#Asset Performance Management Regional Analysis

Explore tagged Tumblr posts

Text

Asset Performance Management Study by Latest Research, Trends, and Revenue till Forecast

Leading Forces in the Asset Performance Management Market: Forecasts and Key Player Insights Through 2032

This Global Asset Performance Management research report offers a comprehensive overview of the market, combining both qualitative and quantitative analyses. The qualitative analysis explores market dynamics such as growth drivers, challenges, and constraints, providing deep insights into the market's present and future potential. Meanwhile, the quantitative analysis presents historical and forecast data for key market segments, offering detailed statistical insights.

According to Straits Research, the global Asset Performance Management market size was valued at USD XX Billion in 2021. It is projected to reach from USD XX Billion in 2022 to USD 9230 Million by 2030, growing at a CAGR of 10.5% during the forecast period (2022–2030).

Who are the leading companies (Marketing heads, regional heads) in the Asset Performance Management

ABB Group

Aveva Inc.

Bentley System

GE Digital

IBM Corporation

Infor Inc.

Oracle Corporation

SAP SE

SAS Institute Inc.

Siemens AG

We offer revenue share insights for the Asset Performance Management Market, covering both publicly listed and privately held companies.

The report integrates comprehensive quantitative and qualitative analyses, offering a complete overview of the Asset Performance Management. It spans from a macro-level examination of overall market size, industry chain, and market dynamics, to detailed micro-level insights into segment markets by type, application, and region. This approach provides a holistic view and deep understanding of the market, covering all critical aspects. Regarding the competitive landscape, the report highlights industry players, including market share, concentration ratios, and detailed profiles of leading companies. This enables readers to better understand their competitors and gain deeper insights into the competitive environment. Additionally, the report addresses key factors such as mergers and acquisitions, emerging market trends, the impact of COVID-19, and regional conflicts. In summary, this report is essential reading for industry players, investors, researchers, consultants, business strategists, and anyone with a stake or interest in entering the market.

Get Free Request Sample Report @ https://straitsresearch.com/report/asset-performance-management-market/request-sample

The report integrates comprehensive quantitative and qualitative analyses, offering a complete overview of the Asset Performance Management markets. It spans from a macro-level examination of overall market size, industry chain, and market dynamics, to detailed micro-level insights into segment markets by type, application, and region. This approach provides a holistic view and deep understanding of the market, covering all critical aspects. Regarding the competitive landscape, the report highlights industry players, including market share, concentration ratios, and detailed profiles of leading companies. This enables readers to better understand their competitors and gain deeper insights into the competitive environment. Additionally, the report addresses key factors such as mergers and acquisitions, emerging market trends, the impact of COVID-19, and regional conflicts. In summary, this report is essential reading for industry players, investors, researchers, consultants, business strategists, and anyone with a stake or interest in entering the market.

Global Asset Performance Management Market: Segmentation

By Type

Predictive Asset Management

Asset Reliability Management

Asset Strategy Management

Others

By Component

Software

Services

By Deployment Mode

On-premise

Cloud

Solutions

By Enterprise Size

Large Enterprises

Small- & Medium-sized Enterprises

By Industry Vertical

Energy and Utilities

Oil and Gas

Manufacturing

Mining and Metals

Healthcare and Life Sciences

Chemical and Pharmaceuticals

Government and Defense

IT and Telecom

Food and Beverages

Others

Explore detailed Segmentation from here: @ https://straitsresearch.com/report/asset-performance-management-market/segmentation

The report forecasts revenue growth at all geographic levels and provides an in-depth analysis of the latest industry trends and development patterns from 2022 to 2030 in each of the segments and sub-segments. Some of the major geographies included in the market are given below:

North America (U.S., Canada)

Europe (U.K., Germany, France, Italy)

Asia Pacific (China, India, Japan, Singapore, Malaysia)

Latin America (Brazil, Mexico)

Middle East & Africa

This Report is available for purchase on Buy Asset Performance Management Market Report

Key Highlights

To explain Asset Performance Management the following: introduction, product type and application, market overview, market analysis by countries, market opportunities, market risk, and market driving forces

The purpose of this study is to examine the manufacturers of Asset Performance Management, including profile, primary business, news, sales and price, revenue, and market share.

To provide an overview of the competitive landscape among the leading manufacturers in the world, including sales, revenue, and market share of Asset Performance Management percent

To illustrate the market subdivided by kind and application, complete with sales, price, revenue, market share, and growth rate broken down by type and application

To conduct an analysis of the main regions by manufacturers, categories, and applications, covering regions such as North America, Europe, Asia Pacific, the Middle East, and South America, with sales, revenue, and market share segmented by manufacturers, types, and applications.

To investigate the production costs, essential raw materials, production method, etc.

Buy Now @ https://straitsresearch.com/buy-now/asset-performance-management-market

About Us:

StraitsResearch.com is a leading research and intelligence organization, specializing in research, analytics, and advisory services along with providing business insights & research reports.

Contact Us:

Email: [email protected]

Address: 825 3rd Avenue, New York, NY, USA, 10022

Tel: +1 6464807505, +44 203 318 2846

#Asset Performance Management#Asset Performance Management Industry#Asset Performance Management Share#Asset Performance Management Size#Asset Performance Management Trends#Asset Performance Management Regional Analysis#Asset Performance Management Growth Rate

0 notes

Text

Asset Performance Management Market Insights: Opportunities and Challenges

The global Asset Performance Management (APM) market was valued at USD 19.32 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.0% from 2023 to 2030. This substantial growth is driven by the increasing demand for digital solutions across a wide range of industries, including oil & gas, manufacturing, chemical, and others, which are seeking to optimize their operations and reduce operational expenses.

APM systems play a crucial role in asset management by collecting diverse data from a variety of assets, such as machinery, heavy equipment, and other industrial assets, through the use of sensors. These systems integrate data from disparate sources, creating a centralized data analytics platform that provides a comprehensive view of all operational assets. By analyzing this data, businesses can gain valuable insights that help improve asset management processes, prioritize maintenance activities, and ultimately enhance overall operational efficiency.

The growing adoption of APM systems is further fueled by their integration with complementary technologies, such as mobile solutions and geographic information systems (GIS). This integration enables more efficient use cases for the systems, allowing businesses to enhance their asset management strategies across multiple platforms. As a result, the market is seeing steady growth as organizations seek to capitalize on the enhanced capabilities offered by these integrated systems.

Additionally, APM systems are leveraging the power of the Industrial Internet of Things (IIoT) to improve equipment reliability. Since ensuring the reliability of equipment is a fundamental aspect of asset performance management, industries are increasingly drawn to APM systems that utilize IIoT technologies to monitor and maintain the health of their equipment. This further drives the demand for APM systems, particularly within the industrial sector, as companies look to improve equipment uptime, reduce maintenance costs, and prevent potential failures that could lead to costly downtime.

