Major industrial and researcher efforts are being made constantly to reduce the production cost while improving their power conversion efficiency. To do that, one of the main steps is to reduce reflection losses for solar cells, using anti-reflection coating (ARC) materials at the front surface of the cells, thereby coupling more sunlight into the cell to increase the photocurrent and efficiency [2].

Metal oxides nanostructure materials play an important role in the fields of optoelectronics and energy harvesting applications [3-5]. Oxides are a vital component of PV cells due to the various applications of oxides in PV cells. New oxide materials are being introduced for use in PV where numerous transition metal oxide nanostructures with various morphologies have been synthesized using numerous techniques to achieve the requirements of the desired application [6-9]. Several highly transparent and high refractive index materials have been investigated as ARC in Si solar cells such as ZnS [10], CeO [11] TiO2 [12] Ta2O5 [13], ZnO [14] and ZrO2 [15] either in a single layer or multiple layer coating. Besides, the choice of SiNx nowadays as a highly transparent ARC material is attributed to the large band gap energy (5.1 eV) with little absorption between 300 and 1150 nm where Si solar cells operate [16]. ARCs with uniform thickness and good optical properties are synthesized by different vacuum-based processes such as physical vapor deposition, reactive sputtering and chemical vapor deposition including plasma-enhanced chemical vapor deposition PECVD and atomic layer deposition [17].

Thin-film TiO2 has the potential to reduce the production cost of Si-based solar cells, depending on the cell design. This material can serve multiple purposes as anti-reflective coating (ARC) film, oxide passivation compatible film and doping source for emitter diffusion [18]. Zirconium as an abundant terrestrial metal (74 million metric) [19] is sufficient to produce Si solar cells on a terawatt scale [20]. Optical properties of ZrO2 are considered as a suitable ARC on Si solar cells [21] where it has a large band gap of 6.1 eV [22] for cubic ZrO2 and a refractive index value n=2 at 600 nm for dc-pulsed magnetron- sputtered ZrO2 films which similar to PECVD SiNx films [23]. Previously was also observed a similar trend in ZrO2 films prepared by spray deposition [24] and by pulsed laser deposition [25] and by Magnetron sputtering [26- 29]. In this work, the structural and optical properties of three ARC films, namely TiO2, ZrO2 and Ti50-Zr50 oxide, were prepared by dc-pulsed magnetron sputtering to investigate the suitability of the prepared films for ARCs on p-n Si cells.

Experimental Procedure

Thin films preparation

Dc pulsed magnetron sputtering was used to coat a fixed thickness of 40nmthin films of TiO2, ZrO2 and Ti50-Zr50 oxide on glass and Si (100) wafer p-n-junction. The films were grown by sputtering using ZrO2, TiO2 and Ti50-Zr50 Oxide targets with purity of 99.99%, 50mm diameter and 3mm thickness. The glass substrates were ultrasonically cleaned with, methanol, acetone and water. Si substrates were cleaned with diluted HF to remove native oxide from the surface. Sputtering is a type of physical vapor deposition technique that is widely used in both the laboratory and production. During sputtering an applied voltage is used to generate plasma that is confined close to a target material which ejects species that are then transferred to the substrate. Metal oxides can be grown directly from ceramic targets by sputter gas (argon), while metal targets can be sputtered using reactive oxygen together with the sputter gas. DC -pulsed magnetron sputtering can be used to deposit compact oxide coatings with relatively good properties at low temperatures. All details about magnetron sputtering can be found in separate reviews [30-32].

The schematic diagram of the dc–pulsed magnetron sputtering system is presented in Figure 1. Briefly, the system consists of a stainless-steel chamber with a diameter of 30 cm and was evacuated by turbo and rotary pumps to obtain a base pressure of 9× 10−6 mbar. Argon gas (Ar) was introduced into the chamber to launch a total working gas pressure of 7×10−3 mbar which was measured by means of a manometer. The dc-pulsed power supply model: Pinnacle Plus pulsed was conducted to initiate the discharge. A powerful magnet was employed to ionize the target materials and direct it to settle on the substrate in the form of thin film. The selected substrates were fixed on a sample holder at a distance of 7cm from the target. The film thickness was adjusted to be around 40nm. The operating parameters of ZrO2, TiO2 and Ti50-Zr50 oxide of the coatings are listed in Table 1.

