#ACCA for CMA qualified

Explore tagged Tumblr posts

Text

Benefits of ACCA for CA & CMA Qualified Professionals: Enhance Your Global Career

For professionals already qualified as Chartered Accountants (CA) or Certified Management Accountants (CMA), earning the Association of Chartered Certified Accountants (ACCA) qualification can unlock a world of global opportunities. ACCA not only enhances your existing expertise in accounting and finance but also provides international recognition, enabling you to work in diverse markets worldwide. ACCA certification covers a broader range of global accounting standards, corporate law, and financial management practices, making it the perfect complement to CA or CMA qualifications. By pursuing ACCA, CA and CMA professionals can boost their career prospects, expand into international markets, and take on strategic leadership roles in multinational organizations. Read More: https://cfonext.co.in/acca/ca-cma-qualified-acca/

#ACCA for CA professionals#ACCA for CMA qualified#Benefits of ACCA for CA#ACCA vs CA#ACCA for CMA in India#Global opportunities for CA and CMA with ACCA

0 notes

Text

ACCA vs. CMA: Which Qualification Leads to Higher Salaries?

When considering a career in accounting or finance, two of the most prominent qualifications to pursue are the ACCA (Association of Chartered Certified Accountants) and the CMA (Certified Management Accountant). Both of these qualifications are widely recognized globally, but they cater to different career paths and have distinct focuses. For prospective students and professionals trying to decide which certification is right for them, one of the most important factors to consider is the salary potential each qualification offers.

In this blog, we’ll delve into a detailed comparison of the ACCA and CMA qualifications, focusing on which one leads to higher salaries, the differences between them, and how factors like ACCA pass rates, ACCA exemption fees, and job prospects influence career outcomes.

Overview of ACCA and CMA

Before diving into salary considerations, let’s first understand the core differences between the ACCA and CMA qualifications.

ACCA (Association of Chartered Certified Accountants)

The ACCA qualification is one of the most prestigious qualifications for accountants globally. It focuses on providing a comprehensive understanding of financial accounting, taxation, audit, and financial management. ACCA offers a broad skillset that is suitable for a variety of roles in accounting, auditing, finance, and management. With over 200,000 members worldwide, ACCA professionals are in demand across industries.

CMA (Certified Management Accountant)

The CMA qualification is issued by the Institute of Management Accountants (IMA) and is primarily focused on management accounting. It equips professionals with skills in cost management, budgeting, financial analysis, and performance evaluation, with a stronger emphasis on decision-making and strategic management. CMAs are typically employed in corporate finance, management accounting, and business analysis roles.

Comparing Salaries: ACCA vs. CMA

Now, let’s address the main question: which qualification leads to higher salaries? The answer depends on several factors, such as industry, location, and level of experience, but we can still provide a general comparison of salary ranges for both ACCA and CMA professionals.

ACCA Salary Potential

ACCA-qualified professionals typically have higher earning potential due to the broad range of roles they can pursue across different industries. Salaries for ACCA members tend to be higher in accounting and finance functions, particularly in roles like financial analysts, auditors, financial controllers, and CFOs. Here’s a breakdown:

Entry-level: For new ACCA graduates, the salary can range from $45,000 to $55,000 per year, depending on the country and industry.

Mid-career: With 5–10 years of experience, ACCA professionals can earn between $70,000 and $120,000 annually.

Senior-level: For seasoned professionals with over 10 years of experience, especially those in senior management roles such as CFO or financial director, salaries can exceed $150,000 or more.

CMA Salary Potential

CMA professionals also enjoy competitive salaries, but they are typically focused on managerial and corporate finance roles. CMA professionals are highly sought after for roles like financial analysts, cost accountants, and financial controllers in manufacturing, business consulting, and corporate strategy. Here’s an overview:

Entry-level: CMAs starting their careers can expect to earn between $50,000 and $60,000 annually.

Mid-career: With 5–10 years of experience, CMA professionals can expect salaries ranging from $80,000 to $110,000 per year.

Senior-level: Senior-level CMAs in high-level strategic roles can earn between $120,000 and $150,000, or higher, depending on the company and industry.

Factors Influencing Salary: ACCA vs. CMA

While the salary ranges mentioned above provide a general idea of potential earnings, it’s important to understand the factors that influence salaries for both ACCA and CMA professionals.

1. Industry

The industry in which you work plays a significant role in determining your salary. ACCA professionals, due to their broad skillset, tend to find opportunities in various sectors, including public accounting, banking, insurance, and multinational corporations. As a result, ACCA salaries can be higher in industries that require more regulatory compliance and financial reporting.

On the other hand, CMA professionals, with their focus on management accounting and strategic decision-making, typically earn higher salaries in industries like manufacturing, technology, and large corporations with extensive financial operations.

2. Location

Salaries for both qualifications also vary by location. In regions like the Middle East, Western Europe, and North America, the demand for ACCA professionals is high due to the international recognition of the qualification. Similarly, CMA professionals can earn higher salaries in countries where strategic financial management is valued, particularly in large businesses.

3. Level of Experience

The more years of experience you have, the higher your earning potential. Both ACCA and CMA professionals can command premium salaries as they progress in their careers. Senior roles, such as CFOs or finance directors, typically earn higher salaries for both qualifications.

4. Job Responsibilities

ACCA professionals, with their emphasis on financial reporting and auditing, can often take on more senior, high-paying roles. In contrast, CMA professionals are more focused on financial decision-making and performance management, which can also lead to managerial positions with lucrative salaries in corporate finance.

ACCA vs. CMA: Which is Better for You?

When deciding between ACCA and CMA, it’s important to consider which qualification aligns best with your career goals, interests, and salary expectations.

ACCA or CMA — Which is Better?