Gather more insights about the market drivers, restrains and growth of the Asset Performance Management Market

Regional Insights

North America

North America dominated the global asset performance management (APM) market with a share of over 30.0% in 2022. This dominance is primarily driven by the region's increasing demand for high-speed data networks and the significant presence of software vendors. These factors contribute to the growth of the regional market, as companies in North America are heavily investing in IT infrastructure, particularly in the research and development (R&D) of cloud infrastructure. These investments fuel the expansion of APM solutions, as organizations seek more efficient ways to manage and optimize their assets.

One of the key drivers of growth in North America is the favorable business environment and supportive government policies, which help companies innovate and deploy advanced cloud-based solutions. These conditions have allowed businesses to develop and launch improved cloud platforms, which in turn increase the adoption of asset performance management (APM) systems. The region also benefits from a high concentration of computer scientists, data analysts, and software engineers in countries like Canada, who are increasingly leveraging cloud-based solutions and services. This talent pool further accelerates the development and implementation of APM technologies, contributing significantly to the region’s market growth.

Asia Pacific

Asia Pacific is expected to register the highest CAGR during the forecast period, driven by substantial investments from large firms and the implementation of new technologies across various industries and enterprises. Many companies in this region are migrating their workloads to the cloud as part of their ongoing digital transformation efforts. As a result, the adoption of cloud-based solutions, including APM systems, is rising, and this shift is expected to fuel growth in the regional market.

In addition, growing investments in IT infrastructure development by major tech giants are likely to provide numerous opportunities for stakeholders in the APM market. These investments will not only improve the infrastructure but also contribute to the development and adoption of more advanced asset management solutions.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global geographic information system market size was valued at USD 9.80 billion in 2023 and is projected to grow at a CAGR of 8.7% from 2024 to 2030.

• The global digital twin market size was estimated at USD 16.75 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 35.7% from 2024 to 2030.

Key Companies & Market Share Insights

The APM market is highly competitive, with numerous players operating on a global scale. As organizations increasingly focus on improving asset performance, maintaining equipment health, and reducing time to market, there is a rising demand for advanced APM solutions. This demand is encouraging vendors to innovate and introduce new systems that better meet the needs of businesses.

To stay competitive, market players are expanding the capabilities of APM systems by integrating complementary technologies such as artificial intelligence (AI), machine learning (ML), mobility solutions, geographic information systems (GIS), augmented reality (AR), virtual reality (VR), and mixed reality (MR). These technological integrations enable APM systems to become more intelligent, predictive, and adaptable to changing business environments. In particular, the growing use of cloud-based APM solutions and predictive analytics is transforming the way companies monitor and maintain their assets.

The increasing need for mobility and data portability is also driving the demand for data-centric solutions, which in turn fuels the growth of the APM market. With the rising reliance on data for decision-making, companies are investing in APM systems that can offer real-time insights, predictive capabilities, and improved operational efficiency.

Some prominent players in global asset performance management market include:

• ABB Ltd

• Aspen Technology, Inc.

• AVEVA Group plc

• Bentley Systems, Incorporated

• DNV GLAS

• GE Digital

• International Business Machines Corporation

• Rockwell Automation

• SAP SE

• SAS Institute, Inc.

• Siemens Energy

Order a free sample PDF of the Asset Performance Management Market Intelligence Study, published by Grand View Research.

#Asset Performance Management Market#Asset Performance Management Market Analysis#Asset Performance Management Market Report#Asset Performance Management Market Regional Insights

0 notes

Text

Top Strategies for Successful Stock Trading - Unirav Shopping

Navigating the stock market can be both exhilarating and daunting. For beginners and seasoned investors alike, successful stock trading requires a strategic approach, a solid understanding of market dynamics, and continuous learning. This blog delves into the top strategies for successful stock trading, emphasizing the importance of planning, discipline, and informed decision-making.

1. Educate Yourself

Before diving into stock trading, it’s crucial to educate yourself about the market. Understanding the basic concepts, terminology, and mechanics of trading will lay a strong foundation for your investment journey.

Books and Online Courses: There are numerous resources available, from classic investment books like “The Intelligent Investor” by Benjamin Graham to online courses offered by reputable institutions.

Financial News and Websites: Stay updated with financial news, market trends, and analysis from trusted sources like Bloomberg, CNBC, and MarketWatch.

Stock Simulators: Use stock simulators to practice trading without risking real money. This hands-on experience can help you understand market fluctuations and trading strategies.

2. Set Clear Goals and Objectives

Having clear financial goals and objectives is essential for successful stock trading. Define what you want to achieve with your investments, whether it’s long-term wealth accumulation, short-term gains, or income generation.

Risk Tolerance: Assess your risk tolerance to determine the types of stocks and trading strategies that suit you.

Time Horizon: Consider your investment time horizon, as this will influence your trading decisions and risk management strategies.

Capital Allocation: Decide how much capital you are willing to invest in the stock market and how you will allocate it across different stocks and sectors.

3. Develop a Trading Plan

A well-defined trading plan acts as a roadmap for your trading activities. It helps you stay disciplined and focused, reducing the likelihood of impulsive decisions.

Entry and Exit Criteria: Establish clear criteria for entering and exiting trades. This can include technical indicators, fundamental analysis, or a combination of both.

Position Sizing: Determine the size of your positions based on your risk tolerance and the overall market conditions.

Risk Management: Implement risk management strategies to protect your capital. This can involve setting stop-loss orders, diversifying your portfolio, and avoiding overleveraging.

4. Conduct Thorough Research

Thorough research is the backbone of successful stock trading. Analyzing companies, industries, and market trends can help you make informed investment decisions.

Fundamental Analysis: Evaluate a company’s financial health by examining its earnings, revenue, profit margins, and balance sheet. Pay attention to industry trends and economic factors that could impact the company’s performance.

Technical Analysis: Use technical analysis tools to study price charts, patterns, and indicators. This can help you identify potential entry and exit points and gauge market sentiment.

Sentiment Analysis: Monitor investor sentiment and news to understand the market’s mood and potential impact on stock prices.

5. Diversify Your Portfolio

Diversification is a crucial risk management strategy that involves spreading your investments across different asset classes, sectors, and geographic regions. This can help reduce the impact of any single stock’s poor performance on your overall portfolio.

Asset Allocation: Allocate your capital across various asset classes, such as stocks, bonds, and commodities, to balance risk and reward.

Sector Diversification: Invest in stocks from different sectors to mitigate sector-specific risks.

Geographic Diversification: Consider investing in international stocks to reduce exposure to country-specific economic and political risks.

6. Stay Disciplined and Emotionally Detached

Emotional decision-making can be detrimental to stock trading. It’s essential to stay disciplined and stick to your trading plan, regardless of market volatility or emotional impulses.

Avoid Overtrading: Overtrading can lead to increased transaction costs and reduced overall returns. Stick to your trading plan and avoid making impulsive trades.

Manage Fear and Greed: Fear and greed are common emotions in stock trading. Develop strategies to manage these emotions, such as setting realistic expectations and using stop-loss orders.

Review and Adjust: Regularly review your trading plan and performance. Make necessary adjustments based on changing market conditions and your financial goals.

7. Utilize Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are essential tools for managing risk and protecting your capital. These orders automatically close your positions at predetermined price levels, helping you lock in profits and limit losses.

Stop-Loss Orders: Set stop-loss orders to automatically sell a stock if its price falls below a certain level. This helps protect your capital from significant losses.