Thin-film characterization

The optical properties of deposited thin films were investigated from transmittance and reflectance measurements at room temperature in the wavelength range of 200-1000nm using Jasco V-670 UV/VIS spectrophotometer. The structural of the deposited films were determined using Bruker D8 Advance diffract meter operated at low angle incidence using 40 keV and 40 mA with Cu-Kα1 radiation (λ = 1.54056 Å).

Gamma rays irradiation effect

The output power of solar cells can be increased by improving the efficiency (η) and radiation resistance. In such a situation, radiation resistance is an important factor, because the continuous impact of high-energy particles damages the semiconductor lattice, degrades the performance of the cell, and thus limits its life. The MEGA gamma I irradiation facility in Egypt as type J-6500 was supplied by the Canadian Atomic Energy Corporation Ltd. at the National Center for Radiation Research and Technology in Cairo, with a source of cobalt-60 used to irradiate samples with 5k grey [33,34].

Result and Discussion

X-ray diffraction patterns of various antireflection coatings TiO2, ZrO2 and Ti50-Zr50 oxide deposited on a glass substrate with a constant thickness t=40 nm demonstrated in Figure 2. It is obvious from the figure that the small diffraction peaks at 24˚ and 62˚ correspond to (1 0 1) and (2 0 0) diffraction planes for the anatase phase and another very small peak at around 45˚ corresponds to the (211) of the rutile phase for TiO2 antireflection coating. The X-ray diffraction patterns of ZrO2 displays very small diffraction peaks at 25.5˚ and 45.4˚ related to monoclinic structure oriented in (110) and (202) planes, respectively. The antireflection coating of Ti50-Zr50 oxide has a completely amorphous structure.

Optical properties

The optical transmittance and reflectance of TiO2, ZrO2 and Ti50-Zr50 oxide on p-n silicon as a function of wavelength are shown in Figure 3. The appearance of interference fringes, which indicates that the films are homogeneous and flat, has been reported elsewhere [31]. The optical transmittance and reflectance depend on the type of ARCS and the category of deposition technique. In our case, the optical reflectance for long wavelengths (>600nm) of different ARCs reduces close to zero. Moreover, the optical reflectance of ZrO2 is the lowest with respect to that of anti-reflectors TiO2 and Ti50-Zr50 oxide. At long wavelengths, ZrO2 has slightly higher transmission compared to the others of anti-reflectors and p-n silicon. On the other hand, the transmission at short wavelengths has different behavior. At 300 nm it finds a decrease in transmission and starts to increase until the maximum transmission is at about 600 nm for Ty50-Zr50 oxide.

Where β is a constant that depends on the transition probability, h is the plank’s constant, υ is the photon frequency, Eg is the energy band gap. The optical energy gap is the minimum energy required to excite an electron from the valence band to the conduction band by an allowed optical transition. The value of the optical energy gap is usually determined by measuring the optical absorption coefficient as a function of the photon energy. The exponent (m) determines the type of direct and indirect transition that have values 1/2, 2, respectively.

Figure 4a illustrates the absorption coefficient depending on wavelength for the entire study spectra. This figure reflects the absorption edge in the visible region. It can be seen that at the wavelength up to 1000 nm, all metal oxides precipitating at the pn junction have almost the same values of absorption coefficient except for Ti50-Zr50 oxide at 300 to 500 nm and TiO2 at 400 to 650 nm. Figure 4b shows the variations of (αhυ)0.5 versus the photon energy (hυ) for the prepared samples. The values of the energy band gap (Eg) and refractive indices are listed in Table 2. The values of Eg are higher than those of SiN3 at thickness of 75 nm. The increase in the energy band gap in the present work may be due to the up shift in the conduction band and downshift in the valence band leading to the band gap widening at 600nm. The results show that the band gap energy of Ti50-Zr50 oxide is the highest values than other antireflective coating TiO2 and ZrO2. Moreover, the minimum energy gap value for ZrO2 was obtained.

Where (λ) is the wavelength of the normal-incidence light in a vacuum. For solar cell applications, the refractive index and thickness of the ARC are designed to minimize the reflection at 600nm. This wavelength is close to the maximum power point of the solar spectrum.

Where (λ) is the coefficient of absorption, λ is the wavelength of the incident beam, A is the absorbance and d is the thickness (Figure 6).