Choosing between ACCA or CMA, or CMA or ACCA which is better, depends on whether you’re more interested in financial accounting and regulatory work (ACCA) or strategic decision-making and cost management (CMA). Here are some key points to consider:

ACCA is better suited for individuals who want to pursue careers in public accounting, auditing, or corporate finance, and who want a globally recognized qualification that opens doors in various industries.

CMA is ideal for those looking to specialize in management accounting and work in strategic roles within companies, especially in industries like manufacturing, business analysis, and corporate finance.

If your goal is to achieve a broader scope with the potential for higher salaries across different sectors, ACCA might be the right choice. However, if you’re aiming for a specific career path in management accounting or corporate strategy, CMA could be the better option.

Additional Considerations: ACCA Pass Rates and Exemption Fees

When choosing between ACCA and CMA, it’s important to consider the ACCA pass rates and ACCA exemption fees, as they can significantly affect your overall cost and time investment in obtaining the qualification.

ACCA Pass Rates: Historically, ACCA pass rates have been challenging for many candidates, with pass rates varying between 40–60% depending on the level of the exam. High pass rates may require more time and effort, which could extend your journey to becoming ACCA-qualified. However, passing ACCA exams can significantly increase your earning potential once you become qualified.

ACCA Exemption Fees: If you have prior qualifications, you may be eligible for ACCA exemptions. ACCA exemption fees allow you to skip certain exams, reducing the number of exams you need to take. However, these fees can add up, so it’s important to factor this into your decision-making process. The cost of exemptions can influence your budget and impact your timeline for completing the qualification.

Conclusion: ACCA vs. CMA — Which Qualification Leads to Higher Salaries?

Ultimately, both ACCA and CMA qualifications lead to well-paying careers, but the salary potential varies depending on your career trajectory, industry, and job location. ACCA professionals tend to have higher salary potentials due to the broader scope of job roles they can pursue across industries. On the other hand, CMA professionals with a focus on strategic management accounting can also earn competitive salaries, particularly in specialized roles in corporate finance.

When deciding between the two, weigh factors like your career aspirations, interest in accounting versus management, and the potential salary you can achieve in your chosen industry. Either way, both ACCA and CMA qualifications offer strong career prospects and the potential for higher salaries.

In the end, whether you’re asking ACCA or CMA which is better or seeking guidance on ACCA vs CMA, the right choice comes down to your individual goals, preferences, and how each qualification fits into your long-term career plan.

#acca pass rates#acca or cma which is better#cma or acca which is better#acca exemption fees#acca vs cma

0 notes

Text

What Are The Advantages Of CMA USA Over CA?

What Are The Advantages Of CMA USA Over CA?

Leave a Comment / Courses / By admin

After finishing your tenth and twelfth grades, it can be difficult to establish your interests and future professional path. If you have an aptitude for numbers and want to pursue a career in accounting, consider CA, US CMA, CPA, or CIMA. A CA or CPA degree is a preferable option for those who want to study accounting exclusively. However, if you are more interested in the management side of accounting, courses such as US CMA and CIMA are worth considering. If you’re unsure about the difference between accounting and management accounting, which makes it tough to pick between US CMA and CA, this guide can assist clarify your worries by differentiating between US CMA and CA and showing the benefits of choosing CMA USA / US CMA over CA

Before beginning with the advantages of CMA USA over CA let us first see what is CMA USA and CA.

What is CMA USA ?

CMA USA or commonly called US CMA. The Certified Management Accountant (CMA) credential is a professional certification in the fields of management accounting and financial management. It indicates that the holder has expertise in financial planning, analysis, control, decision support, and professional ethics and controlled by the board Institute of Management Accountants (IMA)

What is CA ?

Chartered Accountants (CA) are professional accountants qualified to perform various specialised tasks within the accounting field. Their typical responsibilities include auditing financial statements, filing corporate tax returns, and offering financial advice and controlled by the board ICAI – The Institute of Chartered Accountants of India

Now let us know more about CMA USA and CA Differences CMA USA CABoard IMA (Institute of Management Accountants)ICAI – The Institute of Chartered Accountants of IndiaCourse Duration 6-9 Months 5 Years Eligibility CriteriaThe applicant should have either a Passing mark sheet for class 12th.A National Diploma in Commerce or a diploma in Rural Service Examination from a recognized board. The applicant should have successfully completed their 10th and 12th examination to appear for the entry-level CA foundation course with a 50% aggregate score in 12th. Scope Financial Risk Manager Internal Auditor Cost Accountant CFOTaxation Advisory Internal Auditing Forensic Auditing Statutory Audit Actuary ProfessionalSalary INR 5 to 20 LPAINR 6 to 10 LPA

After knowing the difference between CMA USA and CA let us now know the advantages of CMA USA over CA

Advantages of CMA USA over CA

Short course with good exposure This short professional course can be completed in 6 to 9 months, depending on your learning pace and career goals. The US CMA program provides industry-relevant knowledge and strategic management skills, fostering both professional and personal growth. Upon successful completion, you could have the opportunity to work with multinational companies like Accenture, Big 4 audit firms, and US-based banks.

Globally accepted Unlike CA, the US CMA is a globally approved certification in North America, the Middle East, Europe, Australia, and some Asian nations. If you want to advance your career overseas, you should acquire a qualification that is recognised in your preferred country. One key factor for the recent surge in US CMA applications is the potential to work abroad.

Can be pursued after 12th You can enrol in this course right after completing your 12th standard and pursue it alongside your graduation degree. The US CMA course combines accounting and finance knowledge with a deep understanding of management strategies. Other globally recognized courses you can pursue after 12th grade include ACCA, CA, and the FRM course.

Be on the management side of business A Chartered Accountancy degree will largely focus your abilities and experience on accounting-related activities such as budgeting and taxation. With a management accounting degree, you’ll be able to make strategic decisions based on financial information.