Take-Profit Orders: Use take-profit orders to automatically sell a stock when it reaches a predetermined profit level. This allows you to lock in gains and avoid holding onto winning positions for too long.

8. Keep an Eye on Market Trends

Staying informed about market trends and economic indicators can provide valuable insights for your trading decisions.

Economic Indicators: Monitor key economic indicators, such as GDP growth, unemployment rates, and inflation, as they can influence market sentiment and stock prices.

Market Trends: Identify and analyze market trends, such as bull and bear markets, to adjust your trading strategies accordingly.

News and Events: Stay updated on news and events that could impact the stock market, such as corporate earnings reports, geopolitical developments, and central bank announcements.

9. Learn from Your Mistakes

Mistakes are inevitable in stock trading, but they can also be valuable learning opportunities. Analyze your past trades to identify what went wrong and how you can improve your strategies.

Trading Journal: Keep a trading journal to document your trades, including entry and exit points, reasons for the trade, and outcomes. This can help you identify patterns and areas for improvement.

Self-Assessment: Regularly assess your trading performance and reflect on your decision-making process. Identify common mistakes and develop strategies to avoid them in the future.

Continuous Learning: Stay committed to continuous learning and improvement. Attend webinars, read books, and seek advice from experienced traders to enhance your skills.

10. Seek Professional Advice

If you’re unsure about your trading strategies or need personalized guidance, consider seeking advice from financial professionals. Financial advisors, brokers, and investment analysts can provide valuable insights and recommendations tailored to your needs.

Financial Advisors: Work with a financial advisor to develop a comprehensive investment plan and receive personalized advice.

Brokers: Consult with brokers who have expertise in stock trading and can provide valuable market insights and trade execution services.

Investment Analysts: Follow recommendations from investment analysts who conduct in-depth research and analysis on stocks and market trends.

Conclusion

Successful stock trading requires a combination of education, planning, discipline, and continuous learning. By implementing these top strategies, you can enhance your trading skills, make informed decisions, and achieve your financial goals. Remember, the stock market is unpredictable, and there are no guarantees of success. However, with a strategic approach and a commitment to learning, you can navigate the complexities of the market and build a successful trading career.

10 Positive Reviews

Educational Resources: Utilizing various educational resources like books, online courses, and stock simulators significantly enhances trading knowledge and skills.

Clear Goals: Setting clear financial goals and objectives ensures a focused and disciplined approach to stock trading.

Comprehensive Trading Plan: A well-defined trading plan provides a roadmap for successful trading activities and helps avoid impulsive decisions.

Thorough Research: Conducting thorough research through fundamental, technical, and sentiment analysis leads to informed investment decisions.

Diversification: Diversifying investments across different asset classes, sectors, and geographic regions mitigates risks and enhances portfolio stability.

Emotional Discipline: Staying disciplined and emotionally detached from trading decisions minimizes the impact of market volatility and emotional impulses.

Risk Management Tools: Utilizing stop-loss and take-profit orders effectively manages risk and protects capital.

Market Awareness: Keeping an eye on market trends and economic indicators provides valuable insights for strategic trading decisions.

Learning from Mistakes: Analyzing past trades and learning from mistakes fosters continuous improvement and better trading strategies.

Professional Guidance: Seeking professional advice from financial advisors, brokers, and investment analysts offers personalized guidance and expert insights for successful stock trading.

By following these strategies and reviews, traders can enhance their chances of success in the dynamic and ever-changing world of stock trading.

Investing in the stock market can be an excellent way to build wealth over time. Whether you’re saving for retirement, aiming to make a major purchase, or just looking to grow your financial portfolio, understanding how to start investing in stocks is crucial. This guide will provide a step-by-step approach to get you started on your investment journey.

#Stock Trading Strategies#Successful Trading Tips#Stock Market Education#Risk Management in Trading#Investment Portfolio Diversification#Top Strategies for Successful Stock Trading

2 notes

·

View notes

Text

monday.com - seamless solution to all your marketing project

Quick Summary:Are your campaigns truly driving enough sales opportunities? Do you possess sufficient insights into the performance of your campaigns? Can you make informed strategic decisions based on the success rate of your previous endeavors? These are the pressing questions that marketers grapple with today. Thankfully, a tool like monday.com offers a seamless solution to all your marketing project management needs.

What monday.com Brings to the Table?

Marketing teams bear the responsibility of managing a wide range of tasks, from defining and overseeing the brand to devising effective content strategies, digital asset management, product marketing, creative requests, social media monitoring, and driving SEO, among others. monday.com steps in to provide the visibility necessary for monitoring every marketing endeavor, be it a campaign, a social media post, or a customer interaction.

Implementing a marketing project management tool like monday.com allows for efficient management and execution of marketing activities. Let's delve into the top ten tips for using monday.com in your marketing project management:

1. Get everyone on board

To fully utilize the innovative potential of monday.com, ensure that your marketing teams embrace the platform. Educate and train them on the importance and benefits of using monday.com, addressing any concerns or reservations they may have.

2. Choose the right template

monday.com offers a diverse selection of pre-designed templates to cater to different marketing project management needs, ranging from content planning to campaign tracking, editorial calendars, and competitor analysis, enabling you to kickstart your projects promptly while saving valuable time and resources.

3. Utilize calendars for planning and tracking

monday.com enables you to customize calendars to suit unique use cases. Add action items, color-code activities, drag and drop tasks, assign priorities, delegate authority, and more.

4. Visualize campaign planning

With monday.com, group campaigns by type, label them as needed, sort them by significance, and keep everyone in sync with automated notifications for scheduled, delayed, or completed campaigns.

5. Leverage request forms for data collection

Take advantage of monday.com's request forms to gather all the information you need about customers, campaigns, and more. Share form links with other team members or embed them into your website, ensuring that responses populate automatically into respective boards.

6. Enable contextual annotations for streamlined feedback

To streamline the review process, activate contextual annotations on monday.com which eliminates the need for back-and-forth communication. Store all comments and edits directly within your images and videos. It ensures that your teams stay aligned at all times.

7. Stay updated with the latest file versions

Avoid the challenge of keeping your teams informed about the latest file versions. monday.com allows you to store every iteration in a coherent timeline, eliminating the complexity of file updates. Add new versions as you work and easily identify the latest version with a simple glance.

8. Efficiently track and manage activities across all platforms

With marketing teams engaged in numerous campaigns across various platforms and regions, monday.com provides an intuitive platform to manage, track, and organize the results of each campaign. Utilize the platform to monitor campaign progress, performance, as well as the time and money invested in each initiative.

9. Integrate with existing tools

By integrating monday.com with the tools you already use, you can eliminate the time wasted switching between different apps. Connect the platform with apps and platforms such as HubSpot, Facebook Ads, Mailchimp, SEMrush, Adobe Creative Cloud, and more, reducing the time spent on achieving desired results.

10. Leverage automation

monday.com offers extensive automation capabilities, allowing you to save time on repetitive and mundane tasks. Set up rules to handle common tasks and streamline daily workflows. Trigger actions on one board based on activities on another board, or create custom combinations tailored to your unique needs.

