#Agent Institution BBPS

Explore tagged Tumblr posts

Text

What is Agent Institution under BBPS: A Comprehensive Guide

The Bharat Bill Payment System (BBPS) has revolutionized the way consumers pay their bills by offering a unified and interoperable platform for multiple services. Within this ecosystem, Agent Institutions (AIs) play a pivotal role in connecting consumers to the BBPS framework, ensuring convenience, reliability, and wide accessibility.

In this blog, we’ll explore the concept of Agent Institutions under BBPS, their roles, benefits, and how they contribute to the seamless functioning of this innovative payment system.

What is an Agent Institution under BBPS?

An Agent Institution BBPS (AI) is an entity that serves as an interface between customers and the BBPS. These institutions facilitate bill payment services through their extensive network of agents, providing users with access to BBPS at multiple touchpoints.

Typically, AIs work under a BBPOU (Bharat Bill Payment Operating Unit), which is a certified entity authorized to operate under BBPS guidelines. Together, BBPOUs and AIs ensure that the BBPS network operates smoothly and efficiently.

Key Roles of Agent Institutions

Providing Accessibility: AIs operate through a network of agents (physical locations, online platforms, or mobile applications) to ensure BBPS services are available across urban and rural areas.

Customer Facilitation: They assist customers in making payments for electricity, water, telecom, gas, DTH, insurance premiums, and other utility services.

Payment Processing: AIs collect payment data and securely transmit it to BBPS through the respective BBPOUs. This enables real-time processing and confirmation of payments.

Expanding Digital Literacy: Many AIs help educate customers, especially in rural areas, about the benefits of digital payments and BBPS, thus promoting financial inclusion.

Revenue Generation: By charging a nominal fee for their services, AIs generate revenue while offering value-added services to end-users.

How Do Agent Institutions Operate?

Agent Institutions rely on two main setups:

Physical Agents: Retail outlets, kirana stores, or customer service points that provide over-the-counter bill payment services to customers.

Digital Platforms: Websites, mobile applications, or chat-based platforms offering online bill payment services directly integrated with the BBPS.

Both methods ensure that customers have diverse options for accessing BBPS services, catering to their unique needs and preferences.

Benefits of Agent Institutions under BBPS

Convenience: Customers can pay bills from a single platform, eliminating the need to visit multiple service providers.

Wide Reach: With a strong presence in rural and semi-urban areas, AIs enhance the accessibility of bill payment services.

Real-Time Transactions: Payments made through AIs are processed instantly, ensuring timely credit to billers.

Secure Payments: Transactions facilitated by AIs adhere to the stringent security protocols mandated by BBPS.

Transparency: Customers receive instant confirmations and receipts for their transactions, promoting trust.

Challenges Faced by Agent Institutions

Despite their benefits, Agent Institutions face certain challenges:

Operational Costs: Managing a large network of agents involves significant costs, including training, technology, and compliance.

Digital Divide: Limited digital literacy in rural areas may hinder customers' ability to fully utilize BBPS services.

Technical Integration: Ensuring seamless integration with BBPOUs and the BBPS system requires robust technical infrastructure.

Accelerate Agent Institution Onboarding with plutos.One BBPS TSP

plutos.One empowers Agent Institutions by delivering a comprehensive and flexible BBPS solution tailored to meet business needs. It combines cutting-edge technology with a seamless deployment process, enabling businesses to:

Add Bill Payments with Ease: Integrate BBPS bill payment functionality into your platform without the hassle of building infrastructure from scratch.

Leverage Ready-to-Deploy Screens: Get pre-designed, customizable screens for mobile apps, websites, WhatsApp, and other platforms.

Boost Engagement with Incentives: Every transaction comes with integrated incentives to drive user retention and increase repeat usage.

Whether you’re a digital platform, a fintech startup, or a traditional business looking to expand your services, plutos.One’s AI-as-a-Service can help you deliver exceptional bill payment functionality to your consumers with ease and efficiency.