Huge Demand in Indian Market as well If you’re contemplating CA because of its popularity in the Indian market, you might be shocked to find that the US CMA is also in high demand. Following the epidemic, many Indian businesses have begun to build financial teams led by skilled Certified Management Accountants who can strategically manage cash flows. The increasing demand for insurance policies and goods expands potential for US CMAs in India.

These are the few pointers that explain the advantage of choosing CMA USA over CA. Keeping the exposure, growth , duration , salary , job opportunities and few other essential factors in consideration CMA USA has more exponential growth over CA.

Conclusion :

Choosing between CMA USA and CA depends on your career goals and interests. If you are looking for a globally recognized certification with a shorter duration and a focus on strategic management, CMA USA is an excellent choice. It offers diverse job opportunities, high demand in both international and Indian markets, and the flexibility to pursue it alongside your graduation. In contrast, CA is a more traditional route with a focus on accounting and auditing, primarily within the Indian context. Both certifications have their unique benefits, but CMA USA stands out for those seeking a rapid and international career trajectory.

FAQs on advantages of CMA USA over CA

What is the primary difference between CMA USA and CA?

CMA USA focuses on management accounting and strategic decision-making, while CA emphasises auditing, taxation, and financial reporting.

Can I pursue CMA USA right after completing my 12th grade?

Yes, you can enrol in the CMA USA course after completing your 12th grade and pursue it alongside your graduation.

How long does it take to complete the CMA USA course?

The CMA USA course can be completed in 6 to 9 months, depending on your learning pace and career goals.

Is the CMA USA certification recognized globally?

Yes, the CMA USA certification is globally recognized in North America, the Middle East, Europe, Australia, and several Asian countries.

What are the job prospects for CMA USA in India?

CMA USA holders are in high demand in India, especially after the pandemic, as many Indian firms are building financial teams led by Certified Management Accountants to manage cash flows strategically.

0 notes

Text

ACCA Eligibility

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious qualifications in the field of finance and accounting. Recognized worldwide, ACCA equips professionals with the skills and knowledge required to excel in the global finance industry. If you’re considering a career in accounting, understanding the ACCA eligibility criteria is your first step toward joining the ranks of this elite group.

Who Can Pursue ACCA?

The ACCA qualification is open to anyone with the requisite academic background, but the path to eligibility varies based on your educational qualifications:

10+2 (High School) Graduates: If you have completed your high school education (10+2) with a minimum of 50% in subjects like Mathematics, Accounting, or English, you are eligible to begin your ACCA journey. This route is popular among students who wish to start early in their accounting careers.

Graduates: Those who hold a bachelor's degree in Commerce (B.Com), Business Administration (BBA), or an equivalent degree from a recognized institution can also apply for ACCA. Graduates may be eligible for certain exemptions from the foundational exams, depending on their prior studies.

Postgraduates and Professionals: If you have completed a master’s degree in Commerce, Finance, or any other relevant field, or if you are already a qualified Chartered Accountant, you may be eligible for additional exemptions, allowing you to fast-track your ACCA qualification.

Non-Commerce Students: Even if your educational background isn’t in commerce or finance, you can still pursue ACCA. However, you might be required to start from the foundational level and may not be eligible for exemptions.

Why ACCA?

The ACCA qualification opens doors to a multitude of career opportunities across the globe. Whether you aspire to work in public accounting, corporate finance, auditing, or any other financial services sector, ACCA provides a comprehensive framework to hone your skills. The qualification is not only recognized in over 180 countries but is also highly respected by employers and institutions.

The ACCA Journey

The ACCA qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Students are required to complete 13 exams, gain three years of relevant work experience, and complete the Ethics and Professional Skills module to become an ACCA member. The journey, though rigorous, is rewarding, offering a blend of theoretical knowledge and practical application.

Conclusion

Pursuing ACCA can be a transformative step in your career, offering global recognition and diverse opportunities in the field of finance and accounting. With the right educational support, such as that provided by Zell Education, you can navigate the rigorous ACCA journey with confidence and emerge as a qualified professional ready to take on the world. If you're aspiring to join the ranks of ACCA professionals, ensuring you meet the eligibility criteria and choosing the right coaching partner are the first crucial steps.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in Touch

0 notes

Text

ACCA Eligibility

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious qualifications in the field of finance and accounting. Recognized worldwide, ACCA equips professionals with the skills and knowledge required to excel in the global finance industry. If you’re considering a career in accounting, understanding the ACCA eligibility criteria is your first step toward joining the ranks of this elite group.

Who Can Pursue ACCA?

The ACCA qualification is open to anyone with the requisite academic background, but the path to eligibility varies based on your educational qualifications:

10+2 (High School) Graduates: If you have completed your high school education (10+2) with a minimum of 50% in subjects like Mathematics, Accounting, or English, you are eligible to begin your ACCA journey. This route is popular among students who wish to start early in their accounting careers.

Graduates: Those who hold a bachelor's degree in Commerce (B.Com), Business Administration (BBA), or an equivalent degree from a recognized institution can also apply for ACCA. Graduates may be eligible for certain exemptions from the foundational exams, depending on their prior studies.

Postgraduates and Professionals: If you have completed a master’s degree in Commerce, Finance, or any other relevant field, or if you are already a qualified Chartered Accountant, you may be eligible for additional exemptions, allowing you to fast-track your ACCA qualification.

Non-Commerce Students: Even if your educational background isn’t in commerce or finance, you can still pursue ACCA. However, you might be required to start from the foundational level and may not be eligible for exemptions.

Why ACCA?

The ACCA qualification opens doors to a multitude of career opportunities across the globe. Whether you aspire to work in public accounting, corporate finance, auditing, or any other financial services sector, ACCA provides a comprehensive framework to hone your skills. The qualification is not only recognized in over 180 countries but is also highly respected by employers and institutions.