In-Conclusion: While marketing project management may initially appear complex and cumbersome, by leveraging monday.com's remarkable features, including boards, views, dashboards, and automation, you can swiftly establish efficient workflows and connect all the dots across your marketing organization.

Curtesy: Screenshot Source | monday.com

For more Information

Visit our website:

amrutsoftware.com / amrutsoftware.ae

2 notes

·

View notes

Text

Streamline Your Grocery Business with Multi-Store Management Software in 2023

Do you operate a grocery business with multiple stores and seek an efficient way to manage them all from a single location? If so, Multi-Store Management Software is the solution you’ve been looking for. In 2023, these innovative software solutions offer an intuitive user interface, unique features, and top-notch service to simplify the setup and management of multiple stores.

Before delving into the specifics, let’s explore why Multi-Store Management is a game-changer for your grocery business.

Why Choose Multi-Store Management for Your Grocery Business?

Multi-store management is a software solution that empowers you to oversee multiple online grocery stores through a single account, saving both time and effort. With this setup, you can efficiently manage and operate multiple stores, each featuring its own products, customers, orders, and themes.

The advantages of multi-store management for grocery businesses are numerous:

Streamlined Administrative Tasks: Multi-store management eases the burden of administrative tasks.

Centralized Management: It enables you to manage multiple storefronts effortlessly from a single platform.

Enhanced Customer Insights: Gain a deeper understanding of customer behavior across stores, facilitating more effective marketing campaigns.

Wider Market Reach: Reach new audiences and expand your market reach with increased efficiency.

In-depth Product Analysis: Get valuable insights into product performance and profitability.

Multi-store management is a time-saving and efficiency-boosting tool, becoming indispensable in the evolving grocery industry landscape. By the end of 2023, it’s projected that Multi-Store Management will be a fundamental necessity for grocery delivery businesses. As the demand for grocery stores grows, optimizing store management becomes paramount. Multi-store management software solutions are the key to saving time and energy while expanding your grocery business.

Key Benefits of Managing Multiple Grocery Stores with Multi-Store Management

In 2023, operating multiple grocery stores is a significant asset for businesses, offering a multitude of benefits, from increased profits to enhanced customer engagement. Here are some key advantages of managing multiple grocery stores with Multi-Store Management:

1. Better Market Reach

Running multiple grocery stores with grocery delivery solutions allows businesses to reach a vast audience, especially beneficial for international customers unfamiliar with the main store. Multi-store management software enables targeting specific countries or regions, offering tailored services and products in their preferred language or currency.

2. Enhanced Customer Loyalty

Multi-store management fosters customer loyalty by providing the best shopping experience possible, catering to diverse needs and preferences. Grocery delivery apps show customers that your business cares about their unique requirements.

3. Store Pick-up or Home Delivery

With multi-store management, you can offer customers the choice of store pick-up or home delivery, enhancing convenience and expanding your store’s reputation beyond its immediate vicinity.

4. Increased Sales Opportunities

Multiple grocery stores allow businesses to tap into various markets and customer segments, increasing sales opportunities by exposing customers to a wider product range. Custom-built Grocery Delivery Software broadens your audience and revenue potential.

5. Efficient Communication

Effective communication is vital for managing a multi-store grocery business, and a robust multi-store management system streamlines this crucial aspect.

6. Detailed Reporting and Analytics

Multi-Store Management Systems provide comprehensive reports, offering insights into customer behavior, loyalty programs, and inventory management. These detailed reports empower grocery businesses with valuable information for informed decision-making.

Conclusion

In today’s fast-paced world, people have limited time for grocery shopping, making a top-tier grocery delivery service the most efficient way to attract more customers.

Are you seeking an all-in-one solution to manage your multi-grocery store efficiently?

Unlock the Future of Grocery Management with Our Grocery Delivery App called ShopUrGrocery.

#MultiStoreManagement#GroceryBusiness#GroceryDelivery#RetailTech#OnlineGrocery#StoreManagementSoftware#RetailSolutions#BusinessEfficiency#CustomerLoyalty#MarketExpansion#GroceryDeliveryApps#BusinessInsights#DigitalTransformation#StorePickUp#HomeDelivery#SalesGrowth#CommunicationTools#Analytics#GroceryIndustry#2023Trends#Shopurgrocery

2 notes

·

View notes

Text

Digital Twin Market Size 2023-2030: ABB, AVEVA Group plc, Dassault Systemes

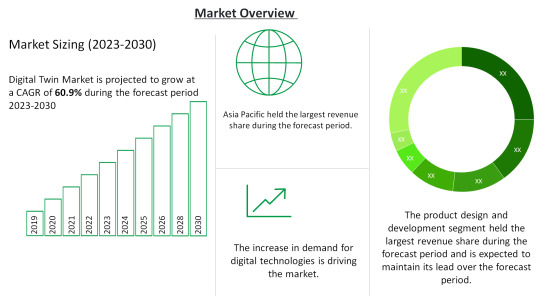

Digital Twin Market by Power Source (Battery-Powered, hardwired with battery backup, Hardwired without battery backup), Type (Photoelectric Smoke Detectors, Ionization Smoke Detectors), Service, Distribution Channel, and region (North America, Europe, Asia-Pacific, Middle East, and Africa and South America). The global Digital Twin Market size is 11.12 billion USD in 2022 and is projected to reach a CAGR of 60.9% from 2023-2030.

Click Here For a Free Sample + Related Graphs of the Report at: https://www.delvens.com/get-free-sample/digital-twin-market-trends-forecast-till-2030

Digital twin technology has allowed businesses in end-use industries to generate digital equivalents of objects and systems across the product lifecycle. The potential use cases of digital twin technology have expanded rapidly over the years, anchored in the increasing trend of integration with internet-of-things (IoT) sensors. Coupled with AI and analytics, the capabilities of digital twins are enabling engineers to carry out simulations before a physical product is developed. As a result, digital twins are being deployed by manufacturing companies to shorten time-to-market. Additionally, digital twin technology is also showing its potential in optimizing maintenance costs and timelines, thus has attracted colossal interest among manufacturing stalwarts, notably in discrete manufacturing.

The shift to interconnected environments across industries is driving the demand for digital twin solutions across the world. Massive adoption of IoT is being witnessed, with over 41 billion connected IoT devices expected to be in use by 2030. For the successful implementation and functioning of IoT, increasing the throughput for every part or “thing” is necessary, which is made possible by digital twin technology. Since the behavior and performance of a system over its lifetime depend on its components, the demand for digital twin technology is increasing across the world for system improvement. The emergence of digitalization in manufacturing is driving the global digital twin market. Manufacturing units across the globe are investing in digitalization strategies to increase their operational efficiency, productivity, and accuracy. These digitalization solutions including digital twin are contributing to an increase in manufacturer responsiveness and agility through changing customer demands and market conditions.

On the other hand, there has been a wide implementation of digital technologies like artificial intelligence, IoT, clog, and big data which is increasing across the business units. The market solutions help in the integration of IoT sensors and technologies that help in the virtualization of the physical twin. The connectivity is growing and so are the associated risks like security, data protection, and regulations, alongside compliance.