#Agent Institution#Agent Institution BBPS#BBPS-TSp#Bharat bill payment system#bharat connect#biller operating unit#customer operating unit#bbps-bou#bbps-cou

0 notes

Photo

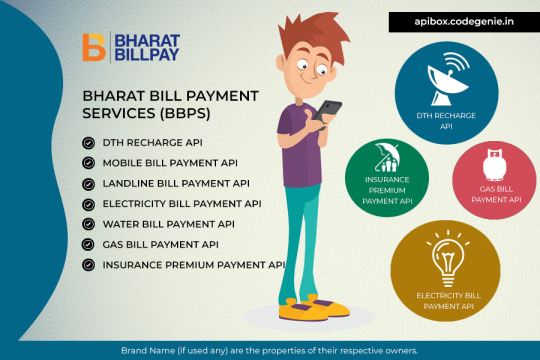

BBPS API Provider in India.--The first of its kind bill payment system in India is here to change the way bills are being paid. Bringing a revolution in India's bill payment market, #Bharat #BillPay enables every citizen to pay their different bills under the same window. This unified ecosystem brings banks, non-banks like eCommerce portals and online payment platforms under one roof as its official operational units for bill collections. CodeGenie is an Authorised Agent Institution for #BBPS. http://bit.ly/2LcLK5F

#BBPS API Provider in India.#CodeGenie is an Authorised Agent Institution for BBPS#The first of its kind bill payment system in India is here to change the way bills are being paid. Bringing a revolution in India's bill pay

0 notes

Text

Make Recurring Payments On Your Credit Cards Through Bharat Bill Pay Service On CRED

Make Recurring Payments On Your Credit Cards Through Bharat Bill Pay Service On CRED

The dreary task of paying your bills every month can be exhausting. Keeping track of your bills, analyzing your spends and budgeting can be made easier if you opt for credit cards to make these transactions. Over the years, members have opted to use CRED to pay credit card bills. Now, with CRED as a Key Agent Institution for Bharat Bill Pay System (BBPS), members can use the platform to make…

View On WordPress

0 notes

Text

Now Use Bharat Pay And Pay Your Bills From Anywhere With Spice Money

The Bharat Bill Payment System (BBPS) is a Reserve Bank of India (RBI)-a designed system that provides consumers with interoperable and accessible bill payment services via digital (bank channels) and a network of agents and bank branches. It is managed by the National Payments Corporation of India (NPCI).

The Bharat Bill Payment System is an interoperable platform that allows you to pay your bills on a regular basis. It was created with the goal of providing clients with interoperable and accessible bill payment services through a network of agents that could take a variety of payment methods and give quick payment confirmation.

Consumers can pay their invoices using a variety of payment alternatives provided by the BBPS. Cash, credit, debit, prepaid cards, IMPS, UPI, AEPS, Internet Banking & UPI, and Wallets are all accepted as payment options by BBPS.

To initiate BBPS transactions, a variety of payment channels can be used, including digital channels like the Internet, Internet banking, Mobile, Mobile Banking, POS (Point of Sale terminal), MPOS (Mobile Point of Sale terminal), KIOSK, and offline channels like ATM, Bank Branch, Agents, and Business Correspondents.

Spice Money is an internet platform that can assist you in starting a business. Spice Money is one of India's largest rural fintech startups, with a revolutionary impact on digital, financial, and e-commerce services in rural and semi-urban areas. They have trained over 5 lakh rural entrepreneurs (Adhikaris) and manage financial transactions of USD 12 billion, with an annual growth rate of over 150 percent. Spice Money is one of the most trusted Rural Fintech firms in modern India offering business opportunities, with a consumer base of 100 million.

Spice Money also provides financial services for a variety of business opportunities. Spice Money Adhikaris and consumers can use the lending services to get low-interest loans with attractive terms. Since the loans are given by well-known banks and financial institutions, the service is safe. These loans offer a speedy approval process and don't demand a lot of documentation or a long wait.