The ACCA Journey

The ACCA qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Students are required to complete 13 exams, gain three years of relevant work experience, and complete the Ethics and Professional Skills module to become an ACCA member. The journey, though rigorous, is rewarding, offering a blend of theoretical knowledge and practical application.

Conclusion

Pursuing ACCA can be a transformative step in your career, offering global recognition and diverse opportunities in the field of finance and accounting. With the right educational support, such as that provided by Zell Education, you can navigate the rigorous ACCA journey with confidence and emerge as a qualified professional ready to take on the world. If you're aspiring to join the ranks of ACCA professionals, ensuring you meet the eligibility criteria and choosing the right coaching partner are the first crucial steps.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in Touch

0 notes

Text

ACCA Eligibility

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious qualifications in the field of finance and accounting. Recognized worldwide, ACCA equips professionals with the skills and knowledge required to excel in the global finance industry. If you’re considering a career in accounting, understanding the ACCA eligibility criteria is your first step toward joining the ranks of this elite group.

Who Can Pursue ACCA?

The ACCA qualification is open to anyone with the requisite academic background, but the path to eligibility varies based on your educational qualifications:

10+2 (High School) Graduates: If you have completed your high school education (10+2) with a minimum of 50% in subjects like Mathematics, Accounting, or English, you are eligible to begin your ACCA journey. This route is popular among students who wish to start early in their accounting careers.

Graduates: Those who hold a bachelor's degree in Commerce (B.Com), Business Administration (BBA), or an equivalent degree from a recognized institution can also apply for ACCA. Graduates may be eligible for certain exemptions from the foundational exams, depending on their prior studies.

Postgraduates and Professionals: If you have completed a master’s degree in Commerce, Finance, or any other relevant field, or if you are already a qualified Chartered Accountant, you may be eligible for additional exemptions, allowing you to fast-track your ACCA qualification.

Non-Commerce Students: Even if your educational background isn’t in commerce or finance, you can still pursue ACCA. However, you might be required to start from the foundational level and may not be eligible for exemptions.

Why ACCA?

The ACCA qualification opens doors to a multitude of career opportunities across the globe. Whether you aspire to work in public accounting, corporate finance, auditing, or any other financial services sector, ACCA provides a comprehensive framework to hone your skills. The qualification is not only recognized in over 180 countries but is also highly respected by employers and institutions.

The ACCA Journey

The ACCA qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Students are required to complete 13 exams, gain three years of relevant work experience, and complete the Ethics and Professional Skills module to become an ACCA member. The journey, though rigorous, is rewarding, offering a blend of theoretical knowledge and practical application.

Conclusion

Pursuing ACCA can be a transformative step in your career, offering global recognition and diverse opportunities in the field of finance and accounting. With the right educational support, such as that provided by Zell Education, you can navigate the rigorous ACCA journey with confidence and emerge as a qualified professional ready to take on the world. If you're aspiring to join the ranks of ACCA professionals, ensuring you meet the eligibility criteria and choosing the right coaching partner are the first crucial steps.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in Touch

0 notes

Text

ACCA Eligibility

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious qualifications in the field of finance and accounting. Recognized worldwide, ACCA equips professionals with the skills and knowledge required to excel in the global finance industry. If you’re considering a career in accounting, understanding the ACCA eligibility criteria is your first step toward joining the ranks of this elite group.

Who Can Pursue ACCA?

The ACCA qualification is open to anyone with the requisite academic background, but the path to eligibility varies based on your educational qualifications:

10+2 (High School) Graduates: If you have completed your high school education (10+2) with a minimum of 50% in subjects like Mathematics, Accounting, or English, you are eligible to begin your ACCA journey. This route is popular among students who wish to start early in their accounting careers.

Graduates: Those who hold a bachelor's degree in Commerce (B.Com), Business Administration (BBA), or an equivalent degree from a recognized institution can also apply for ACCA. Graduates may be eligible for certain exemptions from the foundational exams, depending on their prior studies.

Postgraduates and Professionals: If you have completed a master’s degree in Commerce, Finance, or any other relevant field, or if you are already a qualified Chartered Accountant, you may be eligible for additional exemptions, allowing you to fast-track your ACCA qualification.

Non-Commerce Students: Even if your educational background isn’t in commerce or finance, you can still pursue ACCA. However, you might be required to start from the foundational level and may not be eligible for exemptions.

Why ACCA?

The ACCA qualification opens doors to a multitude of career opportunities across the globe. Whether you aspire to work in public accounting, corporate finance, auditing, or any other financial services sector, ACCA provides a comprehensive framework to hone your skills. The qualification is not only recognized in over 180 countries but is also highly respected by employers and institutions.

The ACCA Journey

The ACCA qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Students are required to complete 13 exams, gain three years of relevant work experience, and complete the Ethics and Professional Skills module to become an ACCA member. The journey, though rigorous, is rewarding, offering a blend of theoretical knowledge and practical application.

Conclusion

Pursuing ACCA can be a transformative step in your career, offering global recognition and diverse opportunities in the field of finance and accounting. With the right educational support, such as that provided by Zell Education, you can navigate the rigorous ACCA journey with confidence and emerge as a qualified professional ready to take on the world. If you're aspiring to join the ranks of ACCA professionals, ensuring you meet the eligibility criteria and choosing the right coaching partner are the first crucial steps.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in Touch

0 notes

Text

ACCA Eligibility

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious qualifications in the field of finance and accounting. Recognized worldwide, ACCA equips professionals with the skills and knowledge required to excel in the global finance industry. If you’re considering a career in accounting, understanding the ACCA eligibility criteria is your first step toward joining the ranks of this elite group.

Who Can Pursue ACCA?