During the COVID-19 pandemic, the use of digital twin technologies to manage industrial and manufacturing assets increased significantly across production facilities to mitigate the risks associated with the outbreak. Amid the lockdown, the U.S. implemented a National Digital Twin Program, which was expected to leverage the digital twin blueprint of major cities of the U.S. to improve smart city infrastructure and service delivery. The COVID-19 pandemic positively impacted the digital twin market demand for twin technology.

Delvens Industry Expert’s Standpoint

The use of solutions like digital twins is predicted to be fueled by the rapid uptake of 3D printing technology, rising demand for digital twins in the healthcare and pharmaceutical sectors, and the growing tendency for IoT solution adoption across multiple industries. With pre-analysis of the actual product, while it is still in the creation stage, digital twins technology helps to improve physical product design across the full product lifetime. Technology like digital twins can be of huge help to doctors and surgeons in the near future and hence, the market is expected to grow.

Market Portfolio

Key Findings

The enterprise segment is further segmented into Large Enterprises and Small & Medium Enterprises. Small & Medium Enterprises are expected to dominate the market during the forecast period. It is further expected to grow at the highest CAGR from 2023 to 2030.

The industry segment is further segmented into Automotive & Transportation, Energy & Utilities, Infrastructure, Healthcare, Aerospace, Oil & Gas, Telecommunications, Agriculture, Retail, and Other Industries. The automotive & transportation industry is expected to account for the largest share of the digital twin market during the forecast period. The growth can be attributed to the increasing usage of digital twins for designing, simulation, MRO (maintenance, repair, and overhaul), production, and after-service.

The market is also divided into various regions such as North America, Europe, Asia-Pacific, South America, and Middle East and Africa. North America is expected to hold the largest share of the digital twin market throughout the forecast period. North America is a major hub for technological innovations and an early adopter of digital twins and related technologies.

During the COVID-19 pandemic, the use of digital twin technologies to manage industrial and manufacturing assets increased significantly across production facilities to mitigate the risks associated with the outbreak. Amid the lockdown, the U.S. implemented a National Digital Twin Program, which was expected to leverage the digital twin blueprint of major cities of the U.S. to improve smart city infrastructure and service delivery. The COVID-19 pandemic positively impacted the digital twin market demand for twin technology.

Regional Analysis

North America to Dominate the Market

North America is expected to hold the largest share of the digital twin market throughout the forecast period. North America is a major hub for technological innovations and an early adopter of digital twins and related technologies.

North America has an established ecosystem for digital twin practices and the presence of large automotive & transportation, aerospace, chemical, energy & utilities, and food & beverage companies in the US. These industries are replacing legacy systems with advanced solutions to improve performance efficiency and reduce overall operational costs, resulting in the growth of the digital twin technology market in this region.

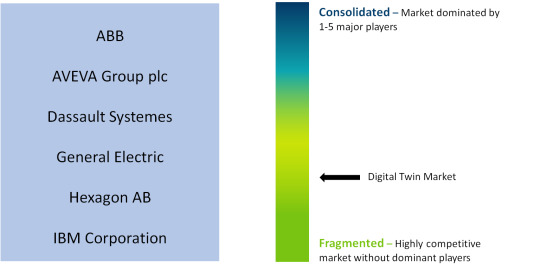

Competitive Landscape

ABB

AVEVA Group plc

Dassault Systemes

General Electric

Hexagon AB

IBM Corporation

SAP

Microsoft

Siemens

ANSYS

PTC

IBM

Recent Developments

In April 2022, GE Research (US) and GE Renewable Energy (France), subsidiaries of GE, collaborated and developed a cutting-edge artificial intelligence (AI)/machine learning (ML) technology that has the potential to save the worldwide wind industry billions of dollars in logistical expenses over the next decade. GE’s AI/ML tool uses a digital twin of the wind turbine logistics process to accurately predict and streamline logistics costs. Based on the current industry growth forecasts, AI/ML might enable a 10% decrease in logistics costs, representing a global cost saving to the wind sector of up to USD 2.6 billion annually by 2030.

In March 2022, Microsoft announced a strategic partnership with Newcrest. The mining business of Newcrest would adopt Azure as its preferred cloud provider globally, as well as work on digital twins and a sustainability data model. Both organizations are working together on projects, including the use of digital twins to improve operational performance and developing a high-impact sustainability data model.

Reasons to Acquire

Increase your understanding of the market for identifying the best and most suitable strategies and decisions on the basis of sales or revenue fluctuations in terms of volume and value, distribution chain analysis, market trends, and factors

Gain authentic and granular data access for Digital Twin Market so as to understand the trends and the factors involved in changing market situations

Qualitative and quantitative data utilization to discover arrays of future growth from the market trends of leaders to market visionaries and then recognize the significant areas to compete in the future

In-depth analysis of the changing trends of the market by visualizing the historic and forecast year growth patterns

Direct Purchase of Digital Twin Market Research Report at: https://www.delvens.com/checkout/digital-twin-market-trends-forecast-till-2030

Report Scope

Report FeatureDescriptionsGrowth RateCAGR of 60.9% during the forecasting period, 2023-2030Historical Data2019-2021Forecast Years2023-2030Base Year2022Units ConsideredRevenue in USD million and CAGR from 2023 to 2030Report Segmentationenterprise, platform, application, and region.Report AttributeMarket Revenue Sizing (Global, Regional and Country Level) Company Share Analysis, Market Dynamics, Company ProfilingRegional Level ScopeNorth America, Europe, Asia-Pacific, South America, and Middle East, and AfricaCountry Level ScopeU.S., Japan, Germany, U.K., China, India, Brazil, UAE, and South Africa (50+ Countries Across the Globe)Companies ProfiledABB; AVEVA Group plc; Dassault Systems; General Electric; Hexagon AB; IBM Corp.; SAP.Available CustomizationIn addition to the market data for Digital Twin Market, Delvens offers client-centric reports and customized according to the company’s specific demand and requirement.

TABLE OF CONTENTS

Large Enterprises

Small & Medium Enterprises

Product Design & Development

Predictive Maintenance

Business Optimization

Performance Monitoring

Inventory Management

Other Applications

Automotive & Transportation

Energy & Utilities

Infrastructure

Healthcare

Aerospace

Oil & Gas

Telecommunications

Agriculture

Retail

Other Industries.

Asia Pacific

North America

Europe

South America

Middle East & Africa

ABB

AVEVA Group plc

Dassault Systemes

General Electric

Hexagon AB

IBM Corporation

SAP

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

UNIT NO. 2126, TOWER B, 21ST FLOOR ALPHATHUM SECTOR 90 NOIDA 201305, IN +44-20-8638-5055 [email protected] WEBSITE: https://delvens.com/

#Digital Twin Market#Digital Twin#Digital Twin Market Size#Digital Twin Market Share#Semiconductors & Electronics

2 notes

·

View notes

Text

This report analyzes key players, including their market share, market size, growth drivers, and company profiles. The purpose of this research report is to provide an in-depth analysis of the market overview, prevalent trends, demand, and recent changes that are affecting the global edge computing market.