It is observed that the k values increase with increasing wavelength up to 600 nm for TiO2 and up to 350 nm for ZrO2 and Ti50-Zr50 oxide and thus the k values are very sensitive to the antireflection coating (ARC) type in the visible region. However, at the longer wavelengths, all (ARC) TiO2, ZrO2 and Ti50-Zr50 oxide are close. In this work, it was found that TiO2 has a refractive index of about 2.7 at t = 40 nm and ZrO2 and Ti50-Zr50 oxide have a refractive index of about 1.95 and 2.19, respectively. Elsewhere, SiNx has a refractive index of 2.05 at t = 75 with different deposition techniques as shown in Table 2 [15].

Effect of radiation on optical properties of (p-n) junction

In order to understand the behavior of samples with gammairradiation, one has to investigate the effect of gamma-radiation on solid material. Gamma-irradiation produces mainly ionization and excitation in the constituent atoms of the material. Moreover, it may also cause a small amount of atomic displacement depending on its energy and the atomic number of the target atoms [33,35]. The effect of ϒ – radiation on optical properties of Si p-n junction cells coated with TiO2, ZrO2 and T50-Zr50 oxide antireflection films with 40nm has been investigated at an irradiation dose of 5K Grey. The Optical reflectivity of the studied antireflection coatings before and after irradiation with dose 5K Grey is shown in Figure 7.

It can be observed that there is a noticeable change in reflectivity of the samples after irradiation as compared with un-irradiated ones. For irradiated TiO2 films, the decrease in reflectivity lies in the wavelength range from 400-700nm while the relative increase in its value from 700-1000 nm occurs for irradiated lies in the wavelength range from 300 to700 films. For irradiated ZrO2, the decrease in reflectivity lies only in the wavelength range from 275- 475 nm and for irradiated Ti50-Zr50 oxide has slightly difference with that of un-irradiated one. Based on the former notion, one has to discuss this effect on the evaporated films and the Si base as well. For anti-reflection coating films, ϒ-radiation may have a minor effect on their optical properties because of the following reasons

a) The film thickness is ultra-thin and therefore radiation damage is minimal.

b) The amorphous nature of the evaporating films may cause the radiation effect to be temporary with no permanent damage.

Therefore, the major effect of gamma-irradiation on samples reflectivity comes from its impact on the Si base. In other words, the change of reflectivity with irradiation may be attributed to active vacancies produced in the Si base by gamma radiation, where electrons are trapped at these vacancies. Figure 8 show the variation of absorption coefficient with wavelength for various (ARC) TiO2, ZrO2 and Ti50-Zr50 oxide on p-n silicon after gamma irradiation with 5KGrey. It can be observed that the intensity of the absorption decreases after irradiation by the ratio 2-4% at 600nm for TiO2. In addition, a noticeable change in the optical transitions between the bound states of the trapped electrons coupled with the vibration of the host Si crystal leads to vibrational absorption and emission as compared non-irradiated ones [34] and hence reduction in reflectivity over the certain optical range is expected to occur and vice versa. The values of energy band gap Eg increase after irradiation due to the increase of structural defects and the decrease at 600nm due to the damage of the substrate under the effect of gamma irradiation. The gamma irradiation induces changes in the refractive index over a wide range of wavelengths. The refractive index tends to be greater in the visible range (600nm) compared to the values measured in the other wavelengths. The induced refractive index increases after irradiation when moving toward the infrared range of the spectra. The gamma irradiation induces disordering of p-n junction, which can lead to broadening and spectral shift in the fundamental IR absorption band. The absorption modification results change in the refractive index of the materials. The values of energy band gap refractive indices before and after gamma irradiation with 5KGray are listed in Table 3.

Conclusion

The possibility of using various metal oxides prepared by dc pulsed magnetron sputtering such as TiO2, ZrO2 and Ti50-Zr50 oxide as a coating for n-p Si junction has been studied. The structural and optical properties of dc magnetron sputtering TiO2, ZrO2 and Ti50-Zr50 oxide were studied and compared with commercial PECVD SiNx. The X-ray diffraction patterns of the antireflection TiO2, ZrO2 and Ti50-Zr50 oxide show a completely amorphous structure. The optical reflectance for ZrO2 and Ti50-Zr50 oxide drops to nearly zero in the range from 600 to 1000 and even lower than n-p Si junction alone. The decrease in reflectivity (10%) of the various coatings at 600 nm is similar to that of SiNx. The results showed that the TiO2, ZrO2 and Ti50-Zr50 oxide has a refractive index of about 2.00 at 600 nm which is similar to that of SiNx. The energy gap value and refractive indices of coated n-p Si increase slightly with that of uncoated substrate. Samples irradiated with gamma rays at a dose of 5 k Gray show different behavior in reflectivity due to displacement damage in Si-based cells. The results show that ZrO2 thin films prepared by dc pulsed magnetron sputtering can be used as anti-reflective coatings for solar cells and other siliconbased photosensitive devices.