The ACCA qualification is open to anyone with the requisite academic background, but the path to eligibility varies based on your educational qualifications:

10+2 (High School) Graduates: If you have completed your high school education (10+2) with a minimum of 50% in subjects like Mathematics, Accounting, or English, you are eligible to begin your ACCA journey. This route is popular among students who wish to start early in their accounting careers.

Graduates: Those who hold a bachelor's degree in Commerce (B.Com), Business Administration (BBA), or an equivalent degree from a recognized institution can also apply for ACCA. Graduates may be eligible for certain exemptions from the foundational exams, depending on their prior studies.

Postgraduates and Professionals: If you have completed a master’s degree in Commerce, Finance, or any other relevant field, or if you are already a qualified Chartered Accountant, you may be eligible for additional exemptions, allowing you to fast-track your ACCA qualification.

Non-Commerce Students: Even if your educational background isn’t in commerce or finance, you can still pursue ACCA. However, you might be required to start from the foundational level and may not be eligible for exemptions.

Why ACCA?

The ACCA qualification opens doors to a multitude of career opportunities across the globe. Whether you aspire to work in public accounting, corporate finance, auditing, or any other financial services sector, ACCA provides a comprehensive framework to hone your skills. The qualification is not only recognized in over 180 countries but is also highly respected by employers and institutions.

The ACCA Journey

The ACCA qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Students are required to complete 13 exams, gain three years of relevant work experience, and complete the Ethics and Professional Skills module to become an ACCA member. The journey, though rigorous, is rewarding, offering a blend of theoretical knowledge and practical application.

Conclusion

Pursuing ACCA can be a transformative step in your career, offering global recognition and diverse opportunities in the field of finance and accounting. With the right educational support, such as that provided by Zell Education, you can navigate the rigorous ACCA journey with confidence and emerge as a qualified professional ready to take on the world. If you're aspiring to join the ranks of ACCA professionals, ensuring you meet the eligibility criteria and choosing the right coaching partner are the first crucial steps.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in Touch

0 notes

Text

ACCA Eligibility

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious qualifications in the field of finance and accounting. Recognized worldwide, ACCA equips professionals with the skills and knowledge required to excel in the global finance industry. If you’re considering a career in accounting, understanding the ACCA eligibility criteria is your first step toward joining the ranks of this elite group.

Who Can Pursue ACCA?

The ACCA qualification is open to anyone with the requisite academic background, but the path to eligibility varies based on your educational qualifications:

10+2 (High School) Graduates: If you have completed your high school education (10+2) with a minimum of 50% in subjects like Mathematics, Accounting, or English, you are eligible to begin your ACCA journey. This route is popular among students who wish to start early in their accounting careers.

Graduates: Those who hold a bachelor's degree in Commerce (B.Com), Business Administration (BBA), or an equivalent degree from a recognized institution can also apply for ACCA. Graduates may be eligible for certain exemptions from the foundational exams, depending on their prior studies.

Postgraduates and Professionals: If you have completed a master’s degree in Commerce, Finance, or any other relevant field, or if you are already a qualified Chartered Accountant, you may be eligible for additional exemptions, allowing you to fast-track your ACCA qualification.

Non-Commerce Students: Even if your educational background isn’t in commerce or finance, you can still pursue ACCA. However, you might be required to start from the foundational level and may not be eligible for exemptions.

Why ACCA?

The ACCA qualification opens doors to a multitude of career opportunities across the globe. Whether you aspire to work in public accounting, corporate finance, auditing, or any other financial services sector, ACCA provides a comprehensive framework to hone your skills. The qualification is not only recognized in over 180 countries but is also highly respected by employers and institutions.

The ACCA Journey

The ACCA qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Students are required to complete 13 exams, gain three years of relevant work experience, and complete the Ethics and Professional Skills module to become an ACCA member. The journey, though rigorous, is rewarding, offering a blend of theoretical knowledge and practical application.

Conclusion

Pursuing ACCA can be a transformative step in your career, offering global recognition and diverse opportunities in the field of finance and accounting. With the right educational support, such as that provided by Zell Education, you can navigate the rigorous ACCA journey with confidence and emerge as a qualified professional ready to take on the world. If you're aspiring to join the ranks of ACCA professionals, ensuring you meet the eligibility criteria and choosing the right coaching partner are the first crucial steps.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in Touch

0 notes

Text

Foundation in Accountancy Course - Start Your Accounting Journey

CFO NeXT offers the Foundation in Accountancy course designed for aspiring accountants looking to build a solid base in financial and accounting principles. Our expert team of qualified professionals provides students with the knowledge and support necessary to succeed in their accountancy career. The course covers key topics like financial accounting, management accounting, and business law, laying the groundwork for advanced certifications like ACCA, CPA, or CMA. With our practical approach and dedicated mentorship, students will be fully equipped to excel in the world of accountancy.

#Foundation in Accountancy course#Accountancy foundation training#Accounting basics for beginners#Foundation in Accountancy for ACCA#Foundation accounting course CFO NeXT

0 notes

Text

ACCA Eligibility

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious qualifications in the field of finance and accounting. Recognized worldwide, ACCA equips professionals with the skills and knowledge required to excel in the global finance industry. If you’re considering a career in accounting, understanding the ACCA eligibility criteria is your first step toward joining the ranks of this elite group.

Who Can Pursue ACCA?

The ACCA qualification is open to anyone with the requisite academic background, but the path to eligibility varies based on your educational qualifications:

10+2 (High School) Graduates: If you have completed your high school education (10+2) with a minimum of 50% in subjects like Mathematics, Accounting, or English, you are eligible to begin your ACCA journey. This route is popular among students who wish to start early in their accounting careers.

Graduates: Those who hold a bachelor's degree in Commerce (B.Com), Business Administration (BBA), or an equivalent degree from a recognized institution can also apply for ACCA. Graduates may be eligible for certain exemptions from the foundational exams, depending on their prior studies.