The study also discusses product launches, market expansion, strategic growth analysis, market potential analysis, and technological advancements. It provides market size, prospective expansion, trends, and leading competitors' expansion plans.

With the help of this report, you will be able to gain insight into the competitors' positioning, market scope, growth potential, and future prospects.

Our report provides in-depth insights into the leading players in the global edge computing market for the next few years. To gain a stronghold in the global edge computing market, these key participants have adopted various business strategies. As a result, other businesses can gain a better understanding of how market leaders maintain dominance and expand their customer bases to secure a majority share.

There are a number of major players in the edge computing market, including:

AT&T Inc., Amazon Web Services (AWS), Cisco Systems Inc., Fujitsu Limited, Dell Inc., IBM Corporation, Huawei Technologies Co. Ltd., Hewlett Packard Enterprise (HPE), Nokia Corporation, Microsoft Corporation

Request for Sample Report: https://www.nextmsc.com/edge-computing-market/request-sample

As part of this study, we will examine how COVID-19 impacted and altered the global edge computing market market environment. Demand, consumption, transportation, consumer behavior, supply chain management, exports, imports, and manufacturing are among the factors considered in the study. Furthermore, analysts have highlighted the elements that can help businesses identify opportunities in the near future and stabilize the industry.

Some of the key advantages discussed in this study report are a neutral outlook on market performance, recent industry trends, competitive landscapes and key players' strategies, potential and niche segments, and geographical regions contributing to promising growth.

Furthermore, the report provides historical, current, and future market sizes, along with a geographical forecast.

Depending on their industry verticals, the global edge computing market is divided into:

Energy & Utilities

Government & Public Sector

Healthcare

Manufacturing

Media & Entertainment

Transportation

Retail

Telecom & IT

Others

Global edge computing market applications can be categorized into:

Connected Cars

Smart Grids

Critical Infrastructure Monitoring

Traffic Management

Environmental Monitoring

Augmented Reality

Assets Tracking

Security & Surveillance

Others

A comprehensive analysis of all of the critical features of the global edge computing market industry has been conducted in the latest study. Market size, competition, development trends, niche markets, market drivers and challenges, SWOT analysis, Porter's five forces analysis, value chain analysis, and so on are covered from a macro-level to a micro-level.

According to the report, markets are categorized based on their component, industry verticals, organization size, applications, and regions, among other factors.

In order to be able to target products, sales, and marketing strategies accordingly, decision-makers must be familiar with the market segments. Businesses can advance product development by being guided on how to develop products tailored to meet the needs of different market segments.

Key stakeholders can use this market research report to develop plans for supporting the company's success by using statistics, tables, and graphs. It provides an in-depth analysis of the edge computing market across all major geographic regions, including North America, Asia-Pacific, Latin America, the Middle East, and Africa.

This report examines the dynamics of several regions in order to gain a clearer picture of the global market.

Read More: https://www.nextmsc.com/report/edge-computing-market

Inquire Before Buying: https://www.nextmsc.com/edge-computing-market/inquire-before-buying

About Us

Next Move Strategy Consulting is an independent and trusted third-platform market intelligence provider, committed to deliver high quality, market research reports that help multinational companies to triumph over their competitions and increase industry footprint by capturing greater market share. Our research model is a unique collaboration of primary research, secondary research, data mining and data analytics.

We have been servicing over 1000 customers globally that includes 90% of the Fortune 500 companies over a decade. Our analysts are constantly tracking various high growth markets and identifying hidden opportunities in each sector or the industry. We provide one of the industry’s best quality syndicates as well as custom research reports across 10 different industry verticals. We are committed to deliver high quality research solutions in accordance to your business needs. Our industry standard delivery solution that ranges from the pre consultation to after-sales services, provide an excellent client experience and ensure right strategic decision making for businesses.

For more insights, please visit, https://www.nextmsc.com

#edge computing#edge computing market#market analysis#market forecast#market growth#market trends#market share#market size#market value#market demand

3 notes

·

View notes

Text

Security Information and Event Management Market 2024-2033 : Demand, Trend, Segmentation, Forecast, Overview And Top Companies

The security information and event management global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Security Information and Event Management Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The security information and event management market size has grown rapidly in recent years. It will grow from $4.73 billion in 2023 to $5.34 billion in 2024 at a compound annual growth rate (CAGR) of 12.8%. The growth in the historic period can be attributed to increasing regulatory compliance requirements, data breaches and cyber attacks, data explosion and complexity, and insider threats and user behavior.

The security information and event management market size is expected to see strong growth in the next few years. It will grow to $7.78 billion in 2028 at a compound annual growth rate (CAGR) of 9.9%. The growth in the forecast period can be attributed to rising cyber threat sophistication, regulatory compliance mandate, cloud adoption and hybrid it environment, and zero trust security framework. Major trends in the forecast period include cloud-native siem, ai, and machine learning integration, zero trust architecture, extended detection and response, automation and orchestration, and edge security.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/security-information-and-event-management-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Security Information and Event Management Market Overview

Market Drivers - The increasing cyber threats are expected to propel the growth of the security information event management market going forward. Cyber threats refer to malicious activities and actions that pose a risk to the confidentiality, integrity, and availability of digital assets, systems, networks, and data. Cyber threats are increasing due to several factors contributing to the evolving landscape of cyber security risks such as increased connectivity, and evolving tactics employed by malicious actors. SIEM Security information and event management is instrumental in addressing cyber threats by providing organizations with comprehensive capabilities to monitor, detect, and respond to security incidents effectively. For instance, in November 2022, according to the Australian Cyber Security Centre, an Australia-based cyber security agency, the number of cybercrime reports received in 2022 was 76,000, an increase of 13% from the year before. Therefore, the rising cyber threats are driving the growth of the Security information and event management market.

Market Trends - Major companies operating the security information and event management market are innovating new technologies such as Security Management Outsourcing Services to increase their profitability in the market. Security Management Outsourcing Service offers businesses a group of professionals who are always on the lookout for, detecting, and responding to cyber threats. For instance, in July 2023, NTT Data a Japan-based cyber security company launched a Security Management outsourcing service. The service is intended to minimize damage in the event of an incident and to prevent incidents altogether. Beginning in July 2023, the MDR service will be offered in Japan. By the fiscal year that ends in March 2024, it will be available everywhere. As part of the organization's CSIRT, advanced security engineers with over 20 years of experience in incident response will act on behalf of client companies with the MDR service, carrying out a comprehensive set of actions to determine the cause, carry out emergency response measures, optimize recovery efforts, and prevent recurrence.