To Know More About Juniper Online Journal Material Science Please click on: https://juniperpublishers.com/jojms/index.php

For more Open Access Journals in Juniper Publishers please click on: https://juniperpublishers.com/index.php

#Juniper Publishers#Material Science#Materials Theory#Structural Materials#Juniper publisher reviews#Juniper publisher journals

0 notes

Text

Recent Innovations and Trends in Semiconductor Manufacturing Equipment

The semiconductor industry is continuously evolving, driven by technological advancements and innovations in semiconductor manufacturing equipment. This research article explores the latest trends and innovations in semiconductor manufacturing equipment, supported by qualitative and quantitative data analysis.

Market Size: The semiconductor manufacturing equipment market has witnessed significant growth in recent years, fueled by the increasing demand for semiconductor chips across various industries such as consumer electronics, automotive, and telecommunications. According to recent market reports, the global semiconductor manufacturing equipment market was valued at approximately USD 91.2 billion in 2023. Projections indicate robust growth, with the market of semiconductor manufacturing equipment to reach USD 149.8 billion by 2028, representing a CAGR of 10.4% during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263678841

Market Trends: Advanced Process Technologies: The semiconductor industry is transitioning towards advanced process nodes such as 7nm, 5nm, and beyond, driving the demand for cutting-edge manufacturing equipment capable of delivering higher precision and efficiency.

Lithography Innovation: Lithography remains a critical process in semiconductor manufacturing, and recent innovations in extreme ultraviolet (EUV) lithography technology have enabled manufacturers to achieve finer feature sizes and higher yields.

3D Packaging and Integration: With the increasing complexity of semiconductor devices, there is a growing trend towards 3D packaging and integration techniques. Advanced equipment for wafer bonding, through-silicon via (TSV) formation, and die stacking are essential for enabling these advanced packaging technologies.

Industry 4.0 and Smart Manufacturing: The adoption of Industry 4.0 principles and smart manufacturing solutions is revolutionizing semiconductor fabs. Equipment with integrated sensors, connectivity, and data analytics capabilities are enhancing operational efficiency, predictive maintenance, and overall productivity.

Environmental Sustainability: There is a growing emphasis on sustainability in semiconductor manufacturing, driving the development of equipment with lower energy consumption, reduced chemical usage, and improved waste management systems.

Semiconductor Manufacturing Equipment

Innovations: Next-Generation Etching Systems: Advanced etching systems with atomic layer etching (ALE) capabilities are enabling precise and uniform etching processes, essential for the fabrication of advanced semiconductor devices.

Metrology and Inspection Solutions: Innovations in metrology and inspection equipment, such as optical and scanning electron microscopes (SEM), are enhancing defect detection and process control at nanoscale resolutions.

Materials Deposition Technologies: Novel deposition techniques, including atomic layer deposition (ALD) and chemical vapor deposition (CVD), are facilitating the deposition of thin films with exceptional uniformity and conformality, crucial for advanced device manufacturing.

Robotic Automation: Robotic automation solutions are increasingly being integrated into semiconductor manufacturing equipment to improve throughput, reduce human error, and enable lights-out manufacturing operations.

AI-Enabled Process Optimization: Artificial intelligence (AI) and machine learning (ML) algorithms are being deployed to optimize semiconductor manufacturing processes, leading to improved yield, reduced cycle times, and enhanced product quality.

The semiconductor manufacturing equipment industry is undergoing rapid transformation driven by technological innovations and emerging trends. Manufacturers must embrace these advancements to stay competitive in an increasingly dynamic market landscape. By leveraging cutting-edge equipment and adopting innovative manufacturing strategies, semiconductor companies can enhance productivity, accelerate time-to-market, and drive sustainable growth in the semiconductor industry.

0 notes