Postgraduates and Professionals: If you have completed a master’s degree in Commerce, Finance, or any other relevant field, or if you are already a qualified Chartered Accountant, you may be eligible for additional exemptions, allowing you to fast-track your ACCA qualification.

Non-Commerce Students: Even if your educational background isn’t in commerce or finance, you can still pursue ACCA. However, you might be required to start from the foundational level and may not be eligible for exemptions.

Why ACCA?

The ACCA qualification opens doors to a multitude of career opportunities across the globe. Whether you aspire to work in public accounting, corporate finance, auditing, or any other financial services sector, ACCA provides a comprehensive framework to hone your skills. The qualification is not only recognized in over 180 countries but is also highly respected by employers and institutions.

The ACCA Journey

The ACCA qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Students are required to complete 13 exams, gain three years of relevant work experience, and complete the Ethics and Professional Skills module to become an ACCA member. The journey, though rigorous, is rewarding, offering a blend of theoretical knowledge and practical application.

Conclusion

Pursuing ACCA can be a transformative step in your career, offering global recognition and diverse opportunities in the field of finance and accounting. With the right educational support, such as that provided by Zell Education, you can navigate the rigorous ACCA journey with confidence and emerge as a qualified professional ready to take on the world. If you're aspiring to join the ranks of ACCA professionals, ensuring you meet the eligibility criteria and choosing the right coaching partner are the first crucial steps.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in Touch

0 notes

Text

ACCA Eligibility

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious qualifications in the field of finance and accounting. Recognized worldwide, ACCA equips professionals with the skills and knowledge required to excel in the global finance industry. If you’re considering a career in accounting, understanding the ACCA eligibility criteria is your first step toward joining the ranks of this elite group. Who Can Pursue ACCA? The ACCA qualification is open to anyone with the requisite academic background, but the path to eligibility varies based on your educational qualifications: 10+2 (High School) Graduates: If you have completed your high school education (10+2) with a minimum of 50% in subjects like Mathematics, Accounting, or English, you are eligible to begin your ACCA journey. This route is popular among students who wish to start early in their accounting careers. Graduates: Those who hold a bachelor's degree in Commerce (B.Com), Business Administration (BBA), or an equivalent degree from a recognized institution can also apply for ACCA. Graduates may be eligible for certain exemptions from the foundational exams, depending on their prior studies. Postgraduates and Professionals: If you have completed a master’s degree in Commerce, Finance, or any other relevant field, or if you are already a qualified Chartered Accountant, you may be eligible for additional exemptions, allowing you to fast-track your ACCA qualification. Non-Commerce Students: Even if your educational background isn’t in commerce or finance, you can still pursue ACCA. However, you might be required to start from the foundational level and may not be eligible for exemptions. Why ACCA? The ACCA qualification opens doors to a multitude of career opportunities across the globe. Whether you aspire to work in public accounting, corporate finance, auditing, or any other financial services sector, ACCA provides a comprehensive framework to hone your skills. The qualification is not only recognized in over 180 countries but is also highly respected by employers and institutions. The ACCA Journey The ACCA qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Students are required to complete 13 exams, gain three years of relevant work experience, and complete the Ethics and Professional Skills module to become an ACCA member. The journey, though rigorous, is rewarding, offering a blend of theoretical knowledge and practical application. Conclusion Pursuing ACCA can be a transformative step in your career, offering global recognition and diverse opportunities in the field of finance and accounting. With the right educational support, such as that provided by Zell Education, you can navigate the rigorous ACCA journey with confidence and emerge as a qualified professional ready to take on the world. If you're aspiring to join the ranks of ACCA professionals, ensuring you meet the eligibility criteria and choosing the right coaching partner are the first crucial steps. Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in Touch

0 notes

Text

ACCA Eligibility

The Association of Chartered Certified Accountants (ACCA) is one of the most prestigious qualifications in the field of finance and accounting. Recognized worldwide, ACCA equips professionals with the skills and knowledge required to excel in the global finance industry. If you’re considering a career in accounting, understanding the ACCA eligibility criteria is your first step toward joining the ranks of this elite group.

Who Can Pursue ACCA?

The ACCA qualification is open to anyone with the requisite academic background, but the path to eligibility varies based on your educational qualifications:

10+2 (High School) Graduates: If you have completed your high school education (10+2) with a minimum of 50% in subjects like Mathematics, Accounting, or English, you are eligible to begin your ACCA journey. This route is popular among students who wish to start early in their accounting careers.

Graduates: Those who hold a bachelor's degree in Commerce (B.Com), Business Administration (BBA), or an equivalent degree from a recognized institution can also apply for ACCA. Graduates may be eligible for certain exemptions from the foundational exams, depending on their prior studies.

Postgraduates and Professionals: If you have completed a master’s degree in Commerce, Finance, or any other relevant field, or if you are already a qualified Chartered Accountant, you may be eligible for additional exemptions, allowing you to fast-track your ACCA qualification.

Non-Commerce Students: Even if your educational background isn’t in commerce or finance, you can still pursue ACCA. However, you might be required to start from the foundational level and may not be eligible for exemptions.

Why ACCA?

The ACCA qualification opens doors to a multitude of career opportunities across the globe. Whether you aspire to work in public accounting, corporate finance, auditing, or any other financial services sector, ACCA provides a comprehensive framework to hone your skills. The qualification is not only recognized in over 180 countries but is also highly respected by employers and institutions.

The ACCA Journey

The ACCA qualification is structured into three levels: Applied Knowledge, Applied Skills, and Strategic Professional. Students are required to complete 13 exams, gain three years of relevant work experience, and complete the Ethics and Professional Skills module to become an ACCA member. The journey, though rigorous, is rewarding, offering a blend of theoretical knowledge and practical application.