Spice Money's Adhikaris can accept payments for all utility bills, including water, electricity, gas, DTH, broadband, and mobile phones, using the Bharat Bill Payment System (BBPS). In the next months, customers will be able to recharge and top up numerous streaming services. Other services made easy by the BBPS service include FasTag, Municipal Corporation Tax, LIC Premiums, and others. Spice Money's digital payment app can help with all types of

0 notes

Photo

Bharat Bill Payment – One Stop Solutions for All Bill Payments

Bharat bill payment system (BBPS) introduced by the reserve bank of India (RBI) and driven by the national payments corporation of India (NPCI). BBPS is a one-stop integrated online platform that allows any time anywhere utility bills payment by providing interoperable and accessible services that ensure reliability and safe transactions. Unlike Paytm, it offers services to people from rural areas to urban areas. One can make payments through business correspondents like iServeU, ATMs, MPOS machines, and iServeU agents which provide the services in the unbanked and under banked areas.

Key Features of BBPS:

· 100% Secure Transactions

· User-friendly Platform

· Unite the different payment ecosystem

· Accepts multiple channel and modes of payment

· Proper complaints management

· Easily accessible

· Multiple clearing and guaranteed settlements

· Benefits of Bharat bill payment system:

· It offers an integrated platform for timely and guaranteed settlements.

· If you have any problem with the system, you can contact the dispute management and complaint management system.

· Instant settlements will improve the liquidity position of Billers

· Convenient, easy to use, and total time saver

· One can rely on this system because of transparency in the transaction process

· Get instant approval or confirmation

· Great customer’s experience

· Multiple payment modes like NEFT or IMPS

· Anytime Anywhere Payment option

· A move towards a cashless society

· Bill Payment from electronic channels

Steps to follow to make bill payment using Bharat Bill Payment System

Step 1: Visit a bank or branch/connect to any internet banking or app of your respective bank or visit a retail shop offering BBPS services.

Step 2: Click on bill payment or BBPS Tab

Step 3: Choose the category of biller and enter the details of the bill

Step 4: Initiate a payment and get instant approval.

The BBPS is introduced to provide a unified payment solution to everyone. It is an economical, easy to operate, and convenient substitute to cash or wallet payment with lots of features. With this system, you can pay bills of:

· Electricity

· DTH

· Internet

· Water/Municipality

· Gas supply

· Telephone

· Government payments

· Charity

· Institutional fees such as school fees or college fees.

· Other payments Insurance, mutual funds, credit card bills

· Key Participants

· Here is the list of key participants:

· Bharat bill payment central Unit

· Bharat bill payment Operating Unit

· Agent institutions

· Business Correspondent

· Agents

· Billers/Utility Company

· Charges of BBPS

· The charges of Bharat bill payment services is Nil. There’s no monthly service fee to use Bill Pay.

The Bottom Line:

The introduction of Bharat bill payment has provided ease to customers and improve their experience. One can rely on this payment system as the government has launched it with a motto to integrate all the payment systems. Now the customers don’t have to go to different offices for bill payments. One can easily pay the bills with the help of a business correspondent like iServeU. iServeU Agents are in every corner of India and helping rural people to pay their utility bills with ease. For more info, visit iserveu.in or call on 08338088000.

0 notes

Text

Why use XPay Life to Pay Online Utility Bills

The bill payment online has been of the greatest concern with people stranded inside the homes over the madness of the coronavirus spread, that is taking lives. But, on the pretext of leading lives, we still need to pay bills at any given condition. When things go out of hand and most people are being quarantines to assure safety. Use XPay Life to provide the bill payment facility through the most secure online modes through the Mobile application that is compatible with both Android and iOS devices. Also, the tneb bill payment can be paid without any hassles through the mobile application.

Why XPay Life?

XPay Life is an NPCI/BBPS approved agent institution facilitating bill payment in the recurring categories of Electricity, water, piped gas, LPG, Mobile postpaid, Mobile prepaid, Landline postpaid, Broadband postpaid, Insurance, school fees, Cable TV, Loan repayment through EMI, cable TV, DTH recharge and more. Hence stay safe indoors and make all the payment like tata power electricity bill payment delhi and enjoy the benefits of the utility that provides the continuous supply even at the dire times where that whole world is confined inside.

Also, one of the main reasons to use XPay Life is that it is provided with the most secure payment platform built on blockchain technology along with the futuristic technologies of Artificial Intelligence, Mobility, IoT, and Cloud. HEnce aiding in the built of the futuristic technologies that are highly dependant on security and data analysis to provide customer-centric services. Already XPay Life is catering for the online and offline customers through the platform. Pay tamil nadu electricity bill without any hassles.

torrent electricity bill payment can be paid as the payment is quite easy by following a few instructions through the Mobile Application. Logging in easy with XPay Life as the process has been made for the lame man and any villager. With just by using the phone number and receiving the OTP, the XPayLfie App can be logged in. Selection of the category, with the biller name and customer ID are all simple data entry processes that lead to the confirmed payment.