The security information and event management market covered in this report is segmented –

1) By Solution: Software, Services 2) By Deployment: Cloud, On-Premise 3) By Vertical: Banking, Financial Services and Insurance (BFSI), Information Technology and Telecom, Retail and E-commerce, Healthcare and Life Sciences, Manufacturing, Government & Defense, Energy and Utilities, Other Verticals

Get an inside scoop of the security information and event management market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=14187&type=smp

Regional Insights - North America was the largest region in the security information event management market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the security information and event management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the security information and event management market are The International Business Machines Corporation, Splunk Inc., McAfee Corporation, Fortinet, Juniper Networks, FireEye, Rapid7, SolarWinds Corporation, Micro Focus (ArcSight), AT&T Cybersecurity AlienVault, Trustwave, LogRhythm, Alert Logic, Fidelis Cybersecurity, Exabeam, Securonix, Proficio, Logsign, LogPoint , Cygilant, Seceon, Gurucul, Graylog, Intel Security

Table of Contents 1. Executive Summary 2. Security Information and Event Management Market Report Structure 3. Security Information and Event Management Market Trends And Strategies 4. Security Information and Event Management Market – Macro Economic Scenario 5. Security Information and Event Management Market Size And Growth ….. 27. Security Information and Event Management Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Global AI In Logistics Market Overview 2024: Size, Growth Rate, and Segments

The ai in logistics global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

AI In Logistics Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The ai in logistics market size has grown exponentially in recent years. It will grow from $12.21 billion in 2023 to $18.01 billion in 2024 at a compound annual growth rate (CAGR) of 47.5%. The growth in the historic period can be attributed to increasing complexity in supply chain networks, rising demand for real-time logistics solutions, advancements in ai and machine learning technologies, growing e-commerce sector, need for efficiency and cost optimization in logistics operations.

The ai in logistics market size is expected to see exponential growth in the next few years. It will grow to $83.26 billion in 2028 at a compound annual growth rate (CAGR) of 46.6%. The growth in the forecast period can be attributed to expansion of autonomous vehicles and drones in logistics, rising demand for predictive analytics in supply chain management, growth of smart warehouses and fulfillment centers, integration of blockchain technology for transparent and secure transactions, increasing focus on sustainability and green logistics. Major trends in the forecast period include adoption of ai-powered route optimization for delivery fleets, development of ai chatbots for customer service and support, emergence of predictive maintenance solutions for logistics assets, utilization of ai for demand forecasting and inventory management, implementation of ai-enabled risk management systems for supply chain resilience.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/ai-in-logistics-global-market-report

Scope Of AI In Logistics Market The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

AI In Logistics Market Overview

Market Drivers - The rising growth of the e-commerce sector is expected to propel the growth of the AI in logistics market going forward. E-commerce refers to the buying and selling of goods or services over the internet and the transfer of data and funds to complete the transactions. The adoption of AI in logistics helps e-commerce businesses streamline their operations and improve efficiency, leading to benefits such as route optimization, supply chain optimization, and personalized shopping recommendations. For instance, in September 2022, according to the International Trade Administration, a US-based department of commerce, consumer e-commerce now made up 30% of the UK's overall retail sector (up from 20% in 2020), with an annual e-commerce revenue of more than $120 billion. Further, in 2021, 82% of people in the UK will have made at least one online purchase. Therefore, the rising growth of the e-commerce sector is driving the growth of the AI in logistics market.

Market Trends - Major companies operating in the AI in logistics market are focusing on introducing technologically advanced solutions, such as AI-powered supply chain management and orchestration solutions, to increase their profitability in the market. AI-powered supply chain management and orchestration solutions leverage artificial intelligence to streamline and optimize various aspects of the supply chain. For instance, in December 2023, Blue Yonder, an India-based digital supply chain management solutions company, launched Blue Yonder Orchestrator, a new generative AI tool that simplifies supply chain management and orchestration. This new feature combines large language models (LLMs), cloud data, and prompt engineering to recommend supply chain decisions. This AI-powered solution gives business users instant access to advice, forecasts, and intelligent decisions, so they can make the best choices possible and have a positive impact on their supply chain. With so many professionals finding it difficult to retain institutional knowledge in today's supply chain environment, Blue Yonder Orchestrator can be a useful supply chain assistant that helps businesses enhance intuition by leveraging the value of data to make decisions more quickly and effectively.

The ai in logistics market covered in this report is segmented –

1) By Offering: Software, Services 2) By Technology: Machine Learning, Natural Language Processing, Context Awareness Computing, Computer Vision 3) By Application: Self-driving Vehicles And Forklifts, Planning And Forecasting, Machine And Human Collaboration, Automation Of Ordering And Processing 4) By Industry Vertical: Automotive, Food And Beverages, Manufacturing , Healthcare, Retail

Get an inside scoop of the ai in logistics market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=13568&type=smp

Regional Insights - North America was the largest region in the AI in logistics market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the ai in logistics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the ai in logistics market report are Amazon.com Inc, Alphabet Inc., Microsoft Corporation, DHL International GmbH, United Parcel Service, Inc., FedEx Corporation, CEVA Logistics AG, Intel Corporation, IBM Corporation, Oracle Corporation, Kuehne + Nagel International AG, NVIDIA Corporation, XPO Logistics, Inc., Zebra Technologies, HAVI , Infor, Echo Global Logistics, Symbotic , C3 AI, Turvo Inc., project44 Inc., Wise Systems, Inc., Covariant , Cognitivescale Inc., Slync.io Inc., Transportation Applied Intelligence LLC

Table of Contents 1. Executive Summary 2. AI In Logistics Market Report Structure 3. AI In Logistics Market Trends And Strategies 4. AI In Logistics Market – Macro Economic Scenario 5. AI In Logistics Market Size And Growth ….. 27. AI In Logistics Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

A Step-by-Step Overview of The Gainers' Strategy on Portfolio Management

In the ever-changing arena of financial investment, portfolio management services are the key strategy through which investors hope to maximize their returns without taking too much risk. The Gainers have devised an approach that converts complicated challenges in investment into strategic opportunities and offers a full-fledged road to success for their clients.

Portfolio Management: It's More Than a Number Game

Portfolio management services are an art and science in itself, more complex than mere arithmetic. It needs to understand market dynamics, the individual's financial goals, and how all the different asset classes interplay. The Gainers' approach in portfolio management is distinguished by a structured, data-driven strategy focusing on client-specific objectives and long-term financial growth.

Awareness Stage: Discovering Investment Potential

Most investors feel overcome by the intricacies of the financial markets. Volatility in the markets, the emergence of economic trends, and the diversity of investment alternatives render them incapacitated to decide. The Gainers understand this and, through a very well-crafted methodology, turn uncertainty into opportunity.

Their approach starts with a simple truth: no investment portfolio should ever be exactly the same as another because no person or organization is alike. In other words, each investment portfolio should be different; each should be personalized because every financial goal is specific.

The Gainers' Advanced Methodology

Strategic Portfolio Analysis

The most important part of The Gainers' portfolio management services methodology involves a strategic portfolio analysis. It is not merely on the surface but delves deeply into:

Current asset allocation

Performance history

Risk tolerance

Long-term investment goals

Through detailed scrutiny, The Gainers can identify weak spots and opportunities in a matured investment portfolio.

Advanced Diversion Techniques

Diversification is the pillar for shrewd management of investment. The Gainers are a few notches more advanced by making diversion more complex through a multilayered diversification strategy far beyond the ordinary distribution into asset classes.

This is achieved through:

Regional diversion across international economies

Sector-based strategies for distribution

Alternative investment strategies

Rebalancing

This advanced approach allows portfolios to remain resilient during market fluctuations while retaining the potential for steady growth.