Conclusion

Pursuing ACCA can be a transformative step in your career, offering global recognition and diverse opportunities in the field of finance and accounting. With the right educational support, such as that provided by Zell Education, you can navigate the rigorous ACCA journey with confidence and emerge as a qualified professional ready to take on the world. If you're aspiring to join the ranks of ACCA professionals, ensuring you meet the eligibility criteria and choosing the right coaching partner are the first crucial steps.

Satyamedh Nandedkar, a seasoned finance professional, holds ACCA, CA, US CMA & CS credentials. With 10+ years of experience, he's a master ACCA tutor, IFRS trainer, adept in global financial standards, and a trusted advisor in navigating complex financial landscapes.

Get in Touch

0 notes

Text

Discover the Best Online Education Platform: Foundation Learning

In today's fast-paced world, quality education is the key to success. Foundation Learning stands out as a premier online education platform, offering a wide range of professional and competitive courses tailored to meet the needs of students globally. Best online Education Platform in India

Foundation Learning provides comprehensive courses in ACCA, US CMA, US CPA, IFRS, and RAS, ensuring students receive top-notch education from experienced and highly qualified instructors. The platform is designed to build strong conceptual foundations while integrating practical aspects, making learning both effective and engaging.

One of the key features of Foundation Learning is its flexibility. Students can access courses through a user-friendly mobile app available on both Android and iOS, or via their web portal. This allows learners to study anytime, anywhere, fitting education seamlessly into their busy lives. The platform also supports Hindi, making it accessible to a broader audience in India. Online ACCA Course

Foundation Learning's dedication to excellence is evident in the success stories of its students. With personalized teaching methods, timely completion of syllabi, and a focus on vital areas, students are well-prepared to excel in their exams and professional careers. The platform's comprehensive test series and regular performance assessments ensure that learners are always on the right track.

Moreover, Foundation Learning is not just about academic success; it aims to nurture well-rounded individuals. The platform encourages interactive learning, critical thinking, and practical application of knowledge, equipping students with the skills they need to thrive in their chosen fields. ACCA Course in India

In conclusion, Foundation Learning is a beacon of quality education, providing unparalleled online learning experiences. Whether you're aiming for professional qualifications or preparing for competitive exams, Foundation Learning is your trusted partner in achieving educational excellence. Enroll today and take the first step towards a brighter future.

Visit Here - ACCA Coaching Classes

0 notes

Text

Unlocking Your Financial Career: A Comprehensive Guide to Professional Courses

In today’s competitive job market, financial professionals need to stay ahead of the curve by acquiring relevant qualifications and certifications. Among the myriad options available, the ACCA Course, Chartered Wealth Manager Course, ICWIM Courses, and CMA Courses stand out as top choices for aspiring finance professionals. This blog will delve into these courses, highlighting their benefits, structure, and career prospects. Additionally, we will explore why India is home to some of the best CMA coaching in India.

ACCA Course: Your Gateway to Global Accounting

The ACCA Course (Association of Chartered Certified Accountants) is a globally recognized qualification for accountants. It equips you with the skills necessary to work in various accounting roles, from financial reporting to auditing and taxation.

Course Structure and Requirements

The ACCA Course is structured into three levels:

Applied Knowledge: Covers the fundamentals of accounting and business.

Applied Skills: Focuses on advanced topics like performance management and taxation.

Strategic Professional: Includes essential and optional modules, allowing for specialization in areas like advanced financial management and auditing.

To enroll in the ACCA Course, you typically need to have completed secondary education. However, graduates and professionals with relevant work experience may also qualify for exemptions from certain exams.

Career Prospects

Completing the ACCA Course opens doors to numerous career opportunities globally. ACCA members are in high demand in various sectors, including public practice, corporate finance, and government agencies. The qualification is also a stepping stone to senior management positions, offering lucrative salary packages and job security.

Chartered Wealth Manager Course: Mastering Wealth Management

The Chartered Wealth Manager (CWM) Course is designed for professionals seeking to specialize in wealth management and investment advisory services. This course provides comprehensive knowledge on managing high-net-worth individuals’ assets, investment strategies, and financial planning.

Course Content and Eligibility

The CWM Course covers topics such as:

Wealth management process and strategies

Investment analysis and portfolio management

Estate planning and wealth transfer

Eligibility criteria typically include a bachelor’s degree and relevant work experience in finance or investment. The course often involves a combination of self-study and examinations.

Career Opportunities

Chartered Wealth Managers are in high demand in financial institutions, private banks, and investment firms. This certification can significantly enhance your career prospects, allowing you to offer specialized services to high-net-worth clients and advising them on wealth creation and preservation.

ICWIM Courses: International Certificate in Wealth and Investment Management

The ICWIM Courses focus on international wealth and investment management, providing a strong foundation for those looking to work in global financial markets.

Course Overview

ICWIM Courses cover essential areas such as:

Financial markets and investments

Wealth management principles

Regulatory environment and ethics

These courses are ideal for finance professionals aiming to deepen their understanding of global wealth management practices. They typically require a background in finance, but specific prerequisites may vary.

Global Career Prospects

Holding an ICWIM certification can enhance your credibility and employability in international finance. This qualification is highly valued by employers in global banks, asset management companies, and multinational corporations, positioning you for roles such as investment advisor, wealth manager, or financial consultant.

CMA Courses: Becoming a Certified Management Accountant

Certified Management Accountant (CMA) Courses are designed for professionals interested in management accounting and financial management. The CMA credential is recognized worldwide, emphasizing strategic management and decision-making.

Course Structure and Requirements

CMA Courses are divided into two parts:

Part 1: Financial Planning, Performance, and Analytics

Part 2: Strategic Financial Management

Candidates need a bachelor’s degree and two years of relevant work experience. The CMA exam is rigorous, testing your knowledge and analytical skills in management accounting.