Payment through XPay Life can also be very exciting with amazing discounts waiting for your way. Now pay and save with the application. Use the coupon code XPAYHOLI that is valid till 31 March 2020. You can also redeem referral points and save on the bill payment money. Download the application from the google Playstore or Appstore.

Manage your capacity portions at whatever point in your fingertips thought you adaptable, unreasonably fast, generally clear and most secure technique for your capacity bills online portions, less complex to stay on track with xpay life

Pay your tata power electricity bill payment mumbai in as less as three clicks via XPay Life Web, Mobile App and Touch Screen Kiosk. XPay Life has integrated Blockchain secure payment gateway with all payment channels.

Source: https://www.apsense.com/article/why-use-xpay-life-to-pay-online-utility-bills.html

0 notes

Text

How To Make Utility bill payment Online Through XPay Life?

Utility bill payment Online has gained an increased customer base with the current scenario that the nation is going through. More people are health-conscious and prefer to pay all their multi-utility bills like Electricity, water, piped gas, LPG, Mobile postpaid, Mobile prepaid, Landline postpaid, Broadband postpaid, Insurance, school fees, Cable TV, Loan repayment through EMI, DTH recharge through the online modes though XPay Life. This platform is providing the highest security platform for bill payment. Hence staying indoors that still have access to the important facilities through XPay Life.

XIPHIAS XPay Life PvT Ltd is an NPCI/BBPS approved agent institution facilitating bill payment through a gamut of digital solutions that have revolutionized the bill payment sector. The innovations include the Mobile Application, Online Web, ATP Kiosk, PoS machine, and Mobile Van. Hence the digital solutions are catering to the online and offline customers by accepting payment through UPI payments, Credit/debit cards, Internet Banking, Mobile Banking, QR code payment, and cash as well while Online Broadband Bill Payment.

The Mobiel Application is very user-friendly and provides to pay electricity bill without login that is the login process doesn't consist of cumbersome entry of the passwords and userID. Instead, one can directly login using the phone number, Facebook, Gmail. Hence the bill payment is quite easy without multiple authentication processes and at the same time highly secure. AS the Application is built on the most secure Blockchain technology that is highly resistant to any changes that happen with the customer's sensitive data. Hence breaking the reach of the online fraudulent.

postpaid mobile bill payment IOS is quite easy with the XPayLife as it is compatible with both Android and iOS devices thus making it possible for the customers to download the application from any smartphone. Also, while paying the bills through XPay Life, exciting offers can be availed by using the coupon codes and avail upto Rs 200 discount on bill payment. One other advantage of XPaylife is that the platform doesn’t store any credit/debit card details in the platform thus providing the safest security and less exposure of the customer's personal and confidential data to the cyber fraudulent and hence decreasing the chances of being victimized to cybercrimes.

Download the XPayLife App through the GOOgl Playstore or Appstore and pay water bill online without any hassles and through India’s first blockchain-enabled bill payment sector.

Source: https://justpaste.it/79v7p

0 notes

Text

2 BHK Apartment in Geelong: property agreement

RENTAL AGREEMENT OF PROPERTY FOR HOUSING WITH OPTION OF PURCHASE OR DENOMINATED RENTAL-SALE (Part II)

Benefits for the tenant: If the tenant has strictly complied with the monthly rent payments, he / she will have the option to purchase the property.

The lessee can use his purchase option through the financial system, meeting the requirements that the financial institution requires.

Users can find more Apartment in Australia on Free Classified Website in Australia for many cities in Australia like: Apartment in Adelaide, Apartment in Brisbane, Apartment in Melbourne, Apartment in Perth, Apartment in Sydney, Apartment in Gold Coast, Apartment in Sunshine Coast, Apartment in Townsville, Apartment in Geelong, Apartment in Newcastle, Apartment in Wollongong, Apartment in Bunbury, and users can Post Free Classified Ads in Australia on these classified websites.