Sophisticated Risk Management Strategies

Risk is not something to be feared but instead strategically managed. The Gainers use advanced risk management techniques beyond the ordinary protective strategies. Their strategy includes:

Predictive risk modeling

Stress testing investment scenarios

Ongoing portfolio monitoring

Adjusting strategy based on conditions

These techniques make proactive risk management possible. Potentials that could turn out to be vulnerabilities become strategic advantages.

Decision-Making: Why Choose The Gainers?

Choosing a portfolio management services partner is a decision of high importance. The Gainers present several reasons why they stand out from other investment management companies:

Personalized Solutions: Each portfolio is carefully designed to suit the specific needs of every client, making it completely customized.

Transparent Processes: Clients get detailed information on investment strategies, allowing them to understand and fully trust the strategy.

Technology-Driven Insights: Advanced analytics and machine learning enable The Gainers to make data-driven investment recommendations.

Proven Track Record: Years of successful portfolio management under different market conditions speak to their experience and trustworthiness.

The Road to Financial Security

Professional portfolio management services are not only about safeguarding assets but also about creating roads to financial growth and security. The Gainers have consistently been able to optimize investments by employing smart, intelligent management strategies.

Next Step

For investors looking to redefine their financial landscape, The Gainers are more than a service—they are a partnership for long-term investment success. Their holistic approach to portfolio management services exemplifies a paradigm shift in investment strategy.

Do you want to unlock your investing potential? Schedule a consult with The Gainers and discover how professional portfolio management can revolutionize your financial future.

#portfolio management#investment strategy#risk management#asset allocation#diversification#financial planning#return optimization#wealth management

0 notes

Text

How to Analyze Your Investment Portfolio for Long Term Success

Ongoing analysis of your investment portfolio is vital to long-term financial success. By consistently reviewing and adjusting your investments, you can ensure alignment with your financial goals, risk tolerance, and market conditions. A thorough portfolio analysis assesses your asset allocation and examines your investments' costs, risks, and tax efficiency.

Asset allocation is a pivotal factor in determining the success of your portfolio. It involves the distribution of your assets - stocks, bonds, cash, and other types - across various asset classes. The goal is to strike a balance that aligns with your time horizon and risk tolerance. A diversified portfolio can reduce market volatility by spreading risk across various assets. For instance, a mix of value and growth equities can provide a buffer during market downturns.

Alongside asset allocation, diversity plays a crucial role in risk management. It's not only important to have a range of assets; it's also important to ensure they are not all closely correlated. Investing across industries, regions, and even alternative assets like real estate or commodities can provide a sense of security, knowing that a downturn in one area won't spell disaster for your entire portfolio.

Understanding the risk in your portfolio is critical to long-term success. Everyone's risk tolerance is different and is influenced by any factors including age, financial goals, and investment time horizon. Some choose a conservative strategy, while others believe in superior returns via risk. This understanding puts you in control of your long-term success.

Using factor analysis is an excellent way to manage risk. This approach clarifies how several elements affect your portfolio, including firm size, profitability, and value. Small-cap stocks, for instance, have more volatility but usually have more growth potential. Over time, juggling these risks with more steady assets like bonds or large-cap companies can help your portfolio perform better.

Examining your portfolio also means evaluating the quality and maturity of your fixed-income investments - especially bonds. Usually less volatile than stocks, bonds help to lower the total portfolio risk. Not all bonds, meanwhile, bear the same degree of risk. Agency ratings of bond credit quality - the possibility of the bond issuer paying back the debt - show that while lower-rated bonds give higher yields but come with more risk, better-rated bonds (AAA) are less hazardous but offer fewer profits.

Furthermore, your bonds' maturity influences their sensitivity to interest rate fluctuations. While more interest rate sensitive, bonds with longer maturities usually provide better yields. Combining short-term and long-term bonds in a well-built portfolio helps control interest rate risk and liquidity.

Portfolio performance depends heavily on investment expenses. Over time, costs such as adviser fees, mutual fund management fees, and brokerage charges can diminish returns. Little expenses may mount up, particularly in long-term ventures. Review these costs often and look for methods to cut them without compromising the caliber of your investing plan. Low-cost indexes and exchange-traded funds are two reasonably cheap investment choices that can help lower your portfolio costs.

Maintaining discipline through market swings is one of the cornerstones of a successful long-term portfolio plan. Reacting to short-term market fluctuations, such as selling during a downturn or chasing high-performing stocks, can lead to underperformance. Instead, focus on your long-term goals to diversify your portfolio and align with your financial objectives. This discipline will help you avoid emotional decision-making and stay on course for long-term success.

1 note

·

View note

Text

Enterprise Asset Management Market To Grow with a High CAGR- Global Industry Analysis

Analysis of Enterprise Asset Management Market Size by Research Nester Reveals the Market to grow with a CAGR of 10.5% During 2025-2037 and Attain USD 18.6 billion by 2037

Research Nester assesses the growth and market size of the global enterprise asset management market, which is anticipated to be due to the rising adoption of digital technologies.

Research Nester’s recent market research analysis on “Enterprise Asset Management Market: Global Demand Analysis & Opportunity Outlook 2037” delivers a detailed competitors analysis and a detailed overview of the global enterprise asset managementmarket in terms of market segmentation by component, application, organization, deployment, end user, and by region.

Digital Technologies Such As AI and ML Effectively Transforming Enterprise Asset Management Solutions

The integration of digital technologies such as the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and big data analytics is leading to the development of advanced enterprise asset management (EAM) solutions with enhanced real-time monitoring and predictive maintenance capabilities. The IoT devices and AI systems work together and offer end users an effective asset management method.

Advanced data analytics and big data aid organizations in gaining actionable insights from asset performance data. This further also helps in optimizing asset utilization, reducing downtime, and improving the decision-making process. These capabilities are driving the enterprise asset management solution sales growth.

Growth Drivers:

Cloud-based enterprise asset management solutions gaining traction globally

Rise in remote work jobs driving the demand for modern EAM solutions

Challenges

The upfront cost associated with the installation of enterprise asset management solutions and implementation of services is quite high. This deters organizations especially small and medium-sized ones working on tight budgets from adopting these solutions. Also, enterprise asset management solutions can require significant customization and integration with existing systems. This complexity leads to extended implementation times, high costs, and potential disruptions to business operations, limiting their sales growth.

Access our detailed report at: https://www.researchnester.com/reports/enterprise-asset-management-market/6449

By end user, the manufacturing segment is estimated to capture 30.5% of the revenue share through 2037. Manufacturing companies usually operate with a diverse array of assets including machinery, equipment, and infrastructure. EAM systems help manage this complex inventory by providing an effective and centralized platform for tracking and optimizing the performance, maintenance, and lifecycle of these assets.

Based on region, North America is projected to hold a market share of 37.5% through 2037. North America has a strong presence of industries such as healthcare, manufacturing, and utilities, which need to comply with strict regulatory requirements related to asset management. Enterprise asset management solutions aid these organizations in maintaining compliance by providing accurate records and facilitating audits.

Customized report@ https://www.researchnester.com/customized-reports-6449