Career Benefits

The CMA designation can significantly enhance your career in management accounting, corporate finance, and business analysis. CMAs are often employed in high-level positions, such as CFOs, controllers, and financial analysts, with attractive salaries and career advancement opportunities.

Why India is the Hub for the Best CMA Coaching

India has emerged as a leading destination for CMA coaching, attracting students from across the globe. The best CMA coaching in India is renowned for its comprehensive curriculum, experienced faculty, and high success rates in CMA exams.

Advantages of CMA Coaching in India

Experienced Faculty: Indian coaching institutes boast highly qualified instructors with extensive industry experience.

Comprehensive Study Material: The study material provided is thorough and updated regularly to reflect the latest industry trends and exam patterns.

Affordable Fees: Compared to other countries, the cost of CMA coaching in India is relatively low, making it accessible to a broader range of students.

Supportive Learning Environment: Many coaching centers offer personalized attention, doubt-clearing sessions, and mock exams to prepare students thoroughly.

Success Stories

Many students who have undergone CMA coaching in India have gone on to achieve top ranks in the CMA exams and secure prestigious positions in multinational corporations. The success rate of Indian coaching institutes is a testament to their quality and effectiveness in preparing students for the CMA designation.

Conclusion

Choosing the right professional course can significantly impact your career trajectory in the finance sector. Whether you opt for the ACCA Course, Chartered Wealth Manager Course, ICWIM Courses, or CMA Courses, each offers unique advantages and career opportunities. For those aspiring to become management accountants, India’s reputation for providing the best CMA coaching in India makes it an attractive destination for your studies.

Investing in your education and professional development through these courses can open doors to exciting career opportunities, high earning potential, and global recognition in the finance industry. As the demand for qualified financial professionals continues to grow, obtaining these certifications can set you apart and pave the way for a successful and fulfilling career.

0 notes

Text

Why ACCA DipIFR :

More than 140 countries require or permit the use of International Financial Reporting Standards for their select class of companies. India has also mandated certain class of companies to follow Ind AS (converged with International Financial Reporting Standards) for financial reporting purpose.

The companies are currently focussing on recruiting the employees who have knowledge of Ind AS and other global financial reporting standards. Accordingly, the demand for professionals with knowledge in Global Financial Reporting Standards / Ind AS is increasing at rapid pace.

DipIFR is an international qualification in International Financial Reporting Standards accredited by the leading professional accounting organization – ACCA which is based in UK. DipIFR course is designed to develop working knowledge on International Financial Reporting Standards, providing an in-depth understanding of the concepts and principles and their practical application.

On Completion of This Program the Participants Will Acquire :

In-depth understanding of key International Financial Reporting Standards principles and rules.

Skills necessary for preparing financial statements.

Experience in developing professional judgment on practical application.

Understanding of key differences between Indian GAAP, Ind AS and International Financial Reporting Standards.

DipIFR exam is assessed by a single three-hour Computer Based Exam (CBE), which is held twice a year in June and December at ACCA’s exam centres, including Pune and other centres in India. The pass mark is 50%.

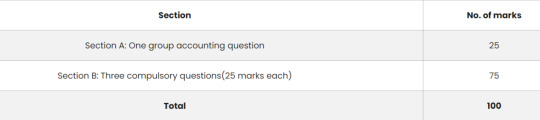

The exam paper is divided in two sections. It contains a mix of computational and discursive elements. Some questions adopt a scenario/case study approach. Section A includes a mainly computational question and Section B contains a mix of computational and discursive questions.

Who Is DipIFR For:

CFOs/ Finance Directors

Practicing CA, CS & CMA

Finance Controllers

Accountants and Analysts

Investment bankers

Professionals working in the Mergers and Acquisitions Department

Professionals involved in auditing, reporting, accounting and finance domain

Accounting professionals working in KPOs / BPOs, shared service centres and back offices

Who is Eligibile for DipIFR?

If you are a professional accountant or auditor engaged in practice or business, and are qualified according to national accounting standards, then you are eligible to take this ACCA financial reporting qualification (For e.g. Chartered Accountant holding valid membership certificate).

If you are a working professional, but not yet qualified as required above, then you may still be eligible. You will need to prove that you have one of the following:

A relevant degree plus two years’ relevant accounting experience*

An ACCA certificate in International Financial Reporting plus two years’ relevant accounting experience*

Three years’ relevant accounting experience*

ACCA affiliate status

*By submitting experience letter in a specified format. CA Article-ship experience of 3 years may be considered relevant for work experience criteria

Documents required for exam registration:

A. For a qualified Chartered Accountant (CA) with membership certificate:

CA Membership Certificate (Please note: Member Card / Marksheet is not accepted)

Date of birth proof (PAN / passport)

Address proof (Driver’s license / passport)

Identity proof (PAN / passport)

B. Qualified CA without a membership certificate:

It is required to share all the documents mentioned in the point “C” below i.e.,all the documents that a candidates other than qualified CA will provide.

C. For Candidates other than a qualified CA:

B. Com / M. Com degree certificate received from university.(Please note: Marksheet is not accepted)

Experience letter/certificate on company’s/organisation’s letterhead (mentioning tenure in the company & work profile)

Duly filled in and self-attested‘Experience Confirmation Form’(Pls find attached the format in PDF). Please note that experience is required in the field of accounting/ finance/ audit domain. Along-with,Form no.108 for CA article-ship / internship experience is considered as relevant experience (attached herewith is the sample form) for reference

Date of birth proof (PAN / passport)

Address proof (Driver’s license / passport)

Identity proof (PAN / passport)

#ACCA certificate#financial Documents required for exam#registration#Who Is DipIFR For#Who is Eligibile for DipIFR?#Why ACCA DipIFR

0 notes