If it is a single housing acquisition and within the range for financing a MIVIVIENDA loan (up to 50 UIT = S /. 190,000.00 nuevos soles) or the Techo Propio Program, you are entitled to the Good Payer Bonus - BBP or BFH Family Housing Bond respectively.

Users can find more 2 BHK Apartment in Australia on Free Classified Website in Australia for many cities in Australia like: 2 BHK Apartment in Adelaide, 2 BHK Apartment in Brisbane, 2 BHK Apartment in Melbourne, 2 BHK Apartment in Perth, 2 BHK Apartment in Sydney, 2 BHK Apartment in Gold Coast, 2 BHK Apartment in Sunshine Coast, 2 BHK Apartment in Townsville, 2 BHK Apartment in Geelong, 2 BHK Apartment in Newcastle, 2 BHK Apartment in Wollongong, 2 BHK Apartment in Bunbury, and users can Post Free Classified Ads in Australia on these classified websites.

In summary, what the norm purports is to create the lessee a credit history that previously by the demands of the financial market was inaccessible.

Users can find more 3 BHK Apartment in Australia on Free Classified Website in Australia for many cities in Australia like: 3 BHK Apartment in Adelaide, 3 BHK Apartment in Brisbane, 3 BHK Apartment in Melbourne, 3 BHK Apartment in Perth, 3 BHK Apartment in Sydney, 3 BHK Apartment in Gold Coast, 3 BHK Apartment in Sunshine Coast, 3 BHK Apartment in Townsville, 3 BHK Apartment in Geelong, 3 BHK Apartment in Newcastle, 3 BHK Apartment in Wollongong, 3 BHK Apartment in Bunbury, and users can Post Free Classified Ads in Australia on these classified websites.

Benefits for the Owner:

In compliance with the requirements, the Single Process for the execution of eviction is accepted, in case the lessee breaches the obligations agreed in the lease. If the landlord is a real estate developer or estate agent, he / she is exempt from the IGV (General Sales Tax) for a term of three years.

#2 BHK Apartment in Gold Coast#2 BHK Apartment in Sunshine Coast#2 BHK Apartment in Townsville#2 BHK Apartment in Geelong#2 BHK Apartment in Newcastle#2 BHK Apartment in Wollongong

0 notes

Text

Understanding BBPS Bharat Connect: Revolutionizing Bill Payments in India

The Bharat Bill Payment System (BBPS) has transformed the landscape of bill payments in India, making it seamless, secure, and efficient for customers and businesses alike. One of the key players in this revolution is Bharat Connect, a trusted and robust solution provider within the BBPS ecosystem. This blog dives into what BBPS Bharat Connect entails, how it operates, and the role it plays in reshaping financial transactions.

What is BBPS?

BBPS, short for Bharat Bill Payment System, is a one-stop platform for bill payments that operates under the Reserve Bank of India (RBI) and is managed by the National Payments Corporation of India (NPCI). It integrates various billers, customers, and payment service providers, ensuring safe and hassle-free transactions.

The BBPS ecosystem has two key operational units:

Biller Operating Unit (BOU): Onboards billers (utility providers) to the BBPS network.

Customer Operating Unit (COU): Enables customers to make payments via BBPS through multiple channels, including banks, digital wallets, and apps.

Bharat Connect and BBPS - TSP

Bharat Connect serves as a trusted Technical Service Provider (TSP) in the BBPS ecosystem. A bbps TSP acts as a bridge, empowering banks and other financial institutions with technical infrastructure and operational support to seamlessly connect with the BBPS framework.

Why Choose Bharat Connect?

Comprehensive B2B Solutions: Bharat Connect provides end-to-end B2B Bharat Connect TSP services for banks and other financial institutions.

Agent Institution BBPS: Supports agent institutions by offering secure and reliable platforms for handling bill payments.

Unified Presentment Management System: Ensures smooth bill presentment and payment integration across multiple channels.

FASTag TSP: Enables effortless integration and management of FASTag payments under the BBPS ecosystem.

The Role of BBPS in Digital India

The AI-powered Bill Payment System BBPS enables secure, real-time payment processing for a wide range of services:

Utility bills (electricity, water, gas, etc.)

Telecom bills

Subscription fees

FASTag recharges and toll payments

Moreover, its advanced Settlement & Reconciliation system ensures that all transactions are accounted for and settled without discrepancies, fostering trust among customers, agents, and billers.

How Plutos ONE Empowers the BBPS Ecosystem

Plutos ONE is proud to be one of India’s youngest and most innovative BBPS - TSP providers. Here's how we’re making a difference:

Conversational AI Solutions: We enable bill payments through conversational platforms like WhatsApp, making the process user-friendly and accessible to a broader audience.

B2B Bharat Connect Services: Plutos ONE offers specialized TSP services for banks, ensuring seamless integration with the BBPS ecosystem.

Incentives on Transactions: We operate India’s largest Merchant-funded Offers Platform with over 400 online brands, driving engagement through rewards and offers for every transaction.

Clickpay: plutos ONE ClickPay allows you to create a trusted payment URL for direct consumer payments, enabling one-off payments with automated reminders.

Settlement & Reconciliation Excellence: Our advanced systems guarantee accurate and timely settlements, ensuring confidence for all stakeholders.

Merchant-Funded Offers Platform: We also manage card activation and offers platforms for banks, networks, and major brands.

With Plutos ONE, businesses not only gain access to cutting-edge Bharat Connect TSP solutions but also tap into the potential of India’s largest incentive platform.

The Future of Bill Payments with Bharat Connect TSP and BBPS

As digital payments continue to grow in India, systems like BBPS and TSP providers like Bharat Connect and Plutos ONE are critical in driving inclusion, efficiency, and innovation. By enabling Agent Institution BBPS and integrating systems like Unified Presentment Management, the BBPS ecosystem ensures a future where paying bills is just a click away for every Indian.

Plutos ONE is committed to empowering businesses and consumers by enhancing the efficiency of the BBPS ecosystem. From FASTag TSP services to AI-driven solutions, we’re shaping the future of bill payments, one transaction at a time.

Visit Plutos ONE to learn more about our cutting-edge solutions.

#BBPS - TSP#BBPS#Bharat Connect#Bharat Connect TSP#B2B Bharat Connect#B2B Bharat Connect TSP#FASTag TSP#bbps bou#biller operating unit#bbps cou#customer operating unit#agent institution bbps#unified presentment management system#bbps Settlement & Reconciliation#AI-Powered Bill Payment System bbps

1 note

·

View note

Text

Understanding Biller Operating Units (BOU) in BBPS

The Bharat Bill Payment System (BBPS) has revolutionized digital payments in India by offering a unified platform for seamless and secure bill payments. Among its key components are Biller Operating Units (BOUs), which play a critical role in the ecosystem. In this blog, we’ll explore what BOUs are, their functions, and their impact on the bill payment industry, while incorporating relevant keywords for better understanding.

What is BBPS?

The Bharat Bill Payment System (BBPS) is an interoperable platform introduced by the National Payments Corporation of India (NPCI) to facilitate convenient and secure bill payments. BBPS connects multiple stakeholders, including Biller Operating Units (BOUs) and Customer Operating Units (COUs), to ensure a smooth payment process for customers.

What is a Biller Operating Unit (BOU)?

A Biller Operating Unit (BOU) is an entity registered within BBPS to onboard and manage billers (service providers) on the platform. These billers include electricity boards, telecom operators, gas providers, water boards, and other utility companies.

BOUs act as intermediaries, ensuring that service providers can seamlessly integrate with BBPS for bill presentment, payment processing, and reconciliation.

How Does BBPS Work?

BBPS operates through two major units:

Customer Operating Unit (COU): These are entities like banks or fintech companies that enable customers to pay their bills.

Biller Operating Unit (BOU): These entities manage billers and ensure that bills are presented and payments are processed efficiently.

Other essential components include:

Agent Institutions (AI): Entities that offer payment services through BBPS.

Unified Presentment Management System (UPMS): A system enabling bill presentment and payment tracking for better customer experience.

Functions of Biller Operating Units in BBPS

Onboarding Billers: BOUs onboard billers like electricity providers, telecom operators, and other utility services to the BBPS network.

Bill Presentment: Through the Unified Presentment Management System (UPMS), BOUs ensure that bills are presented accurately to customers via COUs.

Payment Facilitation: BOUs facilitate the payment process, ensuring funds are transferred from the customer’s bank account to the biller’s account securely.

Settlement & Reconciliation: A critical role of BOUs is handling BBPS Settlement & Reconciliation to ensure that all payments are accurately recorded and settled between stakeholders.

Data Analytics: BOUs use advanced tools, including AI-powered Bill Payment Systems, to analyze payment patterns and enhance operational efficiency.

Role of Bharat Connect as a BBPS - TSP

Bharat Connect is a Technology Service Provider (TSP) in the BBPS ecosystem. It acts as a bridge between BOUs, COUs, and service providers, enabling seamless integration and efficient management of transactions.

Why Choose Bharat Connect as a TSP?

B2B Solutions: B2B Bharat Connect provides scalable and secure solutions for businesses looking to leverage BBPS for bill payments.

FASTag TSP: Bharat Connect also supports FASTag payments, streamlining toll collections and making travel hassle-free.

Innovative Technology: With AI-driven tools, Bharat Connect ensures faster reconciliation, reducing errors and delays.

Benefits of BOUs in the BBPS Ecosystem

Convenience for Customers: Customers can pay all their bills—electricity, water, gas, telecom, FASTag, and more—on a single platform through their bank or fintech apps.

Enhanced Efficiency for Billers: Billers can focus on their core services while BOUs handle bill presentment, payment tracking, and reconciliation.

Secure Transactions: With robust encryption and compliance measures, BOUs ensure secure transactions for all parties involved.

Real-Time Updates: Through COUs and agent institutions, customers receive instant updates on their bill statuses, enhancing user experience.

Future of Biller Operating Units in BBPS

The role of BOUs is set to grow as the BBPS ecosystem expands to include more billers and payment options. With advancements like AI-Powered Bill Payment Systems, BOUs will offer even faster, more secure, and efficient services.

Conclusion

Biller Operating Units (BOUs) are the backbone of the BBPS ecosystem, ensuring smooth integration of billers, efficient payment processing, and secure reconciliation. Entities like Bharat Connect TSP play a crucial role in supporting BOUs with innovative, AI-driven solutions for better efficiency and scalability.

Whether you're a business looking to streamline bill payments or a customer seeking convenience, BOUs and BBPS are transforming the way we manage payments. Embrace this digital revolution to enjoy a smarter, more efficient way of handling bills.

0 notes

Text

Get To Know About Spice Money Mini Bank

The vast majority of Indians still live in villages. Villages have their own infrastructure apart from city infrastructure. True, the company has its own set of facilities and criteria. This does not, however, rule out the prospect of economic opportunities in rural areas.

Spice Money, a Spice Digital business entity, leverage technology to transform the Kirana store next door into a Spice Money Mini Bank. Cash deposit, cash withdrawal, balance inquiry, bill payment, Aadhaar enabled services, train tickets, and other services are available. Spice Money possesses a number of licenses, including the Reserve Bank of India's Prepaid Instruments License (PPI) and Bharat Bill Payment System (BBPS), as well as the UIDAI's KUC User Authentication (KUA). Through its network of 70,000 transacting agents, it serves 4 million unique clients and conducts 30 million transactions yearly.

The Spice Money Mini Bank utilizes several systems some, of which are:

1. AePS (Aadhaar Enabled Payment System) The Spice Money AePS service allows customers to access their Aadhaar-linked bank account and perform basic financial operations, including withdrawals, deposits, balance inquiries, and bank transfers using their Aadhaar card. All Adhikaris at Spice Money with Digital Dukaan have access to a secure Biometric Scanner, which they may use to complete these transactions.

2. Money Transfer (DMT) Spice Money users may send money to a variety of institutions over a large network. They may send money across all major nationalized and private banks in India with the aid of Adhikaris. This is a safe money transfer method that uses many stages of authentication to ensure maximum security. Spice Money Wallet is a semi-closed PPI wallet that is tied to the sender's cellphone number, making it extremely safe.

3. mPOS All Adhikaris may take payments from consumers using Debit and Credit cards with the Spice Money mPOS service. All major credit cards, including RuPay, Mastercard, Visa, and Maestro, are accepted.

Spice Money also offers financing services for various types of company distributorships. Spice Money Adhikaris and consumers may make use of the lending services to obtain attractive loans with low interest rates. The service is secure since the loans are provided by recognized banks and financial entities. These loans have a quick turnaround time and don't require a lot of paperwork or a long wait time.

Spice Money could be able to help you with simple loans for a greater business chance. You may also buy a Spice Money Bluetooth printer and make money with it. The Spice Money Bluetooth printer is also available for purchase.

0 notes

Photo

BBPS API Provider in India. The first of its kind bill payment system in India is here to change the way bills are being paid. Bringing a revolution in India's bill payment market, Bharat BillPay enables every citizen to pay their different bills under the same window. This unified ecosystem brings banks, non-banks like e-commerce portals and online payment platforms under one roof as its official operational units for bill collections. CodeGenie is an Authorised Agent Institution for #BBPS.http://bit.ly/357ACP0

#BBPS API Provider in India#The first of its kind bill payment system in India is here to change the way bills are being paid. Bringing a revolution in India's bill pay#This unified ecosystem brings banks non-banks like e-commerce portals and online payment platforms under one roof as its official operationa

0 notes

Photo

BBPS API Provider in India! Bharat Bill Payment System! The first of its kind bill payment system in India is here to change the way bills are being paid. Bringing a revolution in India's bill payment market, Bharat BillPay enables every citizen to pay their different bills under the same window. This unified ecosystem brings banks, non-banks like e-commerce portals and online payment platforms under one roof as its official operational units for bill collections. CodeGenie is an Authorised Agent Institution for #BBPS.http://bit.ly/2N37kJP http://bit.ly/2N37kJP

0 notes

Photo

BHARAT BILL PAYMENT SERVICES--The first of its kind bill payment system in India is here to change the way bills are being paid. Bringing a revolution in India's bill payment market, Bharat BillPay enables every citizen to pay their different bills under the same window. This unified ecosystem brings banks, non-banks like e-commerce portals and online payment platforms under one roof as its official operational units for bill collections. CodeGenie is an Authorised Agent Institution for #BBPS. http://bit.ly/2N37kJP #dthrecharge #mobilebill #payment #landlinebillpayment #electricitybillpayment #waterbillpayment #india

0 notes

Photo

BHARAT BILL PAYMENT SERVICES. The first of its kind bill payment system in India is here to change the way bills are being paid. Bringing a revolution in India's bill payment market, #Bharat #BillPay enables every citizen to pay their different bills under the same window. This unified ecosystem brings banks, non-banks like e-commerce portals and online payment platforms under one roof as its official operational units for bill collections. CodeGenie is an Authorised Agent Institution for BBPS. http://bit.ly/357ACP0

#BHARAT BILL PAYMENT SERVICES#DTHRECHARGEAPIMOBILEBILLPAYMENTAPILANDLINEBILLPAYMENTAPIELECTRICITYBILLPAYMENTAPIWATERBILLPAYMENTAPIGASBILLPAYMENTAPIINSURANCEPREMIUMPAYMENT#DTHRECHARGEAPI#MOBILEBILLPAYMENTAPI#LANDLINEBILLPAYMENTAPI#ELECTRICITYBILLPAYMENTAPI#WATERBILLPAYMENTAPI#GASBILLPAYMENTAPI#INSURANCEPREMIUMPAYMENTAPI

0 notes

Photo

BHARAT BILL PAYMENT SERVICES

The first of its kind bill payment system in India is here to change the way bills are being paid. Bringing a revolution in India's bill payment market, Bharat BillPay enables every citizen to pay their different bills under the same window. This unified ecosystem brings banks, non-banks like eCommerce portals and online payment platforms under one roof as its official operational units for bill collections. CodeGenie is an Authorised Agent Institution for BBPS.

https://apibox.codegenie.in/bbps-api.html

#BBPS API Integration#BBPS API Integration Services#dthrecharge#mobilebillpayment#landlinebillpayment#electricitybillpayment#waterbillpayment#integratedservices

0 notes